|

Report from

North America

Hardwood demand remains firm

North American new orders for tropical hardwoods have

experienced a modest slowdown, but the demand for other

hardwoods remains robust especially in high-end projects

and exterior applications, according to Fastsmarkets’

Hardwood Market Report.

The cross-commodity price reporting agency says that

sales for many importers have remained steady in October

compared to September, while other sellers have seen a

modest decline. Most, the report said, “are still

experiencing decent outbound shipments due to solid order

bookings in late summer.”

The October 31 report said that tropical hardwoods are

prevalent in high-end projects because they are relatively

expensive. “At present, importers are experiencing good

demand from producers of high-end residential moulding

and also from commercial millwork manufacturers,” the

report said. “Sales to large and mid-sized residential

flooring and stair plants are slow, but business is holding

up well with custom flooring and stair makers.”

The report also found that in residential markets, demand

for tropical hardwoods for use in exterior applications

remains noticeably stronger than for interior applications.

Sales to outdoor furniture producers remained steady, but

sales of domestic hardwoods to case goods and

upholstered furniture manufacturers are weak.

The overall supply of tropical hardwood sawnwood at US

and Canadian import yards is comparable to overall

demand. However, that is not the case across all species,

thicknesses, and product specifications. For example, 4/4

Sapelli is readily available, but many of the thicker sizes

are scarce. Likewise, some contacts indicate flatsawn

African Mahogany is difficult to source, while

quartersawn material is not.

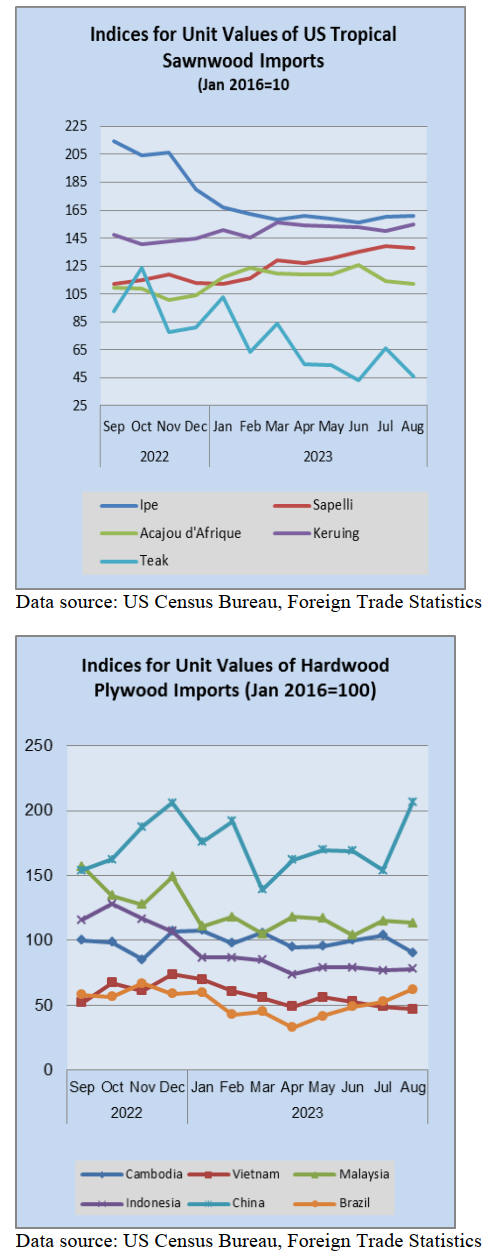

US imports of tropical hardwoods and related products—

which were showing recovery in recent months after a

slow start to the year—slowed markedly in September.

Imports of hardwood plywood tumbled 34% to a level

only about half of what it was two months ago.

US imports of sawn tropical hardwood fell by 7%; imports

of hardwood flooring fell 6%; imports of assembled

flooring panels fell 12%; and imports of wooden furniture

fell to their lowest level since March, dropping 8% in

September.

Imports of tropical hardwood veneer plunged 68%, but

that figure is not as bad as it appears since August is the

peak month for these veneer imports and a sharp drop

regularly occurs in September. On the upside, US imports

of hardwood mouldings gained 19% in September,

surpassing US$12 million for the first time since May.

Yet, despite the gain, the September total was 26% less

than that of September 2022.

US hardwood plywood imports tumble

US imports of hardwood plywood fell for a second straight

month in September, tumbling 34% to a level about half of

what it was two months ago. The 181,900 cubic meters of

plywood imported in September was 27% lower than that

of September 2022 imports.

A 36% decline in imports from China contributed to the

loss. Imports from most major trading partners are now

down more than 50% for the year so far versus last year

with imports from Malaysia off by 77%. Total year-to-

year imports are down 38% through the third quarter of

2023.

Imports of sawn tropical hardwood slump

US imports of sawn tropical hardwood fell by 7% in

September. The 17,924 cubic meters imported in

September was 13% below the volume imported in

September 2022. Imports from Brazil, the top US trading

partner for these products, continued to slip, dropping 26%

in September.

Imports from Brazil are down 33% so far this year versus

2022. Imports from the other chief trader, Indonesia, rose

26% in September but are still behind last year by 61% for

the year so far.

Imports of Sapelli rose 62% to their highest level of the

year yet were still 25% below last September’s level.

Sapelli imports are 22% behind 2022 for the year to this

point. Imports of keruing, which have been strong so far

this year, declined 53% in September to their lowest level

of the year. Despite the drop, imports of keruing are up

15% over last year through September. Total imports

remain down 31% versus last year.

Canadian imports of sawn tropical hardwood fell 1% in

September as sharp gains in imports from Brazil and

Congo/Brazzaville offset losses in imports from Bolivia

and Congo/Zaire. For the year so far, Canadian imports of

nearly every category type of sawn tropical hardwood are

trailing last year’s volume with total imports behind by

16% through August.

US veneer imports retreat from August peak

US imports of tropical hardwood veneer are generally

weak in September, and this year was no exception.

September imports fell 68%, returning to earth after the

August peak. Despite the retreat, imports for the month

outpaced those of last September by 50%.

Imports from Ghana and Cameroon were both down by

more than 90% for the month but are up for the year so far

by 26%, and more than 400%, respectively. Imports from

China more than doubled in September and are up 48%

versus last year for the year so far. Imports from Italy,

traditionally the top trading nation, continue to be erratic

and were zero for the second straight month. Overall

imports are roughly even with last year, up 1% through

September.

US imports of hardwood flooring dips

US imports of hardwood flooring fell 6% in September as

a 92% gain in imports from China nearly made up for

declining imports from Brazil (down 47%) and Malaysia

(down 23%).

Imports from Indonesia, which have been strong all year,

rose 6% in September and are up 168% for the year so far.

As Indonesia has gained market share, imports from

Brazil, China, and Malaysia are all significantly behind

last year’s pace through the third quarter.

Imports of assembled flooring panels fell 12% in

September. Imports from Vietnam were off by 36% and

imports from China fell 27%. Imports from Thailand,

which have been especially weak this year, rose 83% in

September to reach a high for the year.

Despite the gain, imports from Thailand are down 78%

versus last year through the third quarter. Total imports of

assembled flooring panels are down 35% versus 2022 so

far this year.

Moulding imports make gains

US imports of hardwood mouldings gained 19% in

September, surpassing US$12 million for the first time

since May. Despite the gain, the September total was 26%

less than that of September 2022.

Imports from China rose 52% in September, while imports

from Canada climbed 25%. Year-to-date imports from

most trading partners remain well behind last year’s pace

as total imports for the year are 31% behind last year

through the end of the third quarter.

US wooden furniture imports at lowest since Marrch

US imports of wooden furniture fell to their lowest level

since March, dropping 8% in September from the previous

month. The US$1.56 billion in imports was 20% less than

the previous September’s total. Imports from most trade

partners fell from between 3% and 9%, while imports

from Canada rose 8% and imports from India rose 6%.

Imports from Canada remain roughly even with last year’s

levels while imports from most other countries remain

behind last year’s pace from 25% to 40%.

Total wooden furniture imports are down 26% versus

2022 through the first three quarters of the year.

|