Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Dec

2023

Japan Yen 145.00

Reports From Japan

GDP revised down

Japan's economy contracted at an annualised 2.9% in the

July-September quarter from the previous year, worse than

the initial estimate of a 2.1%. On a quarter-on-quarter

basis, GDP shrank 0.7%, compared with the initial 0.5%

drop reading and a median forecast for a 0.5% fall.

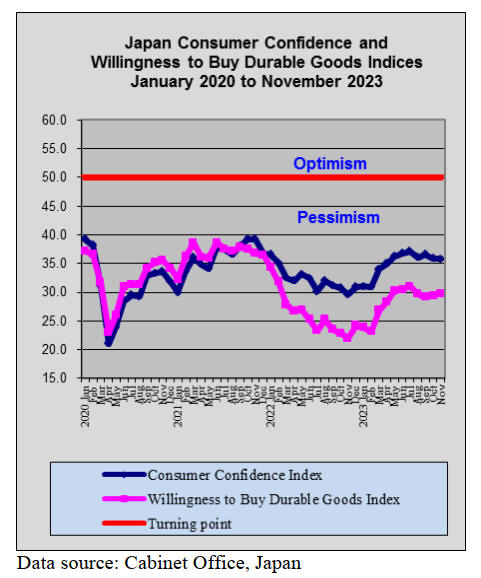

Private consumption, which makes up over half of GDP,

dropped 0.2% as rising prices of energy and household

goods eroded household sentiment. Inflation is a very

negative factor because what wage growth there has been

is more than offset by rising prices.

With inflation being above the Bank of Japan’s

target of

2% for more than a year the public find it difficult to

accept that the inflation goal has not yet been achieved.

See:

https://english.kyodonews.net/news/2023/12/993f488b958b-update1-japans-economy-shrinks-29-in-july-sept-revised-down.html#google_vignette

The Bank of Japan’s (BoJ) latest Tankan survey of

business sentiment shows large Japanese manufacturers

have become more optimistic over the past three quarters

despite many of the economic indicators pointing to

economic contraction. An index of sentiment among

Japan’s major manufacturers rose in December, the third

straight quarterly gain. The quarterly tankan survey

considered a leading indicator of medium term business

prospects.

The December survey reported sentiment among major

non-manufacturers rising for the seventh consecutive

quarter driven by the recovery of international tourism and

a resurgence domestic travel.

See:

https://www.boj.or.jp/en/statistics/tk/index.htm

and

https://www.japantimes.co.jp/business/2023/12/13/economy/boj-tankan-survey-business-mood-improves/

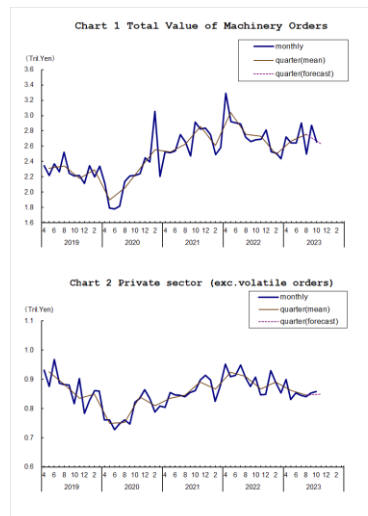

Machinery Orders in October, 2023

Private-sector machinery orders, excluding volatile ones

for ships and those from electric power companies,

increased a seasonally adjusted by 0.7% in October.

Source:

https://www.esri.cao.go.jp/en/stat/juchu/2023/2310juchu-e.html

Cash payouts and tax cuts to aid household finances

The government has adopted a 13.20 trillion yen (US$90

billion) extra budget for the current business year to March

2024 to ease the burden on households from rising prices.

Low income households will receive 70,000 yen in a

hand-out and subsidies will be continued to lower fuel

costs until next spring.

The economic package also includes a temporary tax

cut

of 40,000 yen per person that will be implemented in the

next fiscal year. The tax reduction has been criticised by

opposition parties.

See:

https://asia.nikkei.com/Economy/Japan-enacts-13tn-yen-FY2023-extra-budget-for-inflation-relief

Scrap-and-rebuild cycle doubles emissions from

home

renovation

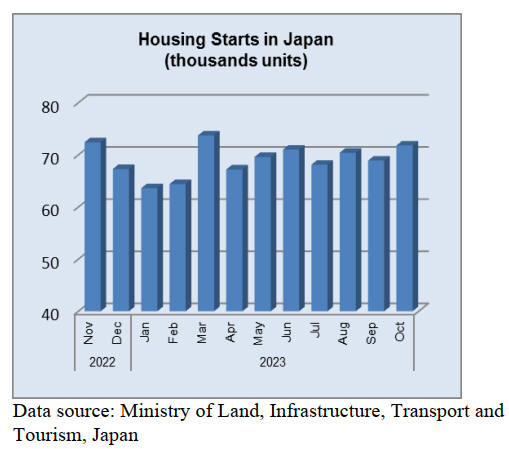

The traditional system of demolishing homes after around

30 years and then rebuilding rather than renovating the

existing home is now being reassessed given concerns

over sustainability and the high contribution to green

house gas emission in the construction sector.

Refurbishment of homes is becoming more popular mainly

because construction costs for new residences have risen

and because the government is promoting the longer term

use of existing properties through renovation. A recent

article says the scrap-and-rebuild cycle could produce

nearly double the emissions of renovations.

A joint study Sumitomo Realty and Development and

Musashino University attempted to determine how

renovating houses could reduce carbon dioxide emissions

compared with building new houses from scratch. It was

reported that renovating an entire home could cut around

47% of emissions from the traditional ‘scrap and rebuild’

process.

See:

https://www.japantimes.co.jp/environment/2023/08/27/sustainability/japan-scrap-build-sustainability/

Yen surge on remarks by BoJ Governor

The yen rose against the US dollar to its highest level in

four months in mid December, briefly strengthening to

around 141 for the first time since August. The brief yen

surge came over a remark by Bank of Japan Governor

Ueda Kazuo when he said the situation in Japan “will get

more challenging in the year-end and early next year”

fueling speculation that interest rates may be lifted.

Import update

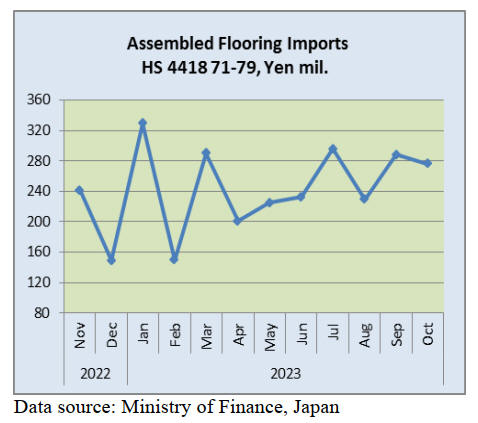

Assembled wooden flooring imports

Of the various categories of assembled flooring imports in

October HS441875 was the largest, accounting for close to

70% of the total value of assembled flooring imports

followed by HS441879. The main shippers of HS441875

in October were China 49% the EU, Vietnam, Malaysia,

Thailand and Indonesia.

The value of Japan’s October imports of assembled

flooring (HS441871-79) dropped slightly (4%) compared

to the value of September arrivals. Year on year the value

of October assembled flooring imports fell around 16%. In

the first 10 months of 2023 Japan’s imports of assembled

wooden flooring (HS441871-79) were around 15% below

those in the first 10 months of 2022.

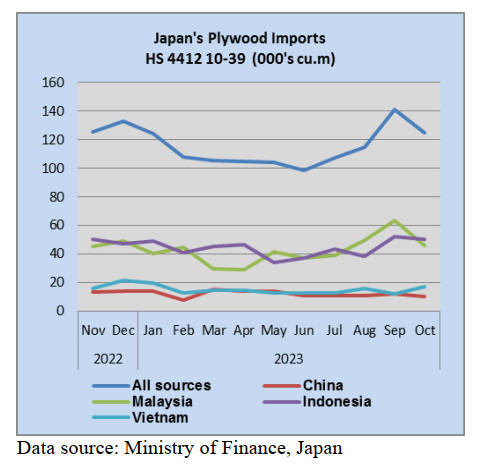

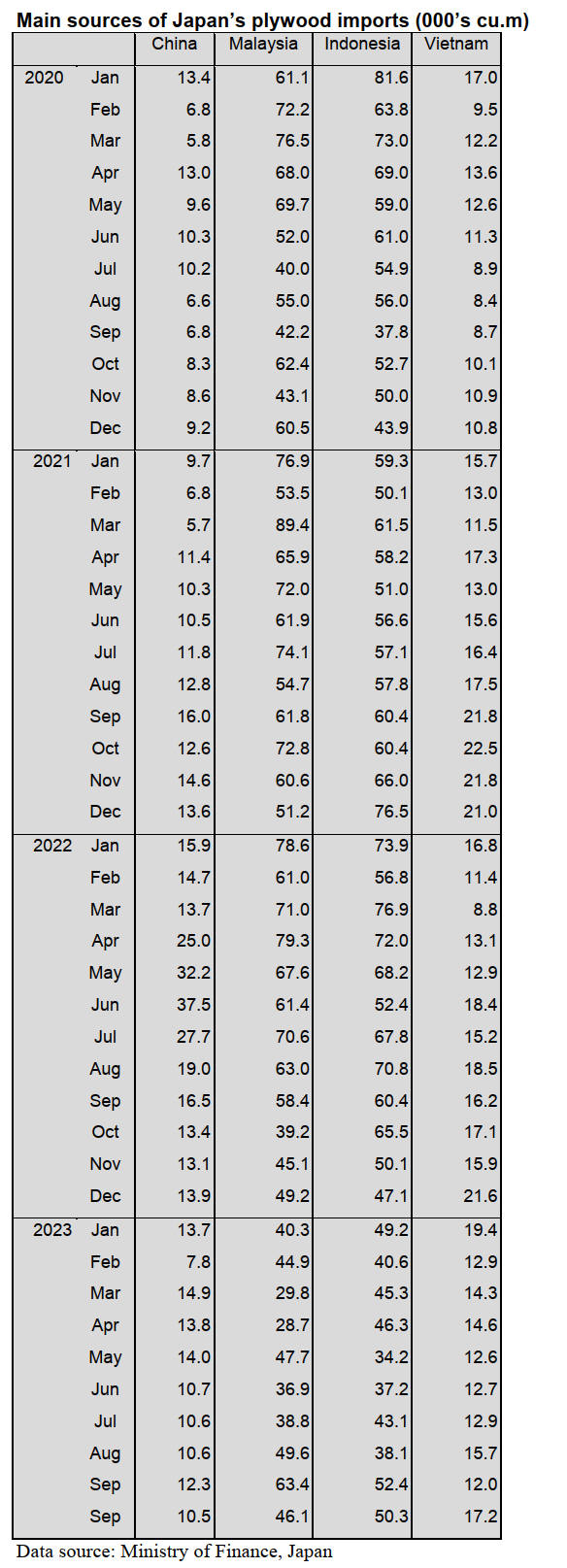

Plywood imports

After two months of expansion there was a correction in

the volume of plywood imports by Japan. The volume of

October imports stood at 124,969 cu.m, down around 11%

month on month and down 9% year on year.

Despite the October dip in imports in the 10 months to

October 2023 plywood imports rose almost 50% from the

same period in 2022.

Imports from China rose over 80% in 2023 from a year

earlier, the volume of imports from the top two suppliers,

Indonesia and Malaysia, were up over 50% in the first 10

months of 2023 compared to the same period in 2022,

however, the volume of plywood shipped to Japan from

Vietnam in the first 10 months of 2023 was little changed

from a year earlier.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Supplementary budget of fiscal year 2023

The Ministry of Agriculture, Forestry and Fisheries

announced the supplementary budget of fiscal year 2023.

140.1 billion yen will be included in the budget.

The total budges is 818.2 billion yen to eliminate

dependency on imports, to mitigate an influence of high

prices of commodities, to enforce policies for TPP, and for

disaster prevention, disaster risk reduction and national

resilience.

45.8 billion yen will be used for strengthening in

international competitive power at forestry and wood

industries and for expand demand in Japan. For details,

strengthening in production base of forestry and wood

industries, promoting digitalization and innovation in

forestry industry, supplying more structural lumber, using

more structural lumber, increasing demand and supply for

lumber and export.

6 billion yen will be used for preventing hey-fever. Cedar

artificial forests will be reduced by 20 % in 10 years later.

33.2 billion yen is added to recovery and reconstruction

from the heavy rain disaster occurred during May to July,

2023. 26.8 billion yen is added to avoid the damages of

driftwood, debris flows and hillside collapses from the

earthquakes or heavy rains. 17.2 billion yen is required for

thinning, reforestation, establishment or improvement of

mainlines and infrastructure facilities.

There will be a support of energy saving on production

facilities for mushroom producers because the price of fuel

oil and raw materials has increased. Also, there will be a

support for producing wooden biomass fuels. 2 billion yen

will be added to the supports. Another support is 100

million yen for securing next generation in forest industry

and preventing damages from wild animals.

The Ministry of Land, Infrastructure, Transport and

Tourism also announced the supplementary budget of

fiscal year 2023. 210 billion yen will be included in the

budget for supporting energy saving houses. The total

national expense is 2.5 trillion yen.

The five aims are below.

To protect people from high prices of

commodities.

To raise salaries in regional towns and small and

medium-sized businesses.

To promote people to invest in Japan

To stop population decline and promote social

change

To ensure peace and safety from disaster

prevention and disaster mitigation by national

resilience

The total budget for energy-saving houses is

421.5 billion yen from The Ministry of Land,

Infrastructure, Transport and Tourism (MLIT),

The Ministry of Economy, Trade and Industry

(METI) and The Ministry of the Environment

(MOE).

There will be support for remodeling houses to be

energy-

saving. 210 billion yen is from MLIT. 135 billion yen is

from MOE for high thermal insulation windows. 58 billion

yen is from for high performance water heaters and

18.5billion yen is for remodeling existing rental

apartments to be energy-saving rental apartments from

METI.

Log markets in Fukushima Prefecture

The price of cedar logs for posts and cypress logs for sills

have skyrocketed in the middle of September and the

prices are still high because there have been less logs. The

log markets were held in Octobe and November but there

were not a lot of logs as usual and the log price were very

high.

In the beginning of November, the price of 3m cedar log

was around 17,000 yen, delivered per cbm and it is 3,000

yen more than the previous month. The highest price was

18,000 yen, delivered per cbm.

Once, the price of cedar log was under 10,000 yen,

delivered per cbm, during the rainy season to the summer

season. Therefore, loggers reduced cutting down the trees

and some of them changed their businesses to cut down

trees for wooden biomass fuels or to cut down trees

around steel towers or forests for solar power plants by

contract. As a result, the cedar logs for posts started to rise

after the holiday in the middle of August. There was also

influence of damage by the typhoons in September and

volume of logs decreased at the markets.

The price of 3 m cedar log for posts rose to 10,000 yen,

delivered per cbm at the end of August and then the price

rose by over 2,000 yen every month after August. The

price of 4 m cedar log also rose to 10,000 yen, delivered

per cbm in the middle of September. Then, the price was

12,000 – 13,000 yen, delivered per cbm at the end of

September.

November, the price kept rising to 13,000 – 14,000 yen,

delivered per cbm. The price with good quality cost

15,000-16,000 yen, delivered per cbm. The price of 2 m

cedar log with low quality had been around 7,000 yen,

delivered per cbm until the beginning of October and the

price rose to 9,000 yen, delivered per cbm in November.

There were a lot of inquiries for cypress lumber as

substitution of Doulgas fir lumber. The price of 4 m

cypress logs for sills rose to 20,000 yen, delivered per cbm

the end of September from 15,000 – 16,000 yen,

delivered per cbm, during the rainy season to the summer

season.

The price rose again in October and it was 24,000 yen,

delivered per cbm. The highest price of 4 m cypress logs

for sills is 29,000 yen, delivered per cbm and of medium

sized cypress logs for sills is 27,000 – 28,000 yen,

delivered per cbm. Also, the price of 3 m cypress logs rose

to 22,000 – 24,000 yen, delivered per cbm in November.

Domestic lumber and logs

The log price recovered and lumber is in short supply so

supply and demand is balanced. There had been less logs

until summer through the nation but the volume of logs

started to increase in autumn, when the demand for lumber

is the peak season, and there was a huge log and lumber

market held in some areas. Actual demand for cedar and

cypress logs increased because there are not enough

Douglas fir lumber. Inquiries for logs rise because it is the

season for cutting down the trees.

In Kyushu region, the price of cypress logs recovered

suddenly because there were not enough logs due to the

torrential rains in summer. 4 m cypress for sills in

Kumamoto Prefecture is around 26,000 yen, delivered per

cbm.

In Chugoku region, once the price of cypress log was

under 20,000 yen in summer but the price recovered in

autumn because there were a lot of inquiries. Consumers

in Okayama Prefecture started to buy cypress logs instead

of Douglas fir logs and the price of cypress logs

skyrocketed to 47,000 yen at the beginning of October.

Now, the price of cypress log is settled down to around

25,000 – 27,000 yen.

4 m cypress log for sills in the northern part of Kanto

region is around 30,000 yen in November. 3 m cedar log

for posts is around 20,000 yen.

There are not enough logs in the northern part of Kanto

region and the price of cedar and cypress lumber has been

bullish. KD 3 m x 105 mm cedar post is around 65,000

yen, delivered per cbm. KD 3 m x 30 x 105 mm cedar stud

rose to 65,000 yen and this is 5,000 yen higher than the

previous month. Cypress sill is 85,000 yen. 4 m x 45 mm

cypress taruki is around 90,000 yen.

Plywood

The price of 12 mm 3 x 6 domestic and structural plywood

has been decreasing slightly. Some plywood

manufacturers started to reduce the price before the

autumn because of sluggish demand and some distributors

started to reduce the price because it was the accounting

period. 12 mm 3 x 6 structural plywood was 1,450 – 1,500

yen, delivered to wholesalers per sheet.

The price decreased by over 50 yen, delivered to

wholesalers, per sheet. 24 mm plywood is 3,100 yen,

delivered to wholesalers per sheet and 28 mm plywood is

3,650 yen, delivered to wholesalers per sheet. These prices

are 100 yen, delivered to wholesalers per sheet, lower than

the previous month.

For imported plywood, the yen was 150 yen against

the

US dollar in November but the price of softwood plywood

is weak so it is difficult to raise the price. 2.5 mm plywood

is 780 yen, delivered to wholesalers per sheet. 4 mm

plywood is 1,000 yen, delivered to wholesalers per sheet.

5.5 mm plywood is 1,200 yen, delivered to wholesalers

per sheet. Structural plywood is 1,800 yen, delivered to

wholesalers per sheet. 12 mm3 x 6 form plywood is 1,990

–2,000 yen, delivered to wholesalers per sheet. At some

wholesalers, the price of 12 mm 3 x 6 form plywood is

around 1,950 yen.

For South Sea plywood, South Asian exporters announced

about its price hike and there is no contracts signed yet.

Inventory of South Sea plywood in Japan is decreasing but

there are not many orders for South Sea plywood from

Japan. In South Asia, 2.4 mm 3.x 6 is US$950, delivered

per sheet. 3.7 mm is US$880, delivered per sheet. 5.2 mm

is US$850, delivered per sheet. 12 mm 3 x 6 painted

plywood for concrete form is US$670 – 680, delivered per

sheet. Plywood form is US$580, delivered per sheet.

Structural plywood is US$560 – 570, delivered per sheet.

Wood biomass in Japan

It has been twelve years since the FIT (Feed-in Tariff) of

renewable energy enforced. Wood biomass power

generation business has some issues which were

unpredicted at that time. The issues are the high prices of

commodities, difficulties in collecting woody fuels and

intensified competition of wood biomass power generation

business.

According to the survey, which Japan Woody Bioenergy

Association held to the members, about 40 % of woody

power generators struggle to operate the wood biomass

power plants as they scheduled. About 17 % of the woody

power generators answered that difficulties in collecting

woody fuels and high-priced woody fuels are the reasons

for not operating the wood biomass power plants

smoothly. The latest issue is a short supply of unused and

domestic logs with low quality.

Since demand for domestic lumber and plywood plunged

this year, supply and demand for domestic logs with high

quality became very low and this situation influenced the

domestic logs with low quality. The price of unused and

domestic logs for fuels in Eastern Japan is 6,000 – 7,000

yen, delivered per ton and the price in Western Japan is

7,000 – 8,000 yen, delivered per ton.

There is a short supply of unused and domestic logs in

some areas because there have been built and permitted

many woody biomass power plant with its output 2,000

kW.

The price of unused chip in Eastern Japan is 9 – 11 yen,

delivered to silos per kilo and the price in Western Japan is

10.5 – 12 yen, delivered to biomass power plants per kilo.

Hokkaido Prefecture - Demand and supply for chips is

not a problem so far because the procurement network is

good. The price of larch logs for papermaking and chips is

16.2 yen, delivered to silos per kilo. The price of Sakhalin

fir logs for chips is 16 yen, delivered to silos per kilo.

Tohoku region - Demand for lumber and plywood

decreased and there are less logs for woody biomass fuels.

The price of unused logs is 6,000 – 7,000 yen, delivered to

chip plants per ton.

Kanto region - The price of unused logs is 6,000 – 7,000

yen, delivered to chip plants per ton with barks. The price

of chips for wood biomass power plants is 9 yen, delivered

to silos per kilo.

Chubu region - The log price for buildings is low and it is

difficult to collect logs. The price of unused logs for wood

biomass power plants is over 10,000 yen, per ton in some

areas in Chubu region but demand for logs for plywood is

now settled down so there is not an extremely short

supply.

Chugoku region - A short supply of fuels for biomass

power plants influences the price of raw materials to rise.

The price of raw materials for fuels in Okayama Prefecture

used to be 5,500 – 6000 yen, delivered to chip plants per

ton. The price in Hyogo Prefecture is 8,500 – 9,000 yen,

delivered to chip plants. The price of unused logs for pulps

without proof in the northern part of Okayama Prefecture

is 8,000 – 8,500 yen, delivered per cbm.

Kyushu region - The price unused raw materials for fuels

in the northern part of Kyushu region is 8,500 yen,

delivered to chip plants per ton and the price in the

southern part of Kyushu region is 8,500 – 9,000 yen,

delivered to chip plants per ton. The price of unused logs

for export is 10,000 – 11,000 yen, delivered to ports per

cbm. The logs for papermaking cost 8,000 yen, delivered

to chip plants per cbm.

|