Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jan

2023

Japan Yen 144.82

Reports From Japan

Magnitude 7.6 quake

on New Year's Day

Central Japan continues to be rocked by earthquakes

following the deadly magnitude 7.6 temblor on New

Year's Day.

Rescue operations are ongoing in hard-hit Ishikawa

Prefecture, where officials say over 200 are confirmed

dead. Tens of thousands remain without electricity. It's

feared many are trapped under collapsed houses. Officials

warn that aftershocks of similar intensity may occur this

week.

At a meeting of the prefecture's disaster countermeasures

headquarters, Suzu Mayor said the damage is catastrophic.

Many of the 6,000 homes in the city alone have been

almost or totally destroyed. When reconstruction can

begin there will be an urgent need for all building

materials.

See:

https://www3.nhk.or.jp/nhkworld/en/news/20240103_13/

Major Japanese companies expected the domestic

economy to grow in 2024

Days before the 1 January devastating quake and tsunami

to hit the Noto Peninsula, Ishikawa Prefecture according to

a Kyodo News survey, more than 70% of major Japanese

companies expected the domestic economy to grow in

2024 as they believed consumer and capital spending will

reduce the negative impact of inflation. The positive view

coincided with the Organization for Economic

Cooperation and Development's growth projection for

Japan of 1.0 percent in 2024, a slower pace than 1.7

percent estimated for 2023.

Meanwhile, 22% expected zero growth while 3% said

Japan's economy will contract moderately.. This was

despite the economic contraction in July-September

quarter ending two consecutive quarters of growth.

The government has stated wage increases will be

particularly crucial in 2024 as the Bank of Japan, which

has long maintained a monetary easing policy, is watching

spring wage negotiations this year closely to determine

whether it should end its negative interest rate policy.

The disruption of manufacturing and trade as a

result of

the latest disaster will cloud the picture of economic

prospects for months.

See:

https://english.kyodonews.net/news/2024/01/e68278bedf5c-over-70-of-firms-expect-japan-economy-to-keep-growing-in-2024.html

and

https://www.weforum.org/agenda/2023/11/global-growth-slow-2024-economics-news/

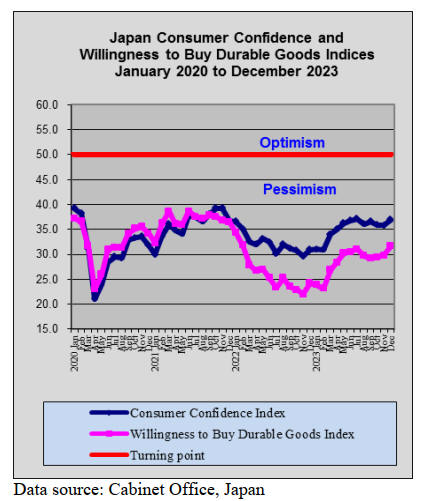

December consumer confidence up, brace for

downturn in January

Japan's consumer confidence index improved in December

2023 according to Cabinet Office data. The overall

livelihood index was up and the the income growth

indicator rose, the employment index also saw a rise and

the willingness to buy durable goods strengthened. Within

days of the release of the December consumer confidence

indices the country suffered a massive earthquake and

tsunami which are sure to influence the January

confidence data.

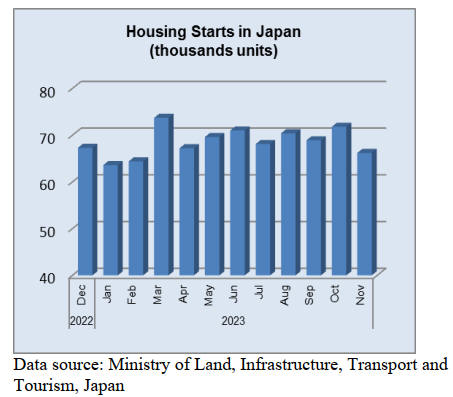

Houses destroyed and damaged

The recent Noto Peninsula Earthquake caused severe

property damage, with at least 12,000 houses either

destroyed or severely damaged in 17 municipalities,

according to the Ishikawa Prefectural government. The

earthquake leveled wooden buildings in the Noto

Peninsula and the low earthquake-proofing rate in this

area, exacerbated by its high ratio of elderly residents,

meant it was hit particularly hard.

According to the Suzu Municipal Government, only 51%

of the roughly 6,000 homes in the city at the tip of the

Noto Peninsula met national earthquake resistance

standards. The national average was 87% for the same

period. It is still difficult to ascertain the full extent of the

damage in the severely afflicted cities of Wajima and Suzu

and the number of damaged buildings is likely to increase.

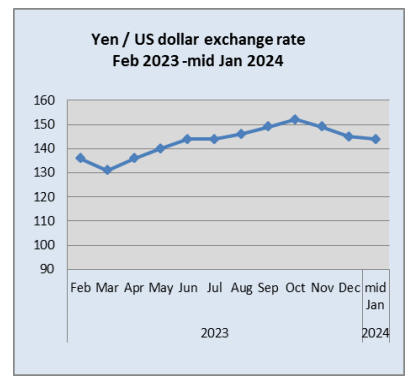

Yen weakens as BoJ unwinding deferred

In the last days of 2023 the Yen drifted lower as traders

unwound expectations that the Bank of Japan will alter

course on its monetary policy. The USD/JPY rate moved

to a two-week high around the 145 as the New Year.

The powerful earthquake that hit Japan on New Year’s

Day makes it harder for the Bank of Japan (BoJ) to abolish

negative interest rates later this month as anticipated.

Speculation about a January change of policy direction by

the BoJ has receded but it is possible the BoJ could shift

away from ultra-loose monetary policy settings in April

after the annual wage negotiations.

See:

https://www.fxstreet.com/news/japanese-yen-hits-two-week-low-against-usd-bears-take-breather-ahead-of-us-nfp-202401050143

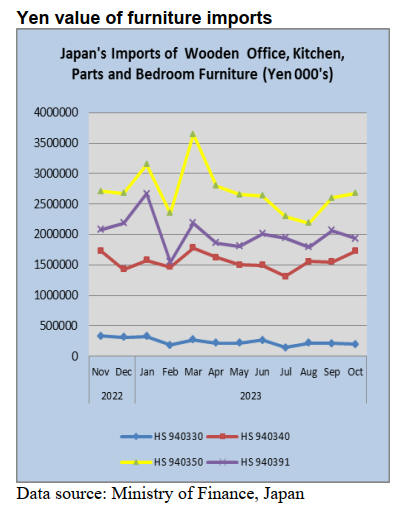

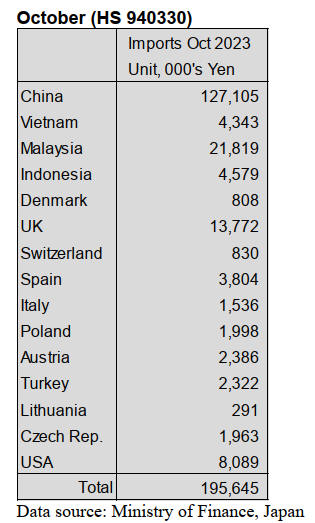

October wooden office furniture imports (HS

940330)

In October, shippers in China and Malaysia were, once

again, the top shippers of wooden office furniture

(HS940330) to Japan respectively accounting for 65%

(77% in Sept) and 11% (19%in Sept) of the total value of

imports. Shippers in China, Malaysia along with shippers

in the UK accounted for around 90% of the value of

imports of wooden office furniture in October.

The value of October arrivals from China was down

compared to September as were arrivals from Malaysia.

Year on year, the value of October 2023 imports of

wooden office furniture was down 20% and there was also

a decline in the value of imports compared to the level

reported for September. In October the number of shippers

supplying wooden office furniture to Japan was below that

in September.

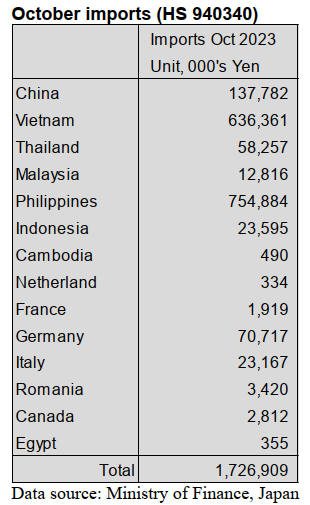

October kitchen furniture imports (HS 940340)

As in previous months shippers in the Philippines and

Vietnam together accounted for most of Japan’s imports of

wooden kitchen furniture. In October the top four shippers

were the Philippines (44% of total import value), Vietnam

(37%) and China (8%). In October Germany was the forth

raked shipper in terms of value.

After the slight decline in the total value of imports of

HS940340 in September there was a change of direction

with month on month October 2023 imports rising 11%.

Year on year the value of imports grew 14%.

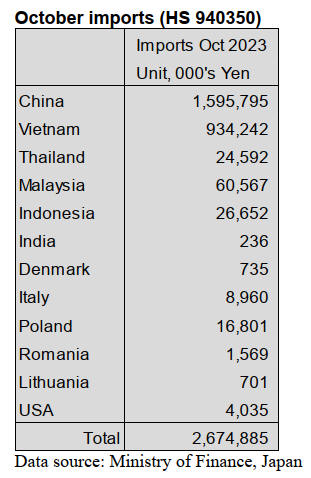

October wooden bedroom furniture imports (HS

940350)

After a good start to 2023 the value of imports of wooden

bedroom furniture began to decline and fell steadily for

most of the second and third quarters of 2023.

The downtrend reversed in September and there was a

further increase in the value of imports in October. With

most trading being conducted in US dollars the impact of

the weak Yen clouds the actual trend direction.

China and Vietnam continue to be the main shippers of

wooden bedroom furniture to Japan, together accounting

for over 90% of the value of imports.

The value of October imports from China was higher

compared to a month earlier whereas the value of imports

from Vietnam was unchanged month on month. Year on

year the value of October imports was little changed.

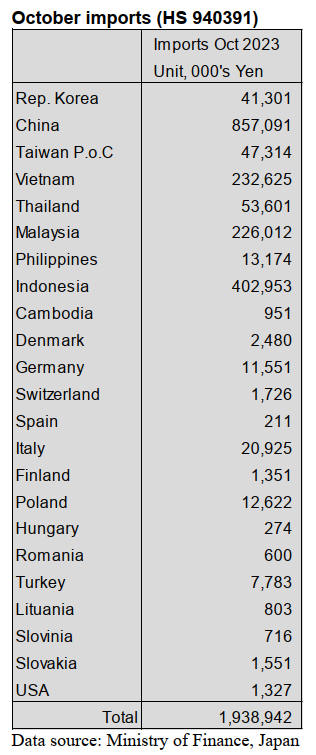

October wooden furniture parts imports (HS

940391)

From the beginning of the second quarter 2023 the value

of imports of wooden furniture parts HS940391 have

remained steady, rising and dipping but not showing any

discernable trend.

After the July and August declines the value of

Japan’s

imports of wooden furniture parts (HS940391) rose 15%

in September, but in October there was a 6% month on

month fall in the value of imports and year on year

October imports were down 17%.

The top suppliers of wooden furniture parts in October

were China (44%), Indonesia (21%), Malaysia (11%) and

Vietnam (12%). The top three shippers saw the value of

arrivals fall, it was only for Vietnam that the Japanese

Ministry of Finance reported a rise in the value of imports.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the

ITTO Tropical Timber Market Report to reproduce news on the

Japanese market precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Volume of imported lumber declines

A forecast of imported lumber in 2023 will be under

9,000,000 cbms, 27.8 % less than 2022. There are five

major kinds of the imported lumber, which are lumber*,

plywood, laminated structural lumber and wooden

boards**. In 1998, when it was deflationary depression,

the imported lumber was 29.4 % less than 1997.

According to Japan Lumber Importers’ Association, the

imported lumber in January to October, 2023 is 7,475,000

cbms, 30.9 % less than the same period last year.

Volume of five major kinds of imported lumber in January

to October 2023, is 4,668,000 cbms, 30.6 % down from

the same period last year. Volume of plywood, laminated

structural lumber and wooden boards is 2,807,000 cbms,

31.5 % down from the same period last year. A forecast

for the volume of imported lumber 2023 will be 8,71,000

cbms.

Since the influence of the wood shock, the volume of

imported lumber has been 12,000,000 cbms for two years

continuously but the volume in this year decreases nearly

3,000,000 cbms. Volume of European lumber in January

to October, 2023 is 41.6 % down from the same period last

year. North American lumber is 24.2 % down. Russian

lumber is 43.1 % down. Plywood is 28.9 % down.

Laminated structural lumber is 44.4 % down.

It is the first time in 25 years for a huge decrease in

imported lumber. In 1998, demand for houses, which was

active after the bubble economy, had settled down. A

consumption tax was raised to 5 % from 3 % in 1997 and

also the price of health insurance and utility bills were

raised. Therefore, the economy in Japan slid into deflation

due to the low consumer confidence in 1998.

Russia banned exporting logs in 2022 for the first time in

70 years. Additionally, it has been 30 years for the system,

which was launched to supply European lumber to Japan

stably. 2023 will be a milestone year for importing lumber

businesses.

Number of bankruptcies in 2023

Tokyo Shoko Research, Ltd. classified the results of a

survey about home renovation companies and 82 home

renovation companies went bankrupt during January to

October, 2023. This result is the highest number in

recorded history. The survey started in 2002 and in 2012,

98 home renovation companies went bankrupt.

The number of debts in January to October, 2023 is 5

billion yen. A reason for bankruptcy is sluggish sales, 61

home renovation companies had answered the survey.

71 home renovation companies had under 100 million yen

in debt. 78 home renovation companies had less than 10

employees. Some reasons for bankruptcy are a decrease in

jobs due to the COVID-19, high-priced materials and

housing equipment and a shortage of workers.

Demand and supply of domestic softwood plywood

Shipment of domestic softwood plywood in October, 2023

is 204,000 cbms, 9.8 % more than October, 2022 and this

is 1.4 % more than September, 2023. This is straight two

months for keeping a level of 200,000 cbms.

Production of structural plywood is 202,000 cbms, 2.0 %

more than the same month last year and this is 0.3 % more

than the previous month. The production has been

increasing for eight months continuously. However,

shipment of domestic softwood plywood in October is

2,000 cbms higher than the production so the inventory at

the end of October is decreased slightly.

Radiata pine logs and lumber

The price of radiata pine logs from New Zealand is bullish

to Japan in December, 2023 because the price of radiata

pine logs to China has been rising.

The price of radiata pine logs to China is around $130,

C&F per cbm. The price in October and November, 2023

was $120 – 125, C&F per cbm. The price to Japan would

be higher than the previous time and it was $160 – 165,

C&F per cbm.

The price of NZ lumber in Japan is a level of 60,000 yen,

delivered per cbm and this is stabilized from last month. It

is said that the price of NZ lumber would rise and even

though it is strong yen against the dollar, the import cost

would be higher than the previous time. Chilean thin

boards in Japan are 57,000 – 59,000 yen, FOB per cbm.

Squares are 55,000 – 57,000 yen, FOB per cbm.

Wholesalers in the Greater Tokyo Metropolitan area raised

the price of Chilean lumber by 2,000 yen, FOB per cbm in

November, 2023. However, there is an increase in import

cost so there is not enough profits. Therefore, some

wholesalers plan to raise the price of Chilean lumber again

next year.

Some other wholesalers say that it depends on the foreign

exchange because, now, the yen is rising against the

dollar.

Radiata pine lumber shipped to Japan in December,

2023

will arrive to Japan in the middle of January, 2024.

South Sea logs and lumber

Movement of hardwood lumber is still dull. The yen

strengthens against the dollar in the middle of November,

2023. The yen was 147 yen against the dollar. Japanese

buyers purchased some kinds of lumber, which are in short

supply. Low demand for houses has been influencing.

Demand for interiors, doors, windows and screens at

stores and facilities are still good.

The lumber market in China is also sluggish. Some

reasons are demand for lumber is low and the purchase

price is high. Since the labor cost and the product cost in

South Asia rose, South Asian sellers are not able to lower

the prices. The price of South Sea logs are high due to the

less inventory and so as the South Sea lumber.

|