|

1.

CENTRAL AND WEST AFRICA

Operational delays and transport problems

continue

The timber industries in Central and West African

countries are facing several challenges with adverse

weather conditions and operational difficulties affecting

production and trade. Unprecedented rainfall has been

observed across the region causing production delays and

transport problems as many areas have experienced

flooding.

The impact of weather related issues extend from Douala

in Cameroon to Libreville and Port Gentil in Gabon and

even Pointe Noire in Congo Brazzaville. Landslides,

damaged railways and logistical disruptions have become

prevalent due to the continuous heavy rain.

Operational challenges are widespread affecting the

supply of logs and hindering the movement of fuel and

food to remote areas especially in Cameroon and Gabon.

Road and rail repair and maintenance are a constant

challenge.

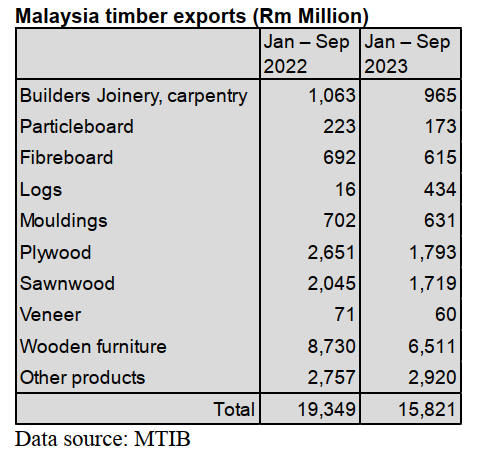

Producers report demand for wood products remains

subdued and this is reflected in stable prices. The slower

demand at present has means mills can adjust output to

adapt to disrupted harvesting and transport problems.

Suspected illegal trafficking of Kevazingo

Recent developments in Gabon have highlight the issue of

illegal trafficking in Kevazingo. News is circulating in

trade circles that Kevazingo logs and sawnwood were

discovered in containers ready for dispatch.

Also in Gabon, the government has expressed the intention

to have Gabonese workers constitute 90% of the timber

sector workforce with 10% being expatriates. However,

implementing this has meant some mills are short of

workers and middle management staff which has slowed

operations especially in the veneer peeling mills. It is

understood the government has formed a working group to

prepare suggestions on implementation.

Increasing capacity in professional oerganisations

The ATIBT has reported that, beginning in the last quarter

of 2023, the professional organisations Artisan au Féminin

and ATBO in Cameroon, CMA, Cluster bois and AMC in

Congo, FGBSP, Dynamique bois and the PO members of

the Chambre Nationale des Métiers de l'Artisanat du

Gabon (CNMAG) in Gabon, COPEMECO and ACEFA in

the DRC will benefit from capacity building on the

operation of an association and on strategies for accessing

public contracts or projects.

This effort is being undertaken by the Cameroon

Federation of Promoters of Secondary and Tertiary wood

processing (FECAPROBOIS) in response to the needs

expressed by industry players.

See:

https://www.atibt.org/en/news/13414/with-adefac-8-professional-organizations-in-the-forestry-and-timber-industry-strengthen-their-organizational-capacities

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in the Republic of Congo and Gabon.

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

2.

GHANA

Marginal growth in exports to Europe

According to the Timber Industry Development Division

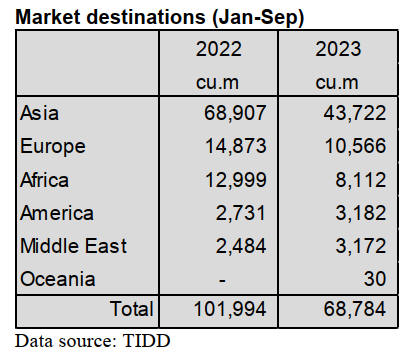

(TIDD) third quarter 2023 wood export report there were

one hundred and fifty one (151) exporters during that

period. The total export volume for the period was 68,695

cu.m, compared to 101,882 cu.m for the same period in

2022.

Exports were of air and kiln-dried sawnwood (73%),

plywood for all markets (12.5%), veneers (5%), billets

(4%), and teak logs (2%), the balance was other wood

products.

Of Ghana’s market destinations Asia, Europe and Africa

accounted for more than 90% of the total export volumes

in both 2022 and 2023. North America and Middle East

markets accounted for less than 10% of Ghana’s total

export volumes.

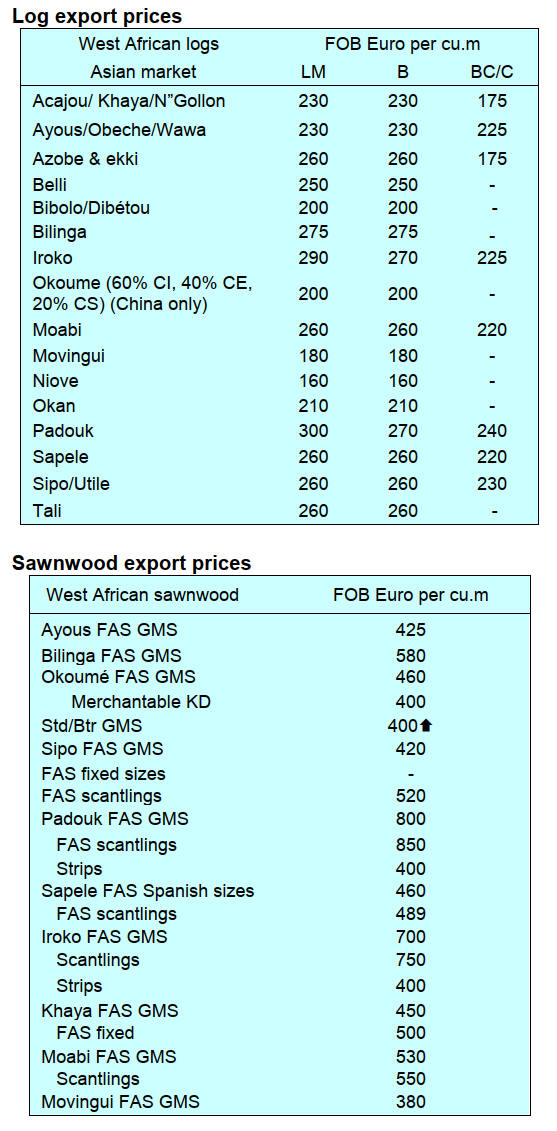

The table above shows that, of the three main market

blocks only Europe recorded a marginal increase. In

contrast, the 2023 trade with Asian and African markets

declined year on year. Ghana’s exports to the Asia earned

Eur17.03 million (56%) from 43,722 cu.m. (64%) of wood

products exports during the third quarter of 2023

compared to the 2022 figures of Eur27.78 million (61%)

and 68,907 cu.m (68%) considerable declines. India was

the primary destination (in terms of value) for Ghana’s

wood products.

For exports to Europe total receipts were Eur6.13 million

from a volume of 10,566 cu.m during the third quarter of

2023. The figures indicated decreases of 35% and 29% in

value and volume respectively as compared to Eur9.43

million (21%) obtained from the volume of 14,873cu.m

(15%) recorded in the third quarter of 2022.

The data also showed exports of wood products to

European markets included products such as air and kiln

dried sawnwood, plywood, billets, rotary veneers,

mouldings, sliced veneer, teak logs, briquettes and

kindling.

Wood products exported to Africa were air and kiln dried

sawnwood, plywood, rotary veneer, mouldings and

veneers. These were valued at Eur3.12 million from a total

volume of 8,112 cu.m during the third quarter of 2023.

These figures showed decreases of 33% and 38% in value

and volume respectively when compared to the Eur4.68

million from a volume of 12,999 cu.m recorded in 2022.

Egypt, South Africa, Morocco, Tunisia, Algeria and

Mauritius were the main destinations for these wood

products.

For the period under review a total of ten ECOWAS

(Economic Community of West African States) countries

within the sub-region accounted for an export volume of

6,959 cu.m valued at Eur2.49 million out of the total

African wood products in 2023 against 12,237 cu.m

(Eur4.23 million) recorded in the same period last year.

This translates to an overall higher average unit price of

Eur357/cu.m for the period in 2023 compared to

Eur346/cu/m in 2022.

Objections raised over proposed mining in forest

reserves

Some Civil Society Organizations (CSOs) have been

alarmed by the plans prepared by a new mining company,

High Street Ghana Limited, to mine in one of Ghana’s

Recreational Forest Reserves, the Kakum Park. This

comes after there were reports suggesting the mining

company took over of some parts of the Kakum National

Park for mining.

The public have expressed outrage over how part of the

country’s forest reserves were allocated for mining. This

prompted stakeholder organisations in the forestry and

environmental fields to call for an immediate review of the

Legislative Instrument (L.I 2462) on Environmental

Protection (Mining in Forest Reserves.

During a stakeholder engagement on the new Regulation

on Mining in Ghana’s Forest Reserves (LI 2462) 2022 the

Director of Nature and Development Foundation

cautioned against the potential widespread destruction of

the country's forests if the Legislative Instrument (LI

2462) is not revoked.

According to a stakeholder analysis of L.I. 2462, the new

regulations on mining in the forest resetrves had no

legislative foundation and were not consistent with the

country's environmental policies. In response the Chief

Executive Officer (CEO) for the Minerals Commission,

Martin K. Ayisi, said there is currently no law in Ghana

that bans mining in forests.

However, the media report the Minerals Commission has

rejected the application from High Street Ghana Limited

for a mining license within the Kakum National Park.

The Ghana Institute of Architects (GIA), which also

expressed great concern about the attempt to mine within

the Kakum National Park, has commended the

Commission in refusing the permit.

See:

https://thebftonline.com/2023/11/13/cso-coalition-kicks-against-mining-in-forest-reserves/

and

See:https://www.myjoyonline.com/high-streets-application-to-mine-in-kakum-park-was-rejected-minerals-commission/

3. MALAYSIA

Effectiveness of certification

policing questioned

A recent report claims there are weaknesses in the

Malaysian Timber Certification Scheme (MTCS) which,

the report says, casts doubt on the effectiveness of the

Malaysian Timber Certification Council (MTCC) and the

PEFC in guaranteeing standards and enforcing

compliance.

It is claimed in the report that SIRIM, the accrediting and

auditing body, does not have a clear limit on how many

issues of non-compliance lead to suspension or revocation

of certificates.

The Report says “We know that the government of

Sarawak is making real and concerted efforts to protect

their forests. But the way that MTCS is currently

functioning simply cannot guarantee any of the standards

they claim to uphold, says the report. The system needs to

be reformed.” The report lays out 15 key

recommendations for improving the system with a focus

on reforming the grievance procedures.

See:

https://www.bmf.ch/en/news/lost-in-certification-new-report-exposes-greenwashing-in-malaysian-timber-industry-241

and

Read more:

https://www.nst.com.my/news/nation/2023/11/978474/groups-cite-violations-forest-certification-standards-call-review-timber

Auditor-General’s report highlights forest management

issues

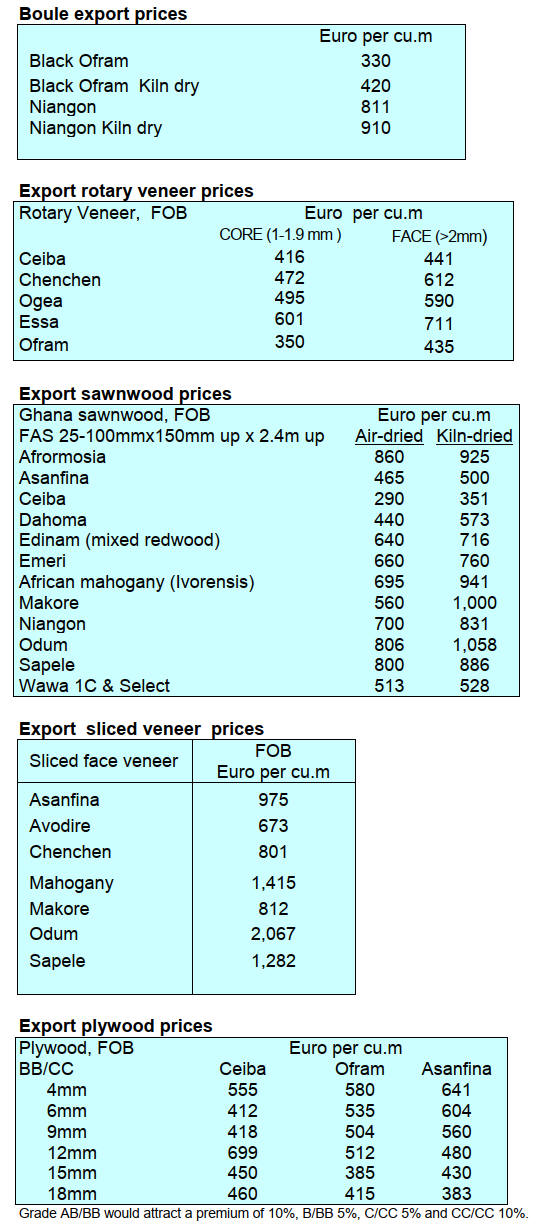

According to the 2022 Auditor-General’s Report the

country’s forestry sector contributed RM6.601 billion to

GDP or 0.4% of GDP and exports by the timber industry

contributed a total of RM22.744 billion in 2021.

The report says “Overall, based on the scope of the audit,

forest management in Malaysia has been done sustainably

to provide socio-economic benefits and maintain

environmental sustainability. However, based on audit

samples reviewed in nine states there were cases where the

weakness in forest management in development of forest

plantations, logging, mining and quarry activities within

the Permanent Forest Reserve (HSK) had “posed a

negative impact on the environment.”

To ensure that the objective of Sustainable Forest

Management is achieved the report recommends that the

Ministry of Natural Resources, Environment and Climate

Change (NRECC), the Forestry Department of Peninsular

Malaysia and the Forest Departments in Sarawak and

Sabah create a database on the area of the permanent

forest reserve, protected areas and forest land.

See:

https://www.thestar.com.my/news/nation/2023/11/22/public-can-monitor-issues-highlighted-in-a-g039s-report-via-digital-dashboard

and

https://www.malaymail.com/news/money/2023/11/22/a-gs-report-forestry-sector-contributes-rm6601b-to-malaysias-gdp/103533

Sarawak enacts climate change law

The Sarawak State Legislative Assembly passed the

Environment (Reduction of Greenhouse Gases Emission)

Bill making Sarawak the first state in the country to have

legislation to address climate change. The Bill aim to

safeguard Sarawak's environment by implementing

strategies to reduce greenhouse gas emissions and achieve

net zero carbon emissions in the State by 2050.

While Malaysia had committed to reduce greenhouse gas

emissions by 45% by 2030 and achieve carbon neutrality

by 2050 in accordance with the Paris Agreement, the

country’s Parliament has not yet adopted legislation to

achieve these obligations.

The measures provided in the Bill in Sarawak include

requiring registered businesses in scheduled economic

sectors to submit annual carbon emission reports and the

setting carbon emission thresholds. Where any registered

business entity is unable or unwilling to bring their carbon

emissions down to the emission threshold levels, a carbon

levy at a rate to be determined by the State Cabinet will be

imposed.

The Bill provides for a robust system for verification and

validation by appointed carbon standard administrators to

ensure integrity and credibility for carbon credits issued in

Sarawak.

See:

https://www.thestar.com.my/news/nation/2023/11/20/sarawak-first-in-the-country-to-enact-anti-climate-change-law

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Malaysia

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

4.

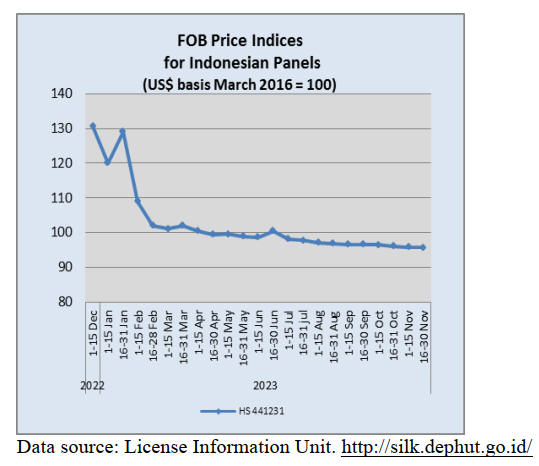

INDONESIA

Knock-down furniture

exports to Europe decline

Sapto Daryono, the Chairman of the Regional Committee

for the Indonesian Furniture and Crafts Industry

Association (Asmindo) said that knock-down furniture

exports are still experiencing a decline as global demand

falters. The Association had pinned hopes on the domestic

market especially as the government encouraged furniture

entrepreneurs to produce E-Catalogues.

However, the domestic market is increasingly difficult to

penetrate because it is flooded with imported products

which are offered at very affordable prices. He added,

“people tend to choose cheaper products even though the

quality of Asmindo products is higher and the products are

unique.

He said he hopes locally made products will be given a

chance so that imported goods do not dominate the local

market.

In related news, according to ACE Director, Teresa

Wibowo, the furniture market in Indonesia is predicted to

grow further in the future and this will be good for

Indonesian furniture businesses. Moreover, the Indonesian

economy is growing and this will have a positive impact

on the potential for development of the domestic furniture

market.

"I continue to think positively about the future

development of the Indonesian furniture business because

many foreign investors are arriving to secure business.

This year could be the revival of the national furniture

industry, said Teresa, as the government is supporting

several international exhibitions which could boost trade.”

See:

https://jogja.tribunnews.com/2023/11/16/ekspor-furniture-diy-ke-eropa-turun-kerajinan-masih-bisa-bertahan

and

https://economy.okezone.com/read/2023/11/07/455/2916069/potensi-besar-bisnis-furniture-di-indonesia?page=2

Furniture design competition, support for a

sustainable furniture industry

The furniture industry is a very strategic sector for

Indonesia’s economic development. There are several

criteria that make furniture making a strategic sector and

these are because it is an added value sector and

Indonesian furniture is globally competitive. An advantage

is that Indonesia has abundant natural raw materials and it

also has manufacturing and design skills.

To further increase interest in sustainable furniture among

the Indonesian people a programme entitled "Indonesian

Sustainable Furniture Design Competition" (ISFDC) will

be held.

Hartono Prabowo, Technical Director of FSC Indonesia

said the ISFDC is an excellent opportunity for professional

designers to be able to increase their role in forest

sustainability by creating furniture designs that use

materials from sustainable sources so that forest managers,

including forest farmers in remote villages can benefit.

See:

https://wartaekonomi.co.id/read518853/indonesian-sustainable-furniture-design-competition-dukungan-untuk-industri-furniture-berkelanjutan

The Indonesian forestry paradigm

The Ministry of Environment and Forestry has invited

academics and the Dean of the Faculty of Forestry, Gadjah

Mada, University (UGM) to offer inputs regarding the re-

orientation of Indonesia's sustainable forestry development

paradigm. The Minister of Environment and Forestry, Siti

Nurbaya, said it was important to formulate a re-

orientation of sustainable forestry development and this

discussion could be important for future forest

management, including strengthening the National Level

Forestry Plan (RKTN).

Minister Siti conveyed some notes for particpants:

First, on a green manufacturing orientation, Minister Siti

said this was something important and this would be the

basis for the Ministry. For example, when talking about

social forests there is already a Presidential Regulation on

Integrated Area Development based on social forests. The

government has positioned National Parks as the center or

source of regional economic growth. National Parks can

also provide examples for appropriate income distribution.

Second, it is necessary to develop a centre of excellence.

This is intended for forest landscape management. As a

start, The Minister encouraged UGM's Special Purpose

Forest Area (KHDTK) to become a centre of excellence in

Java. She added, "because we have different landscapes,

centres of excellence need to be developed in other

locations such as Kalimantan and Sumatra”.

Third, Minister Siti said that forest management in

Indonesia could be an evolutionary development with

forests and other land uses at the centre.

See:

https://www.medcom.id/pendidikan/news-pendidikan/4KZMX9wk-klhk-minta-masukan-20-guru-besar-ugm-soal-paradigma-kehutanan-indonesia

and

https://www.tribunnews.com/nasional/2023/11/14/menteri-lhk-tekankan-pentingnya-reorientasi-paradigma-pembangunan-kehutanan-indonesia-berkelanjutan.

and

https://www.msn.com/id-id/berita/nasional/klhk-bahas-pembangunan-kehutanan-indonesia-bersama-20-guru-besar-ugm/ar-AA1jV6LK

Carbon trading scheme for forestry sector

Indonesia has launched a carbon trading scheme to boost

GHG emissions absorption in the forestry and other land

use sectors to reach carbon dioxide reduction targets by

2030.

The Chairman of the Indonesian Association of Forest

Concessionaires (APHI), Indroyono Soesilo, in a press

release, stated that half of the companies holding Forest

Utilisation Licenses (PBPH) have been included in the

carbon trading scheme, adding there are 600 PBPH

holders that have been included.

According to Indroyono, PBPH holders must meet several

requirements to enter the carbon credit scheme including

drafting a Mitigation Action Plan Document before being

included in the National Registration System. Emissions

Reduction Certificate (SPN) will be released after a

verification and monitoring processes.

See:

https://en.tempo.co/read/1795204/indonesia-releases-carbon-trading-scheme-for-the-forestry-sector

Entrepreneurs encouraged to adopt multi-business

forestry

The Ministry of Environment and Forestry is encouraging

companies receiving Forest Utilisation Business Permits

(PBPH) to implement Multi-business Forestry plans to

support Indonesia's FOLU Net Sink 2030 which is in line

with achieving the Global Development Goals.

The Director General of Sustainable Production Forest

Management in the Ministry, Agus Justianto, explained

that corrective steps are needed to strengthen strategic

policies to stimulate the forestry sector, especially in the

upstream sector and in addressing climate change. This

includes providing support to businesses to implement

Multi-Business Forestry.

A change in the forest management paradigm through

Multi-business Forestry is expected to encourage the

development of various multifunctional forest

management models so that the spectrum of types and

business options that are implemented become wider.

For the implementation of Multi-business Forestry

companies need to apply an appropriate management

regime according to local conditions including

environmental carrying capacity, land suitability, agro-

climate and socio-economic institutions. He emphasised

that Multi-business Forestry needs to be interpreted not

just as an exploitative business model but must be able to

accommodate a variety of local, regional, national and

even international interests.

See:

https://forestinsights.id/pengusaha-hutan-didorong-implementasikan-multi-usaha-kehutanan/

Improving the human resources for the furniture and

crafts industry

The Indonesian Furniture and Crafts Industry Association

(Himki) stated that they are committed to improving

human resources in the national furniture and crafts

industry.

The Chairman of Himki, Abdul Sobur, stated that human

resources are an important factor in the furniture and crafts

industry and play a central role in determining product

value. However, Abdul Sobur admitted that some

companies still have difficulty finding experienced and

certified workers with skills. He added, the furniture and

crafts industry is currently experiencing high competition

with other industrial sectors for labour.

The Himki held a meeting with the Head of the Industrial

Human Resources Development Agency, Ministry of

Industry and conveyed some suggestions including the

need to increase the budget for student scholarships at the

Furniture and Wood Processing Industry Polytechnic

(Polifurnika) as well as providing student scholarships at

universities that have majors supporting the furniture and

craft industry.

It is necessary to develop Vocational High Schools and

universities related to the furniture and craft industry to

achieve a link and match with the industry, he said. Also

establishing integrated training centres would help

upgrade the quality of human resources.

See:

https://www.antaranews.com/berita/3823803/himki-berkomitmen-tingkatkan-kualitas-sdm-industri-mebel-dan-kerajinan

National economy continuing to grow amid global

uncertainty

The Indonesian economy is continuing to grow positively

despite global uncertainty according to economist and

Research Director at the Center of Reform on Economics

(CORE) Indonesia, Piter Abdullah. He said this was

evident by positive growth in 2022 and this year.

2023 presented risks to the economy but “we have been

able to survive and continue to grow positively" he told

the media, because Indonesia's economic fundamentals

remained solid.

The characteristics of the Indonesian economy, which

relies mostly on domestic demand, provides scope for

continued positive growth, he argued. Statistics Indonesia

reported tha, in the third quarter of 2023, the national

economy grew by 4.94% year on year. The figure reflected

a slight slowdown compared to the previous quarter's

growth of 5.17%.

See:

https://en.antaranews.com/news/298848/national-economy-continuing-to-grow-amid-global-uncertainty-expert

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Indonesia

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

BMRC Webinar ‘Incentivising Good Tropical Forest

Governance’

Dr. Krisdianto Sugiyanto, Honorary Chair of the Broader

Market Recognition Coalition (BMRC) Interim

Secretariat, delivered opening remarks at a BMRC

Webinar ‘Incentivising Good Tropical Forest Governance’

the text of which is provided below.

“The BMRC is a platform to endorse, monitor and

promote implementation of national sustainable forestry

systems and to label and promote trade of forest products

that originated from BMRC-endorsed national systems.

The BMRC will also promote internationally harmonised

standards for legal and sustainable forest products in trade

regulations and public and private sector procurement that

give recognition to BMRC labelled products.

Development of the BMRC was initiated since

deliberations and discussions in the Indonesian Pavilion

during COP 26 and several global fora on forest policy on

the need to provide incentives for good forest governance

through broader market recognition beyond FLEGT VPA

upon qualifying national verification systems.

Producer countries have been developing robust national

systems on timber legality assurance system and call for

wider recognition by markets beyond the FLEGT VPA

partners. In a Policy Forum on Broader Market

Recognition in London in September 2022, multi-

stakeholders of 6 (six) countries (Indonesia, Ghana,

Liberia, Guyana, Cameroon, and the Republic of Congo)

agreed to collaborate towards formalisation of a coalition

to work towards broader market recognition on national

verification systems beyond FLEGT VPA processes. The

Forum also drafted a joint statement that subsequently was

finalised and signed in the margin of COP 27.

Subsequently, in a meeting in Bali in February/March

2023, the coalition countries agreed to entitle the coalition

as Broader Market Recognition Coalition (BMRC) and

developed a draft of roadmap and action plan to secure

broader market recognition of national sustainable forestry

systems.

An interim secretariat of BMRC was also established to

facilitate the works of the coalition towards the intended

missions.

The Coalition has also developed its logo and website as a

platform to disseminate BMRC visions and missions and

to accommodate query and inputs and to share and discuss

how to reward good governance with recognition and

strong market incentives upon BMRC forest products.

As stipulated in the roadmap, the Coalition will further

develop institutional arrangement and mechanism for

recognition of endorsement of national systems, on-

product labelling and promotion of BMRC forest products.

Further the coalition will also work towards development

of partnership and mutual collaboration towards

achievement to provide market incentives upon the

national systems as outlined in the joint statements and the

roadmap.

The founding countries of BMRC invite other timber-

producer countries to join the initiative to foster a broader

market recognition of national systems, as well as

participation of non-tropical countries. Both producer and

consumer countries will mutually be benefiting from such

collaboration.

We believe that collectively the BMRC is a

strategic

measure to drive stronger transformation and a platform to

supports efforts to combat illegal logging and associated

trade, to promote implementation of sustainable forest

management, and to contribute to the global ambition in

addressing climate challenges.

In addition to efforts to introduce BMRC in global setting,

the BMRC Interim Secretariat and coalition members have

carried out outreach and sharing information to respective

stakeholders upon the establishment of the Coalition,

including in meetings of the Asia Pacific Forestry

Committee (APFC) 2023 in Sydney, the 59th International

Tropical Timber Council (ITTC) in Pattaya Thailand, and

the Global Legal & Sustainable Timber Forum (GLSTF)

2023 in Macau China. This was to provide information

regarding the existence, mission, and objectives of this

coalition.

Further, the Interim Secretariat of BMRC invites

participation of stakeholders to BMRC sessions in the

Pavilion of Indonesia and COMIFAC in COP 28 Dubai to

share vision, roadmap and recent development of BMRC

and the future works and activities to be carried out by the

coalition. We believe that wider participation of stake-

holders form both producer and consumer countries will

help to strengthen the platform and to expand its positive

impact to support achievement towards transformations to

a better global forest management.”

See: https://forestgovernance.org/

5.

MYANMAR

Emerging role of NTFP and plantation timber

The Myanmar Wood-Based Furniture Association

(MWBFA) has taken another step in its business

promotion efforts with a visit to Union Minister of Natural

Resources and Environmental Conservation (MONREC)

to discuss the opportunities from utilising non-timber

forest products and plantation species other than teak.

Early this month the MWBFA sponsored the Myanmar

Furniture Exhibition (TTM Report Volume 27 Number

21). According to local news outlets the Association

members showcased furniture made from non-timber

forest products such as rattan, bamboo and from fast

growing plantations species such as Acacia.

Because of sanctions on the Myanma Timber Enterprise

(MTE) opportunities for wood product exports are

impacted. The MTE is the State institution which is solely

authorised to extract timber from the natural forest.

Commentators in Myanmar are of the opinion that timber

from the private plantations and non-timber forest

products (NTFP) could be exempted from sanctions since

there is no direct or indirect involvement of the MTE.

Climate vulnerability in Myanmar

In a press release the UN warned that the ongoing conflict

in Myanmar has not only caused a human tragedy but is

also an environmental catastrophe. The press release

continues “It is imperative that world leaders help end the

crisis in Myanmar by supporting communities to mitigate

climate impacts.

Increasingly isolated from the global economy and

strapped for cash, the military junta has accelerated the

exploitation of Myanmar’s natural resources, including

timber, jade and rare earth minerals to fund its human

rights abuses. The press release adds “growing resource

extraction, often unregulated and facilitated by the military

or other armed groups, is degrading the environment,

polluting water sources, ravaging forests and exacerbating

climate change risks. Myanmar is ill-prepared to deal with

the fast-approaching effects of climate change.”

See -

https://www.ohchr.org/en/press-releases/2023/11/military-coup-has-exacerbated-already-severe-climate-risks-myanmar-un

Disruption of border trade at more locations

The domestic media has reported recent armed clashes

have had a severe impact on the border trade and

businesses are suffering huge losses after the main China

border trade zone was closed after an alliance of three

ethnic groups launched offensives and took control of all

major routes to the border trading towns of Muse, Chin

Shwe Haw, Laukkai and Hseni.

The Muse border accounts for about 70% of Myanmar’s

cross-border trade with China and with it closed an

estimated US$400,000 in daily tax revenue has been lost.

The media report the estimated tax revenue in the first six

months of this year at US$77 million.

During the first five months of the 2023-2024 fiscal

year

trade between Myanmar and China exceeded US$3,832

million. China imported over US$2,510 million worth of

goods according to the Ministry of Economy and

Commerce.

See-

https://news-eleven.com/article/283189

and

https://www.irrawaddy.com/business/myanmar-china-trade-corridor-closed-as-battle-rages-in-northern-shan.html

6.

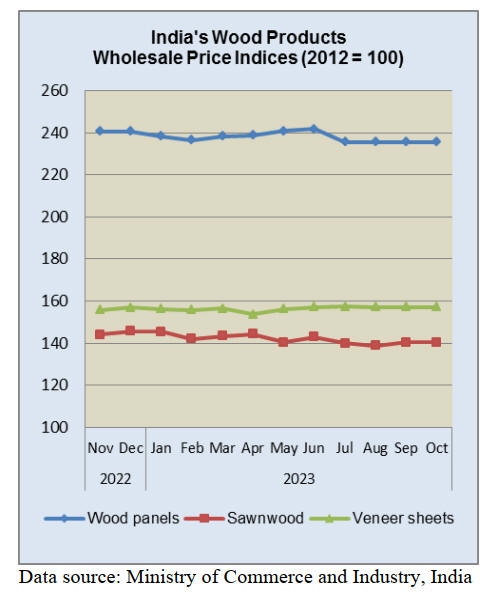

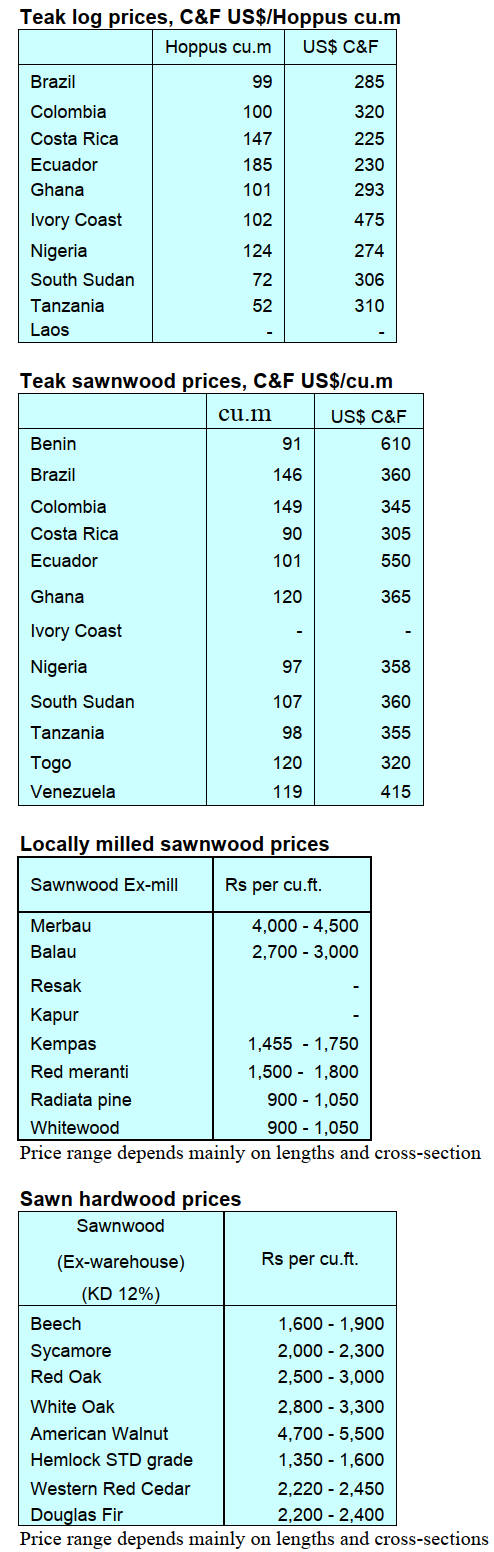

INDIA

No change in manufacturing

price index

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) in October, was minus

0.52% in October compared to minus 0.26% recorded in

September 2023. The negative rate of inflation in October,

2023 was primarily due to fall in prices of chemicals and

chemical products, electricity, textiles, basic metals, food

products, paper and paper products as compared to the

corresponding month of previous year.

The index for manufacturing remained constant at 140.3 in

October2023 and September 2023. Out of the 22 NIC two-

digit groups for manufactured products, 13 groups

witnessed an increase in prices, 7 groups witnessed a

decrease in prices whereas 2 groups remained unchanged.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

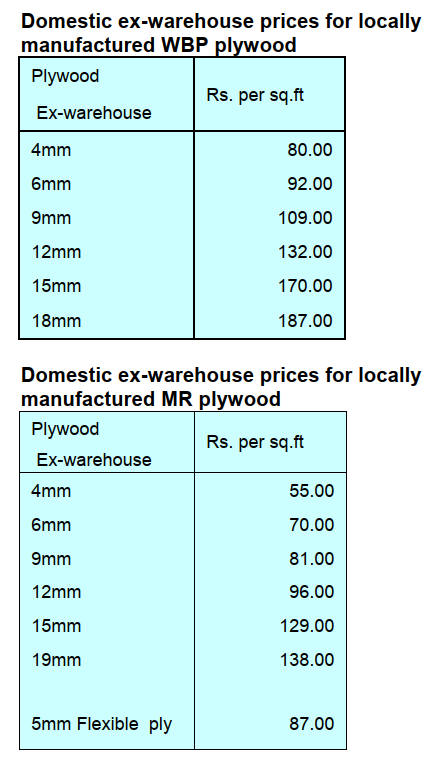

Mandatory Standards for for panels and furniture

The Bureau of Indian Standards (BIS) has issued

mandatory quality control orders for plywood, blockboard,

doors, MDF, particleboard, shuttering ply and a range of

other products and advised businesses to prepare and

secure BIS compatible. The order applies to domestic

producers and overseas suppliers.

The Order, called the Wood-Based Boards (Quality

Control) Order, 2023 will come into force six months from

the date of publication of the notification. The

Government order will apply tom overseas producers of

MDF and Plywood who export materials to India and

suppliers have been anxiously contacting importers.

The BIS order is mandatory for all companies and it is

understood that plywood manufacturers in India’s

unorganised sector will be given up to twelve months to

comply. The BIS order will apply to wood products

manufactured locally for export and the entry into force

will be 6 months for large companies, 9 months for

medium sized companies and 12 months for small and

micro industries.

Sources at the BIS confirm that overseas panel producers

have been approaching the BIS office to be certified but

for many there are questions such as “how to get BIS

certification and what are the costs for meeting the BIS

Standard”

Products affected

Panels

MDF is being imported to India from Vietnam, Malaysia,

and Thailand. Similarly, plywood is being imported from

Russia, Vietnam, Nepal, Indonesia, Malaysia and China

and others. Particleboard is being imported mainly from

Malaysia, Thailand, China and Vietnam.

After the notification of mandatory BIS for these products

the importers are insisting that overseas shippers obtain

the BIS standard.

The Indian particleboard industry has a very short of time

to secure the ISI Mark (a standards-compliance mark for

industrial products in India since 1950. The mark certifies

that a product conforms to an Indian standard) because the

deadline for them is 10 February 2024. According to the

BIS approximately 80% of particleboard and pre-lam

particleboard producers have not obtained an ISI mark

from the BIS.

BIS Officials confirm that the BIS Quality Control Order

is final and for the benefit of consumers and that the

industry should come forward and secure certification. It

has been reported that India has 90 pre-lam board

producers but as of October this year only 18 have ISI

certificates.

Furniture

The government also proposes bringing furniture under

BIS marks but this has been resisted by local

manufacturers and importers saying quality

standardisation will be very difficult to meet.

The Bureau of Indian Standard (BIS) wants beds, wooden

tables and chairs to be able to take a load of 110 kgs and

60 kgs respectively and meet stability, strength and

durability tests.

The industry says that the Quality Control Order (QCO),

which applies to imported and domestically produced beds

and chairs, is putting excessive burdens on them as the

Standards are tough to comply with.

The private sector and industry bodies have sought a

review of the Standards arguing that they should be

aligned with international standards. They also want a

phased implementation plan instead of rolling out the

Standards at one time. The government proposed bringing

wooden furniture under the Quality Control Order from

2025.

Plywood

It is understood that the main plywood manufacturing

companies have requested BIS to reconsider the quality

standards as for B Grade plywood/inferior quality

plywood there is no specific standards for which

certification from BIS can be secured. They argue that the

standards were made several years ago and needs to be

updated taking account of the reality in the market.

Also, there are over 1,000 small and micro manufacturers

(unorganised sector) which are producing plywood and for

them buying new machinery, laboratory equipment and

implementing quality control procedures will be expensive

and they asked for more time and a waiver on marking

fees.

MDF

Medium Density Fibreboard (MDF) is another industry in

India which is relatively young having been operating for

around 15-20 years and the sector is dominated by big

corporations and is well organised.

As of October 70-80% of MDF manufacturers were

certified companies hence BIS will hardly affect the

domestic MDF manufacturers. However, importers of

MDF will face some hurdles as the overseas suppliers will

require BIS certification.

Decorative plywood

Decorative Plywood is heavily dependent on imported

base panels coming from Malaysia, Indonesia and China.

As of November BIS Certifications have not been issued

to any overseas manufacturers/suppliers of plywood for

the manufacture of veneered decorative plywood.

Industry sources say it may take companies 3-6 months to

secure BIS certification and there is considerable concern

among manufacturers and importers.

The above was compiled from reports in the media, from

PlyReporter and from discussions with various industries

and importers.

See:

https://www.plyreporter.com/article/143714/imported-wood-panels-to-be-bis-marked-proposed

and

https://www.plyreporter.com/article/143759/overseas-panel-producers-seek-bis-standard-certification

Sandalwood plantation owners cheer

In what could help sandalwood plantation owners earn

more through exports the Convention on International

Trade in Endangered Species of Wild Fauna and Flora

(CITES) has removed India from its Review of Significant

Trade (RST) for Red Sanders Sandalwood.

The RST listing is the result of instances of species

smuggling. This decision was taken at the 77th meeting of

the Standing of CITES.

Red sanders (Pterocarpus santalinus) is a high value tree

endemic to few districts in Andhra Pradesh. The species

has been listed in Appendix II under CITES since 1994.

However, red sanders sourced from plantations comprise a

major part of the legal export.

https://www.business-standard.com/industry/agriculture/red-sanders-removed-from-cites-review-of-significant-trade-bhupendra-yadav-123111300597_1.html

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

W&WP exports to Canada in October 2023 were worth

US$19.8 million, up 22% compared to October 2022. In

the first 10 months of 2023 W&WP exports to Canada

reached US$62 million, down 22% over the same period

in 2022. The rate of decline has tended to narrow thanks to

consecutive increases in export turnover in recent months.

W&WP exports to the UK in October 2023 were valued at

US$18.7 million, up 25% compared to October 2022. This

is the second consecutive month that exports to the UK

increased year on year. This growth contributed to slowing

the gradual decline in exports in the first 10 months of

2023.

In October 2023 exports of kitchen furniture reached

US$112.7 million, up 23% compared to October 2022. In

the first 10 months of 2023 exports of kitchen furniture

reached US$947.1 million, down 16% over the same

period in 2022.

In October 2023 tali wood imported into Vietnam stood at

29,400 cu.m worth US$12.5 million, down 6% in volume

and 6% in value compared to September 2023. Compared

to October 2022, it decreased by 44% in volume and 41%

in value.

In the first 10 months of 2023 tali wood imports were

328,500 cu.m, worth US$137.5 million, down 26% in

volume and 24% in value over the same period in 2022.

Imports of raw wood (logs and sawnwood) from the US in

October 2023 increased again reaching 45,000 cu.m at a

value of US$18.5 million, up 6% in both volume and

value compared to September 2023.

The total volume of raw wood imported from the US in

the first 10 months of 2023 was 436,880 cu.m, worth

US$185.77 million, down 26% in volume and 34% in

value over the same period in 2022.

Wood and forest product exports

Vietnam earned US$11.65 billion from exporting wood

and forest products in the first ten months of this year, a

19% decline year-on-year according to the Vietnam

Timber and Forest Product Association. Export revenue

was US$1.28 billion in October, down 0.2% cent year-on-

year, of which wood and wood product exports earned

US$1.2 billion.

The decline in demand was put down to inflation and

tightened monetary policies in major wood product

markets and this has resulted in a decline in export

earnings since the beginning of the year, according to the

Association. However, many wood enterprises have begun

to receive more orders to satisfy year-end festive season

demand in global markets. The export of wood and forest

products for 2023 is estimated to reach US$15 billion

according to the Association.

Timbers from Laos and Cambodia - import ban

extended

Five years ago Vietnam’s Ministry of Industry and Trade

issued Circular No. 44/2018/TT-BCT regulating the

temporary suspension of import and re-export of round

wood and sawnwood from natural forests from Laos and

Cambodia. This Circular is effective until December 31,

2023.

After 5 years of implementation the Ministry of Industry

and Trade has conducted a review and assessment of the

implementation of Circular No. 44/2018/TT-BCT. Based

on the results of the summary and assessment and to avoid

legal gaps when Circular No. 44/2018/TT-BCT expires,

the Ministry issued Circular No. 21/2023/TT-BCT dated

November 14, 2023 extending the suspension of import

and re-export of roundwood and sawnwood from natural

forests in Laos and Cambodia.

Vietnam is committed to implement policy mechanisms

and measures to improve the effectiveness of forest

management and forest product management to ensure

compliance with international norms and regulations.

Vietnam has participated in a Voluntary Partnership

Agreement between Vietnam and the EU on forest law

enforcement, forest governance and forest product trade

(VPA/PLET), the Convention on International Trade in

Endangered Species of Wild Flora and Fauna (Cites) and

is active in strengthen measures to protect the environment

and to combat climate change.

See:

https://vietnamagriculture.nongnghiep.vn/laos-and-cambodias-natural-forest-wood-import-and-re-export-ban-d368639.html

Certification of 1 million hectares

It has been determined that sustainable forest certification

for one million hectares of large-sized timber forests can

be a passport for Vietnam's wood processing industry to

increase export earnings and diversify markets. Moreover,

achieving sustainable forest certification for one million

hectares of large-sized timber forests will help reduce

dependence on imported raw materials.

According to statistics from the Department of Forestry,

the country's current total forest area is about 14.74

million hectares. Of this planted forests account for 31%.

In 2022 Vietnam earned US$15.67 billion from exporting

forest and wood products. The country aims to achieve

US$18- 20 billion from exports by 2025 and US$23-25

billion by 2030.

According to Vu Thanh Nam, Head of the Forest

Department’s Forest Utilisation Division, the country

currently has about 4 million hectares of production

forests providing about 20 million cubic metres of wood

and this is planted mainly with acacia, eucalyptus,

cinnamon and pine.

However, forestry experts advised that Vietnam should

switch to investing in large-sized timber forests to further

increase export value.

Of the 4 million hectares of production forests the

plantation area of large sized timber (over 10 year old) is

currently about 440,000 hectares. The State has a policy to

support forest planting at VND8 million per hectare and

the Ministry of Agriculture and Rural Development has

submitted to the Government proposals to promulgate a

policy for forest planters to borrow capital to produce

large sized logs.

The Ministry of Agriculture and Rural Development is

developing a project to create plantations to produce large

sized logs including mechanisms and policies on

cooperation and association with the aim to have 1 million

hectares of large-sized timber forests by the end of 2030.

In addition, local groups and communities will be

encouraged to plant for long rotations to produce large

logs.

According to Tran Lam Dong, Deputy Director of the

Vietnam Academy of Forest Sciences, it is necessary to

expand cultivating trees in areas with sustainable tree-

planting certification to produce raw material for

manufacturers.

Vietnam has two types of forest certification including the

national forest certification system (VFCS) from the

Office of Sustainable Forest Management Certification

and FSC forest management certification from the

International Forest Stewardship Council. As of

September 2023 Vietnam's total forest area that has

achieved both VFCS and FSC certification is nearly

500,000 hectares.

See:

https://en.sggp.org.vn/vietnam-strives-to-have-1-million-hectares-of-large-wood-with-certifications-post106573.html

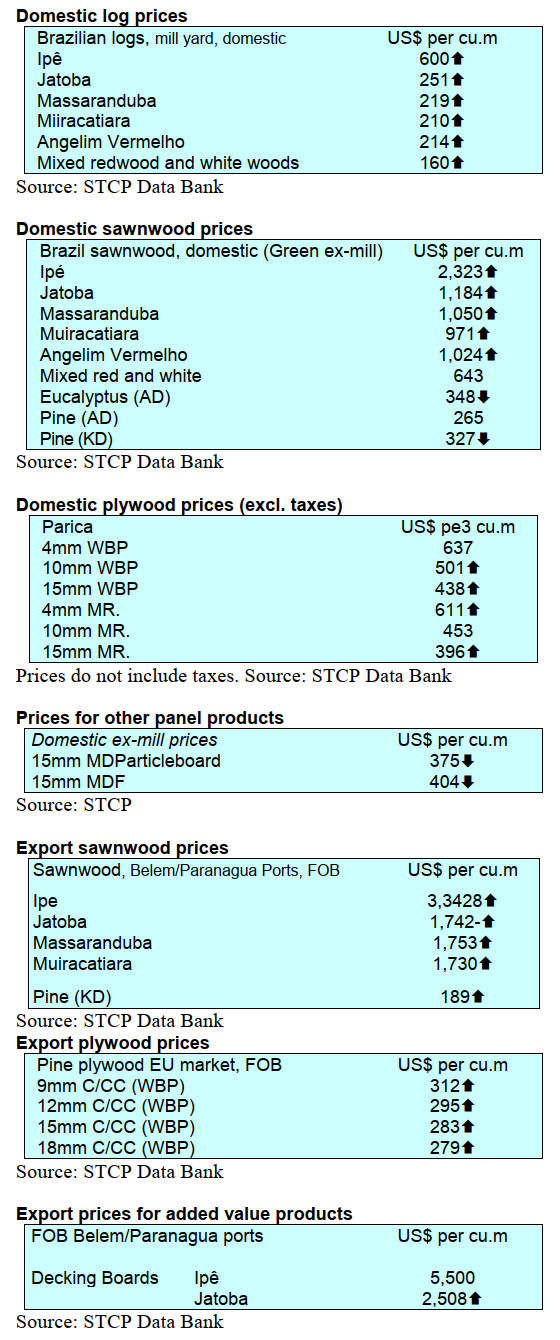

8. BRAZIL

Drop in timber exports

from Acre in 2023

Timber exports from the state of Acre in the Amazon

Region fell sharply from US$16.3 billion between January

and October 2022 to US$4.7 billion in the same period this

year, a drop of 71% according to the Ministry of Industry,

Foreign Trade and Services Comex statistics. In October

2023 wood product exports accounted for 22%

(US$400,000) of the total value of exports.

A recovery of timber exports is expected to improve the

state's economy. Its potential and importance in logging

and industrial production generate many jobs and

economic dividends throughout the production chain,

including services. It is hoped that an understanding

between the environmental agencies and the agents

involved in timber production can restore normal export

levels.

See:

https://www.remade.com.br/noticias/19580/queda-nas-exportacoes-de-madeira-faz-comercio-exterior-do-acre-perder-quase-10-milhoes-de-dolares-em-2023

Reforestation is not just about eucalyptus and pine

During a meeting with various forest-based sectors the

Ministry of Agriculture, Livestock and Supply (MAPA)

presented a Sustainable Forest + Plan which aims to

identify forest production chains, increase the area of

planted forests for commercial purposes and set up a

network that will connect project-holding institutions and

investors.

The Plan is due to be launched nationally by MAPA along

with a call for projects targeted at investors who want to

help with sustainable forest management. The Plan will

also focus on forest seed production, forest nurseries for

seedling production, agroforestry systems, research and

development, conservation of endangered species and

carbon value chains.

In particular, MAPA wants to demystify the idea that

reforestation is just about eucalyptus and pine. There are

many alternative species suitable to support the sustainable

use of wood from forest plantations or natural forests

according to the Secretariat for Innovation, Sustainable

Development, Irrigation and Cooperatives.

See:

https://forestnews.com.br/mapa-projeto-incentivar-a-producao-florestal/

Export update

In October 2023 Brazilian exports of wood-based products

(except pulp and paper) decreased 31% in value compared

to October 2022, from US$317.1 million to US$219.7

million.

Pine sawnwood exports dropped 43% in value between

October 2022 (US$50.4 million) and October 2023

(US$28.6 million). In volume terms exports decreased

34% over the same period, from 192,700 cu.m to 127,900

cu.m.

Tropical sawnwood exports decreased 43% in volume,

from 36,200 cu.m in October 2022 to 20,600 cu.m in

October 2023. In value terms, exports decreased 50% from

US$18.2 million to US$9.1 million over the same period.

Pine plywood exports also declined 29% in value in

October 2023 compared to October 2022, from US$61.6

million to US$43.5 million. In volume, exports dropped

18% over the same period, from 171,800 cu.m to 140,600

cu.m.

As for tropical plywood, exports decreased in volume 23%

and in value by19%, from 2,200 cu.m and US$1.6 million

in October 2022 to 1,700 cu.m and US$1.3 million in

October 2023.

The value of wooden furniture exports decreased from

US$52.9 million in October 2022 to US$ 46.3 million in

October 2023, an almost 13% fall.

Logs from Brazil arrive at Indian port

For the first time in 10 years a shipment of logs from

Brazil arrived at the Indian port of Cochin. Cochin

Port or Kochi Port is a major port on the Arabian

Sea in the State of Kerala and is one of the largest ports in

India. The vessel, MV Chintana Naree, anchored with

15,000 tonnes of logs mainly eucalyptus destined for

plywood manufacturers in Kerala, said R. Dileep, Director

of Aaron Logistics the handling agent for the ship.

Cochin Port offers incentives and ensured discount on

vessel related charges and storage rent to reduce handling

costs. The trade unions have also extended support to

reduce handling cost so as to get regular arrivals.

See:

https://www.thehindubusinessline.com/economy/logistics/after-a-decade-cochin-port-receives-timber-log-shipments-from-brazil/article67528335.ece

Export of wooden houses to DRC

The State of Santa Catarina in southern Brazil hopes to

export 1,500 prefabricated houses to the Democratic

Republic of Congo (DRC) over the next few years.

Negotiations began in 2022 involving the country's

government and the Amurel Cooperative, a consortium

made up of five timber companies located in Jaguaruna

and Tubarão, in the State of Santa Catarina.

According to the Amurel Cooperative and FIESC Litoral

Sul, initially 50 prefabricated houses will be shipped as a

trial. If everything goes according to the plan then over

the next 10 years the sale of the 1,500 structures will be

negotiated.

The funds for the purchase of the houses will come from a

UN fund earmarked for the purchase of affordable housing

in countries with a high level of social vulnerability as

determined by the United Nations.

See:

https://forestnews.com.br/santa-catarina-negocia-exportacao-de-casas-de-madeircom-republica-do-congo/

Through the eyes of industry

The latest GTI report lists the challenges identified by the private

sector in Brazil.

https://www.itto-ggsc.org/static/upload/file/20231121/1700552181514582.pdf

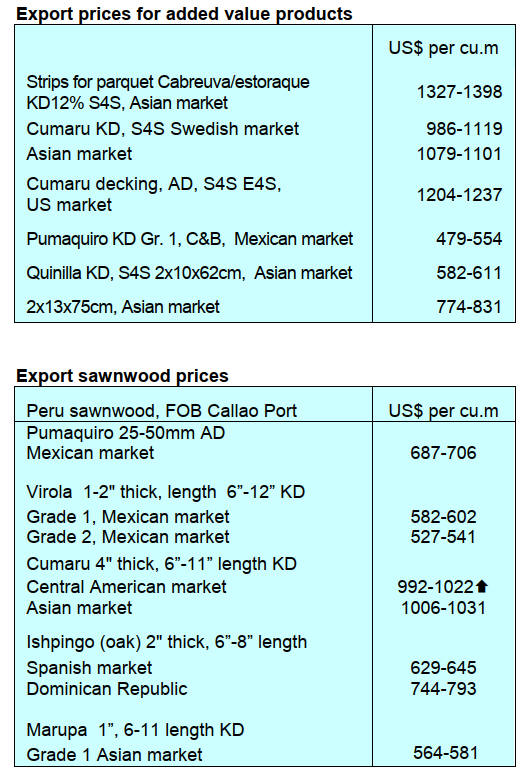

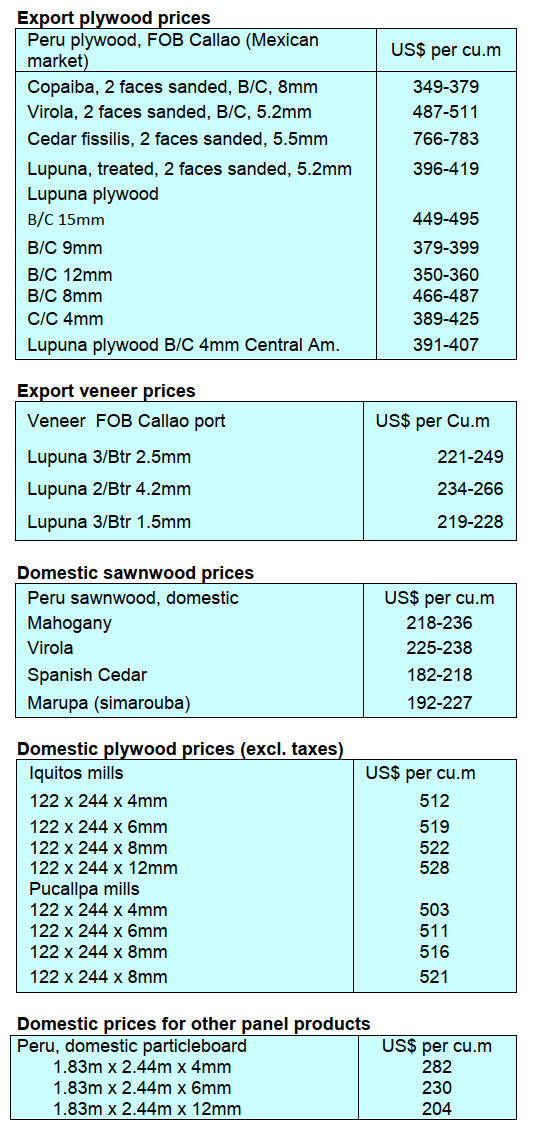

9. PERU

SERFOR approves granting

of benefits for good

forestry practices

The National Forestry and Wildlife Service (SERFOR)

approved the criteria and procedures for the evaluation and

granting of incentives and/or benefits for voluntary

forestry certification and for carrying out other good

forestry practices that will favor the competitiveness of the

sector.

With these guidelines SERFOR seeks to promote the

adoption of good practices by forestry and wildlife

companies and producers that contribute to the

sustainability of forestry and wildlife management as well

as competitiveness and social inclusion.

In Peru there are 9.3 million hectares of natural forests

under forest management of which 1.38 million hectares

have forest certification to international standard, over 80

initiatives under 40 FSC certificates at different points in

the wood supply chain and 1.9 million hectares with

carbon certification among other types of certificates.

SERFOR seeks to reward these initiatives and encourage

other holders of forest titles which include permits granted

to native and peasant communities.

See:

https://www.gob.pe/institucion/serfor/normas-legales/4810954-d000244-2023-midagri-serfor-de

Proposals to improve and promote forest

plantations

Within the framework of the National Forestry Week and

the Sustainable Productive Forests (BPS) programme,

representatives of SERFOR were present at two events

held in Cajamarca and Lima through the participation of

the management of the Forestry Project ‘Investment in

Commercial Forest Plantations’.

A presentation was given on the scope of the project in

seven regions in the country.

The School of Forest Engineering at the National

University of Cajamarca organised a forum ‘Forest

plantations in Cajamarca, perspectives in a climate change

scenario’ an event that brought together leading experts

from the university, the state and civil society to discuss

solutions to strengthen the department in relation to

forestry investment.

This event was held at the facilities of the regional branch

of the College of Engineers of Peru. In addition, it was

promoted within the framework of the National Forest

Week 2023 in coordination with the National University

of Cajamarca, SERFOR and FONCREAGRO.

See:

https://www.gob.pe/institucion/serfor/noticias/866599-serfor-participo-en-eventos-sobre-propuestas-para-mejorar-e-impulsar-las-plantaciones-forestales

OSINFOR records promote competitiveness in the

forestry sector

During the first half of November the Forestry and

Wildlife Resources Supervision Agency (OSINFOR)

delivered Certificates of Compliance to 22 holders of

enabling titles in Ucayali. This document that recognises

good forestry practices and contributes to strengthening

the legality of forest products and their competitiveness in

national and international markets.

The head of OSINFOR, Lucetty Ullilen, said “we want to

give this recognition to those who are doing their job well

and who, in addition, serve as an incentive for discounts in

the payment of rights for forestry use”. She added that the

Compliance Certificates are part of OSINFOR's

promotional approach which seeks to encourage those who

are fulfilling their obligations in forest management.

See:

https://www.gob.pe/institucion/osinfor/noticias/861586-constancias-de-cumplimiento-del-osinfor-promueven-la-competitividad-del-sector-forestal

In related news, OSINFOR has developed and

successfully implemented optimised supervision which

uses a selective logging detection algorithm to improve

monitoring efficiency to ensure the sustainability of forests

and their services.

See: https://www.gob.pe/institucion/osinfor/noticias/862656-osinfor-optimiza-las-supervisionescon-tecnologia-de-vanguardia-e-innovacion-para-hacer-frente-a-la-tala-

illegal

|