Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Sep

2023

Japan Yen 149.30

Reports From Japan

Removing hurdles

faced by foreign companies

investing in Japan

To boost foreign investment in Japan the government is

considering a policy package to revise laws in order to

relax regulations on foreign investment, address Japan's

‘unique’ business practices and ease hurdles faced by

foreign companies wishing to enter the Japanese domestic

market. Part of this plan may involve setting up special

economic zones tailored where administrative procedure

can be completed solely in English.

In related news, a survey by Kyodo News found that 86%

of municipalities in Japan are facing a serious shortage of

workers in farming and other key sectors because of the

aging population and declining birthrate. To address this

municipalities want to see an increase in foreign workers.

See:

https://english.kyodonews.net/news/2023/09/09627910f55e-japan-pm-vows-to-set-up-special-zones-to-boost-foreign-investment.html

and

https://english.kyodonews.net/kyodo_news

No policy shift (yet) by Bank of Japan

At its end of September policy board meeting the Bank of

Japan (BoJ) decided to maintain the ultra-low interest rates

and reaffirmed its commitment to monetary easing despite

market expectations it could be preparing for a policy

shift.

The September meeting was the first since BoJ Governor,

Kazuo Ueda, alluded to the possible ending of the Bank’s

negative interest rate policy if prices and wages rise. The

latest decision means the BoJ will continue moving in a

opposite direction to the US Federal Reserve and the

European Central Bank which are raising interest rates to

tame inflations. The BoJ said inflation expectations are

rising but it is not convinced on the sustainability of wage

growth, an essential if interest rates are to be lifted.

See:

https://mainichi.jp/english/articles/20230922/p2g/00m/0bu/020000c

August trade deficit

Data from the Ministry of Finance for August show that

Japan recorded a trade deficit of over US$6 billion largely

because of the imposition of trade restrictions especially

by China which led to the biggest drop in food exports to

China in 12 years and the cost of imports, especially

energy, surged.

China imposed an import ban on Japanese seafood in late

August, after the operator of the crippled Fukushima No. 1

nuclear power plant began releasing treated radioactive

water into the Pacific Ocean. Food exports to China

tumbled 41.2% from a year earlier to ¥14.19 billion .

Japan's overall exports to China dropped 11.0% to ¥1.44

trillion while imports decreased 12.1% to ¥1.93 trillion,

leading to a ¥493.09 billion trade deficit.

See:

https://www.japantimes.co.jp/business/2023/09/20/august-exports-fall/

Worker shortage a risk to economic security

The Japanese government is becoming increasingly

concerned about a looming worker shortage which is seen

as yet another risk to economic self-reliance and economic

security.

This concern comes at a time when the sustainability of

wage growth is the focus of attention because of the

efforts being made by the Bank of Japan (BoJ) to achieve

a steady 2% annual inflation.

If the BoJ target is to be achieved it will be necessary for

the government to convince the private sector that annual

wage increases must be higher than the country's inflation

rate. This will be a major challenge as Japan's widespread

seniority-based employment system, low labour

productivity and worker reluctance to move from one job

to another have been among the factors behind the slow

wage growth for years.

Shipping captured carbon dioxide – discussions with

Malaysia

Japan is discussing with the Malaysian government a

proposal for shipping captured carbon dioxide to Malaysia

for underground storage as part of an Asian

decarbonisation project.

The project, if implemented, will be Japan's first shipment

and storage of captured carbon dioxide and could begin in

2028. Japan and several Southeast Asian countries plan to

build an Asia-wide carbon dioxide capture, utilisation and

storage network by 2030 in hopes of achieving

decarboniation and economic growth simultaneously in

the region.

See:

https://www.japantimes.co.jp/business/2023/09/26/economy/japan-carbon-capture-storage/

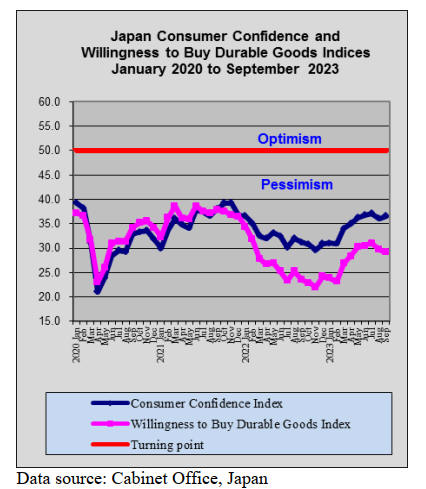

Rise in household assets

Assets held by Japanese households hit a record US$14

trillion at the end of June this year, an almost 5% rise from

a year earlier. Stock holdings surged 26%. Cash and

deposits, which accounted for over half of total household

assets, were up 1.4%. Despite the rise in overall assets

consumers are still very cautious on the future direction of

the economy so personal consumption is subdued.

See:

https://mainichi.jp/english/articles/20230920/p2g/00m/0bu/026000c

Smaller cities see land price rise

This year average land prices outside of the three largest

metropolitan areas in Japan rose for the first time in over

30 years on the back of sharp increases in land prices in

the smaller cities such as Sapporo, Sendai, Hiroshima and

Fukuoka which saw an 8% increase. In these and other

smaller cities recent redevelopment investment has

attracted residents and businesses to these cities.

Of 38 regional prefectures, 27 recorded a decline in their

overall land prices. However, 20 prefectures saw the

figures increase or remain unchanged in their capitals.

However, these increases are exceptions as land prices

have been declining in most regional areas.

See:

https://www.asahi.com/ajw/articles/15009758

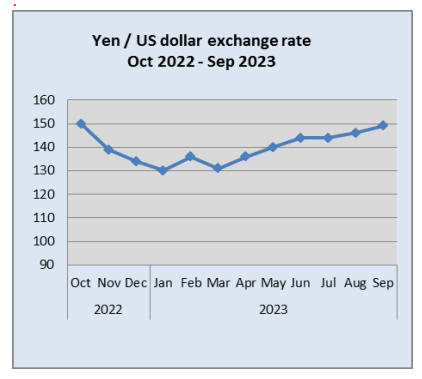

Yen closing in on 150 to the US dollar

If the Japanese yen weakens beyond 150 to the dollar as it

appears likely to do so in the coming weeks the BoJ could

be forced into changing its policy stance earlier than it

wishes. The yen slipped to 148.2 in the third week of

September after reaching its lowest in almost 10 months at

148.47 to the US dollar.

As the yen weakens overseas tourists are benefitting and

Japan has become a more affordable destination. Chinese

tourists, known for their shopping sprees, are back in

Japan. The weak yen, which remains close to multi-decade

lows, has delighted exporters but it has hurt domestic

household budgets as the cost of imports continues to

surge.

.

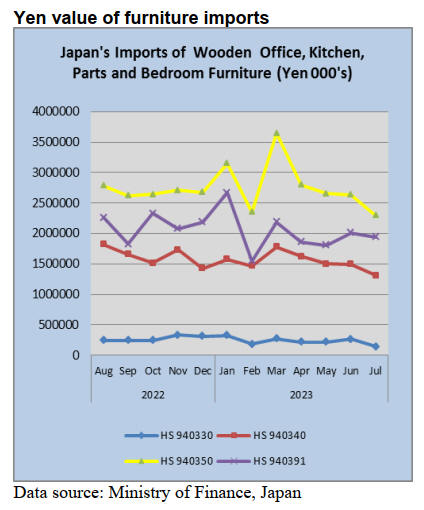

Import update

There was a decline in the value of Japan’s wooden

furniture imports in July compared to a month earlier.

Year on year there was a considerable fall in the value of

imports which, if set against the yen exchange rate which

has fallen from around 130 a year ago to 147 to the US

dollar in September, signals a significant downturn in

wooden furniture imports.

Expanding outside of Japan

Japanese furniture company Nitori Holdings has opened

its first outlet in Hong Kong and by 2032 it plans to have

20 outlets in Hong Kong. Nitori already has 75 locations

in mainland China and hopes to expand that to lift that to

100 by the end of the year. Nitori manufactures most of its

goods in mainland China and in Southeast Asia.

See:

https://asia.nikkei.com/Business/Retail/Japan-furniture-retailer-Nitori-plans-20-Hong-Kong-outlets-by-2032

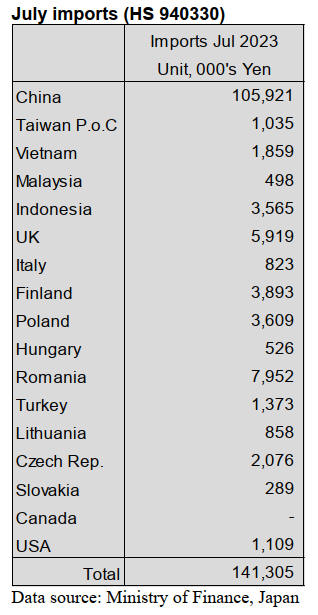

July wooden office furniture imports (HS 940330)

The value of Japan’s wooden office furniture imports in

July this year was 47% down compared to June and down

over 40% compared to July 2022. July shipments of

wooden office furniture from China accounted for 75% of

all shipments of wooden office furniture, down from the

84% share in June.

Of the other 18 July shippers Romania and the UK were in

the top five suppliers. There appears to have been a

diversification of sources of wooden office furniture in

July with several new shippers being identified in the

import statistics. Indonesia, Finland and Poland stand out

as accounting for around 3% each of July arrivals.

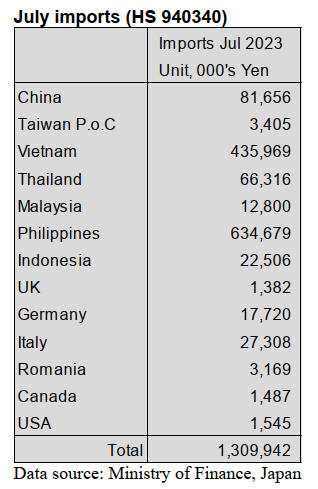

July kitchen furniture imports (HS 940340)

Two suppliers, the Philippines and Vietnam, continue to

dominate Japan’s imports of wooden kitchen furniture but

in July the value of shipments to Japan from these two

main suppliers declined which drove down the total value

of arrivals of wooden kitchen furniture despite the rise in

the value of imports from China, Malaysia and Indonesia.

Year on year the value of wooden kitchen furniture

imports dropped 28% and month on month there was a

12% decline. The value of Japan’s imports of wooden

kitchen furniture was falling for four consecutive months

up to July.

In July shipments from the Philippines accounted for 48%

of the value of imports of HS940340 with a further 33%

coming from Vietnam. The other shippers of note in July

were China and Italy.

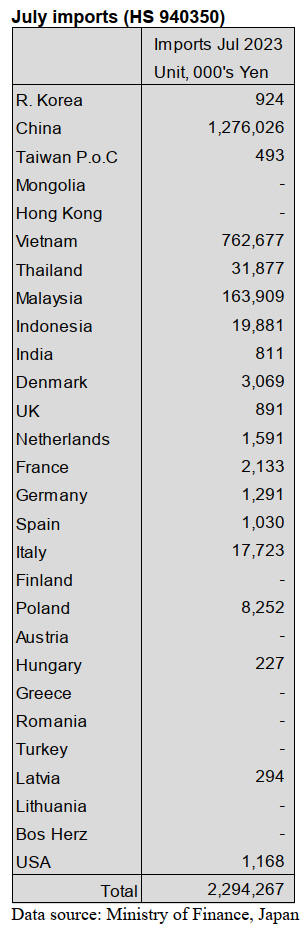

July wooden bedroom furniture imports (HS 940350)

Since April this year there has been a steady reduction in

the value of imports of wooden bedroom furniture. China

and Vietnam are the largest suppliers of wooden bedroom

furniture to Japan together accounting for around 90% of

imports of this category of wooden furniture. The decline

in the value of imports from these two main shippers

disguises the advances made in market share by some

other shippers such as Malaysia and some EU member

states.

In July this year there was an 18% decline in the value of

wooden bedroom furniture and month on month the

decline was in the order of 12%.

July wooden furniture parts imports (HS 940391)

Year on year the value of Japan’s imports of wooden

furniture parts dropped 14% and there was a 4% decline

compared to the value of June imports. The top suppliers

in July were, as in previous months, China (44%),

Indonesia 21%, Malaysia (11%) and Vietnam 7%. For the

past four months the value of wooden furniture parts

imports has been within a narrow range and the decline in

the overall value of imports has been felt by all of the

main shippers.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Demand and supply of lumber at Tokyo port

Inventory of lumber at Tokyo port in August, 2023 is

119,000 cbms and it is 3,500 cbms more than July, 2023.

The inventory has been decreasing since September, 2022

but it stops decreasing. Arrival volume of Canadian

lumber in August declines due to the strike at a harbor in

Canada but the inventory of lumber keeps a level of

110,000 cbms. Shipment in August is almost the same

shipment in July. The inventory was 209,000 cbms in

August, 2022 and it is 43.1 % down in August, 2023.

Plywood supply for the 1st half of 2023

The supply of plywood in the first half of 2023 decreased

from the first half of 2022. A total plywood supply is

2,116,000 cbms, 28.2 % lee than January to June, 2022.

Domestic plywood is 1,188,000 cbms, 23.9 % less and

imported plywood is 927,000 cbms, 33 % less than the

same period last year.

Product of domestic plywood in June, 2023 is 9.4 % up

from May 2023 and it is 19.4 % less than June, 2022. The

anticipation of falling prices is about to calm down

because the price of 12 mm 3 x6 structural softwood

plywood almost reached the bottom in Eastern and

Western Japan in July, 2023. The price was 1,600 yen,

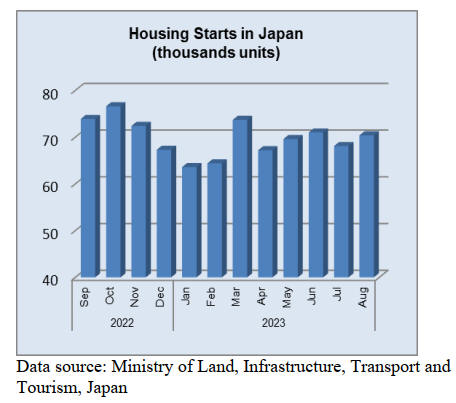

delivered per sheet. However, demand of houses has been

low so the shipment of plywood in the future remains

unclear.

Imported plywood in June, 2023 is 38.2 % down from

June, 2022. Malaysian plywood in January to June, 2023

is 40 % less than June, 2022. Indonesian plywood at the

first half of 2023 is 196,000 cbms, 37.2 % down from the

first half of 2022. Indonesian plywood in June, 2023

increases slightly from May, 2023 and it is 30.4 % down

from June, 2022.

Demand and supply of domestic softwood plywood in

the 1st half of 2023

Product of domestic structural softwood plywood is 25.3

% down from January to June, 2022. The reason is that

plywood manufacturers have been reducing product to

control demand and supply since last October.

Since the housing market is sluggish, shipment of

domestic structural softwood plywood is 24.8 % less than

January to June, 2022. However, shipment of domestic

structural softwood plywood in June, 2023 is 5.9 % up

from May, 2023. Inventory of domestic structural

softwood plywood in June, 2023 is 138,629 cbms, 82.7 %

more than June, 2022.

Orders for house builders

New orders for many house builders in July, 2023 rise by

4 % from July, 2022. However, the results of July, 2022

were low so it is hard to say that this situation is good.

Many house builders do not get a strong sense of recovery

in orders and they have no idea that this situation would be

better in the future. Some house builders have a good

result by non-housing buildings. The price of a house is

lowered but starts of house still do not increase. The price

of lumber is decreasing but other materials for building

structures are high.

South Sea logs and lumber

South Sea log such as Keruing for producing lumber is

about to run short. Demand of South Sea log shipbuilding

and steel companies have been strong until June, 2023 and

other demand has been low so demand and supply has

been balanced. However, demand for truck bodies

increased suddenly. Then, some distributors import South

Sea logs by container ships hurriedly.

Inquiries for truck bodies were very low last year. One of

the reasons is that the semiconductors were short. The

other reason is that a major commercial vehicle company

in Japan did wrong on engines and the sales were not

good. However, a shortage of semiconductors had solved

after April, 2023 and the sales rose. Then, demand of truck

bodies recovered in June.

It takes three to four months to import South Sea lumber

from overseas so South Sea lumber companies in Japan

got orders. Thus, South Sea lumber companies in Japan do

not have enough South Sea logs and they make every

effort to get South Sea logs.

Movement of South Sea lumber and Chinese lumber is

sluggish due to low demand in Japan and the weak yen.

The sales of trucks are not good even though product of

truck body recovered. It is unclear that how long this

situation would continue.

|