4.

INDONESIA

Ministry seeks Presidential

Regulation on social

forestry

The Ministry of Environment and Forestry (KLHK) has

asked the government to immediately enact a Presidential

Regulation on Integrated Planning for the Acceleration of

Social Forestry Management. Secretary General of the

Ministry of Environment and Forestry, Bambang

Hendroyono, said social forestry is a national strategic

programme that needs support from every ministry or

institution in Indonesia.

A presidential regulation is considered vital in accelerating

the distribution of social forestry so that the target area of

12.7 million hectares can be achieved.

There are three main elements for accelerating the

distribution of legal access namely forest management,

technical assistance and improving forestry business

development.

See:

https://lampung.antaranews.com/berita/627113/klhk-desakperpres-perencanaan-perhutanan-sosial-segera-diresmikan

Strengthening Global Cooperation – the answer to

world forest management

Indonesia believes that innovative solutions and

strengthened cooperation are needed to address the

challenges of sustainable forest management around the

world and much will depend on economic recovery after

the Covid-19 pandemic and efforts to mitigate climate

change. This was the view of the Indonesian delegation at

the High Level Roundtable of the 17th Sessions United

Nation Forum on Forest (UNFF).

Agus Justianto, Head of the Indonesian Delegation said it

was necessary to emphasise the role of the UN Strategic

Plan for Forests (UNSPF) as a tool to encourage

sustainable forest management based on the principle of

"common but differentiated responsibility and respective

capabilities" in accordance with the sovereignty of each

country.

Some of the issues that must be resolved are bringing

together public and the private sectors in the framework of

sustainable forest management and to promote sustainable

timber trade and food production.

See:

https://forestinsights.id/2022/05/14/unff17-sepakati-aksipengelolaan-hutan-lestari-indonesia-andalkan-folu-net-sink-2030/

Perhutani's products expand to Europe

Perum Perhutani's non-timber forest products (NTFPs)

have successfully penetrated Asian markets of India,

Pakistan, Turkey, Vietnam, UAE and in 2022 expanded to

European countries such as Portugal and Italy through

direct selling supported by the Perhutani online sales

application (POTP).

Head of the Commercial Division of NTFPs, Perhutani

Sukasno, said that the sales of NTFP products, namely

Gum Rosin, Turpentine and derivatives contributed more

than 40% to the company's total revenue.

See:

https://www.medcom.id/ekonomi/bisnis/GNlW81GKproduk-perhutani-tembus-pasar-asia-dan-meluas-ke-eropa

Indonesia/US MoU to support forestry

Indonesia, through the Ministry of Environment and

Forestry (MoEF) and the United States, through the United

States Agency for International Development (USAID),

agreed to work in partnership on the Government of

Indonesia’s long-term vision for climate-resilient, lowemission

development.

A memorandum of understanding (MOU) was signed by

MoEF Secretary General Bambang Hendroyono and

USAID Mission Director Jeff Cohen.

“Through this MOU, we are pleased to deepen our

partnership with the Government of Indonesia to address

the challenges of climate change by supporting the

MoEF’s leadership on sustainable land use and protecting

valuable forests across the country that are so vital for

Indonesia’s prosperous, resilient, green future,” said Jeff

Cohen.

Among the activities envisioned under the MOU, MoEF

and USAID plan to partner to support ongoing reduced

deforestation and forest degradation; sustainable forest

management, including tree planting and land

rehabilitation; management and restoration of peatlands

and mangroves to limit greenhouse gas emissions and

Indonesia’s efforts in conservation and biodiversity.

See:

https://id.usembassy.gov/indonesia-and-united-states-signmemorandum-of-understanding-to-support-forestry-and-otherland-use-net-sink-2030-goals/

Forest Biomass power, Association explores funding

Indroyono Soesilo, chairman of the Association of

Indonesian Forest Concession Holders (APHI), said the

Association supports the government's programme to

develop forest biomass power plants as an alternative and

renewable energy source. Indroyono said APHI is seeking

green financing for the development of forest biomass

power generation.

In a meeting with Nina Jacoby, Senior Advisor at Business

Finland, Indroyono said he hopes that developed countries

can provide green investments for the development of

clean energy to reduce greenhouse gas emissions. Ms.

Jacoby said she was ready to facilitate potential investors

in Indonesia communicate with financing sources in

Finland.

See:

https://forestinsights.id/2022/05/20/kembangkan-listrikberbasis-biomassa-hutan-aphi-gali-sumber-pendanaan/

April exports a record

The value of Indonesia’s exports reached the highest on

record at US$27.33 billion in April this year according to

Statistics Indonesia Head, Margo Yuwono. Compared to

April 2021, the export value surged by almost 48%. By

sector, non-oil and gas export between January–April

2022 increased 29% compared to the corresponding period

of 2021 while exports of agricultural, forestry and fishery

products swelled 12% and exports of mining and other

products shot up by 106%.

See:

https://en.antaranews.com/news/229869/indonesias-exportstouch-record-us2733-bln-in-april-bps

5.

MYANMAR

New developments - the currency

and banking issues

According to the latest order from the administration

private and government institutions can now accept only

MMK for all payments. Most hotels quote their rates both

in US dollars and MMK and many restaurants popular

with foreigners have been accepting dollars. The change is

notable since it now includes government institutions.

It is not clear how the recent order will be enforced for all

government institutions including the Myanma Timber

Enterprise (MTE) which has required payment for logs in

US dollars. MTE’s sales of logs have declined because

products milled from MTE logs cannot be marketed in the

EU (for logs sold after June 2021) and US (for logs sold

after April 2021).

For the US and EU markets manufacturers source earler

harvested logs from private stocks but asking prices are

higher than for fresh logs from MTE. Manufacturers are

paying strict attention to the requirements in the EU and

US markets and continue to buy old and often lower

quality-logs but output recovery is lower than from fresh

logs.

Millers complain that, as yet, there has been no official

information from MTE on its tender sale procedures under

the new rules. Currently incoming US dollars must been

converted into MMK so millers are unsure how to retain

dollars to meet the MTE requirement that payment for logs

must be in dollars. MTE has not yet reset their regulation

to accept only MMK in line with the new regulation.

Previously, MTE accepted direct international

remittance from the importers on behalf of millers

however, after MTE was sanctioned by the EU and US last

year direct remittances to MTE were halted. Now, because

of the new banking regulation, millers have no dollars to

pay MTE.

Exporters have urged MTE to accept MMK in equivalent

to their sale price in dollars.

In other news, companies which had export licenses

withdrawn have been attempting to get them reactivated

but the process is complicated (and according to some

inconsistent) involving the commercial banks, the Central

Bank of Myanmar and the Trade Department.

Economic uncertainty and growing poverty

Over the past two weeks Myanmar has experienced a fuel

shortage and this is further undermining the economy.

According to Focus-Economics the economy is expected

to have contracted significantly in FY 2021 but likely

improved in FY 2022 (October 2021–September 2022).

However, current business activity has been impacted by

energy shortages, sanctions and currency controls which

are now impacting the lives of ordinary people in the

country as Myanmar depends on imports for many daily

necessities including edible oil, fuel oil and medicines.

The United Nations Office for the Coordination of

Humanitarian Affairs (OCHA Myanmar) has said of the

54 million people in Myanmar about 14.4 million are in

need of humanitarian assistance. The statement said that

25 million people about half of Myanmar's population,

were living in poverty.

As of 2 May this year, according to OCHA, 249,500

people have been displaced since February 2021 in

southeastern Myanmar due to the conflict and

humanitarian access to conflict-affected areas is

immediately needed to provide assistance.

See:

https://www.focus-economics.com/countries/myanmar.

and

(

https://elevenmyanmar.com/news/about-144-million-of-54-million-people-in-myanmar-need-humanitarian-assistance-ochamyanmar)

6.

INDIA

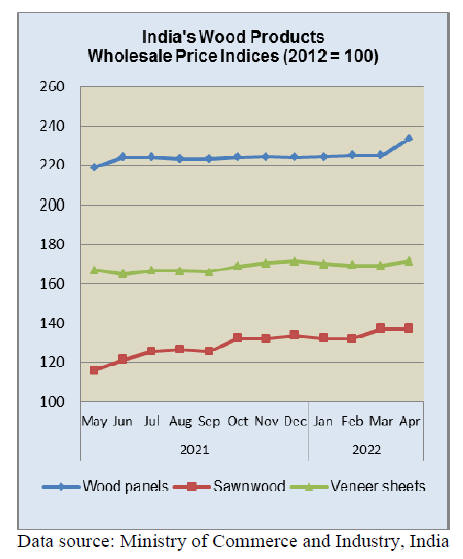

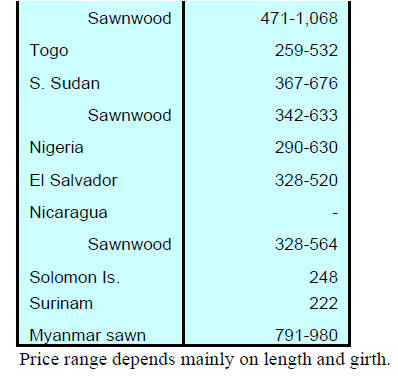

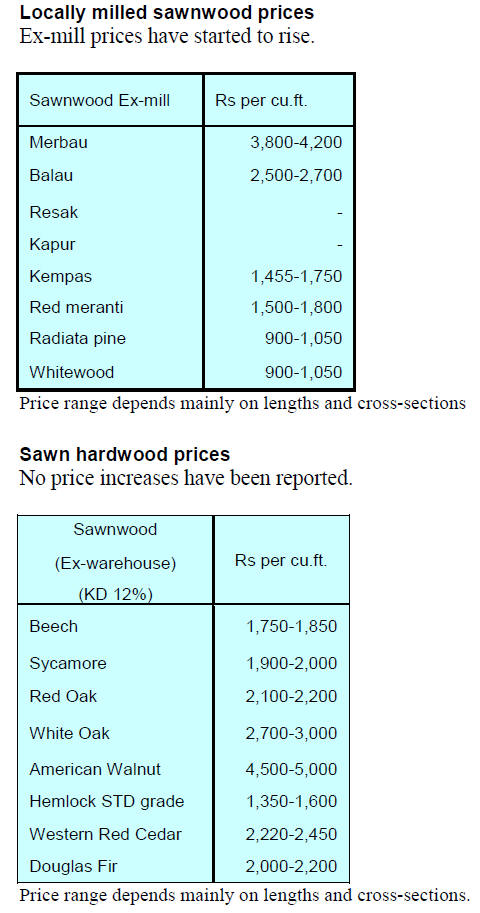

Wholesale price indices for April

2022

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade, has published

wholesale price indices for April 2022. The index for

manufactured products increased to 144 in April 2022

from 141.6 in March.

The increase in the overall index was mainly contributed

by rises in prices of basic metals, chemicals and chemical

products, textiles, machinery and equipment, electrical

equipment and food products. Some of the groups that saw

prices drop were motor vehicles, trailers, computers,

electronic and optical products and leather goods.

The year on year change in annual rate of inflation was

reported at 15.1% for April 2022.

The high rate of inflation in April 2022 was primarily due

to rise in prices of mineral oils, basic metals, crude

petroleum & natural gas, food articles, non-food articles,

food products and chemicals & chemical products.

Price inflation for wood products and cork items over the

past six months to April 2022 were 5.49%, 5.32, 4.11%,

4.55% , 4.65% and 4.77%.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

Heatwave – 49 degrees

The Indian economy has been impacted on many fronts

and a recent heatwave and then floods caused disruption of

transport and manufacturing. Delhi saw a new record with

temperatures rising to 49 degrees. Many other parts of the

country including Uttar Pradesh, Rajasthan and Madhya

Pradesh continue to suffer.

First quarter growth likely below expectations

Local economists expect a downward revision in 2022-23

growth forecasts and also a lower than expected growth in

the first quarter 2022 which could mean growth for fiscal

2021-22 will be lower than expected.

The National Statistical Office will publish GDP figures

for the first quarter 2022 at the end of May and on 8 June

the Monetary Policy Committee of the Reserve Bank of

India will publish its GDP growth forecasts for 2022-23.

Corporate leaders attending the World Economic Forum

said, when meeting the media, that addressing the surging

cost of commodities and food items should be the top

priority of the government and the Reserve Bank of India.

They added, while Covid control measures caused

disruptions and the Russian invasion of Ukraine has

resulted in an uncertain world the Indian economy is set to

grow in the mid-to-long term.

In related news, Borge Brende, President of the World

Economic Forum said India's GDP is set to grow 7-8% in

the current fiscal year, much higher than the global rate of

3%.

See:

https://www.businesstoday.in/wef-2022/story/taminginflation-will-help-bring-consumption-back-on-track-india-incat-wef-334769-2022-05-23

Positive outlook for Indian real estate sector

The India Real Estate Show (IRES 2022) in Dubai will

bring together some of India’s biggest real estate players

and provide both non-resident Indians and foreign

investors in the UAE with the opportunity to secure

purchases and financing opportunities.

Analysts write, “the outlook for the real estate sector in

India remains positive as growth delivers wealth to the

expanding middle class driving demand for housing and

office space”. According to Knight Frank’s latest market

evaluation report, despite the third wave of the Covid

pandemic, quarterly sales in the first quarter of 2022 were

robust with Mumbai recording the highest sales and Delhi-

NCR recording the highest year-on-year growth in the

sales.

See:

https://www.zawya.com/en/world/indian-subcontinent/india-real-estate-show-offers-lucrative-deals-skyc1rdq

https://indianrealestateshow.com/

Particleboard production to expand

Kerala is emerging as another centre for particleboard

manufacturing according to authors of a story from

Plyreporter, the India timber sector magazine. There are

five new production lines to be installed in the state this

year. Presently Kerala has 4 particleboards manufacturing

lines producing around 600 cubic metres of particleboard.

See;

https://www.plyreporter.com/article/92998/kerala-adding-5-new-particle-boards-lines

7.

VIETNAM

Trade Highlights

Wood and wood product (W&WP) exports in April 2022

topped US$1.59 billion, up 12% compared to April 2021.

In particular, WP exports reached US$1.14 billion, up

5.5% compared to April 2021.

In the first 4 months of 2022, W&WP exports totalled

US$5.6 billion, up 6.7% over the same period in 2021. WP

exports accounted for US$4.17 billion of the total, up

2.6% over the same period in 2021.

In April 2022 Vietnam's W&WP exports to the EU

reached US$57 million, down 10.9% compared to April

2021. In the first 4 months of 2022 exports of W&WPs to

the EU reached US$259.3 million, up 3.2% over the same

period in 2021.

W&WP exports to Australia in April 2022 reached

US$18.3 million, up 27.5% compared to April 2021. In the

first 4 months of 2022 W&WP exports to the Australian

market amounted to US$64.3 million, up 17.8% over the

same period in 2021.

Data from the General Department of Customs show that

W&WP imports in April 2022 were valued at US$273.7

million, up 15.0% compared to March 2022 and up 3.8%

compared to April 2021.

In the first 4 months of 2022 imports of W&WP reached

US$952.1 million, down 4.2% compared to the same

period in 2021.

Vietnam's imports of tali wood in April 2022 reached

31,100 cu.m worth US$12.7 million, up 1.9% in volume

and 1.5% in value compared to March 2022. Compared to

April 2021 the imports of this species increased by 9.7%

in volume and 11.2% in value.

In the first 4 months of 2022, tali wood imports from all

sources reached 160,100 cu.m worth US$65.2 million, up

20.6% in volume and 20.7% in value over the same period

in 2021.

Imports of log and sawnwood from Southeast Asia in

April 2022 were 88,000 cu.m worth US$31.0 million, up

24% in volume and 17% in value compared to March

2022.

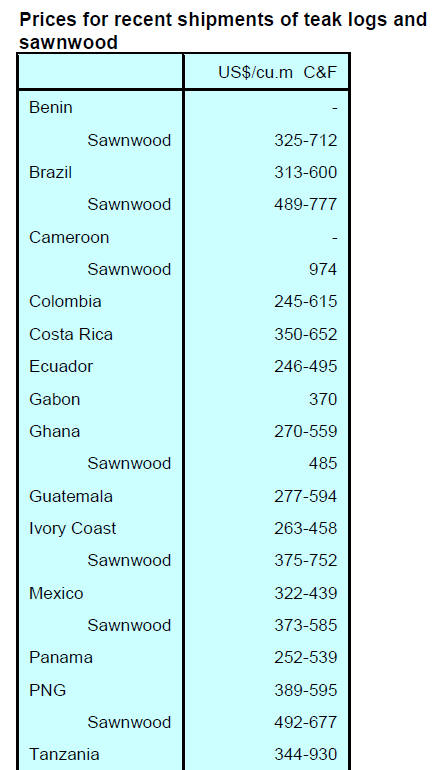

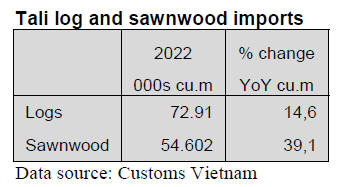

Tali log and sawnwood imports

In the first 3 months of 2022 tali log imports were

recorded at 72,900 cu.m, worth US$27.1 million, up

14.6% in volume and 11% in value over the same period

of 2021.

Imports of tali sawnwood reached 54,600 cu.m worth

US$5.0 million, a year-on-year growth of 39% in volume

and 40% in value.

Price of imported tali

The average price of tali wood from non-African sources

reached US$436.4 US$/cu.m, down 17% compared to the

same period of 2021.

The price of tali from Nigeria was reported

US$242.0/cu.m, down 4.8%; from China US$394.3/cu.m,

down 25.4%. In contrast, the price of this wood from

Cameroon reached US$409.1 /cu.m, up 3.7% over the

same period of 2021.

Tali sources

In the first 3 months of 2022 Vietnam’s tali wood imports

from Cameroon, China, Nigeria, Laos, Cambodia and EU

increased.

Tali wood imports from Cameroon contributed 66.6% of

total imports in the first 3 months of 2022 .

After Cameroon, imports of tali wood from China, as an

intermediary supplier, reached 8,300 cu.m worth US$3.3

million, a sharp increase in volume and value over the

same period of 2021.

Tali wood imports from Nigeria amounted to 5,480 cu.m

worth US$1.3 million, up 137% in volume and 125% in

value.

Tali wood imports from some other sources in the first 3

months of 2022 increased compared to the same period in

2021 such as from Laos where imports increased sharply,

from Cambodia, from the EU and from British Virgin

Islands.

In contrast imports of tali wood from some sources

dropped. In particular, imports from Congo decreased by

29%, from Gabon they dropped 17%, from Hong Kong

down by 18.5% and from Thailand imports dropped 1.5%.

Vietnam’s wood imports from Southeast Asia

increasing

According to the General Department of Customs imports

of wood from Southeast Asia in the first 3 months of 2022

was 208,580 cu.m and valued at US$72.72 million, down

23.5% in volume and 5.9% in value over the same period

of 20.

Imports of wood from Southeast Asia in April 2022

amounted to 88,000 cu.m, worth US$31.0 million, up 24%

in volume and 17% in value compared to March 2022. The

total imports from this market region in the first 4 months

of 2022 reached 296.58 thousand m3, worth US$ 103.72

million, down 21.5% in volume and 5.6% in value

compared to the same period in 2021.

SE Asia suppliers

In the first 3 months of 2022 Vietnam’s imports of wood

from Southeast Asia decreased due to a drop in shipments

from Thailand, Malaysia, Cambodia, Indonesia and

Singapore.

In contrast, imports from Laos continued to increase. The

detailed information and data on wood imports from this

region is as follows:

Thailand:

Thailand is a major supplier of wood material (mostly,

wood-based panels) for Vietnam. Imports from Thailand

in March 2022 reached 36,002 cu.m, worth US$9.79

million, down 23% in volume and 5% in value compared

to February 2022 and decreased by 54.4% in volume and

45.5% in value compared to March 2021.

In the first 3 months of 2022 imports of wood from

Thailand reached 126,390 cu.m, worth US$31.14 million,

down 29% in volume and 21% in value over the same

period in 2021.

Wood materials imported from Thailand are mainly

fibreboard and particleboard accounting for 97% of the

total wood imported from this source.

Laos:

The Laos government has issued regulations to reinforce

the control of logging as well as the inspection of timber

transportation and trade.

Accordingly, except for wood harvested from planted

forests, export of all wood materials of natural forest is

banned. However, roundwood and sawnwood derived

from natural forests in Laos continues to pose a threat for

Vietnam’s wood industry.

Imports of wood from Laos in March 2022 amounted to

23,640 cu.m worth US$12.74 million, up 135% in volume

and 126 in value compared to February 2022 and

increased by 95.7% in volume and 102.9% in value

compared to March 2021.

Over 90% of the wood imported from Laos into Vietnam

in the first 3 months of 2022 was sawnwood that

amounted to 51,300 cu.m worth US$31.14 million, up

89% in volume and 73% in value compared to the same

period in 2021.

Imports of round wood from Laos in the first 3 months of

2022 were 4,450 cu.m, worth US$980,000, up 42% in

volume and 74% in value over the same period in 2021.

Malaysia:

Vietnam’s wood imports from Malaysia in March 2022

reached 5,685cu.m worth US$2.04 million, up 190% in

volume and 163% in value compared to February 2022

showing a decrease of 42% in volume and 34% in value

compared to March 2021.

The accumulated imports of wood materials of all kinds

from Malaysia over the first months of 2022 reached

11,580 cu.m worth US$ 4.13 million, down 61% in

volume and 52% in value compared to the same period in

2021. The overall decline was because of a drop in imports

of

The 3 major types of wood materials imported from the

Southeast Asia into Vietnam are fibreboard, particleboard

and sawnwood.

National Strategy on Climate Change

The Vietnam Law and Legal Forum magazine provides an

anlysis of how forest protection and management will be a

part of the National Strategy on Climate Change for 2050

with a focus on enhancing restoration, community

participation and employment opportunities in the forestry

sector.

This was compiled from the proceedings of a workshop

jointly organised by the Ministry of Natural Resources and

Environment, UNDP, and GIZ in Hanoi to discuss the

draft National Strategy on Climate Change for 2050.

More information can be found at:

https://www.vn.undp.org/content/vietnam/en/home/presscenter/speeches/consultation-workshop-on-draft-viet-nam-nationalclimate-change-.html

and

https://vietnamlawmagazine.vn/national-strategy-on-climatechange-for-2050-to-focus-on-forest-protection-48528.html

8. BRAZIL

Project to create economically

sustainable forests

A project “Amazon Movement” developed as a

partnership between an environmental conservation

organisation and the Federal University of Amazonas

(UFAM) aims to find a balance between people,

agriculture and the forest.

With support from the Secretary of the Environment and

the Government of the State of Amazonas 20,000 trees

will be planted to create agroforestry plots in three

communities in the Amazon Forest. The seedlings will be

special selected taking account of the biome of the area.

Incentives for conserving the Amazon

The “Forest+ Amazon” project, an initiative of the

Ministry of the Environment and the United Nations

Development Program (UNDP) with resources from the

Green Climate Fund will reward those who protect and

recover the forest and contribute to the reduction of

greenhouse gases emissions.

The initiative will recognise the work of small rural

producers and family farmers, support projects by

indigenous peoples and traditional communities as well as

innovation focused on sustainable development in the

Legal Amazon.

Export update

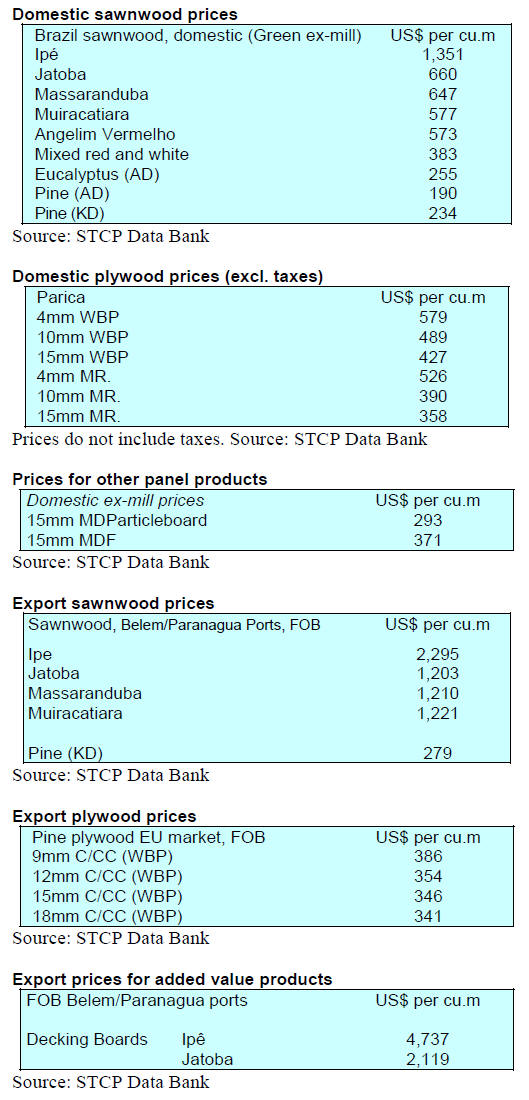

In April 2022 Brazilian exports of wood-based products

(except pulp and paper) increased 22% in value compared

to April 2021, from US$380.5 million to US$465.3

million.

Pine sawnwood exports grew significantly (29%) in value

between April 2021 (US$59.7 million) and April 2022

(US$77.2 million). In volume, exports declined slightly

over the same period from 285,500 cu.m to 281,100 cu.m.

In April tropical sawnwood exports increased 17% in

volume from 35,000 cu.m in April 2021 to 40,900 cu.m in

April 2022. In value exports grew 31% from US$14.4

million to US$18.8 million over the same period.

Pine plywood exports faced a 4.5% drop in value in April

2022 compared to April 2021, from US$104.7 million to

US$100.0 million.

In volume exports also decreased (2.9%) over the same

period, from 241,000 cu.m to 234,100 cu.m.

As for tropical plywood, exports increased in volume

(7.7%) and in value (34.3%), from 7,800 cu.m (US$3.5

million) in April 2021 to 8,400 cu.m (US$4.7 million) in

April 2022.

As for wooden furniture, the exported value declined from

US$72.2 million in April 2021 to US$52.8 million in April

2022, a 27% fall.

Record exports to the US

According to the Brazilian-American Chamber of

Commerce (AMCHAM Brazil) in the first quarter of 2022

bilateral trade between Brazil and the United States

totalled US$19 billion with unprecedented exports and

imports between the two countries.

In regional terms, trade between Paraná (southern state of

Brazil) and the US recorded growth of almost 40% in the

first three months of 2022 compared to the same period of

the previous year.

The state's exports to the US had the highest value in the

historical series for a first quarter, equivalent to US$411.3

million, a 50% growth. Shipments from Paraná accounted

for 5% of total exports by Brazil and the positive result

was driven by sales of processed wood products (+47%),

coffee (+47%) and pulp (+96%) among others.

Exports from Paraná to the US in the first quarter 2002

were the highest ever since records were kept. Overall,

total Brazilian exports to the US grew 36%, reaching

US$7.6 billion while imports totalled US$11.4 billion in

the first quarter, both figures are records for the period.

The general increase in Brazilian shipments was driven

mainly by sales of wood products and other agricultural

and mining items.

Sustainable forest management drives exports

In the first quarter of this year Acre, one of timber

producing states in the Amazon region, registered US$20

million in exports and surpassed the value in the same

period last year. In 2021 Acre exported US$48.8 million

and imported US$3.7 million which represented a new

record in foreign trade. Wood product exports were the

main driver of the increase.

The most exported timber species from the state of Acre is

Dipteryx odorata, known as tonka-bean. Although this

species is not the most valuable in the forest it is abundant.

The main exported product made from tonka-bean is

decking. The main export markets were in Europe such as

Germany, France, Belgium, Denmark and the Netherlands.

There were also sales to New Zealand, Australia and

China.

9. PERU

Shipments of semi-finished wood

products recovering

The export of semi-manufactured wood products in the

first quarter of this year reached US$20.5 million, up

around 24% compared to the first three months of 2021

according to the Management of Services and Industries

Extractives Division of the Association of Exporters

(ADEX).

The rise is explained in part by greater demand from

countries such as France (2nd place in the ranking) and

Belgium (3rd position) which increased their orders by

37% and 212%, respectively.

The main markets were China (US$6.8 million a 33%

share) up around 3%. The other top five markets were

France (US$6.1 million), Belgium (US$3.1 million),

Denmark (US$1.8 million) and the US (US$0.82 million).

The main export product molded tropical which

represented 55.2% of the total.

Other products exported were other profiled wood, slats

and unassembled parquet friezes (US$ 3.6 million); slats

for unassembled parquet (US$3.5 million) and misc.

profiled wood (US$1.5 million).

The main producing regions for semi-manufactured wood

goods were Lima (US$10.8 million), Ucayali (US$5.8

million) and Madre de Dios (US$3.9 million). These

products were mostly exported from Callao Port.

Cooperation on degraded land restoration

The National Forest and Wildlife Service (Serfor) and a

consortium made up of international organisations have

agreed financing and technical assistance for projects that

will contribute to meeting Peru's goal of restoring

2,150,000 ha. of degraded hectares.

The Executive Director of Serfor welcomed this initiative

to help Peru implement and promote restoration through

the Forest Landscape Restoration Implementation Hub

(FLR-Hub Center), a technical facility involving IUCN,

WRI and WWF as this will contribute to the Sustainable

Development Goals and the fulfillment of Nationally

Determined Forest Contributions.

Promoting investment

Andina has reported that Cesar Landa, Minister of Foreign

Affairs and Oscar Graham, Minister of Economy and

Finance participated in a Americas Society/Council of the

Americas (AS/COA) event aimed at promoting business

opportunities in Peru.

AS/COA is a leading US organisation in the promotion of

understanding and dialogue as well as in discussion of

strategic issues of foreign policy, development, trade,

economy and politics.

The meeting, chaired by AS/COA CEO Susan Segal,

served to deliver the Peruvian Government's interest in

promoting business and investments.

See:

https://andina.pe/Ingles/noticia-peru-fa-finance-ministersmeet-with-businesspeople-and-investors-at-ascoa-event-894842.aspx

Technical internship on timber industry cluster

In May at Tarma, Oxapampa and Villa Rica a forestindustry

cluster internship was conducted aimed at

strengthening awareness, knowledge and skills in

technologies and good practices in the production chain

for plantation eucalyptus, pine and some native species.

In Oxapampa and Villa Rica professionals from public and

private entities involved in the wood chain, including

senior management from Serfor, Sede Central y

adminstaciones tecnicas forestales y de fauna silvestre

(ATFFS) as well as the private sector observed harvesting

in a 500 hectare plantation as well as a housing complex

with houses built entirely with eucalyptus wood from

commercial plantations. A visit was also made to a nursery

and groforestry plots with commercial and native species.