Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Apr

2023

Japan Yen 133.6

Reports From Japan

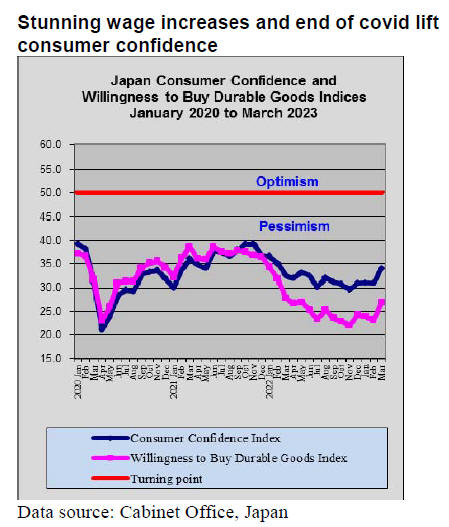

Japan’s consumer confidence gave the government some

optimism as the index rose in March from a month earlier

to the highest level since May 2022. At the core of the

improvement in confidence are the stunning wage

increases agreed by major companies, the prospect that the

covid pandemic is on the wane and that spring came early

this year.

Warnings on volatility amid fresh banking concerns

The government retained its assessment that the economy

is recovering moderately but maintained its warning about

market volatility amid fresh banking concerns prompted

by troubled Credit Suisse and the collapse of two US

banks.

In its March economic report the government cut its

assessment on production for the first time since

December amid slowing international demand and as a

result forecasts for corporate earnings were downgraded

for the first time in nearly three years.

Japan's economy avoided a recession in the final quarter of

2022 but prospects are good as private consumption,

which makes up over half of gross domestic product, has

been rising.

No plans for changes to interest rate policy

Japan’s new Bank of Japan (BoJ) governor, Kazuo Ueda

indicated that the Bank has no plans for major changes in

its ultra-low interest rate policy as slowing global growth

is a risk for a sustained rise in inflation and wages, the

prerequisite for phasing out the controversial monetary

stimulus policy.

Inflation and wage growth are showing of improvement.

After hitting a 41-year high of 4.2% in January, core

consumer inflation remains above 3% as more firms lift

prices to cover rising production costs. To compensate

households for the increase in living costs major firms

have offered wage hikes of nearly 4% this year in annual

labour talks, the fastest pace in about three decades.

See:

https://japantoday.com/category/business/new-boj-headsays-banks-stable-rules-out-major-policy-shift

New programme planned to securing foreign

manpower

A government panel has been reviewing the country’s

programme on foreign technical trainees and has

recommended scrapping the current approach and a launch

of a new programme that emphasises securing manpower.

Japan introduced the current programme in 1993 with the

aim of contributing to skill development for ‘trainees’

from developing countries, however, because of poor

oversight and loopholes in the regulations the programme

has been abused by some Japanese companies with

workers complaining of unpaid wages, long work hours

and other violations.

Labour shortages are becoming more apparent in Japan.

One of the reasons for this shortage of personnel despite

the lackluster economy is that labor supply has reached a

plateau. The inflow of foreign workers decreased due to

control measures imposed after the start of the COVID

pandemic. Another factor behind the stagnation of labour

supply is that labour participation among women and the

elderly, which had been strong before COVID, has stalled.

As economic activity continues to normalise Japan will

find itself facing a serious labour shortage.

See:https://japannews.yomiuri.co.jp/politics/politicsgovernment/20230410-102701/

and

https://www.jri.co.jp/en/reports/jrirj/2023/nishioka/01/

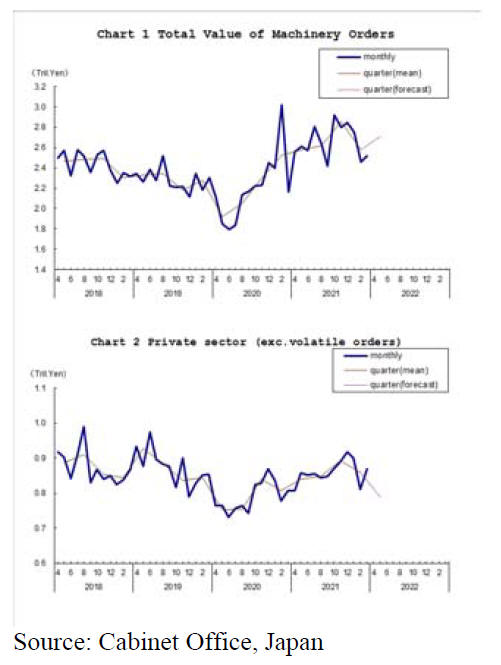

Second quarter to see machinery orders decline

The total value of machinery orders (excluding volatile

ones for ships and those from power companies) received

by manufacturers increased by 2.5% in March, however,

in the January-March period orders declined almost 10%

compared with the previous quarter.

Private-sector machinery orders (excluding volatile ones

for ships and those from power companies) increased a

seasonally adjusted by 7.1% in March but dipped 3.6% in

the first quarter of this year.

In the April-June period private sector machinery orders

have been forecast to drop by 8% from the previous

quarter.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2022/2203juchue.html

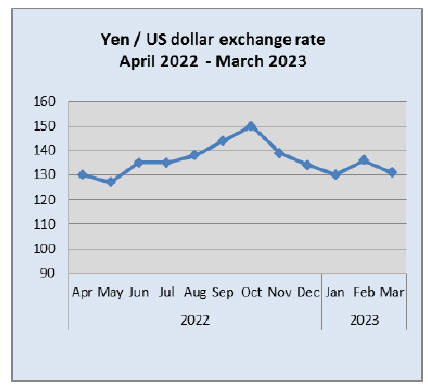

Yen slipped on news no change to BoJ policy

After the new BoJ governor reported that the Bank will

maintain current ultra-loose monetary policy that has been

in place for around 10 years. Immediately after the

statement the yen weakened slightly but the downturn was

short lived. On 10 April the yen was at 133 to the US

dollar.

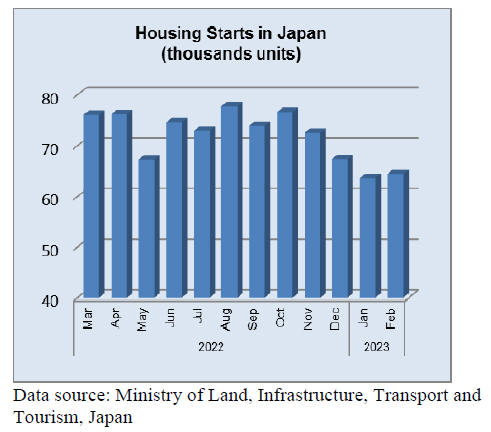

Dicusssions on housing finance for youg

families

The Japanese government has established a panel to

discuss measures to address the country’s falling birthrate.

Under consideration are scrapping the income cap for

child benefits, extending the period of eligibility for

benefits and providing housing support to child-rearing

households.

The idea of housing support has been welcomed by many

as a significant shift away from the usual (and largely

ineffective) cash hand-outs. The move to support young

couples with their housing could result in demand for

smaller first time homes.

Import update

Assembled wooden flooring imports

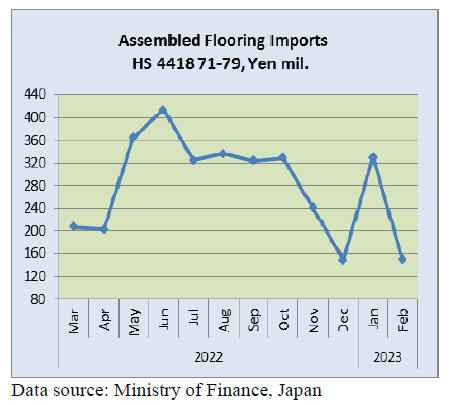

There was a massive correction in Japan’s imports of

assembled wooden flooring (HS441871-79) in February

bringing the value of imports back to the same level as in

December 2022.

A possible explanation for the correction (other than the

January data was incorrect) is the strengthening of the yen

against major currencies in January this year which

importers took advantage of. However, the value of

imports of other wood products in January did not show

the same surge as seen with flooring.

The value of Japan’s imports of assembled wooden

flooring (HS441871-79) in February was down 30% year

on year. There has been a steady decline in the value of

imports of assembled wooden flooring since mid 2022.

Month on month, the value of February imports were

down almost 55%.

Three shippers accounted for over 70% of Japan’s imports

of assembled flooring in February, China 44%, Austria

20% and Thailand 8%. There were no shipments from

Vietnam in February most likely because of the Tet

celebrations.

Plywood imports

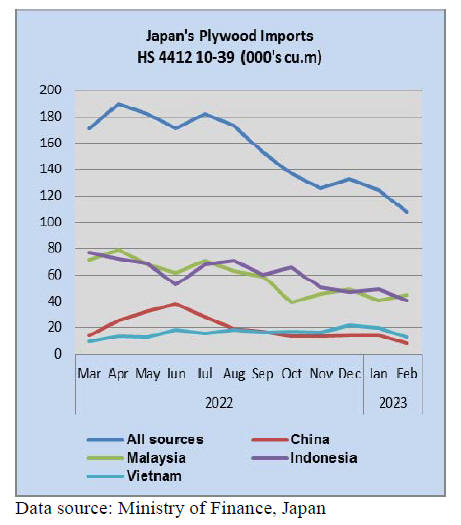

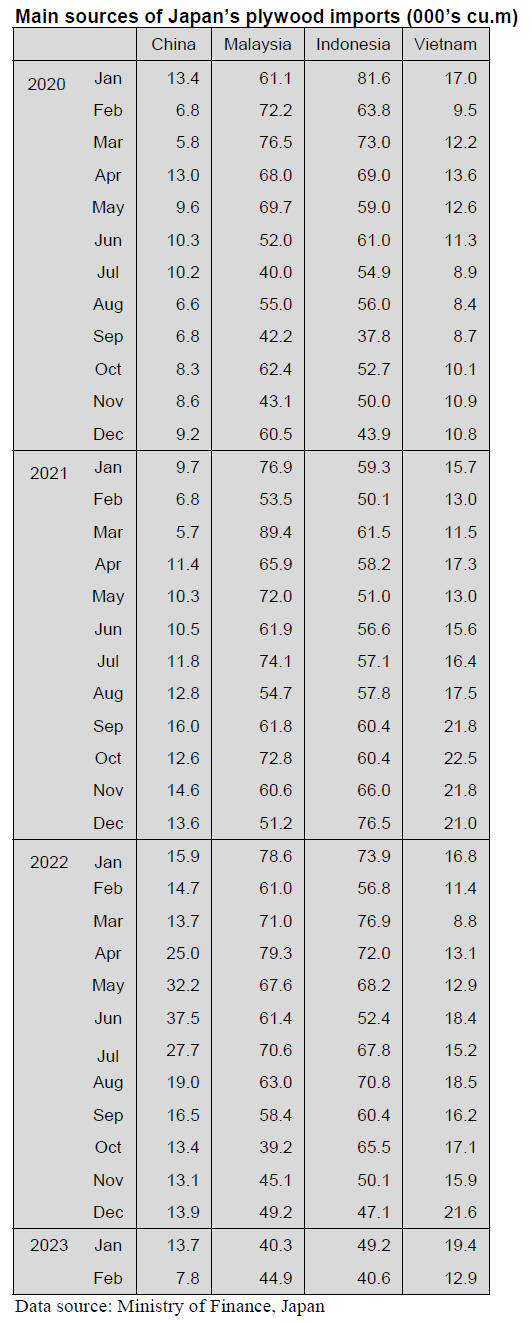

The volume of plywood imports into Japan has been

declining since the beginning of 2022 as milling of

domestic logs for plywood has increased. In 2022

Malaysia and Indonesia accounted for over 80% of the

volume of Japan’s plywood imports and while this

dominace of imports is being maintained the total volumes

of imports from all sources has dropped.

In February 2023 shipments of plywood from Malaysia

were down over 26% year on year and shipments from

Indonesia were down almost 30% over the same period.

Shippers of plywood in China saw a 47% drop in volumes

imported by Japan in February mainly because of the

Chinese New Year celebrations. Month on month there

was a 34% drop in the volume of plywood imported from

Vietnam.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

A new plant in Vietnam

Ed. Inter Co., Ltd. in Hyogo Prefecture finished building a

plant in Vietnam. A completion ceremony was held on

10th, March. Ed. Inter is well known as a wooden toy

manufacturer in Japan. The new plant is located at Bau

Bang Industrial Park in Binh Duong Province. The site of

the plants is 12,000 square meters and the plants building

is 5,000 square meters. The company will increase the

production five times by 2028.

The company has not only certifications for Japan but also

for Europe and the U.S.A. such as CE marking and ASTM

International. The company is also able to use FSC lumber

and will get ISO9001 and BSCI certifications in this year.

METRO Particle secures certifications

METRO Particle Co., Ltd. in Thailand, one of

METROPLY Group’s companies, got certifications of JIS

(Japanese Industrial Standards) on particleboards and lowpressure

melamine boards on 27th, February. METRO

Particle produces particleboards, low-pressure melamine

boards and high-pressure melamine boards.

The particleboards of the company consist of 95% gum

and 5% eucalyptus or fruitwood. The company will

increase using eucalyptus more because the company

owns an afforested area of eucalyptus in southern part of

Bangkok.

Urea resin and melamine resin are used as glue mainly and

sometimes MDI (methylene diphenyl diisocyanate) is used

as glue. The company supplies 80% production to

overseas and 20% of production to Thailand. Productive

capacity of JIS particleboard is 300,000 cbms annually and

of JIS low-pressure melamine board is 900,000 sheets

annually.

The company supplies about 4,000 low-pressure melamine

boards to Japan Kenzai Co., Ltd. in Japan in a month.

Since the company got the certifications of JIS, production

of low-pressure melamine boards will be raised to 40,000

boards from 4,000 boards. There are two more plants in

Thailand.

The company also produces MDF, plywood, hard boards,

LVL, wood veneers, flush doors and laminated floorings.

To start operation at wood biomass power plant

Aioi wood biomass power plant, which was invested by

The Kansai Electric Power Company, Incorporated and

Mitsubishi Corporation Energy Solutions Ltd., has started

an operation on 24th, March in Hyogo Prefecture.

The power output is 200,000 kw. This wood biomass

power plant is the largest plant in Japan.

It supposed to start an operation in the middle of January,

2023 but equipment, which sends wooden pellets to a

boiler, was imperfect so the operation delayed.

An annual electric power generation of the wood biomass

power plant is 1.3 billion kwh and about 550,000 tons of

CO2 will be reduced. About 600,000 – 700,000 tons of

woody pellets will be consumed and natural gas will be

used as a burning assistant.

There are several wood biomass power plants, which are

related to The Kansai Electric Power Company, in Japan.

One of them is Asago biomass power plant built in

December, 2016 in Hyogo Prefecture, which is not in

operation right now, and the power output is 5,600 kw.

The other power plant is Kanda power plant in Fukuoka

Prefecture started an operation in February, 2021 and its

power output is 75,000 kw. Another power plant is Iwaki

biomass power plant started an operation in April, 2022

and its power output is 112,000 kw. Aioi wood biomass

power plants is the fourth biomass power plant for the

company.

The Kansai Electric Power Company will create 5,000,000

kw renewable energy by 2040 and will develop to create

9,000,000 kw renewable energy in the future.

|