|

Report from

Europe

Europe’s wooden furniture consumption falls to lowest

level since 2015

The last three and half years, marked from the start of

2020 by the Covid-19 pandemic and from February 2022

by war in Ukraine, have seen unprecedented changes in

Europe’s wood furniture sector.

The sector passed through a period characterised by an

initial but very short-lived fall in demand in the second

quarter of 2020, followed by rapid demand escalation in

2021 at a time when material shortages and other logistical

challenges greatly reduced availability, and then by

another sharp decline starting in the second half of 2022

and continuing this year.

During this relatively short period, major changes have

occurred in patterns of supply and demand, trade flows,

consumer preferences and working conditions, distribution

channels, design, and fashion trends. Companies

throughout the sector are having to evolve new strategies

in response to a transformed world.

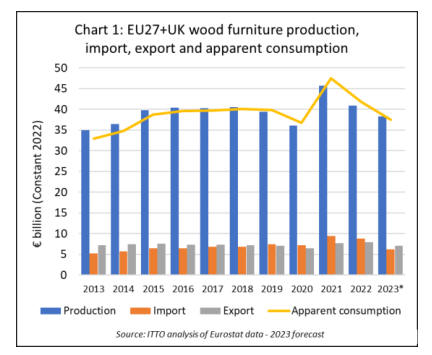

Recent trends in the value of production trade and

consumption of wood furniture in the EU27+UK are

shown in Chart 1. This highlights that the onset of the

pandemic led to a 9% downturn in the euro value of

EU27+UK wood furniture production and 8% decline in

consumption in 2020. This was followed in 2021 by a

strong 27% and 29% rebound in production and

consumption respectively. In 2022, production and

consumption fell back even more sharply than in 2020,

respectively by 11% and 12%.

Based on performance in the first half of 2023, production

and consumption are forecast to fall by another 6% and

10% this year. With a forecast value of around €38 billion

in 2023, European wood furniture production and

consumption this year are expected to be at a level not

seen since 2015.

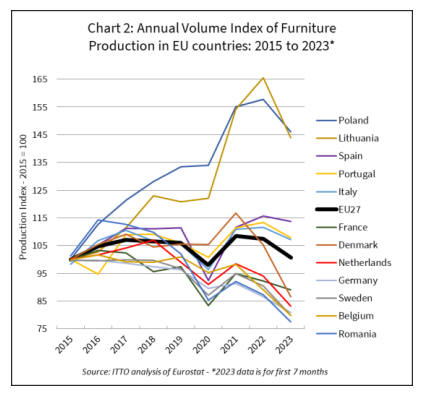

Furniture sector performance has varied widely between

European countries. Eurostat data shows that while overall

EU27 furniture production in 2023 is now at the level

prevailing in 2015, some countries including Romania,

Belgium, Sweden, Germany, Netherlands, Denmark, and

France, have fallen well below this level. Most of these

countries recorded only a modest rebound in furniture

production in 2021 followed by a dramatic downturn from

the second half of 2022 onwards.

In contrast, furniture production in Poland and Lithuania

continued strong even during the first year of the

pandemic in 2020 and increased very rapidly during 2021

and 2022. Although there has been a sharp downturn this

year, production in Poland and Lithuania is still well

above the pre-pandemic level.

Furniture production in Italy, Portugal and Spain has been

less volatile than in other European countries in the last

three and half years and is likely to remain above the pre-

pandemic level despite sliding this year (Chart 2).

Recent trends in the quantity of European wood furniture

trade as revealed by Eurostat data are shown in Chart 3.

The long-term rise in European internal trade and in

imports from outside the region which began in 2013 as

the European economy gradually recovered from the

eurozone currency crisis, continued throughout the

pandemic in 2020 and accelerated in 2021.

European exports of wood furniture to countries outside

the region, which were flat in the period between 2013 and

2020, also increased in 2021. However, European imports,

exports and internal trade in wood furniture all declined

sharply in 2022, a trend which has continued in 2023

(Chart 3).

Internal EU trade in wood furniture in the first 6 months of

this year was down 20%, while imports fell 19% and

European exports were down 11%.

These figures underline the extent of the downturn in the

European economy. Consumer confidence and spending

has fallen sharply as state support for households is

running out and retail energy prices remain very high and

are expected to rise again during the winter months.

Higher interest rates have increased mortgage costs while

real incomes continued to be undermined by high levels of

inflation.

The latest purchasing managers’ indices reveal that

activity continues to contract in the European service

sector and in construction. Stingier bank lending is leading

to a 0.4 percentage-point reduction in GDP growth each

quarter, according to Goldman Sachs. Corporate

insolvencies in the EU rose by more than 8% in the year’s

second quarter, compared with the first, and have reached

their highest since 2015.

The impact of tighter monetary policy will peak in the

second half of this year, predicts Oliver Rakau of Oxford

Economics, a consultancy.

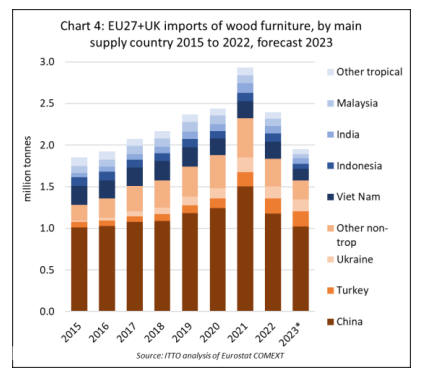

The total quantity of EU27+UK imports of wood furniture

from outside the region fell 18% in 2022 to 2.40 million

tonnes. In the first six months of this year, imports were

already down another 19%.

Total imports this year will likely be back to a level last

seen in 2016 (Chart 4). While declining imports in 2022

were at least partly due to continuing supply problems

caused by renewed COVID lockdowns in China and the

war in Ukraine, this year the leading driver has been a

dramatic falloff in European consumption.

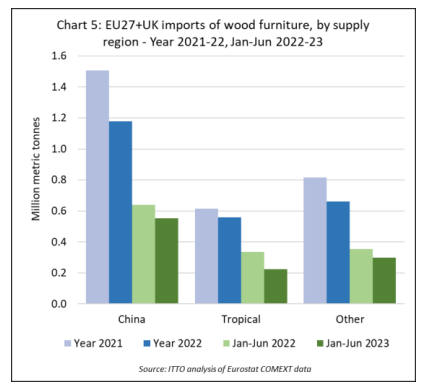

Wood furniture imports into the EU27+UK decreased

from all main supply regions during the first six months of

2023; by 13% from China to 550,000 tonnes, by 33% from

the tropics to 220,000 tonnes, and by 16% from other

countries to 300,000 tonnes (Chart 5).

Tropical countries have lost share in the European market

this year as supplies from China have come back online

with the end of COVID restrictions there.

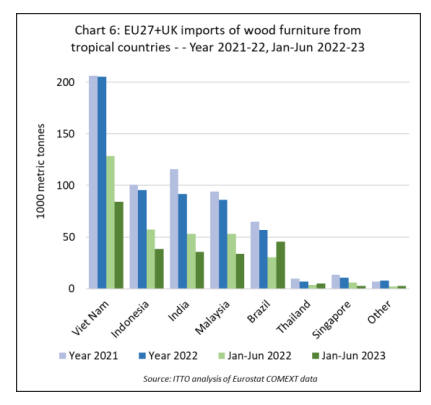

Imports from all tropical countries supplying wood

furniture to the EU27+UK declined very sharply in the

first six months of this year including Vietnam (-35% to

84,200 tonnes), Indonesia (-32% to 38,700 tonnes), India

(-33% to 35,600 tonnes), Malaysia (-37% to 33,700

tonnes), Brazil (-19% to 25,300 tonnes), Thailand (-71%

to 1,700 tonnes) and Singapore (-27% to 2,800 tonnes)

(Chart 6).

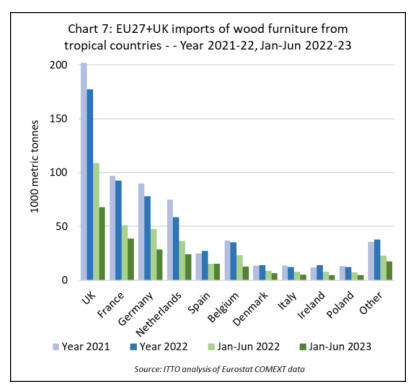

There was a sharp fall in tropical wood furniture imports

into the UK, the largest European market, in the first six

months of this year, down 38% to 67,600 tonnes.

Large declines were also recorded by France (-25% to

38,500 tonnes), Germany (-40% to 28,500 tonnes),

Netherlands (-35% to 23,900 tonnes), Belgium (-47% to

12,400 tonnes), Denmark (-27% to 6,300 tonnes), Italy (-

35% to 5,100 tonnes), Ireland (-38% to 4,800 tonnes), and

Poland (-35% to 4,800 tonnes).

Of all large European markets, only in Spain did imports

hold up reasonably well in the first half of this year,

reaching 15,100 tonnes, the same level as last year (Chart

7).

European outdoor furniture market at pre-pandemic

level

While trade data indicates a sharp downturn in tropical

wood furniture imports into Europe this year and last, the

latest report on the overall European outdoor furniture

market by CSIL, the Italian furniture industry market

research organisation, paints a more positive picture of

long-term prospects in this sector.

CSIL highlight that the increased attention paid to outdoor

spaces in recent years has boosted the demand for outdoor

furniture in Europe, which has seen significant growth,

outperforming on average the whole furniture sector.

Total annual sales of outdoor furniture in Europe are

estimated by CSIL to be around €3.3 billion. Following a

slight reduction in 2020 the sector recorded a double-digit

rebound in 2021, well above the sector average, and

remained buoyant in the first half of 2022.

The market slowed at the end of last year and in the first

half of 2023 but is still at around the pre-pandemic level.

The largest outdoor furniture markets within Europe are

Germany, the United Kingdom, France, and Italy,

accounting for a combined market share of over 50%.

According to CSIL, the growth of the European outdoor

furniture market has been driven by an array of factors,

such as house sales, residential and non-residential

construction, outdoor renovations, income availability, and

demographic changes. The pandemic played a significant

role to boost consumption of outdoor furniture and the

desire to experience outdoor spaces at home, in the office,

and in public spaces has remained strong. Demand came

from private consumers, contract, hotels, and office

design.

CSIL note that although the outdoor furniture market is

seasonal and strongly dependent on weather conditions,

customers now consider outdoor furniture as part of a

wider furnishing project, in line with a lifestyle concept in

which outdoor spaces are designed to be used all year

round with the terrace, balcony and garden seen as an

extension of indoor spaces.

European manufacturers and designers have responded to

the increasing demand for outdoor furniture by offering a

wide range of stylish and innovative options. Several

furniture companies formerly focused on interior products

have expanded their product portfolios to include outdoor

furniture, maintaining the characteristics of design and

comfort, with a focus and research on durable materials.

The presence of non-specialist outdoor brands, especially

from the upholstery, contract, and home furniture

segments, has grown significantly in the industry. Many of

these new players operate in the high-end and luxury

segments.

Outdoor furniture remains one of the best performing

furniture sectors in Europe and currently represents a 7%

share of total contract furniture sales in the region

according to CSIL figures. With a growing preference for

outdoor spaces, hotels, restaurants, cafés, and other

hospitality venues are ever more investing in high-quality,

durable outdoor furniture to enhance the onsite experience

of their guests.

With some of the world's most popular tourist destinations,

Europe experienced a significant revival in domestic and

inter-regional travel between the summers of 2021 and

2023. There has been strong expansion in the numbers of

hotel developments and refurbishments, further boosting

demand for outdoor furniture.

The outdoor sector is much more dependent on imports

than other furniture sectors in Europe. Slightly more than

half of all outdoor furniture imported by EU countries is

from countries outside the EU, with around 60% of non-

EU imports derived from China and 30% from tropical

countries in Southeast Asia.

Until last year, there was a long-term rising trend in

European imports of outdoor furniture from outside the

region. However, recent global supply challenges and

trade policy measures may lead to a partial reshoring of

sourcing activities in the next few years.

CSIL note that the outdoor furniture market is served via a

wide variety of channels, both specialist and non-specialist

distributors, from large scale retail chains to small

independent stores, and from 'pure' online players to brick-

and-mortar operators. Overall the role of non-specialist

retailers is higher in this sector than for most other

furniture sectors such as upholstery, kitchen furniture, and

office furniture.

DIY chains and garden centres are still pivotal sales

channels. However, there has been some growth in sales

via more specialist retailers in recent years, first as the

large-scale furniture chains expanded outdoor collections

and more recently as more independent retailers are

promoting designer outdoor brands.

The e-commerce channel is also growing rapidly. Both

manufacturers and retailers are extending their web

marketing activity and upgrading their on-line presence.

No longer do they only display product pictures and

prices, but also seek to guide and inspire customers with

design suggestions and case studies.

CSIL closely monitors the performance of the outdoor

furniture market in Europe through the comprehensive

Reports: ‘The Outdoor Furniture Market in Europe’ and

‘The Contract Furniture and Furnishings Market in

Europe’. These studies delve into statistics and indicators,

demand drivers, country analysis, competitive landscapes,

and product categories. More details are available at:

www.worldfurnitureonline.com.

|