Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Nov

2023

Japan Yen 151.00

Reports From Japan

Fragility of the

country’s recovery

Japan's economy shrank by an annualised 2.1% in the

July-September period from the previous quarter marking

the first contraction in three quarters and this highlights

the fragility of the country’s recovery and supports the

case for continued Bank of Japan (BoJ) easing as well as

the new economic support package.

The contraction was partly driven by higher import costs

which rebounded from a sharp drop in the spring with net

exports deducting 0.1 percentage points from the overall

GDP figure. The recent data suggest that Japan’s

economic recovery is more fragile than previously thought

and in need of continued government and central bank

support.

BoJ governor Kazuo Ueda has maintained that the bank

will not change its policy until there are clearer signs that

wage increases, price stability and growth are achieved.

See:

https://www.japantimes.co.jp/business/2023/11/15/economy/japan-gdp-shrinks/

In related news, the International Monetary Fund has

forecast that Germany will overtake Japan this year as the

world’s third-largest economy. In its World Economic

Outlook the IMF forecast that Japan’s nominal GDP will

decrease 0.2% from the previous year to US$4.23 trillion

(630 trillion yen) while Germany’s will increase 8.4% to

US$4.43 trillion.

See:

https://www.imf.org/en/Publications/WEO/Issues/2023/10/10/world-economic-outlook-october-2023

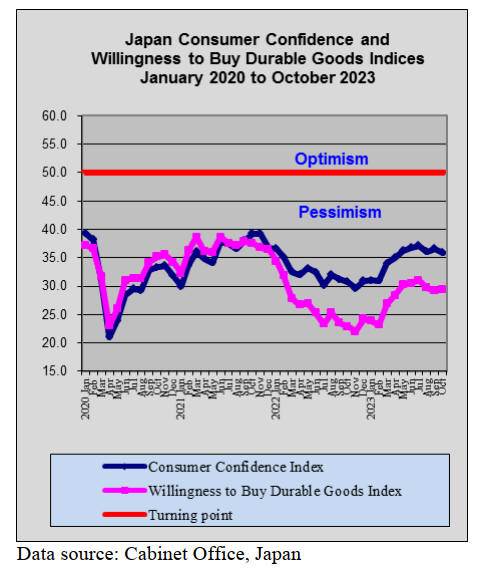

Households cut down spending

Household spending in September fell 2.8% from a year

earlier, dropping for the seventh consecutive month as

people cut back spending on food and other items because

of price increases and the decline in real wages.

Purchases of food, which account for around a third of

household spending, decreased almost 4% falling for the

12th straight month. Spending on housing also declined as

repairs and maintenance were put on hold. Other statistics

from the government showed that real, inflation-adjusted

wages in September dropped over 2% from the previous

year for the 18th consecutive month.

See:

https://mainichi.jp/english/articles/20231107/p2g/00m/0bu/006000c

Massive support package to cushion rising costs

The government has agreed a range of measures to help

household finances that have been dealt a blow from

inflation and the rising cost of imports. This package, at

more than 17 trillion yen (US$112 billion), will further

worsen the country's finances.

Analysts are agreed that this initiative will not boost

consumption but could help household finances. The

package includes temporary cuts to income and residential

taxes, cash payments to low-income households and

subsidies for petrol and utility charges. The government

expects the petrol and utility subsidies to reduce consumer

inflation by about 1%.

See:

https://www.reuters.com/markets/asia/japans-kishida-announces-113-bln-package-combat-inflation-pain-2023-11-02/

Slow recovery of earnings drives many companies

under

The number of corporate bankruptcies in Japan jumped

almost 40% to an eight-year high in the April-September

fiscal first half from a year earlier. This came as many

companies found it impossible to repay government relief

loans taken during the pandemic.

During the pandemic bankruptcies were low thanks to the

interest-free, unsecured loans extended by the government.

Business failures are rising as companies experience slow

earnings recovery and higher costs.

See:

https://japannews.yomiuri.co.jp/business/economy/20231011-142431/

Renouncing inheritance of family apartments

Government figures show Japan is grappling with an aging

population and properties abandoned by the families of the

deceased. This is not only the case in rural areas. In many

resort areas across Japan where, during the economic

bubble time many people invested in luxury apartments,

these are now valued at a fraction of the original price and

require maintenance and for which apartment block

management fees are due. In the face of this many are

giving up on inheriting apartments which leaves the

apartment management short of money to maintain

services to the block.

In the past ten years, there have been more than

10,000

instances of this reported. Urban areas with large

populations, such as Tokyo and Osaka, saw the highest

number of instances but in per capita terms, Niigata

Prefecture's Yuzawa Town topped the list followed by

Atami in Shizuoka Prefecture and other regional tourist

destinations.

See:

https://www3.nhk.or.jp/nhkworld/en/news/backstories/2828/

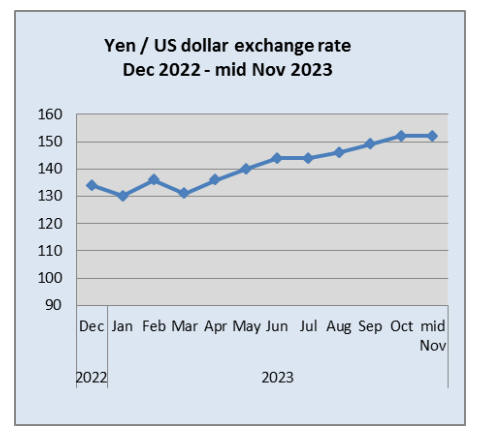

Government tries verbal support for yen

The yen suffered its biggest daily fall against the dollar

since April in early November after the Bank of Japan

made only modest changes to its policy of holding down

government bond yields.

The US dollar/yen exchange rate surged to a 12-month

high of almost 152 in early November prompting

government spokespersons to offer verbal support. Sadly,

the yen's fundamentals are weak and the currency is

comparable to some of the world's worst performing

currencies according to Deutsche Bank.

See:

https://www.ft.com/content/68689510-c413-45ea-91c4-f28cc5f47c4b

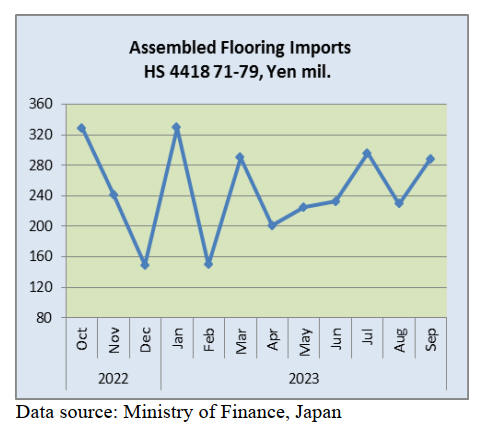

Import update

Assembled wooden flooring imports

The value of Japan’s September imports of assembled

flooring, (HS441871-79) dropped by over 10% year on

year but compared to the value of August imports there

was a 25% increase bringing monthly import values back

the high seen in July.Of the various categories of

assembled flooring imports in September HS441875 was

the largest, accounting for 68% of the total value of

assembled flooring imports followed by HS441879.

The main shippers of HS441875 in August were China

51%, the EU 27% followed by Vietnam, Malaysia,

Thailand and Indonesia. In August there were no recorded

arrivals from Indonesia but shipments resumed in

September.

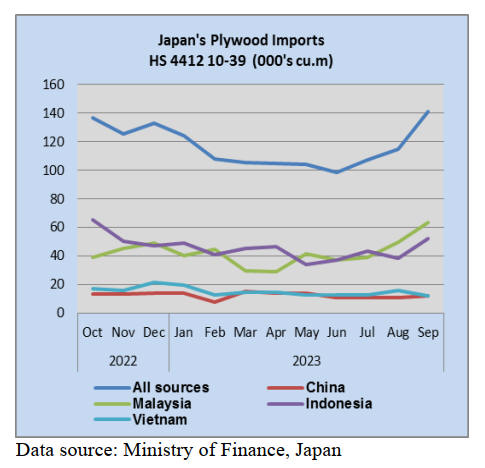

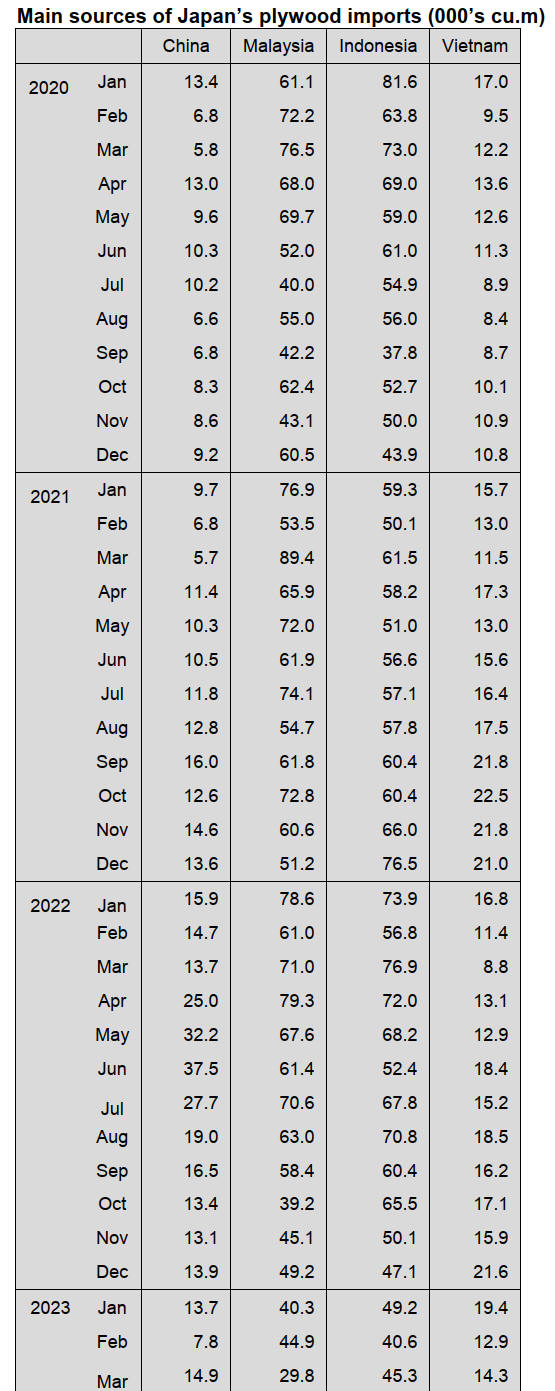

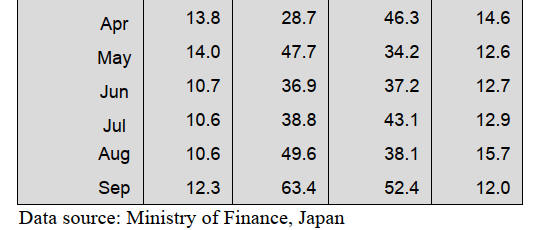

Plywood imports

For the second straight month there was a rise in the

volume of plywood arrivals in Japan. Since the beginning

of this year the volume of imports had been on a steady

downward trend so the up-tick in August and September is

welcome news for shippers.

Despite the two good months, year on year the

volume of

plywood imports was down 8% in September but

compared to a month earlier there was a 23% increase

with most of this extra being shipped by Indonesia and

Malaysia with a slight rise in imports from China. The

only loser in September was Vietnam where the volume of

September shipments was down compared to a month

earlier.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

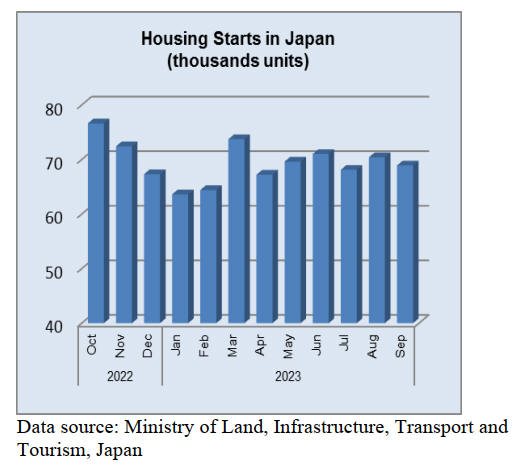

Demand and supply of domestic softwood plywood

According to the Ministry of Agriculture, Forestry and

Fisheries, shipment of structural plywood in September,

2023 is 201,000 cbms, 6.6 % more than September, 2022.

This is for the first time in thirteen months to be over

200,000 cbms. Shipment is 5 % increased from previous

month. Production of structural plywood is 201,000 cbms,

10.3 % down from September 2022. This is for the first

time in twelve months to be over 200,000 cbms.

Production of over 24 mm plywood is 92,000 cbms, 9.8 %

less than the same month last year but this is 14 % more

than the previous month. Inventory of structural plywood

is 133,000 cbms, 4.1 % more than the same month last

year. This is 0.4 % up from last month.

Inquiries to domestic softwood plywood are bullish even

though demand for houses is low. Shipment at some

distributors in Western Japan has been increasing since

September. However, the demand for houses is unclear in

the future so the distributors purchase domestic softwood

plywood to fill current needs.

The price of domestic softwood structural plywood is on a

slow decline. 12 mm, 3 x 6 is 1,600 yen, delivered per

sheet. Some companies sell the domestic softwood

structural plywood by 1,550 yen, delivered per sheet, for

sales promotion. Shipment of thick softwood structural

plywood is rising. 24 mm 3 x 6 is 3,200 yen, delivered per

sheet, and this is unchanged price from the previous

month. 28 mm 3 x 6 is 3,750 yen, delivered per sheet and

this is also unchanged price from the previous month.

Movement of imported plywood is dull. Arrival volume of

imported plywood has been declining but the inventory of

imported plywood in Japan is not in short supply. Japanese

importers hesitate to buy plywood due to the weak yen and

low demand.

The price of South Sea plywood in South Asia levels off

from last month but some South Asian shippers raised the

price by US$10, C&F per cbm.

The South Asian shippers raised the price because the

inventory of plywood in Japan has been decreasing. 12

mm 3 x 6 painted plywood for concrete form is $670 –

680, C&F per cbm. Structural plywood is US$560 – 570,

C&F per cbm. Form plywood is around $580, C&F per

cbm.

2.4 mm 3 x 6 plywood is around US$950, C&F per cbm.

3.7 mm 3 x 6 plywood is around $880, C&F per cbm. 5.2

mm 3 x 6 plywood is around US$850, C&F per cbm.

These prices have been unchanged since summer.

The price of plywood will be raised in Japan due to the

weak yen. 12 mm 3 x 6 painted plywood for concrete form

is 1,990 – 2,000 yen, delivered per sheet and this is around

50 yen up from September. Structural plywood is 1,800

yen, delivered per cbm. 2.5 plywood is 780 yen, delivered

per sheet. 4 mm plywood is 1,000 yen, delivered per sheet.

5.5 mm plywood is 1,200 yen, delivered per sheet.

Price of standing timber

Japan Real Estate Institute announced the survey of the

price of standing timber at the end of March, 2023. The

price of cedar, cypress and pine timber declined from the

previous survey. The national average of cedar is 4,361

yen, per cbm and this is 12.7 % less than March, 2022.

Cypress is 8,865 yen, per cbm and this is 18.2 % less and

pine is 2,672 yen, per cbm and this is 2.1 % less than the

same month last year. The sizes of cedar, cypress and pine

trees are 20 – 22 cm x 3.65 – 4 m.

This survey began in 1959. The highest price of cedar was

22,707 yen, per cbm in 1980 and of cypress was 42,947

yen, per cbm in 1980.

Orders for house builders

New orders for some house builders in September, 2023

are 10 % less than September, 2022. The housing market

has been sluggish in this year except the beginning of this

year. Some sales staffs say that they could not attract

customers to the display home villages in May, when there

was a long holiday, because many customers went to

leisure facilities. Some results in September, 2023 are

better than the same month last year because the results in

September, 2022 were terrible.

In this year, the customers are cautious to purchase houses

and the house builders have raised the selling price.

Therefore, the number of orders does not rise. However,

some customers start to purchase built for sale houses

because the price of condo is skyrocketing. Orders for

rental houses and for non-housing buildings are still strong .

New system for carbon dioxide emission

Taisei Corporation in Tokyo Prefecture developed a new

system, which calculates an amount of Co2 emissions at

processes of manufacturing building materials, procuring

building materials and building structures. The new

system is the first in the construction industry and is called

‘T – CARBON Navios’. The new system calculates an

amount of Co2 emission automatically on each kind of

building materials by integrated data.

The company has already developed a system for

calculating an amount of Co2 emission at a process of

building structures in 2010 and has been offering the

system to clients. By adding the new system to the existing

system, it will calculate an amount of Co2 emission in a

few minutes accurately.

It took several months to calculate an amount of Co2

emission at processes of manufacturing building materials

before but the new system calculates an amount of Co2

emissions of procuring building materials by just typing a

kind of building materials and a number of building

materials.

Conclusion for promoting use of wood products

Nippon Life Insurance Company in Osaka Prefecture

concludes an agreement with the Ministry of Agriculture,

Forestry and Fisheries in promoting the use of timber. This

is the Japan’s first agreement of a financial company and

the country.

100 wooden buildings will be built by 2030 and 4,800

cbms of timber will be used. Timber must be from

companies which registered Clean Wood Act.

Confusion for importers and exporters

The Japan Lumber Reports in its November 10, 2023 issue

No. 840 reports the following reaction to new regulations

from the Ministry of Agriculture, Forestry and Fisheries

(MAFF): ‘We have to put the exporter’s name on all

imported plywood as of next year’, Japanese importers and

distributors said. Also, they have to put the exporter’s

name on OSB and laminated lumber so Japanese importers

and exporters in overseas are confused. The exporters

overseas say that it is not realistic to put names on every

plywood and laminated lumber.

They have not concluded what to do for this new rule. The

new rule will be effective in February, 2024. There are

many questions about the new rule. What if there were no

exporter’s name on the products after February 2024, what

would happen? Who would pay for this trouble? Some

Japanese importers say that conditions for the new rule

must be written down on the contracts.

There are thirteen kinds of wood products, such as

laminated lumber, structural panels, floorings, plywood,

wooden pellets and so on, under the JAS standards. The

name of the product, of manufacturers, sizes and a kind of

glue must be printed on JAS certificated wood products.

However, there are just names of plants or companies

printed on the products so far.

Then,MAFF guided the Japanese importers and exporters

in foreign countries to follow the rules. Since a Chinese

manufacturer was discovered wrongdoing on plywood last

year, the rules about that become stricter than before.

The MAFF announced Japanese companies and

companies, which are authorized by JAS in overseas, to be

ready for the new rule by the end of January, 2024.

Plants have a certain amount of forecast production and

the products are bundled so it is difficult to put the

exporter’s names on each product. The plants get orders

for products from not only Japana but also other countries.

These situations make Japanese companies to feel anxious

about supply of product from overseas. It might take more

time to deliver the JAS certificated products.

Especially, the Japanese companies are concerned that

laminated structural lumber would be less because

consumers started to purchase laminated structural lumber

instead of Douglas fir lumber. Since there was a fire at

Chugoku Lumber Co., Ltd.’s plant and the company

limited to accept orders for Douglas fir lumber.

The balance of demand and supply for structural lumber

would be influenced by the new rule.

Japanese importers are not sure about the products without

exporter’s name would be treated as non-JAS products or

not. Also, they are wondering about the stocks of products

and there would be punishment or not if there were no

names on the products.

|