US Dollar Exchange Rates of

10th

Jan

2023

China Yuan 7.16

Report from China

Tariff adjustments for 2024

The State Council has announced adjustments to trade

tariffs for 2024 to address domestic supply and demand

and assist with the development of advanced

manufacturing.

These adjustments include tariff waivers for key medical

goods, tariff reduction on resources in short supply,

critical equipment and key parts and certain agriculture

products and tariff increases on certain commodities.

China will impose tariffs on 8,957 tax items in

2024.

1,010 items, including certain medical products,

key equipment and parts, resources in short supply,

and some agriculture products, will be subject to

provisional import tariff rates as of 1 January 2024,

which are lower than the most favored nation (MFN)

tariffs.

Import tariffs on some commodities will be raised

to assist with the development of domestic industry

and cope with changes in supply and demand as of 1

January 2024. Examples include ethylene, propylene,

and liquid crystal glass substrates.

The conventional tariff rates will be applied to

imported goods originating from 30 countries or

regions, under the 20 free trade agreements and

preferential trade arrangements that have been signed

and entered into force between China and relevant

countries or regions.

The preferential tariff rates will continue to be

applied to 43 least-developed countries that have

established diplomatic relations with China and

completed the exchange of documents to support and

help the least-developed countries accelerate their

development. The zero tariff treatment for Vanuatu

will end.

The tariff quota management will continue to be

implemented on eight categories of commodities

including wheat and the tax rates will remain

unchanged.

Export tariffs will be imposed on 107

commodities, including ferrochrome, 68 of which are

subjected to provisional export tariff rates.

Wood products among some agriculture products will be

subject to provisional import tariff rates as of 1 January

2024 which are lower than the most favored nation (MFN)

tariffs. The most favored nation (MFN) tariff rates in

2024 for wood products will be at six levels, namely 3%,

4%, 6%, 7%, 8% and 12%.

The provisional tariff rates in 2024 for wood products will be at

three levels. Details can be found at:

http://gss.mof.gov.cn/gzdt/zhengcefabu/202312/t20231221_3923368.htm

and

http://gss.mof.gov.cn/gzdt/zhengcejiedu/202312/t20231221_3923371.htm

Change in wood products trade between China and

Malaysia

The following analysis is based on China’s Customs data.

China will mark the 50th anniversary of diplomatic

relations with Malaysia in 2024. For the past 14 years

China had been Malaysia's largest trading partner but

recently the trade in wood products between the two

countries has changed dramatically.

Malaysia was a major supplier of logs to China between

1998 and 2007 and China imported 29,300 cubic metres of

logs from Malaysia in 2003. After the global financial

crisis in 2008 China’s log imports from Malaysia fell,

dropping to less than 10,000 cubic metres.

In 2020 and 2021 China imported only 4,633 cubic metres

and 1,374 cubic metres of logs from Malaysia

respectively.

Malaysia was once a major exporter of plywood to China.

China imported 2.08 million cubic metres of plywood

from Malaysia in 1995 and plywood imports remained

above 1 million cubic metres between 1995 to 2000,

dropping to 196,000 cubic metres in 2022.

China became a major plywood producer with production

accounting for around 50% of the world total so no longer

needs to import plywood. China now exports plywood to

more than 200 countries and accounts for about 30% of

the world total. China's plywood imports account for less

than 1% of the world total.

Rise in forest products trade between China and

Malaysia

According to China Customs, in 2022 the total value of

forest products trade (including wood products and non-

wood products) between China and Malaysia rose year on

year by 16% to US$7.82 billion.

The value of wood products and non-wood products

amounted to US$3.42 billion and US$4.39 billion, up 24%

and 10% respectively.

Trade in wood products between China and Malaysia

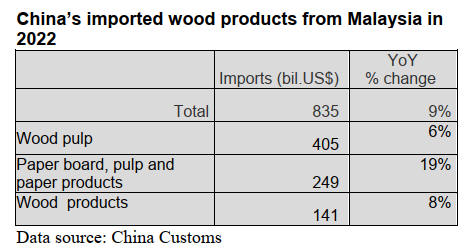

China mainly imported three categories of wood products

from Malaysia in 2022, wood pulp; paper board, pulp and

paper products; timber and timber products. The value of

these three major wood products accounted for 95% of the

national total value of wood products imports in 2022.

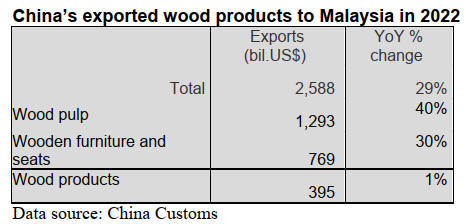

China mainly exported three categories of wood products

to Malaysia in 2022, namely wood pulp; wood furniture

and seats; timber and timber products, which the value of

these three major wood products made up 95% of the

national total value of wood products exports in 2022.

Log and sawnwood imports from Malaysia

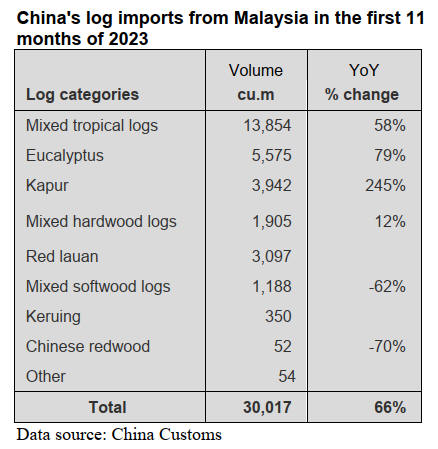

China’s log imports from Malaysia in the first 11 months

of 2023 rose 66% to 30,017 cubic metres valued at

US$10.69 million, up 16% over the same period.

Mixed tropical logs was the largest category of imports at

13,854 cubic metres in the first 11 months of 2023.

China’s eucalyptus and kapur log imports from Malaysia

rose dramatically.

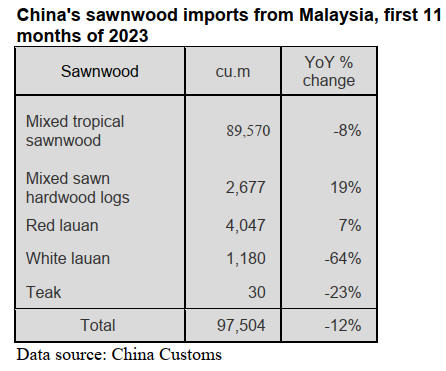

China’s sawnwood imports from Malaysia in the first 11

months of 2023 fell 12% to 97,504 cubic metres valued at

US$34.05 million, down 23% year on year. China’s

mixed tropical sawnwood imports from Malaysia

amounted to 89,570 cubic metres in the first 11 months of

2023, down 8% from the same period of 2023.

|