|

Report from

North America

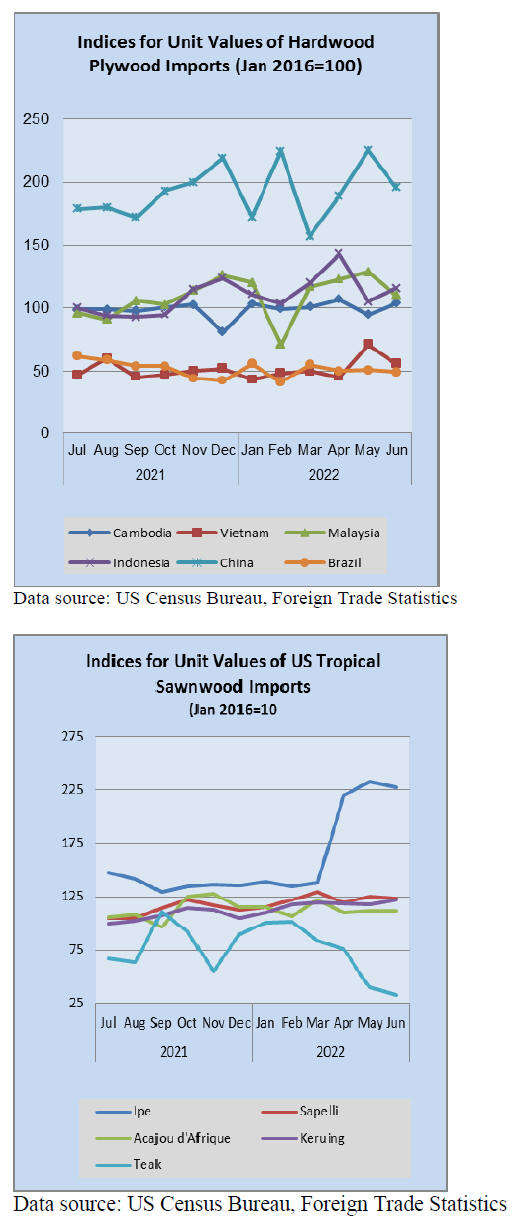

Sawn tropical hardwood imports fall

Imports of sawn tropical hardwood fell 12% in June as

volumes retreated from a near record high. The 24,229

cubic metres imported in June was the second lowest total

of the year so far. Imports of Keruing and Mahogany fell

by 22% while imports of Sapelli and Ipe decreased by 7%

and 16%, respectively. Imports of lower-volume woods

like Meranti, Iroko, and Padauk were all down more than

50%.

Imports from Indonesia and Cameroon both decreased by

more than one-third while imports from Malaysia were off

by 14%. Imports from Congo (Brazzaville) gained 43% in

June, rising to their best month of the year along with

imports from Ghana which improved by 140%.

Despite the dip, total imports of sawn tropical hardwood

remain up 211% so far this year. However, changes made

this year by the US government in how it classifies

tropical hardwoods make direct comparison with last year

difficult.

Canada increased its imports of sawn tropical hardwood

for the fifth straight month in June. The more than US$2.5

million imported was the highest total since August 2014.

The increase was driven by a huge month for Iroko

imports. More Iroko was imported into Canada in June

than in all of 2021. Overall imports are up 40% year to

date over 2021 figures.

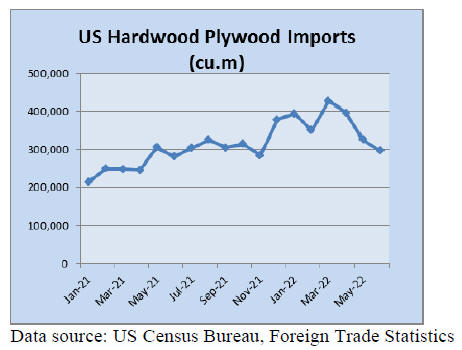

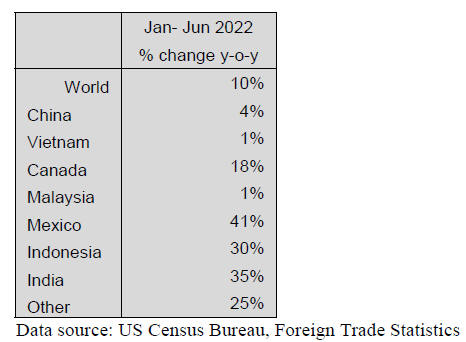

Hardwood plywood imports continue downward

US imports of hardwood plywood fell for a third straight

month, declining by 9% in June. The 296,900 cubic

metres imported was the lowest volume month of the year

and was 2.3% less than the previous June. mports from

Russia continued their decline, plunging 51% in June to

their lowest level since February 2013.

Imports from Indonesia and Malaysia both fell more than

40%, while imports from Vietnam and China rebounded

strongly from poor volume in May. Year to date, imports

from Russia are still up 4%, but most every other trading

partner is showing much larger gains in 2022. Overall

volume is up 41% through the first half of the year.

Veneer imports advance

Imports of tropical hardwood veneer rose 8% in June as

imports from Cameroon leapt to their highest totals in

more than four years. Imports from Italy also gained

sharply while imports from India, Ghana and Cote d¡¯Ivoire

all retreated by more than half.

Total imports are up 31% through the first half of 2022,

with nearly all trading partners showing gains of 10% or

more. Imports from Cote d¡¯Ivoire are the exception, down

14% versus last year through June.

Hardwood flooring imports tumble

Imports of hardwood flooring came back to earth in June

after a record showing in May. Imports declined 21%,

mostly due to a steep drop in imports from lower-volume

supply countries such as Vietnam and a 7% drop in

imports from Malaysia.

Imports from the top US trading partners either stayed

level (Brazil down less than 1%) or improved (Indonesia

up 70%, China up 10%). Total imports are ahead of last

year 14% through the first half of 2022.

Imports of assembled flooring panels gained 6% in June.

Imports from Brazil more than doubled while imports

from Indonesia grew by 70%. This was offset to some

degree by declines of around 20% in imports from China

and Thailand.

Total imports of assembled flooring panels are up 57%

through the first half of the year as imports from Brazil are

more than double that of 2021 so far and imports from

Thailand are up more than fourfold.

Moulding imports remain flat

Imports of hardwood mouldings rose a modest 2% in June.

Imports from Brazil and China rose sharply to rebound

from weak May numbers. Imports from top supplier

Canada did just the opposite, falling 15%, continuing an

up and down pattern we¡¯ve seen all year.

Despite the volatility by countries each month, imports are

up sharply among all suppliers year to date. Through the

first half of the year, total imports are ahead by 38% over

2021 with imports from Brazil up 86%, China up 54%,

and Canada up 36%.

Wooden furniture imports retreat

After setting an all-time record in May, US imports of

wooden furniture fell by 7% in June. Despite the retreat,

the US$2.33 billion of goods imported was more than 5%

higher than the previous June and among the strongest

months ever.

Imports fell from nearly every major partner with imports

from India, Malaysia and Vietnam seeing the steepest

declines. Still, total imports of wooden furniture are up

10% through the first half of 2022 with all major trading

partners ahead of 2021 totals.

Lower duties on Canadian sawnwood, Canada wants

them removed

The Commerce Department ruled this month that the tariff

applied to some Canadian sawn softwood imports will

drop to 8.59% from 17.91%. Canada¡¯s government said

the US tariffs have caused ¡°unjustified harm¡± to the

industry and workers.

The Trump administration imposed tariffs on Canadian

softwood lumber in 2017 saying the industry is unfairly

subsidised. The US raised rates on imports in 2021 even as

an unprecedented rally lifted prices to record highs during

a pandemic-fueled homebuilding and renovation boom.

¡°Canada is disappointed that the United States continues

to impose unwarranted and unfair duties,¡± International

Trade Minister Mary Ng said in a statement.

¡°While the duty rates will decrease from the current levels

for the majority of exporters, the only truly fair outcome

would be for the United States to cease applying baseless

duties.¡±

See:

https://www.woodworkingnetwork.com/news/woodworkingindustry-news/war-words-over-continuing-lumber-tariffs

|