Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Oct

2023

Japan Yen 151.00

Reports From Japan

Tax cuts to help

households

The government has decided on a temporary reduction in

income tax to help households. If agreed the tax cut could

be for one year and a separate programme will help low-

income earners who are already exempt from taxation.

Critics question the effectiveness of a tax cut as a means to

address rising prices of everyday goods and cite the

lengthy process and legislative work that will be required

to implement the scheme. It is anticipated it will take until

June 2024 to have all the procedures in place.

See:

https://mainichi.jp/english/articles/20231020/p2g/00m/0na/065000c

Tourism and domestic demand drives growth

The Bank of Japan (BoJ) recently raised its forecast for

economic growth in six of the nation's nine regions.

Growth was helped by stronger domestic demand (despite

inflation) and the rise in foreign tourist arrivals.

The Kanto-Koshinetsu area centered on Tokyo is among

the six that saw an upgrade. All nine regions reported that

their respective economies had been either picking up or

recovering moderately. Private consumption has been

supported by pent-up demand for services after the

removal of antivirus restrictions.

See:

https://mainichi.jp/english/articles/20231019/p2g/00m/0bu/037000c

Relief as exports rise

Japan’s exports grew for the first time in three months in

September but the conflict in the Middle East and

slowdown in China could undermine further expansion.

Exports grew 4.3% in September from a year earlier

according to the Ministry of Finance.

Exports were driven by car shipments, which account

for

18% of overall exports, offsetting declines in exports of

chip-related products. China-bound food exports,

including fishery products tumbled 58% year-on-year in

September due to its ban on Japanese food imports on

worries about water released from the Fukushima nuclear

power plant.

Exports to the US rose 13% year-on-year led by hybrid

vehicles, mining and construction machinery and motors.

The trade data also showed imports fell 16% in the year to

September.

See:

https://japannews.yomiuri.co.jp/news-services/reuters/20231019-144156/

In related news, according to the Ministry of

Economy

Trade & Industry (METI) retail sales increased 7% year-

on-year in August 2023, unchanged from the revised

figure for the previous month and exceeding the consensus

forecast for a 6.6% growth. The latest rise was the 18th

consecutive month of expansion in retail sales and the

fastest pace since February as consumption continued to

recover from the pandemic-induced slump.

By sector, sales for food retailers advanced the most

(9.4%), followed by automobile retailers (9.0%), fuel

retailers (7.9%), various product retailers (7.2%), other

retailers (6.8%), machine equipment retailers (5.6%),

pharmaceuticals and cosmetics (3.9%), non-store retailer

(3.5%) and textile, apparel & accessories retailers (0.9%).

See:https://www.meti.go.jp/english/statistics/tyo/syoudou/index.html

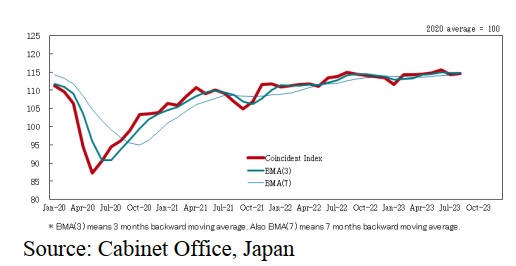

Measure of current economic conditions

A report from the Cabinet Office shows Japan's coincident

indicator index rose for the first time in four months in

October as economic activity expanded. The October

index of coincident economic indicators, which consists of

a range of data including factory output, employment and

retail sales, gained from the previous month.

Japan's index of coincident indicators measures current

economic conditions and offers an insight to the amplitude

of the fluctuations of economic activities. The composite

indices are constructed by aggregating the changes in a

range of selected economic series.

Wage increases – plan needed for small companies

In fiscal 2021 over 60% of small companies in Japan did

not declare a profit so did not pay any tax which means

plans by the government to offer tax relief to companies

that raise wages will not help workers in small companies.

Small and midsize businesses make up more than 99% of

companies in Japan.

Fueling interest in the expansion of appropriate and

meaningful tax incentives for companies is the growing

concept of "human capital management," which sees

employees as capital and their education and training as an

investment to boost productivity.

See:

https://asia.nikkei.com/Spotlight/Datawatch/Japan-fails-to-boost-wages-with-tax-break

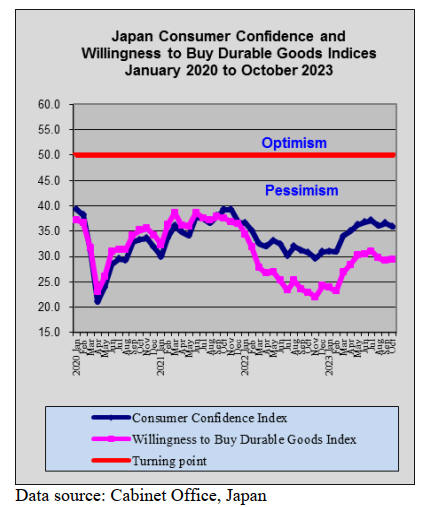

Cost-push inflation to slow in coming months

Consumer prices rose just 3% in September, the slowest

pace in about a year as imported energy costs dipped but

this was above the Bank of Japan’s (BoJ) 2% target for the

18th straight month. Much of the pressure on prices was

because the weak yen has pushed up the cost of imports.

The BoJ expects cost-push inflation to slow in the coming

months. A fresh outlook report will be released at the end

of a two-day policy meeting in late October.

See:

https://mainichi.jp/english/articles/20231020/p2g/00m/0bu/020000c

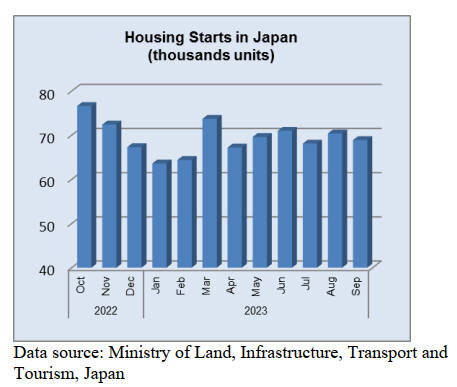

Tiny homes attract interest from older generation

In 2021 a start-up company based in Nishinomiya, Hyogo

Prefecture announced plans to develop a micro house

using a 3D printer and since then the company has

received many inquiries. The homes have a floor space of

just 10 square metres and are priced at between 3-4

million yen (US$20-25,000).

Kaito Ogata, the chief technology officer, said the

company initially aimed to offer affordable housing to

young people because of surging house prices in urban

areas. The company was surprised that many of the

inquiries were from people aged 60 or older.

When interviewed some of the older people said they

found it too expensive to renovate their aging homes while

others said they were considering buying low-priced

housing because they were refused rental contracts once

they turned 60. Ogata said this exposes the unique

situation Japan’s elderly population face with housing.

See:

https://japannews.yomiuri.co.jp/editorial/political-pulse/20231014-142876/

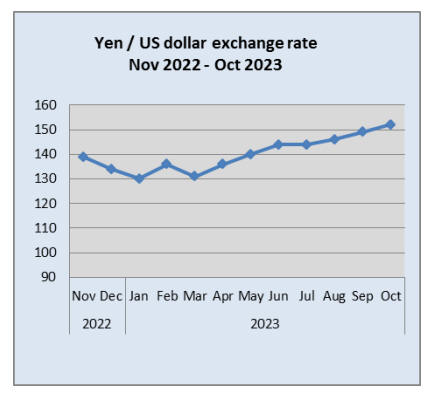

Interest rate change at BoJ but Yen unresponsive

At its recent policy board meeting the BoJ further

loosened its grip on long-term interest rates by changing

its bond yield control policy and this was interpreted as

another signal that its unique and controversial monetary

stimulus policy may be slowly dismantled.

But, rather than strengthening the yen it actually weakened

after the decision as traders focused on the BoJ's dovish

pledge to "patiently" maintain it current policy.

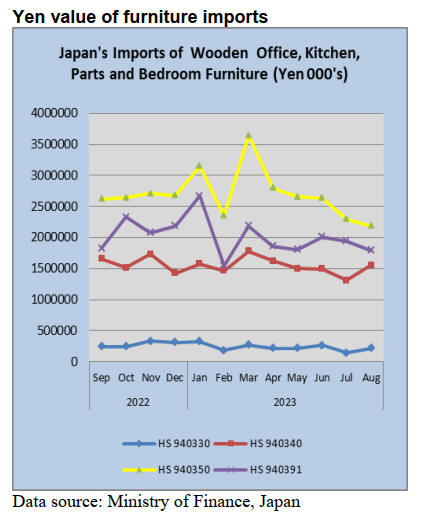

Wooden bedroom furniture (HS940350) imports into

Japan are worth more than all other categories of wooden

furniture and the value of imports has consistently been

higher than all others. Over the past 5 months the value of

wooden bedroom furniture has steadily declined and in

August the value of imports dropped closer to the value of

wooden kitchen furniture and furniture parts.

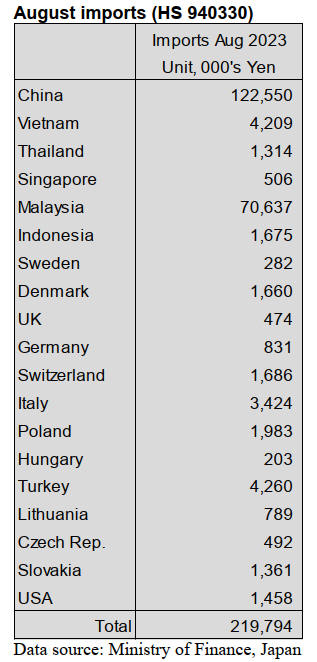

August wooden office furniture imports (HS 940330)

The value of Japan’s wooden office furniture imports in

August up a massive 56% compared to the unusually low

value of July imports.

In August shippers in China and Malaysia dominated

imports accouting for 44% and 37% respectively of total

imports of wooden office furniture (HS940330). For the

first time shippers in Turkey shipped sufficient for the

country to enter the top 20 shippers but at just 4% of total

imports of wooden office furniture this was small.

Year on year, the value of August 2023 imports of wooden

office furniture was down 14% but compared to the value

of July imports there was a slight increase. The

diversification of sources of wooden office furniture

observed in July appears to have been maintained into

August.

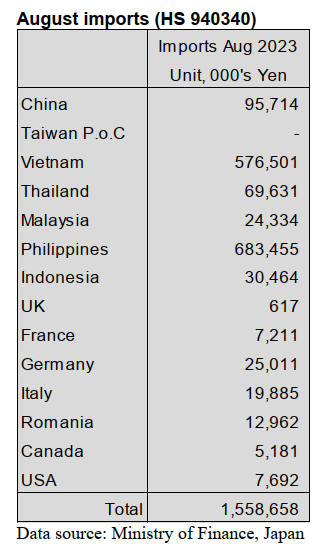

August kitchen furniture imports (HS 940340)

The Philippines and Vietnam together accounted for over

80% of the value of Japan’s imports of wooden kitchen

furniture in August, as was the case in previous months.

In August, the top four shippers, the Philippines, Vietnam,

China and the EU all recorded a rise in the value of

August arrivals.

Year on year the value of wooden kitchen furniture

imports in August dropped 14% adding to the 28% month

on month decline in July.

In August shipments from the Philippines accounted for

44% of the value of imports of HS940340 with a further

37% coming from Vietnam.

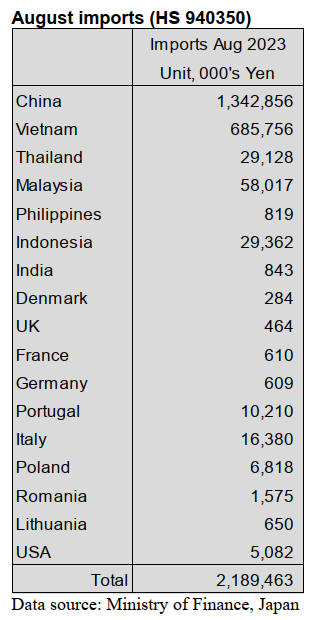

August wooden bedroom furniture imports

(HS 940350)

Since April this year there has been a steady reduction in

the value of Japan’s imports of wooden bedroom furniture.

China and Vietnam were the main suppliers of wooden

bedroom furniture in August, together accounting for over

90% of imports of this category of wooden furniture.

August imports from China were at around the same level

as in July but there was a drop in the value of imports from

Vietnam.

The decline in the value of imports from these two main

shippers disguises the advances made in market share by

some other shippers such as Malaysia and some EU

member states. Having achieved a significant market

share in July (around 7%) Malaysia share of August

arrivals dropped to around 4%.

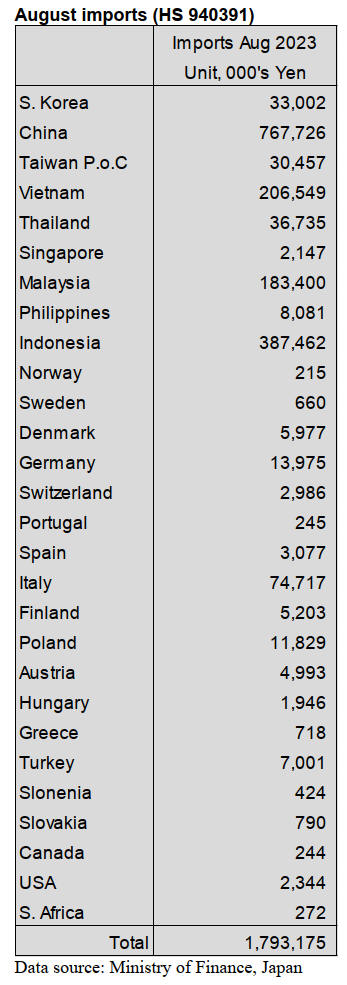

August wooden furniture parts imports (HS 940391)

Since the third quarter of 2022 there has been a steady

decline in the value of Japan’s wooden furniture parts

imports. Year on year the value of August wooden

furniture parts imports dropped 21% and there was an 8%

decline compared to the value of July imports.

The top suppliers in August were, as in previous months,

China (43%), Indonesia (22%), Vietnam 12% up from the

7% in July) and Malaysia (10%).

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

100% domestic timber for homes

Daito Trust Construction Co., Ltd. started construction

work for apartment houses made of all domestic lumber by

2 x 4 method in Iwate Prefecture.

This is the company’s first to build a house made of all

domestic lumber. In some area, only cedar is used for

studs or other several parts of a house but in this case,

domestic lumber is used for all parts of a house.

Red pine is used for floor joists and taruki. Daito Trust

Construction had been testing the strength of red pine

lumber with the relevant organizations and they confirmed

that the strength of 2 x 4 red pine lumber is good enough.

Kesen Precut Business Cooperative produces 2 x 4 cedar

and red pine lumber and supplies panels.

There are two houses and floor area of one house is about

350 square meters and floor areas of the other house is

about 460 square meters. 2 x 4 and 2 x 6 of cedar lumber

is used for studs of walls, frames and sills. 2 x 4, 2 x 6, and

2 x 10 of red pine lumber is used for floor joists on the

first floor and the second floor. 2 x 4 – 10 cedar and red

pine are used for lintels. 4 x 10 larch structural LVL is

used for beams.

Domestic softwood plywood such as cedar plywood, larch

plywood and red pine plywood are used for the apartment

houses. All lumber is made in Iwate Prefecture. Total

volume of lumber used for one house is 44 cbms except

plywood and the other house is 60 cbms. 50 cbms of red

pine lumber, 51 cbms of cedar lumber and 3 cbms of larch

lumber are used for these two houses.

After the confirmation of the strength on 2 x 4 red pine

lumber last year, Kesen Precut got the JAS certification on

red pine lumber. They except to expand the use of 2 x 4

red pine lumber in Tohoku area.

South Sea logs and lumber

The price of laminated board in South East Asia has been

declining. South East Asian sellers did not lower the price

because demand in Japan was low. Since demand in China

is sluggish, so the South East Asian sellers lowered the

price, which is the similar price of Indonesian Merkushi

pine lumber. Distributors do not purchase new laminated

boards because of low demand and the weak yen in Japan.

Inquiries for South Sea lumber recovered slightly. There

was a certain number of orders for decks when the yen

was 146 yen against the dollar. Also, there was a certain

number of orders for truck bodies. South Sea log for

Keruing lumber has been in short supply. Since production

of truck has recovered, demand of truck body also has

recovered and some trading companies order South Sea

log to manufacturers in Japan because it takes a lot of time

to import South Sea logs form South Asia.

However, the manufacturers in Japan do not have enough

South Sea logs. Therefore, the trading companies imported

8,797 cbms of South Sea log in August by containers in a

hurry. The import cost is rising due to the weak yen

against the dollar.

Short supply of logs

Cedar posts and cypress sills are in short supply in Kanto

area. In Tochigi Prefecture, there are less cypress logs and

an operational rate at plants, which produce cedar post, is

declining. Inquiries to cypress sills and taruki are

increasing instead of Douglas fir lumber. The price of

cedar and cypress logs keep rising but there are still not

many logs. Now, the prices of cedar post and cypress sill

are rising.

Movement of lumber in August and September, 2023 was

sluggish and KD cedar post was 55,000 yen, delivered per

cbm but the price is 60,000 yen, delivered per cbm.

The price of KD cypress sill used to be around 70,000 –

75,000 yen, delivered per cbm in September and the price

is now 80,000 yen, delivered per cbm. The log price kept

rising in August and September but the lumber price did

not rise so the profitability was not good. 3 m cedar log

costs around 11,000 yen, delivered per cbm at the end of

June and it is around 16,000 yen, 45 % up from June.

4 m cypress log was around 16,000 yen at the end of July

and the price increased to around 23,000 yen, 44 % up

from July. Cedar post is around 55,000 yen and cypress

sill are around 70,000– 75,000 yen. Logs started to decline

in July in Tochigi Prefecture. The logs at the market in

September was 30 % less than September, 2022.

Therefore, many lumber plants were losing logs from their

inventory.

Lumber plants are concerned about the movement of

lumber after October and if the price hike of cedar or

cypress lumber did not succeed, it would be difficult to run

the lumber plants. There is a possibility that cedar and

cypress logs will be not enough volume. 3 m cedar log

was around 17,000 yen and 4 m cypress log was around

21,000 cbms in the beginning of this year.

The price of cypress is skyrocketing to be around 30,000

yen, which was the price at the woodshock. However, the

loggers feel dangerous to deliver logs to the log market

because once the log price dropped suddenly in spring.

Cedar log was around 10,000 yen and cypress log was

around 14,000 yen at that time and these low-priced logs

kept for several months.

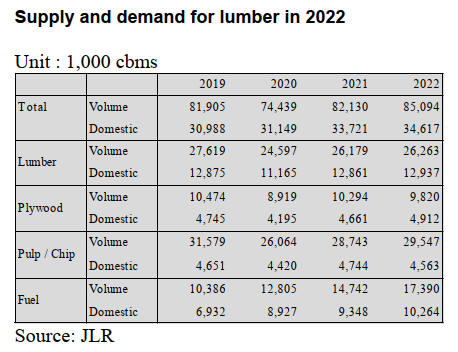

This is two straight years increasing. Demand for lumber,

plywood and pulp / chip is unchanged from the previous

year but demand of woody fuel is 18 % increased.

Domestic woody fuel is 10 % up and imported woody fuel

is 32 % up from last year. Domestic woody fuel increases

thirteen years continuously.

Imported woody fuel increases by 30 % for two years

continuously so a rate of self-sufficiency in domestic

woody fuel is 40.7 % down for two straight years. Total

demand for woody fuel exceeds 85,000,000 cbms for the

first time in sixteen years. Total demand is 17,390,000

cbms, 18 % up from 2021. In 2021, total starts of owner’s

unit increased about 10 % from 2020 so as the demand of

structural materials increased.

Since the woodshock in spring, 2021 affected lumber and

plywood to be a short supply, there was a movement of

supplying for structural lumber. Then, total demand of

structural lumber and plywood has leveled off from 2021.

Imported woody fuel has been increasing since 2021. In

2021, imported woody fuel was 5,390,000 cbms, 39 %

more than 2020. In 2022, it was 7,130,000 cbms, 32 %

more than 2021.

Domestic woody fuel was 9,350,000 cbms, 5 % up from

2020 and was 10,260,000 cbms, nearly 10 % up from

2021. Imported woody fuel consists of 80 % wooden

pellets, 10 % fuel chips and 10 5 charcoals. Wooden pellet

in 2021 was 70 %. Domestic woody fuel consists of 99 %

fuel chips.

Total demand for structural lumber and plywood is

36,080,000 cbms, 1.1 % less than 2021. A rate of self-

sufficiency in domestic structural lumber / plywood is 49.5

%, 1.5 point up. Total demand for pulp, chip and woody

fuel is 49,010,000 cbms, 7.3 % more than the previous

year. A rate of self-sufficiency is 34.2 %, 1.3 point less

than last year.

Total domestic consumption of total demand 85,000,000

cbms is 34,620,000 cbms. The details are 70 % logs and

30 % woody fuels. The details of imported wood,

50,000,000 cbms are 7 % logs, 20 % lumber, 9 %

plywood, 10 % pulp, 40 % chip and 14 % woody fuels.

|