|

1.

CENTRAL AND WEST AFRICA

Gabon and Cameroon, holidays and elections

Many of the logging and milling operations in CAR, Congo, Gabon and Cameroon

have reduced production as it is the time for staff vacations and because

buying in the main markets of the US, EU and China is quiet, also because of

the holiday season.

On the domestic fron, Gabon will hold its presidential and local elections

towards the end of August and preparations for the election are always

disruptive for businesses. In the CAR there is an upcoming referendum where

the President seeks to extend his term. This has sparked tension and

uncertainty in the country.

Rain returning to some regions

Rain has returned in Cameroon, north Congo and CAR with the onset of the

rain season. This may impact timber operations in these areas and poses

logistical challenges during transportation and harvesting. Meanwhile, Gabon

and south Congo are still experiencing the dry season. However, there are

early indications of changes in weather patterns and the first rains are

expected soon. Typically the rain season lasts from September until

mid-December, followed by a two-month semi-dry period before the return of

heavy rains which run to June.

Road and railways, repairs and challenges

In Cameroon road repairs are underway with special attention given to the

laterite roads that were affected during the rain season. According to

operators in the southern region of Cameroon much of the road network needs

attention.

In Central Gabon road maintenance efforts are focused on the section between

Lastourville and Lopé. The aim is to improve this stretch of road but with

the rain season approaching prospects for repair of this section of road are

uncertain.

Congo boasts a well-developed road system, particularly the tarmac roads

that run from the northern to the southern regions of the country.

Additionally, an alternative transportation route is available through river

transport to Brazzaville, followed by train services to Pointe Noire. This

robust infrastructure enhances the movement of goods and people within the

country.

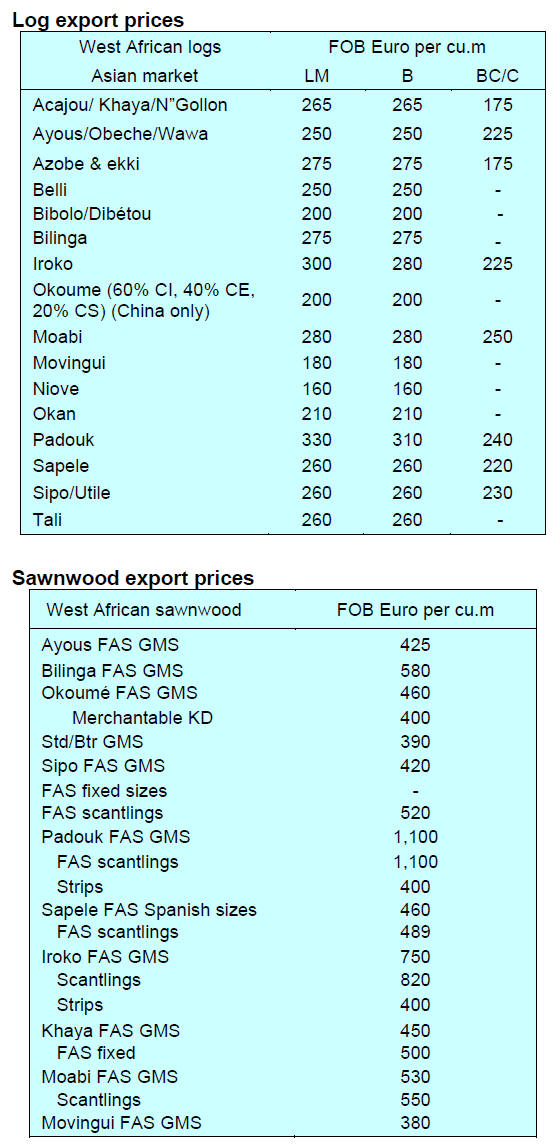

Weaker demand for okoume and ayous in Asian markets

A slowdown in demand in Asia for species such as okoume and redwoods has

become apparent. Importers in the Philippines have reduced imports of okoume

sawnwood by around 30% which is affecting trade across the region. In China,

demand for okoume and ayous is weak while, for other species such as

ovangkol, belli and okan demand remains stable. With falling demand in China

Chinese mills in the region are shifting their focus from okoume to other

species including azobe for markets in Holland and Germany but, with the

holiday period in Europe bring reduced construction activity, demand in the

hydraulic sector has fallen.

Frequently Asked Questions (FAQ) on CITES

In February, in collaboration with tropical timber producing countries, the

ATIBT launched an initiative specifically designed to address CITES-related

issues. The main objective of this action is to better inform stakeholders

about the issues linked to species listed in Appendix II of CITES as well as

changes to this Appendix.

In this context, a Frequently Asked Questions page has been created and is

regularly updated. ATIBT is currently assisting several companies with

CITES-related actions, such as export and import permit applications.

See:

https://www.atibt.org/en/news/13364/monitoring-cites-activities-at-atibt

2.

GHANA

Plywood registers strong export performance

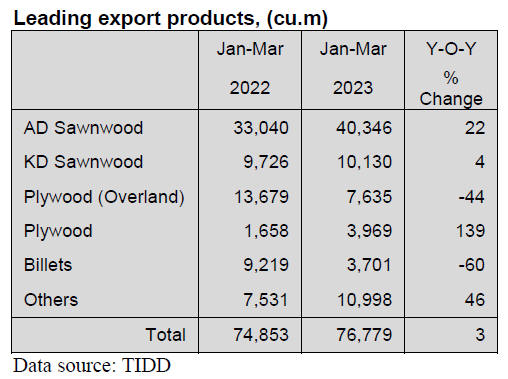

According to the first quarter statistical report published by the Timber

Inspection Development Division (TIDD) of the Forestry Commission, plywood

was one of the leading wood products exported from Ghana during the first

three months of 2023, the others being air and kiln dry sawnwood and

billets.

In the first quarter 2023 the volume of plywood exported through Ghana’s

seaport for the period recorded a significant increase of 139% against the

2022 figure (1,658 cu,m) for the same period, to reach 3,969 cu.m to become

the highest ever for a quarter.

The data showed a consistent month-on-month volume increase from January

2023 (983 cu.m) through February 2023 (1,382 cu.m) to March 2023 (1,604 cu.m)

which accounted for the 3,969 cu.m exported in the first quarter 2023.

Total export receipts for plywood during the period under consideration

also increased by 1057% to US$1.19 million in 2023 as against US$0.58

million recorded for the same period in 2022.

Species used for plywood manufacture were Eucalyptus (89%), Ceiba (10%) and

Mixed Whiteboard (1%). Egypt (22%), Saudi Arabia (19%), Finland (11%) and

France (11%) were the major market destinations which accounted for over 60%

of total export volumes with thirteen other countries accounting for the

remaining balance.

Dutch government support for SMEs

The Netherlands government has made available Eur 500,000 for some 100 Small

and Medium-sized Enterprises (SMEs) in Ghana to help them expand and sustain

their businesses. Participants from five regions across Ghana (Accra,

Kumasi, Ho, Takoradi and Tamale) benefitted from a six-month intensive

capacity building and mentorship training under the Netherlands Orange

Corners programme.

Orange Corners is an initiative of the Ministry of Foreign Affairs of the

Netherlands that provides young entrepreneurs across Africa, Asia and the

Middle East with training, mentorship, networking, funding and facilities to

start and grow their businesses. At a graduation ceremony Jeroen Verheul,

the Netherlands Ambassador to Ghana, explained that the aim is to provide

SMEs with financial resources to scale up their businesses and be resilient

in the face of current business challenges.

The occasion was also to mark the lanuch of the ‘Cohort Eight’ programme

which will provide funding support targeting women and youth led SMEs in

Ghana.

In a related development, Micro, Small and Medium Enterprises (MSME), have

been urged to take advantage of the African Continental Free Trade Area (AfCFTA)

to scale up their activities and expand into the African markets.

According to the AfCFTA Coordinating office this would enable them have

access to a market of 1.3 billion people across the continent and provide

endless opportunities for the socio-economic growth. It is estimated there

will be and increase in intra-African trade by US$35 billion external

imports could decline by US$10 billion annually.

See: https://www.orangecorners.com/

and

https://gna.org.gh/2023/07/netherlands-provides-eur500000-to-100-ghanaian-smes/

Bank of Ghana tries to slow inflation

The Monetary Policy Committee of the Bank of Ghana has increased the

monetary policy rate by 0.5% from 29.5% to 30.0% in an attempt to tame

inflation.

The public reaction to this decision has been one with mixed feelings. The

Ghana National Chamber of Commerce and Industry (GNCCI) and the Ghana Union

of Traders Association (GUTA) have expressed concern that the rise in

interest rate could result in more manufacturing firms folding. Many

industrialists have said they find it difficult to access working capital.

See:

https://myjoyonline.com/bog-hikes-policy-rate-by-50-basis-points-to-30

Ghana’s PPI for June 2023 drops

The Ghana Statistical Service (GSS) has reported Producer Price Inflation

for June 2023 at 29.9%. The latest figures indicates slight decrease in the

PPI relative to the rate recorded in May (30.3%).

According to data from the GSS website the PPI in the industrial sector

declined to 31% in June 2023 from 32% in May 2023. While in the services

sector the rate decreased from 181% in May 2023 to 17.6% in June 2023.

See:https://statsghana.gov.gh/gssmain/fileUpload/Industry/June_PPI_All%20activities%20(summary)_17723.pdf

Ghana’s first half trade surplus

Ghana recorded a trade surplus of US$1.77 billion in the first half of 2023

which is approximately 2.4% of Gross Domestic Product (GDP). This figure is

higher than the US$1.47 billion (2.0% of GDP) registered during the same

period last year.

According to the July 2023 Summary of Economic and Financial Data by the

Bank of Ghana (BoG), the country’s total exports as of June 2023 are

estimated at US$8.17 billion while imports stood atUS$6.40 billion.

In related news, the Ghana cedi remained stable in June and July 2023

against the US dollar, possibly linked to the positive impact of the

International Monetary Fund (IMF) programme. According to the BoG data, the

cedi’s Year-To-Date depreciation stood at 28.4% as of July 21, 2023when

compared to 28.5% in March 2023, 27.8% in April 2023, 28.0% in May 2023 and

28.3% in June 2023.

See:

https://ghstandard.com/ghana-records-trade-surplus-of-1-77-billion-in-first-half-of-2023-bank-of-ghana/96118/

and

https://www.bog.gov.gh/wp-content/uploads/2023/07/Summary-of-Economic-Financial-Data-July-2023.pdf

3. MALAYSIA

Successful business matching at Wood Expo

The Malaysia External Trade Development Corporation (MATRADE), in

collaboration with the Malaysian Timber Council (MTC), successfully matched

88 Malaysian producers of woodbased products with foreign buyers from 23

countries capturing RM147 million in export orders.

A press release from MTC says these business meetings were held in

conjunction with the Malaysian Wood Expo (MWE) 2023 organised by MTC on 19

June 2023 at the Malaysia International Trade and Exhibition Centre (MITEC).

MWE is considered one of the flagship programmes of the MTC and this year it

concluded on a high note.

MWE’s sales in 2023 reached an impressive RM182.5 million, marking a

significant increase compared to its sales of approximately RM140 million in

2019. With over 3,000 visitors and 124 local and international exhibitors

MWE 2023 sales were largely driven by its ‘Incoming Buying Mission’ (IBM)

which was one of the major highlights of the Expo.

The IBM, which was conducted in collaboration with MATRADE, involved 88

buyers from 23 countries. A total of 773 business meetings took place during

the IBM. The products of interest to these foreign buyers were plywood,

medium density fibreboard (MDF), veneer, wooden doors, wood flooring and

furniture products.

Puan Sharimahton Mat Saleh, MATRADE’s Deputy Chief Executive for Export

Acceleration said, “We are honoured to join forces with MTC as the

collaboration highlights the strength of strategic partnership in

accelerating and boosting exports for Malaysian wood industry players.” She

added, “All Malaysian exporters are urged to leverage MATRADE’s export

initiatives to stay resilient amidst global challenges”.

MTC Chairman Tuan Haji Zainal Abidin Haji Abdullah said, “We are steadfast

in our commitment to nurture the growth of the Malaysian timber industry.

Both MATRADE and MTC will continue to provide valuable platforms and

initiatives for Malaysian companies to expand their export opportunities and

strengthen their global presence.”

Among the top export destinations include the United States, Japan and

China. Malaysian companies who are keen to take part in MATRADE programmes

are encouraged to contact MATRADE via email at info@matrade.gov.my, visit

MATRADE’s social media channels or go to www.matrade.gov.my for more

details.

See:

https://mtc.com.my/images/media/1545/MATRADE-MTC_JOINT_PRESS_RELEASE_ON_INSP_MWE_2023_-_23_June_-approved-.pdf

and

http://theborneopost.pressreader.com/article/282351159254775

Planting non-timber species

The Sarawak Forest Department issued a Circular addressed to all holders of

licences for planted forests.

It has been reported that the circular says, pursuant to the Revised Policy

Direction on Industrial Forest Plantation in Sarawak wherein the Minister of

Natural Resources and Urban Development agreed and approved a proposal to

encourage inter-planting of non-timber species such as bamboo, rattan,

pharmaceutical or medicinal species, etc. as one of the mechanisms to

achieve one million hectares of planted forests by 2025.

Now any holder of a licence for Planted Forests who intends to carry out

such planting of non-timber species shall obtain a written permission from

the Director of Forests by submitting a written application together with

the proposed amendment to the Tree Planting Plan (TPP).

See:

https://sta.org.my/index.php/2-website/46-sta-review

4.

INDONESIA

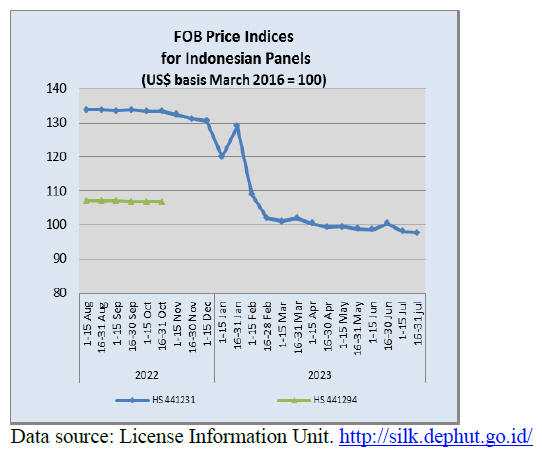

First half exports signal

slight recovery

Exports of forest and wood products reached US$6.7 billion in the first half

of 2023, however, this was below the level of the US$7.03 billion earned in

the first half of 2022. Despite the year on year decline the performance,

when set against the current international demand, suggests the sectors are

recovering from the impact of the pandemic.

Based on data from the Ministry of Environment and Forestry (KLHK) processed

by the Indonesian Forestry Community Communication Forum (FKMPI),

Indonesia's exports of wood products in the first half of 2023 are still

dominated by paper, pulp and plywood. Paper products recorded an export

value of US$2.24 billion, pulp US$1.86 billion and wood panels US$1.23

billion.

Plywood is still one of the top three contributors to timber exports but in

terms of value it has experienced a sharp decline. The value of plywood

exports in the first half of 2023 decreased by 26% year on year.

Exports of other wood products in the first half of 2023, which also

experienced a sharp decline, were furniture with an export value of US$748.8

million, a decrease of 32% year on year and builders’woodworking exports

with an export value of US$428.9 million, a decrease of 19% year on year.

The decline in the export earnings can be explained by the sluggishness in

the North American and the EU markets.

The export value of wood products to North America in the first half of 2023

was valued at US$925.9 million, down 36% year on year. Exports to the EU

were recorded at US$572.4 million, down 13% year on year. Meanwhile, the

Asian market is still showing growth due to demand from China. Exports of

Indonesian wood products in the first half of 2023 to the Asian region

reached US$4.6 billion, up 6% year on year.

See:

https://forestinsights.id/capai-67-miliar-dolar-as-pada-semester-pertama-2023-ekspor-industri-kehutanan-mencoba-bangkit/

Furniture exports weaker in second quarter

The domestic furniture industry is still under pressure as export demand is

weak with the value of orders in the first half being only half of that

compared to the same period in 2022. Abdul Sobur, the Chairperson of the

Indonesia Furniture Industry and Craft Association (HIMKI), said that the

export performance of the furniture industry has not yet shown normal

growth.

Based on HIMKI records, Abdul said the average value of requests from

international buyers is only around 30-50% of pre-pandemic levels however he

forecasts a 6 to 8% year on year rise in the value of furniture exports to

be reported for the quarter of 2023.

See:

https://www.msn.com/id-id/berita/other/industri-furnitur-masih-terseok-ekspor-tetap-lesu-pada-kuartal-ii2023/ar-AA1dLN2R

Exports to Japan become easier

The Ministry of Trade released a new regulation that makes it easier to

exports to Japan, the Electronic Certificate of Origin (CoO). The Ministery

of Trade Regulation was issued based on recommendations from IJEPA, the

Indonesian-Japan Economic Partnership Agreement.

The Ministry of Trade Regulation was issued as a joint commitment between

Indonesia and Japan for the implementation of the IJEPA Electronic CoO.m.

Indonesia is optimistic that the good relations between the two countries

can be improved, especially with the IJEPA bilateral agreement to strengthen

mutual economic relations amid the current global economic situation

according to Zulkifli Hasan, the Minister of Trade.

The Director of Export and Import Facilitation, Bambang Jaka Setiawan, said

Indonesian business players who export to Japan must understand the rules of

origin when preparing a CoO. According to Bambang, the implementation of the

trade agreement will enable Indonesia to benefit from preferential tariffs

and reduce transaction costs.

See:

https://forestinsights.id/kemendag-rilis-permendag-20-tahun-2023-ekspor-ke-jepang-makin-mudah-dengan-ska-elektronik/

Can the IEU-CEPA negotiations be completed?

The Indonesian President recently discussed the Indonesia-European Union

Comprehensive Economic Partnership Agreement or IEU-CEPA and reflected on

the risk that negotiations will continue.

From the Indonesian perspective there are five strategic issues that need to

be resolved as soon as possible in order for the negotiations to be

completed by the end of 2023.

The Coordinating Minister for the Economy, Airlangga Hartarto, said these

are related to:

Transparency in government spending or purchases

Special assignments for state-owned enterprises

Export duties

Indonesia's demand for greater market access

the settlement of investment disputes

See:

https://www.kompas.id/baca/english/2023/07/13/en-airlangga-lima-isu-strategis-perlu-diselesaikan-untuk-merampungkan-ieu-cepa

and

See:https://www.msn.com/id-id/berita/other/jokowi-dorong-penyelesaian-kerja-sama-ekonomi-komprehensif-indonesia-uni-eropa/ar-AA1dOuZy

Potential of rattan in Central Kalimantan not grasped

The potential of rattan in Central Kalimantan is being examined. Out of a

potential harvest of 10,000 tonnes per month only 1,000 tonnes are utilised

by furniture manufacturers. The ban on rattan exports remains an issue for

the sector according to Teten, the Vice Governor of Central Kalimantan. He

has called for the removal of the ban at least for semi-finished products.

According to Teten, rattan from Central Kalimantan is mainly used by

furniture makers in Cirebon, West Java as well as entrepreneurs in Central

Java and East Java but volumes are small compared to the potential.

See:

https://www.kompas.id/baca/english/2023/07/14/en-potensi-besar-rotan-kalteng-terhadap-kebijakan

Wood chip factory for Bangka

A wood chip plant is being built in Bangka Belitung Islands Province. The

plant aims to meet the needs for coal-mixed biomass or co-firing steam power

plants in the Province. In addition to the wood chip plant there are plans

for production of wood pellets. It is planned that the wood pellets be

exported to a number of countries such as Japan, South Korea and China.

See:

https://www.kompas.id/baca/english/2023/07/10/en-perkuat-pasokan-wood-chip-pt-mahakarsa-energi-biru-bangun-pabrik-di-bangka

5.

MYANMAR

EU imposes seventh round of sanctions

A press release from the EC says the Council imposed a seventh round of

restrictive measures in view of the situation in Myanmar against six

individuals and one entity in response to the continuing escalation of

violence, grave human rights violations and threats to the peace, security

and stability in Myanmar/Burma.

The listings includes three Union Ministers, for Immigration and Population,

Labour and Health and Sports, two members of the State Administration

Council (SAC), the Quartermaster General, as well as No. 2 Mining Enterprise

(ME 2), a state-owned enterprise that is controlled by and generates revenue

for the Myanmar Armed Forces (Tatmadaw).

Restrictive measures currently apply to a total of 99 individuals and 19

entities. Those designated are subject to an asset freeze and a travel ban

which prevents them from entering or transiting through EU territory.

In addition, EU persons and entities are prohibited from make funds

available to those listed. Other EU restrictive measures remain in place:

See:

https://www.consilium.europa.eu/en/press/press-releases/2023/07/20/myanmar-burma-eu-imposes-seventh-round-of-sanctions-against-six-individuals-and-one-entity/

Banking a challenge for MTE

The State-owned Myanma Timber Enterprise (MTE) is struggling to continue in

business and has reportedly discussed opening a bank account at the

state-owned Myanmar Economic Bank (MEB) as there are sanctions on the Myanma

Foreign Trade Bank (MFTB) and Myanma Investment and Commercial Bank (MICB)

previously used by the MTE and Myanma Oil and Gas Enterprise (MOGE).

See:

https://www.irrawaddy.com/news/burma/myanmar-juntas-timber-enterprise-eyeing-secret-bank-accounts-to-bypass-sanctions.html

Encouraging citizens to work overseas

The government is encouraging its citizens to find jobs overseas viewing

remittances from workers abroad as an important source of foreign currency

as the country has lost much of its foreign investment and international

aid.

Many young people in Myanmar are seeking jobs overseas. The government has

introduced rules favoring cash remittances from expatriate workers.

Myanmar's central bank has fixed the official exchange rate for its currency

but at the end of August 2022, it issued a notice saying remittances from

expats were exempt. Workers abroad can send money home at close to the

market rate which is around 2,850 kyat to the dollar versus the official

rate of 2,100 kyat per dollar.

See:

https://asia.nikkei.com/Spotlight/Myanmar-Crisis/Myanmar-urges-citizens-to-work-abroad-to-ease-forex-shortage

)

Myanmar further tightens foreign trade regulations

The authorities have introduced more restrictions on imports and exports as

well as controls on the flow of foreign currency. The Ministry of Commerce

issued a Directive on 28 June requiring border trade exporters to deposit up

to 35% of the value of their commoditieswith the Trade Department.

The deposits can be made in four currencies: Myanmar kyat, US dollars, Thai

baht or Chinese yuan, with exchange rates based on the market rates at the

borders.

The Directive said ernings from exports must be remitted into bank accounts

within seven working days of export declarations being issued, a period

reduced from what used to be three months. However, just over a week from

issuing the Directive this requirement was relaxed to 15 working days.

See:

https://myanmar-now.org/en/news/myanmar-regime-further-tightens-foreign-trade-regulations/

6.

INDIA

Confidence returns,

consumers are spending

Consumer confidence in India has surpassed pre-COVID levels as renewed

spending on travel and high-value purchases drives corporate earnings to new

heights. The Reserve Bank of India's bi-monthly survey revealed that the

consumer confidence index reached 88.5 in May, exceeding the high reading in

March 2020 of 85.6.

See:

https://rbi.org.in/Scripts/PublicationsView.aspx?id=21775

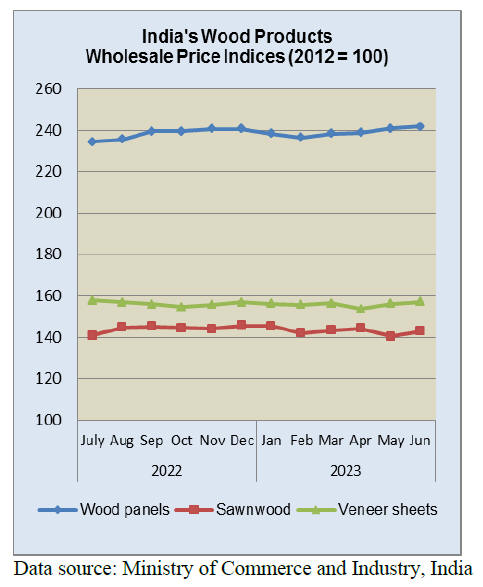

Wood product prices tilt higher

The annual rate of inflation based on the all India Wholesale Price Index (WPI)

in June was minus 4.12% compared to minus 3.48% recorded in May 2023. The

decline in the rate of inflation in June, 2023 is primarily due to fall in

prices of mineral oils, food products, basic metals, crude petroleum and

natural gas and textiles.

Out of the 22 NIC two-digit groups for manufactured products, 11 groups saw

a decrease in prices while 9 groups saw price increases. Some of the groups

that saw an increase in prices were tobacco products; computers, electronic

and optical products; leather and related products; motor vehicles; trailers

and semi-trailers and products of wood and cork.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Plywood output back to pre-covid levels

The output of plywood mills in Perumbavoor, Kerala State especially Aluva,

Kalady and Muvattupuzha have returned to near normal after the serious

downturn triggered by demonetisation and the two years of Covid restrictions

and depressed demand.Manufacturers say they are now facing a shortage of

wood raw material which is partly due to the rain season. So far this year

India’s erratic weather patterns have made headlines with non-seasonal

rainfall in March-April followed by intense heat waves in May.

The industry urged the government to encourage planting of softwood to

enable the sector to have sufficient raw materials. The plywood sector is

important in terms of employment and contributions to the State’s economy.

Sources said the plywood industry in Perumbavoor directly employs around

50,000 people most of who are from other States.

See:

https://www.thehindu.com/news/cities/Kochi/plywood-industry-picks-up-pace-after-pandemic/article66980093.ece

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

According to the General Department of Customs in June 2023 W&WP exports

were valued at US$1.1 billion, up 3.7% compared to May 2023 but down 23%

compared to June 2022.

The WP export alone, contributed US$750.7 million, down 1.3% compared to May

2023 and down 21% compared to June 2022.

In the first 6 months of 2023 the value of W&WP exports totalled US$ 6.1

billion, down 28% over the same period in 2022. In which WP exports reached

US$4.1 billion, down 32% over the same period in 2022.

The W&WP exports to the Canadian market in June 2023 stood at US$15.7

million, down 28% compared to June 2022. In the first 6 months of 2023

exports of W&WP to the Canadian market were valued at US$75.8 million, down

32% over the same period in 2022.

Vietnam's office furniture exports in June 2023 generated US$22.9 million,

down 31% compared to June 2022. In the first 6 months of 2023 office

furniture exports were reported at US$122.1 million, down 36% over the same

period in 2022.

In June 2023 W&WP imports into Vietnam were worth US$190.5 million, down 12%

compared to May 2023 and down 37% compared to June 2022. In the first 6

months of 2023 imports of W&WP totalled US$1.04 billion, down 34% over the

same period in 2022.

Vietnam’s imports of wood raw material from China in June 2023 were 48,000

cu.m, worth US$23.0 million, up 6% in volume and 6% in value compared to May

2023 but down 32% in volume and 48% in value compared to June 2022.

In general, over the first half of 2023, imports of wood raw material from

China reached 251,500 cu.m, worth US$120.96 million, down 37% in volume and

45% in value over the same period in 2022.

Vietnam's W&WP exports to the South Korea in June 2023 amounted to US$55.1

million, down 42% compared to June 2022. In the first 6 months of 2023

exports of W&WP to South Korea were reported at US$380.4 million, down 30%

over the same period in 2022.

In June 2023 bedroom furniture exports reached US$102.5 million, down 51%

compared to June 2022. In the first 6 months of 2023 bedroom furniture

exports reached US$684.4 million, down 47% compared to the same period in

2022.

Vietnam's oak imports in June 2023 were 35,800 cu.m, worth US$19.7 million,

up 6% in volume and 5% in value compared to May 2023. Compared to June 2022

imports increased by 12% in volume but decreased by 11% in value.

In the first 6 months of 2023 oak imports reached 140,200 cu.m, worth

US$78.5 million, up 6% in volume and down 8% in value over the same period

in 2022.

Imports of wood raw material from the EU to Vietnam in June 2023 are

estimated at 66,000 cu.m, worth US$21.0 million, down 11% in volume and 8%

in value compared to May 2023.

The total wood raw material imported from the EU in the first half of 2023

amounted to 330,710 cu.m, worth US$102.03 million, down 17% in volume and

22% in value over the same period in 2022.

Tali wood import situation

According to statistics provided by Customs, Vietnam's imports of tali wood

in June 2023 amounted to 59,000 cu.m, worth US$26.6 million, up 5% in volume

and 5% in value compared to May 2023. Compared to June 2022, import

sincreased by 109% in volume and 120% in value.

In the first 6 months of 2023, tali wood imports reached 257,000 cu.m, worth

US$110.4 million, up 0.2% in volume and 4% in value over the same period in

2022.

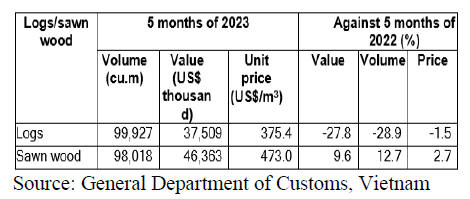

Imports of tali logs and sawnwood

In the first 5 months of 2023 imports of tali logs were at 99,900 cu.m,

worth US$37.5 million, down 28% in volume and 29% in value over the same

period in 2022.

Imports of tali sawnwood were 98,000 cu.m, worth US$46.4 million, up 10% in

volume and 13% in value over the same period in 2022.

Fluctuation of tali wood price

The price of tali imported in the first 5 months of 2023 averaged at

US$423.7/cu.m, up 3% over the same period in 2022. The average price of tali

imported from Cameroon increased by 4% over the same period in 2022, up to

US$428.2/cu.m; from Congo prices rose 5% to US$472.9/cu.m; from Gabon prices

rose by 1.3% to US$369.0/cu.m.

In contrast, tali (equivalent) imports from Laos decreased by 2% over the

same period in 2022 to US$730.6/cu.m; from Nigeria prices dropped by 11%, to

US$219.7/cu.m.

Tali (and subsitutes) wood suppliers

Vietnam's tali wood imports from Cameroon, the top supplier, contributed

74.5% of Vietnam’s total tali imports in the first 5 months of 2023 reaching

147,400 cu.m, worth US$63.1 million, up 5% in volume and 9% in value over

the same period in 2022.

In the first 5 months of 2023, tali imports from Congo, Gabon, Nigeria,

Laos, Hong Kong, China dropped against the same period in 2022, while the

imports from Cameroon, Equatorial Guinea, Ghana increased.

In particular, tali wood imports from Congo decreased by 17% in volume and

12% in value over the same period in 2022, reaching 17,850 cu.m, worth

US$8.44 million and accounted for 9% of total tali imports.

Tali wood imports from some other markets decreased year-on-year: from

Nigeria down by 46%; Laos by 31%; Hong Kong by 45%.

In contrast, imports of this wood from the Cameroon reached 147,370 cu.m,

worth US$63.1 million, up 5% in volume and 9% in value over the same period

in 2022 and accounting for 75% of total imports of tali in the first 5

months of this year.

The imports of tali from other suppliers increased against the same period

in 2022, such as from Equatorial Guinea increased by 53%; from Ghana by 34%;

from Colombia by 30%.

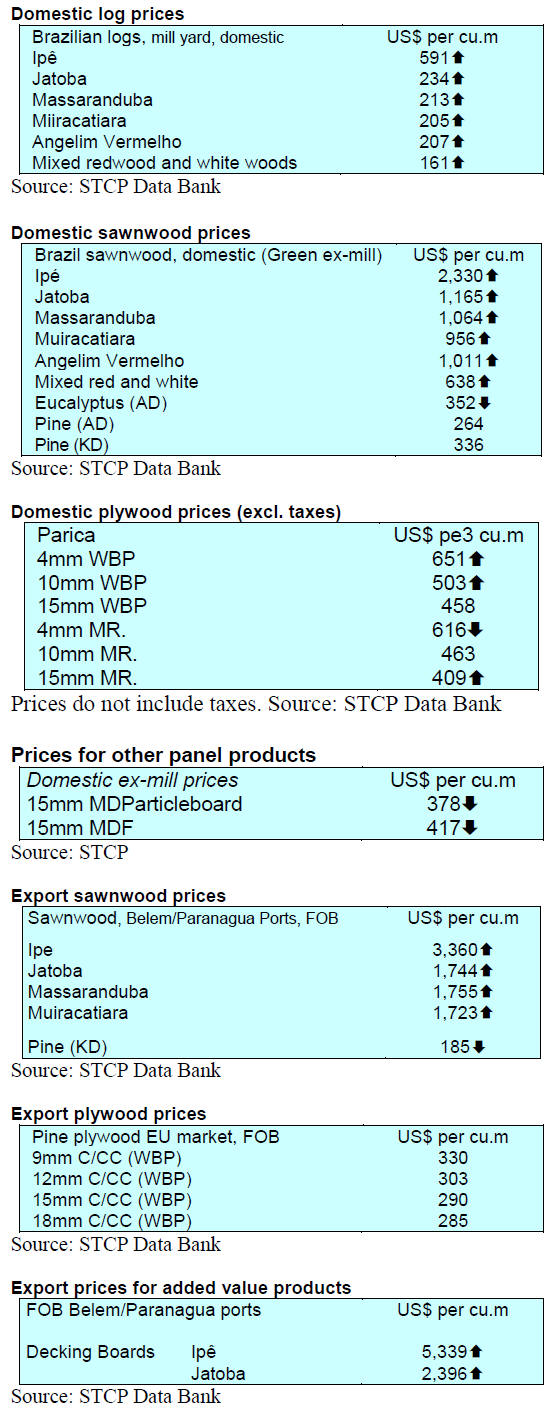

8. BRAZIL

Sector wide quality

programme for plasticised plywood

Plasticised plywood formboard is widely used in the construction sector and

now benefits from the Plasticised Plywood Certification Programme (PSQ), led

by the Brazilian Association for Mechanically Processed Timber (ABIMCI) in

partnership with the Brazilian Association of Technical Standards (ABNT) and

the Institute of Technology in Wood and Furniture. This programme aims to

ensure the quality and performance of plasticised plywood for concrete

formwork following the technical standard ABNT NBR 17001.

According to ABIMCI the initiative has already obtained the approval of the

main companies that manufacture the product providing a seal of the

Certification Programme for high quality products which now meet the

performance requirements required by the new technical standard. Company

Quality Management Systems are periodically audited and products regularly

tested in an independent laboratory.

See:

https://abimci.com.br/abimci-lanca-psq-compensado-plastificado/

ABIMÓVEL joins the National Council for Industrial Development

Representatives of ABIMÓVEL, the Brazilian Furniture Industries Association,

recently met with the Ministry of Development, Industry and Foreign Trade (MDIC)

to discuss proposals for the development of the furniture sector and the

national industry.

The main topics addressed were the payroll exemption tax reform

(establishment of a less onerous system, which encourages investments and

competitiveness in the country), the inclusion of furniture in the "Minha

Casa, Minha Vida" Programme (inclusion of furniture in the financing of the

Federal government's housing programme), trade agreements (mainly, approval

of the Mercosur-European Union Agreement to increase exports and increased

participation of the Brazilian industry and industrial policy.

ABIMÓVEL seeks financial relief and a better business environment for

companies in the furniture sector so as to boost production, innovation and

job and income generation. The furniture sector is the the eighth largest

employer in Brazil.

In addition, it was announced that ABIMÓVEL will be part of the National

Council for Industrial Development (CNDI) which represents a significant

achievement for the Brazilian furniture industry. The country's furniture

industry is one of the largest in the world and composed of thousands of

companies, mostly micro and small-sized entities which face challenges to

expand their performance and productivity. The development of new industrial

policies could be a measure to address these issues.

See:

http://abimovel.com/a-convite-de-alckmin-abimovel-passa-a-integrar-o-conselho-nacional-de-desenvolvimento-industrial/

Export update

In June 2023 Brazilian exports of wood-based products (except pulp and

paper) decreased 39% in value compared to June 2022, from US$481.0 million

to US$292.0 million.

Pine sawnwood exports decreased 23% in value between June 2022 (US$75.7

million) and June 2023 (US$58.6 million). In volume, exports decreased 5%

over the same period, from 264,800 cu.m to 251,000 cu.m.

Tropical sawnwood exports decreased 49% in volume, from 56,200 cu.m in June

2022 to 28,800 cu.m in June 2023. In value, exports decreased 47% from

US$26.9 million to US$14.4 million, over the same period.

Pine plywood exports faced an almost 50% decrease in value in June 2023

compared to June 2022, from US$96.9 million to US$48.7 million. In volume,

exports decreased 33% over the same period, from 221,900 cu.m to 148,300

cu.m.

As for tropical plywood, exports decreased in volume 49% and in value by

47%, from 5,500 cu.m and US$3.5 million in June 2022 to 2,900 cu.m and

US$1.8 million in June 2023.

As for wooden furniture the exported value dropped from US$59.3 million in

June 2022 to US$45.5 million in June 2023, a 23% fall in the total exports

of the product during the period.

Amazon countries discuss sustainable development projects

The Ministry of Planning and Budget, together with the Inter-American

Development Bank (IDB), led a meeting with ministers from the six Amazonian

countries (Bolivia, Colombia, Ecuador, Guyana, Peru and Suriname) to discuss

the "Amazonia Forever" programme.

The aim of the programme is to boost the sustainable development of the

region while preserving the forest and involving the local population. At

the meeting a joint declaration was signed expressing support for the

programme and emphasising the need for expanded and innovative financing,

knowledge sharing and economic coordination among the Amazonian countries.

The IDB's "Amazonia Forever" programme has received endorsement with

projects already identified worth US$1 billion for the region.

The IDB underlined the importance of coordination among the countries to

address climate challenges in the Amazon. The "Amazonia Forever" programme

seeks to promote sustainability in the region and is organised on three

fronts: mapping existing resources to facilitate new financing, designing

and facilitating new projects and creating a network of finance and planning

ministers to oversee the results.

The initiative seeks to combine environmental preservation with sustainable

development and livelihood alternatives for local populations in the Amazon.

See:

http://abimovel.com/paises-amazonicos-discutem-iniciativa-para-coordenar-projetos-de-desenvolvimento-sustentavel-e-inclusivo/

Mercosur/EU trade agreement and the EUDR

The potential negative impact of the European Union Deforestation-Free

Regulation (EUDR) scheduled to go into effect in December 2024) on Brazilian

products were recently discussed at a joint meeting of the Agriculture and

Industry and trade committees of the Chamber of Deputies.

The Ministry of Development, Industry and Foreign Trade said the measure is

unilateral and will impact almost 35% of the products Brazil exported to the

EU.

The government representatives also pointed out negative effects of this

regulation in negotiation of a trade agreement between Mercosur and the EU.

The EUDR applies to timber, palm oil, rubber and derivatives among other

products. Among the penalties are suspension of imports, seizure or

destruction of products and a fine of up to 4% of the operator's annual

turnover. The EUDR considers “forest” any area with 10% tree cover.

The Director of the Department of Deforestation and Forest Fire Control

Policies in the Ministry of Environment and Climate Change pointed out that

the EUDR encompasses all areas of Brazilian biomes not just the Amazon and

the Atlantic Forest.

According to him the majority of Brazilian producers meet all the

requirements of EUDR but the problem is proving that. Failure to prove that

can cause losses which would be especially damaging to small and

medium-sized producers without access to high-cost private certification. He

suggested the Brazilian government should discuss the transition rules with

the EU.

Brazil already has the Action Plan for the Prevention and Control of

Deforestation in the Legal Amazon (PPCDAM) and product traceability systems

that are beginning to be implemented in some states which are achieving

results in curbing deforestation.

The joint meeting also included participation of representatives of the

National Confederation of Industry (CNI) and Agriculture (CNA) which

emphasised the risk of negative effects of trade restrictions on Brazil.

See:

https://www.camara.leg.br/radio/programas/979833-brasil-pode-recorrer-a-omc-contra-lei-europeia-sobre-desmatamento/#:~:text=O%20Brasil%20pode%20recorrer%20%C3%A0,partir%20de%20dezembro%20de%202024.

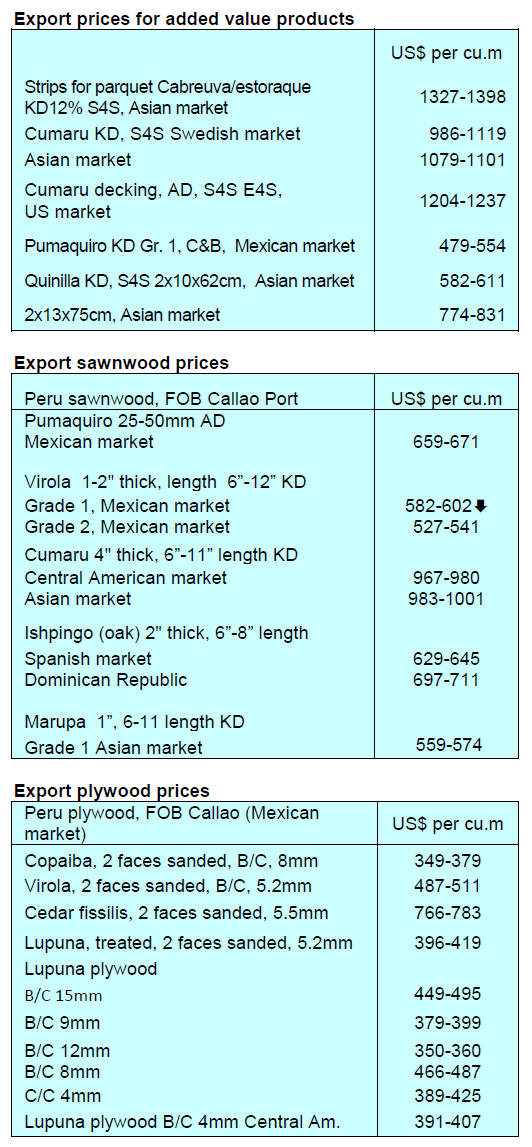

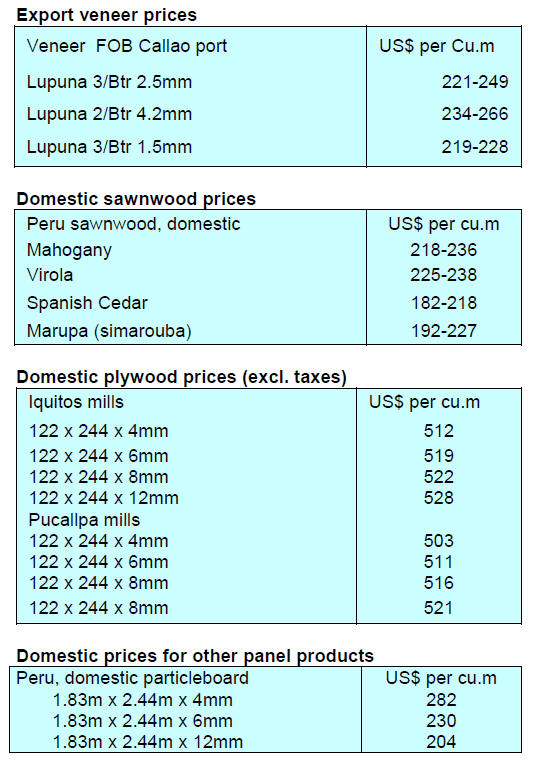

9. PERU

CITES action plan – no

disruption of shihuahuaco and tahuarí trade

The National Forestry and Wildlife Service (SERFOR) has announced an "Action

Plan” to ensure the correct implementation of the inclusion of Shihuahuaco

(genus Dipteryx) and Tahuarí (genus Handroanthus) in Appendix II of CITES.

The plan aims to define the technical and regulatory conditions so that from

November 2024 the international trade in products from these species is

maintained.

The SERFOR plan was presented to three Departments, Madre de Dios, Loreto

and Ucayali to the regional governments as well as to holders of qualifying

titles, forest producers, manufacturers, universities and other

stakeholders. 116 management plans were evaluated through which it was

determined that are 18,253 cu.m of shihuahuaco and 1,665 cu.m tahuari

processed.

This information will allow SERFOR to propose various actions so that, as of

November 2024, the measure adopted by CITES do not negatively affect the

country's timber industry.

See:

https://www.gob.pe/institucion/serfor/noticias/810033-serfor-implementa-plan-de-accion-para-la-inclusion-del-shihuahuaco-y-del-tahuari-en-el-apendice-ii-de-la-cites

Non- cash fine mechanism to encourage behavioral change in forest users

The Agency for the Supervision of Forest Resources and Wildlife (OSINFOR)

held a workshop in June to explain how holders of enabling titles for forest

permits in native and peasant communities in Loreto can access the Fines

Compensation Mechanisms for violations of the Forest and Wildlife Law.

During the workshop information was provided on the role of compensation for

fines as a measure to encourage behavioral change in forest users and as a

key strategy to promote sustainable use of resources.

The Fine Compensation Mechanism approved by the National Forestry and

Wildlife Service (SERFOR), contemplates five ways that allow forest users to

off-set fines through conservation and/or recovery actions of degraded

areas, control and surveillance, participation in training and support in

supervision.

See:

https://www.gob.pe/institucion/osinfor/noticias/791143-loreto-osinfor-impulsa-los-mecanismo-de-compensacion-en-taller-dirigido-a-titulares-de-permisos-forestales-en-comunidades-nativas

Strengthening capacities to address forest crimes

Holders of titles in native communities in Ucayali reinforced their

capacities to detect and prevent environmental crimes during a workshop

organised by the Agency for the Supervision of Forest Resources and Wildlife

(OSINFOR).

Workshop attendees were trained in the identification and prevention of

forest crimes as well as in the correct registration of operations related

to enabling titles.

Workshop participants also received detailed information on the most common

illegal behaviors that affect forest resources and wildlife as well as the

prevention and control measures that must be implemented to combat these

illegal activities.

The participants learned the importance of keeping detailed and accurate

records of all the operations related to their enabling titles using the

Book of Operations for Enabling Titles.

|