4.

INDONESIA

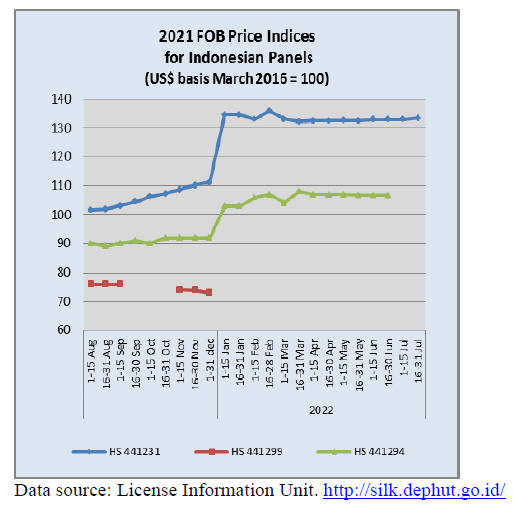

Disrupted global economies but wood

product exports

still positive

Despite the current global issues due to the prolonged

Covid-19 pandemic and the continued aggression by

Russia in Ukraine, wood product exports are encouraging.

As of June wood product exports totalled US$7.06 billion,

an increase of 11% year on year.

The performance up to June was driven by exports of three

products, paper, woodbased panels and pulp.

The value of paper product exports was US$2.05 billion

(up 6.4% YoY), woodbased panels at US$1.66 billion (up

27% YoY) and pulp at US$1.56 billion. The other product

recording growth was prefabricated buildings. The slowest

growth was recorded for joinery products.

The upstream sector also experienced a positive trend.

Production of logs from natural forests, plantation forests

and Perhutani managed areas increased slightly. Until June

log production from natural forests was 2.30 million

cu.m,, an increase of 0.2% year on year. Log production

from plantation forests was 22.44 million cu.m,, up 2.2%.

See:

https://forestinsights.id/2022/07/16/ekonomi-globalbergejolak-ekspor-produk-kayu-indonesia-masih-catat-trenpositif/

Breakthrough in exports of Lightwood products

The Minister of Trade, Zulkifli Hasan, said he applauds

the efforts being made by the Indonesian Light Wood

Association (ILWA) to improve exports through

collaboration with a light wood processing company in

Austria.

ILWA will work to increase the added value of light wood

products through capacity expansion, product

adaptation/innovation and technology utilisation.

In 2021 Indonesia's exports of light wood products

(plywood and flooring) totalled US$3.2 billion or 45% of

Indonesia's total exports of wood products. Indonesia's

wood product exports in 2021 reached US$7.94 billion, an

increase of 31% compared to the previous year.

See:

https://wartaekonomi.co.id/read431253/tingkatkan-kinerjaekspor-produk-kayu-ringan-mendag-zulkifli-hasan-dukungterobosan-ilwa

'Redefine, Inspire, Innovation' theme for IFEX 2022

The Indonesian Furniture and Handicraft Industry

Association (HIMKI) and Dyandra Promosindo, a leading

professional exhibition organiser, are preparing to stage

Indonesia's largest B2B furniture and craft exhibition,

‘Indonesia International Furniture Expo’ (IFEX) 2022 on

18-21 August. Abdul Sobur, chairman of HIMKI, said

more than 200 exhibitors (more than 95% of the target

exhibitors) will participate in this year's show. The theme

for the exhibition is 'Redefine, Inspire, Innovation' and the

aim is to redefine the concept of furniture and handicraft

products for the international market, inspire local

products to compete in the global market and present the

latest innovations in furniture and handicraft products.

Indonesian exports of furniture and handicrafts in 2021

were recorded at US$3.46 bil. Up 27% year on year.

See:

https://www.furniturenews.net/events/articles/2022/08/18/32278579-indonesian-exhibition-set-galvanise-local-industry

and

https://ifexindonesia.com/

‘NeXT Forest’ a technology for peat-forest

management

Sumitomo Forestry Co., Ltd. and the IHI Corporation have

joined forces to introduce satellite technology via ‘NeXT

Forest’ a project that can guide companies holding Forest

Utilisation Permits (PBPH) and oil palm plantations to

address the challenges of managing peatlands and tropical

forests. The Director General of Sustainable Forest

Management at the Ministry of Environment and Forestry

(KLHK), Agus Justianto, indicated that he hopes NeXT

Forest can support Indonesia's FOLU Net Sink 2030.

‘NeXT Forest’ combines Sumitomo’s Forestry experience

and knowledge of best practices in peat management with

satellite technology and weather monitoring system

developed by a leading Japanese company, IHI

Corporation. NeXT Forest is a tool for oil palm plantation

and peatland forest managers and is able to monitor the

health of the forest and will support the development of

Indonesia’s carbon credit market.

See:

https://agroindonesia.co.id/sumitomo-forestry-ihicorporation-perkenalkan-next-forest-tawarkan-solusipengelolaan-hutan-gambut-berkelanjutan/

and

https://www.ihi.co.jp/csr/english/nextforest/

Young forest rangers have crucial role in forestry

sector: ministry

Bambang Hendroyono, ,Secretary General of the Ministry

of Environment and Forestry said young forest rangers

who contribute to the management of forests have an

important role in the forestry sector. He encouraged young

foresters to become initiators, actors, motivators, catalysts

and even educators in promoting forestry development. In

this quickly changing world imaginative leadership is

needed in all sectors and levels of organisations including

the forestry sector, he said.

See:

https://en.antaranews.com/news/239945/young-forestrangers-have-crucial-role-in-forestry-sector-ministry

5.

MYANMAR

Timber drops from list of major

exports

Exports of agricultural products earned US$4,624 million

in fiscal 2020-2021. The main products were rice, broken

rice, beans and pulses. Despite of the depreciation of

MMK, exporters did not enjoy a rise in income as earnings

had to be exchanged for local currency at the fixed rate of

1850 MMK. In the unofficial market the dollar earns

MMK2,500 MMK.

Timber exports were previously among the top three

export products since 2000 but the ranking declined from

2014 when the log export ban was introduced. Before

2014 timber exports were worth over US$500 million

annually.

Ways to increase foreign reserve holdings

It has been confirmed that the Central Bank ordered the

Myanma Timber Enterprise (MTE) to conduct its sales in

local currency (MMK) and also to accept the MMK at a

fixed exchange rate of MMK1,850 per dollar for logs sold

prior the new regulation. Timber exporters are less

impacted compared to importers in other sectors relying

on imported raw materials, prices of which increased by

40 to 60%.

It is also learnt that the Forest Joint Venture Corporation,

an economic institution with a large the government

shareholding, has been required to convert its US$

holdings to MMK. According to information from the last

General Assembly, FJVC had around US$16-18 million in

cash deposits. This new exchange regulation resulted in

the FJVC to lose about MMK10 billion because of the

government fixed exchange rate.

Currency chaos continues

In a recent press conference a Deputy Minister in the

government stated that the government has considerable

foreign reserve and there is no possibility of state

bankruptcy like Sri Lanka. Despite of these assurances

demand for the US dollar is growing as a result of

the alarming rate of depreciation rate of MMK.

Recently, the Ministry of Trade said that import license

will only be issued if the importer buy dollars from the

bank. The result of this is that prices have shot up. For

example prices for medicines have increased at 25 to

50% and many essential drugs are no longer avaialble.

In a recent move, the Central Bank has ordered companies

and individual borrowers to suspend repayment of foreign

loans as foreign reserves fall. In a related development, the

Central Bank ordered companies with up to 35% foreign

ownership to convert foreign exchange holdings into the

local currency.

Myanmar GDP at bottom of ASEAN

Singapore is ASEAN’s richest country with a GDP per

capita of US$65,233 while Myanmar is at the bottom in

ASEAN. Brunei and Malaysia are the second and the

third-richest countries with per capita GDP of US$31,087

and US$11,414.

By contrast, Myanmar is among the poorest country in the

region, with a GDP per capita of US$1,408. East Timor

and Cambodia also have a GDP per capita of less than

US$2,000.

6.

INDIA

More trade with Russia

The Reserve Bank of India (RBI) has endorsed use of the

rupee for international settlements which will likely

increase Russia-Indian trade. Indian imports from Russia

jumped 272% in the April-May period this year as Russian

companies search for alternative markets.

The Russian oil and gas sectors have been the main

exporters to India but it is reported the two countries are

seeking ways to diversify trade beyond the traditional

areas. India is looking at expanding into new areas such as

coking coal, timber, LNG and agricultural products.

See:

https://www.russia-briefing.com/news/why-russianexporters-should-be-looking-to-the-india-consumer-market-fordiversifying-trade.html/

Rising interest rates dampen consumer sentiment

There were signs in June that economic activity was

slowing as price increases, rising interest rates and a

weakening rupee dampened consumer sentiment. Pent-up

demand drove an economic revival but now rising prices

are biting. The RBI raised rates recently to slow price

growth and is likely to raise rates when it meets again.

See:

https://economictimes.indiatimes.com/news/economy/indicators/indias-economic-recovery-falters-as-high-prices-start-tobite/articleshow/93015250.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

In mid July the rupee fell to an all-time low of

80.05 against the US dollar. This has pushed up import

costs which are hard to pass on currently.

See:

https://www.outlookindia.com/business/rupee-below-80-atwhat-level-will-it-become-unsustainable-for-indian-economy--news-209585

Declining investment in real estate

As prospects for continued growth in the short term have

weaked institutional investments in the Indian real estate

sector has fallen. In the second quarter of this year there

was a 27% year on year drop in total investments. In the

office segment there was an increase in investment but it

was the lower investment in the housing segment that

pulled down the overall figure.

See:

https://www.jll.co.in/en/trends-and-insights/research/pulsereal-estate-monthly-monitor-may-2022

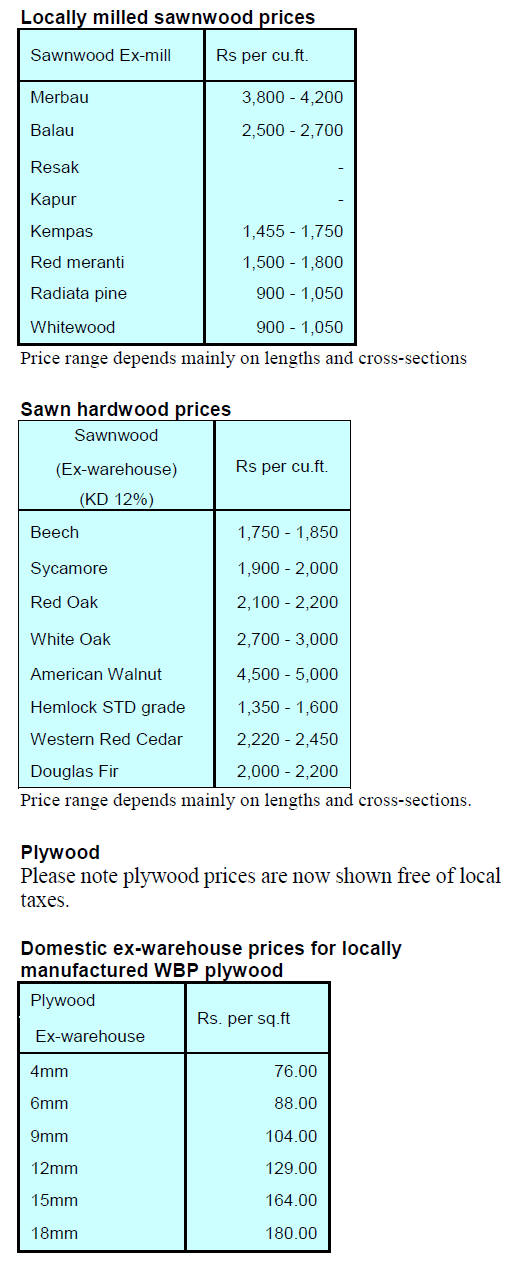

Plywood market sluggish

The slowing of economic growth has impacted sales of

wood products and the plywood sector has been affected.

Weak sentiment, a reaction to steep inflation, rising costs

and labour shortages are major issues. Recent efforts to

raise plywood prices have met with little success

especially by small producers which need to sustain sales

in a down market.

A PlyReporter “Market Sentiment Survey” found that

major plywood sales in the tier three cities have been

performing well for plywood and laminates thanks to

various projects and steady demand for

furniture. PlyReporter foresees a pickup in sales during

June-July and that the resumption of work-in-office will

help drive sales.

See:

https://www.plyreporter.com/article/93087/plywooddemand-remain-to-be-sluggish

7.

VIETNAM

Wood and wood product (W&WP) trade highlights

Export earnings from W&WPs in June 2022 reached

US$1.4 billion, down 10.9% compared to June 2021. Of

this WP exports reached US$ 936.5 million, down 25%

compared to June 2021. For the first 6 months of 2022

W&WP exports reached US$8.4 billion, up 1.7% over the

same period in 2021.

The W&WP exports to Japan in June 2022 reached

US$166 million, up 3% compared to June 2021. In the

first half of 2022 W&WP exports to Japan reached

US$844.3 million. a rise of almost 20% over the same

period in 2021.

In June 2022 exports of wooden bedroom furniture earned

US$205.2 million, down 12% compared to June 2021. In

the first 6 months of 2022 earnings from the export of

wooden bedroom furniture reached US$1.28 billion, up

3.4% over the same period in 2021.

W&WP imports in June 2022 reached US$303 million,

down 5.4% compared to May 2022 but compared to June

2021 it increased by 13%. In the first 6 months of 2022

imports reached US$1,577 billion, up 2.0% over the same

period in 2021.

Vietnam's imports of ash wood in June 2022 are estimated

at 36,700 cu.m, worth US$8.8 million, down 2% in

volume and 5.4% in value compared to May 2022.

Compared to June 2021 imports were up 7.4% in volume

and 8.8% in value.

Imports of logs and sawnwood from the US in May 2022

reached 56,310 cu.m, worth US$28.54 million, up 33.8%

in volume and 35.6% in value compared to April 2022 but

down 2.3% in volume, but up 11.0% in value compared to

May 2021.

In general, in the first 5 months of 2022 imports of logs

and sawnwood from the US reached 211,285 cu.m, worth

US$102.01 million, down 33.9% in volume and 21% in

value over the same period in 2021.

W&WP exports to Japan surging

W&WP exports to Japan in June 2022 reached US$166

million, up 34.9% compared to June 2021. In the first half

of 2022 exports to Japan totalled at US$844.3 million, up

20% over the same period in 2021.

Exports of woodchips, wood-based panels, flooring,

wooden doors and handicrafts increased sharply in May

2022 leading to a significant increase exports to Japan.

Wooden furniture was the second largest export group

to Japan in the first 5 months of 2022 and were worth US$

226.8 million, up 1.3% over the same period last year.

Demand for wooden furniture in Japan has always been

high. In the global market Japan is the 5th largest import

market after the US, EU, UK and Canada. Japan's import

of wooden furniture in the first 5 months of 2022, reached

330,000 tonnes worth 23.2 billion yen , down 8% in

volume but up 11% in value over the same period in

2021.

Japan imported the largest volume of wooden furniture

from China reaching 150,100 tonnes worth 58.7 billion

yen, down 8.5% in volume and 10.5% in value over the

same period in 2021.

This was followed by imports from Vietnam reaching

84,400 tonnes, worth 29.7 billion yen, down 7.9% in

volume but up 13.4% in value over the same period in

2021.

Amongst the range of wooden furniture exported from

Vietnam to Japan in the first 5 months of 2022 livingroom

and dining-room furniture accounted for 21% ,

bedroom furniture (34%), wooden seats (25%), kitchen

furniture (49%) and the balance was mainly office

furniture.

Vietnamese manufacturers exporting to Japan enjoy the

advantage of tax reductions under the free trade

agreements to which Vietnam and Japan are signatories,

such as Vietnam - Japan Economic Partnership Agreement

(VJEPA), ASEAN - Japan Comprehensive Economic

Partnership (AJCEP), Comprehensive and Progressive

Agreement for Trans-Pacific Partnership (CPTPP),

Regional Comprehensive Economic Partnership

Agreement (RCEP).

Ash wood imports in the first 6 months of 2022

In the first 6 months of 2022, ash wood imports amounted

to 195,400 cu.m, worth US$45.9 million, down 21.6% in

volume and 22.2% in value year on year.

Imports of ash from the EU were the largest reaching

152,200 cu.m, worth US$34.5 million down 21.5% in

volume and 23.8% in value over the same period in 2021.

Imports from Belgium decreased by 29%; France down

by 7%; the Netherlands dropped by 18%; Denmark fell by

22%; Croatia minus 9% against the same period in 2021.

Ash imported from the US accounted for 1.4% of total

imports, reaching 2,300 cu.m, worth US$1.5 million,

down 72% in volume and 51% in value over the same

period in 2021. The average import price of ash logs in the

first 5 months of 2022 was US$ 234/cu.m, down 1.3%

over the same period in 2021.

Wood imports from the US regaining growth

Following many months of decline Vietnam’s imports of

logs and sawnwood from the US have increased. Imports

of log and sawnwood from the US in June 2022 increased

for the 4th consecutive month reaching 78,000 cu.m.

In the first 6 months of 2022 imports of logs and

sawnwood from the US were estimated at 289,285 cu.m,

with the value of US140.01 million, down 23% in volume

and 9% in value over the same period in 2021.

To assure the legality of exported wood products in line

with VPA/FLEGT requirements Vietnam needs a large

quantity of wood imported from low-risk sources such as

the US. To satisfy the demands of certain groups of US

customers Vietnamese furniture manufacturers have been

using American wood to produce furniture for export to

the US market. With the lower price of sawnwood sourced

in the US imports of log and sawnwood from the US are

expected to rise further.

In the first 5 months of 2022, the average price of

imported sawnwood from the US was US$645/cu.m, up

by 48% over the same period in 2021.

Doubts raised on timber company growth prospects

Wood products sales are rising bringing some relief to

manufacturers. However, skyrocketing prices of raw

materials and logistic costs will weigh on profits this year.

VNDIRECT Securities Corporation estimated that the

total revenue of listed wood and wood products companies

in the first quarter (Q1) of 2022 rose by 10.2% year-onyear

thanks to the recovery of wood product

manufacturers in the south.

After the social distancing order was lifted most wood

product manufacturers in the southern region resumed

operations at 90% capacity in the first quarter of 2022, in

the second half of 2021 it was only 60-65%.

The Market research and consulting firm Grand View

Research forecast that the US wooden furniture market

value would grow by around 7.9% over the five years

from 2022 to 2027 driven by significant growth in singlefamily

houses, while home loans in the US are at the

highest level since 2018, with home loan contracts up 8%

over last year in April.

Analysts expected that high demand for housing in the US

would boost the purchase of wooden furniture products

and that Vietnam’s timber industry could benefit from

China's reduction in production capacity.

Despite countries around the world easing COVID

measures, China continued to pursue the zero COVID

policy with prolonged lockdowns in many areas such as

Jiangsu, Jilin, Guangdong and Shanghai. It has been

reported that three of the ten largest wood manufacturers

in China have had to close factories in Shanghai and

Jiangsu due to the impact of COVID-19.

The securities firm forecast that the real estate market

would witness a recovery in the supply side in 2022 as

developers would focus on boosting sales to improve cash

flow. This was reflected in the prospects of strong growth

in sales of listed real estate companies this year.

VNDIRECT believes that the profit margins of wood and

furniture companies in 2022 would be affected as the

supply shortage would continue to push up the price of

wood materials. This year the gross profit margin of wood

and furniture companies would continue to fall 0.4-0.6

percentage points, VNDIRECT said.

Container shipping costs have increased from US$1,00 per

40ft container (Shanghai-Los Angeles route) in July 2019

to nearly US$8,850 per 40ft container in March, six times

higher over five years.

Although transportation costs have shown signs of cooling

in April, down 10% from the previous month, the

securities company still expected that logistics costs would

remain at a high level.

See:

https://en.vietnamplus.vn/rising-costs-cast-doubt-on-woodcompanies-growth-prospects/231868.vnp

Investigation into Vietnam's export of wooden cabinets

The Vietnam Timber and Forest Products Association

said the US Department of Commerce (DoC) had notified

Vietnamese authorities of an application to investigate

suspicions of trade remedy tax evasion on wooden

cabinets imported from Vietnam and Malaysia.

The products proposed for investigation is wooden

cabinets with HS codes 9403.40.9060, 9403.60.8081 and

8403.90.7080. The plaintiff is the American Kitchen

Cabinet Alliance representing a number of US wood

cabinet manufacturers.

According to the Association the US issued an order to

impose anti-dumping and anti-subsidy taxes on the same

products originating from China in February 2020. Since

then exports of these products from China to the US have

plummeted by 54%. Regarding other imported timber

products from Vietnam, the DoC announced an extension

of the time to issue the final conclusion on the antidumping

and anti-subsidy tax evasion investigation

case with hardwood plywood from Vietnam.

The DoC is expected to issue its final conclusion on

October 17, 2022, instead of April 20, 2022, as previously

announced. This is the DoC's third renewal of this content.

See:

https://vietnamnews.vn/economy/1190387/us-initiates-aninvestigation-into-viet-nam-s-export-of-wooden-cabinets.html

8. BRAZIL

Proposals for forest preservation in

the Northern

Region

An expert group for the Amazonia Que Eu Quero (The

Amazon I Want) released ten suggestions to address the

problems debated in the ‘Forests’ forum according to the

Amazon Network Foundation (FRAM).

The proposals will be included in an agenda with all the

others from the five forums; Infrastructure, Clean Energy,

Economic Model in the Amazon, Entrepreneurship and

Forests, which will be delivered in September 2022 to the

Brazilian Congress.

The proposals on forests include the need to value the

cultural and economic practices in forest use, strengthen

governance, provide resources for R&D, encourage startups

and company investment, correctly value standing

forests, improve production chains and foster public

policies for the sustainable multiple use of forest

resources.

The objective of the ‘'Amazônia Que Eu Quero’' initiative

is to expand the capacity for analysis of the population of

the Northern region by gathering information on public

management. The project is developed in the states of

Amazonas, Acre, Amapá, Rondônia and Roraima.

See:

https://g1.globo.com/am/amazonas/noticia/2022/07/19/amazoniaque-eu-quero-divulga-10-propostas-de-preservacao-de-florestasda-regiao-norte.ghtml

National leader in wooden furniture exports

The State leader for exports of wooden furniture, the Santa

Catarina furniture industry, achieved earnings of

US$166.3 million in exports in the first half of 2022, an

almost 5% increase in comparison with the same period in

2021.

The United States was the main destination for Santa

Catarina furniture exports with a 58% share followed by

the United Kingdom with 9% and France with a 6%.

Among the Santa Catarina products sold abroad, the

highlight is the wooden furniture. Manufacturers in the

State have a competitive furniture industry. The sector has

great opportunities to advance in the domestic and

international markets by adding value to its products

according to the Industry Federation of Santa Catarina

(FIESC).

Industrial production of wood products increased almost

5% May 2022 compared to April 2022, this was higher

than the national average of 3.2% according to FIESC.

The pace of growth also genered new formal jobs.

Between January to May this year the timber and furniture

sectors generated 2,800 new jobs.

See:

https://visornoticias.com.br/santa-catarina-ja-exportou-maisde-r900-milhoes-em-moveis-de-madeira-em-2022/

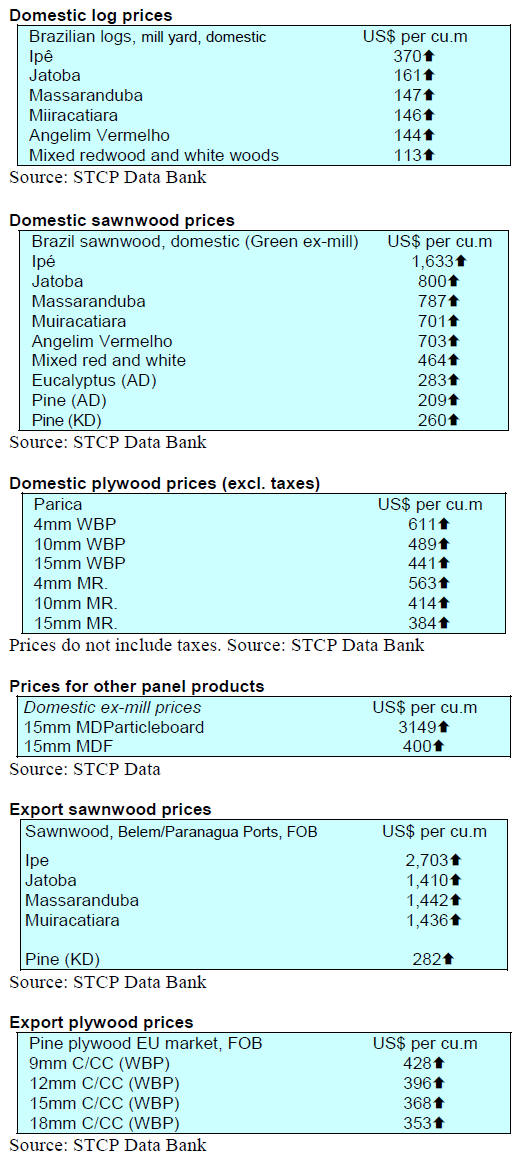

Export update

In June 2022 Brazilian exports of wood-based products

(except pulp and paper) increased 222% in value

compared to June 2021, from US$395.8 million to

US$483.5 million.

Pine sawnwood exports grew 14% in value between June

2021 (US$66.6 million) and June 2022 (US$75.8 million).

In terms of volume, exports declined 5% over the same

period, from 278,700 cu.m to 264,700 cu.m.

Tropical sawnwood exports increased significantly rising

41% in volume, from 40,000 cu.m in June 2021 to 56,300

cu.m in June 2022. In terms of value, exports grew 91%

from US$14.1 million to US$26.9 million over the same

period.

Pine plywood exports faced a 29.9% decrease in value in

June 2022 compared to June 2021, from US$138.4 million

to US$97.0 million. In volume, exports also decreased

7.5% over the same period, from 239,800 cu.m to 221,800

cu.m.

As for tropical plywood, exports increased in volume

(3.8%) and in value (25.0%), from 5,300 cu.m (US$2.8

million) in June 2021 to 5,500 cu.m (US$3.5 million) in

June 2022.

As for wooden furniture export earnings dropped from

US$62.5 million in June 2021 to US$59.3 million in June

2022, a 5% decline.

Participation in Argentine furniture fair

In order to foster trade partnerships with Argentina the

‘Orchestra Brazil’ project managed by the Furniture

Industry Union of Bento Gonçalves (Sindmóveis) with

support from the Brazilian Agency for Export Promotion

and Investment (ApexBrazil) carried 18 companies to the

mid July International Wood and Technology Fair

(FITECMA) 2022.

As the second largest economy in South America

Argentina is one of the main markets for Brazilian

furniture industry suppliers, ranking among the main

buyers of accessories, components, machinery, tools,

finishes, raw materials and technology made in Brazil. In

2021 alone the Brazilian furniture sector exported

approximately US$497.3 million to Argentina placing the

country in second position among those that most import

from Brazil behind only the United States.

See:

https://forestnews.com.br/setor-moveleiro-orchestra-brasilviaja-para-argentina-durante-fitecma/

Furniture sector registers an increase in sales

The furniture industry in the state of Rio Grande do Sul

(one of the main furniture clusters in the country) recorded

revenues of R$11.2 billion in 2021. Between January and

May this year, the industry reported profits of R$ 4.4

billion. The state accounts for a quarter of the furniture

sector revenue in Brazil according to the Association of

Furniture Industries of Rio Grande do Sul (Movergs).

In 2021 alone 2,623 new jobs were created in the furniture

sector in Rio Grande do Sul and a total of US$293 million

was earned from exports up significantly on 2020.

Between January and April 2022 companies in the state

exported US$83.5 million worth of furniture. The five

largest importers of Rio Grande do Sul furniture were the

United States, Chile, Peru, Uruguay and the United

Kingdom.

See:

https://www.jornaldocomercio.com/economia/2022/07/856179-setor-moveleiro-gaucho-registra-faturamento-de-rs-44-bilhoesentre-janeiro-e-maio.html

9. PERU

Changes to Forestry and Wildlife Law

raise concerns

The Congress in Peru Republic recently approved

substitute text for Bills 649/2021-CR and 894/2021-CR

which modify the Forestry and Wildlife Law (LFFS) No.

29763. According to the government the objective behind

the change in text is "promotion of development" during

forest zoning processes in different regions of the country.

According to Patricia Torres Muñoz, legal advisor to the

Peruvian Society of Environmental Law (SPDA), the new

provision would legalise a change of unauthorised land

use to land for agricultural purposes and this has raised

concerns as this would bypass the mandatory technical

evaluation that is required for land use change without

evaluation of the impact on the forest and wildlife

heritage.

This change also appears to remove the regulatory

function of the National Forestry and Wildlife Service

(Serfor) in its capacity as the National Forestry and

Wildlife Authority.

See:

https://agraria.pe/noticias/congreso-aprobo-sin-sustentotecnico-propuesta-que-debilitar-28636

and

https://agraria.pe/noticias/serfor-alerta-que-cambio-enclasificacion-de-tierras-y-regla-28672

High fire frequency in some Departments

The National Forest and Wildlife Service (Serfor) has

registered 449 forest fire alerts throughout the country of

which the Departments of Junín (52), Puno (50) and

Ucayali (49) had the highest number.

Serfor’s Functional Satellite Monitoring Unit (UFMS)

forwards fire reports to the Regional Forest and Wildlife

Authorities so that timely action can be taken to combat

the fires.The UFMS also registered a total of 23,283 heat

sources throughout the country. Serfor works with

satellites such as TERRA, AQUA and SUOMI NPP that

provide information on thermal anomalies and has recently

incorporated information from the GOES 16 and GOES 17

satellites for the detection of heat sources with hourly

updates.

See:https://agraria.pe/noticias/congreso-aprobo-sin-sustentotecnico-propuesta-que-debilitar-28636

High fire frequency in Junín, Puno and Ucayali

departments

In related news, Serfor together with the Regional

Governments and the Ministry of Development and Social

Inclusion (Midis), have come together with the aim of

reducing forest fires that affect wild flora and fauna

resources, forests, means of subsistence and the health of

inhabitants.

Serfor, together with 15 GORE, developed training on risk

management in the event of forest fires that included 26

virtual courses. Some 1,630 representatives of district and

provincial municipalities, prefects and sub-prefects,

universities and numerous public institutions participated

in this training.

In related news, in order to provide technical advice and

support the sustainable management of forest resources by

the Regional Government of Ucayali Serfor created a Unit

Functional Liaison (UFE).

Ucayali is the Department with the highest wood

production in the country making it a key region in the

management of forest resources and wildlife. The

functions of the UFEs are to guide, advise and serve the

users of the services provided by the Serfor in forestry and

wildlife matters as well as all the dependencies of the

Forestry Authority in the region.

See:

https://agraria.pe/noticias/congreso-aprobo-sin-sustentotecnico-propuesta-que-debilitar-28636

High fire frequency in Junín, Puno and Ucayali

departments

Peruvian timber exporter in trouble

The Office of the United States Trade Representative has

announced that the Interagency Committee on Trade in

Timber Products from Peru has directed the United States

Customs and Border Protection agency to continue to

block any timber imports from a named Peruvian exporter

as illegally harvested timber has been identified in its

supply chain.

See:

https://www.law360.com/articles/1515575/us-continuesbarring-illegally-harvested-peruvian-timber

and

https://ajot.com/news/ustr-announces-enforcement-action-toblock-illegal-timber-imports-from-peru