|

1.

CENTRAL AND WEST AFRICA

Impact on forestry sector from change in Gabon

unclear

In Gabon there have been significant developments related

to corruption investigations being undertaken by the

military authorities. This is a massive undertaking that

spans most ministries and involves former ministers and

former Director-Generals. It is very difficult to get an

accurate picture of the situation in Gabon and how the

forestry sector is being impacted. Links to some domestic

media reports are included below:

See:

https://www.lenouveaugabon.com/fr/securite-justice/2009-20134-noureddin-bongo-et-des-anciens-membres-du-cabinet-d-ali-bongo-places-sous-mandat-de-depot-a-la-prison-de-ibreville

https://www.jeuneafrique.com/1487161/politique/au-gabon-raymond-ndong-sima-vise-un-dialogue-national-entre-avril-et-juin/

https://www.lenouveaugabon.com/fr/mining/2109-20139-mines-le-gouvernement-leve-la-suspension-temporaire-des-activites-auriferes

https://www.lenouveaugabon.com/fr/gestion-publique/2709-20155-dette-interieure-la-federation-des-entreprises-du-gabon-recense-ses-membres-creanciers-de-l-etat

The media has reported Marc Ona Essangui, founder of

the NGO Brainforest, has assumed the position of third

Vice President of the Gabon Senate. His appointment is

seen as positive considering his background. Essangui has

said he intends to “lead the battle for the transparency of

contracts signed between the State and foreign

companies”.

See:

https://www.lepoint.fr/afrique/marc-ona-essangui-la-transition-doit-etre-beaucoup-plus-inclusive-14-09-2023-2535404_3826.php

Worker dispute at Nkok mediated

In a recent press release the Administrative Authority of

the Nkok economic zone announced that 14 companies

operating in the zone were put on notice “for

regularisation of their operations” and this was done to

find a solution to the demands of zone workers.

A dialogue was initiated between the Administrative

Authority of Nkok (AAN) and the Economic Zone

Workers Cooperative. Following the discussions progress

was made on most of the worker’s demands and the

Cooperative agreed the resumption of work while

discussions continue.

See:

https://www.lenouveaugabon.com/fr/sante-social/1409-20119-zis-de-nkok-14-societes-mises-en-demeure-pour-situations-irregulieres

In other news, Gabon has been experiencing very heavy

rain which has disrupted logging operations. In

neighbouring Cameroon similar heavy rain has forced

many mills to halt production.

It has been reported that three sawmills in the Douala area

have been requested to relocate their mills further inland

due to the need for Douala to accommodate housing

projects for its growing population which now stands at 4

million.

Exports from the CAR are currently low also due to the

bad weather. The Wagner Group's operations in the

country are facing increasing international pressure and it

is rumoured that buyers in the UK and France have

cancelled many contacts.

See:

https://adf-magazine.com/2023/08/illegal-logging-in-the-car-by-wagner-group-and-criminal-syndicates-drives-insecurity/

Call for Expressions of Interest

ATIBT has reported the Central African Forest Initiative

(CAFI) is launching a call for Expressions of Interest to all

relevant implementing organisations interested in

investing in private sector companies in its partner

countries (the Democratic Republic of the Congo, the

Republic of the Congo, the Gabonese Republic, the

Republic of Cameroon, the Republic of Equatorial Guinea

and the Central African Republic) to address the drivers of

deforestation and forest degradation.

See:

https://www.cafi.org/cafi-launches-call-expressions-interest-regional-private-sector-facility

2.

GHANA

Billet exports tumble

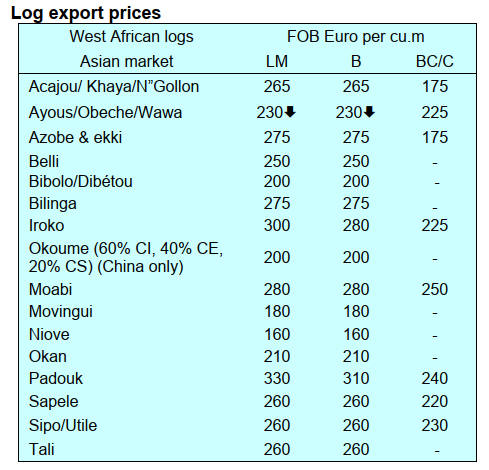

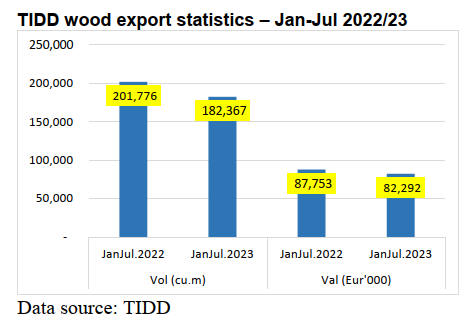

Ghana experienced a decline in wood product exports in

the first seven months of this year. The Timber Industry

Development Division (TIDD) reported an almost 10%

drop in export volumes and a 6% drop in earnings

compared to the same period for previous year.

In its report for the first seven months of the year the

TIDD recorded 182,367 cu.m of wood product exports

compared to 201,776 cu.m in the same period last year.

The total export value for the first seven months of 2023

was Eur82.29 million compared to Eur87.75 million in the

same period in 2022.

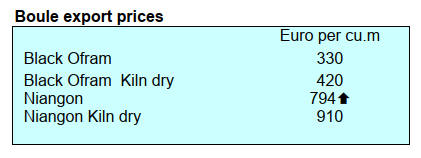

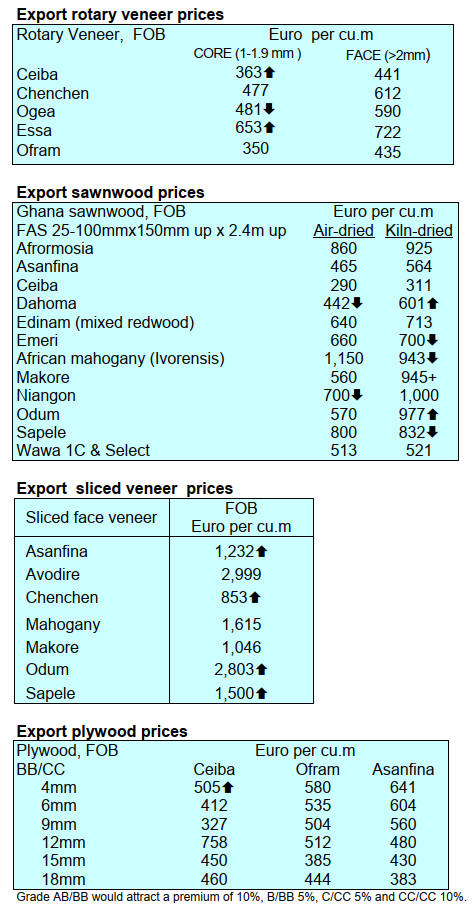

TIDD wood export statistics – Jan-Jul. 2022/2023

In spite of the dip in volume and value of the wood

product exports the data showed five (5) products that

recorded some improvements in export volumes during the

period. These included rotary veneer (3.7%), mouldings

(13%), plywood (73%), briquettes and kiln dried boules.

The main exporter of briquettes was Sustainable Biomass

Solution Ghana Limited. The company was the sole

exporter shipping 1,192 cu.m of their product earning

Eur214,719 during the first 7 months of 2023. The only

species used for this product was wawa with the United

Kingdom as the only market. The average unit price

(AUP) for briquettes for the period reviewed fell to

Eur175.79/cu.m compared to Eur252.30/cu.m in 2022.

The products for which export volumes declined

significantly were billets which dropped to 9,162 cu.m in

the first seven months of this year from 24,404cu.m in the

same period in 2022, a massive 63% decline. The

corresponding revenue also fell by 63%, from Eur 7.72

million in in the first seven months of last year to Eur 2.82

million in the current year.

The top species for billet production were teak and

gmelina which accounted for 94% and 6% respectively of

the total export volume for the first seven months of 2023.

This product is mainly shipped to India (96%) and the

United Kingdom (4%).

Ghana’s Primary Products, which comprised billet and

teak logs, earned Eur4.75 million from a total volume of

15,124 cu.m of the total wood products exports in the first

seven months of 2023. The figures represent decreases of

38% in value and volume compared to the timber export

figures registered during January-July 2022 which were

24,404 cu.m (12%) valued at Eur7.72 million (8.80%).

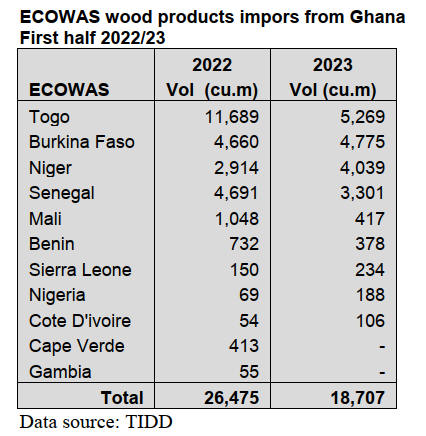

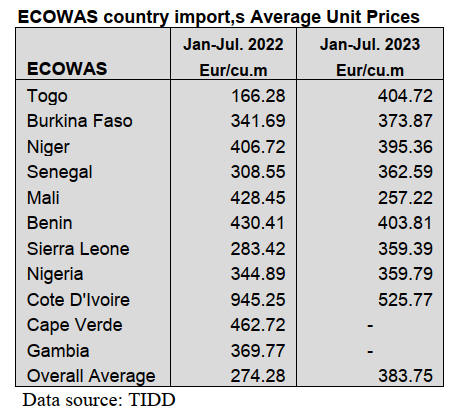

ECOWAS Market – higher average prices despite drop

in volume

Of total wood products export the first seven months of

2023, eleven ECOWAS countries accounted for

18,707cu.m, which earned the country Eur7.18 million in

2023 as against 26,375cu.m valued at Eur7.26million in

2022.

The 2023 ECOWAS import volumes and values resulted

in a higher average unit price (AUP) of Eur383.75/cu.m

compared to Eur274.28/cu.m for the same period last year.

According to TIDD data the ECOWAS sub-region market

registered the largest share of 18,707cu.m representing

82%, valued at Eur 7.18 million (77%) of the total African

wood products exported from Ghana during the first seven

months of 2023 as compared to Eur7.26 million recorded

during JanJul.2022.

In a related development, available data from the United

Nations Conference on Trade and Development

(UNCTAD) on the African Continental Free Trade Area

(AfCFTA) show that, as of January this year, intra-Africa

trade was low at just 14.4% of total African exports.

Countries trading under the AfCFTA regime, which

commenced in January 2021, have been urged to fashion

out a deliberate policy decisions to increase intra-African

trade and investment, grow local businesses to accelerate

industrialisation.

See:

https://thebftonline.com/2023/08/24/brics-2023-deliberate-policy-decisions-advocated-to-drive-intra-african-trade/

Training on performance management systems

The Forestry Commission (FC) organised Performance

Management System (PMS) training for eighteen senior

staff at the Forestry Commission Training Centre (FCTC)

at Akyawkrom in the Ashanti Region.

The resource person for the training, the Director of

FCTC, Andy Okrah, explained that Performance

Management is a strategic and integrated process that

delivers sustained success to an organisation by improving

performance of employees and developing their

capabilities.

He indicated that, some of the objectives of the workshop

were to provide an insight into FC’s Performance

Management Systems, develop the capacity of employees

in target setting for effective implementation of FC’s PMS

and teach how to set targets under FC’s PMS.

Participants were schooled on how to set targets using the

SMART Model, which states that; a target should be

Specific, Measurable, Attainable, Realistic and Timely.

Mr. Okrah explained that, one must first identify his key

job areas in order to set a ‘SMART’ target and per the

Forestry Commission PMS (target setting), employees are

to set 5-8 goals in general, which should be derived from

employee’s technical, personality and managerial

competencies. He coached participants on what makes a

target SMART.

Participants were taken through a practical and interactive

session to demonstrate how to have a face-to-face

discussions with subordinates on their targets and give

unbiased feedback on their strengths and weakness, skills

attitude, job knowledge and behaviour at work.

See: https://fcghana.org/?p=4086

Ghana-Turkey trade projected to hit US$1 billion

The Ghana-Turkey Chamber of Commerce has hinted the

annual value of trade between Ghana and Turkey could

rise to US$900 million by 2025 which will subsequently

exceed the US$1 billion mark by the close 2027.

According to the Chamber, as of 2020 the total trade value

between Ghana and Turkey stood at US$771 million, from

a progressive growth of US$479 million in 2016. In 2019,

Ghana became Turkey’s third-biggest trading partner in

sub-Saharan Africa taking a dip in 2021 and 2022 due to

the global economic slowdown.

The Chief Executive Officer of the Chamber, Dr. Daniel

Amateye Anim-Prempeh, stated that, while the current

trend of trade between the two nations is promising,

improving relations and expanding areas of trade

guarantee that it will grow at a faster rate. According to

TIDD statistics, Turkey’s imports from Ghana include air-

dried, kiln-dried, rotary veneer and processed

lumber/mouldings wood products.

See:

https://thebftonline.com/2023/09/18/ghana-turkey-trade-to-hit-us1bn-in-2027/

Meanwhile, according to the September 2023 Bank of

Ghana (BoG) summary of macroeconomic and financial

data, Ghana’s trade balance grew by about 13% from the

US$1.78 billion in July 2023 to US$2.01 billion in August

2023, which represented 2.6% of GDP.

See:

https://www.bog.gov.gh/wp-content/uploads/2023/09/Summary-of-Economic-Financial-Data-September-2023.pdf

3. MALAYSIA

Sarawak company looses forest

certification certificate

The Malaysian logging company Samling has lost its

forest certification certificate for the Ravenscourt Forest

Management Unit (FMU), one of its certified natural

forests under the Malaysia Timber Certification Scheme

(MTCS) in Sarawak.

The certification body SIRIM withdrew the certificate

after Samling failed to provide effective corrective action

to address issues of non-compliance with the MTCS

standard. There are currently no logging on-going

activities in the Ravenscourt FMU.

See:

https://borneoproject.org/as-trial-looms-samling-loses-forest-certificate-in-sarawak/

US furniture wholesaler

US-based ‘Top-Line Furniture Corporation’, a large

furniture importer and wholesaler based in Chicago,

Illinois has expressed an intention to increase its imports

from Malaysia over the next few years to RM230 million

per year.

The company has been sourcing home furnishings from

Malaysia since 2000 with total imports amounting to

approximately RM840 million to date. The increase in

imports will not only benefit Malaysian furniture

manufacturers but also benefit companies along the supply

chain.

Malaysia’s furniture exports in 2022 totalled RM13.86

billion with the US being its top export market at RM7.24

billion or 52% of total furniture exports last year. For the

first six months this year Malaysia’s furniture exports

were RM4.07 billion, of which 49% went to the US.

Production of highly-marketable bamboo products

should be prioritised

The bamboo industry possesses immense potential to be

developed and used as an alternative to timber according

to Deputy Prime Minister. He added, bamboo is an

abundant natural resource and Malaysia is home to about

70 bamboo species with 45 being local species found in

Malaysian forests.

He said that although export earnings from bamboo are

small compared to other forest products, bamboo has the

potential to be developed and used as an alternative to

wood in a variety of applications. The production of

highly-marketable bamboo products should be prioritised.

Currently there are some 577 industries actively involved

in the industry through sectors such as furniture,

construction, textiles, plantations, food, charcoal (bamboo

briquettes) and handicraft. To effectively spur the national

bamboo industry, a more effective and holistic approach

must be taken to create a conducive environment. The

Forest Research Institute Malaysia (FRIM) has conducted

extensive research on bamboo since the 1980s.

FRIM is committed to commercialisation activities as one

of its main sources of revenue through products and

technologies developed by its scientists. Its Innovation and

Commercialisation Division Director, Mohd Salleh, said

FRIM’s Research and Development projects successfully

produced potential outputs in various forms such as

products, processes, formulations, designs and plant

varieties.

He said that all the institute’s intellectual property was

developed by FRIM scientists using local bio-resources

which are suitable for the climatic environment and

applications as well as meet industry standards and market

requirements.

See:

https://www.thestar.com.my/news/nation/2023/09/22/fadillah-vast-potential-for-bamboo-industry-to-grow

FRIM to mainstream commercialisation

Supporting Nature-based Solution projects in Malaysia

In a press release, PETRONAS has announced the

company and the Malaysia Forest Fund (MFF) have

signed a Memorandum of Understanding (MoU) to

explore and develop high-quality Nature-based Solutions

(NBS) projects in Malaysia.

NBS comprise all activities related to the conservation and

restoration of natural ecosystems to lower the

concentration of greenhouses gases in the atmosphere. It

offers immediate, scalable and cost-effective pathways to

reduce net emissions, as well as contributes to climate

mitigation and community co-benefits.

Given its importance in addressing the climate and nature

crises, the selection of NBS projects must be of high

quality with strong environmental integrity drivers and

additional co-benefits, assessed and verified by credible

framework and international standards.

PETRONAS' participation in the REDD Plus initiative

also signifies its commitment to conducting and expanding

its business in a manner that generates positive

contributions to both society and the environment, thereby

strengthening PETRONAS’ stance on nature and

biodiversity.

See:

https://www.petronas.com/media/media-releases/petronas-partners-malaysia-forest-fund-explore-high-quality-nature-based

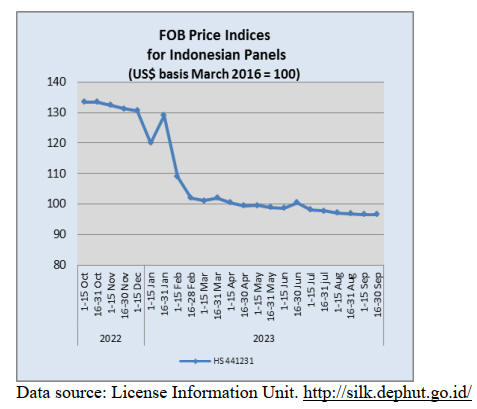

4.

INDONESIA

Foreign partners offer

way of diversifying international

marketing

During the 2023 Indonesia Furniture and Design Expo in

Tangerang, Banten the Indonesian President urged

Indonesian furniture makers to look for foreign partners as

a way of diversifying international marketing.

He said that the domestic furniture industry is ranked 17th

in the world with a total revenue of only US$2.8 billion

amid the world furniture market potential of almost

US$800 billion.

In related news, the President said that the government

will continue to encourage the furniture and crafts sectors

so they become more competitive with imported products

in the domestic market. He added that domestic products

should be marketed through the internet which will attract

private as well as government buyers.

The President said he is confident that domestic

manufacturers have a great future in the domestic market.

HIMKI Collaboration with CNFMA

The Indonesia Furniture Industry and Crafts Association

(HIMKI) intends to collaborate with the China National

Forestry Machinery Association (CNFMA) to promote

appropriate wood processing technology for the furniture

industry.

HIMKI General Chairperson, Abdul Sobur, explained that

both HIMKI and CNFMA appreciate the relationship

between technological developments and the success of

the furniture industry. According to Sobur, the impact of

technology in the furniture and crafts sectors is undisputed

as this can raise production efficiency and process

precision.

In addition machine technology can expand the

possibilities for furniture design. Designers can

experiment with new materials and shapes knowing that

modern machines can deliver with precision. Sobur

commented that machining technology has changed the

furniture and crafts industry by enabling mass production,

increased efficiency and precision, has encouraged

innovation and customisation and contributing to

sustainability efforts.

In related news, The HIMKI is working with the China

Foreign Trade Guangzhou Exhibition General Corp, the

organiser of the China International Furniture Fair, to

expand Indonesia’s share of the furniture market in China.

See:

https://en.antaranews.com/news/293631/jokowi-indonesia-furniture-industry-needs-foreign-partners

and

https://agroindonesia.co.id/tingkatkan-daya-saing-produk-furnitur-himki-gandeng-cnfma/

Furniture sector exports declined in first half

of 2023

Data from Indonesia’s Central Statistics Agency shows

exports all types of furniture (except plastic furniture)

weakened in the first half of 2023. In the first half of this

year the total volume of national furniture exports reached

253,500 tonnes, down 26% compared to the first half of

2022. In the same period export earnings from furniture

exports also fell (-31%) to US$1.07 billion.

In the first half of 2023 the largest export earnings were

delivered by wooden furniture, reaching US$731.1

million. However, this was 32% below the value of

wooden furniture exports in the same period in 2022.

The main export markets for Indonesian wooden furniture

were the United States, Japan, the Netherlands, Germany,

Belgium, Australia, England, France, Canada and Spain.

However, in the first semester of 2023, almost all

countries reduced their imports.

The value of wooden furniture exports to Japan fell 25%,

the Netherlands (-40%), Germany (-47%), Belgium (-

23%), Australia (-42%), the UK (-27%), France (-13%)

and Canada (-58%). The only wooden furniture market

country that increased purchases was Spain but the

increase was only around 3%.

See:

https://databoks.katadata.co.id/datapublish/2023/09/15/ekspor-furnitur-indonesia-melemah-baik-bahan-kayu-maupun-plastik

and

https://databoks.katadata.co.id/datapublish/2023/09/15/negara-pasar-utama-furnitur-kayu-ri-kurangi-belanja-pada-semester-i-2023

Forest owners welcome biomass co-firing concept

Indonesian forest owners have welcomed the biomass co-

firing programme planned by coal fired power plants

saying they are ready to supply wood chips if long-term

contracts can be agreed.

The chairperson of the Association of Indonesia Forest

Concession Holders (APHI), Indroyono Soesilo, stated

that energy plantation forests could replace at least 5% of

the coal currently consumed.

Soesilo said the forestry sector sees attractive prospects in

biomass co-firing.Energy plantation forests can supply

wood chips from Gamal and Kaliandra trees which can be

harvested in two years. He added the biomass price plan

should be 1.2 times higher the price of coal to encourage

the forest growers.

The Ministry of Environment and Forestry (KLHK) has

said Indonesia has forest resources that can be utilised for

the biomass-based green energy sector. The KLHK

supports biomass utilisation programmes by promoting

plantation forests for energy along with utilisation of wood

waste.

See:

https://www.msn.com/id-id/berita/other/industri-hutan-harapkan-kontrak-jangka-panjang-untuk-pasok-wood-chips/ar-AA1gHAg6

and

https://ekonomi.republika.co.id/berita/s12o2y457/klhk-sebut-indonesia-punya-hutan-yang-potensial-untuk-biomassa

Lower threat of forest, land fires

Rasio Ridho Sani, Director General of Law Enforcement

at KLHK has reported the threat of forest and land fires

this year is much lower than in previous years. According

to Sani, the number of forest and land fire cases that often

occur in Sumatra and Kalimantan had decreased because a

team constantly conducts satellite monitoring of hotspots

and raises the alarm.

See:

https://en.antaranews.com/news/294201/threat-of-forest-land-fires-continue-to-decrease-ministry

5.

MYANMAR

Timber export performance reported

The value of timber exports in the first five-month of

2023-2024 declined year on year to around US$30 million.

This downward trend is likely to continue such that the

year-end figure for exports could be around US$75million.

The value of timber exports was US$128 million for the

financial year 2021-22 and US$139 million for 2022-23

according to the Ministry of Commerce.

The impact of sanctions imposed by the US and EU and

the latest measures taken against the state-owned banks,

Myanmar Foreign Trade Banks and Myanmar Investment

and Commercial Bank has weakened the country’s ability

to export wood products. Millers report there are no orders

from the US or EU.

According to the State-Owned Newspaper ‘The Global

New Light of Myanmar’, Dr Than Naing Oo, Deputy

Director-General of Forest Department, was quoted as

saying “Between April and July of this financial year

Myanmar’s teak found its way to 20 countries through 41

companies in 242 containers totalling 2,610 cubic tons.

The export revenue amounted to US$8.137 million.”

India, Singapore, Malaysia, Thailand and China were

reportedly the main markets for timber from Myanmar.

Alarming fluctuations in exchange rates

In recent weeks there have been alarming fluctuations in

exchange rates in Myanmar and this has had a knock-on

impact on prices of household essentials. In an effort to

gain control of money markets the Central Bank of

Myanmar (CBM) announced it had revoked the licenses of

a further 123 currency exchange companies raising the

number of licenses revoked within the last 11 months to

168.

The CBM took similar actions last October and this year

in January, March, July and August against a total of 45

companies including Myanmar National Airlines saying

the companies had failed to comply with the bank’s rules

and directives.

The CBM cited the same reason for its latest move to

revoke currency exchange permits. Companies whose

licenses were revoked on Tuesday included trading firms,

travel & tour operators, construction groups, hotels

including Yangon’s luxury Sedona Hotel and financial

services companies.

The CBM’s current reference exchange rate is 2,100 kyats

per US dollar although the black market rate went over

3,500 Kyats at the end of August 2023.

See:

https://www.irrawaddy.com/business/junta-shutters-myanmar-currency-exchanges-in-futile-bid-to-prop-up-economy.html

Government re-shuffle

In another development Myanmar’s military has

reshuffled the country’s ruling council (State

Administration Council) and Cabinet, state media

reported, with an apparent purge of two high-ranking

generals who independent media have said are under

investigation for alleged corruption.

See:

https://apnews.com/article/myanmar-army-corruption-cabinet-reshuffle-9e2a235d2e4cc31b17a2e42f6bf12a31

and

https://www.irrawaddy.com/business/myanmar-junta-continues-tightening-the-screws-on-its-economic-team.html

)

Running out of power: World Bank report

Myanmar’s power sector has been in a downward spiral

since the February 2021 military take-over and the

prolonged electricity blackouts will likely worsen

according to a recent World Bank report and a former

advisor to the Myanmar Ministry of Electricity and

Energy.

Major cities, including Yangon, Mandalay, and Naypyitaw

are facing regular power outages while industrial zones

across the country are bracing for crippling power cuts and

surging fuel prices says the World Bank report “In The

Dark: Power Sector Challenges in Myanmar.”

UN calls for a unified strategy to end the worsening

crisis in Myanmar

UN Secretary-General António Guterres, said financial aid

should be boosted to previous levels to enable the world

body to respond to an “enormous tragedy.” He said the

situation in Myanmar has further deteriorated since he met

with ASEAN leaders in a 2022 summit and again called

on the Myanmar government to immediately free all

political prisoners and “open the door to a return to

democratic rule.” Guterres made the case for an

international response in a news conference before joining

the Association of Southeast Asian Nations leaders’

summit meetings in Indonesia.

See:

https://www.asahi.com/ajw/articles/15000256#:~:text=U.N.,the%20worsening%20crisis%20in%20Myanmar.

and

https://apnews.com/article/asean-myanmar-united-nations-antonio-guterres-c0b88922566e879ca816206d94666eeb

6.

INDIA

Some wood product prices

dip lower

The annual rate of inflation based on the all India

Wholesale Price Index (WPI) in August was minus 0.52%

compared to minus 1.32% recorded in July 2023. The

decline in the rate of inflation in August 2023 was

primarily due to a decline in prices for mineral oils, basic

metals, chemicals and chemical products, textiles and food

products.

Out of the 22 NIC two-digit groups for manufactured

products, 15 groups saw an increase in prices whereas for

6 groups there was a decline in prices.

The increase in price was mainly contributed

by food

products; electrical equipment; computers, electronic and

optical products; other manufactures and motor vehicles.

The groups for which prices dropped were paper and paper

products; machinery and equipment; fabricated metal

products; pharmaceuticals and furniture.

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Expanding forest plantations

The Indian government is encouraging the expansion of

forest plantations and at the same time reviewing the

regulations on their management and finances as this will

boost the country's mission for clean and green growth as

well as providing long-term benefits to the environment

and economy.

The Prime Minister was quoted as saying “bringing

together 'prakriti' (nature) and 'pragati' (development) has

been the hallmark of the ‘New India’ development model.

The PM said the involvement of local communities in the

plantation drive will deliver a sense of ownership and

environmental stewardship.

See:

https://www.thehindubusinessline.com/news/national/will-boost-indias-mission-for-clean-green-growth-pm-modi-lauds-assam-govts-mega-plantation-drive/article67317635.ece

In related news, the first meeting of the Wood

Industries

Committee of India (WINCOIN) under the chairmanship

of the Director-General, ICFRE (Indian Council of

Forestry Research & Education) was held at the Institute

of Wood Science and Technology. Attending were around

140 participants including industrial members,

representatives of wood industries associations, officials,

scientists and scholars.

The ICFRE-WINCOIN can be a unique platform

comprising of all wood industry associations along with

officials and Scientists that would bring synergy to the

field of wood science, tree improvement and research. In

his inaugural address Dr. A.S. Rawat, Director General,

ICFRE, emphasised the need to explore domestic species

and said he will work closely with the wood based

industries.

During Open-end discussion the Director of Institute of

Forestry Products, Ranchi, reported that the institute has

developed clones of poplar especially for North Bihar

State area and extensive planting of poplar has been

carried out by farmers. Representative from Institute of

Forest Genetics and Tree Breeding (IFGTB) said poplar,

eucalyptus and melia dubia are being used for plywood

manufactire.

See:

https://iwst.icfre.gov.in/wincoin/wincoin%20meeeting%20brochure%2021%20July%20_21%20July2023.pdf

and

https://plyinsight.com/the-first-meeting-of-icfre/

Success of big conglomerates obscures pressures

on

smaller businesses

According to the World Trade Organisation, small-and

medium-sized enterprises (SMEs) represent over 90% of

the business population, account for 60-70% of

employment and 55% of GDP in developed economies. In

developing countries SMEs are the heart of the

manufacturing sector.

Nowhere is this more apparent than in India according to

Sunil Kant Munjal, an Indian businessman and the

chairman of Hero Enterprise.

He said “For India to grow we need more and more of our

small businesses to mature into large firms”, Some Indian

economist say India’s growth and the rapid expansion of

the country’s biggest conglomerates has obscured the

pressures on smaller businesses.

According to the Mumbai-based fund manager Marcellus,

20 companies took 80% of the profits generated by the

Indian economy in 2022. By contrast, in a February survey

of more than 100,000 small business owners by the

Consortium of Indian Associations, three-quarters of

respondents reported they were not profitable and one-

third claimed their business’ performance had declined

over the past five years.

One of the first recent challenges for small business was

demonetisation which resulted in the elimination of

circulation of Rs500 and Rs1,000 notes, the core of SME

trading, which overnight rendered 86% of India’scurrency

notes unusable.

The SMEs (the so-called unorganised sector) had almost

recovered from demonetisation when the Goods and

Services Tax was introduced. This disrupted the economy

for a considerable time.

The unorganised sector was desperately trying to get back

on its feet when in 2020 yet another road block appeared

in the form of a covid lockdown implemented within four

hours of the announcement bringing the country to a

standstill.

See:

https://www.ft.com/content/ef93bf55-4273-4090-add0-ed7d1d16353c

and

https://qz.com/india/2095466/demonetisation-gst-covid-lockdown-wrecked-indias-small-tradersanda/2095466/demonetisation-gst-covid-lockdown-wrecked-indias-small-traders

Attracting foreign investment to expand furniture

exports

The Trade Promotion Council of India (TPCI) and the

World Furniture Confederation (WFC) agreed a MoU

aimed at establishing furniture industrial clusters in India.

The MoU was signed during the Annual General Meeting

of the World Furniture Confederation in Dongguan, China.

Representing India was Mohit Singla, Chairman of

the Trade Promotion Council of India. TPCI is currently

headed by Xu Xiangnan, President of the China National

Furniture Association.

Singla, commented that “the MoU will promote

engagement with global major furniture manufacturers,

promote ‘Make in India’ for domestic and export markets

and is the first signal of global cooperation in the

organised furniture sector for India”.

He added that this cooperation is expected to

attract foreign investment, enhance India's furniture

exports and reduce the country's dependency on furniture

imports.

See:

https://www.cnbctv18.com/business/india-trade-council-joins-forces-with-global-body-to-boost-furniture-manufacturing-17572141.htm

and

https://www.furniturenews.net/news/articles/2019/06/1868205500-world-furniture-confederation-expands-membership

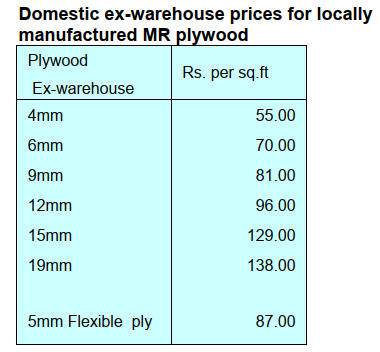

Plywood

Price increases for plywood are currently being discussed,

any changes will be reported as soon as they are available.

7.

VIETNAM

Wood and Wood Product (W&WP) trade highlights

The General Department of Customs has reported W&WP

exports to India in August 2023 reached US$13.8 million,

up by more than x3 compared to August 2022.

In the first 8 months of 2023 W&WP exports India were

valued at US$64.9 million. While W&WP exports to key

markets such as the US, EU and China have been

declining, growth in the Indian market is expected to offer

opportunities for Vietnamese exporters.

Vietnam’s W&WP exports to Taiwan P.o.C in August

2023 were reported at US$5.1 million, down 63%

compared to August 2022. Over the first 8 months of 2023

W&WP exports to this market were worth US$44.4

million, down 47% over the same period in 2022.

Vietnam's W&WP imports in August 2023 amounted to

US$185.3 million, down 3% compared to July 2023 and

down 35% compared to August 2022.

In the first 8 months of 2023 W&WP imports were

valued

at US$1.416 billion, down 34% over the same period in

2022.

Logs and sawnwood imports from the US in August 2023

totalled 45,000 cu.m, at a value of US$19.0 million, up

2.3% in volume and 6% in value compared to July 2023.

Over the first 8 months of 2023 the total volume of

imports from the US was 351.900 cu.m at a value of

US$150.64 million, down 23% in volume and 31% in

value over the same period in 2022.

Vietnam’s W&WP exports to Canadia in August 2023

earned US$15 million, down 29% compared to August

2022. In the first 8 months of 2023 the W&WP exports to

Canada were valued at US$122 million, down 31% year-

on-year.

Cameroon remains as the largest supplier of tropical

hardwood sharing 69.5% of total tali wood imports to

Vietnam in the first 7 months of 2023 reaching 170,900

cu.m, worth US$73.0 million, down 1.7% in volume and

1.9% in value over the same period in 2022.

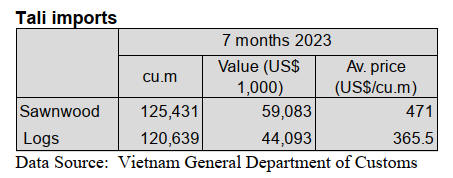

General situation of Vietnam’s tali wood imports

According to preliminary statistics, Vietnam's tali wood

imports in August 2023 reached 33,900 cu.m, worth

US$13.1 million, up 3.6% in volume and 2.7% in value

compared to July 2023; Compared to August 2022, it

decreased by 44.8% in volume and 48.3% in value. Over

the first 8 months of 2023, tali wood imports accumulated

at 279,100 cu.m, worth US$115.9 million, down 20.0% in

volume and 19.2% in value over the same period in 2022.

In the first 7 months of 2023 imports of tali logs were at

125,400 cu.m, worth US$59.1 million, up 4.4% in volume

and 8.4% in value over the same period in 2022. Imports

of tali sawnwood were 120,600 cu.m, worth US$44.1

million, down 28% in volume and 31% in value over the

same period in 2022.

Tali price fluctuations

The average price of tali imported into Vietnam in the first

7 months of 2023 stood at US$419.3 per cu.m, up 2.2%

over the same period in 2022. In particular, the price of tali

from Cameroon increased by 3.6% against that of the last

year to US$426.8/cu.m; from Congo up by 5.2% to

US$456.7/cu.m; from Nigeria by 4.8% to US$255.3/cu.m.

Log and sawnwood imports from the US to regaining

growth

Statistics provided by Vietnam’s General Department of

Customs showed that log and sawnwood imports from the

US in July 2023 amounted to 43,980 cu.m, with a value of

US$17.88 million, down 6% in volume and 13% in value

compared to June 2023 and down 47% in volume and 55%

in value compared to July 2022.

In the first 7 months of 2023 imports of logs and

sawnwood from the US totalled at 306,900 cu.m, at

US$131.64 million, down 17% in volume and 27% in

value over the same period in 2022.

The raw material Vietnam imported from the US in

August 2023 increased to reach 45,000 cu.m, with a value

of US$19 million, up 2.3% in volume and 6.3% in value

compared to July 2023.

In the recent months as W&WP export orders have shown

positive signals in key markets the demand for legally-

sourced wood from trusted suppliers such as the US and

EU is expected to recover.

The average price of imported US sawnwood in July 2023

stood at US$469 per cu.m, up by 0.4% compared to June

2023 but down by 31.3% against July 2022.

In the first 7 months of 2023 the average

price of

sawnwood imported from the US was US$481 per cu.m,

down by 26% over the same period in 2022.

Log imports from the US July 2023 averaged

US$305/cu.m, down by 23% compared to June 2023 but

up by 17% compared to the same period in 2022. In the

first 7 months of 2023 the average price of logs imported

from the US stood at US$337/cu.m, up 22% over the same

period in 2022.

Imports from the EU forecasted to increase

Imports of logs and sawnwood from the EU in July 2023

amounted to 87,840 cu.m, worth US$27.23 million, down

2.9% in volume and 0.4% in value compared to June 2023

but up 17% in volume and 4.5% in value over the same

period in 2022. In the first 7 months of 2023, imports of

wood from the EU totaled at 443,010 cu.m, worth

US$135.60 million, down 6.1% in volume and 13.8% in

value year-on-year.

New market opportunities

Although Vietnam’s wood industry is still facing many

difficulties W&WP exports have shown positive signals

with orders coming from key markets such as the US and

Europe and businesses are likely regaining consumers.

This lead to increased demand for imported wood raw

material for the manufacture value-added products for

export. Imports of roundwood and sawnwood from the EU

are expected to increase slightly from now to the end of

2023.

India and Middle East offer new opportunity for

Vietnam’s timber exporters.

With the sharp fall in exports of wood products to

traditional and well-established markets such as the US,

China, Japan, South Korea and the EU, India and the

Middle East are emerging as new opportunities for

Vietnamese exporters.

According to the Vietnam Timber and Forest Products

Association (VIFOREST) Vietnam’s wood export orders

for the US in the first half of the year fell by around 30%

depending on product categories, while those for the EU

market also shrank by up to 40%.

India and the Middle East are becoming prospective

markets for Vietnamese wood products although revenue

remains low with no large and long-term orders.

India is not Vietnam’s main timber export market but

customs data showed export earnings in the early months

of 2023 had already reached US$21 million, three times

higher than the same period last year. Vietnam’s main

export to India is medium-density fiberboard (MDF)

which accounted for 47% of total exports.

Similarly, Vietnam’s wood exports to Middle Eastern

countries also witnessed strong growth with revenues from

the United Arab Emirates up by 38% to US$11 million.

The main exports to this market were construction

wood,

chairs and other wooden items.

But according to enterprise leaders the tastes in the Indian

market are different from that of the European and US

markets as their favoured products are not being

manufactured by Vietnam. For now only the younger

consumers are using products similar to western countries.

For the Middle East there was an increased demand for

construction wood in the early months of the year some

were facing difficulties in securing timber from their

traditional suppliers due to economic and political

uncertainties.

Although their purchases remain limited the Middle East’s

rising import of Vietnamese timber is offering new hopes

for Vietnamese enterprises amidst the current crisis.

VIFOREST Chairman Do Xuan Lap said the US is still

the most important market for Vietnamese timber. To

increase the competitive advantage in this market

Vietnamese enterprises need to review their strategic

products and look into products with high levels of

potential with which they have a competitive edge.

For the Indian market wood enterprises need to learn about

the demand for MDF and other wood products. Regarding

the Middle East they need to conduct thorough surveys of

the potential for exports to these markets and the products

which are in demand.

See:

https://en.nhandan.vn/india-and-middle-east-offer-new-opportunity-for-vietnams-timber-exporters-post127890.html

National plan on implementation of Glasgow

Declaration on forests

Vietnam will closely manage natural forests and gradually

deal with forest and land degradation as set in the national

plan recently approved by Deputy Prime Minister Tran

Luu Quang on the implementation of the Glasgow

Leaders’ Declaration on Forests and Land Use.

The declaration was launched at the United Nations

Climate Change Conference (COP26) in November 2021.

A total of 143 nations signed the declaration, accounting

for over 90% of the world’s forests. This effort aimed to

“halt and reverse forest loss and land degradation by 2030

while delivering sustainable development and promoting

inclusive rural transformation.”

The national plan by 2030 is intended to realise goals of

sustainable agricultural and rural development, greenhouse

gas emission reduction, climate change response,

biodiversity conservation, sustainable forest management,

and transition to a green economy and a circular economy.

Under the plan, the area of downgraded natural forests

restored and upgraded is set at 10% by 2025, and 20% by

2030. In addition, the forested area to be certified for

sustainable forest management is expected to reach 0.5

million hectares by 2025, and 1 million hectares by 2030.

Vietnam will perfect mechanisms and policies to promote

sustainability in agro-forestry production and consumption

and raise resilience of forest land to climate change.

Efforts will be made to improve rural livelihoods by

empowering local communities, consolidating land

management systems and improving the multi-purpose

management of forests.

The plan also aims to promote the access to, and efficient

use of domestic and international financial resources as

well as public-private partnership in agro-forestry

production and sustainable forest management, and

support local residents, especially of ethnic minority

groups.

See:

https://en.vietnamplus.vn/national-plan-issued-to-implement-glasgow-declaration-on-forests-land-use/266949.vnp

8. BRAZIL

Mato Grosso leads national

production of traceable

native wood

According to the Brazilian Institute of Geography and

Statistics (IBGE) the forest-based sector in the state of

Mato Grosso in the Amazon Region has grown to become

the leading national roundwood producer with production

of over 4 million cubic metres per year. Harvesting

through Sustainable Forest Management Plans (PMFS)

includes approximately 50 native tree species.

In addition, the forest-based sector is among the ten

industrial segments that provide the most tax revenue in

Mato Grosso with R$66.2 million being collected by the

State government in 2022.

In addition to the economic impact and the significant

concentration of micro and small companies (67.8% in

Mato Grosso's forest-based sector), the sector also stands

out as an important generator of jobs with an annual

increase of 18% in the wage bill according to the

Federation of Industries in the State of Mato Grosso

(FIEMT).

After the COVID-19 crisis in 2019 and 2020 the sector

returned to growth in 2022 with a growth rate of 43%

compared to 2021 and contributied significantly to the

local economy (almost half of Mato Grosso's

municipalities (47%) have forestry industries).

In addition, the Center for Timber Producing and

Exporting Industries of the State of Mato Grosso (CIPEM)

has highed the importance of the new Document of Forest

Origin (DOF) system. The mandatory DOF+ traceability

permit is a tool for issuing, managing and monitoring the

transport and storage of forest products from tree species

native to Brazil. The system ensures standardised practices

and a high levels of environmental responsibility.

See: cipem.org.br/noticias/segmento-florestal-de-mt-lidera-producao-nacional-de-madeira-nativa-rastreada

Castanha-do-brasil shows great potentiali n

recovering

degraded land

Embrapa research carried out in the Amazon region

indicates that castanha-do-brasil (the Brazil nut tree,

Bertholletia excelsa) is a useful species for recovering

degraded lands and is a promising solution for forest

restoration.

Brazil nut trees are capable of producing for more than 40

years with little or no nutrient input, contributing to

environmental preservation and providing economic

opportunities for local communities. Studies show that the

soil under Brazil nut tree stands recover in a similar way to

soils in the natural forest.

According to the Food and Agriculture Organization

Brazil is the world's largest producer of Brazil nuts with

around 33,000 tonnes produced every year. In Fazenda

Aruanã, located in the municipality of Itacoatiara in the

state of Amazonas, there are the largest Brazil nut

plantations in the world with around 1.3 million trees. This

planted area of 3,000 hectares, became the largest Brazil

nut plantation in the world and was established on

degraded pasture land.

See:

http://www.remade.com.br/noticias/19459/castanheira-da-amazonia-mostra-eficiencia-na-recuperacao-de-solos-degradados

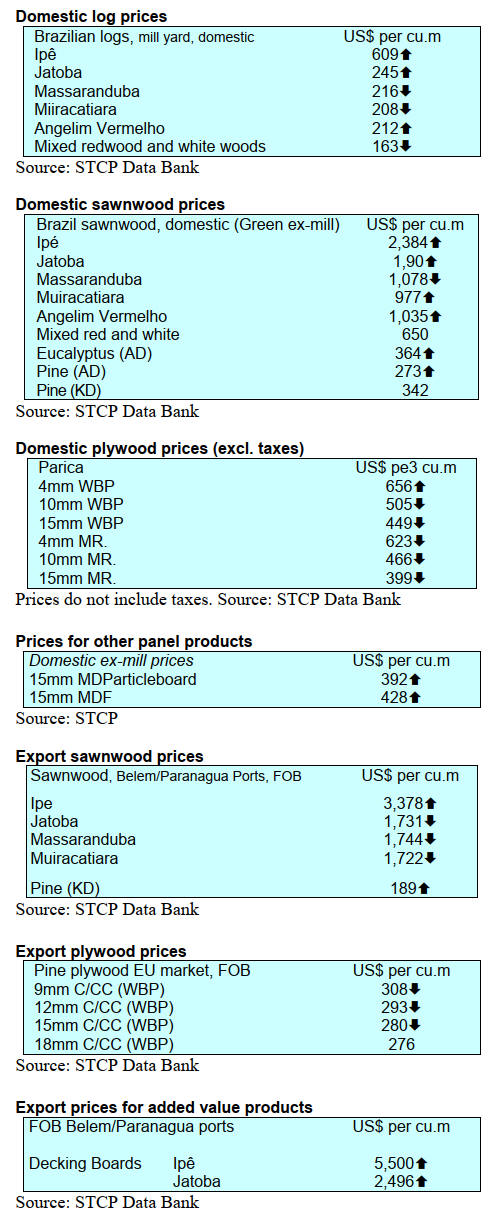

Export update

In August 2023 the value of Brazilian exports of wood-

based products (except pulp and paper) dropped 26%

compared to August 2022, from US$404.0 million to

US$299.8 million.

Pine sawnwood exports declined 29% in value between

August 2022 (US$74.6 million) and August 2023

(US$53.2 million). In volume, exports decreased 9.5%

over the same period, from 254,200 cu.m to 230,100 cu.m.

Tropical sawnwood exports also dropped 26% in volume,

from 35,700 cu.m in August 2022 to 26,300 cu.m in

August 2023. In value, exports decreased 22% from

US$16.2 million to US$12.6 million over the same period.

In contrast, pine plywood exports recorded a 4% increase

in value in August 2023 compared to August 2022, from

US$50.6 million to US$52.8 million. In volume terms,

exports increased 32% over the same period, from 127,400

cu.m to 168,500 cu.m.

Tropical plywood exports declined in volume by 54% and

in value the decline was 60% from 5,200 cu.m and US$3.7

million in August 2022 to 2,400 cu.m and US$1.5 million

in August 2023.

As for wooden furniture the exported value decreased

from US$60.9 million in August 2022 to US$54.0 million

in August 2023, an 11% drop.

Challenges facing the wood panel industry in Brazil

According to the Brazilian Tree Industry (IBÁ), in the

second quarter of 2023 consumption of wood based panels

(particleboard/MDP, MDF/HDF and hardboard) in Brazil

fell by 1.4% compared to the same period last year, from

1.74 million cu.m to 1.72 million cu.m.

In addition, exports of Brazilian wood-based panels in the

first half of 2023 totaled US$144.8 million representing a

significant drop of 48% compared to the US$277.9 million

exported in the first half of 2022.

Latin American countries continued to be the main

regional export markets for Brazilian panels in the first

half of 2023 with US$80.4 million (US$126.0 million in

2022) a reduction of 36%, followed by the North

American market at US$33.5 million, which also

presented a considerable reduction of 69%, compared to

US$107.1 million in 2022.

The volumes exported by Brazilian wood panel

manufacturers fell by 42.0% in the first half of 2023

totaling 499,000 cu.m compared to the 861,000 cu.m

exported in the first half of 2022.

See:

http://www.remade.com.br/noticias/19437/consumo-e-exportacao-de-paineis-de-madeira-brasileiros-caem-no-1%C2%BA-semestre-de-2023

Brazil at forefront in development of technology

for the

forestry sector

Brazil stands out as a leader in the development of

technological solutions for the forestry sector. According

to the Indústria Brasileira de Árvores (IBÁ) the average

productivity of eucalyptus has reached its highest level

since 2014 at 38.9 cu./ha/year in 2021 while pine reached

29.7 cu.m/ha/year.

This level of productivity is above the global average and

was achieved by investment in technology. Today, it is not

just large companies that realise the importance of

investment but small and medium-sized companies have

also been taking advantage of the benefits that innovative

solutions bring to production.

The technologies developed have enabled more efficient

sustainable forest management. New software makes it

possible to analyse data collected in order to solve

problems and continuously improve processes, resulting in

greater productivity and profitability.

Despite challenges such as infrastructure connectivity

Brazil continues to boost forest productivity and

strengthen its leadership in the development of technology

for the forest sector through partnerships and exchange of

knowledge.

See:

https://www.madeiratotal.com.br/impulsionador-de-produtividade-brasil-e-referencia-no-desenvolvimento-de-tecnologia-para-o-setor-florestal/

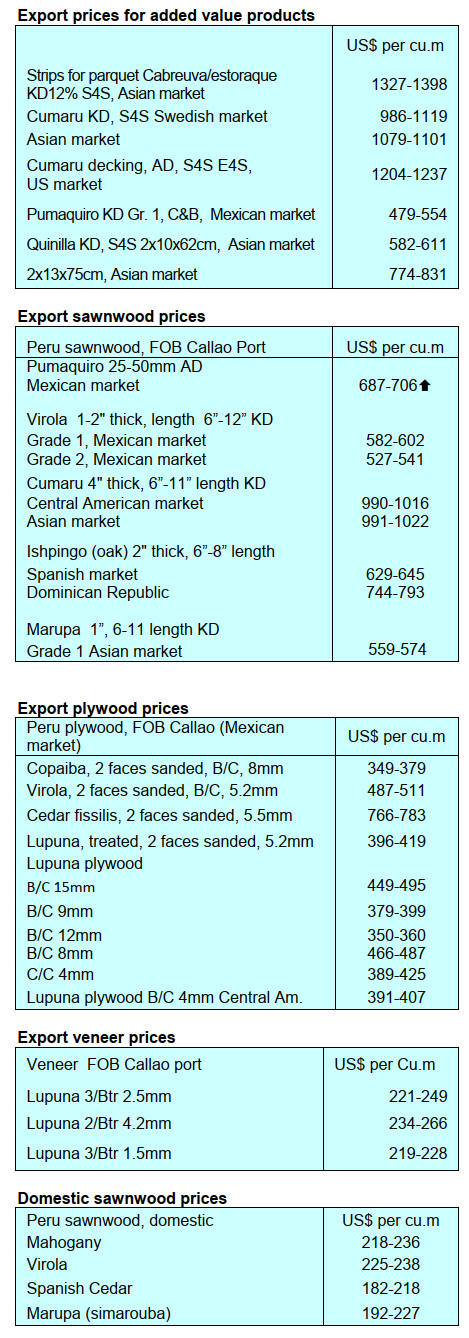

9. PERU

Export shipments of

wooden furniture fall

The export of wooden furniture and parts between January

and July 2023 were valued at US$2.1 million, a year on

year contraction of 22% as reported by the Association of

Exporters (ADEX).

Despite a 25% drop in orders the US was its main buyer of

wooden furniture at US$1.2 million or 59% of total

wooden furniture exports. In the period January to July

2022 exports to the US were worth US$ 1.6 million.

Other furniture markets were Italy (US$0.19 million), a

slight increase of 0.6% and Chile (US$0.15 million), a

drop of 50%. Completing the top ten export markets were

El Salvador (US$0.12 million), Spain (US$93,061),

Guatemala (US$85,796), Ecuador (US$1,165), Bermuda

(US$53,324), Trinidad and Tobago (US$47,995) and

Aruba (US$ 6,415).

In terms of categories the main export was of ‘other’

wooden furniture (US$1.02 million)accounting for 50%

despite suffering a decline of 369% compared to the same

period in 2022 .

Also shipped was wooden bedroom furniture (US$0.36

million), seats with padding and wooden frames (US$0.25

million), other seats with wooden frames (US$ 0.24

million) and wooden furniture used in offices. (US$0.13

million).

Wooden furniture and its parts ranked fifth among all

categories of wooden furniture exported between January

and July, or 4% of the total. These products earned less

than sawn wood (US$25.1 million), semi-manufactured

products (US 4.4 million), construction products (US$3.2

million) and firewood and charcoal (US$2.6 million). In

2022 shipments of wooden furniture and parts totalled

US$4.6 million, a year on year growth of 7%.

Unified databases to protect forest resources

The governor of Ucayali, Manuel Gambini and the

Director of the National Forest Service (Serfor), Luis

González, signed a protocol that seeks to strengthen the

management of information between both institutions with

the aim of making the management of forest resources in

Ucayali more efficient.

The document served to establish agreements that will

bring benefits to the region. All the information on the

respective geoportals will be available to the public. The

governor indicated that indigenous peoples will be the

main beneficiaries.

Gonzáles maintained that what has been established is an

information tool that will contribute to management with

the objective of unifying the GORE-Ucayali database with

that of Serfor to ensure the availability of the information

in a transparent manner.

Serfor approves timber control protocol for river

transport

In order to exercise complete control of the transport of

forest products the National Forestry and Wildlife Service

(Serfor) approved a protocol 'Timber control in river

transport'. This came into force through an Executive

Directorate Resolution No. D000210-2023-MIDAGRI-

SERFORDE published in the Legal Standards of the

Official Gazette El Peruano.

|