|

Report from

North America

April brings more relief to US imports

US imports of tropical hardwood and related products showed

gains for a second month in April but still remain far below last year’s

levels. Imports of tropical hardwood, hardwood plywood, wooden furniture

and tropical hardwood veneer all rose in the 9%-15% range in April. But

through the first four months of the year, these imports are

considerably behind 2022 year-to-date numbers. Numbers are trending in

the right direction, but there is still plenty of ground to make up.

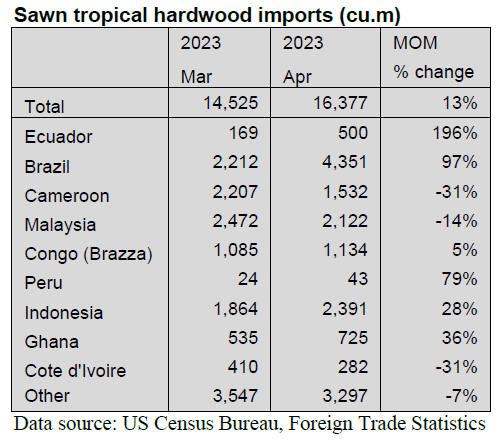

Sawn tropical hardwood imports halt slide

US imports of sawn tropical hardwood rose 13% in April, gaining

for a second consecutive month to continue a recovery from several

months of decline. The 16,377 cubic metres imported in April was 37%

below the volume from April 2022.

A rise of 97% in imports from Brazil accounted for most of the gain,

although imports from Ecuador, Indonesia, and Ghana also showed

significant growth. Even with the monthly gains, imports from all major

trading partners are lagging behind 2022 totals through the first four

months of the year—with the two biggest traders, Brazil and Indonesia,

down 46% and 76%, respectively.

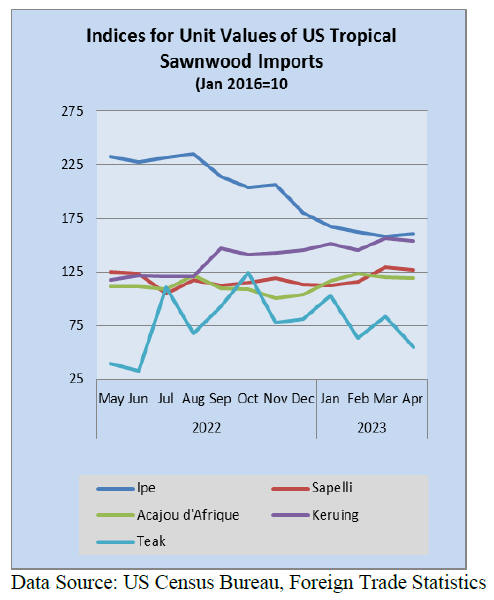

Imports of Balsa tripled in April, but that barely brought the monthly

volume to 1% above that of last April. Imports of Ipe and Sapelli also

gained while imports of Mahogany, Teak and Acajou d’Afrique declined in

April. Imports of Mahogany, Cedro and Keruing remain ahead of last

year’s totals through March, while imports of all other tropical

hardwoods are behind, many by significant margins. Imports of Ipe, for

example, are off by 66%.

Overall, US sawn tropical hardwood imports are down 41% from last year

through April.

Canada’s imports of sawn tropical hardwood fell 28% in April, reversing

their gains from the previous month. Imports were 19% lower than the

previous April, as imports of Sapelli, Virola, Imbuia and Balsa all fell

by about a third from the previous month. Year-to-year imports, which

were ahead of 2022 by 10% last month, are now only up 2%.

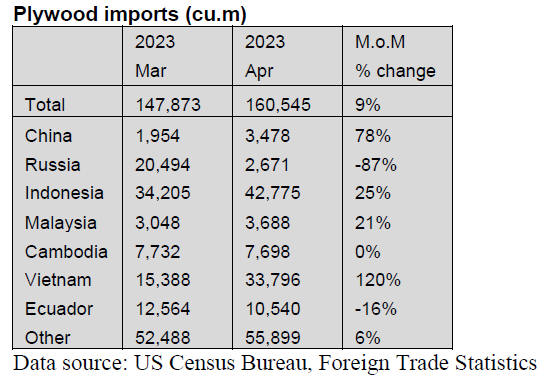

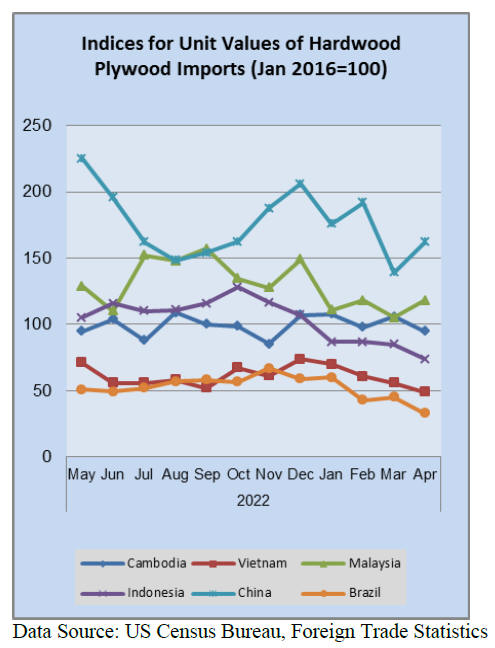

Hardwood plywood imports gain

US imports of hardwood plywood rose for a second straight

month, gaining 9% in April. While the trend is encouraging, the 160,545

cubic metres of plywood imported last month is nearly 60% less than the

over 396,000 cubic metres imported in April 2022.

Imports from Vietnam, China, Indonesia, and Malaysia all showed

significant improvement, but a further drop of imports from Russia

tempered those gains. Total imports for the first four months of the

year are down 63% versus 2022, with imports from most major supplying

countries down in the 60% to 80% range.

Veneer imports up 9% in April

US imports of tropical hardwood veneer grew 9% by value in

April on a spike in imports from Cameroon. Imports from Cameroon rose

more than 4,000% and accounted for more than a third of all veneer

imports in April. Imports from India, which have been down considerably

this year, more than doubled in April.

Imports from Cote d’Ivoire rose 44% in April and are outperforming 2022

by 347% so far this year. Imports from Italy remain volatile from month

to month, falling sharply in April. Total imports are up 25% year to

year through April.

Hardwood flooring edges up

US imports of hardwood flooring edged up 2% by value in April.

Nearly 42% higher than imports from April 2022, hardwood flooring is one

of the few areas of consistent growth in 2023. Imports from China and

Brazil, which have been lagging so far this year, showed the biggest

growth in April, while imports from Indonesia and Malaysia continued to

show steady growth. Imports from Indonesia are up over 300% so far this

year. Total imports of hardwood flooring are up 15% over last year

through April.

Imports of assembled flooring panels fell 10% in April, despite gains

from most major trading partners. While imports from the biggest

supplying nations all rose—imports from Vietnam up 72%, Indonesia up

18%, and Thailand up 15%—they are all still well below imports from last

April and far behind year-to-year imports versus 2022.

A dive into the numbers shows that the April downtick was due to a 35%

drop in imports from smaller supplying countries around the world such

as Italy and Austria. Total imports of assembled flooring panels remain

behind 2022 by 43%.

Moulding imports end slide, gain 11%

US imports of hardwood moulding saw an 11% value gain in April,

ending a six-month slide. Imports from Malaysia and Canada both gained

more than 10% for the month. Imports from China, which fell sharply in

March, quadrupled in April to recover, while imports from Brazil

continued downward, dropping by nearly 50% for a second month in a row.

Total imports are down 33% so far this year versus last year.

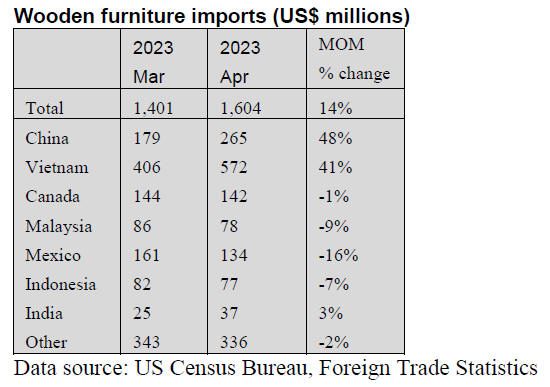

Wooden furniture imports gain on surge from China and Vietnam

US imports of wooden furniture ended their skid in April on

stronger numbers from China and Vietnam. While the US$1.604 billion in

April imports was 30% less than April 2022 totals, it was 14% above that

of the previous month. Imports from China rose 48% in April and imports

from Vietnam rose 41%.

However, even with the gain, imports from the two countries are far

behind their April 2022 levels and their 2022 totals through the first

four months of the year. Total wooden furniture imports are down 29% so

far this year versus 2022.

US cabinet sales down 3.5% in April

According to the Kitchen Cabinet Manufacturer's Association's

(KCMA) monthly Trend of Business Survey, participating cabinet

manufacturers reported a decrease in sales of 3.5% in April. Sales were

up by 8.6% for April 2023 compared to the same month in 2022.

The survey reported that compared with the previous month custom sales

were down 23%, semi-custom sales were up 8.2% and stock sales were down

7.1%. Compared with April 2022 custom sales were up 2.5%, semi-custom

sales were up 20.4% and stock sales were down 17.2%

In an analysis by Woodworking Network, economic concerns combined with

ongoing labor and supply chain issues are leaving cabinet manufacturers

with a cautious outlook for 2023 of flat or small gains compared to the

year prior.

See:

https://kcma.org/insights/february-trend-business-report

and

https://www.woodworkingnetwork.com/cabinets/kcma-sales-year-over-year-down-month-over-month

|