|

Report from

Europe

UK tropical wood and wooden furniture imports at all

time low

The import value of tropical wood and wooden furniture

into the UK in the first eight months of this year was

USD655 million, 38% less than the same period last year.

In quantity terms, the UK imported 273,400 tonnes of

tropical wood and wooden furniture in the January to

August period, 19% less than the same period last year.

This is an extraordinarily low figure, in tonnage terms the

lowest level of UK tropical wood products imports for the

first eight months of the year since at least the early 1990s,

and probably well before then.

It is 4% below the previous record low which came in the

first eight months of 2013 at the end of one of the longest

periods of economic stagnation on record in the UK. It is

5% less than recorded in the first eight months of 2020

when the country was at a complete standstill at the start

of the COVID pandemic.

Coming as it does after two historically good years for the

UK trade in 2021 and 2022 during the immediate post-

COVID recovery, this is a classic case of boom and bust.

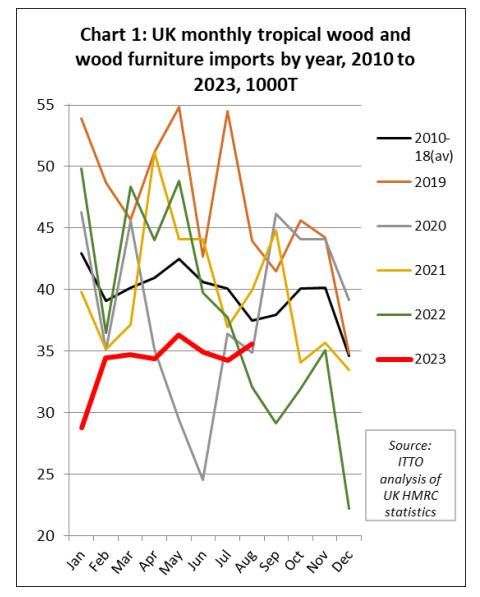

The monthly data shows that the total tonnage of UK

imports of tropical wood and wooden furniture fell to an

extreme low of only 22,000 tonnes in December 2022

before rising to 35,000 tonnes in February 2023.

Since then, imports have barely shifted from this level

which is about 20% below the long-term average for the

time of year (Chart 1).

Mounting signs of stagnation in the UK economy

The extremely slow pace of UK tropical wood and

wooden furniture imports this year is symptomatic of a

wider economic downturn in the country. KPMG’s latest

UK Economic Outlook issued 25th September notes that

“high interest rates, continued uncertainty and low

productivity could see the UK struggle to keep its head

above water in the second half of the year – with GDP

growth forecast at 0.4% in 2023 and 0.3% in 2024”.

KPMG go on to report that “While the labour market is

gradually returning to balance, household excess savings

are broadly used up and the effect of higher interest rates

is now feeding through to investment intentions,

transaction volumes and corporate insolvencies, with the

full impact on households and housing sectors yet to be

felt”.

The Institute for Fiscal Studies (IFS), an independent

thinktank, observes in its latest report on the UK economy

published on 17th October that “UK GDP is still 5.2%

short of its 2012–19 trend: a worse relative performance

than either the United States or the Euro Area where the

shortfalls range between 2% and 3%. The UK economy

remains stuck between weak growth but continued

inflationary risks”.

IFS note that the support previously offered to the UK

economy by COVID recovery measures and falling energy

prices since the heights of last winter are now fading.

Furthermore, credit growth has, in recent months, dropped

to levels only previously observed in the immediate

aftermath of the 2008 Global Financial Crises.

The value of both financial and housing wealth has been

eroded since 2020 by the surge in inflation.

Unemployment has increased from 3.5% in the 2022

trough to 4.3% now.

The signs of resilience in the UK construction sector

reported in the summer months this year have also faded

away. The latest S&P Global/CIPS UK Construction

Purchasing Managers’ Index (PMI) registered 45.0 in

September, down sharply from 50.8 in August and below

the neutral 50.0 value for the first time since June.

Residential work (index at 38.1) was by far the worst

performing area of construction output during September,

followed by civil engineering activity (45.7). Aside from

the pandemic, the latest fall in housing activity was the

steepest since April 2009.

Respondents to the S&P Global/CIPS survey widely

commented on cutbacks to house building projects amid

rising borrowing costs and weak demand conditions.

Commercial building declined at only a modest pace in

September (index at 47.7), but this represented a

considerable setback after the solid growth seen

throughout the summer. Some firms noted that worries

about the economic outlook had dampened client demand

and led to a lack of new work to replace completed

projects.

Sentiment surrounding prospects in the UK construction

sector were a little more positive. According to the S&P

Global/CIPS survey, the number of construction firms

predicting a rise in output over the year ahead (41%)

continued to exceed those forecasting a decline (17%).

This was linked to long-term business expansion plans and

hopes of a turnaround in customer demand.

UK import value of tropical wooden furniture falls

The UK imported USD287 million of tropical wooden

furniture products in the first eight months of 2023, which

is 48% less than the same period last year. In quantity

terms, wooden furniture imports were 77,600 tonnes

during the eight-month period, 32% less than the same

period last year.

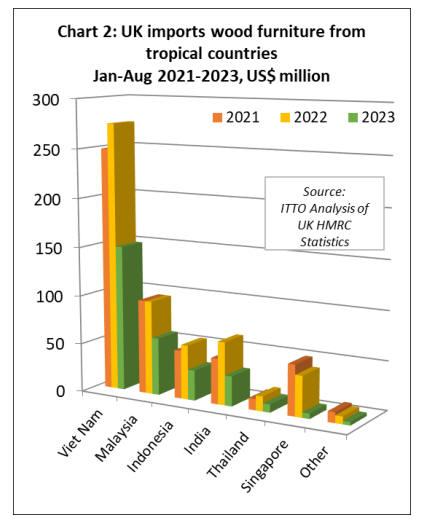

In the first eight months of 2023 compared to last year,

UK import value of wooden furniture from Vietnam was

down 46% to USD149 million, Malaysia was down 39%

to USD59 million, India was down 52% to USD31

million, Indonesia was down 45% to USD31 million,

Thailand was down 46% to USD8 million, and Singapore

was down 87% to USD5 million (Chart 2).

cross the board decline in UK import value of all

tropical wood products

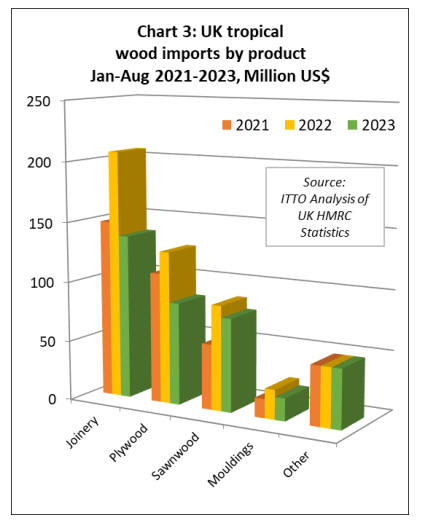

Total UK import value of all tropical wood products in

Chapter 44 of the Harmonised System (HS) of product

codes was USD368 million between January and August

this year, 26% less than the same period in 2022. In

quantity terms imports decreased 12% to 195,800 tonnes

during the period.

Compared to the first eight months of 2022, UK import

value of tropical joinery products decreased 34% to

USD137 million, import value of tropical plywood

decreased 33% to USD85 million, import value of tropical

sawnwood decreased 11% to USD78 million, and import

value of tropical mouldings/decking decreased 23% to

USD19 million (Chart 3).

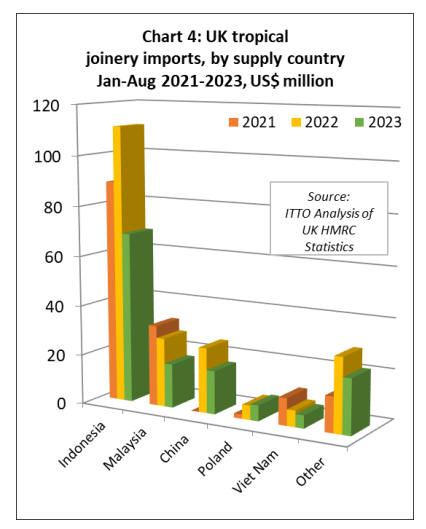

UK import value of joinery products from Indonesia

(mainly doors) was USD69 million in the first eight

months of 2023, down 38% compared to the same period

last year. UK import value of joinery products from

Malaysia (mainly laminated products for kitchen and

window applications) fell 36% to USD18 million during

the same period. UK import value of Chinese tropical

joinery products, nearly all comprising doors, was USD17

million in the January to August period, 33% less than the

same period last year (Chart 4).

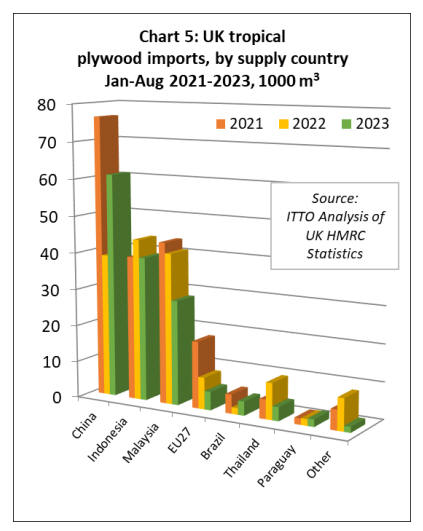

UK direct imports of tropical hardwood plywood offset

by rise from China

In the first eight months of 2023, the UK imported

144,800 cu.m of tropical hardwood plywood, 6% less than

the same period last year. A significant decline in direct

imports of tropical hardwood plywood from tropical

countries partly offset by a rise in imports from China

(Chart 5).

The UK imported 61,000 cu.m of tropical hardwood

plywood from China in the first eight months of 2023,

57% more than the same period last year. Last year, UK

imports of Chinese products faced with tropical

hardwoods fell sharply in favour of Chinese products

faced with temperate hardwoods.

This trend has been reversed in 2023 with China again

shipping a larger proportion of tropical hardwood faced

plywood to the UK. This is likely to at least partly reflect

concern that plywood comprised of Russian birch was

being shipped from China in contravention of UK trade

sanctions imposed following Russia’s invasion of Ukraine.

UK imports of Indonesian plywood in the first eight

months this year were, at 39,200 cu.m, 10% less than the

same period last year. The UK imported 28,500 cu.m of

plywood from Malaysia in the first eight months of 2023,

31% less than the same period last year.

UK plywood imports from Thailand were down 62% to

3,800 cu.m in the first eight months this year. However, in

the same period there was a large percentage increase from

a very small base in tropical hardwood plywood imports

from Brazil (+115% to 3,800 cu.m). Imports from

Paraguay also increased 13% to 2,000 cu.m.

Meanwhile, the combined effects of Brexit, supply

shortages and rising energy and other material costs on the

European continent continue to impact on UK imports of

tropical hardwood plywood from EU countries which were

just 5,000 cu.m in the first eight months of this year, 42%

less than the same period last year.

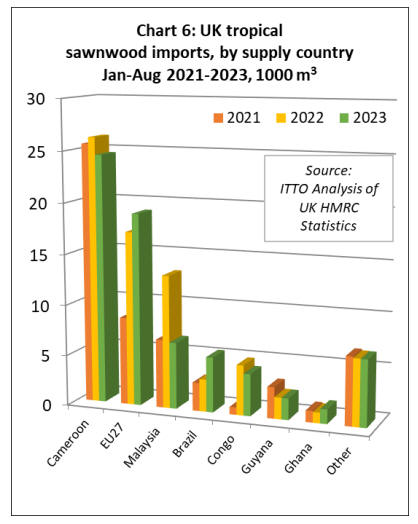

Rising UK imports of tropical sawnwood from the EU

UK imports of tropical sawnwood were 69,700 cu.m in the

first eight months of this year, 6% less than the same

period in 2022.

Although UK imports of this commodity appear to have

held up reasonably well compared to other tropical

products this year, a larger share has been sourced

indirectly from the EU and not direct from the tropics

(Chart 6).

Furthermore, a large increase in UK imports of tropical

hardwood sawnwood (HS 4407) from Brazil this year is

also offset by a significant decline in imports of Brazilian

tropical hardwood decking/mouldings (HS4409).

Therefore, it may be that reported trends for both

commodities are distorted by changes in the way products

from Brazil are categorized respectively as “sawnwood”

and “mouldings”.

UK imports of tropical sawnwood from Cameroon were

24,500 cu.m in the first eight months of 2023, 6% less

than the relatively high level in the same period in 2022.

UK tropical sawnwood imports from Malaysia, which

revived to some extent last year after many years of

decline, fell by 50% in the first eight months of this year to

6,500 cu.m.

UK imports of tropical sawnwood from Brazil were

reported as 5,400 cu.m in the first eight months of this

year, a gain of 70% compared to the same period in 2022.

Imports also increased from Ghana during the eight-month

period, by 36% to 1,400 cu.m. However, imports from

Republic of Congo fell 16% to 4,100 cu.m. Imports from

Guyana, at 2,100 cu.m were the same as last year.

Indirect UK imports of tropical sawnwood via the EU

recovered ground despite the Brexit disruption, increasing

11% to 19,000 cu.m in the first eight months of 2023. To

some extent, UK’s continuing dependence on indirect

imports of tropical sawnwood from the EU is due to a

shortage of kiln drying space in African supply countries

combined with lack of any hardwood kiln drying capacity

in the UK.

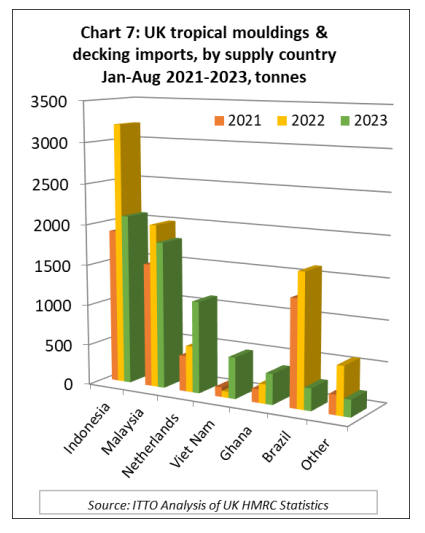

UK imports of tropical hardwood mouldings/decking fell

23% in the first eight months of 2023 to 6,400 tonnes.

Imports of 2,100 tonnes from Indonesia were 35% less

than the same period in 2022.

Imports from Malaysia totalling 1,800 tonnes were down

10% compared to the same period last year. Imports of this

commodity group from Brazil were recorded at less than

300 tonnes in the first eight months of this year, 83% less

than the same period last year.

In contrast, imports increased 99% from the Netherlands

to 1110 tonnes, while imports from Vietnam increased

nearly 6-fold to 500 tonnes from a very small base (Chart

7).

|