|

Report from

North America

Housing starts fell in June but Canada sees

largest jump in 10 years

Single-family homebuilding fell in June but permits for future

construction rose to a 12-month high on the weakness of the existing

home sales market. The decline in housing starts came after a massive

19% surge in May which propelled the number of starts on single-family

projects to an 11-month high. Starts in June dropped to a seasonally

adjusted annual rate of 1.43 million (below economists’ expectations for

1.48 million) according to the US Census Bureau. That was down 8.1% from

a year ago and 8.0% from May.

In June only 600,000 existing homes were listed for sale across the US,

noted Bright MLS Chief Economist, Lisa Sturtevant. “While new

construction will not immediately solve the supply problem in the

housing market, the recovery in the homebuilding industry and the

delivery of more new homes is essential for meeting the nation’s housing

needs and easing housing affordability challenges for prospective home

buyers,” she said.

Overall, single‐family housing starts in June came in at a rate of

935,000, 7% below the revised May figure of 1,005,000. The June rate for

units in buildings with five units or more was 482,000. Issued permits,

an indicator for future completions, also decreased 3.7% overall from

May, and were 15.3% lower from a year ago. But single-family permits

increased (+2.2%) while the more volatile multifamily permits declined

(-12.8%).

The number of single-family homes under construction remains high, while

a record number of multifamily units are under construction even if the

pace of expansion is slowing.

Canadian housing starts rose 41% in June compared with the previous

month, the largest increase in the last 10 years, led by groundbreaking

on multiple unit urban homes, data from the national housing agency

showed. The seasonally adjusted annualized rate of housing starts rose

to 281,373 units in June from a revised 200,018 units in May, the

Canadian Mortgage and Housing Corporation (CMHC) said.

See:

https://www.census.gov/construction/nrc/current/index.html

and

https://www.housingwire.com/articles/housing-starts-surprised-on-the-downside-reflecting-headwinds/

and

https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-data/data-tables/housing-market-data/monthly-housing-starts-construction-data-tables

Home sales fall and inventory at near historic low

Sales of previously occupied homes in the US fell in June to the slowest

pace since January, as a near-historic low number of homes for sale and

rising mortgage rates kept many would-be homebuyers on the sidelines.

Existing home sales fell 3.3% in June from May’s seasonally adjusted

annual rate of 4.16 million said the National Association of Realtors (NAR).

Sales sank 19% compared to June last year. All told, sales are down 23%

through the first half of this year.

The latest housing market figures are more evidence that, even with

prices easing back after rising for more than a decade, many house

hunters are being held back by a persistently low inventory of homes for

sale. Some 1.08 million homes remained on the market at the end of June,

down 14% from a year earlier said the NAR. That amounts to a 3.1-month

supply at the current sales pace. In a more balanced market between

buyers and sellers, there is a 5- to 6-month supply.

Existing-home sales in the Northeast grew 2.0% from May to an annual

rate of 510,000 in June, down 22% from June 2022. In the Midwest, sales

were unchanged from one month ago at an annual rate of 990,000 in June,

slumping 20% from one year ago. Sales in the South fell 5% from May to

an annual rate of 1.91 million in June, a decrease of 16% from the

previous year. In the West, sales declined 5% from the previous month to

an annual rate of 750,000 in June, down 23% from one year ago.

See:

https://www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales

US job market cools but continues growth

The US economy added 209,000 jobs in June in yet another monthly jobs

gain but the smallest increase since the end of 2020. The jobs report

cames as market watchers are eyeing the Federal Reserve to see if

interest rate hikes will return to tame inflation amid high employment.

The figures released by the Bureau of Labor Statistics fell short of the

estimated 230,000, while the unemployment rate ticked down to 3.6%, from

3.7 %, near the lowest level in 50 years. His indicates that hiring in

the US is cooling after a recovery from the loss of jobs during the

COVID pandemic.

Employment in construction continued to trend up in June (+23,000).

Employment in the industry has increased by an average of 15,000 per

month thus far this year compared with an average of 22,000 per month in

2022. Employment in manufacturing showed no significant change in June.

See:

https://www.bls.gov/news.release/empsit.nr0.htm

and

https://www.msn.com/en-us/money/markets/us-hiring-falls-below-expectations-with-209-000-jobs-added-in-june/ar-AA1dz1Xn

Consumer sentiment rises to best level in two years

Consumer sentiment in July rose to its highest level since 2021 a survey

by the University of Michigan found. The mid-July report showed that job

prospects and lower inflation have consistently boosted consumer

sentiment about economic conditions in recent months.

Consumer sentiment rose for the second straight month, soaring 13% above

June and reaching its most favorable reading since September 2021 the

preliminary survey from the University of Michigan says, adding “the

sharp rise in sentiment was largely attributable to the continued

slowdown in inflation along with stability in labour markets."

All components of the index improved from June levels with optimism

increasing by 19% for long-term business conditions. For consumers, the

sentiment improved for all but low-income households.

Headline inflation in the US moved to its lowest point since early 2021,

rising 3% over the 12-month period to June. So-called core inflation,

which strips out volatile food and energy prices, was at 4.8% annually

to June, only slightly lower than in May.

See:

http://www.sca.isr.umich.edu/

US manufacturing troubles worsen

US manufacturing activity fell for the eighth consecutive month in

June according to the latest Manufacturing Institute of Supply

Management (ISM) Report On Business.

The ISM survey placed the manufacturing PMI gauge at 46 in June, down

from 47 in May and falling short of estimates (a rating below 50

reflects contraction). The latest June ISM Manufacturing PMI marked the

lowest point since May 2020, when business activity plummeted due to

Covid-19 restrictions.Timothy R. Fiore, chair of the ISM Manufacturing

Business Survey Committee said “Demand remains weak, production is

slowing due to lack of work, and suppliers have capacity.

There are signs of more employment reduction actions in the near term.”

The most recent data confirms the stark contrast between the

manufacturing sector’s contraction and the service sector’s continued

expansion.

Of the 18 manufacturing sectors surveyed the Wood Products sector was

among the 11 reporting contraction for the month while the Furniture and

Related Products sector reported neither growth nor contraction in June.

After several months of decline the furniture sector reported some

encouraging findings: Furniture and Related Products reported an

increase in orders for the second consecutive month as well as growth in

production and employment in June.

See:https://markets.businessinsider.com/news/etf/us-manufacturing-crisis-worsens-activity-shrinks-for-8th-straight-month-to-lowest-in-3-years-1032423762

and

https://www.ismworld.org/supply-management-news-and-reports/reports/ism-report-on-business/pmi/march/

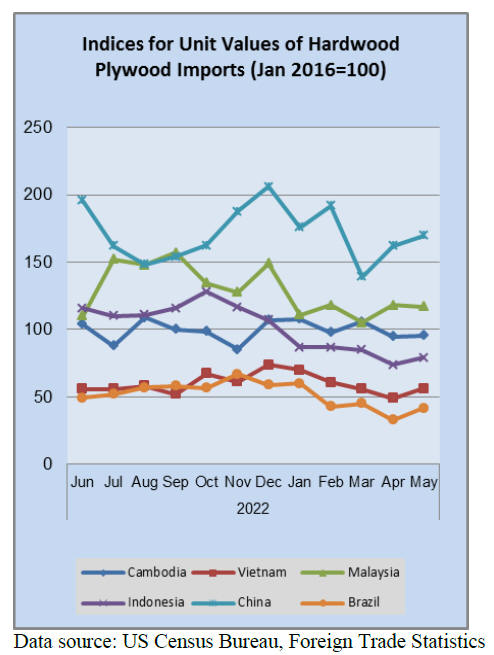

Hardwood plywood from Vietnam ruled as a product of China- duties

imposed

The US Department of Commerce issued its final determination that

hardwood plywood exported from Vietnam using hardwood plywood inputs

sourced from China is, in fact, a product of China. That means the

plywood is subject to the antidumping duty (AD) and countervailing duty

(CVD) orders on hardwood plywood from China. The Commerce Department’s

International Trade Administration published notice of its determination

July 20 in the Federal Register.

Thirty-seven companies were found to have failed to cooperate or failed

to respond to the agency's investigation. The Commerce Department

ordered US Customs and Border Protection to collect cash deposits from

these 37 companies at the China-wide rates of 183% for AD and 23% for

CVD.

In its ruling, the US Department of Commerce "determines that imports of

certain hardwood plywood products (hardwood plywood), completed in the

Socialist Republic of Vietnam (Vietnam) using plywood inputs and

components (face veneer, back veneer, and/or either an assembled core or

individual core veneers) manufactured in the People’s Republic of China

(China), are circumventing the antidumping duty (AD) and countervailing

duty (CVD) orders on hardwood plywood from China."

The Coalition for Fair Trade of Hardwood Plywood brought the

circumvention case against imports from Vietnam in 2020 after imports

from Vietnam spiked following the imposition of antidumping and

countervailing duties on China.

See:https://www.decorativehardwoods.org/sites/default/files/2023-07/US%20Department%20of%20Commerce%20Ruling%20on%20Vietnam%20Circumvention%204403527-01%20%281%29.pdf

and

https://www.woodworkingnetwork.com/news/woodworking-industry-news/certain-hardwood-plywood-vietnam-ruled-product-china-subject

and

https://www.decorativehardwoods.org/sites/default/files/2023-07/Coalition%20for%20Fair%20Trade%20in%20Hardwood%20Plywood%20Vietnam%20Press%20Release%20-%20final%20%281%29.pdf

Canadian wildfires expected to drive up US timber prices

Canada’s devastating wildfire season has impacted the largest amount of

land ever recorded in a single year. As a result timber prices are

expected to rise as Canada supplies approximately 80% of US softwood

sawnwoodimports. However, it is too early to know how much of the

affected areas include harvestable timber, as well as how much will be

damaged in the coming months.

The Canadian provinces of Alberta and Quebec have been hit the hardest

by the fires so far with around 3.8 million and 3.5 million acres burnt,

respectively. Together, they account for 44% of Canada’s annual softwood

sawnwood shipments to the US and 45% of total production. Canada’s

weather conditions are expected to fuel more wildfires throughout the

summer, which paints a grim outlook for timber prices.

See:

https://www.globalwood.org/news/2023/news_20230720a.htm

|