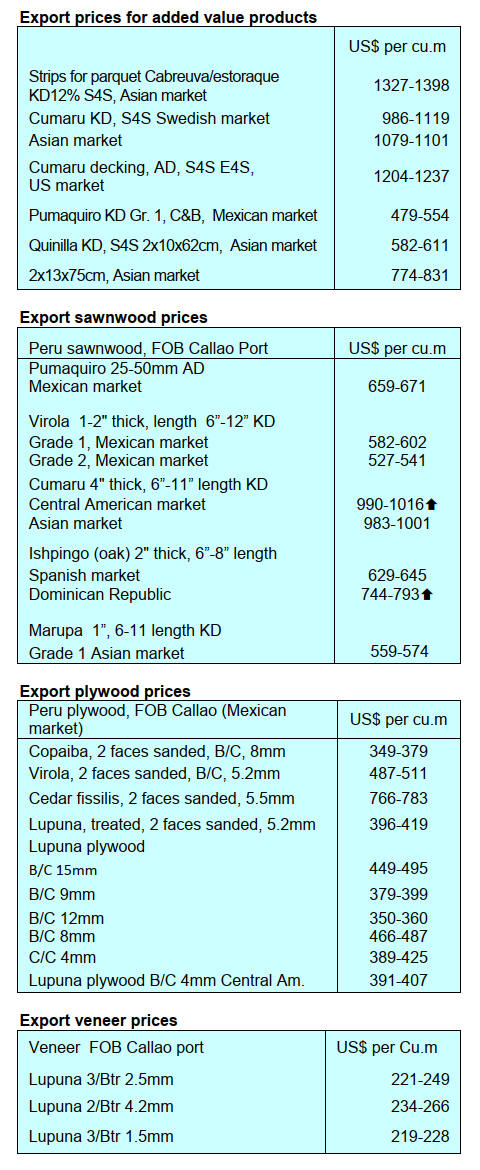

March exports a record

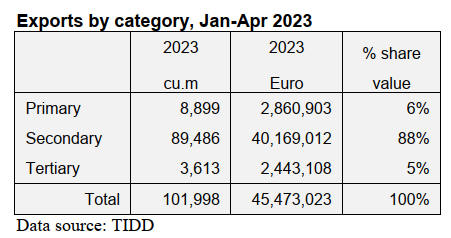

Ghana’s wood product export data for the first four

months of 2023 reveal that March exports were the highest

at 31,467 cu.m representing 31% of the total export

volume of 101,997cu.m for the four month period. Last

year March exports were 30,615 cu.m and represented

30% of the total for the four month period.

Wood product exports in the first four months of 2023

earned the country Eur14.54 million compared to the

Eur10.78 million in 2022. The data show there was a 35%

increase in earnings and a 3% increase in shipment

volumes.

According to the Timber Industry Development Division

(TIDD) report, in the first four months of this year the

leading wood products exported were air and kiln dry

sawnwood, billets and plywood.

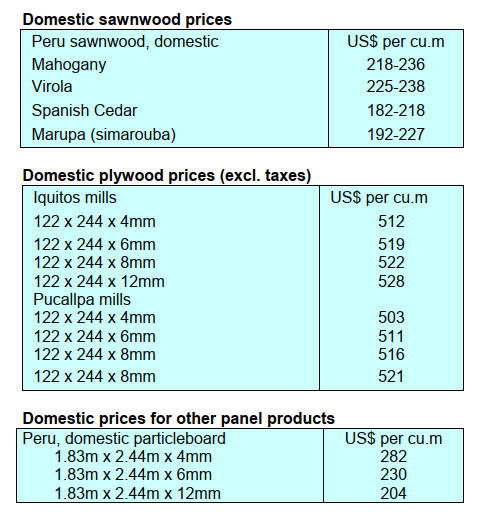

Exports earnings from SPWP rise

Of total exports, secondary processed wood poducts

(SPWP) including furniture parts, moulding and flooring

earned Eur40.17 million in the first four months of 2023,

up 8% from the same period in 2022 while tertiary wood

products (TWP) exports earned just Eur2.44 million, up

6% year on year. However, receipts from primary wood

products dropped 24% to register Eur2.86 million in 2023.

Air and kiln dry sawnwood accounted for more than half

of the total export volume in the first four months of 2023.

Compared to 2022, the value of exports of these two

products rose 19% and 4% respectively.

The TIDD report also indicated the average unit price for

KD sawnwood was Eur662/cu.m, AD sawnwood

Eur366/cu.m, plywood (regional market) Eur394/cu.m and

billets Eur311/cu.m.

Business Expo leads to MoU with US National Black

Chamber of Commerce

Trade between Ghana and the US reached an all-time high

of US$3.7 billion in 2022 with a favourable balance of

trade to Ghana. The country’s export to the US in 2022

amounted to US$2.7 billion while imports from the US

were US$1.0 billion. The Minister of Trade and Industry,

KT Hammond, made this known to the media at the 2023

US – Ghana Business Expo on the theme “Leveraging

U.S. – Ghana Trade Relation for Growth and Prosperity”.

The American Chamber of Commerce website says the

Expo will provide an overview of the current trade

relations between the United States and Ghana,

highlighting success stories, identifying potential areas of

growth, and outlining strategies for fostering further

collaboration with integrated business-to-business

meetings between Ghanaian and U.S. companies.

As part of the Expo, the U.S. Department of Commerce

will lead a Global Diversity Export Initiative (GDEI) trade

delegation that includes 19 companies and six trade

associations, including the National Black Chamber of

Commerce, the National Business League, US Black

Chambers Inc., Dallas Black Chamber of Commerce, the

National Center for American Indian Enterprise

Development and the Organization for Women in

International Trade.

The Expo aimed at providing a platform that would foster

bilateral trade collaborations and economic growth

between Ghana and the US. Business Associations from

the US, the Black Global and Business Network (BGBN)

and the National Black Chamber of Commerce (NBCC)

signed Cooperation agreements for business connections

and exchanges at the Business Expo.

The President of the Association of Ghana Industries

(AGI) Dr. Kwesi Humphrey Ayim Darke and the

Chairman of the Accra Regional Branch of AGI, Mr

Tsonam Cleanse Akpeloo, met the leaders to discuss the

cooperation terms and objectives.

The National Black Chamber of Commerce, said to be the

largest Black business association in the world, is

dedicated to economically empowering and sustaining

African American communities through entrepreneurship

and capitalistic activity within the US and the Black and

Global Business Network is the largest Network ever

convened to solely focus on expanding, connecting and

empowering Black International Entrepreneurs.

See:

https://amchamghana.org/event/2023-u-s-ghana-business-expo/

and

https://agighana.org/agi-signs-corporate-agreements-with-the-usa-black-national-chambers-of-commerce-and-black-global-business-network/

AGI raises concerns on duplication by Organised

Crime Office

The Association of Ghana Industries (AGI) has become

concerned at the frequent visits to some of its members by

representatives of the Economic and Organised Crime

Office (EOCO).

According to the chairman for the Ashanti, Bono and

Bono East Regions AGI, Kwasi Nyamekye, EOCO

officials frequent the offices of its members and regularly

request for the financial statements and sales records

among others which the Ghana Revenue Authority (GRA)

also regularly reviews. Nyamekye said EOCO requests for

the same information as collected by the GRA is a

duplication and companies are becoming concerned.

See:

https://thebftonline.com/2023/08/18/agi-unhappy-over-eocos-non-stop-presence-at-members-premises/

IFAD approves US$52.5 million loan

The Ghana Government has received approval to arrange a

US$52.5 million loan from the International Fund for

Agricultural Development (IFAD) to finance the

Promotion of a Rural Opportunities, Sustainable Profits

and Environmental Resilience (PROSPER) project.

The PROSPER project is designed to complement ongoing

interventions in the agricultural sector such as Planting for

Food and Jobs (PFJ) with a concentration on smallholder

farmers, the Ghana Agricultural Sector Investment

Programme (GASIP), the Savannah Zone Agricultural

Productivity Improvement Project (SAPIP) and the

Savannah Investment Programme (SIP) among others.

See:

https://webapps.ifad.org/members/eb/134/docs/EB-2021-134-R-45-Rev-1.pdf

3. MALAYSIA

Strengthened law

enforcement contributed to decline

in deforestation

The Guardian newspaper in the UK reported Global Forest

Watch (GFW) Senior Geographic Information System

Research Manager, Liz Goldman, as saying Malaysia and

Indonesia can be considered examples of success stories in

controlling deforestation and the counties have made

strides where deforestation was concerned for a number of

years

The Guardian also quoted Arief Wijaya, Programme

Director for the World Resources Institute in Indonesia as

saying strengthened law enforcement, peatland restoration,

fire mitigation efforts and farming bans in sensitive areas

contributed to the fall in deforestation.

See:

https://www.theguardian.com/environment/2023/aug/07/progress-on-slowing-deforestation-could-boost-climate-efforts-say-experts-aoe

Promoting trade in domestic currencies

Indonesia, Malaysia and Thailand intend to promote the

use of local currencies in bilateral transactions. According

to a joint statement by Bank Indonesia, Bank Negara

Malaysia and the Bank of Thailand MoUs have been

signed providing a framework for cooperation to promote

bilateral transactions in local currencies. This agreement

was concluded on the sidelines of the recent ASEAN

Finance Ministers and Central Bank Governors’ meeting.

See:

https://www.aa.com.tr/en/asia-pacific/indonesia-malaysia-thailand-sign-deal-to-use-local-currencies-in-bilateral-transactions/2976340

Logging to continue as carbon markets developed

At a seminar on Introduction of Forest Carbon Activities

in Sarawak, Forest Department Director, Hamden

Mohammad, said logging activities in Sarawak will

continue along side the new emphasis on forest carbon

activities. He said that completely stopping logging and

timber processing would adversely impact the livelihood

of many people, particularly those involved in downstream

activities. Hamden made this clarification after opening a

seminar on Introduction of Forest Carbon Activities in

Sarawak.

Hamden said since 2018 the pace of logging has slowed

from the 8 million cubic meteres to 3-4 million cubic

metres in 2020 to around 2 million cubic metres in 2022.

See:

http://theborneopost.pressreader.com/article/281479280936526

Environmental sustainability and social

responsibility

During the Malaysian Wood Expo (MWE) 2023 the

Malaysian Timber Council (MTC) arranged for a

presentation on the growing demands of consumers and

investors for corporations to improve their social

responsibility. MTC invited the Chairperson of the Ethical

Trade Alliance (ETA), Lawrence Christoffelsz, to speak

on this topic.

In the presentation “Forced Labour and Sustainability

Reporting Requirements in Global Trade” Christoffelsz

highlighted the rapid increase in global reporting

requirements, including the issue of modern day slavery,

carbon reporting, climate change, corporate social

responsibility (CSR) and environmental social governance

(ESG).

Christoffelsz said “Regulations across the globe are

leading to restriction and export and import bans of certain

products that don’t comply with ESG requirements,

amongst others.”

He also mentioned the list of countries that were banned in

2022 for forced labour and the European Union’s Carbon

Border Adjustment Mechanism (CBAM) which targets

imports of carbon-intensive products that are in full

compliance with international trade rules.

“The entire supply chain must be transparent and

accountable,” said Christoffelsz adding that there are

opportunities in this area to create new revenue streams as

companies become ethical and sustainable across the

globe.

See:

https://mtc.com.my/images/publication/253/TM_may_June_23.pdf

In related news, Sarawak Premier, Abang Johari Tun

Openg, has said the operations of Sarawak Timber

Industry Development Corporation (STIDC) need to

reflect the global shift towards the environmental

sustainability agenda.

He explained that global banking institutions are now

encouraging companies to comply with environmental,

social and governance (ESG) initiatives, and products

produced by sustainable practices are preferred. He urged

STIDC to adapt Sarawak becomes a recognised positive

player for the environment.

See:https://theborneopost.pressreader.com/article/281565180296521

Sabah law to control biological resource use

A Bill was passed in the Sabah State Legislative Assembly

to amend the Sabah Biodiversity Enactment 2000 and

provide for the control of biological resources to stop

anyone from keeping, selling, buying or exporting any

protected biological resource without a valid license from

the Sabah Biodiversity Centre.

The Sabah Biodiversity Center had identified biological

resources that need to be protected and have been listed in

the proposed amendment to ensure that the genetic rights

of the plants are protected in accordance with international

requirements (Nagoya Protocol).

For more details visit:

https://theborneopost.pressreader.com/article/281522230613995

In related news, Sabah is keen to expand its biomass

industry especially now that most countries are

transitioning or in the process of adapting green

technology or green energy. In realising the advantages of

biomass in the production of high value-added products,

such as bio-pellets, bio-fuels and bio-based chemicals, the

Sabah Industrial Development and Entrepreneurship

Ministry is drafting the Sabah Biomass Policy to further

develop the sector.

See:

https://theborneopost.pressreader.com/article/281522230613995

and

https://www.nst.com.my/news/nation/2023/08/940722/sabah-expand-biomass-industry-through-policy-regulations

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Malaysia.

See:

https://www.itto-ggsc.org/static/upload/file/20230816/1692147989860563.pdf

4.

INDONESIA

July exports - paper,

pulp and plywood the top three

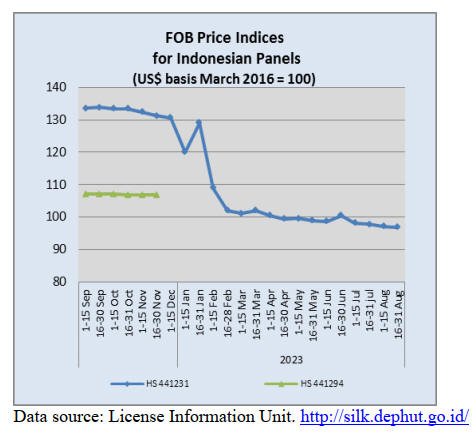

Exports of wood products in July 2023 rebounded after

falling in June to reach US$1.23 billion with a volume of

1.4 million tonnes. Between January and July 2023

exports of wood products totalled US$7.7 billion. In terms

of value exports were 46% of 2022 exports of US$14.21

billion. Exports of paper dominated exports in the first

seven months of 2023 at 33% of the total export value.

The second largest contributor to exports was pulp

products at 28% followed by plywood at 16% of total

exports for the period. The main export destination for

Indonesian wood products were Asian markets at 67% of

the total followed by North America 14% and the EU at

11%.

See:

https://forestinsights.id/kinerja-ekspor-produk-kayu-juli-2023-kontribusi-plywood-capai-159-persen/

Trade Minister Hasan to the UK - keep trade policies

open

Trade Minister Zulkifli Hasan urged the United Kingdom

not to adopt policies that could hinder Indonesia's exports

which he said appears the EUDR will.

In a bilateral meeting with British Minister of State for

International Trade, Nigel Huddleston, Hasan reported that

the UK's environmental policies were discussed against

the background of the EUDR. In addition to environmental

policies, Hasan revealed that he and Minister Huddleston

discussed the upgrade of their Joint Economic and Trade

Committee (JETCO) into a Comprehensive Economic

Partnership Agreement (CEPA).

Meanwhile, Deputy Minister of Trade, Jerry Sambuaga,

said that Indonesia had sent a clear message regarding the

importance of formulating and implementing balanced,

egalitarian and fair trade policies.

See:

https://en.antaranews.com/news/291561/trade-minister-hasan-expects-uk-to-not-implement-eudr-like-policies

and

https://finance.detik.com/berita-ekonomi-bisnis/d-6886147/zulhas-harap-kebijakan-lingkungan-inggris-tak-ganggu-ekspor-pertanian-ri

In a related development, Indonesia stressed the

importance of upholding the principles of equality and

fairness in trade with the EU during the ASEAN-EU

Economic Ministers' Consultative Meeting.

Sambuaga said Indonesia emphasised the importance of

ensuring balance and upholding objective principles to

incorporate the values of fairness and equality into trade.

The Deputy Minister affirmed that related parties should

take into account objective principles during the policy

formulation process in the hopes of creating a fair trade

climate for all.

See:

https://en.antaranews.com/news/291564/indonesia-spotlights-importance-of-trade-equality-fairness-to-the-eu

Customary forest disbursement target – 80%

achieved

The Ministry of Environment and Forestry (KLHK) is

optimistic that the distribution of customary forests will

achieve the 2023 target. Based on Presidential Decree No.

28 of 2023 the target is to distribute 380,000 hectares.

Currently 308,495 hectares of land have been given

customary forest status.

The Director General of Social Forestry and

Environmental Partnerships in the Ministry of

Environment and Forestry, Bambang Supriyanto, said that

political issues will not be allowed to interfere with the

process of granting customary forests to communities.

Bambang explained that the Ministry of Environment and

Forestry would step in to monitor and guide the local

governments if they experienced problems in preparing

customary forest proposals in order to accelerate the

process of granting customary forest status to the

community.

See:

https://www.cnnindonesia.com/nasional/20230809180158-20-984029/klhk-kejar-target-beri-hutan-adat-tahun-ini-sudah-80-persen

Carbon Exchange launch planned for September

The Chairman of Financial Services Authority (OJK),

Mahendra Siregar, has targeted late September for the

launch of Indonesia's carbon exchange. Currently, the

Ministry of Law and Human Rights is processing the

release of OJK regulation on carbon exchange.

Previously, the Chief Executive of Capital Markets,

Financial Derivatives and Carbon Exchange Supervisor of

OJK, Inarno Djajadi, said that the regulation, PIJK No. 14

of 2023 will provide the legal definition and steps

necessary for the conduct of a carbon exchange trade.

See:https://en.tempo.co/read/1762117/ojk-to-launch-carbon-exchange-in-september

Ministries collaborate to help MSMEs go global

Indonesia's Foreign Affairs and Finance ministries have

agreed to collaborate to help micro, small and medium

enterprises (MSMEs) enter global markets.

To strengthen cooperation the two ministries signed a

Memorandum of Understanding (MoU) on Cooperation in

the Field of State Finance and Foreign Relations to

Support Economic Diplomacy.

Finance Minister, Sri Mulyani Indrawati, said the

government will support MSMEs to enter global markets,

adding that she anticipates the collaboration between the

two ministries to be implemented immediately in

Indonesia's 131 representative offices overseas .

In the short term, Marsudi asked a team from the Foreign

Affairs and Finance ministries to map out strategies for

MSMEs and report on opportunities for Indonesian

MSME products.

See:

https://en.antaranews.com/news/291078/foreign-finance-ministries-ink-mou-to-help-msmes-go-global

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20230816/1692147989860563.pdf

5.

MYANMAR

Currency stabilisation task force

The Central Bank of Myanmar (CBM) plans to form a task

force comprising officials from the Bureau of Special

Investigation (BSI), an intelligence agency, a security

service and a department under the Ministry of Home

Affairs to try to bring the exchange rate and the price of

gold under control.

Myanmar has been hit by soaring inflation and attempts to

cool it have not been successful. The latest blow came

early this month after the circulation of a new 20,000-kyat

banknote and the news of freezing about US$1 million by

a Bangladesh bank. Recently the exchange rate varied

from 3600 to 3900 Kyats/US dollar.

The administration has repeated warning to exporters that

they must bank all export earnings within 45 days and that

recently 78 companies were charged for failing to show

bank transaction records for export earnings with the

founders of two companies being imprisoned. He added

that plans are in the works to charge more than 80 other

companies.

The amount of unbanked export earnings is claimed as

much as US$2 billion since 2016. The CBM ordered

exporters to convert 60% of export earnings into kyats at a

fixed rate but this was recently adjusted to 50%. The CBM

has repeatedly claimed that foreign exchange rates and

gold prices were rising because certain businesses are

manipulating them.

Just after the CBM revealed its plan to organise a

task

force to scrutinise, investigate and take action against

market manipulation the foreign exchange rate dropped

from 3900 Kyats to 3600/3650 Kyats per US dollar. The

CBM is taking action against speculators in the foreign

exchange market and illegal money changers to contain

the rising gold prices and dollar exchange rate.

In related news, Sonali Bank, a state-owned Bangladeshi

bank that handles most of the bilateral trade with

Myanmar has frozen the accounts of two key Myanmar

banks on the advice of the US embassy in Dhaka which

asked the government to apply to sanctions imposed by the

US Treasury. The accounts of the Myanma Foreign Trade

Bank (MFTB) and Myanma Investment and Commercial

Bank (MICB) which reportedly have deposits of over

US$1 million at Sonali Bank have been frozen.

See:

https://www.irrawaddy.com/business/myanmar-junta-to-form-task-force-to-tackle-soaring-exchange-rates-gold-prices.html

and

https://www.mizzima.com/article/dollar-trading-difficult-myanmar-after-central-bank-revokes-money-changer-licenses)

and

https://www.asiafinancial.com/key-bangladeshi-bank-freezes-myanmar-regime-accounts

US sanctions aviation fuel suppliers

On 23 August, the US Office of Foreign Assets Control of

Treasury Department issued sanction notices against

a few individuals that operate in the jet fuel sector. Two

individuals and one entity that are involved in the

procurement and distribution of jet fuel to the Myanmar

army have been identified. The targeted persons and

companies are believed to be Singapore-based commercial

entities.

See:

https://home.treasury.gov/news/press-releases/jy1701

6.

INDIA

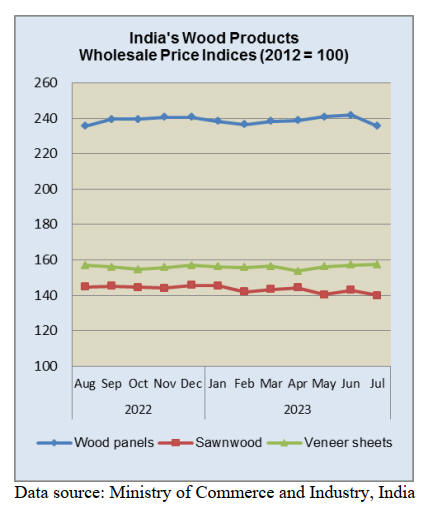

Wood product price indices tilt lower

The annual rate of inflation based on all India Wholesale

Price Index (WPI) in July was minus 1.36% compared to

minus 4.12% recorded in June 2023. The decline in the

rate of inflation in June, 2023 is primarily due to fall in

prices of mineral oils, basic metals, chemical and chemical

products, textiles and food products.

Out of the 22 NIC two-digit groups for manufactured

products, 11 groups saw an increase in prices whereas 10

groups witnessed a decrease. The increase in price was

mainly contributed by food products; machinery and

equipment; computers, electronic and optical products and

other non-metallic mineral products. Some of the groups

that have witnessed a decrease in prices in July were basic

metals; chemical and chemical products; textiles, paperand

paper products, wood panels and sawnwood.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Plywood industry output back to pre-pandemic

levels

The nearly 500 plywood manufacturing units in South

India such as Kerala and Andhra Pradesh have returned to

near normality after a crisis triggered by de-monetisation,

the epic floods of 2018 and the two years of COVID

pandemic. Industry sources said the plywood industry,

however, had its own share of problems caused by the

general deceleration in the economy. But it hopes to go

full steam with the recovery of the economy.

One of the issues confronting the industry is shortage of

raw materials. However, sources said it was a seasonal

issue as raw materials fall short of demand when the rainy

season sets in.

In the long run, the industry had expressed the view that

the government should encourage planting of softwood to

enable the sector to have sufficient raw materials.

Besides, there is shortage caused by the slowdown in

replanting of rubber trees in the State. The industry is

important in terms of employment generation and its

general contribution to the State’s economy. Sources said

the plywood industry in Kerala directly employed around

50,000 people.

https://www.thehindu.com/news/cities/Kochi/plywood-industry-picks-up-pace-after-pandemic/article66980093.ece

Economic activity gaining momentum

India has seen economic activity gaining momentum amid

continuing global uncertainties. The last quarter’s GDP

data was surprising but not completely unexpected. The

GDP growth in the fourth quarter has pushed up the full-

year GDP growth of FY2022–23 to 7.2%, higher than

forecast. The recently released Annual Economic

Review for May 2023 highlighted that quarterly trends in

consumption and investment exceeded pre-pandemic

levels.

Most analysts are bullish about the Indian economy

expecting the India economy to grow between 6% and

6.3% in FY2023–24. The significance of these

developments and their implications for India are

discussed in a review by the IMF. The first-quarter data is

driving confidence in the improving health of the Indian

economy, inflation has been contained and is at the lowest

since the quarter of September 2019.

See:

https://asia.nikkei.com/Economy/IMF-upgrades-India-economic-outlook-while-China-s-recovery-loses-steam

and

https://www2.deloitte.com/us/en/insights/economy/asia-pacific/india-economic-outlook.html

Interset rate hike dampens demand for affordable

housing

India Today has reported affordable housing demand has

weakened sharply. Consultant firm Knight Frank India has

said sales of affordable housing fell due to the Reserve

Bank of India’s aggressive interest rate hike which

significantly increased the cost of housing loans. Demand

for affordable housing has declined compared demand in

the mid and high-range segments of the market.

In related news it is anticipated that Delhi will see a big

surge in housing-unit launches during the forthcoming

festive period as many a slew of developers acquired land

over the past six months to address the escalating demand

for homes . In the first half of this the number of new units

available was close to that in the first half of 2019.

See:

https://www.indiatoday.in/business/story/affordable-housing-in-india-takes-a-hit-knight-frank-research-report-2423050-2023-08-18

and

https://timesofindia.indiatimes.com/business/india-business/delhi-ncr-set-for-record-housing-unit-launches-in-festive-season-luxury-segment-in-focus/articleshow/102835302.cms?from=mdr

RBI seems to have acted to support rupee

The Indian rupee has recovered slightly from its recent

record low of around 83.5 to the US dollar helped by a

reversal in US Treasury yields which also offered support

to other Asian currencies. The rupee has been under

consistent pressure in recent sessions and observers

suggest it has required US dollar sales by the Reserve

Bank of Indi a (RBI) to steady the exchange rate.

See:

https://www.reuters.com/markets/currencies/rupee-recovers-record-closing-low-importers-exporters-more-active-2023-08-18/

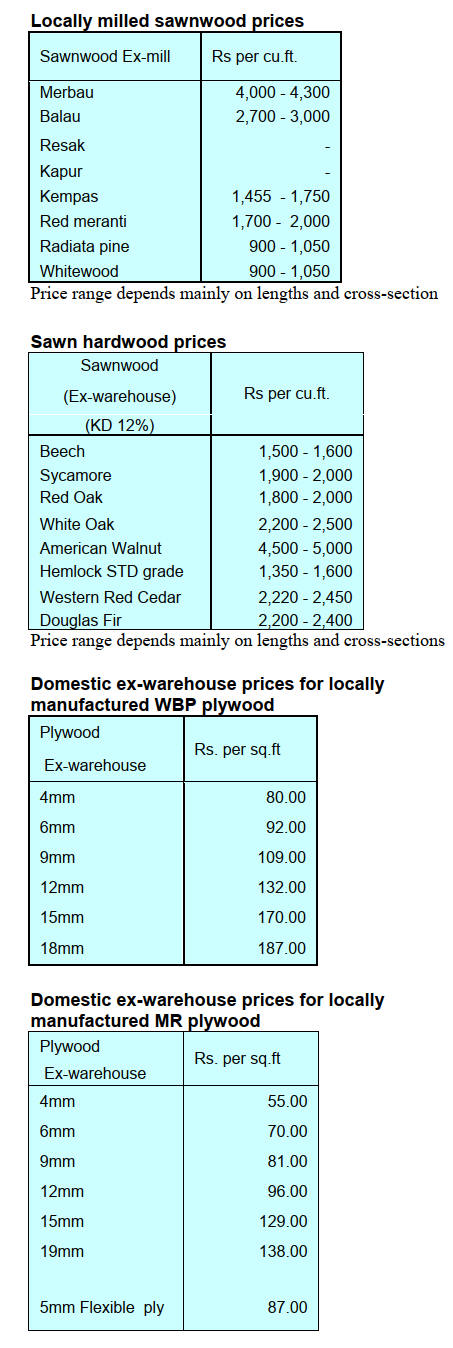

Import prices, June 2023

Teak log prices

Teak prices are being updated for inclusion in the next

report

US hardwood exports to India

The value of US hardwood exports to India reached

US$3.247mil. in the first quarter of 2023 according to the

latest data released by the United States Department of

Agriculture (USDA). Total hardwood sawnwood

shipments from the US to India increased by 36% in value

to US$2.142mil., up from US$1.581mil. for the same time

period in 2022 and by 68% in volume to reach 3,796 cu.m.

The USDA data shows direct exports of American

hardwood veneers to India were worth US$77,000, up by

38% and exports of hardwood logs increased by 50% to

2,023 cu.m.

The top five American hardwood species exported to India

in the first quarter 2023 were ash, white oak, red oak,

maple and hickory.

See:

https://panelsfurnitureasia.com/exports-of-us-hardwoods-to-india-hit-us3-247m-in-q1-2023/

Sculpture from ancient teak log

A 700-year-old teak log has been sculptured into an image

of Ananta Seshasayana Sri Maha Vishnu reclining on a

coiled snake by artists from Myanmar and India

commissioned by Anuradha Timbers International.

See:

https://www.thehindu.com/news/cities/Hyderabad/700-year-old-teak-turned-into-a-sculpture-of-vishnu-in-hyderabad/article67022796.ece

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

According to statistics from Vietnam General Department

of Custom W&WP exports to the US in July 2023 were

valued at US$609.3 million, down 11% compared to July

2022. In the first 7 months of 2023 W&WP exports to the

US were recorded at US$3.9 billion, down 30% over the

same period in 2022.

In July 2023 exports of kitchen furniture reached US$108

million, up 2.8% compared to June 2023, the third

consecutive monthly increase. However, when compared

to July 2022 the export value decreased by 14%.

In the first 7 months of 2023 the exports of kitchen

furniture totalled US$633.2 million, down 24% over the

same period in 2022.

Vietnam's office furniture exports in July 2023 were

valued at US$25 million, down 25% compared to July

2022. In the first 7 months of 2023 office furniture exports

totalled US$148 million, down 34% over the same period

in 2022.

Imports of logs and sawnwood from Southeast Asia in

July 2023 fell for the second consecutive month reaching

65,000 cu.m, worth US$19.0 million, down 11% in

volume and 5% in value compared to June 2023 and also

down 7% in volume and 21% in value compared to July

2022.

In general, in the first 7 months of 2023 imports of wood

raw material from Southeast Asia reached 478,600 cu.m,

down 8% year on year.

Vietnam’s imports of logs and sawnwood from Africa in

June 2023 dropped to 43,880 cu.m, worth US$15.79

million, down 48% in volume and 56% in value compared

to May 2023 and also down 61% in volume and 63% in

value compared to June 2022.

Overall, in the first 6 months of 2023 total imports of

wood raw material wase 413,080 cu.m, worth US$164.72

million, down 28% in volume and 23% in value over the

same period in 2022.

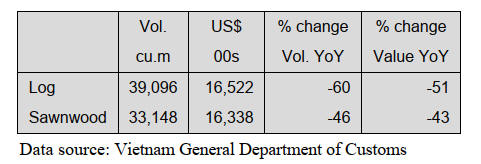

Imports of doussie plummeted

Vietnam's imports of doussie wood in the first 6 months of

2023 amounted to 52,700 cu.m. worth US$23.6 million,

down 59% in volume and 51% in value over the same

period in 2022.

According to the Customs Office Vietnam's doussie wood

imports in July 2023 amounted to 12,900 cu.m, worth

US$6.1 million, up 16% in volume and 16% in value

compared to June 2023. However, compared to July 2022

doussie imports dropped.

In the first 6 months of 2023, doussie log imports totaled

at 39,1000 cu.m. worth US$16.5 million, down 60% in

volume and 51% in value over the same period in 2022.

Doussie sawnwood imports in the first half of the year

were estimated at 33,100 cu.m, worth US$16.3 million,

down 46% in volume and 43% in value over the same

period in 2022.

Vietnam’s forest cover in 2022

In 2022, Vietnam’s forested area was reported at

14,790,075 ha, including 10,134,082 ha of natural forests

and 4,655,933 ha of planted forest according to the

Ministry of Agriculture and Rural Development. The total

area of forests that meet the standards for calculating

forest cover was 13,926,043 ha. or 42.02%.

The Ministry assigned the Administration of Forestry to

establish a national forest resources database. Provincial-

level People's Committees nationwide were asked to

assign the People's Committees at lower levels to perform

the responsibilities of state management of forestry in

accordance with the provisions of the Forestry Law. The

Ministry required localities that recorded a reduction in

natural forest area in 2022 to investigate the causes of the

reduction and undertake measures to restore the forests as

well as identifying those responsible for the reduction in

forest area.

See:

https://vietnamnet.vn/en/vietnam-s-forest-coverage-remains-at-42-02-agriculture-ministry-2156777.html

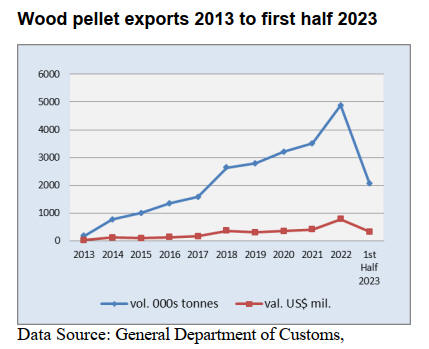

Wood pellet production and trade highlights

In the first 6 months of 2023 Vietnam’s wood pellet

exports amounted to 2 million tonnes with the value of

nearly US$325 million being down year-on-year by 12%

in volume and 8% in value.

After several months of rising prices in the second half of

2022 in the first 6 months of 2023 the average price for

wood pellets exported from Vietnam dropped by 3% to

approximately US$157/tonne.

In June 2023 the export price of wood pellet had fallen

below US$136/tonne, down by nearly 30% compared to

the priced recorded over 6 previous months. South Korea

and Japan remain the two largest buyers of Vietnamese

wood pellets.

In the first 6 months of 2023 Japan imported over 1.16

million tonnes of pellets worth more than US$195 million,

up 6% in volume and 29% in value over the same period

in 2022. During the same period, South Korea imported

more than 840,000 tonnes worth nearly US$116 million,

down more than 33% in volume and nearly 43% in value

compared to the same period in 2022.

The price of exported wood pellets from January 2022 to

the end of June 2023 is shown below. After a year of price

soaring and peaking at US$189 per tonne in December

2022 wood pellet prices cooled and started falling from

March 2023.

8. BRAZIL

IDB and BNDES to invest in

small businesses in the

Amazon

The Inter-American Development Bank (IDB) and the

National Bank for Economic and Social Development

(BNDES) signed a letter of intent to implement the PRO-

AMAZÔNIA Programme, which aims to finance Micro,

Small and Medium-sized Enterprises (MSMEs) in the

Brazilian Legal Amazon. MSMEs represent 99% of the

number of companies in Brazil and account for 27% of the

Gross Domestic Product (GDP) and 46% of jobs, mainly

in the service sector.

The programme will focus on modernisation, expansion,

procurement, innovation and sustainable practices to

create jobs and a balanced economy in the region.

The Amazon is crucial for biodiversity and the global

climate, making the programme an opportunity for

businesses that combine economic development with

sustainability.

Supporting MSMEs in the region will boost sustainable

technologies and economic drive. The total R$ 4.5 billion

loan will be implemented by accredited financial

institutions, respecting environmental and social policies.

The programme is scheduled to start in 2024 and aims to

foster sustainable development in the Amazon region and

reduce inequalities by supporting small businesses and

entrepreneurs.

See:

https://www.madeiratotal.com.br/bid-e-bndes-planejam-investir-r-45-bilhoes-em-pequenos-negocios-na-amazonia/

Bidding opens for forest concessions in Southern

Brazil

The Federal Official Gazette published a tender notice for

sustainable forest management and the utilisation

concessions in the Irati National Forest (Floresta Nacional

- FLONA) in the state of Paraná, Southern Brazil.

The Irati FLONA was created in 1986, covering 3,800

hectares in the Atlantic Forest biome. The Irati FLONA

was included in the Federal Government's Investment

Partnership Program (PPI) so can now be commercially

utilised with the possibility of replacing exotic species,

such as pines, with native species like araucaria.

The sale of pine, which is not native to the region will

benefit the region economically, deliver social gains and

improve sustainability. The forest concession aims to

revitalise the forest through the sale of wood not native to

the Atlantic Forest and to promote sustainable

management in the Irati National Forest.

See:

https://gmaisnoticias.com/governo-federal-abre-licitacao-para-manejo-florestal-sustentavel-na-flona-de-irati

Export update

In July 2023, Brazilian exports of wood-based products

(except pulp and paper) dropped 36% in value compared

to July 2022 from US$431.4 million to US$278.0 million.

Pine sawnwood exports decreased 56% in value between

July 2022 (US$90.5 million) and July 2023 (US$40.1

million). In volume, exports declined 43% over the same

period, from 305,800 cu.m to 173,500 cu.m.

Tropical sawnwood exports decreased 42% in volume,

from 45,500 cu.m in July 2022 to 26,400 cu.m in July

2023. In value, exports decreased 34% from US$20.3

million to US$13.4 million, over the same period.

Pine plywood exports witnessed a 21% decline in value in

July 2023 compared to July 2022, from US$65.3 million

to US$1.6 million.

However, exported volumes increased 2.4% over the

same

period, from 156,100 cu.m to 159,900 cu.m.

As for tropical plywood, exports decreased in volume by

51% and in value 54%, from 5,900 cu.m and US 3.7

million in July 2022 to 2,900 cu.m and US$1.7 million in

July 2023.

Wooden furniture export values decreased from US$58.1

million in July 2022 to US$47.5 million in July 2023, with

an 18% fall.

Strategies for environmental balance debated at

Amazon Summit

During the Amazon Summit countries of the Amazon

Cooperation Treaty Organization (ACTO) - Bolivia,

Brazil, Colombia, Ecuador, Guyana, Peru, Suriname and

Venezuela agreed to protect the largest rainforest that is

home to 10% of the world's biodiversity.

Combating deforestation, protecting biodiversity and

sustainable development in the forest were emphasised as

key strategies to reverse this situation. Sustainable Forest

Management (SFM) as advocated by institutions such as

AIMEX (Association of Timber Exporting Industries of

the State of Pará) is a solution allowing legal timber

extraction.

SFM in Federal Public Forests is authorised by Brazilian

Institute for Environment and Renewable Natural

Resources (IBAMA). Logging is only carried out in

authoriszed forest management units and it can be shown

it is possible to produce and preserve at the same time.

The entire timber production chain is traced/controlled

until products reach the consumer.

See:

http://www.remade.com.br/noticias/19367/cupula-da-amazonia---manejo-florestal-sustentavel-e-uma-das-principais-estrategias-para-o-equilibrio-ambiental-na-amazonia

Increase in production but exports revenues fell

in

Pará

According to the Ministry of Industry, Foreign Trade and

Services in the first half of 2023 in the State of Pará there

was a 40% decline in revenue from timber exports despite

an 8% increase in the volume of timber traded

internationally compared to the same period in 2022.

In the first six months of this year the State collected

US$133 million from exports compared to US$221.9

million in the first half of the previous year, exporting

about 150,000 tonnes with the US being the main

destination. The US and the EU accounted for more than

75% of the state's total export revenue in the period.

Pará remains Brazil's main exporter of timber from natural

forests. The fall in exports is attributed to the weakness in

the global economy which led to a decline in wood

consumption. The depreciation of the US dollar and the

excess stock of timber in the EU also affected prices.

The most exported product during this period was from

teak plantation logs in Pará, with 62,000 tonnes exported

to India according to AIMEX. In Pará, timber can only be

exported in its raw form if it comes from forest

plantations. Otherwise it must be processed in the state.

One of the main processed products is profiled timber,

including flooring, decking and friezes.

See:

https://g1.globo.com/pa/para/noticia/2023/07/28/para-teve-queda-no-faturamento-com-exportacao-de-madeira-mesmo-diante-de-aumento-na-producao.ghtml

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230816/1692147989860563.pdf

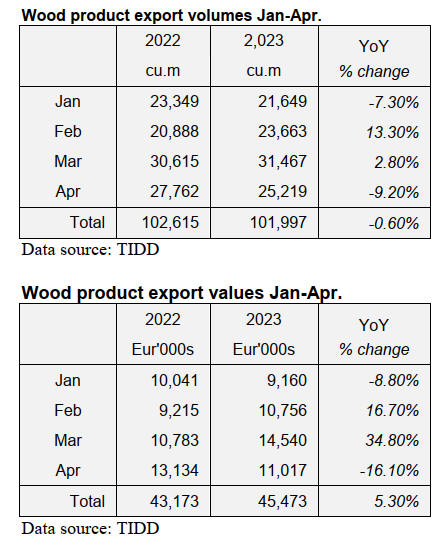

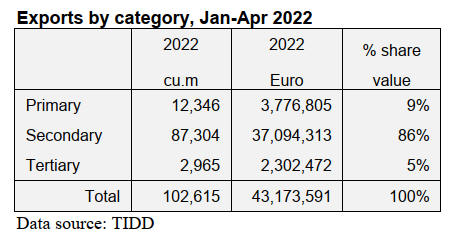

9. PERU

Shipments of sawnwood

declined

According to the Management of Services and Extractive

Industries Division of the Association of Exporters

(ADEX,) exports of sawnwood in the first five months of

the year earned US$18.1 million, representing a drop of

21% year on year. The main destination for exported

sawnwood was China which accounted for almost 30% of

all shipments.

Exports of sawnwood to China increased around 15%

compared to the same period of the previous year. The

second largest market was the Dominican Republic which

accounted for 26% of exports of sawnwood but here there

was a decline of around 45%.

Meanwhile, Mexico the third largest market, increased

sawnwood imports from Peru by over 65%. Likewise,

Ecuador doubled sawnwood imports from Peru.

Training to detect and control forest crimes

A total of 24 prosecutors and assistant prosecutors in the

Ucayali region successfully completed a course on

Sanctioning Administrative Procedure that will contribute

to the evaluation of environmental crimes.The Director of

OSINFOR's Forestry and Wildlife Sanctioning Procedures

said “we have seen a decrease in illegal activities in the

forestry sector but it is still not enough. That is why this

course was important for strengthening skills to detect

crimes and act in a timely manner”.

Inclusion of shihuahuaco and tahuari in CITES

The National Forest and Wildlife Service (SERFOR),

together with the National Amazon University of Madre

de Dios (UNAMAD), organised a course on species

identification focused on the genera Dipteryx and

Handroanthus .

The course, which is part of the actions of the "Action

Plan for the proper implementation of the inclusion of the

Shihuahuaco (Dipteryx genus) and Tahuarí (Handroanthus

genus) in Appendix II of CITES, had the objective of

strengthening the capacities of the technicians responsible

for carrying out forest censuses and/or population studies

in the Departments of Madre de Dios, Loreto, Ucayali and

Junín.

The Action Plan aims to provide the foundation for

technical and regulatory conditions so that from November

2024 the international trade in the products obtained from

these forest species is uninterrupted and the socio-

economic benefits of those in the supply chain are

maintained.