|

Report from

Europe

Plywood imports fall from record highs to record lows

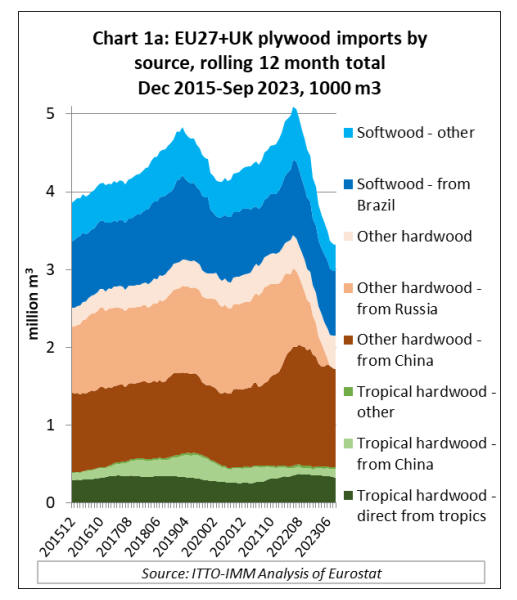

For the first time ever in a 12-month period, total EU+UK

imports of plywood from outside the region exceeded 5

million cu.m between 1t July 2021 and 30th June 2022.

However, by the end of September 2023, the twelve-

month rolling total had fallen to just 3.3 million cu.m

(Chart 1a).

If imports remain weak in the fourth quarter, which seems

likely, total EU+UK imports for the whole of 2023 could

fall below 3.1 million cu.m, which is the previous record

low occurring during the global financial crises in 2009.

In the first nine months of 2023, total EU+UK plywood

imports from outside the region were 2.67 million cu.m,

30% less than the same period in 2022. Imports of tropical

plywood were down 6% at 353,000 cu.m, imports of

temperate hardwood plywood were down 38% at 1.31

million cu.m, and imports of softwood plywood were

down 24% to 1.01 million cu.m.

The recent extreme volatility in EU+UK plywood imports

is due largely to geo-political issues, mainly relating to the

Russia Federation, combined with the lingering effects of

the COVID pandemic. EU+UK plywood imports from the

Russian Federation were rising almost continuously

between 2014 and 2019, encouraged by extreme weakness

of the Russian ruble against the euro and other EU

currencies.

At that time, a sharp decline in confidence in the Russian

economy following a collapse in oil prices and economic

sanctions on Russia following the country's annexation of

Crimea had led Russian manufacturers to boost exports in

search of hard currency.

Most plywood that was imported into the EU+UK from

Russia during the period comprised birch plywood,

including thicker film-faced boards which competed

directly with tropical products, and most was destined for

Germany, the Baltic States, Poland, the UK, and

Netherlands.

EU demand for plywood at this time was given added

impetus by a design trend to use plywood as the sole

manufacturing material in furniture and interior finishes,

with faces and edges expressed, even unfinished, to reveal

its structure and achieve an ‘industrial look’.

Birch was the favored species in these applications.

EU+UK plywood imports from Russia and elsewhere

dipped a little in early 2020 with the onset of the pandemic

but reached new heights in 2021 and the first half of 2022

with the sharp rebound in construction and DIY activity

after the first lockdown period.

Then, in February 2022, Russia invaded Ukraine and the

EU and UK responded by imposing economic sanctions

on Russia and Belorussia, including a total ban on all

imports of timber products from both countries. Some

large European companies also responded with their own

self-imposed boycotts of products from these countries.

Direct EU+UK imports of Russian and Belorussian

plywood had fallen to negligible levels by August 2022.

This occurred just at a time when the wider European

economy was beginning to cool against the background of

sharply rising interest rates to control high levels of

inflation, itself partly driven by a massive hike in energy

prices as availability of Russian gas and oil was curtailed.

Public funds to support post-COVID recovery were also

being progressively removed, while confidence was

severely hit by the political instability in Eastern Europe

and the downturn in the wider global economy.

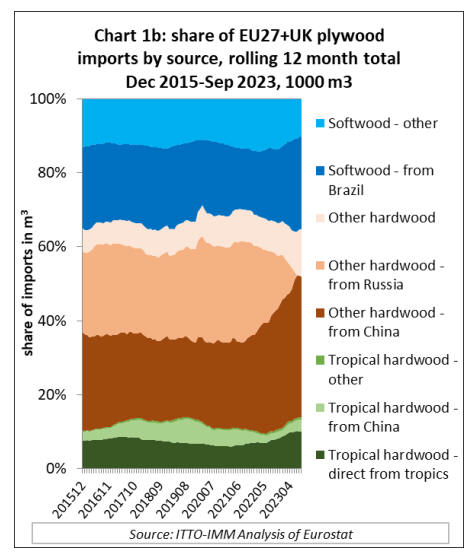

As a result, the anticipated surge in plywood imports into

Europe from alternative supply countries following the

removal of Russian and Belorussian products from the

market was less dramatic than expected. By far the biggest

gain in market share was made by temperate hardwood

plywood from China (Chart 1b left).

There was also a surge in birch plywood imports into the

EU from Kazakhstan, raising immediate concerns that

some European importers were deliberately circumventing

the sanctions by sourcing Russian birch plywood from

third countries.

For tropical hardwood suppliers, EU plywood importers

were rushing to buy Indonesian products in the second and

third quarters of 2022 and Indonesian mills were being

encouraged to ramp up production as much as possible for

the EU market and to relaunch production of thicker film-

faced boards.

However, the ability of Indonesian mills to do this was

constrained by lack of log supply and existing demand for

their products in other markets. By far the biggest gains in

EU imports of plywood faced with tropical hardwood

during 2022 were made by products from China and

Gabon.

The signs are that EU domestic plywood manufacturers

were also unable to significantly increase production in

response to the supply gap that opened following the

sanctions on Russian and Belorussian products. Data from

the European Panels Federation indicates that total EU

plywood production fell 2.5% from 3.2 million cu.m in

2021 to 3.1 million cu.m in 2022. Similarly, Eurostat data

shows that production of plywood in Finland, by far the

largest birch plywood manufacturing country in the EU,

fell from 1.13 million cu.m in 2021 to 1.11 million cu.m in

2022.

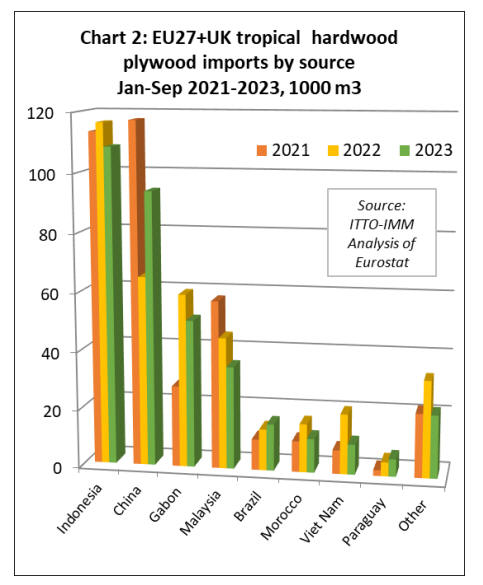

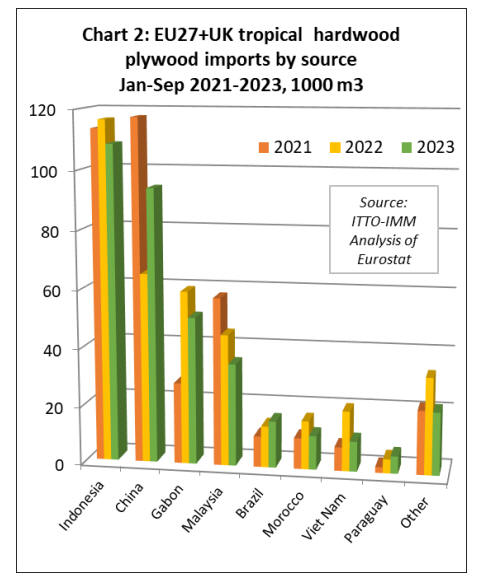

This year, EU+UK imports of tropical plywood have held

up better than imports of both temperate hardwood and

softwood plywood. In the first nine months of 2023,

EU+UK plywood imports of tropical plywood were down

only 6% at 353,000 cu.m. However, direct imports from

the tropics fell 15% to 244,000 cu.m.

The relative stability in overall imports was mainly due to

a 45% increase, to 94,000 cu.m, in imports of plywood

faced with tropical hardwood from China. Most Chinese

product was destined for the UK and the rise this year in

fact represents a rebound to more normal levels after a

sharp downturn in 2022 due to supply problems during

COVID lockdowns in China.

As a result, the anticipated surge in plywood imports into

Europe from alternative supply countries following the

removal of Russian and Belorussian products from the

market was less dramatic than expected. By far the biggest

gain in market share was made by temperate hardwood

plywood from China (Chart 1b left).

There was also a surge in birch plywood imports into the

EU from Kazakhstan, raising immediate concerns that

some European importers were deliberately circumventing

the sanctions by sourcing Russian birch plywood from

third countries.

For tropical hardwood suppliers, EU plywood importers

were rushing to buy Indonesian products in the second and

third quarters of 2022 and Indonesian mills were being

encouraged to ramp up production as much as possible for

the EU market and to relaunch production of thicker film-

faced boards.

However, the ability of Indonesian mills to do this was

constrained by lack of log supply and existing demand for

their products in other markets. By far the biggest gains in

EU imports of plywood faced with tropical hardwood

during 2022 were made by products from China and

Gabon.

The signs are that EU domestic plywood manufacturers

were also unable to significantly increase production in

response to the supply gap that opened following the

sanctions on Russian and Belorussian products. Data from

the European Panels Federation indicates that total EU

plywood production fell 2.5% from 3.2 million cu.m in

2021 to 3.1 million cu.m in 2022. Similarly, Eurostat data

shows that production of plywood in Finland, by far the

largest birch plywood manufacturing country in the EU,

fell from 1.13 million cu.m in 2021 to 1.11 million cu.m in

2022.

This year, EU+UK imports of tropical plywood have held

up better than imports of both temperate hardwood and

softwood plywood. In the first nine months of 2023,

EU+UK plywood imports of tropical plywood were down

only 6% at 353,000 cu.m. However, direct imports from

the tropics fell 15% to 244,000 cu.m.

The relative stability in overall imports was mainly due to

a 45% increase, to 94,000 cu.m, in imports of plywood

faced with tropical hardwood from China. Most Chinese

product was destined for the UK and the rise this year in

fact represents a rebound to more normal levels after a

sharp downturn in 2022 due to supply problems during

COVID lockdowns in China.

Considering EU+UK plywood direct imports from tropical

countries between January and September this year,

Indonesia was down 7% at 108,400 cu.m, Gabon was

down 15% at 51,500 cu.m, Malaysia was down 22% at

35,100 cu.m, Morocco was down 30% at 11,600 cu.m, and

Vietnam was down 50% at 10,300 cu.m.

However, imports of tropical hardwood plywood from

Brazil increased 13% to 16,000 cu.m, while imports from

Paraguay increased 24% to 5,900 cu.m (Chart 2 above).

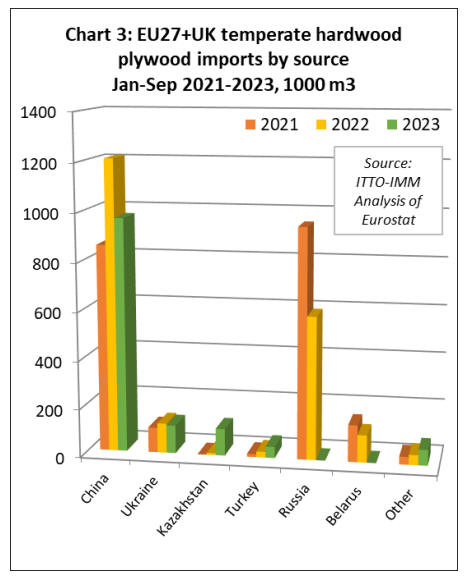

In the first nine months of this year, EU+UK plywood

imports of temperate hardwood plywood were down 38%

at 1.31 million cu.m. The decline was mainly due to

imports from Russia and Belarus, which were 591,000

cu.m and 113,000 cu.m respectively in the first nine

months last year, falling to zero this year.

Imports of temperate hardwood plywood from China were

also down 20% at 969,000 cu.m during the January to

September period, while imports from Ukraine fell 6% to

116,000 cu.m.

A rise in imports from Kazakhstan - from negligible levels

to 112,000 cu.m in the first nine months of this year - and

a doubling of imports from Turkey, to 47,000 cu.m, did

little to offset the overall downturn (Chart 3 left).

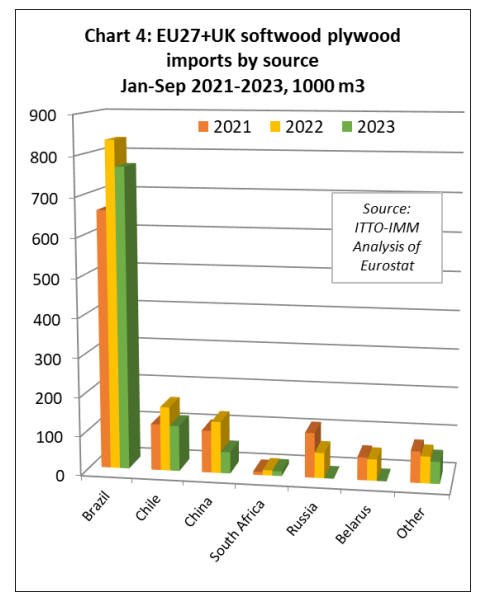

In the first nine months of 2023, EU+UK softwood

plywood imports were down 24% to 1.01 million cu.m. In

the case of softwood plywood, the decline in imports was

across the board for all major supply countries (Chart 4).

Again, imports from Russia and Belarus were at zero this

year, but these countries were only ever relatively minor

suppliers of softwood plywood into the EU+UK,

contributing 65,000 cu.m and 55,000 cu.m respectively in

the first nine months of last year.

Bigger declines in absolute import volumes were recorded

for softwood plywood from Brazil (down 8% to 769,000

cu.m), Chile (down 29% to 117,000 cu.m), and China

(down 58% to 55,000 cu.m).

A clear indicator of the overall weakness of the EU+UK

plywood market this year is that it took much longer than

usual for the duty-free softwood import quota – set this

year at 482,648 cu.m in the EU and 201,500 cu.m in the

UK - to be filled. The EU quota was only filled in July,

whereas the UK quota was only filled in September.

Meanwhile, the EU and UK sanctions on imports of

Russian plywood have significant knock-on effects for the

global plywood market.

In a presentation to the FORESTA 2023 conference held

in San Marino in November, Mr. Nikolay Ivanov of the

Union of Timber Manufacturers and Exporters of Russia,

reported that overall birch plywood production in Russia

was projected to fall only 5% from 3.3 million cu.m in

2022 to 3.15 million cu.m in 2023, while exports would

fall more dramatically, by 19%, from 1.98 million cu.m to

1.60 million cu.m.

This implies that apparent consumption of birch plywood

in Russia is expected to rise 11% from 1.41 million cu.m

last year to 1.56 million cu.m in 2023.

The balance of export destinations for Russian plywood is

also expected to change dramatically. In 2022, the leading

destinations, in order of share (by volume) were Europe

(35%), Middle East and North Africa (34%), North

America (11%), other CIS (10%), China (6%), South

Korea (2%), and all others accounting for 3%. In 2023, the

forecast share of export destinations is Middle East and

North Africa (47%), China (16%), other CIS (15%), North

America (15%), South Korea (4%), and all others

accounting for 3%.

In other words, with Europe no longer buying Russian

plywood, larger volumes are now being distributed in

other parts of the world, particularly in the Middle East

and North Africa, China, and CIS countries, notably in

South Asia.

A small proportion of these products may be finding their

way, indirectly, into the European market, but most will be

competing with other plywood and panel suppliers in other

global markets.

|