|

1.

CENTRAL AND WEST AFRICA

Downturn in major markets of concern

As the year comes to a close the timber industries in the

region face a challenging landscape with notable

developments in various markets. For China, the

Philippines and Middle East countries producers describe

the prospects as disastrous as these key markets are

showing a significant demand downturn with purchases

limited to only particular species and specific sizes

negotiated contract by contract.

Heavy rain taking a toll on production

In the region heavy rain has taken a toll on production

especially in Central African countries but hopes are

rising for better conditions as the dry season should arrive

in Cameroon and North Congo by mid to end December.

In Gabon producers say they have experienced a

disappointing two months with demand for okoume being

very quiet and this has impacted peeler mills in special

economic zones.

The new government in Gabon is implementing significant

reforms in the Special Economic Zone of NKOK to

address issues such as irregular social security payments,

low salaries and concerns on overtime. The military

presence at NKOK has contributed to an improvement in

labour discipline say producers.

Over the past month there were no changes or additions to

government regulations. The private sector hopes the issue

of so called ‘mission fees’ will be examined as part of the

new Minister’s review of the sector workforce structure

and operations, The outcome of this review is expected to

be made available by the end of December or early

January 2024. The industry is bracing for potential

surprises, suspecting irregularities and discrepancies

within the system may be exposed.

President meets Gabon forestry sector stakeholders

The Gabon Review has reported on a meeting of

stakeholders in the forestry sector with the President of the

Transitional government, Brice Clotaire Oligui Nguema.

It is reported that the meeting provided an opportunity for

the President to learn of the constraints and opportunities

faced by the forestry sector and envisage an attractive and

better regulated business climate and environment for

busineses. It was reported that excluding hydrocarbons,

the forestry sector contributes around 60% of GDP and

supports an estimated 20,000 direct and 14,000 indirect

jobs.

According to a Presidential Communication reported in

the domestic media 3.4 million cubic metres of wood are

processed in Gabon each year and the Communication

recognised that the sector is experiencing weakness in

internal and international markets and many challenges in

production such as rising fuel costs, problems with VAT

reimbursement and challenging infrastructure, especially

concerning road and rail transport.

The President and the Forestry Minister committed to a

revitalisation of the forestry sector and indicated that all

ministries which deal with the forestry and infrastructure

sectors must pool their efforts and work together to

address the constraints facing the private sector. The

Minister is reported as saying “the observation is that

forestry operators are having difficulty adopting industrial

approaches that guarantee dynamic and sustainable

exploitation of the resource hence the need for the

Gabonese authorities to support companies to improve

their competitiveness”.

See:

https://www.gabonreview.com/gabon-le-secteur-foret-bois-au-revelateur-doligui-nguema/

Cameroon update

Even at this early date there is considerable speculation in

Cameroon on the 2025 presidential elections and how a

change may impact the forestry sector. Producers in

Cameroon face many challenges especially the heavy

persistent rains which have led to a significant slowdown

in harvesting activities.

The overall situation remains unchanged from the last

report with approximately 30% of operators and mills

being affected by adverse weather. However, there is

optimism that the rains will subside as the dry season is

expected to begin at the end of December and will likely

last for 5-6 months.

Road conditions for transporting timber from forests to

mills and log depots have not improved since the last

report. Rail operations remain stable ensuring the

continued transportation of wood products. Container

availability in Cameroon is reported to be adequate with

no reports of disruptions in stuffing operations. Douala

and Kribi ports said to be operating normally. Reports

suggest log stocks in Kribi remain low.

The domestic media in Cameroon continue to focus on

political news with no significant updates on trade,

manufacturing or the economy.

EUTR expert group briefed on Gabon

The ATIBT published two articles in September and

October on Gabon's timber imports and the EUTR the first

following a meeting of the European Commission, the

other following exchanges between the ATIBT and the

Commission's Directorate-General for the Environment.

As a follow-up the ATIBT was invited to present Gabon's

situation at a meeting of the EUTR expert group in late

November.

See:

https://www.atibt.org/en/news/13421/gabon-the-latest-news-in-the-timber-sector

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

See:

https://www.itto-ggsc.org/static/upload/file/20231215/1702603888131489.pdf

2.

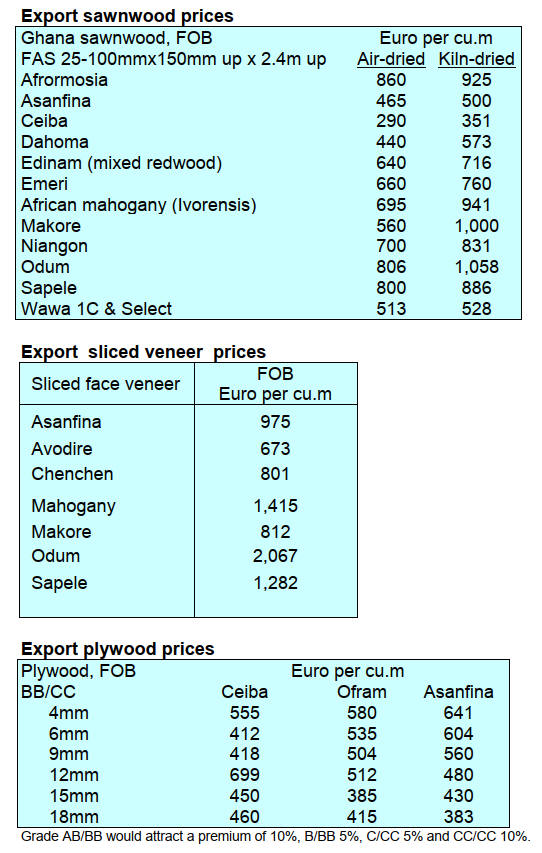

GHANA

Tertiary wood product exports decline in three

consecutive quarters

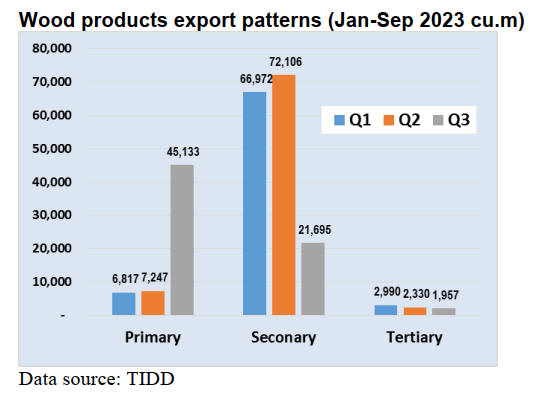

Data on the country’s quarterly wood product exports

published by the Timber Industry Development Division

(TIDD) showed that export volumes of tertiary wood

product (TWP) comprising dowels and mouldings

declined in the first three quarters of 2023 while export

volumes of primary and secondary product exhibited

mixed trends.

Kiln dry sawnwood, plywood, sliced and rotary veneers,

briquettes, kiln dry boules maded up the bulk of the

country’s wood product exports and generated the highest

volumes in each of the three quarters of 2023. The

volumes recorded for first quarter, second quarter and

third quarter were 66,972cu.m, 72,106cu.m and

21,695cu.m.

Primary Products, mainly billets and teak logs, also

recorded moderate export volume increases i.e. from

6,817cu.m in the first quarter to 7,247cu.m in the second

quarter.

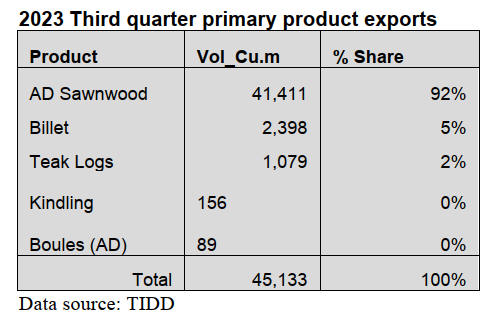

However, export volumes in the third quarter spiked to

45,133cu.m. due to new directives from the Grading and

Inspection Department of the TIDD on data capture in

which air-dried products were recorded as primary

products and kiln-dried products as secondary products.

Following the new directive air dry sawnwood accounted

for over 90% of total primary products exported in the

third quarter with four other products accounting for only

8%, shown below;

Tertiary wood products (mouldings and dowels)

contributed Eur1.58million from a volume of 1,957cu.m to

total wood products exports in the third quarter of 2023.

The figures represent decreases of 16% and 25% in value

and volume respectively compared to the contribution of

Eur1.87million and 2,600cu.m in the third quarter of 2022.

Ghana signs Emission Reduction Agreement at

COP 28

The Forestry Commission, under the auspices of the

Ministry of Lands and Natural Resources, has signed an

Emission Reductions Payment Agreement (ERPA) with

Emergent Forest Finance Accelerator Incorporated

(Emergent), a US-based non-profit organisation that serves

as the convener and coordinator of the Lowering

Emissions by Accelerating Forest Finance (LEAF)

Coalition.

Through the Agreement Ghana will receive up to Fifty

Million US Dollars (US$50 million) for emission

reductions of up to five million tonnes of carbon dioxide

equivalent at a unit price of ten Dollars (US$10.00) per

tonne of carbon dioxide equivalent.

The Agreement was signed on the sidelines of the twenty-

eighth session of the Conference of Parties (COP28) of the

United Nations Framework Convention on Climate

Change (UNFCCC). This made Ghana the first country in

the world, to sign an ERPA under the LEAF Coalition for

the supply of high-integrity jurisdictional REDD+

emission reductions and removals credit.

According to Abu Jinapor, Sector Minister in the Ministry

of Lands and Natural Resources (MLNR) the new

agreement complements other interventions by

government to address climate change such as the flagship

Green Ghana Project, the Ghana Forest Plantation Strategy

and the Ghana REDD+ Strategy.

See:

https://fcghana.org/ghana-signs-us50m-emission-reduction-payment-agreement-under-leaf-coalition/

Forest industries pool resources to optimise

operations

Some private business associations operating under the

Forest Industries Association of Ghana (FIAG) have

formed a united front to address common challenges while

pursuing a sustainable operational model.

According to Richard Nsenkyire, President of the

Association, the priority areas include “ensuring

sustainability by promoting adoption of circular and green

economic principles in their business practices.” He cited

examples where some processing companies are retooling

to be able to use more of their residues while others are

supplying their residues to other companies for further

processing”.

Mr. Nsenkyire indicated the goal of FIAG was to enhance

corporate performance, have a common voice on concerns

and forge a strong entity to continue contributing to the

socio-economic development of Ghana’s forest processing

sector.

FIAG is an umbrella body of players in the timber and

wood related business in the country from 10 timber trade

associations which collectively employ over 300,000 in

the areas of plantation development, logging, milling,

manufacturing, haulage and equipment services, sales and

marketing.

See:

https://www.myjoyonline.com/forest-industries-in-ghana-build-synergies-for-green-sustainable-future/

US$200 million for tree crop diversification

Parliament has approved a US$200 million loan agreement

with the World Bank for the financing the Ghana Tree

Crop Diversification Project (GTCDP) whicjh expected to

boost production and add value to six strategic tree crops.

The Chairman of the Finance Committee, Kwaku

Kwarteng, said the GTCDP would help improve the

economic, climate and social resilience in the productivity

and value addition of the strategic tree crops. He

mentioned cocoa, cashew, shea, mango, coconut, rubber

and oil palm; would be grown in 11 selected districts

across five regions being Western North, Eastern,

Savannah, Bono and Bono East regions.

See:

https://www.graphic.com.gh/news/general-news/ghana-news-parliament-approves-3-loan-agreements.html

Farmers call for reforms in off-reserve timber

resources

Cocoa farmers in the North Western Region of the country

have called on government and industry stakeholders to

initiate steps to amend the Concession Act 1962 (Act 124)

to ensure farmers earn reasonable benefits from the

commercialisation of off-reserve timber resources.

Farmers complain the existing tree tenure and benefit

sharing arrangements for off-reserve timber resources

under Act 124 is unfavourable to farmers.

Tropenbos Ghana a non-governmental organisation has,

on behalf of the farmers, called on the Forestry

Commission of Ghana to take steps to revisit the

Concession Act 1962 (Act 124) which gives the state full

authourity over all naturally occurring trees to the

disadvantage of farmers havmg commercial timber trees

on their land.

According to the Project Manager of Tropenbos Ghana,

Boakye Twumasi Ankra, the Act took away tree

ownership rights from farmers which discourages them

managing these trees as a resource.

See:

https://gna.org.gh/2023/12/cocoa-farmers-in-western-north-call-for-reforms-in-off-reserve-timber-resources/

3. MALAYSIA

Drivers of GDP growth in 2024

Malaysia’s GDP growth is expected to improve to 4.7% in

2024 supported by a recovery in external trade and

sustained growth in domestic demand. Positive job market

conditions, income growth and continued recovery in the

tourism sector would also support the economy. Inflation

is forecast to be above 3% next year being moderated by

fuel subsidies.

A recovery in China and supportive global commodity

prices are expected to boost Malaysia’s export earnings in

2024. The domestic economy is expected to be anchored

by continuous steady consumer spending, busier tourism-

related activities and investment in infrastructure.

See:

https://www.thestar.com.my/business/business-news/2023/12/07/midf-research-expects-malaysia039s-gdp-growth-to-improve-to-47-in-2024

Support for more investment in biomass sector

The Plantation and Commodities Minister, Fadillah Yusof,

recently launched the National Biomass Action Plan 2023-

2030 (NBAP2030) to support increased investments in the

biomass industry aimed at creating around 3,000 jobs. The

Action Plan was developed based on the National Agro-

commodity Policy (NAP) 2021-2030 and is aimed at

boosting the biomass sector.

The Action Plan also calls for establishing biomass hubs to

carry out centralised and systematic collection of biomass

raw materials to drive the national biomass supply chain

systematically and efficiently.

See:

https://www.thestar.com.my/news/nation/2023/12/07/malaysia-can-save-rm7bil-by-using-biomass-pellets-as-energy-source-says-dpm-fadillah

New scheme to raise wages

The government is introducing a programme to raise

wages for more than 1 million low-income workers as the

country grapples with rising living costs and growing

inequality.

The scheme, which targets the small and midsize

businesses that account for the vast majority of Malaysia's

workforce, will be implemented in stages and is meant to

complement the existing minimum wage policy.

See:

https://asia.nikkei.com/Economy/Malaysia-plans-new-wage-scheme-for-low-income-workers?utm_campaign=IC_asia_daily_free&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link

Chairman of STA speaks on challenges in timber

supply chains

In the recent Global Legal & Sustainability Timber Forum

2023 held in Macau a presentation was made by Henry

Lau, Chairman of the Sarawak Timber Association (STA)

addressing ‘Challenges and difficulties on international

cooperation in timber supply chains’. He listed the

following concerns:

a) Timber players labelled as culprits. “Timber industry

players are frequently labelled, described and perceived as

culprits solely driven by economic gain and often

neglecting broader concerns. In reality, when illegal

activities take place there is a tendency to assume that

operators from timber industry are involved prioritising

economic gain over the well being of forests and the

environment”.

b) Where can responsible timber players find help? “For

those who are committed to carrying out their timber

activities with an emphasis on delivering economic values

while equally maintaining social and environmental well-

being and good governance where can they find help and

assistance? In fact, many view the cessation of forest

harvesting for economic gain as absurd saying failing to

realise that if the forests have no economic value they are

vulnerable to conversion for other uses”.

c) Uncertainties in tenure security. “Apart from being

consistently placed in the front line by almost everyone

else timber players are also facing uncertainties in tenure

security. Timber players require long and secure tenure to

implement sustainable forest management in line with the

17 Sustainable Development Goals (SDG) of the United

Nations.

However, Lau asserted that most of the timber players

throughout Malaysia and Sarawak in particular, are facing

insecurity of tenure. What is the effect of these

uncertainties? It was proposed that all stakeholders should

incorporate this issue and remove this constraint to

achieve economic, social and environmental goals”.

d) Complexities and disparities in consumer country

legislation. “Another challenge faced is that of ensuring

compliance with various timber legislation enforced by

consumer countries as well as gaining market recognition

for the efforts undertaken by producing countries. The

timber legislation can be highly complex and differs

significantly from one country to another. Inconsistent

definitions, regulations and requirements can create trade

barriers and confusion in international cooperation

efforts”.

e) EUDR. “This regulation poses a significant challenge

for tropical timber-producing countries because they still

need to develop their economies. This situation could lead

to a vicious cycle where market share is lost, producers

experience reduced incomes potentially increasing poverty

which in turn may contribute to an increase in

deforestation through forest clearing as a means of

survival”.

f) Timber products a more sustainable material. “The rise

of alternative materials like plastics, steel, aluminium,

composites and engineered wood products has made them

an increasingly popular choice for consumers. This poses a

threat to the timber industry as it could reduce the demand

for wood products. More efforts are required to promote

the utilisation of wood as a sustainable materials in

alignment with the concept of a circular bio-economy”.

See:

https://sta.org.my/images/Forumpaper21112023FINAL.pdf

Undersanding forest ecosystem functions to promote

SFM

The Sarawak Forest Department and the National Institute

for Environmental Studies (NIES) in Japan have signed a

memorandum of understanding on collaboration in

research activities for sustainable forest management. The

focus will be on developing an effective methodology for

the evaluation and implementation of essential forest

ecosystem functions and services to promote SFM and

conservation as outlined in the global biodiversity

frameworks under United Nations.

Other areas of cooperation covered under the MoU include

collaboration in forest ecosystem and biodiversity

conservation, establishing a standard research

methodology for Permanent Sample Plot networks and

joint publication of findings together with workshops,

conferences and training.

See:

https://theborneopost.pressreader.com/article/281904482942186

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia

See:

https://www.itto-ggsc.org/static/upload/file/20231215/1702603888131489.pdf

4.

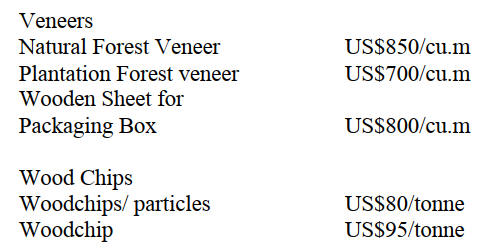

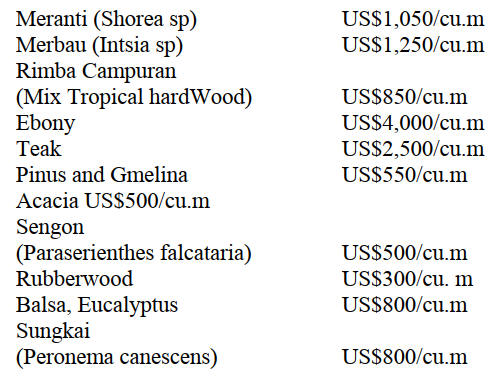

INDONESIA

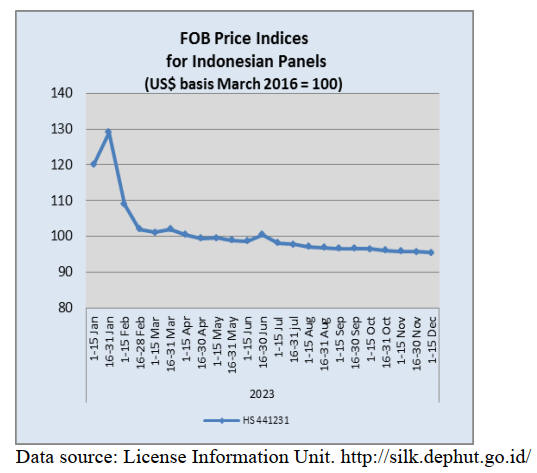

Export Benchmark Prices

December 2023

The following is a list of benchmark prices for December

2023.

Processed Wood

Processed wood products which are leveled on all four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 1000 sq.mm to

4000sq. mm (ex 4407.11.00 to ex 4407.99.90)

Processed wood products which are leveled on all

four

sides so that the surface becomes even and smooth with

the provisions of a cross-sectional area of 4000 sq.mm to

10000 sq.mm (ex 4407.11.00 to ex 4407.99.90)

See:

https://jdih.kemendag.go.id/pdf/Regulasi/2023/Kepmendag%20Nomor%201964%20Tahun%202023.pdf

Healthy domestic economy to spur greater plywood

consumption

The Indonesian Wood Panel Association (Apkindo)

believes that 2024 will see a favorable domestic market

situation that will further drive demand for plywood. This

message was from Bambang Soepijanto after being re-

elected as the General Chair of Apkindo for the 2023-2028

term at the 9th Apkindo National Conference.

In his message he highlighted the domestic market

opportunities saying the latest data shows that investment

in various sectors grew to IDR1,207 trillion which will

drive up domestic demand for plywood. In addition to

private investment the central and regional authorities will

invest in the development of the Indonesian Capital City

(IKN) and this is expected to boost demand for plywood.

Earlier, Bambang mentioned that the national plywood

industry has been impacted by significant challenges such

as the COVID-19 pandemic, a sharp rise in shipping costs,

the US-China trade dispute, and the Russia-Ukraine war

which triggered a global economic downturn. However,

despite headwinds, the plywood industry has survived in

the face of the downturn in exports which was first

observed from the second half of 2022.

See:

https://agroindonesia.co.id/apkindo-industri-kehutanan-masih-bisa-diandalkan/

In related news, at opening of the 9th National Conference

of the Indonesian Wood Panel Association the Minister of

Environment and Forestry, Siti Nurbaya, conveyed a

message that the wood panel industry should not be overly

concerned on the EUDR as the regulation acknowledges

the Indonesian SVLK for wood products as indicated in

paragraph 81 of the EUDR where wood products are

required to meet 8 criteria. However, it will be necessary

to provide geo-location coordinates.

See:

https://agroindonesia.co.id/eudr-akui-keberadaan-svlk/

COP28 commitment to achieving NZE target sooner

than 2060

President Joko Widodo reiterated Indonesia's firm

commitment to achieve the net-zero emissions (NZE)

target sooner than 2060 for the sake of realising an

inclusive economy and emerging as a prosperous and

sustainable country.

According to a press statement the president made this

statement in his speech at the Conference of the Parties 28

(COP28) in Dubai.

He noted that Indonesia has been consistent in reducing

carbon emissions by improving the management of the

land and forests and expediting the clean energy transition.

The President emphasised that Indonesia is successfully

reducing the rate of deforestation.

See:https://en.antaranews.com/news/300021/cop28-indonesia-committed-to-achieving-nze-target-sooner-than-2060

During the negotiations at COP28 Indonesia reaffirmed its

efforts to cooperate with Brazil and the Democratic

Republic of Congo through trilateral understanding

reached during the COP26. The cooperation aims to

strengthen the influence of the world's three largest

tropical forest owners in climate negotiations, including

promoting results-based funding for emissions reduction

from deforestation and forest degradation plus (REDD+).

See:https://www.kompas.id/baca/english/2023/12/02/en-bersama-brasil-dan-kongo-indonesia-tegaskan-lagi-penurunan-emisi-di-sektor-kehutanan

and

https://www.msn.com/id-id/ekonomi/ekonomi/indonesia-brasil-dan-kongo-perkuat-pengelolaan-hutan-tropis/ar-AA1kRW5R

Indonesia, a role model for community-based

climate

resilience

At the 10th Facilitative Working Group - Local

Communities and Indigenous People Platform Road,

Pirawan Wongnithisathaporn, from the Asia Indigenous

Peoples Pact Foundation in Thailand said Indonesia’s

efforts on community-based climate resilience is a world

role model especially for indigenous communities.

Indonesia was represented by Bambang Supriyanto,

Director General of Social Forestry and Environmental

Partnerships who spoke on the development and

recognition of indigenous peoples under the Social

Forestry programme as well as through multi-party

collaboration in empowerment efforts based on local

wisdom for forest sustainability and alternative

livelihoods.

In addition, Bambang reported that the Indonesian

government also collaborates with international

institutions through the Forest Programme project in

Sanggau, West Kalimantan and the Social Forestry

Strengthening Project in four provinces in order to

increase multi-stakeholder assistance activities such as:

increasing and strengthening of livelihoods as well as

improving sustainable forest management.

See:

https://www.menlhk.go.id/news/indonesia-menjadi-role-model-ketahanan-iklim-berbasis-masyarakat/

Opportunities in production of wood pellets for

renewable energy

Several companies are considering the commercial

potential in the wood pellet industry. This sector is

expected to grow due to the global movement toward

renewable energy sources and in Indonesia several

companies are investing in wood pellet factories. For

example PT Indika Energy Tbk (INDY) is allocating

US$21 million for its factory project this year.

The factory is expected to be operational by year end with

a production capacity of 10 tonnes per hour. Also, PT

Maharaksa Biru Energi Tbk (OASA) is developing

renewable energy projects by constructing biomass-based

factories in Bangka, Blora, and Banten.

Another company, PT Sumber Global Energy Tbk

(SGER) has diversified its business by selling processed

wood pellets to the energy industry. In other news, PT

Mitra Biomass International, a joint venture company

between PT Mitra Investindo Tbk, PT Pima Aset Lestari

and Interra Resorts Limited are also in the wood pellet

business.

See:

https://industri.kontan.co.id/news/menilik-potensi-cuan-bisnis-wood-pellet-untuk-energi-terbarukan

Ministry aims to achieve 8 million hectares of social

forestry by 2024

The Ministry of Environment and Forestry (KLHK) is

optimistic that it can realise 8 million hectares of social

forestry approvals by 2024. Bambang Supriyanto, the

Director General of Social Forestry and Environmental

Partnerships at the Ministry of Environment and Forestry,

stated that as of September 2023, social forestry approvals

have been granted for 6.3 million hectares, approximately

half of the 12.7 million hectare target.

Bambang explained that social forestry, a national

strategic project, had been progressing slowly due to a

35% budget cut during the three-year COVID-19

pandemic.

See:

https://www.antaranews.com/berita/3835443/klhk-optimistis-selesaikan-8-juta-hektare-perhutanan-sosial-pada-2024

Rehabilitation of 600,000 hectares of mangrove forest

The Indonesian government has set a target to restore

600,000 hectares of mangrove forest by the end of 2024.

The Ministry of Environment and Forestry (KLHK) is

requesting support and involvement from organisations,

institutions, ministries and local communities to achieve

this goal. The Director of Inland Water and Mangrove

Rehabilitation at the Ministry of Environment and

Forestry, Inge Retnowati, said that this target is contained

in Presidential Regulation (Perpres) Number 120 of 2020

concerning the Peat and Mangrove Restoration Agency

(BRGM).

The Decree aims to accelerate implementation of

mangrove rehabilitation in North Sumatra, Riau, Riau

Islands, Bangka Belitung, West Kalimantan, East

Kalimantan, North Kalimantan, Papua and West Papua.

See:

https://lestari.kompas.com/read/2023/11/23/110000686/indonesia-targetkan-rehabilitasi-600.000-hektare-lahan-mangrove?page=1

Diversifying export markets

The government is encouraging companies to target new

markets such as India, ASEAN, Africa and Latin America

to boost export growth. Trade Minister, Zulkifli Hasan,

explained that a task force on this issue has been

established. Hasan explained that the task force is also

responsible for accelerating the completion of negotiations

on comprehensive economic partnership agreements,

especially the Indonesia-European Union Economic

Partnership.

See:

https://en.antaranews.com/news/299637/govt-encourages-exports-to-new-destinations-to-boost-export-growth

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

5.

MYANMAR

Certification body seeks assistance in accreditation

A recent post on the Myanmar Forest Certification

Committee (MFCC) website mentions cooperation

between MFCC and counterparts in Vietnam to address

issues of accreditation of the certification bodies who are

notified by MFCC.

The post mentions that “in a significant step towards

promoting sustainable forest practices and gaining

international recognition for national certification bodies,

MFCC joined a study tour to Vietnam with the Myanmar

Accreditation Body (MAB) and the Certification Bodies

(CB) notified by MFCC.

The post adds that the MFCC sought assistance from the

Vietnam Bureau of Accreditation (BoA) after the MFCC

had tried unsuccessfully to cooperate with SAC

(Singapore Accreditation Council ) for a Joint-Assessment

between Myanmar Accreditation Body and SAC for the

Accreditation to Myanmar certification bodies.

Since the Myanmar Accreditation Body is not a member

of any International Accreditation Forum, it alone cannot

accredit CBs in Myanmar. Against this background the

Myanmar Accreditation Body had to consider cooperating

with another National Accreditation Body for a joint-

assessment of the Myanmar’s CBs.

It is understood that in, the absence of international

accreditation, Myanmar CBs were not recognised in

international markets and the Myanmar conformity

assessment reports on the legality of Myanmar Forest

Products were viewed as unverifiable.

The cooperation with Vietnam was carried out under an

ITTO-MFCC Project and the joint-assessment process was

outlined between Myanmar and Vietnam which, it is

hoped, will lead to the international recognition of

Myanmar Certification Bodies.

See:

https://myanmarforestcertification.org/strengthening-sustainable-forest-management-a-collaboration-journey-of-mfcc-in-vietnam-together-with-myanmar-accreditation-bodymab-and-certification-bodies-cbs/

World Bank - 1% growth forecast

In a 12 December press release on the World Bank’s semi-

annual Myanmar Economic Monitor the Bank says little

economic growth is expected in Myanmar in the near

term, as rising conflict, trade and logistics disruptions,

kyat volatility and high inflation combine to negatively

impact businesses and households.

The release continues “Myanmar’s economy is projected

to grow by just 1% over the year to March 2024,

according to the report ‘Challenges amid conflict’ conflict

has escalated across much of Myanmar since October,

leading to the displacement of an estimated half a million

people, disrupting key overland trade routes and

increasing logistics costs.

Even if conflict does not escalate further, growth is

expected to remain subdued over the rest of 2024 and into

2025 given a broad-based slowdown across productive

sectors including agriculture, manufacturing, and trade.

The size of Myanmar’s economy remains around 10%

lower than it was in 2019, leaving it the only economy in

East Asia that has not returned to pre-pandemic levels of

economic activity.”

The press release adds,” indicators of business activity

have worsened since mid-2023. Firms reported operating

at just 56% of their capacity in September.”

See:

https://www.worldbank.org/en/news/press-release/2023/12/12/economic-recovery-falters-as-conflict-and-inflation-weigh#:~:text=Myanmar's%20economy%20is%20projected%20to,the%20report%2C%20Challenges%20amid%20conflict.

and

https://www.irrawaddy.com/business/economy/world-bank-myanmars-growth-to-fall-to-1-percent

Efforts to ease exchange controls to favor exporters

On 5 December the Central Bank of Myanmar (CBM)

announced that it will no longer determine the foreign

exchange rate on foreign currency transactions made

through authorised dealer banks via the foreign exchange

online trading system.

Consequently, sellers and buyers are now free to

determine the foreign exchange rate for their transactions

based on the market rate. At the same time, outbound

foreign currency remittances must still adhere to the

procedures issued by the Foreign Exchange Supervisory

Committee.

It appears that through these actions the CBM is aiming to

encourage and boost the country’s exports since exporters

stand to gain the most from these relaxations.

However, it is still mandatory for Myanmar exporters to

convert their foreign currency earnings at the reference

exchange rate of 2,100 kyats per dollar for 35% of export

earnings. After the announcement fuel prices has soared

about by 10%.

In related news, The Myanmar currency (Kyat) slumped

further against the US dollar in December after the Central

Bank of Myanmar announced it will no longer set rates on

its online foreign exchange trading platform. The online

trading platform was launched in June this year to

facilitate interbank and customer dollar transactions.

See:

https://www.vdb-loi.com/mm_publications/cbm-relaxes-foreign-exchange-restrictions-on-exporters/

and

https://www.irrawaddy.com/news/burma/kyat-depreciates-further-after-myanmar-central-bank-abandons-dollar-forex-rate.html

6.

INDIA

Robust economy hightens

inflation risk

The Reserve Bank of India (RBI) raised its growth

forecast on the back of a robust economy and indicated it

will continue its tight monetary policy to address inflation

risks. The RBI expects the economy to expand 7% in the

current fiscal year from 6.5% after stronger than

expected growth in the July-September quarter. The

outlook for inflation remains uncertain according to the

Bank.

The RBI also projected growth for the first three quarters

of 2024-25 saying “Real GDP for the frst quarter is

projected at 6.7% and at 6.5% in the second and third

quarters on the assumption of normal monsoons.

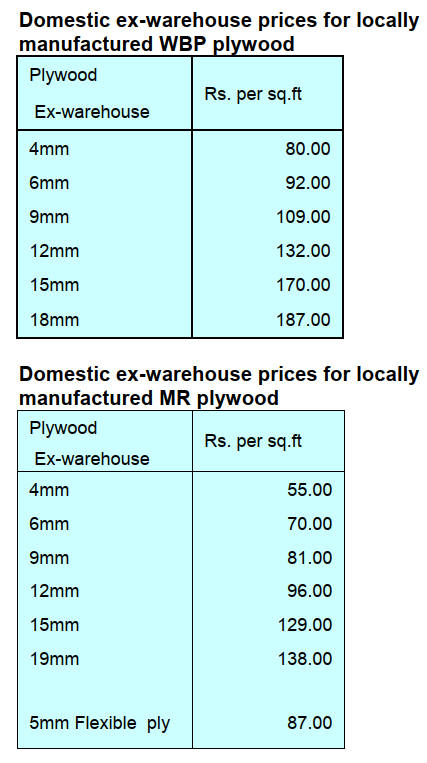

Weak demand for film faced plywood

Plywood manufacturers have reported that demand for

film faced plywood has weakened in the past months. This

type of plywood is mainly used in construction and in

October and Novemeber demand from construction

companies fell. In particular, demand in Bangalore,

Mumbai, Delhi has been slow and this has been put down

to the effect on construction activity of the very high air

polluion.Observers point out that air pollution issues are a

yearly phenomenon. The other reasons for the slow down

is the Diwali festive season when work slows across the

country.The current slow market is expected to recover

with the launch of new real estate projects.

See:

https://www.plyreporter.com/current-issue

In related news, the construction sector grew 13% in July-

September quarter from a year earlier, up from 7.9% on

the previous quarter and its best performance in five

quarters, according to government data.

This helped the economy grow at a remarkable 7.6% in the

quarter. In contrast, Western economies have been

squeezed by high interest rates and energy prices while the

economy in China has been hit by a debt crisis in its

property sector.

See:

https://www.reuters.com/world/india/indias-construction-sector-levels-up-housing-demand-spurs-economy-2023-12-02/

Land owners to see gains from planting commercial

tree species

The new law on forest conservation exempts agroforestry

and plantations from regulatory oversight which, it is

anticipated, will encourge land owners to plant

commercial tree species. As a follow up to the new law the

the central government has published a fact sheet listing

36 species that it suggests for various climatic zones in the

country.

The 36 species include Leucaena leucocephala or subabul

and various varieties of eucalyptus. The list also includes

important timber species such as poplar, teak, shisham

(Indian rosewood) and mahogany. Domestic production of

teak in India is considered to be less than 3% of

consumption and as demand increases this has driven up

prices.

The preamble of the Forest Conservation (Amendment)

Act 2023 focuses on achieving India’s goal of net-zero

greenhouse gas emissions by 2070. Environment Minister,

Bhupender Yadav, is reported a saying it is clearly

indicated in the new Bill that private land owners will be

free to decide whether or not to plant commercial tree

species which will create an opportunity for land owners,

especially small land owners, to generate additional

income.

See:

https://www.hindustantimes.com/india-news/india-implements-new-law-to-promote-agroforestry-lists-36-species-suitable-for-cultivation-and-timber-harvesting-101692556940099.html

Real estate developer establishes ‘urban forest’

Mumbai is pursuing the concept of urban forests and one

of the largest urban forests is the Miyawaki forest located

in the heart of Chandivali, Mumbai. The 34,000 square

metre forest has been developed by the Nahar Group, a

real estate developer.

Miyawaki projects are seen as helping India achievethe

aim of improving its green cover from 25 to 33%. Manju

Yagnik, Vice Chairperson of the Nahar Group said

Miyawaki forests a technique to restore biodiversity and

mitigate climate change impacts within cities.

See:

https://www.fairplanet.org/editors-pick/transforming-urban-india-with-a-japanese-forestry-technique/

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

According to preliminary statistics provided by Vietnam

General Department of Customs in November 2023

Vietnam’s W&WP exports reached US$1.3 billion, up

1.4% compared to October 2023 and up 11% compared to

November 2022. Of this, WP exports contributed US$880

million, up 0.8% compared to October 2023 and up 15.7%

year-on-year.

In the first 11 months of 2023 exports of both W and WP

are estimated at US$12.2 billion, down 17% over the same

period in 2022. In particular, WP exports are estimated at

US$8.3 billion, down 19% over the same period in 2022.

Vietnam's imports of wood raw materials in November

2023 amounted to 406,300 cu.m, worth US$133.0 million,

up 10% in volume and 10% in value compared to October

2023. However, compared to November 2022, there was a

decrease of 16% in volume and a decrease of 24% in

value.

In the first 11 months of 2023, imports of raw wood are

estimated at 4,054 million cu.m worth US$1.376 billion,

down 27% in volume and 35% in value over the same

period in 2022.

W&WP exports to Japan in November 2023 amounted to

US$126 million, down 27% compared to November 2022.

In the first 11 months of 2023 exports of wood and wood

products to Japan are estimated at US$1.5 billion, down

12% over the same period in 2022. Exports of office

furniture in November 2023 were valued at US$23.9

million, down 10% compared to November 2022.

In the first 11 months of 2023, office furniture exports are

estimated at US$245 million, down 28% over the same

period in 2022.

Vietnam's NTFP exports in October 2023 reached

US$57.37 million, up 9% compared to September 2023

and up 9% compared to October 2022. Over the first 10

months of 2023 NTFP exports earned US$596.19 million,

down 14% over the same period in 2022.

Wood pellet production and exports

Vietnam has now become the second largest wood pellet

producer in the world, only after the United States. Most of

the pellets produced in Vietnam are exported, with over

95% of the export volume going to Korea and Japan as

input materials for power generation.

The Vietnamese government released a report ‘Wood

pellet production and export of Vietnam - Current

dynamics and market trends’. Customs data on pellet

export volumes and values were reviewed by a Research

group from Forest Trends and Vietnam timber

associations.

See:

htps://goviet.org.vn/upload/aceweb/content/Wood%20pellet%20production%20and%20export%20of%20Vietnam%20T7-2023_EN.pdf

Key takeaways

Korea and Japan are the two largest wood pellet import

markets of Vietnam. The volume of wood pellets exported

from Vietnam to these two countries accounts for over

95% of the total volume of wood pellets exported from

Vietnam to all markets.

The source of raw materials for the production of pellets

exported to Korea and Japan is different. Wood pellets

exported to Korea are mainly made from the by-products

of the wood processing industry such as sawdust, shavings

and wood chips.

Enterprises exporting pellets to Korea are mainly located

in the Southeast region, where furniture factories are

concentrated. Pellets exported to Japan have to be made

from domestic plantation timber with FSC certificate.

This material is only available where there are large

regions of plantation forests, especially from the Central

region to the North of Vietnam. From the second quarter

of 2022, the export market for wooden furniture has

declined. The by-products of the wood processing industry

used for producing wood pellets have also decreased. This

created a shortage in raw materials for pellets exported to

Korea.

The energy crisis caused by the Russian-Ukraine

conflict

has caused the demand and price of pellets in the world

market to increase sharply. This has led to a wave of

investment in wood pellet production not only in Vietnam

but also in other countries.

This wave has increased the competition between wood

pellet enterprises in Vietnam and between Vietnamese

enterprises and enterprises in other countries such as

Malaysia, Thailand and Indonesia in the future.

At the beginning of 2023, the Korean market experienced

very strong fluctuations. The price of pellets exported to

Korea from Vietnam fell below 90 USD/ton (FOB) in

April, which was below the production cost of many

enterprises. Many, especially small-scale businesses, had

to stop operating. Import volume also dropped sharply.

In the first 5 months of 2023 (5M/2023), the volume of

pellets exported from Vietnam to Korea was 0.65 million

tons, equivalent to 96.1 million USD in value, dropping by

41% in volume and 45% in value compared to the same

period of 2022.

The Japanese market is highly stable in terms of both

quantity and price. In the first 5 months of 2023, the

amount of pellets Vietnam exported to Japan reached 0.87

million tonnes, with a value of US$151 million. The

volume exported fell by 6% while the export value

increased by 20% compared to the same period of 2022.

It is forecast that in the final months of 2023, Vietnam's

production and export of wood pellets will not have much

change. Specifically, (a) The volume and price of exports

to Korea will increase, following the current momentum

but will not increase dramatically.

Export price of wood pellets

The conflict between Russia and Ukraine pushed the price

of pellets in the world market up sharply. The price of

Vietnam's pellet exported to Korea and Japan in the first

months of 2022 fluctuated around US$140/ tonne FOB.

The price then increased sharply, reaching US$180-

190/tonne in the last months of 2022 and early 2023. The

price then fell, especially in the Korean market. According

to some exporters, the export price in this market in June

2023 was only about US$110/tonne while the FOB price

for Japan was US$145 - 165/tonne.

Competition in the future

Vietnam's wood pellet industry will face competition from

wood pellets from other countries. When the energy crisis

occurred due to the conflict between Russia and Ukraine,

the price of pellets in the world increased sharply.

This created a wave of investment in wood pellet

production in other countries (also in Vietnam). There are

already some operating factories and some more coming

soon. In the future, Vietnamese businesses will have to

compete with these factories, especially factories in

Indonesia and Malaysia.

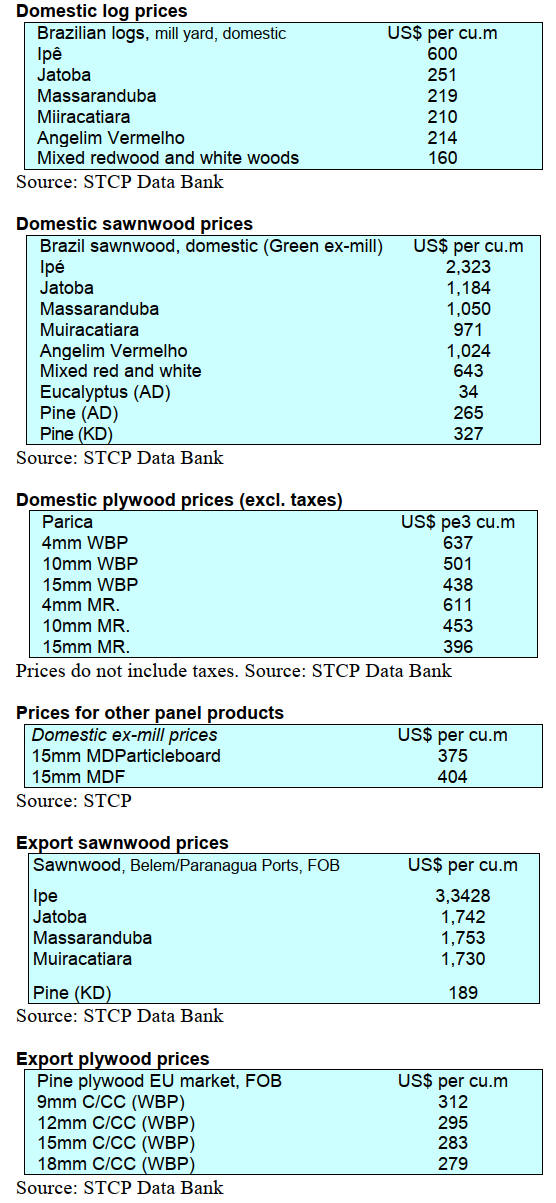

8. BRAZIL

IBA reports growth in the

plantation sector

The Brazilian Tree Industry (IBÁ) Annual Report 2023

reports growth in the plantation forestry sector. According

to the report plantation companies produced 25 million

tonnes of pulp, 11 million tonnes of paper as well as 8.5

million cubic metres of woodbased panels. The report also

points out that Brazil remains the world's largest pulp

exporter.

In terms of exports, the sector exported 1.5 million cubic

metres of woodbased panels and 2.5 million tonnes of

paper generating US$14.3 billion in foreign exchange for

Brazil.

According to IBÁ, in Brazil the area of forest plantations

is around 9.94 million hectares and this is mainly on

degraded land or land where productivity was low. Among

the States, Minas Gerais continues to lead in the expansion

of plantation areas, with 2.2 million ha. (29%) followed by

Mato Grosso do Sul, with 1.1 million ha. (15%) and São

Paulo, with 1 million (15%) ha.

In addition, the sector conserves 6.73 million hectares of

natural forest and this area expanded by around 10% over

the previous year. Also, the protected and production area

stores an estimated 4.8 million tonnes of CO2 equivalents.

Another positive impact of the forest-based sector is the

generation of 2.6 million direct and indirect jobs in 2022.

See:

https://www.remade.com.br/noticias/19587/iba-divulga-relatorio-anual-2023-e-mostra-crescimento-de-6-3-por-cento-no-setor-de-base-florestal

Furniture production increases

After a modest 0.6% growth between June and July 2023

furniture production in Brazil experienced a remarkable

16% increase in output in August totaling 36.8 million

pieces. This increase helped off-set the accumulated losses

for the early part of the year according to IEMI (Institute

for Industrial Studies and Marketing).

The positive situation was driven both by an increase in

domestic consumption which grew by 16% (36.4 million

pieces) and by exports which rose by 14% (US$ 70.6

million) in August. The sector's August imports also rose

by 21% to US$ 23.4 million.

However, despite this boost in September exports and

imports fell by 12% and 6%, respectively. The furniture

sector is facing several challenges including a 0.5% drop

in employment in the sector in August compared to July

and this comes after an annual downward trend of 2.5%.

In addition, imports of furniture-making machinery fell

significantly. Despite the fluctuations in September, the

trade balance remains positive for the year to October.

See:

https://forestnews.com.br/producao-moveisalta-consecutiva-segundo-semestre/

Sustainable production in Mato Grosso highlighted

at

international Forum

Native Brazilian timber logged through legal and

sustainable production was the subject of a presenation by

the president of the Center of Timber Producing and

Exporting Industries of the State of Mato Grosso (CIPEM)

during the Global Forum on Legal and Sustainable Timber

(GLSTF) 2023 held in Macau.

During the event, CIPEM highlighted the state's and the

country's potential to meet the global demand for legally

certified, traceable, sustainable and quality forest products

while also stating that the state of Mato Grosso's forestry

industries are in a position to increase raw material

production, foreign sales volumes and earn more revenue

over the next few years.

Also, according to CIPEM, the expansion of sustainable

forest management plans, combined with the wood

tracking system, guarantees the responsible origin of wood

products without compromising natural forests. The

president of the National Forum for Forest-Based

Activities (FNBF) stated that the area under forest

management in Mato GrossoSstate could be expanded to 6

million (ha). The current forest management area is around

4.7 million hectares.

According to the representatives of CIPEM and FNBF the

recent Forum was an opportunity to show the potential of

the Mato Grosso and the Brazilian timber industry

internationally. In addition to Brazil, other countries

interested in the international timber trade, such as

Indonesia, Malaysia, Congo, Switzerland and France, were

also present at the Forum, which aimed to increase

business networking of the entire production chain of the

timber sector, including producers, buyers, processors and

other market players, to promote the management of

natural forests, create supply networks of legal and

sustainable timber products and facilitate the conscious

use of forest products.

See:

https://simenorte.com.br/noticias/producao-florestal-sustentavel-de-mato-grosso-e-destaque-em-evento-internacional-na-china/

Uruguay - Brazil's top furniture importer

Uruguay stands out as the main importer of furniture from

Brazil accounting for 55% of exports according to IEMI

(Institute of Industrial Studies and Marketing). With a

relatively small population (3.4 million) but a remarkable

economic growth, Uruguay has a sophisticated and

promising consumer market making it a strategic

destination for products aimed at optimising

homes/housing and improving quality of life.

ABIMÓVEL (the Brazilian Furniture Industry

Association) points out that the increase in Brazilian

furniture consumption in Uruguay stems from a preference

for innovative design and superior quality together with

growing environmental and social concerns and these

create opportunities for expansion of the Brazilian

furniture industry.

Furniture consumption in Uruguay in 2022 reached

US$235 million representing an increase of 6.2% on the

previous year with furniture imports accounting for more

than half of this. In addition, the average prices of

Uruguayan furniture imports have grown by 36% since

2018 suggesting that Uruguay not only prefers but is also

willing to pay more for products that meet its needs.

ABIMÓVEL emphasised that Brazilian industries have

untapped potential to expand their range of export

products, especially those with higher added value, which

could boost growth in trade with Uruguay.

See:

https://forestnews.com.br/uruguai-brasil-fornecedor-moveis-colchoes/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

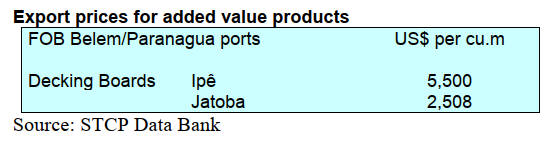

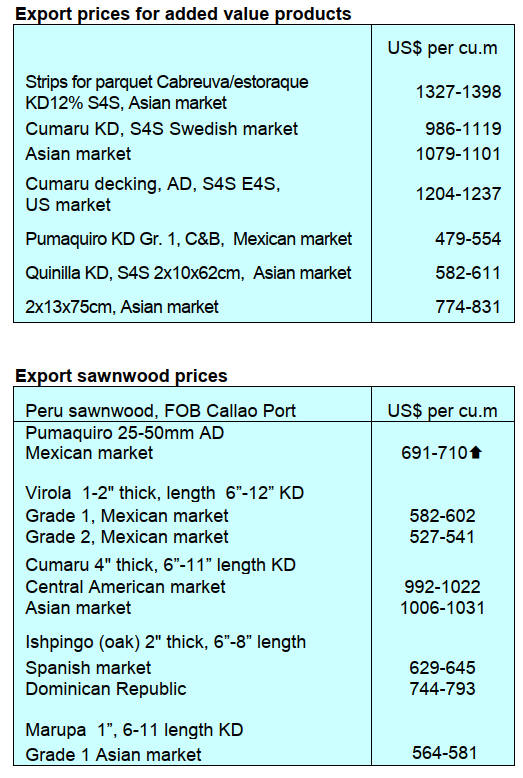

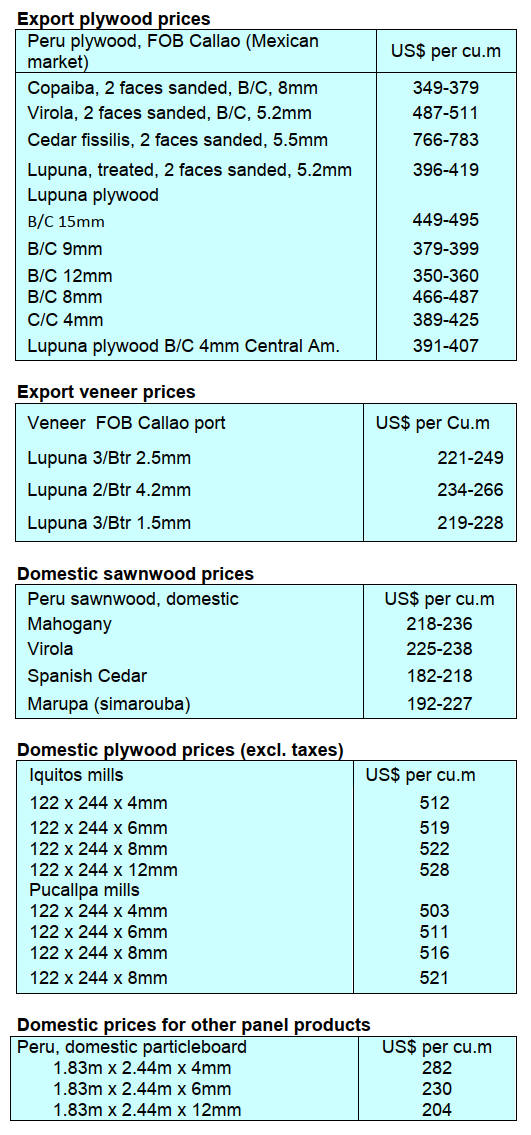

9. PERU

Exports fell between

January and September

Shipments of wood products between January and

September totalled US$76.2 million, a decline of 26%

compared to the same period in 2022 (US$102.7 million)

according to the Services and Industries Management/

Extractives division of the Association of Exporters

(ADEX).

This contraction is partly explained by lower orders from

the two main buyers, China (US$15.5 million) and France

(US$11.5 million) which declined by 25% and 29%,

respectively. In China the real estate sector crisis

dampened demand whereas in the French market recent

price increases for wood products from Peru undermined

competitiveness compared to suppliers elsewhere. Other

markets for wood products from Peru were Mexico

(US$11.1 million), the Dominican Republic (US$8.1

million) but down over 40% and the US (US$6.3 million)

down 24%.

According to figures from the ADEX Commercial

Intelligence System sawnwood was the most exported

product as of November 2023 earning US$32.1 million, a

decrease of 18%. Second ranked products were semi-

manufactured products which earned US$ 27.8 million

despite falling 43% year on year.

ADEX: exports could be 30% down this year

According to ADEX, Peruvian wood product exports in

2023 are likely to be around US$89 million which would

represent a year on year contraction of 30% year on year

compared and a drop of 60% compared to 2018 (US$219

million) when a historical maximum was reached.

Erik Fischer Llanos, the president of the ADEX Timber

and Wood Industries Committee said “Our 14 million

hectares of permanent production forests must be valued

appropriately. We (Peru) are the second largest country in

terms of forest area surpassed only by Brazil but Ecuador

and Uruguay, with less forest, export more wood products

than Peru”. Fischer called for the implementation of

measures that promote the growth of the forestry sector

such as the implementation of a new forestry concession

processes where priority is given to granting rights to

companies which have the technical and economic

resources to ensure sustainable management of the forest.

He added, Peru loses more than 150,000 hectares of

forests annually from shifting agriculture. Fischer also

commented that the inclusion of the shihuahuaco species

(internationally known as Cumarú) in Appendix II of the

International Convention on Endangered Species of Wild

Fauna and Flora (CITES) has created uncertainty in the

market and driven down demand and prices. As of

October 2023 prices in international markets for Cumarú

decking were down 25% and prices for slats were down

37%.

See:

https://agraria.pe/noticias/adex-exportaciones-de-madera-por-parte-de-peru-sumarian-cerc-34003

Completion of Ucayali forest zoning

Through a joint effort between the National Forestry and

Wildlife Service (SERFOR) and the Regional Government

of Ucayali (GOREU) with support from the Regional

Forestry and Wildlife Management (GERFFS) authority in

Ucayali zoning was completed marking an important step

to promote sustainable use of forest resources and wildlife

in the Department.

With the completion of the zoning, the territory will be

able to sustainably take advantage of forest and wildlife

resources according to their potential and limitations. In

addition, this process took into account economic, social,

cultural and ecological aspects to classify the territory into

four categories, which will allow effective management.

What remains now is to send details to SERFOR for

evaluation and subsequent sending to the Ministry of the

Environment (MINAM) for approval through a ministerial

resolution.

See:

https://www.gob.pe/institucion/serfor/noticias/876101-se-logro-la-culminacion-de-la-zonificacion-forestal-de-ucayali

Review of the Sustainable Productive Forests (BPS)

programme

According to Alberto Gonzales-Zúñiga, the Director of the

National Forestry and Wildlife Service (SERFOR), the

Sustainable Productive Forests (BPS) programme is

advancing at a steady pace.

This was his comment during a meeting together with the

executive coordinator of BPS, Daniel Rivera and his entire

team. At the meeting SERFOR informed representatives

of the German Development Bank - KfW on the current

status of the programme as well as the progress in

achieving the objectives of the programme and the

strategies that will be implemented to promote the

progress of its three projects: Forest Plantations, Forest

Management and Forest Planning.

Andreas Weitzel, representative of the German

Development Bank KfW, highlighted how important

forest conservation is for them at an international level.

“In Germany, forests are very important and valuable. The

forestry sector in our country has a study of more than 500

years, one of the oldest in the world. Our goal is to be a

support so that forests around the world can be preserved”,

he said.

It was decided that additional specilaists will be required

lead the technical and administrative areas and those

related to risk management, follow-up and monitoring,

government control and incentive funds.

See: https://www.gob.pe/institucion/serfor/noticias/875218-el-serfor-y-el-banco-de-desarrollo-aleman-se-reunen-para-revisar-avances-del-programa-bosques-

productive-sustainable-bps

In related news, SERFOR staff in Oxapampa, Pasco

Region discussed the Forest Plantations - Sustainable

Productive Forests (BPS) programme an initiative co-

financed by the German Development Bank - KfW.

The project seeks to promote the creation of more than

2,000 hectares of plantations in Oxapampa through

economic incentives to native communities. More than 90

people from the local and regional government were

present at this event along with civil society organisations,

academia, companies and native communities from across

the Department of Pasco.

See:https://www.gob.pe/institucion/serfor/noticias/873238-serfor-lanzo-el-proyecto-plantaciones-forestales-en-oxapampa

|