Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Oct

2023

Japan Yen 149.80

Reports From Japan

Growth forecast

raised

IMF's World Economic Outlook report says growth in the

Japanese economy is forecast at 2% for 2023 up from its

1.4% prediction in July citing "a surge in inbound tourism"

as one of the major factors. However, the IMF left its

forecast growth for the world's third-largest economy in

2024 unchanged at 1%.

As more foreign travelers choose Japan as a holiday

destination, drawn by the yen's recent weakness the

revision to the growth forecast is also attributed to pent-up

domestic demand, a pickup in car exports and the impact

of the ultra-loose monetary policy. After suffering supply

chain disruptions during the COVID-19 pandemic, Japan's

car makers and other export oriented manufacturers have

been recovering.

See:

https://www.imf.org/en/Publications/WEO

Small companies yet to experience a recovery

According to the joint survey by the Finance Ministry and

the Cabinet Office business sentiment among major

Japanese companies improved in the July-September

quarter driven by a recovery in car makers and other

manufacturers.

The business sentiment index for companies with a capital

of yen 1 billion or more rose to plus 5.8 from plus 2.7 in

the previous quarter. The index represents the percentage

of companies seeing their business conditions improve

from the previous quarter minus that of firms feeling the

opposite. A government spokesperson said “the outcome

reflects a continued moderate recovery in the economy.”

The index for large manufacturers rose to plus 5.4 from

minus 0.4, the first positive figure in four quarters as an

easing of semiconductor shortages lifted sentiment in the

auto industry. For large non-manufacturers the index rose

to plus 6.0 from plus 4.1, led by services and real estate

firms. The sentiment index stood at plus 6.1 for mid-size

companies but at minus 5.5 for small companies.

See:https://japannews.yomiuri.co.jp/business/economy/20230914-136382/

Further fall in household spending

August household spending in Japan dropped 2.5% from a

year earlier, declining for the sixth consecutive month as

rising prices forced a cut-back on food, education-related

outlays and non-essential household items such as

furniture. The rate of decline was smaller than the 5% in

July. Households of two or more people spent an average

of yen 293,161/month according to the Ministry of

Internal Affairs and Communications.

Food expenditure, accounting for around one-third of

household spending, fell 2.5% and outlays for education

dropped 14%. In contrast, spending on travel jumped 3%

as more people took a summer vacation following the

removal of coronavirus restrictions.

The continued weakness in spending came as real wages

dropped 2.5% in August for the 17th consecutive month of

decline as the impact of rising prices outweighed that of

salary increases. The data is a key indicator of private

consumption which accounts for more than half of the

country's gross domestic product.

See:

https://japantoday.com/category/business/update1-japan-household-spending-falls-2.5-in-august-on-rising-prices

Home loans now more expensive

In October four major Japanese banks have announced

they have raised their fixed housing loan rates for the third

consecutive month.

MUFG Bank will raise its 10-year rate for most preferred

customers to 0.94% while the rate will rise to 1.14% at

Sumitomo Mitsui Banking and to 1.45% at Mizuho Bank

and to 1.65% at Resona Bank. On the other hand,

Sumitomo Mitsui Trust Bank lowered its most preferred

rate to 1.26% after revising its interest rate system.

See:

https://www.japantimes.co.jp/business/2023/09/30/housing-loans-rate-rise/

According to the Dallas Morning News, one of North

Texas’ most prolific apartment developers is being

acquired by a Japanese forestry and construction

company. A subsidiary of Tokyo-based Sumitomo

Forestry has bought Irving-based JPI which is building

more than 4,000 rental units in Dallas-Fort worth this year.

Significantly, the new acquisition will see a greater focus

on mid-rise construction and the use of mass timber as part

of a global plan to substantially grow its “build to rent”

portfolio of apartment assets. Sumitomo Forestry is now

looking to utilise “2 x 4” mass timber construction to build

net-zero dwellings.

See:

https://therealdeal.com/texas/dallas/2023/10/03/sumitomo-forestry-acquires-irving-based-jpi/

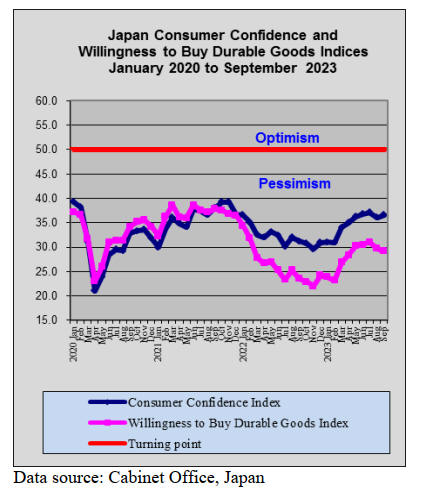

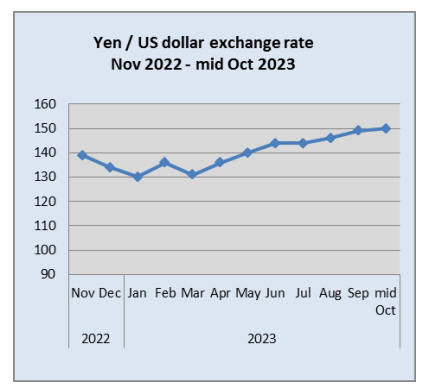

Fighting deflation and taming inflation

With the yen close to its weakest level in decades, food

inflation hitting 9% and households suffering from the

rising cost of living, pressure is mounting on the Bank of

Japan (BoJ) to break loose from its ultra-loose monetary

policy.

Over the past few months, the BoJ has been faced the

impossible task of fighting deflation and taming inflation

simultaneously.

See:

https://asia.nikkei.com/Spotlight/The-Big-Story/Japan-s-yen-dilemma-in-charts-BOJ-juggles-deflation-and-inflation?utm_campaign=IC_asia_daily_free&utm_medium=email&utm_source=NA_newsletter&utm_content=article_link

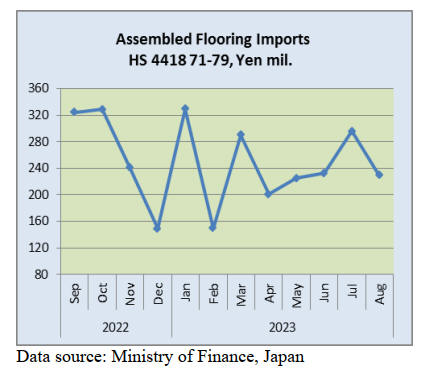

Import update

Assembled wooden flooring imports

After three consecutive months of increases the value of

assembled wooden flooring import in August tilted lower

bringing the monthly average value of imports back to

levels seen in previous quarters. Year on year, August

2023 imports dropped over 30% and compared to the

value of July imports there was an over 20% drop in

August.

Of the various categories of assembled flooring imports in

August, HS441875 was the largest accounting for 67% of

the total value of assembled flooring imports followed by

HS441879. The main shippers of HS441875 in August

were China 44%, Austria 17% and Malaysia 13%. There

were no arrivals from Indonesia in August but shipments

from Thailand accounted for around 5% of the value of all

HS441875 imports.

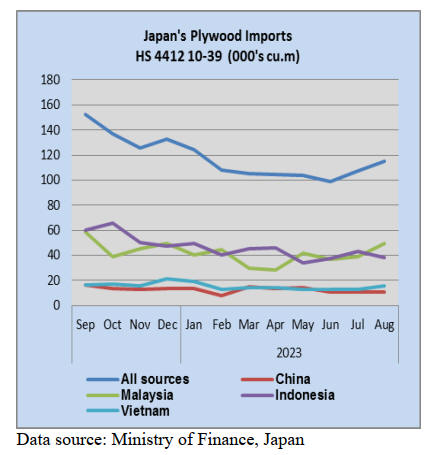

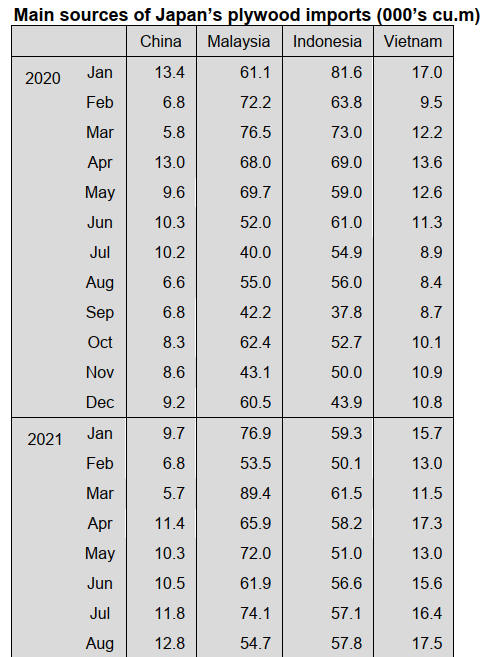

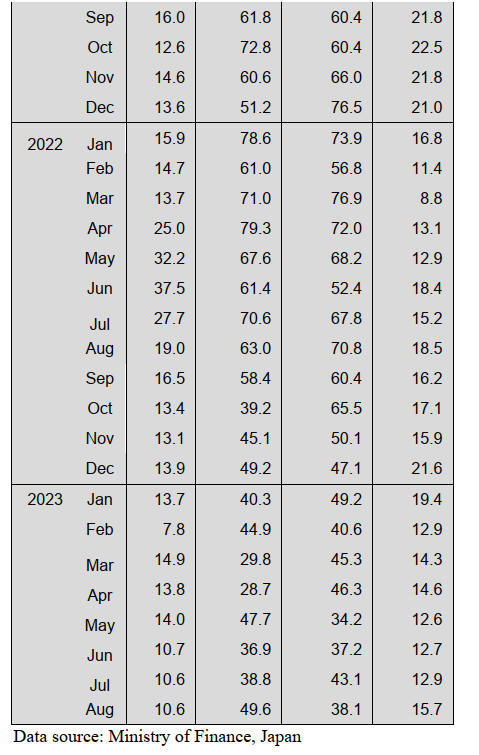

Plywood imports

The volume of plywood imports in August, at 115,000

cu.m ,snapped the downward trend that became evident in

the first half of this year. But, compared to August 2022

imports in August 2023 fell by over 30%. Compared to the

volume imported in July there was a 23% rise.

Year on year the volume of plywood imports from the

main shippers Indonesia, Malaysia, Vietnam and China all

declined with sharper declines being observed for

Indonesia and Malaysia.

The Japan Lumber Report says “the movement of

imported plywood is not good and there is low demand”.

The price of concrete formboard from SE Asia was raised

by around US$20, C&F per cu.m in July. Production costs

are rising for plywood manufacturers and exporters are

seeking higher prices but with weak domestic demand and

the weak yen Japanese importers have to resist demands

for higher FOB prices. (See page 18)

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

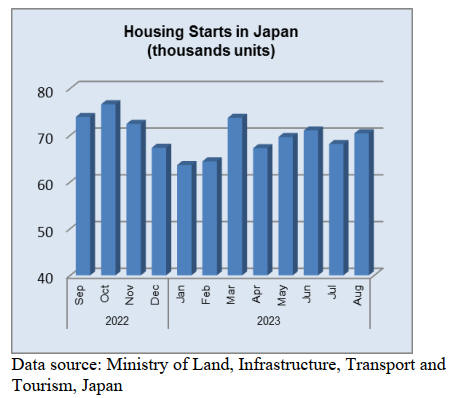

Orders for house builders

New orders for some house builders in August, 2023 are

10 % higher than August, 2022. However, demand of

houses is not recovered. Some house builders have good

sales for high value-added houses and the results of

August, 2022 were very dull.

The building costs were soaring in summer 2022 and

many house builders raised the selling price of a house.

Many house builders struggled with the sales in,

especially, July to September, 2022.

Moreover, demand of houses was different in cities,

suburbs and other areas. It is hard to say that orders for

house builders are good in this autumn. Since the

restrictions of activities due to COVID-19 have been eased

and it is easier to do business or attract customers than

before.

However, customers feel anxious to the economic in

the

future and the rising interest rates. They are cautious to

purchase houses.

Daiken to acquire WTK Reforestation

Daiken Sarawak Sdn. Bhd. in Malaysia, a subsidiary of

Daiken Corporation in Osaka Prefecture, concluded a

share transfer agreement with WTK Reforestation Sdn.

Bhd. in Sarawak, Malaysia on 11th, September and will

obtain all issued shares.

Daiken Sarawak will buy all shares from WTK

Reforestation’s parent company within this year. Daiken

aims to produce MDF made of trees from reforestation.

Daiken has four overseas MDF production bases and

produces about 550,000 cbms annually. About 50 % of

woody fiber materials is trees from Daiken’s reforestation

or other companies’ reforestations and the rest of woody

fiver materials is South Sea remnants.

Daiken Sarawak will reduce using South Sea lumber

gradually by using WTK Reforestation’s trees by 2025.

Also, the company plans to use own trees from own

reforestation for 60 – 70 % more in this year.

WTK Reforestation was established in 2000 and has about

5,400 hectares of reforestation. There are falcata trees and

acacia trees at the reforestation.

Fire resistant plywood

Sumitomo Forestry Co., Ltd. and Shin-Etsu Chemical Co.,

Ltd. developed fire resistant plywood. They started to sell

the fire resistant plywood on 1st, September.

Sumitomo Forestry received the certification on the fire

resistant plywood, which is 24 mm thickness and is used

to cover posts or beams, from the Ministry of Land,

Infrastructure, Transport and Tourism in March, 2023. The

company aims to receive the certification from the

Ministry of Land, Infrastructure, Transport and Tourism

for the fire resistant floors or walls for medium scale

buildings in the future.

The fire resistant plywood is 24 mm thickness, 910 mm

width and 1,820 mm length. The flame-retardant shaped

into tables is used on the both faces of domestic plywood.

Special machines are not needed for the fire resistant

plywood to process. Also, a process of drying the flame-

retardant is not needed. It is able to deliver the fire

resistant plywood in a short time and it will be the cost

reduction.

Demand and supply of domestic softwood plywood

According to the Ministry of Agriculture, Forestry and

Fisheries, inventory of domestic structural plywood in

August, 2023 is 132,000 cbms, 44.6 % more than August,

2022. This volume has remained flat from last month.

Inventory of domestic structural plywood soared in

August, 2022 and the inventory in July, 2023 was 66 %

higher than July, 2022 so it could say that the increase rate

in August, 2023 is decreased.

Shipment of domestic structural plywood is 191,000 cbms,

4.3 % less than the same month last year. Shipment had

been increasing for three months continuously until July,

2023. It was 197,000 cbms in July. The reason is that there

was a summer holiday in the middle of August. Product of

domestic structural plywood is 192,000 cbms, 9.6 % down

from the same month last year. It is about 240 cbms higher

than shipment.

Sudden rise in log price

In Fukushima Prefecture, the price of cedar log plunged to

under 10,000 yen, delivered per cbm during spring to

summer this year. The price recovered to a level of 10,000

yen, delivered per cbm after the summer holiday in

August.

There was a typhoon in the beginning of September and

there were not many logs at the market. Then, the cedar

log price started to rise in the middle of September. It was

around 12,000 yen, delivered per cbm. Also, the price of 4

m cypress log rose and it was around 20,000 yen,

delivered per cbm.When the cedar log price plunged in

June to August, loggers hesitated to deliver the logs to the

market. Then, the logs at the market began to decrease.

There are many log companies in Iwaki city and the

typhoon made terrible damages in that city in September.

The logs at the market decreased again. Then, lumber

companies started to purchase the logs because their

inventory of logs was low. As a result, the log price

skyrocketing.

Plywood

Movement of domestic softwood plywood has been

different on each distributor since September this year.

There is a certain amount of order to trading firms because

the number of workdays is more than August and the heat

has let up so it is easier to work at construction sites.

However, demand of houses is unclear in the future so the

consumers purchase to fill current needs.

The price of 12 mm 3 x 6 structural softwood plywood is

1,600 yen, delivered per sheet. 9 mm 3 x 10 plywood is

2,000 yen, delivered per sheet. 9 mm 3 x 8 plywood is

1,650 yen, delivered per sheet. 3 x 9 plywood is 1,800 yen,

delivered per sheet. These prices are unchanged from the

previous month.

Movement of imported plywood is not good and there is

low demand. The price of painted plywood for concrete

form in South Asia was raised by around $ 20, C&F per

cbm in July. The price of normal plywood and structural

plywood reached the bottom in summer and the price has

been leveling off. 2.4 mm 3 x 6 is around $ 950, C&F per

cbm. 3.7 mm is around $ 880, C&F per cbm. 5.2 mm is

around $ 850, C&F per cbm.

Structural plywood is around $ 560, C&F per cbm. 12 mm

3 x 6 painted plywood for concrete form is around $ 670,

C&F per cbm. Plywood form is about $ 560 – 580, C&F

per cbm.

The prices have been the same from last month. Since the

fuel expenses and product costs are rising in South Asia,

South Asian sellers expect to raise the price to Japanese

buyers. However, the price was not raised due to low

inquiries and the weak yen.

The prices are on the rise in Japan due to the weak yen but

it is difficult to raise the prices because the demand is low.

12 mm 3 x 6 painted plywood for concrete form at

wholesalers and at distribution firms is 1,950 yen,

delivered per sheet. Plywood form and structural plywood

are 1,800 yen, delivered per sheet. 2.5 mm plywood is 780

yen, delivered per sheet. 4 mm plywood is 1,000 yen,

delivered per sheet. 5.5 mm plywood is 1,200 yen,

delivered per sheet.

Trend and usage of woody biomass energy in 2022

The Ministry of Agriculture, Forestry and Fisheries

announced the result of trends and usage on woody

biomass energy in 2022.

There is an increase in the use of thinned wood or forest

remaining wood by about 10 % up because some small

wooden biomass power plants started operations. Output

of the small wooden biomass power plants is less than

2,000 kW. The use of wood chip produce in Japan by

imported chips or imported logs exceeds the 2021’s result.

Volume of thinned wood or forest reaming wood is

4,518,511 BDt, 9.8 % higher than the previous year. This

is 8 straight years exceeding the previous year’s result.

There are 71 small wooden biomass power plants started

operations and this is 14 small wooden biomass plants

increased from 2021. There are 47 large wooden biomass

power plants started operations and this is 3 large wooden

biomass power plants increased.

Remaining materials of lumber is 1,731,619 BDt, 3.3 %

down form 2021. This is for the first time decreasing in 2

years. The reason is that the starts of owner’s in 2022

decrease by 11.3 %. Building waste material is 3,941,095

BDt and this is 1.7 % less than the previous year.

|