Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Aug

2022

Japan Yen 137.13

Reports From Japan

Consumer spending led growth

Japan¡¯s GDP grew at an annualised rate of 2.2% in the

second quarter of 2022 and that pulled the economy to

above what it was at the end of 2019 as consumer

spending rose and as covid restrictions on businesses were

ended. Consumer spending, which accounts for more than

half of Japan¡¯s economic output, led the growth as did

capital expenditure.

Economists expect the Bank of Japan to maintain its

current easing policy and the government to continue

providing support for households hit by both the pandemic

and more recently by surging prices. After taking account

of inflation, worker spending power has been falling for

three consecutive months.

The Norinchukin Research Institute has said it anticipates

growth will continue in the third quarter but that the pace

may slow as inflation takes a toll on disposable incomes.

The way ahead remains uncertain as slowing global

growth, rising inflation, supply chain constraints, a

weakening yen and the recent surge in covis infections

present multiple challenges.

See:

https://www.japantimes.co.jp/news/2022/08/15/business/economy-business/japan-economy-recovery/

Despite the good news most experts remain cautious about

the future. Consumer prices are rising driven by higher

commodity prices. Recently oil prices have begun to

decline but consumers are yet to benefit from this. A

government survey showed that most people expect prices

will remain high or increase.

This consumer pessimism stems from the jump in prices of

energy and food. Electricity prices are up almost 20%

from a year ago as is the cost of gas and low income

families are seriously affected.

Reiko Sakurai, NHK Senior Economic Commentator,

writes ¡°For the past 20 years, Japan has neglected to

prepare for the future. It has invested far less than other

G7 countries in corporate capital expenditure, public- and

private-sector research and development and human

resource development. The result is weak potential for

economic growth, which is why the latest GDP numbers

might not be quite the harbinger of recovery that they

appear¡±.

See:

https://www3.nhk.or.jp/nhkworld/en/news/backstories/2079/

Tax incentives for private forest owners

In 2023 Japan¡¯s Ministry of Environment will offer tax

incentives for private forest owners if they are recognised

as contributing to biodiversity conservation. The

incentives will include real estate acquisition and property

tax reductions for forests where habitats for rare plants and

animals remain conserved. Details of the plan are to be

decided.

At their summit in June 2021 leaders of the G7 including

Japan set a goal of protecting at least 30% of their

countries' land and oceans as healthy ecosystems by 2030.

Currently, the government designates 20.5% of Japan's

land area and 13.3% of its sea area as natural preservation

zones. Since this will not be enough private sector nature

conservation will be encouraged and rewarded.

See:

https://www.japantimes.co.jp/news/2022/08/24/business/privatesector-satoyama-forest-conservation/

Covid travel rules eased further

Japan will enact a series of reduced COVID-19 measures

starting 7 September that will make it easier for people to

enter the country. The government will scrap the need for

a negative COVID test prior to arrival (for all travelers

with at least three vaccine shots) and will increase the cap

on daily visitors to the country. At present, travelers to

Japan must present to airlines a negative Covid PCR test

taken within 72 hours of departure for Japan which has

been called a ¡°major hindrance¡± for both international

visitors and Japanese citizens.

See:

https://www.travelagentcentral.com/asia/japan-ease-entryrequirements-september-7

Japan pledges US$30 billion for Adrican Development

The Eighth Tokyo International Conference on African

Development (TICAD8) held in Tunisia concluded

recently. Japan pledged US$30 bil. in aid for development

in Africa saying it wants to work more closely with

African countries at a time when the rules-based

international order is under threat after Russia¡¯s invasion

of Ukraine.

See:https://www.mofa.go.jp/afr/af2/page1e_000469.html

A report on the TICAD8 Joint Press Conference can be seen at:

https://japan.kantei.go.jp/101_kishida/statement/202208/_00024.html

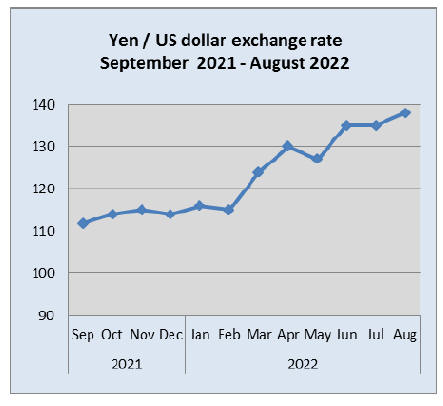

Yen likely to dip further

The divergence between Japanese and U.S. bond yields

has pushed the yen down 15% so far this year and it may

be the yen is heading for its biggest fall against the dollar

since 2013 and third steepest since the era of free-floating

exchange rates began in the early 1970s.

At the end of August the yen was trading around 137 per

dollar and speculation is that uncurbed inflation could

push it closer to a 24 year low of yen 140 per dollar.

See:https://www.asahi.com/ajw/articles/14698540

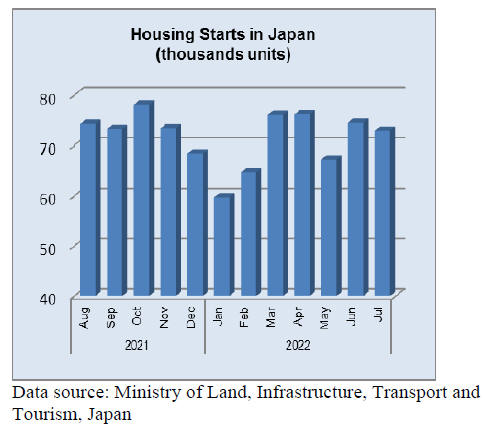

Housing starts in July came in 6% below those of

July

2021 and were slightly below the 75,000 starts in June.

July is not the main holiday period in Japan and it is likely

that August starts will be below the July level.

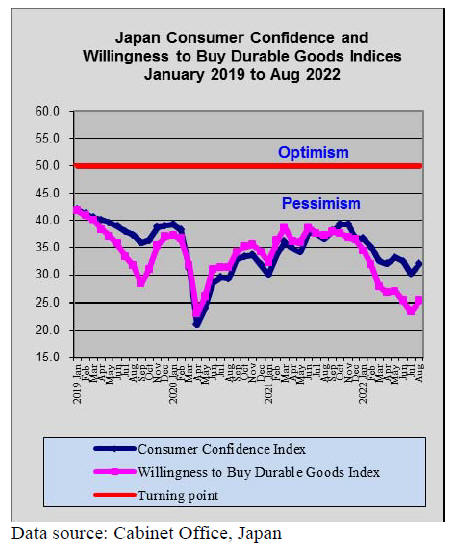

Up-tick in consumer confidence

The consumer confidence index rose slightly in August

which was a welcome change after the continual drop

since the beginning of this year. Households expect prices

to rise in the next 12 months which could sugnal a further

drop in consumption which has been observed in other

countries.

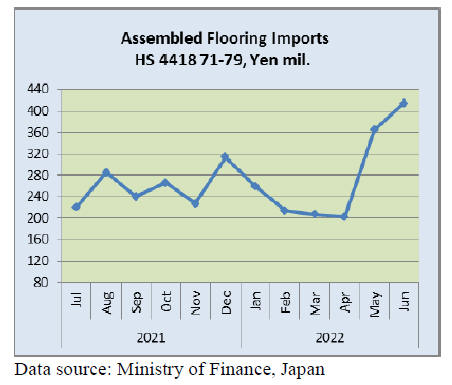

Import update

Assembled wooden flooring imports

The steep rise in the value of assembled wooden flooring

imports (HS441871-79) in June this year can be partly

explained by the depreciation of the yen which, in June,

was down around 7% against the US dollar. But the

exchange rate effect cannot explain the 65% year on year

rise in the value of imports.

The May surge in the value of imports brought the

monthly value back to the average for the preceeding

months.

Of total assembled flooring imports China was the

main

supplier in June accounting for around 55% of all

HS441871-79 imports. HS441875 is the main category of

flooring imports accounting for just over 50% of the total

but within this category most in June was shipped from

Austria, France and Vietnam. Shipments of HS441875

from China were well below those seen earlier in the year.

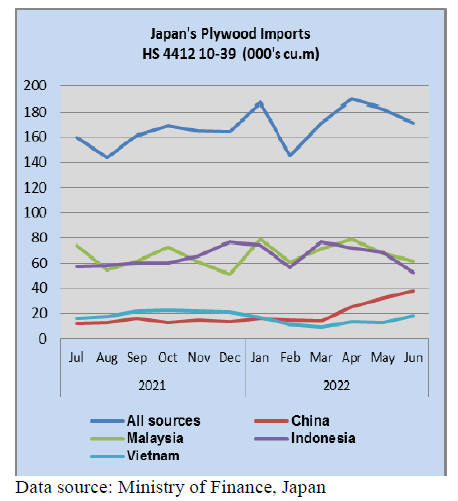

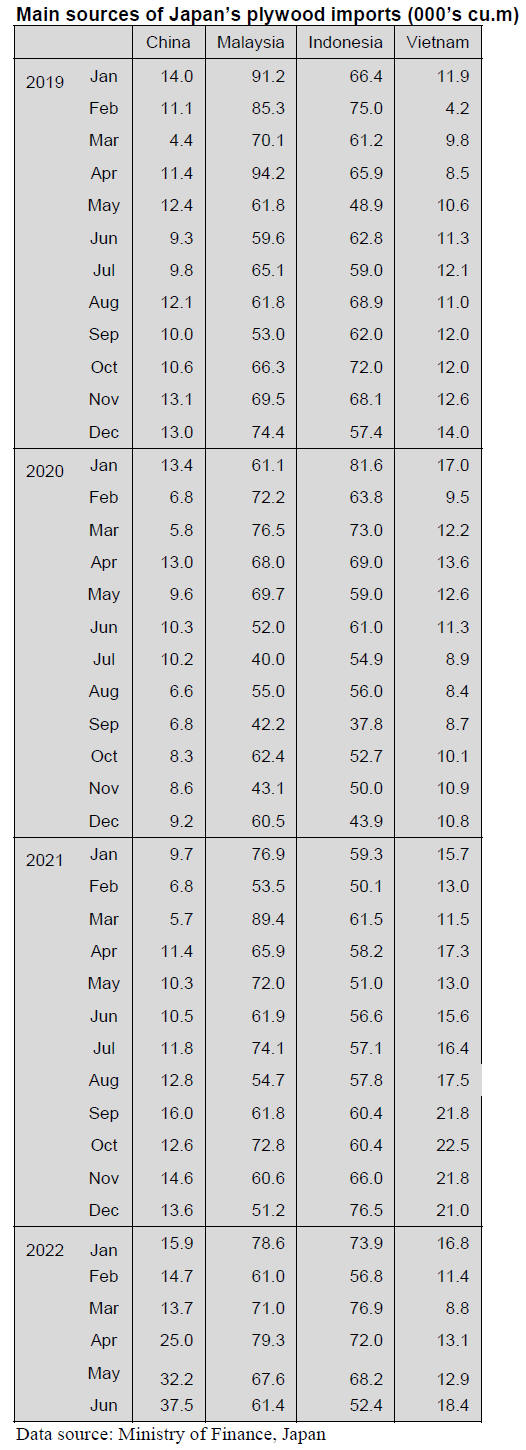

Plywood imports

June imports of plywood stood at 171,465 cu.m up 17%

year on year but down 6% from the previous month.

Indonesia and Malaysia are the main suppliers of plywood

to Japan and together they accounted for close to 70% of

Japan¡¯s June imports. Plywood imports from China have

been steadily rising since the start of the second quarter

and at almost 38,000 cu.m June imports accounted for

over 20% of total plywood imports. Shippers of plywood

in Vietnam also did well in June seeing an almost 40%

increase in shipment.

June shipments from Indonesia fell just over 20% month

on month in June and shipments from Malaysia were

down slightly in June and well below the average for the

year so far.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Log export to China

Export of cedar logs for China is sluggish even though the

lockdown in China was lifted in June. An export volume

in May is 69,592 cbms, 47.3% less than the same month in

2021. This is for the first time with low level since last

August. Some reasons are a business downturn and a weak

real estate market in China.

Over 200,000 cbms of cedar logs were stocked around

Shanghai when the lockdown was lifted then the inventory

at ports dropped down around 160,000 cbms. However, a

shipment from plants and ports is slow and demand from

Chinese importers is inactive.

The present selling prices are around US$140, C&F per

cbm and it is about US$20 lower than the prices in last

spring. The purchase price of logs for exporters is 9,500

yen at ports per cbm and it is 1,500 yen lower than the

peak prices. The prices of ocean freights decreased from

US$140,000 per ship to US$100,000 ¨C 110,000. A weak

yen also makes the selling prices decreasing. Weak yen

helps exporters¡¯ profitability despite drop of dollar export

prices.

It has been four years since the U.S.A. imposed a duty on

logs to China. If the 25% sanction duty decreases, demand

for cedar fences for the U.S. market would be back.

Recently, people have an attention on the prices of NZ

logs. The prices are around US$145, C&F per cbm. It is

difficult to lower the export prices of cedar logs now

because there will be no profit so New Zealand radiate

pine log export prices are concern to Japanese cedar

exporters.

Domestic cedar logs markets are good. Inventory at plants

for lumber and plywood is enough. However, there are not

enough inventory for wooden biomass and the prices are

8,500 yen, delivered a tonne. As long as biomass wood

prices stay up high, it is difficult to reduce cedar log

export prices. Demand in China is less than supply.

Plywood

There is still a shortage of domestic softwood plywood.

The reasons are that demand decreased and Chinese

softwood plywood was imported in May and June with a

volume of 19,000 cbms. However, Japanese plywood

companies¡¯ shipment are very good. The inventory at the

end of June was 92,200 cbms. Shipment base is 0.3 month.

The prices of 3 x 6 and 12mm thickness of plywood are

holding at 2,000 yen, delivered per sheet.

The prices of South Sea plywood are still high. Since it

will be in rainy season in South Asia when new contracts

are produced, there are not much new orders and product

will be started after October. 3 x 6 JAS plywood panel for

concrete forming from costs US$850, C&F per cbm and

the yen cost will be higher in Japan due to a weak yen.

A movement of imported South Sea plywood is sluggish.

This is an unusual situation in this season. Usually, the

sluggish movement occurs at the end of July through

August but it has been slow since the beginning of this

year.

Future prices of JAS 3 x 6 plywood panel for concrete

forming are 2,450 yen, FOB per sheet and this is 50 yen

higher than last month. The prices in Japan are 2,300 yen,

delivered per sheet and this is also 50 yen higher than last

month.

South Sea log and products

The prices of South Sea lumber and Chinese lumber are

skyrocketing due to the high- priced lumber in South Asia

and a weak yen. The prices of Merkusii pine lumber in

Indonesia are US$950, C&F per cbm and of red pine

lumber in China are US$1,020 ¨C 1,050, C&F per cbm.

It is a good season to cut down Merkusii pine in Indonesia

and Indonesian companies are willing to produce.

However, there are enough inventory in Japan so

negotiations for new contracts are rough going. Demand in

Japan is not lively. Indonesian Merkusii pine lumber in

Japan costs around 135,000 yen, delivered per cbm.

Chinese red pine lumber costs around 140,000 yen,

delivered per cbm. Both kinds of lumber are 2,000 yen

more than last month.

The movement of South Sea logs is slow even if there are

much demand of South Sea lumber for steelmakers and

ship building companies and there are not enough demand

for producing trucks. A reason is a lack of semiconductor

supply.

|