|

Report from

North America

Imports continue trending downward

US imports of tropical hardwood products remained on a

downward path in February. Imports of hardwood

plywood fell to their lowest volume in 14 years while

sawn tropical hardwood imports tumbled 25% and imports

of wooden furniture fell 19%. Imports in the sector have

been tracking steadily downward since autumn of 2022.

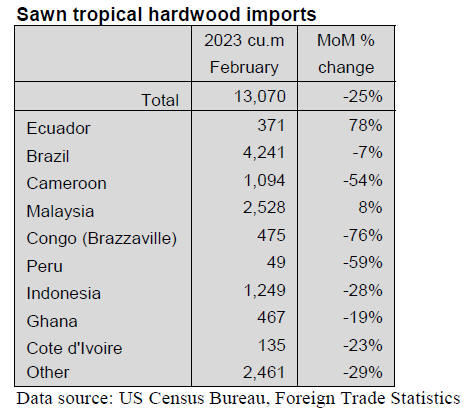

Sawn tropical hardwood imports fall for fifth month

US imports of sawn tropical hardwood fell sharply in

February, declining for a fifth consecutive month. The

13,070 cubic metres imported in February was 25% less

than in January and was 44% less than that of the previous

February.

Imports from all countries are lagging, most notably

imports from Indonesia (down 28% for the month and

73% for the year so far), Cameroon (down 54% for the

month and 39% for the year so far) and Brazil (down 7%

and 37%).

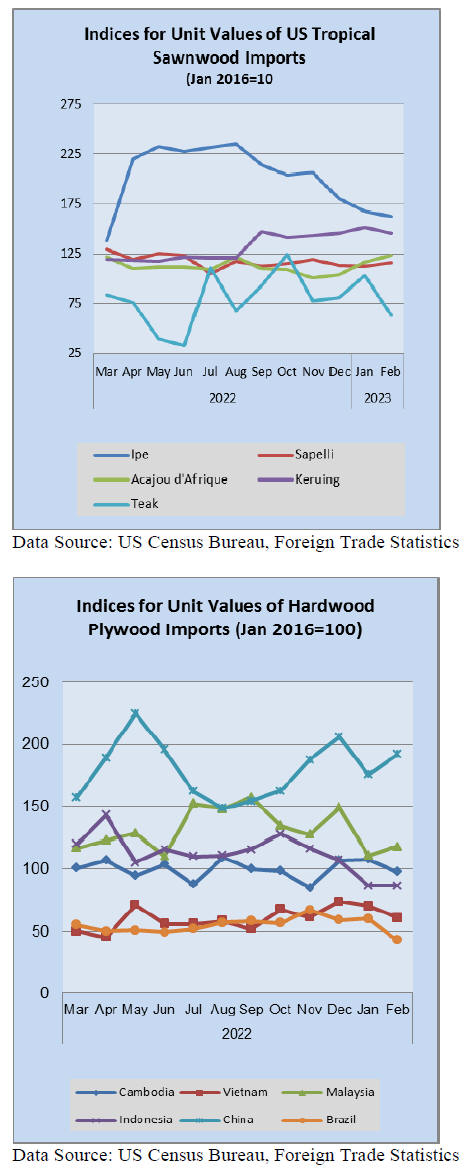

Imports of Sapelli fell for the fifth time in six months,

dropping 66% in February to a level 57% lower than

February 2022, while imports of ipe, acajou d’Afrique,

and meranti all declined significantly. Imports of keruing

rose 20% in February but were still 4% lower than the

previous February. Total imports trail those of last year by

38% after the first two months.

Canada’s imports of sawn tropical hardwood grew in

February, rising 20% from the previous month. Rising

imports from Brazil, Malaysia, and Cameroon fueled the

gain. Total imports are up 5% over last year through the

first two months of the year.

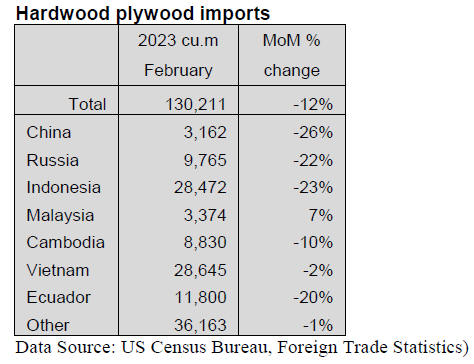

Hardwood plywood imports down 63%

US imports of hardwood plywood continued to plummet

in February. Imports fell 12% for the month to a level 63%

below that of the previous February. The 130,211 cubic

metres imported in February was the lowest monthly

amount imported since March 2009.

Imports from China, Russia and Indonesia all fell more

than 20% and were down well over 50% for the year so

far.

Imports from Ecuador also fell 20% in February but were

up 28% for the year so far. With the exception of

Ecuador, imports from all major trading partners were

down sharply over the first two months of the year as total

imports are off by nearly two thirds.

Veneer imports up 64% over a year ago

While US imports of tropical hardwood veneer fell 17%

by value from the previous month, the February total was

64% above that of February 2022. As imports typically

decline in February, the decline of only 17% can be seen

as a positive sign, as can a significant increase in imports

from Italy in February after an anemic January number.

While year-to-date imports from Italy are still down 46%

through the first two months of the year, total imports are

up 26% overall while imports from Ghana, Cote d’Ivoire,

and Cameroon have more than doubled.

Hardwood flooring imports dip

The value of US imports of hardwood flooring fell back in

February, falling 7% after two months of growth. Imports

from China fell 61% in February while imports from

Brazil fell 41% and imports from Malaysia fell 37%.

Imports from Indonesia, which have fueled most of the

uptick in imports over the last few months fell 19% but

remained more than double what they were a year ago.

Total imports of hardwood flooring were up 12% through

the first two months of the year chiefly due to the strength

of imports from Indonesia.

Imports of assembled flooring panels fell for a fifth

straight month in February, declining 16%. Import figures

remain weak across the board. Imports from China fell

70% for the month and are down 69% year to date.

Imports from Thailand were down 27% in February and

are 86% behind last year to date and imports from

Indonesia fell 22% in February and are off 26% year to

date. Total imports of assembled flooring panels are down

46% versus last year through the first two months of the

year.

Moulding imports down again

The value of US imports of hardwood moulding fell

another 11% in February, declining for the fifth

consecutive month. Gains in imports from Brazil and

China were more than offset by declines from most other

trading partners including Malaysia, which fell by 12%

and a 4% dip in imports from Canada.

Despite the February gain, imports from China are off by

52% so far this year. Total imports of hardwood moulding

are down 21% versus last year through the first two

months of the year.

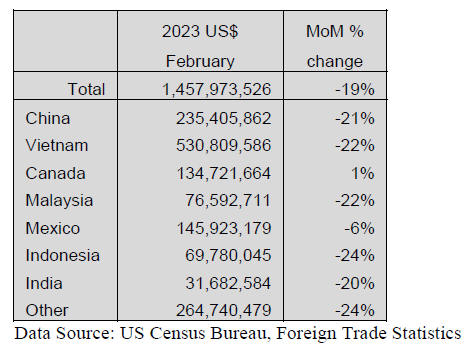

Wooden furniture imports tumble

US imports of wooden furniture tumbled 19% in February,

dropping below the US$1.5 billion mark for the first time

since June 2020. The US$1.46 billion in February imports

is 24% below that of February 2022.

Imports were down consistently among lead suppliers:

imports fell between 20% and 25% from China, Vietnam,

Malaysia, Indonesia, and India. Imports from Mexico

were down only 6% while imports from Canada rose less

than 1%. Total imports of wooden furniture are down

20% through the first two months of the year.

As for the overall furniture market, the latest Smith

Leonard survey of residential furniture manufacturers and

distributors showed new orders in January 2023 were up

5% from December 2022, but fell 25% from January 2022.

Smith Leonard noted that the results for January 2023

pretty much show what most described as a “slowing” of

business for early part of 2023. Approximately 77% of the

participants reported negative growth in orders compared

to January 2022.

US cabinet sales rise

According to the Kitchen Cabinet Manufacturer’s

Association's monthly Trend of Business Survey,

participating cabinet manufacturers reported an increase in

overall cabinet sales of 12.8% for February 2023

compared to the same month in 2022.

Custom and semi-custom cabinet sales increased year over

year as well. Custom sales, year over year, were up more

than 27% and semi-custom sales were up more than 21%.

Stock sales, however, were down 22%.

See:

https://kcma.org/insights/february-trend-businessreport#:~:text=According%20to%20the%20KCMA's%20monthly,the%20same%20month%20in%202022.

US extends duty evasion probe into plywood from

Vietnam

The US Department of Commerce (DOC) recently

unveiled an extension of the deadline for issuing its final

conclusion on a trade remedy duty evasion probe into

hardwood plywood imported from the Vietnamese market.

This marks the sixth time that the DOC has announced an

extension, with the final determination expected on 2 May.

In July 2022, the DOC announced the preliminary

conclusion of the case, saying that plywood from Vietnam

using materials from China should be subject to the same

anti-dumping and anti-subsidy duties applied to the

northern neighbour.

If the materials are produced in Vietnam or other countries

the products will be exempt from any duties. The

provisional tax rate may be up to 378.26%, applicable to

shipments imported into the US from June 17, 2020.

However, the DOC has allowed Vietnamese enterprises to

cooperate in the investigation process in order to selfcertify

that they do not use Chinese materials. The number

of enterprises participating in the self-certification

accounted for about 80% of Vietnamese exports during the

investigation period.

Currently, the US applies an anti-dumping duty of

183.36% and an anti-subsidy tax ranging from 22.98% to

194.90% on the product from China.

Statistics compiled by the US Customs and Border

Protection indicate that exports of plywood using

Vietnamese hardwood materials to the US continuously

increased from US$112.3 million in 2018 to US$226.4

million in 2019, US$248.5 million in 2020, and US$356.7

million in 2021.

See:https://english.vov.vn/en/economy/us-extends-duty-evasionprobe-into-plywood-from-vietnam-for-sixth-timepost1009981.vov

Manufacturing sector still shrinking

Economic activity in the manufacturing sector contracted

in February for the fourth consecutive month following a

28-month period of growth say the nation's supply

executives in the latest Manufacturing ISM Report On

Business.

The ISM's manufacturing PMI edged up to 47.7 last month

from 47.4 in January. The small rise was the first in six

months. Any level below 50 denotes contraction in the

sector.

Only four industries, including transportation equipment

and electrical equipment, appliances and components,

reported growth last month. Paper products, textile mills,

furniture and related products were among the 14

reporting sectors contraction.

But the worst could be over for manufacturing. So-called

hard data on factory production was solid in January,

while business spending on equipment appeared to have

rebounded at the start of the first quarter. Comments from

some manufacturers in the ISM survey were supportive of

this thesis.

See:https://www.ismworld.org/supply-management-news-andreports/reports/ism-report-on-business/pmi/august/

|