Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Nov

2023

Japan Yen 149.00

Reports From Japan

Economy contracts - a challenge for government and

Bank of Japan

Japan's economy contracted in the third quarterof 2023

ending two quarters of expansion. A dip in exports,

especially to China and weak domestic consumption

because inflation has undermined household spending.

The latest data underscores the policy challenges faced by

the government and the Bank of Japan.

Provisional GDP was forecast to have fallen by over 2% in

the third quarter compared to a year earlier after expanding

4.8% in April-June quarter. The economy contracted 0.5%

in the third quarter from the previous quarter after

expanding 1.2% in the second quarter. Thithe third quarter

contraction was larger than expectated.

The disappointing GDP figure was partly driven down by

weaker than expected domestic capital expenditure which

contracted 0.6% in the third quarter from the second

quarter.

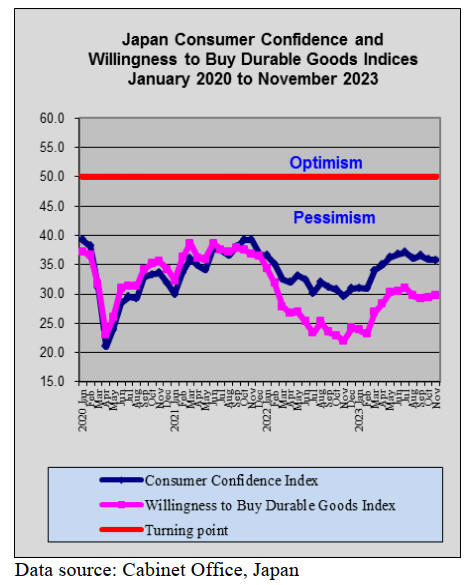

Private consumption in Japan was flat in the third quarter

and it is likely that, because real household incomes will

continue to slide until the middle of next year, consumer

spending will not support growth.

Against this background the government downgraded its

assessment of economic prospects for the first time in 10

months, saying the economy is recovering moderately but

"appears to be pausing in part" on weak domestic demand.

Among the key economic indicators the Cabinet Office cut

its view on capital spending for the first time in nearly two

years.

See:

https://english.kyodonews.net/news/2023/11/523ff7a4f770-japan-cuts-economic-view-1st-in-10-months-on-weak-domestic-demand.html

Improved rights protection for foreign workers

Changes are planned for Japan's controversial trainee

programme for foreign nationals. A panel has

recommended improved rights protection with increased

flexibility for workplace changes and more rigorous

monitoring. It is anticipated that the final report will form

the basis of a Bill to be submitted to parliament next year.

If approved, this will end the current Technical Intern

Training Programme which has been in place since 1993.

Originally designed to transfer skills to developing

countries, the programme has been abused by firms

bringing in inexpensive labour. There have been cases

when trainees ran way due to unjust treatment and with

cases of abuse within the programme, including unpaid

wages and harassment.

See:https://www.japantimes.co.jp/news/2023/11/25/japan/technical-intern-final-report/

Osaka Expo to have world's largest wooden structure

The Japanese company, Sou Fujimoto Architects has

created the centre piece for the 2025 Oaska Expo, it is a

large circular 3-story building using cross-laminated

timber combining traditional and modern timber building

technology .

The huge structure almost 2 km in diameter is made of

local made of wood and is being built on an artificial

island in Osaka Bay. The structure will encircle the

island. The design is a purposeful nod to Japanese

tradition as timber construction is commonly used for

temples. Once completed the structure will become the

world's largest wooden buildings. However, the high

construction cost and recent cost overruns have drawn

criticism.

Expo Osaka 2025 will run between 13 April and 13

October 2025 under the theme ‘Designing Future Society

for Our Lives’ which advocates for a place where cutting-

edge technology will be used to create new ideas and

alleviate global challenges currently plaguing humankind.

See: https://mymodernmet.com/expo-2025-sou-fujimoto-construction/

Discounts on mortgages for families

A Japanese government-related financial institution is

going to offer special discounts on new mortgages for

child-rearing families. The Japan Housing Finance Agency

offers fixed-rate loans of up to 35 years in collaboration

with private financial institutions.

Under the plan, households with children aged under 18 at

the time of application would be eligible for reduced

annual interest rates. The discounts would be valid for the

first five years. Their size would depend on the number of

children per family.

The plan is in the government's supplementary Budget

Bill. The discounts could go into effect as early as February 2024 if the

Diet approves the Bill during its

current session which ends soon.

See: https://www3.nhk.or.jp/nhkworld/en/news/20231124_25/

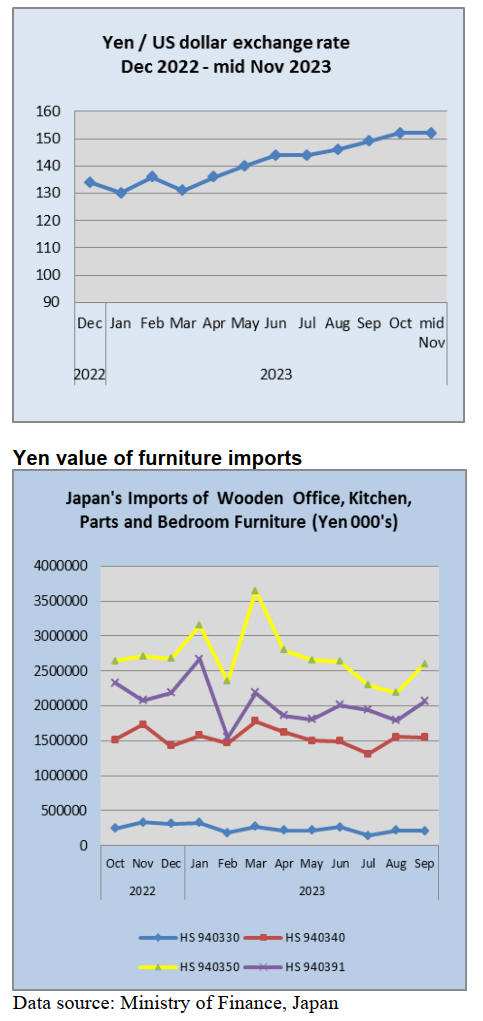

Yen/US dollar up from recnt lows

The yen was trading just over 150 against the US dollar in

late November slightly above the low of 151 seen recently.

The weak yen and its impact on import costs underscores

the fragility of the Japanese economy and the complexities

for the Bank of Japan. It also strengthens the case for the

government’s new economic package aimed at curbing

rising living costs which is expected to include subsidies

and payouts to low-income households.

See

https://www.cnbc.com/2023/11/15/japan-q3-economy-shrinks-far-more-than-expected.html

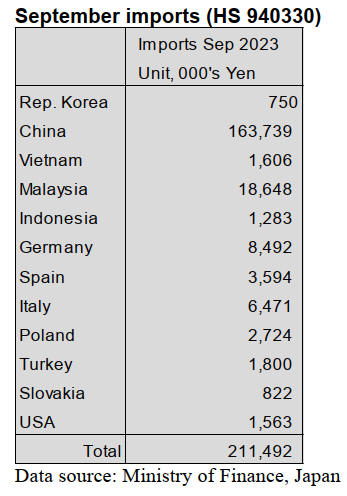

September wooden office furniture imports

(HS940330)

In September, shippers in China and Malaysia once again

were the main shippers of wooden office furniture

(HS940330) to Japan respectively accounting for 77% and

19% of the total value of imports. Shippers in China,

Malaysia and Germany accounted for around 90% of the

value of imports of wooden office furniture in September.

The value of September arrivals from China were up

compared to August and arrivals from Malaysia were

sharply higher compared to a month earlier.

Year on year, the value of September 2023 imports of

wooden office furniture was down 12% and there was also

a decline in the value of imports compared to the level

reported for August.

In August there was a marked increase in the number of

countries shipping wooden office furniture to Japan but in

September the number had fallen significantly.

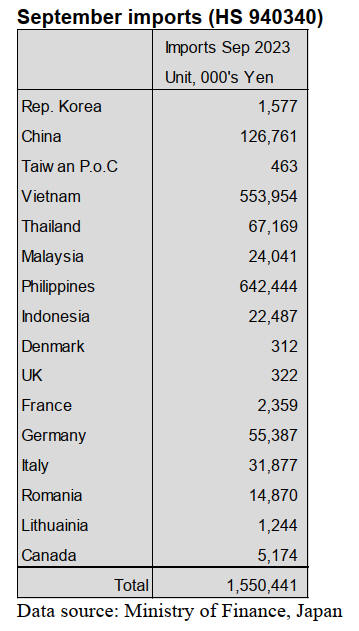

September kitchen furniture imports (HS 940340)

As in previous months, shippers in the Philippines and

Vietnam together accounted for the bulk of Japan’s

imports of wooden kitchen furniture.

In September the top four shippers were the Philippines,

Vietnam, China and Thailand but in September arrivals

from the Philippines, Vietnam and China were all down

compared to levels in August.

Year on year the value of wooden kitchen furniture

imports in September dropped 6% following the first signs

of a recovery that emerged in August.

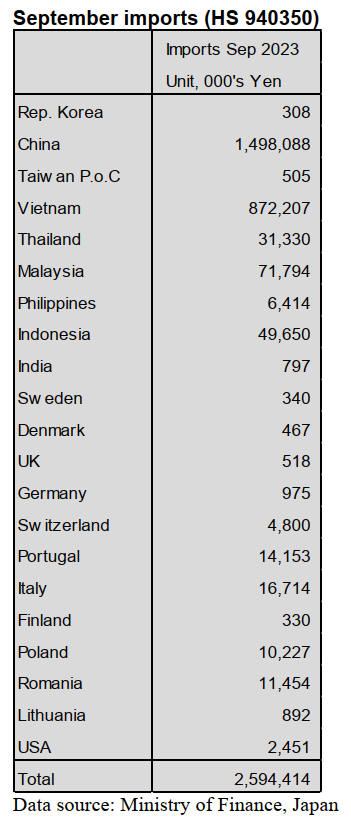

September wooden bedroom furniture imports

(HS940350)

Since April this year there was a steady decline in the

value of Japan’s imports of wooden bedroom furniture

(HS940350) but this downward trend was reversed in

September when the value of imports jumped 19%.

The steady weakening of the yen against the US dollar

which is the trading currency makes it difficult to assess

the precise causes behind the September jump in the value

of imports especially as consumer sentiment in Japan has

taken a hit from the impact of rising prices.

China and Vietnam were the main suppliers of wooden

bedroom furniture in September, together accounting for

over 90% of the value of imports. The value of September

imports from China was up month on month as they were

for Vietnam, Malaysia and Indonesia, the top four shippers

in September.

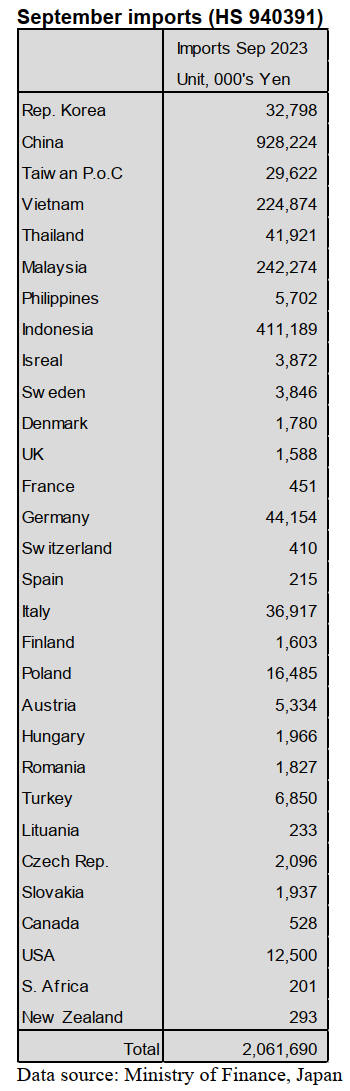

September wooden furniture parts imports (HS 940391)

After declines in July and August the value of Japan’s

imports of wooden furniture parts (HS940391) rose 15%

in September compared to a month earlier and compared

to September 2002 there was a 13% increase.

In September import data published by the Ministry of

Finance in Japan shows there were 28 shippers of wooden

furniture parts in September, the highest number recorded

this year.

The top suppliers of wooden furniture parts in September

were China (45%), Indonesia (29%), Malaysia 12% and

Vietnam 11% and each of the top shippers saw the value

of their imports by Japan rise, especially Malaysia where

in September there was an almost 25% increase month on

month.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

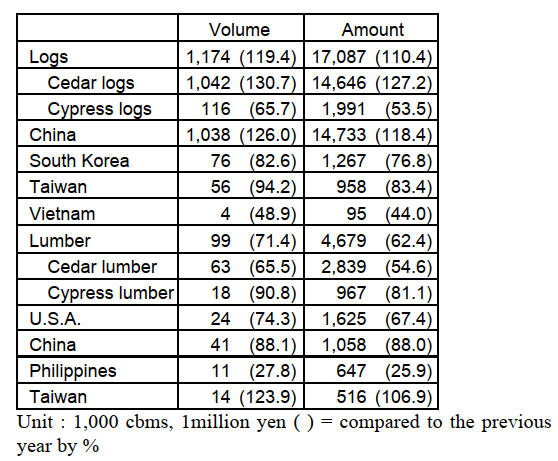

Export trends of logs and lumber

Volume of exported logs during January to September,

2023 was 1,174,000 cbms, 19.4 % more than January to

September, 2022. The total log exports are 17 billion yen,

10.4 % more than the same period last year. On the other

hand, volume of exporting lumber during January to

September, 2023 are 99,000 cbms, 28.6 % less than the

same period last year.

The total lumber exports are 4.6 billion yen, 37.6 % less

than the same period last year. It seems that the weak yen

has not influenced the exporting business. A forecast for

October to December will be would be the same situation

from now. There is a possibility that exporting logs in

2023 will recover and exporting lumber in 2023 will

decrease two years continuously.

Exporting domestic logs and lumber started to rise since

2013 and it stopped rising in 2019. Then, it started to rise

again in 2020 and in 2021, exporting logs and lumber

recorded the highest volume and amount. The yen started

to depreciate against the US dollar in 2022 and total

wooden product exports were 50 billion yen. It was

necessary to pay close attention to export trends of logs

and lumber in 2023.

Exporting cedar logs during January to September, 2023

are 1,042,000 cbms, 30.7 % higher than the same period

last year. Cedar logs for China are 1,038,000 cbms, 26.0 %

higher than the same period last year. Cedar logs for South

Korea, Taiwan and Vietnam decline slightly.

Exporting cedar lumber is 63,000 cbms, 34.5 % down

from the same period last year. Cedar lumber for the

U.S.A. is 24,000 cbms, 25.7 % down from the same period

last year. Cedar lumber for China is 41,000 cbms, 11.9 %

less than the same period last year. A decrease in cedar

lumber for the U.S.A. is because the lumber market is low

in the U.S.A.

Exporting logs to China is very active in Kyushu region

and the latest price of log is slightly below $110, C&F per

cbm. Since the economy in China is low, inquiries for

cedar and cypress are not a lot.

Japanese exporters deliver logs to ports by 10,000 –

11,000 yen, per cbm. However, the price of logs for

biomass power fuel and papermaking has been rising in

Japan so Japanese exporters focus on selling the logs in

Japan.

Sample building materials (deliverey to architects and

interior designers)

Design Future Japan Co., Ltd. started a service called

‘Material Bank Japan’. The service is about delivering

several companies’ building materials as samples to

licensed architects and interior designers. The company

had been conducting a demonstration experiment for the

service since January 2023 and the company received a

good rating from the licensed architects and interior

designers. About 200 building materials companies

participate in this service.

On 18 October a webinar was held for licensed architects

and interior designers. Everyone is able to register the

service and is able to use the service with no charge.

Consumers are able to choose the sample building

materials from about 50,000 kinds. Also, it is able to send

e-mails to the building material company’s staff through

the service. It is able to save what you have ordered

before.

The company has a system which reports about Co2

reduction or reduction in delivery cost when you use the

service.

The service of ‘Material Bank’ began in the U.S.A. and

about 110,000 architectural designers and about 90 % of

major design companies use the service today.

The president of Design Future Japan says that it is

important to raise the clients’ and building material

companies’ satisfaction.

The service in the U.S.A. has 500 building material

companies so the service in Japan also aims to have 500

building material companies.

South Sea logs and lumber

Movement of hardwood lumber would depend on an

exchange rate fluctuation. The price of hardwood lumber

in South Asia won’t decrease so Japanese buyers watch

the foreign exchange carefully to reduce the import cost.

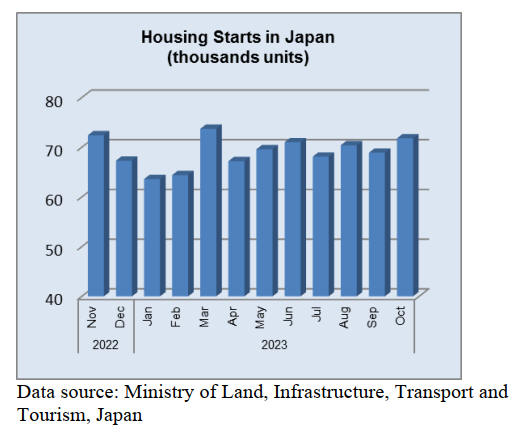

New starts are still low so as a number of stores and there

are not many orders for interior finishing work of stores.

One of the reasons is that high prices of commodities

influenced the selling price of stores. Therefore, Japanese

buyers hesitate to procure a lot of lumber. South Asian

shippers understand the circumstances in Japan so they do

not sell the productactively. Some Indonesian or Chinese

manufacturers lowered the price of laminated boards but

the price of laminated boards in Japan decreased just a

little bit due to the weak yen.

The price of South Sea lumber are still high. There are

many inquires for truck body materials. There is a certain

number of orders for deck materials when the yen

depreciates against the US dollar.

Review the Technical Intern Training Programme

The Japanese government held a meeting for reviewing

the Technical Intern Training Program on 18th October,

2023. The government will set up a new system for

securing employees and training employees.

The new system shows that it is able to change the

company if the employees work at a company for a year.

The current system of the Technical Intern Training

Program is about international contribution by training

employees. There are 88 kinds of jobs and it is able to live

in Japan for maximum 5 years. However, it is unable to

transfer to other companies. If the working conditions

were not good, then a foreign worker would disappear

from the company. This situation is actually happening in

Japan and it is becoming a serious problem. To avoid the

disappearance, the new systems shows that a period of

residence in Japan will be maximum 3 years.

If the foreign workers passed the test of skills and

Japanese-Language Proficiency Test and then worked at a

company for a year, the foreign workers would be able to

transfer to another company but it has to be in the same

business areas.

There had been a difference between Technical Intern

Training and Specified skills visa but it changed to be

simple. If the foreign workers passed the high level tests,

the foreign workers are able to extend their stay for

maximum 5 years. Even if the foreign workers failed the

high level tests, the foreign workers are able to extend the

stay for one more year.

However, there is a concern that the foreign workers might

transfer to companies, which are located in the cities with

good salaries, from countryside where a shortage of

workers occurring.

|