4.

INDONESIA

Benchmark price information system

The Ministry of Environment and Forestry (Directorate of IPHH) is

developing a Benchmark Price Information System (SIPATOK) for forest

products to generate fair Non-Tax State Revenue (PNBP) for the State.

The SIPATOK is being tested in four provinces: Riau, as a representative for

Sumatra, East Java (Java region), East Kalimantan (Kalimantan region) and

South Sulawesi (East Indonesia region). One of the reasons for the

development of SIPATOK is to optimise Non-Tax Revenue.

Based on data from the Directorate General of Sustainable Forest Management

of the Ministry of Environment and Forestry (KLHK) over the last five years

(2018-2022), Non-Tax Revenue from forest utilisation was IDR2.8 - 3.2

trillion per year. This is very small when compared to the potential

considering that production forests in Indonesia cover an area of 68.83

million hectares.

A Ministerial Regulation regarding Benchmark Prices will serve as a guide in

submitting data and information on forest product prices to ensure the

fulfillment of fairness in setting prices reflecting the market prices for

forest products.

SIPATOK will simplify the process of collecting

data and information on prices of forest products and setting benchmark

prices as well as providing access to business actors to directly convey the

real selling prices of forest products based on sales documents/invoices and

other sales documents.

https://agroindonesia.co.id/klhk-kembangkan-sistem-informasi-harga-patokan-sipatok-hasil-hutan-untuk-pnbp-yang-berkeadilan/

Minister unwaveringly in rejection of trade discrimination

Indonesian Coordinating Minister for Economic Affairs, Airlangga

Hartarto, recently met with President Joko Widodo to report the results of

the Indo-Pacific Economic Framework (IPEF) meeting. Airlangga highlighted

several regulations in other countries that are deemed detrimental to

Indonesia.

Airlangga reported on trade facilitation which is still under discussion at

IPEF which has not been completed, the supply chain discussion was completed

as was discussion on the green economy fair economy. Airlangga also informed

the President on the European Union Deforestation Regulation (EUDR). He said

“within 18 months forest commodities must be verified through due diligence

statements and tagging.

Airlangga argued that the EUDR regulation is detrimental to Indonesia

because the implementation does not provide time to adjust saying, “if

within 18 months Indonesia does not comply with the EUDR then a large part

of trade relations with Europe will be disrupted”.

Minister Hartarto appears unwaveringly in his rejection of discrimination by

trading partner countries through the EUDR and Carbon Border Adjustment

Mechanism (CBAM).

CBAM is a policy tool introduced by the EU that requires EU iron and steel

importers to be subject to additional obligations to pay carbon tax rates in

accordance with the amount of iron and steel imported.

The Minister seems to consider the EUDR policy will hurt and harm several

plantation and forestry commodities in Indonesia and Malaysia. In addition,

the EUDR undermines Indonesia's commitments to solve problems related to

climate change issues and to protect biodiversity.

See:

https://en.antaranews.com/news/284244/minister-hartarto-firmly-rejects-discrimination-in-eudr-cbam-policies

and

https://investor.id/business/331568/ri-tolak-kebijakan-diskriminasi-deforestasi-oleh-uni-eropa

Plans to have the forestry sector offset carbon emissions

The Environment and Forestry Ministry plans to have the forestry

sector offset carbon emissions produced by the energy sector with the target

of reaching a net reduction of 140 million tonnes of carbon dioxide

equivalent by 2030.

The ministry's Climate Change Control Director General, Laksmi Dhewanthi,

stated that the energy sector's emissions are still projected to increase in

order to meet the domestic energy demand. "Indonesia, in terms of energy

consumption per capita, is still far below that of average middle-income

countries," she noted in a statement on Tuesday.

If the energy sector still contributes to emissions in the future, then the

forestry sector can already reduce emissions first to achieve a balance

between various sectors in Indonesia, Dhewanthi noted.

See:

https://en.antaranews.com/news/284136/ministry-plans-to-have-forestry-sector-offset-carbon-emissions

Stimulating forestry sector green investment

Agus Justianto, Director General of Sustainable Forest Management,

Ministry of Environment and Forestry said the Ministry (KLHK) supports

growth in green investment in the forestry sector which promises profits for

investors as well as positive impacts on environmental and social

management. He said "green investment is not only oriented to get financial

returns but also produces social and environmental impacts in a sustainable

manner".

One of the efforts to stimulate growth of green investment in the forestry

sector is optimising the economic value of carbon (Carbon Pricing). Carbon

pricing arrangements in the work area of Forest Utilisation Permits (PBPH)

are guided by Presidential Regulation Number 98 of 2021 and Minister of

Environment and Forestry Regulation Number 21 of 2022.

See:

https://forestinsights.id/2023/06/02/klhk-rangsang-investasi-hijau-sektor-kehutanan/

Indonesia braces for forest fires amid El Nino

Indonesia is bracing for the possibility of widespread forest and

land fires this year as scientists predict the return of the El Nino weather

phenomenon in the second half of 2023.

Indonesian National Disaster Mitigation Agency (BNPB) spokesman, Abdul

Muhari, said cases of forest and land fires dropped significantly over the

past three years because of the La Nina weather phenomenon which resulted in

more rainfall.

The World Meteorological Organisation (WMO) said there are signs that the

warm weather phenomenon El Nino will be back this year.

See:https://www.channelnewsasia.com/asia/indonesia-forest-fires-dry-weather-el-nino-3545281

Social forestry permits benefit 1.2 million

families

Since it was implemented in 2016 the area of Social Forestry

Permits as of May 2023 reached 5.5 million hectares comprising over 8,000

units for approximately 1.2 millinon heads of families.

The Minister of Environment and Forestry, Siti Nurbaya, emphasised that the

Social Forestry Programme is one of the national strategic programmes.

She added "By the end of 2025 we aim to have at least 70% of the target of

12.7 million hectares achieved. It is an ideal target that must be

completed." Minister Siti said she would continue to innovate in

strengthening the social forestry programme, especially on

institutional/group aspects, including the application of a GIS shareholding

concept which would reinforce the boundaries for each area.

See:

https://forestinsights.id/2023/05/26/luas-izin-perhutanan-sosial-capai-55-juta-hektare-per-mei-2023-libatkan-12-juta-kepala-keluarga/

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Indonesia.

See:

https://www.itto-ggsc.org/static/upload/file/20230615/1686792092163403.pdf

5.

MYANMAR

Timber exports closed 2022-23 at

US$139 million

For the 2022-23 fiscal year ending on 31 March 2023 timber export

earned US$139 million including US$4 million from the border trade according

to data released by Ministry of Commerce. In fiscal 2021-22 timber exports

were US$128 million.

After the military took power in 2021 logging was suspended but it is widely

anticipated that harvesting will resume this year with a harvesting target

lower than the annual allowable cut (AAC). Although there were no freshly

harvested logs traded because of the logging suspension exports were

maintained as manufacturers used logs stockpiled believing (wrongly) that

products from old logs would be exempted from EU and US sanctions.

Thailand cut power supply to border town

According to the Thai Nation newspaper Thailand’s Provincial

Electricity Authority (PEA) cut the power supply to two small regions of

southeastern Myanmar at the request of the military administration. The

media claim the primary concern was activities in Shwe Kokko, a notorious

gambling hub and centre for online scam operations.

The other region affected by the power cut was Lay Kay Kaw a town in Karen

State around 30 minutes drive from the Myawaddy-Mae Sot border. Law Kay Kaw

was developed with the support of Japan’s Nippon Foundation in 2015 to house

refugees relocated from the series of camps dotted along the

Thailand-Myanmar border.

Rupee will be applied for the trade with India

India has urged Myanmar's administration to speed up the process of

trade settlements through mutual currencies, a mechanism that was earlier

agreed. A delegation of Indian exporters met Myanmar's trade minister U.Aung

Naign Oo, who is on a visit to India and raised the issue.

Myanmar, which is facing shortages of foreign exchange reserves, announced

last year that it would soon start accepting Indian rupees, along with Thai

baht and China's renminbi as official settlement currency to cut its

dependence on the U.S. dollar.

See -

https://www.channelnewsasia.com/business/india-asks-myanmar-expedite-trade-through-rupee-exporters-body-3556431

In related news the Myanmar administration has made it mandatory for

exporters and importers to use the Chinese yuan in trade transactions with

China. The order, issued on 1 June requires traders to open yuan accounts in

local banks if they want permits for cross-border transactions.

Traders applying for import licenses must submit

proof that they have Chinese currency in their bank accounts, which they can

obtain either from export earnings or by purchase from a local bank.

Previously, both US dollars and yuan were permitted for use in border trade

with China.

See -

https://www.irrawaddy.com/news/burma/myanmar-junta-bans-dollars-for-border-trade-with-china.html

)

6.

INDIA

Indian plywood demand forecast

According to IMARC Group’s latest report, “India Plywood Market:

Industry Trends, Share, Size, Growth, Opportunity and Forecast FY 2023 to FY

2028”, the India plywood market reached INR208.5 billion in FY 2022-23.

IMARC expects the market to reach INR306.5 Billion by FY 2028-29.

The expanding construction industry, the emerging trend of urbanisation and

consumer preference for plywood for structural purposes are driving the

India plywood market.

In addition, the launch of several government policies including the Pradhan

Mantri Awas Yojana, DDA Housing Scheme, NTR Housing Scheme, for example,

promote the expansion of housing projects and support demand for plywood.

See:

https://www.imarcgroup.com/plywood-market-size-in-india

National policy needed to drive green development

In a press release CREDAI offered suggestions for a national policy

to help create green development in India.

CREDAI has put together a policy framework that could help drive both demand

for and supply of green development projects in India.

Identifying successful state level policies that

have enabled green development CREDAI recommends a standard national policy

framework which would include:

Increase in Floor Space Index (FSI) or Floor Area Ratio (FAR) in urban

planning and architecture to measure land use intensity.

Different State policies have allowed for higher FSI/ FAR for developers in

the case of Green certified projects. Allowing a higher FSI will incentivize

developers which will also lead to higher value creation overall.

Fast track/ Single Window Environmental Clearance

Facilitating a single window clearance will lead to lower costs and

compliances and enhance the turnaround time for building green projects.

Fee Waivers and Subsidies for MSME Developers

In certain states, there is also a provision to provide

subsidies/reimbursements on amount paid to the plant or on fixed capital

investment. This should be replicated across the country as it will provide

substantial financial benefits which will also have a positive impact on

project costs and housing prices.

Concessional Interest Rates from Financial Institutions

Green building projects should be eligible for financial assistance in the

form of concessional rates from all financial institutions, including Banks

to provide a more conducive financial system that can enable and incentivise

developers.

On the occasion of World Environment Day, CREDAI announced that its

developer members had undertaken more than 55 green projects totalling 32

million square feet with the Indian Green Building Council (IGBC) under

CREDAI’s ‘Green Crusaders’ Programme. These projects are part of CREDAI’s

commitment towards developing 4,000 green projects by 2030.

See:

https://www.credai.org/media/view-details/361

Monsoon tree planting

The Uttar Pradesh Forest Department will produce 480 million

saplings to achieve the target of planting 350 million trees this year in

the monsoon season as a part of the state government’s annual plantation

drive. Over 400 million saplings have been raised already and the rest will

be ready before June. The nurseries are managed by government departments

and include a few private nurseries.

See:

https://timesofindia.indiatimes.com/city/lucknow/uttar-pradesh-forest-dept-to-raise-48-crore-saplings-for-plantation-in-2023/articleshow/99270128.cms?from=mdr

7.

VIETNAM

Wood and wood products (W&WP) trade

highlights

According to the General Department of Customs May 2023 W&WP

exports were worth an estimated at US$1.2 billion, up 10% compared to April

2023 but down 14% compared to May 2022.

WP exports were US$801 million, up 3% compared to April 2023 but down 16%

compared to May 2022. Over the first 5 months of 2023 W&WP exports totalled

at US$5.1 billion, down 27% over the same period in 2022. In particular

exports wood products at an estimated at US$3.4 billion were down 34% over

the same period in 2022.

Vietnam's imports of logs and sawnwood in May 2023 amounted to 500,900

cu.m, equivalent to US$180.3 million, up 51% in volume and 50% in value

compared to April 2023 but compared to May 2022, down 13% in volume and 22%

in value.

Over the first 5 months of 2023 imports of wood raw material were recorded

at 1.6 million cu.m, worth US$579.2 million, down 31% in volume and 35% in

value over the same period in 2022.

Vietnam's exports of NTFPs have been increasing for the first four months

in 2023 reaching US$70.0 million in May 2023, up 12% compared to April 2023

but down 0.3% compared to May 2022.

W&WP exports to the EU in May 2023 stood at US$33.6 million, down 39%

compared to May 2022. In the first 5 months of 2023 W&WP exports to the EU

were estimated at US$206.6 million, down 34% year-on-year.

W&WP exports to Australia in May 2023 were estimated at US$10.3 million,

down 37% compared to May 2022. In the first 5 months of 2023 exports of wood

and wood products to Australia were estimated at US$46 million, down 43%

year-on-year.

Exporters of wood products face many difficulties

Vietnam’s W&WP trade is not expected to increase unless the global

economy regains growth momentum and consumer demand in key markets recovers.

In spite of the cloudy situation, Vietnamese wood processors and traders

forecast better trends in late 2023 - early 2024 when inflation prevailing

in many economies will be controlled and the Russia-Ukraine conflict may

end.

Topping export turnover in the first 4 months of 2023 were wooden-frame

seats with an export value of US$831.5 million, down 32% over the same

period in 2022, followed by wood chips US$691.7 million, up 2%; living and

dining room furniture US$644.4 million, down 43%; wood-based and panels and

floorings, US$501.6 million, down 28%; bedroom furniture, US$478.8 million,

down 33%.

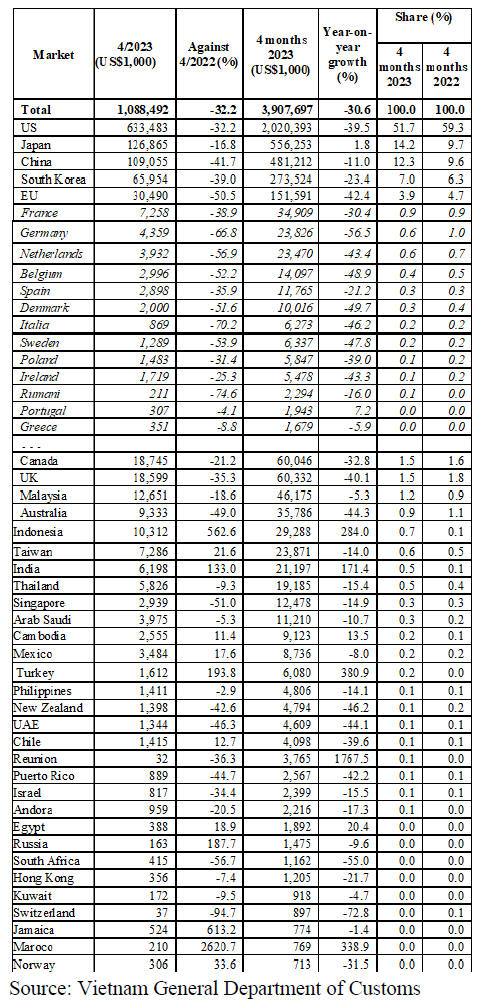

W&WP exports in April and the first 4 months

of 2023

Except for Japan W&WP exports to key markets experience a sharp

turndown in the first four months of 2023. The US market, as the leading

market, consumed over US$2.0 billion, down 40% year-on-year; Japan is the

second market with US$556 million, up 1.8%; China, US$481.2 million, down

11%; Korea, US$273.5 million, down 23%; EU, US$151.6 million, down 42%.

Vietnamese wood exports declined in first

five months

The export of wood and wooden products continued a downward in

early 2023 with export values hitting US$5.1 billion to mark a year-on-year

fall of 27%.

According to the Ministry of Industry and Trade, May alone witnessed the

nation’s export value of wood and wooden products stand at an estimated

US$1.2 billion, up by 10% against April but down by 14% against May 2022.

Most notably, May saw exports of wooden products reach US$801 million, up 3%

on-month but down by 16% on-year. Wooden furniture represented the key

export item accounting for 60% of total exports of wood and wood products.

Throughout the January to May period the export value of wooden furniture

fell sharply by 38% against the same period from last year due to slowing

global demand. High inflation across the world has forced consumers to

tighten their spending as they seek to decrease demand for non-essential

goods such as wood products.

Those factors have led to Vietnamese export value of wood and wooden

products plunging during the reviewed period.

See:

https://wtocenter.vn/tin-tuc/22083-vietnamese-wood-exports-decrease-over-five-month-period

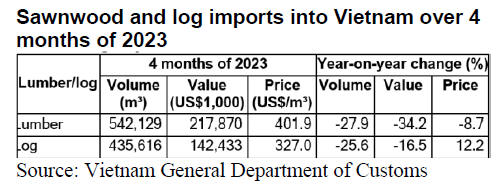

Imports falling

In the first 5 months of 2023, the imports of logs and sawnwood

amounted to 1.6 million cu.m, worth US$579.2 million, down 31% in volume and

36% in value over the same period in 2022.

In the first 4 months of 2023 imports of raw wood from major markets, such

as the EU, Cambodia, China, the US, Thailand, Laos, Chile, New Zealand and

Brazil dropped down against the same period in 2022. At the same time, the

imports from some other markets, such as Malaysia, Angola, Indonesia, Canada

and Namibia increased.

The raw wood imports from the EU markets amounted to 15% of total imported

volume, contributing 190,600 cu.m, worth US$58.2 million, down 18% in volume

and 21% in value over the same period in 2022.

From Cameroon imports decreased year-on-year by 4% in volume and 2% in value

and were 169,300 cu.m, worth US$73.2 million, accounting for 13% of the

total imports.

Imports from the China fell by 33% in volume and 40% in value against the

same period in 2022, amounted to 157,600 cu.m, worth US$76 million, a 13%

share of total imports.

In addition, the import volume of raw wood from some other markets decreased

against the same period in 2022. In particula imports from the US dropped by

5%, Thailand by 25%, Laos by 17%, Chile by 29%, New Zealand by 25%, Brazil

by 59% and Congo by 17%.

In contrast, imports of raw wood from Malaysia increased by 68% in volume

and 24% in value over the same period in 2022, reaching 27,400 cu.m, worth

US$7.2 million, accounting for 2% of total imports.

In addition, imports of raw wood into Vietnam from some other markets in the

first 4 months of 2023 showed an increase compared to the same period in

2022: from Angola increased by 10%; Indonesia by 75%; Canada by 3%, Namibia

by 36%, Equatorial Guinea by 45% and Mozambique by 19%.

Vietnam’s log and sawnwood imports by source and species

In the first 4 months of 2023 imports of major species such as

pine, tali, poplar, oak, doussi/pachi, padouk and eucalyptus declined

year-on-year. Conversely, import volumes of some other species increased,

namely ash, rubberwood, mukulungu, walnut, lagerstromia, menghundor and

douglas fir.

Pine, as the top species imported, accounted for 11%

of total imported raw wood in the first 4 months of 2023, reaching 142,500

cu.m, worth US$31.7 million, down 51% in volume and 61% in value over the

same period in 2022.

Tali/okan imports decreased by 18% in volume and 173% in value over the same

period in 2022, reaching 141,900 cu.m, valued at US$58.6 million and

contributing 11% of total imports.

Poplar imports dropped by 16% in volume and 27% in value year-on-year,

accounting for 80,500 cu.m, valued at US$33.4 million.

In addition, imports volume of some other species decreased compared with

the same period in 2022, such as doussie by 40%, padouk by10%, eucalyptus by

72%, teak by 26% and sapele by 17%.

Conversely, imports of ash in the first 4 months of 2023 surged by 5% in

volume and 18% in value over the same period in 2022, reaching 127,200 cu.m,

worth US$32.8 million, accounting for 10% of total imported raw wood.

Forecast W&WP trade

In the first 5 months of 2023, Vietnam's W&WP exports plummeted by

27% over the same period in 2022 with an export value of US$5.1 billion. The

reason behind the serious downturn in W&WP exports is recession of the

global economy leading to the weakened market demand.

There are signs of recovery but the W&WP markets will barely recover.

Moreover, increasing concerns on the EUDR will trigger new technical and

environmental barriers to the W&WP trade. In addition, China's reopening has

also doubled the competition in Vietnam's W&WP export markets. Apparently,

in both the short term and long term, these factors will continue impacting

the Vietnamese wood industry sector.

Besides the decline of export orders the serious drop of export prices also

exposes another factor worsening the export turnover of W&WP made in

Vietnam. On the other hand, Vietnam, as a big importer, can hardly maintain

the normal level of wood imports with the weakened W&WP demands for both

domestic use and export.

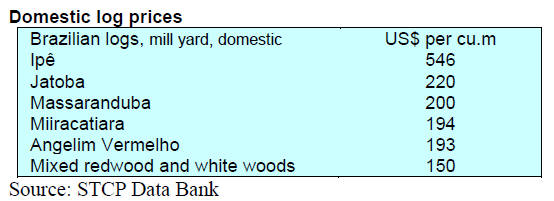

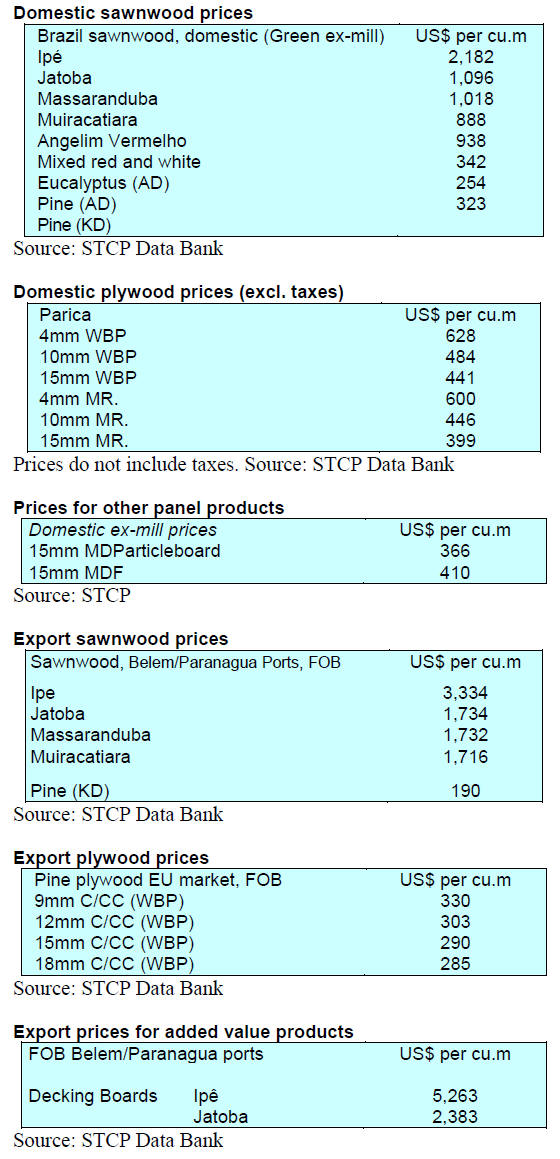

8. BRAZIL

Law on carbon credit trading in public

forests

The law No. 14.590/23, published in the official gazette, changes

the rules of public forest management through concessions. The law allows

the trade in carbon credits and the exploitation of biodiversity in the

granted concession area which until now was prohibited.

According to the law, the public notice of the concession for the

utilisation of forests may include the right to commercialise carbon credits

and other similar instruments for the mitigation of greenhouse gas

emissions.

Non-timber forest products and services may also be the object of forest

concession management. The new law also allows the concessionaire of public

forests to unify forest management activities in contiguous areas of lands

in protected areas.

The new law also provides for:

The Brazilian Forestry Service (SFB) preparation of the Multi-Year Plan

for Forest Granting (PPAOF) with a duration of four years containing the set

of public forests to be granted in the period in which it is in force;

The absolute reserve area (area within the concession that cannot be

exploited) may be located around the conservation unit ( buffer zone ). In

this way, the entire concession area is free for the concessionaire's use in

accordance with the contract;

The granting authority may call the remaining bidders for the public

forest concession in order of classification when the concession contract is

terminated. The new concessionaire must accept the terms of the previous

contract;

The bidding notice for the public forest must provide for civil liability

insurance against any damage caused to the environment or to third parties,

in addition to a guarantee to cover the default of contractual obligations.

Source: Agência Câmara de Notícias

See:

https://www.camara.leg.br/noticias/965520-lei-autoriza-comercio-de-credito-de-carbono-e-acesso-a-biodiversidade-em-florestas-publicas/

Leaves from Amazon tree could replace mercury in gold recovery

Research conducted by the Brazilian Agricultural Research

Corporation (Embrapa) has shown that bio-extraction obtained through use of

the leaves of pau-de-balsa (Ochroma pyramidale), a tree native to the

Amazon, may be a viable and sustainable alternative to replace mercury in

gold recovery.

A new research stage will study which formulations

of bio-extractors can be competitive with mercury. The study will be

coordinated by Embrapa Forests, in Paraná State in partnership with other

research institutions.

The first phase of the research, carried out in 2020, focused on the

chemical characterisation of the pau-de-balsa leaves. In 2023 a new stage of

the study will begin which will be conducted in partnership with a mine in

the Peixoto de Azevedo Region, in Mato Grosso State.

Various bio-extraction formulations will be evaluated for their efficiency

in recovering gold from alluvial ore. The bio-extractor that performs best

will be adjusted to further improve extraction. The extraction efficiency

will be compared to the traditional process through amalgamation with

mercury. In addition, toxicity and cytotoxicity analyses will be carried

out.

The pau-de-balsa tree is fast growing and contributes to improve the

development of secondary forests and can be used in forest restorations. In

the case of the adoption of the pau-de-balsa leaves for gold recovery the

idea is that it will be associated with the use of the species for the

recovery of land affected by mining.

See:

https://www.nativanews.com.br/meio_ambiente/id-1048549/pesquisa_estuda_folha_da_amaz_nia_para_substitui__o_do_merc_rio_na_extra__o_de_ouro

Timber export control for Brazilian wood

According to a Brazilian Institute of the Environment and Renewable

Natural Resources (IBAMA) Timber Management Analytical Report the most

exported species for use in the design and architectural sectors are: ipê (Handroanthus),

cumaru (Dipteryx odorata), garapa (Apuleia leiocarpa) and jatobá (Hymenaea

courbaril).

According to IBAMA's 2022 report the European Union is the largest buyer of

Brazilian wood products taking around 143,000 cu.m worth about R$1 billion

followed by the United States with a purchase of almost 83,000cu.m also

worth about R$1 billion.

The Convention on International Trade in Endangered Species of Wild Fauna

and Flora (CITES) regulates the process of exporting and importing fauna and

flora. According to IBAMA some of the most exported plant species in Brazil

are already listed in CITES Appendix II. These are Dipteryx odorata and

Handroanthus serratifolius (yellow ipê). Others are in the MMA Ordinance No.

443/2014 (List of Brazilian flora species threatened with extinction), such

as Araucaria augustifolia, Apuleia leiocarpa and Mezilaurus itauba.

To ensure legality the first step is to know the origin of the wood.

Although it is difficult to know the true origin of the material, the

Brazilian Association of Interior Designers (ABD) advises checking the

Forest Stewardship Council (FSC) label, in addition to the Forest Origin

Document (DOF) of IBAMA.

According to IBAMA there are a series of norms that regulate the procedures

for authorising the export of wood products and by-products from native

timber species.

Among these are the Normative Instruction IBAMA No. 8/2022 and Normative

Instruction No. 17/2021 which aim to control the export of wood from natural

forests.

Normative Instruction No. 21/2014, established the National System for the

Control of the Origin of Forest Products (SINAFLOR) to control the origin of

wood, charcoal and other forest products and by-products. There is also

Decree No. 3.607/2000 which deals with the implementation of CITES. There is

also Ordinance No. 8/2022, which established the Brazil Single Consent

Platform (PAU Brazil) under IBAMA.

Finally, SECEX Ordinance No. 19/2019, which conrols export licenses, permits

and certificates (LPCO) through the Foreign Trade Single Portal of the

Integrated Foreign Trade System (Siscomex).

See:

https://revistacasaejardim.globo.com/um-so-planeta/noticia/2023/05/entenda-como-funciona-a-fiscalizacao-para-o-uso-de-madeira-brasileira.ghtml

Pará state teak exported to India

India is the main importer of teak roundwood (Tectona grandis)

produced from reforested areas. These forests help to recover degraded land,

create employment, generate foreign exchange and generate income for

municipalities and for the State of Pará.

The State of Pará is the main exporter of wood products from native timber

species and exports of wood products from reforestated areas have been

growing.

According to the Association of Timber Exporting Industries of the state of

Pará (AIMEX), in the first four months of the year timber exports from

reforestation represented the third most valuable product with more than

28,000 tonnes exported worth US$4.9 million with India as the main

destination.

Teak was introduced to Brazil in the 1960s and the first plantations began

in the Pará State in the 1990s.

Currently, Brazil has the largest planted area in Latin America with more

than 90,000 hectares of teak plantations spread over the States of Mato

Grosso, Pará, Rondônia, Acre, Goiás, Minas Gerais, among others. Mato Grosso

and Pará States account for more than 90% of the planted teak area in the

country.

See:

https://redepara.com.br/Noticia/234247/madeiras-plantadas-no-para-sao-utilizadas-na-india

Through the eyes of industry

The latest GTI report lists the challenges identified by the

private sector in Brazil.

See:

https://www.itto-ggsc.org/static/upload/file/20230615/1686792092163403.pdf

9. PERU

ADEX requests change to forestry

legislation

According to the president of the Timber and Timber Industry

Committee of the Association of Exporters (ADEX), Erik Fischer Llanos, while

there is a regulatory framework that aims for best forest practices the

legislation, in effect, limits the competitiveness of the sector.

Fischer suggested it necessary to open a debate with the Legislative Branch

to modify the appropriate laws in support the forestry sector which

generated 27,337 jobs during 2022, being the third largest activity that

generated the most employment for every million dollars in exports.

One of the modifications would be Article 46 of the Forestry Law which

establishes the verification of 100% of the species included in CITES the

deadlines for which result in a considerable administrative and financial

burden.

Fischer considered necessary the promulgation of laws with a technical

basis, taking account of reality and taking into account social needs so as

to promote productivity in the sector.

In addition, Fischer indicated the Association was in favor of the Bill

whose purpose is to modify the Law for the Promotion of Investment in the

Amazon with the aim of specifying that the commercialisation of carbon

credits (bonds) generated in Emission Reduction projects derived from the

Deforestation and Forest Degradation (REDD+), ecosystem services, must be

included in the scope of Law No. 27037.

See:

https://agraria.pe/noticias/urge-adecuar-legislacion-para-impulsar-el-desarrollo-del-sec-31951

Indigenous people to manage their own forest resources

In the fight against illegal logging, deforestation and timber

trafficking in the Peruvian Amazon several indigenous communities in the

Ucayali region strengthened their technical capacity to improve sustainable

management of their forest resources.

Through the Intercultural Training Programme for Trainers in Community

Forest Management (PIFFMFC) leaders and members of the native communities

benefitted from training that will allow them to manage their own forest

resources.

This initiative was promoted by the National Forest and Wildlife Service

(SERFOR) and was supported by WWF Peru, the Ucayali Wildlife Forest

Management (GERFFS-U), the Aidesep Ucayali Regional Organisation (ORAU) and

the Union Region of the Indigenous Peoples of the Amazon (URPIA). The

results of this training will be assessed with the expectation that the

leaders will implement what they have learned and put the necessary systems

into practice.

OSINFOR promotes good practices to improve forest management

Timber concessionaires and holders of forest permits on private

land in the Loreto Region strengthened their capacity to carry out

sustainable management in their forest areas during a workshop held in

Iquitos, Loreto.

A group of OSINFOR trainers explained to 29

attendees including holders of qualifying titles, regents and

representatives of timber concessions and forestry permits what are the

commitments they accept when the State grants them qualifying titles and

obligations they must comply with to avoid falling into forest violations.

During the workshop the relevance of meeting the necessary commitments to

obtain a certificate of compliance was discussed. The imposition of

penalties for forestry and wildlife violations was also explained.

Model to combat corruption in the forestry sector

On May 25, 2023the National Forestry and Wildlife Service (SERFOR),

Ministry of Agrarian Development and Irrigation (MIDAGRI), signed an Act of

Commitment for the Implementation of an Integrity Model through a General

Management Resolution which approved the SERFOR 2023 Integrity Programme.

This action is part of SERFOR's commitment to promote the integrity of its

officials and fight corruption. Advances have been made in the Integrity

Model by approving the pertinent instruments to generate greater confidence.

Through this it has been possible to address the negative perceptions

detailed in the 2022 Integrity Report prepared by the Secretary of Public

Integrity of the Presidency of the Council of Ministers.

SERFOR committed to the fight against corruption by creating the Functional

Integrity Unit (UFI) that reports to the General Management and is in charge

of providing guidance and technical assistance to all the management units.

See:

https://www.gob.pe/institucion/serfor/campa%C3%B1as/9443-implementacion-del-modelo-de-integridad-en-el-serfor