|

Report from

Europe

Tropical wood product imports down 19%

In the first nine months of this year, the EU27 imported

1,237,500 tonnes of tropical wood and wood furniture

products with a total value of US$2.50b, respectively 19%

and 28% less than the same period in 2022. The scale of

the decline in trade in the first nine months of this year is

partly due to imports being at historically high levels in

the first half of 2022, particularly when considered in

value terms.

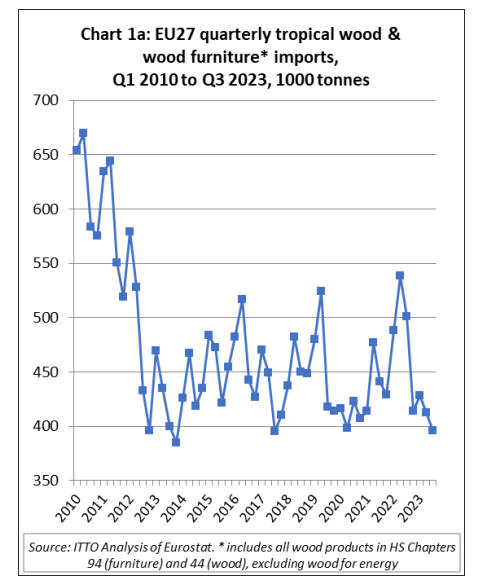

In quantity terms, EU27 imports of tropical wood and

wood furniture totalled 396,000 tonnes in the third quarter

of this year, 4% less than the previous quarter and 21%

down on the same quarter in 2022. The quantity of EU27

imports in the third quarter this year was well below the

long-term average of around 450,000 tonnes per quarter

during the 2012 to 2019 period. (Chart 1a).

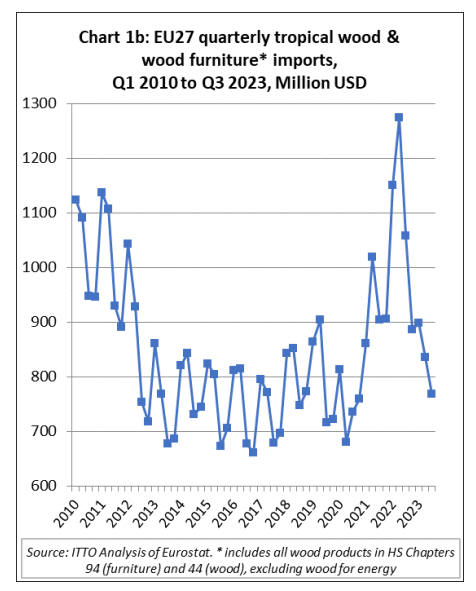

The total value of EU27 imports of tropical wood and

wood furniture was US$768m in the third quarter of this

year, 8% less than the previous quarter and 27% below the

same quarter last year. Despite the steep fall this year,

import value in the third quarter was at around the long-

term quarterly average between 2012 and 2019, the period

of relatively stagnant market conditions for tropical

products that prevailed in Europe before the COVID crises

(Chart 1b).

Overall, the trade data highlights that import prices for

tropical wood and wood furniture products in the EU27

market have remained relatively high this year despite

sharp falls in freight rates and declining consumption. This

is in line with broader inflationary trends impacting on the

EU market, particularly driven by high energy costs.

Another downward revision to EU economic forecasts,

recession looming.

The European Commission’s Autumn Economic Forecast

published on 15 November shows that the EU economy

has lost momentum following the robust post-pandemic

expansion in 2021 and 2022. GDP in the EU contracted

very mildly in the fourth quarter of 2022 and barely grew

in the first three quarters of this year. The high cost of

living took a heavier toll than expected. On the external

side, global trade provided little support. Meanwhile, the

response of monetary policy to high inflation is working

its way through the economy, and fiscal support is partly

being phased out.

The EC projects GDP growth in 2023 at 0.6% in both the

EU and the euro area. This is 0.2 percentage points lower

than projected in the summer and an even larger

downward revision compared to the Spring Forecast, by

0.4 percentage points. Going forward, the EC expects

growth to rebound mildly as consumption recovers with

rising real wages, investment remains supportive and

external demand picks up.

EU GDP growth is forecast to improve to 1.3% in 2024,

still below potential and a downward revision of 0.1

percentage points compared to the Summer Forecast. The

EC forecasts that 10 EU countries — including Germany

— will see their economies shrink this year. All except

Sweden are expected to grow in 2024.

Headline inflation in the EU is forecast by the EC to

decrease from 6.5% in 2023 to 3.5% in 2024 and 2.4% in

2025. The European Central Bank last hiked its policy

interest rates in September, by 25 bps. Interest rates are

thought to have peaked and are expected to ease gradually

now that inflation seems to be under control.

The loss of growth momentum so far this year reflects the

lack of any solid growth drivers in the economy. Domestic

consumption and investment in both the private and public

sectors are weak, and export trade is also down. Wage

growth has lagged behind inflation and retail sales are still

declining.

Spending on services has held up a little better partly due

to further recovery in tourist arrivals to the EU.

Manufacturing output in the EU has been held back by

weak demand and high energy costs. Similarly, high input

and financing costs, as well as labour shortages, are

dragging down construction activity, particularly in

housing.

According to the Financial Times, independent economists

are even more gloomy than the EC about prospects in the

EU. Carsten Brzeski, an economist at Dutch bank ING,

told the FT that “The commission’s forecasts still fall into

the category ‘unbeatable optimism’”. He forecast that

eurozone growth would reach just 0.2 per cent next year

when “we will still see the negative impact from higher

interest rates on growth”.

The HCOB Eurozone Construction PMI dropped from

43.6 in September to 42.7 in October, well below the 50-

mark which is the threshold for stable conditions and

signalling the fastest monthly decline in eurozone

construction activity since December 2022.

In line with the trend seen for over a year, the housing

sector remained a particular point of weakness. Firms in

Germany and France registered a particularly significant

decrease in output. German construction firms recorded

the sharpest fall in activity since April 2020.

Italy was alone in signalling growth in construction output.

Driving the downturn in output was a marked decline in

new orders, as demand conditions deteriorated.

Meanwhile, construction business confidence in the

eurozone worsened, with expectations at their joint-lowest

since last December.

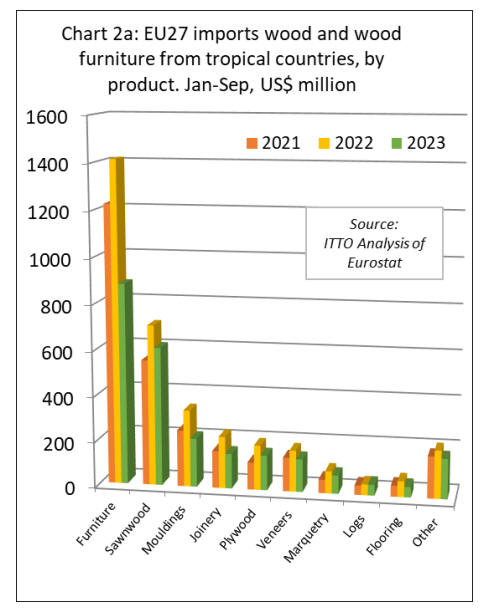

Across the board decline in EU import value of tropical

wood products

There was a year-on-year decline in EU27 import value

for all tropical wood product groups except logs between

January and September this year (Chart 2a).

During the nine-month period, there were large declines in

EU27 import value for: wood furniture from tropical

countries (-38% to US$881m); tropical mouldings/decking

(-37% to US$213m); tropical joinery products (-33% to

US$153m); tropical-hardwood-faced plywood (-22% to

US$153m); tropical veneer (-20% to US$144m); tropical

marquetry (-18% to US$80m); and tropical flooring (-34%

to US$46m).

A more moderate decline was recorded in EU27 import

value of tropical sawnwood, by 14% to US$607m. EU27

import value of tropical logs increased 0.4% to US$47m

during the nine-month period.

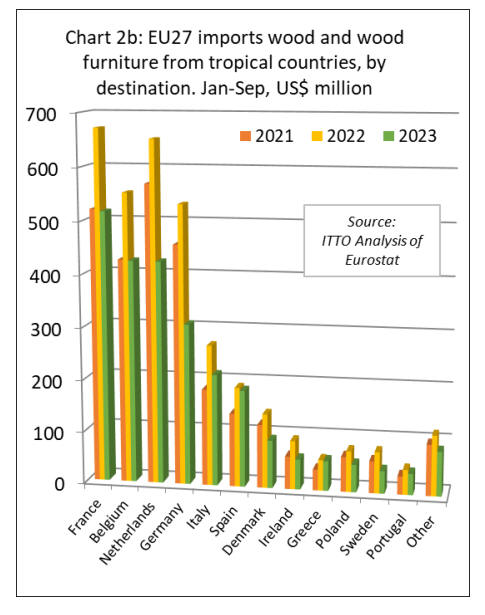

In terms of EU destinations, import value of tropical wood

and wood furniture in the first nine months this year was

down year-on-year in all the main markets. There were

relatively minor declines in Spain (-3% to US$185m) and

Greece (-3% to US$57m).

However, much larger falls were recorded in France (-23%

to US$517m), Belgium (-23% to US$425m), the

Netherlands (-35% to US$425m), Germany (-42% to

US$307m), Italy (-21% to US$213m), Denmark (-35% to

US$92m), Ireland (-40% to US$58m), Poland (-32% to

US$53m), Sweden (-45% to US$43m), and Portugal (-

15% to US$40m) (Chart 2b).

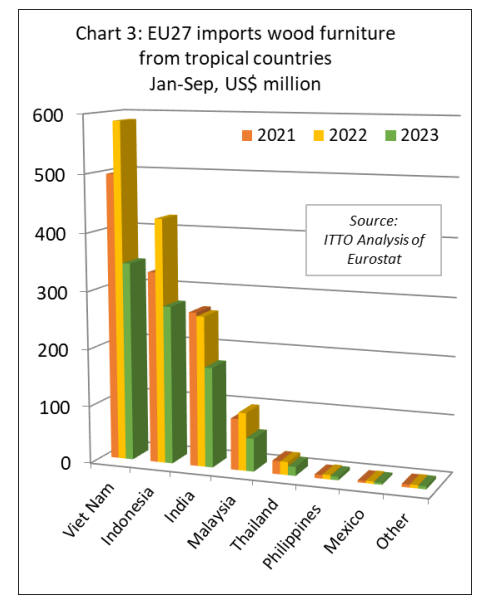

EU27 wood furniture imports from tropical countries

decline by 29%

In the first nine months of 2023, the EU27 imported

201,000 tonnes of wood furniture from tropical countries

with a total value of US$881m, down 29% and 38%

respectively compared to the same period in 2022.

Import value decreased 41% to US$345m from Vietnam,

35% to US$275m from Indonesia, 33% to US$174m from

India, 43% to US$57m from Malaysia, and 31% to

US$16m from Thailand. EU27 wood furniture imports

from all other tropical countries were negligible during the

nine-month period (Chart 3).

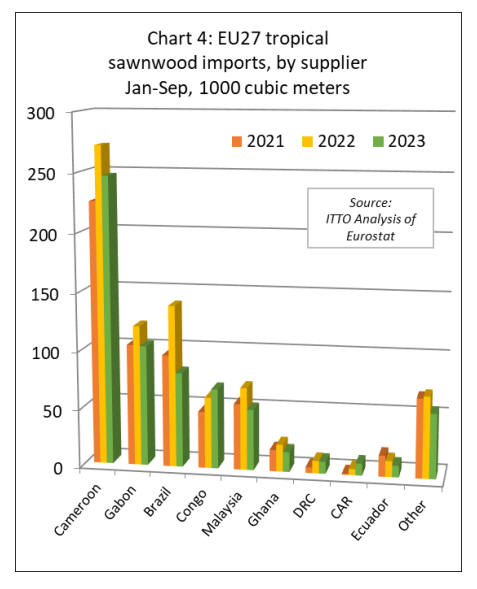

EU27 imports of tropical sawnwood down 14% this year

The EU27 imported 607,300 cubic metres of tropical

sawnwood in the first nine months of 2023, 14% less than

the same period in 2022.

Imports increased from Congo (+12% to 68,500 cubic

metres) and CAR (+98% to 10,300 cubic metres).

However, these gains were offset by declining imports

from Cameroon (-9% to 246,800 cubic metres), Gabon (-

14% to 103,300 cubic metres), Brazil (-41% to 81,300

cubic metres), Malaysia (-26% to 52,200 cubic metres),

Ghana (-26% to 17,100 cubic metres), DRC (-4% to

10,400 cubic metres), and Ecuador (-27% to 10,000 cubic

metres) (Chart 4).

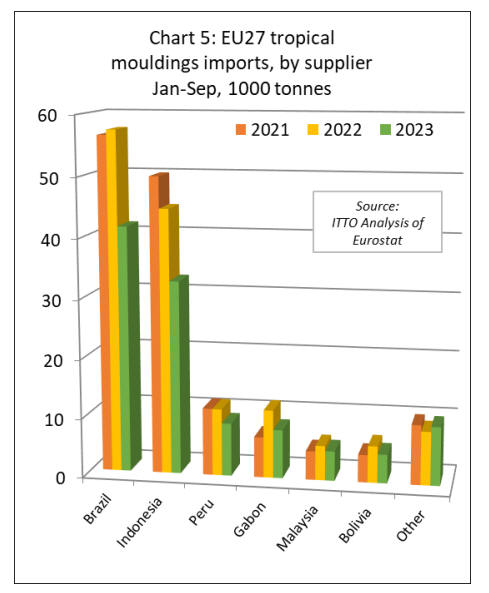

The EU27 imported 111,000 tonnes of mouldings/decking

in the first nine months of 2023, 24% less than the same

period last year. Imports fell sharply from all the leading

supply countries including Brazil (-28% to 41,500 tonnes),

Indonesia (-27% to 32,600 tonnes), Peru (-21% to 8,900

tonnes), Gabon (-29% to 8,200 tonnes), Malaysia (-14% to

5,000 tonnes), and Bolivia (-22% to 4,900 tonnes). (Chart

5).

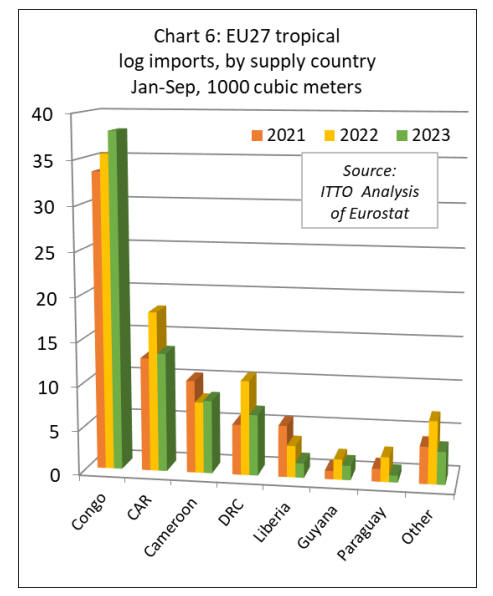

In the first nine months of 2023, the EU27 imported

74,400 cubic metres of tropical logs, 16% less than the

same period in 2022. A notable trend during the period

was a 7% rise in EU27 log imports from Congo to 38,000

cubic metres.

This rise in European arrivals – which was concentrated in

the first quarter of this year - reflects a last-minute effort to

ship logs in advance of the log export ban imposed by the

Republic of Congo from 1st January 2023. EU27 imports

of logs also increased slightly from Cameroon during the

nine-month period, up 3% to 8,300 cubic metres. These

logs may well be sourced from neighbouring Congo or

Central African Republic.

EU27 imports of tropical logs from all other supply

countries declined during the period including Central

African Republic (-26% to 13,400 cubic metres),

Democratic Republic of Congo (-36% to 6,900 cubic

metres), Liberia (-54% to 1,600 cubic metres), Guyana (-

29% to 1,600 cubic metres) and Paraguay (-72% to 780

cubic metres) (Chart 6).

EU27 imports of tropical veneer down 22% and tropical

plywood down 10%

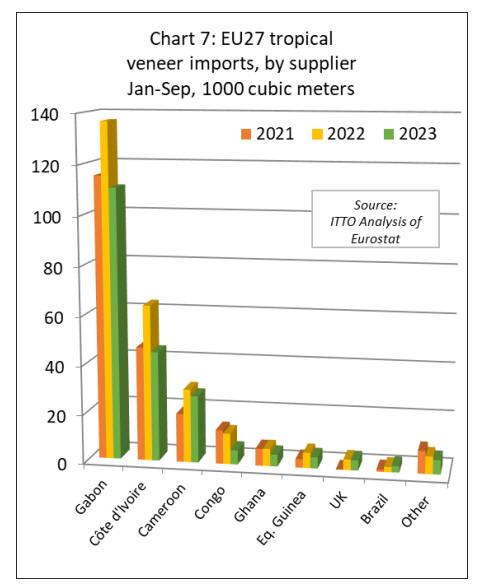

In the first nine months of 2023, the EU27 imported

210,600 cubic metres of tropical veneer, down 22%

compared to the same period last year. Imports of tropical

veneer from Gabon, by far the largest supplier to the

EU27, decreased 19% to 110,500 cubic metres after rising

sharply last year.

EU27 veneer imports in the first nine months of this year

also declined from Côte d'Ivoire (-30% to 44,800 cubic

metres), Cameroon (-9% to 27,400 cubic metres), Congo

(-54% to 5,800 cubic metres), Ghana (-32% to 4,800 cubic

metres), and Equatorial Guinea (-26% to 4,600 cubic

metres). However, imports from Brazil were up 23% to

2,600 cubic metres during the nine-month period (Chart

7).

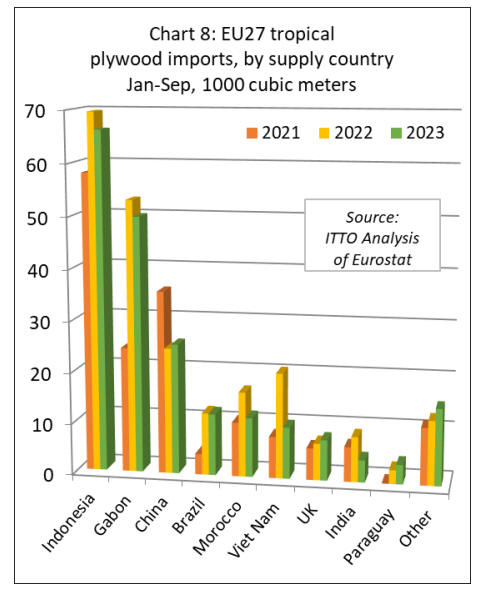

In the first nine months of 2023, EU27 tropical plywood

imports were 206,200 cubic metres, 10% less than in the

same period last year. Imports increased from China (+3%

to 25,400 cubic metres) and Paraguay (+42% to 3,800

cubic metres), while indirect imports via the UK were also

up 10% to 7,900 cubic metres.

However, imports from all the leading tropical supply

countries declined including Indonesia (-5% to 66,200

cubic metres), Gabon (-6% to 49,900 cubic metres), Brazil

(-1% to 12,000 cubic metres), Morocco (-30% to 11,600

cubic metres), Vietnam (-51% to 10,100 cubic metres),

and India (-51% to 4,300 cubic metres). (Chart 8).

EU27 imports of tropical laminated products decline from

all countries except Congo.

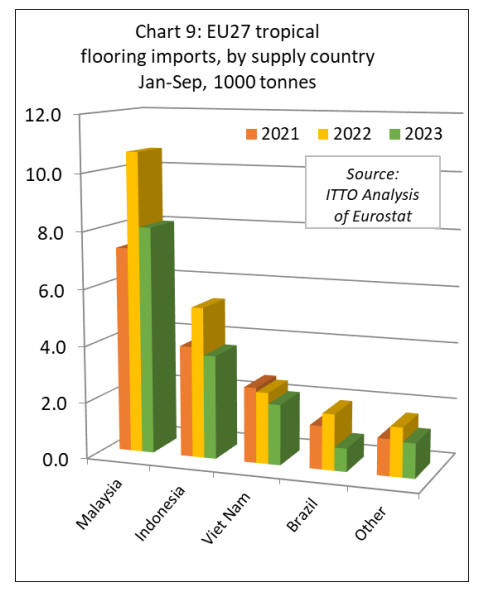

In the first nine months of 2023, the EU27 imported

15,900 tonnes of tropical wood flooring, down 28%

compared to the same period last year. The consistent rise

in EU27 wood flooring imports from Malaysia, that began

in 2020, has stalled this year. Imports of 8,000 tonnes from

Malaysia in the first nine months of 2023 were 25% less

than the same period in 2022. Imports also fell from

Indonesia (-31% to 3,700 tonnes), Vietnam (-15% to 2,100

tonnes), and Brazil (-59% to 820 tonnes) (Chart 9).

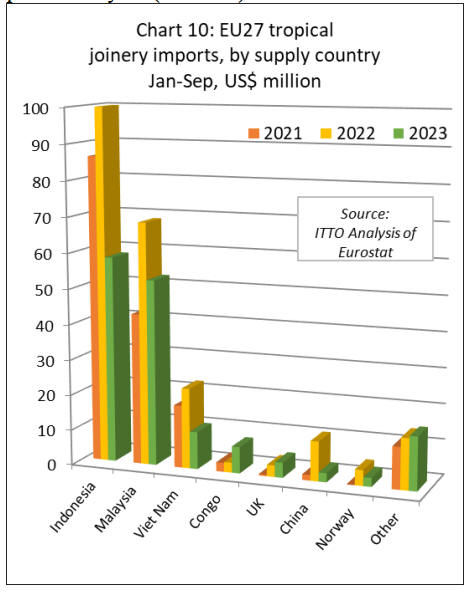

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors –

declined 33% to US$153m in the first nine months of

2023. Imports were down 42% to US$58m from

Indonesia, down 23% to US$52m from Malaysia, down

54% to US$11m from Vietnam, and down 77% to less

than US$3m from China.

In a potentially significant longer-term development, given

efforts in the country to shift up the value chain as log

exports are banned, EU imports of laminated joinery

products from Congo were valued at US$7.5m in the first

nine months of this year, 170% more than during the same

period last year (Chart 10).

|