|

Report from

Europe

EU27 tropical wood product imports decline in first

half of 2023

In the first six months of this year, the EU27 imported

838,900 tonnes of tropical wood and wooden furniture

products with a total value of USD1.73b, respectively 18%

and 29% less than the same period in 2022. The scale of

the decline in trade in the first six months of this year is

partly due to imports being at historically high levels in

the first half of 2022, particularly when considered in

value terms.

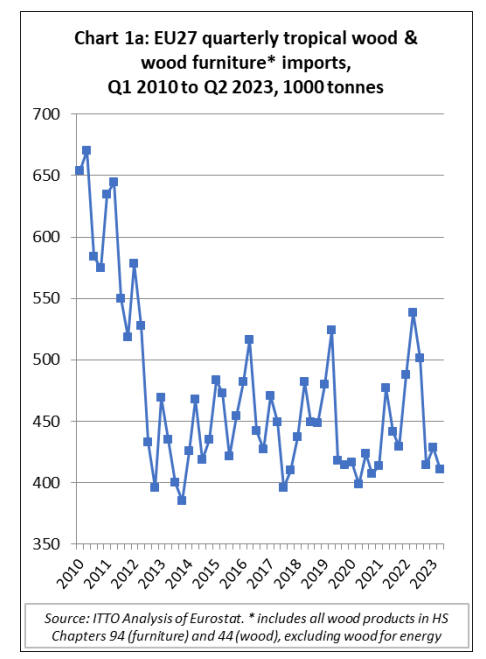

In quantity terms, EU27 imports of tropical wood and

wooden furniture totalled 410,000 tonnes in the second

quarter of this year, 4% less than the previous quarter and

24% down on the same quarter in 2022. The quantity of

EU27 imports in both the first and second quarters this

year was well below the long-term average of around

450,000 tonnes per quarter during the 2012 to 2019

period (Chart 1a).

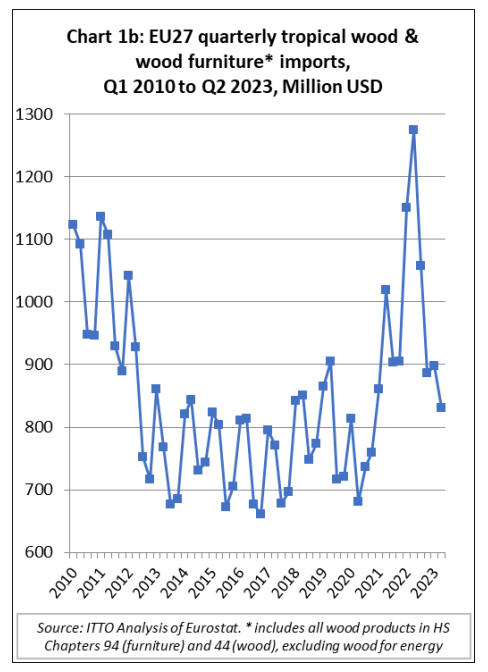

The total value of EU27 imports of tropical wood and

wooden furniture was USD831m in the second quarter of

this year, 7% less than the previous quarter and 35%

below the same quarter last year.

Despite the steep fall this year, import value in both the

first and second quarters was significantly above the long-

term average of around USD800m per quarter between

2012 and 2019, the period of relatively stagnant market

conditions for tropical products that prevailed in Europe

before the COVID crises (Chart 1b).

Overall, the trade data highlights that import prices for

tropical wood and wooden furniture products in the EU27

market remained relatively high in the first half of this

year despite sharp falls in freight rates and declining

consumption. This is in line with broader inflationary

trends impacting on the EU market, particularly driven by

high energy costs.

EU economy forecast to grow just 0.8% this year

The European Commission’s Summer Economic Forecast

published on 11 September indicates that inflation in the

EU, while still high, was easing in the first half of 2023 as

a result of declining energy prices and moderating

inflationary pressures from food and industrial goods. In

the euro area, the annualised inflation rate reached 5.3% in

July, exactly half of the peak level of 10.6% recorded in

October 2022, and remained stable in August.

According to the EC Forecast, energy prices are set to

continue declining for the remainder of 2023, but at a

slowing pace and they may increase slightly again in 2024,

driven by higher oil prices. Inflation in services has so far

been more persistent than previously expected, but it is set

to continue moderating as demand softens under the

impact of monetary policy tightening and a fading post-

COVID boost.

The EC Forecast suggests that the EU economy continues

to grow, albeit with reduced momentum. It revises growth

in the EU economy down to 0.8% in 2023, from 1%

projected in the EC’s Spring Forecast, and 1.4% in 2024,

from 1.7%. The latest Forecast confirms that economic

activity in the EU was subdued in the first half of 2023.

Domestic consumption was weak as tightening monetary

policy has restricted the provision of bank credit to the

economy.

The EC Forecast also highlights that survey indicators

now point to slowing economic activity in the summer and

the months ahead, with continued weakness in industry

and fading momentum in services. This is despite a strong

tourism season in many parts of Europe, declining energy

prices, and an exceptionally strong labour market. The EU

currently has record low unemployment rates and wages

have continued to expand.

The EC Forecast also notes that the global economy has

fared somewhat better than anticipated in the first half of

the year, despite a weak performance in China. However,

the outlook for global growth and trade remains broadly

unchanged compared to spring, implying that the EU

economy cannot count on strong support from external

demand.

Overall, the EC Forecast concludes that “the weaker

growth momentum in the EU is expected to extend to

2024, and the impact of tight monetary policy is set to

continue restraining economic activity. However, a mild

rebound in growth is projected next year, as inflation

keeps easing, the labour market remains robust, and real

incomes gradually recover. Russia's ongoing war against

Ukraine and wider geopolitical tensions continue to pose

risks and remain a source of uncertainty”.

Meanwhile, the construction sector in the EU is

performing poorly. The HCOB Eurozone Construction

PMI edged down to 43.4 in August 2023, well below the

50-mark which is the threshold for stable conditions and

down from the previous month's 43.5. This was the

sixteenth successive deterioration in total activity and the

lowest reading since December 2022.

Housing activity in August posted the fastest pace of

contraction since April 2020, while commercial works and

infrastructure activity declined more slowly. New orders

decreased for the seventeenth successive month, but at

slower pace, and buying levels declined the most since

May 2020. Overall, businesses maintained a pessimistic

outlook for the next 12 months, citing tight financial

conditions, limited investment, and economic uncertainty

as contributing factors.

Particularly large fall in EU import value of secondary

and tertiary tropical products

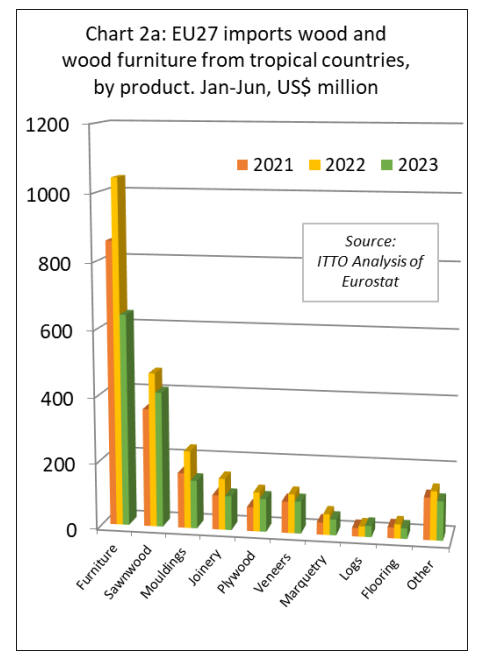

There was a year-on-year decline in EU27 import value

for all tropical wood product groups except logs between

January and June this year (Chart 2a).

Overall, the decline in import value was more severe for

secondary and tertiary processed products than for primary

processed products.

During the six-month period, there were large declines in

EU27 import value for: wooden furniture from tropical

countries (-39% to USD640m); tropical

mouldings/decking (-38% to USD146m); tropical joinery

products (-33% to USD104m); tropical marquetry (-24%

to USD48m); and tropical flooring (-26% to USD32m).

More moderate declines were recorded for EU27 imports

of tropical sawnwood (-12% to USD409m), tropical-

hardwood-faced plywood (-16% to USD100m); and

tropical veneer (-18% to USD97m). EU27 import value of

tropical logs increased 9% to USD34m during the six-

month period.

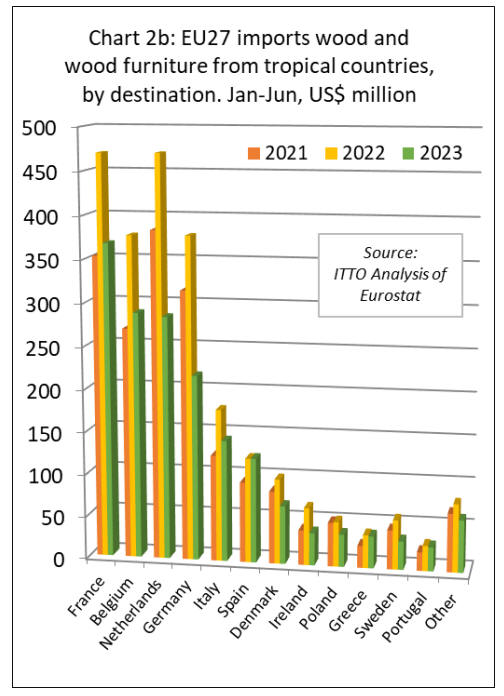

In terms of EU destinations, import value of tropical wood

and wooden furniture in the first six months this year was

down year-on-year in all the main markets except Spain

where import value increased marginally (+0.3% to

USD123m). Elsewhere there was a relatively minor

decline in Greece (-3% to USD38m) and Portugal (-5% to

USD28m).

Much larger falls in import value were recorded in France

(-22% to USD368m), Belgium (-24% to USD288m), the

Netherlands (-40% to USD285m), Germany (-43% to

USD217m), Italy (-20% to USD142m), Denmark (-32% to

USD68m), Ireland (-43% to USD38m), Poland (-28% to

USD38m), and Sweden (-42% to USD34m) (Chart 2b).

EU27 wooden furniture imports from tropical countries

decline by more than 30%

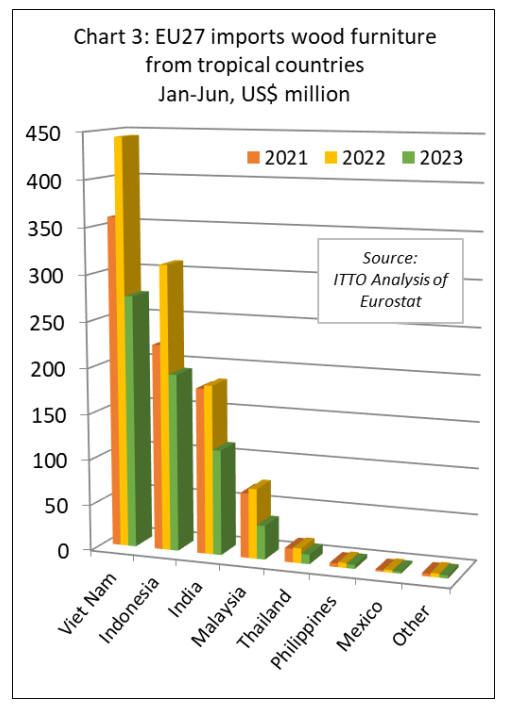

In the first six months of 2023, the EU27 imported

143,000 tonnes of wooden furniture from tropical

countries with a total value of USD640m, down 32% and

39% respectively compared to the same period in 2022.

Import value decreased 38% to USD275m from Vietnam,

38% to USD193m from Indonesia, 38% to USD115m

from India, 52% to USD37m from Malaysia, and 35% to

USD11m from Thailand. EU27 wooden furniture imports

from all other tropical countries were negligible during the

six-month period (Chart 3).

Slowing EU27 imports of tropical sawnwood and

mouldings

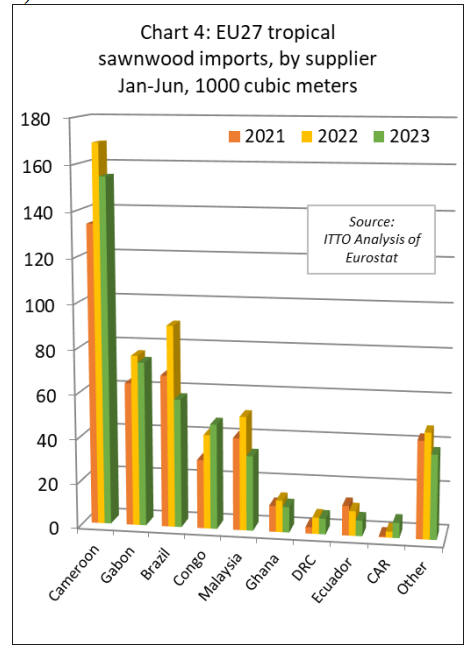

The EU27 imported 436,700 cubic metres of tropical

sawnwood in the first six months of 2023, 15% less than

the same period in 2022. Imports increased from Congo

(+12% to 47,100 cubic metres) and CAR (+154% to 6,800

cubic metres).

However, these gains were offset by declining imports

from Cameroon (-9% to 154,700 cubic metres), Gabon (-

4% to 73,600 cubic metres), Brazil (-36% to 57,600 cubic

metres), Malaysia (-34% to 33,600 cubic metres), Ghana (-

19% to 11,500 cubic metres), DRC (-5% to 7,000 cubic

metres), and Ecuador (-37% to 7,000 cubic metres) (Chart

4).

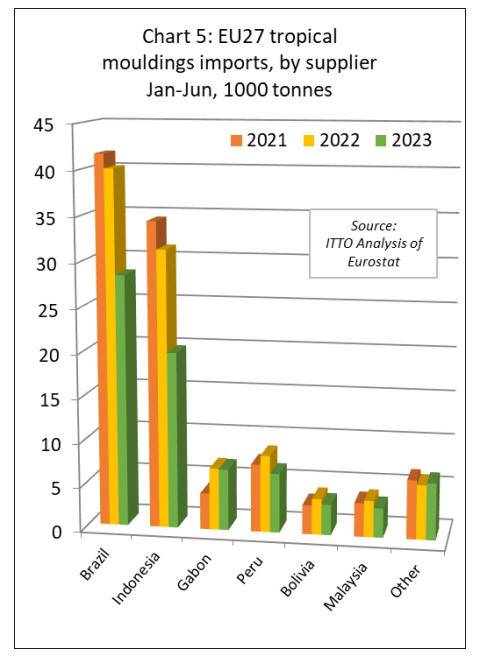

The EU27 imported 75,000 tonnes of mouldings/decking

in the first six months of 2023, 26% less than the same

period last year. Imports from the two largest supply

countries fell sharply: down 29% to 28,400 tonnes from

Brazil; and down 37% to 19,900 tonnes from Indonesia.

Imports from Gabon fell more slowly, down 1% to 6,900

tonnes. There was a sharp fall in imports from Peru (-23%

to 6,700 tonnes), Bolivia (-15% to 3,500 tonnes), and

Malaysia (-19% to 3,300 tonnes) (Chart 5).

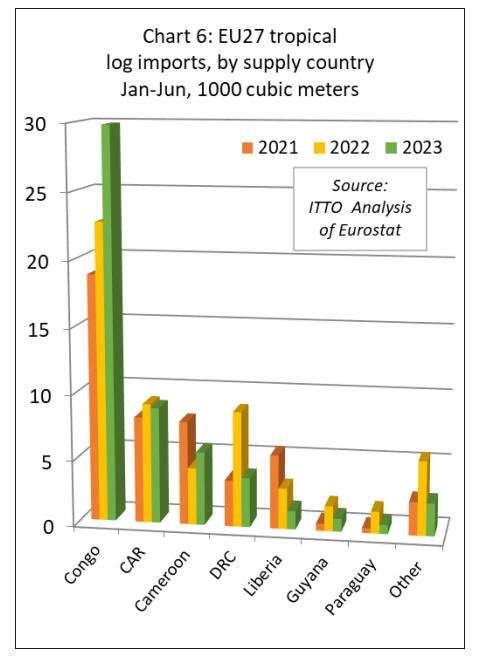

In the first six months of 2023, the EU27 imported 53,500

cubic metres of tropical logs, 6% less than the same period

in 2022. The most significant trend during the period was

a sharp 31% rise in EU27 log imports from Congo to

30,000 cubic metres.

This surge in European arrivals – which was concentrated

in the first quarter of this year - probably reflects a last-

minute effort to ship logs in advance of the log export ban

imposed by the Republic of Congo from 1st January 2023.

EU27 imports of logs also increased sharply from

Cameroon (which may be derived from neighbouring

Congo or Central African Republic) in the first six months

this year, rising 29% year-on-year to 5,600 cubic metres.

EU27 imports of tropical logs from all other supply

countries declined during the period including Central

African Republic (-3% to 8,800 cubic metres), Democratic

Republic of Congo (-57% to 3,800 cubic metres), Liberia

(-55% to 1,400 cubic metres), Guyana (-48% to 1000

cubic metres) and Paraguay (-58% to 700 cubic metres)

(Chart 6).

Downturn in EU27 imports of tropical veneer but

plywood more stable

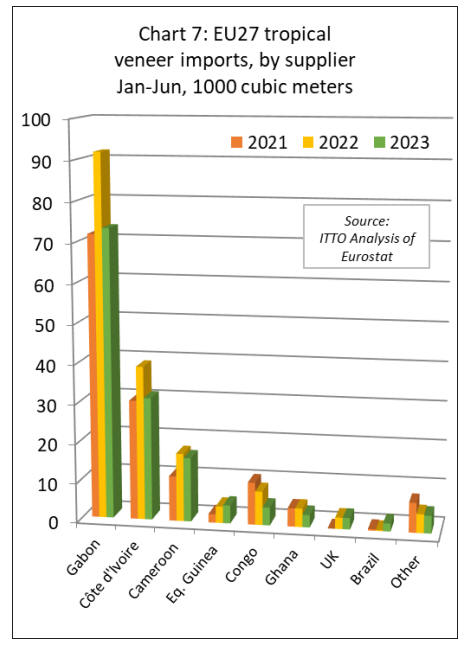

In the first six months of 2023, the EU27 imported

142,400 cubic metres of tropical veneer, down 18%

compared to the same period last year. Imports of tropical

veneer from Gabon, by far the largest supplier to the

EU27, decreased 20% to 73,300 cubic metres after rising

sharply last year.

EU27 veneer imports in the first six months of this year

also declined from Côte d'Ivoire (-20% to 31,100 cubic

metres), Cameroon (-6% to 16,200 cubic metres), Congo

(-47% to 4,600 cubic metres), and Ghana (-33% to 3,200

cubic metres).

However, imports from Equatorial Guinea increased by

9% to 4,600 cubic metres and imports from Brazil were up

sharply from negligible levels last year to 2,000 cubic

metres in the first six months of this year (Chart 7)

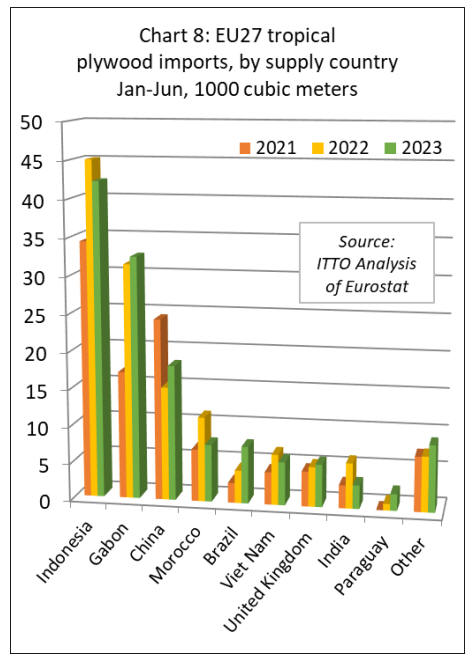

In the first six months of 2023, EU27 tropical plywood

imports were 134,200 cubic metres, unchanged from the

same period last year. Imports from Indonesia, at 42,300

cubic metres, were down 6% compared to the same period

last year. Imports also fell from Morocco (-32% to 7,700

cubic metres), Vietnam (-14% to 5,800 cubic metres), and

India (-48% to 3,200 cubic metres).

However, imports increased from Gabon (+3% to 32,500

cubic metres), China (+19% to 18,100 cubic metres), and

Brazil (+74% to 7,700 cubic metres) (Chart 8).

EU27 imports of tropical laminated products decline

from all countries except Congo

In the first six months of 2023, the EU27 imported 11,000

tonnes of tropical wood flooring, down 20% compared to

the same period last year. The consistent rise in EU27

wood flooring imports from Malaysia that began in 2020

has stalled this year.

Imports of 5,700 tonnes from Malaysia in the first six

months of 2023 were 13% less than the same period in

2022. Imports also fell from Indonesia (-28% to 2,300

tonnes), Vietnam (-16% to 1,700 tonnes), and Brazil (-

39% to 580 tonnes) (Chart 9).

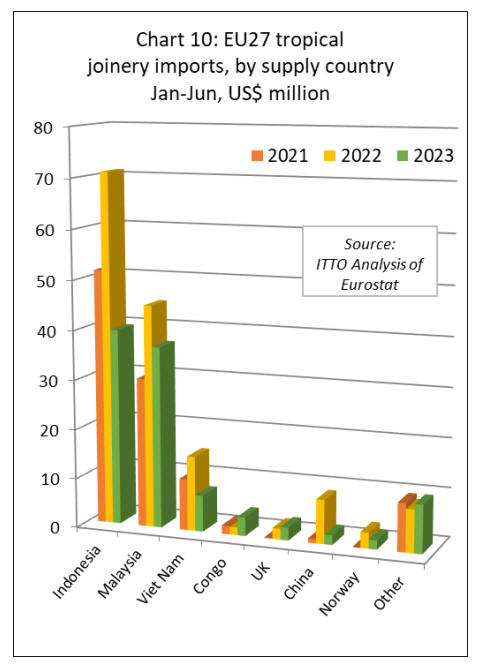

The value of EU27 imports of other joinery products from

tropical countries - which mainly comprise laminated

window scantlings, kitchen tops and wood doors –

declined 33% to US$104m in the first six months of 2023.

Imports were down 44% to US$40m from Indonesia,

down 18% to US$37m from Malaysia, down 52% to

US$7m from Vietnam, and down 78% to less than US$2m

from China.

In a potentially significant longer-term development, given

efforts in the country to shift up the value chain as log

exports are banned, EU imports of laminated joinery

products from Congo were valued at US$3.7m in the first

six months of this year, 140% more than during the same

period last year (Chart 10).

|