4.

INDONESIA

Forestry Ministry seeks APHI

partnership for SFM

Agus Justianto, Director General of Sustainable Forest

Management at the Ministry of Environment and Forestry

has said it expects the Association of Indonesia

Concession Holders (APHI) to become the government's

partner in achieving the five pillars of sustainable forest

management.

The five pillars are securing forestry areas, increasing

business productivity, optimising forest land, diversifying

forestry products and increasing product competitiveness.

The DG also urged forestry business to adopt the multibusiness

scheme set out in the government’s Job Creation

initiative. He reported there are 14 forest utilisation

business proposals for the application of the forestry

multi-business scheme.

The chairman of APHI, Indroyono Soesilo, said that

facilitation of the Forest Utilisation Business Permit

(PBPH) is among the association’s seven strategic

programmes. The other programmes include accelerating

the implementation of the Job Creation Law, facilitating

the fulfillment of APHI members’ obligations regarding

forest management and deregulating taxes and levies.

Also included is strengthening marketing of wood

products, strengthening cooperation in the investment

sector and facilitating overlapping PBPH implementation

with non-forestry activities.

See:

https://en.tempo.co/read/1560353/forestry-ministry-expectsaphi-to-be-partner-in-sustainable-forest-management

Concern on UK’s sustainability regulations

Coordinating Minister for Economic Affairs, Airlangga

Hartarto, recently met with the UK Ambassador to

Indonesia and several senior UK representatives and

expressed the hope of the Indonesia government is that the

UK plan for implementing sustainability standards on a

number of agricultural, plantation and forestry

commodities will not hinder the bilateral trade. Airlangga

said it is import to aligning the Indonesian timber

certification system with whatever plans the UK has.

See:

https://www.merdeka.com/uang/standar-keberlanjutanpertanian-inggris-tak-hambat-perdagangan-ke-ri.html

Mangrove Project funding

The Indonesian government is committed to restoring and

protecting mangroves, including through collaboration

with various parties. One of them is the collaboration with

the World Bank through the Mangrove for Coastal

Resilience Program (M4CR). World Bank Managing

Director for Operations, Axel van Trotsenburg, expressed

his agreement that mangrove ecosystems make a

significant contribution to controlling climate change.

In related news, Vice-president of the European

Investment Bank (EIB) Group, Gelsomina Vigliotti said,

the Bank is ready to back the Indonesian government’s

plans to rehabilitate some 600,000 hectares of degraded

mangroves. As a leading financier of forestry projects

Vigliotti said the EIB Group supports the call by

Indonesian President Joko Widodo for the country to

transition towards a sustainable green economy.

See:

http://ppid.menlhk.go.id/berita/siaran-pers/6413/indonesiajalin-kerjasama-dengan-world-bank-dalam-proyek-mangroveuntuk-ketahanan-masyarakat-dan-mitigasi-iklim

and

https://www.thestar.com.my/aseanplus/aseanplusnews/2022/02/20/european-investment-bank-keen-to-supportindonesia-on-climate-action

Forest biomass for power generation

The President of PT Protech Mitra Perkasa Tbk and

Deputy Chairman of the Indonesian Chamber of

Commerce and Industry, Bobby Gafur Umar, believes that

Indonesia has great potential for biomass energy

production which would help achieve national energy

security.

The area of Energy Plantation Forests (HTE) in Indonesia

is almost 1.3 million hectares and at least 32 business units

are ready to play a role in "processing" this vast area of

THE.

See:

https://ekonomi.bisnis.com/read/20220218/44/1502078/13-juta-hektar-hutan-di-indonesia-berpotensi-hasilkan-listrik

5.

MYANMAR

Singapore

banks tough on timber trade transactions

According to timber exporters, banks in Singapore have

adopted tough measures to stop timber related financial

transactions. Singapore is known as a financial hub for

Myanmar businesses. Last year Singapore banks started to

halt transaction to Myanmar if it believed they were

payment for timber exports.

Initially, when EU and USA announced the sanction on

Myanma Timber Enterprise and the Forest Joint Venture

Corporation, Singapore banks stopped the transaction and

asked the remitters many questions. Recently companies

whose records show financial transactions related to the

timber trade have been asked to close their accounts.

In related news, it has been reported that the EU has

adopted further sanctions in view of the intensifying

human rights violations in Myanmar. The new restrictions

target companies providing substantive resources to the

current administration.

The full list of the new designations is included as an

annex to the implementing regulation can be found at:

https://eur-lex.europa.eu/legalcontent/EN/TXT/?uri=uriserv%3AOJ.L_.2022.040.01.0010.01.E

NG&toc=OJ%3AL%3A2022%3A040%3ATOC

Also see:

https://www.jdsupra.com/legalnews/eu-adopts-fourthround-of-sanctions-6743735/

)

Oil and gas big earners

Since the coup Myanmar’s economy has collapsed. The

World Bank forecast that Myanmar’s GDP would likely

have dropped 18% in 2021 and Fitch has forecast a 4.4%

decline in GDP in 2022. Myanmar relies heavily on

income from exports of oil and natural gas. Gas

projects are expected to deliver US$1.4 billion or around

10% of Myanmar’s revenue in 2022.

See:

https://www.myanmar-now.org/en/news/how-much-moneydoes-myanmars-military-junta-earn-from-oil-and-gas

and

https://www.voanews.com/a/6425156.html. )

Myanmar urged to adopt ASEAN ‘Five-Point

Consensus’

The Cambodian and Malaysian Prime Ministers called for

the “timely and effective implementation” of ASEAN’s

Five-Point Consensus on Myanmar. According to

the statement, the two leaders “underscored the critical

importance of ensuring the effective and timely

implementation of the Five-Point Consensus,” which was

reached at a summit of ASEAN leaders in April last year.

The consensus calls for an immediate cessation of

violence in Myanmar and the facilitation of dialogue

between all parties to the conflict, mediated by the

regional bloc’s special envoy, among other steps.

See:

https://www.irrawaddy.com/news/burma/cambodianmalaysian-pms-call-on-myanmar-junta-to-implement-aseanconsensus.html

)

In related news, Japan’s Foreign Minister released a

statement 1 February saying “As today marks one year

since the coup d’état in Myanmar on 1 February last year I

express concern about the continued lack of action to

improve the situation. Japan takes this opportunity to once

again strongly urge the Myanmar military to take concrete

actions to immediately stop the violence, release those

who are detained and swiftly restore Myanmar’s

democratic political system.

See:

https://www.mofa.go.jp/press/release/press6e_000364.html

JETRO survey - Most Japanese firms plan to stay in

Myanmar

According to a Japan External Trade Organization

(JETRO) report most Japanese companies that have

invested in Myanmar will either maintain or expand their

operations in the country.The report says 52% of Japanese

companies will maintain current levels of operations in

Myanmar, 13.5% will expand operations while around

28% will scale back business. The balance of companies

surveyed will pull out.

See:

https://www.irrawaddy.com/news/burma/most-japanesefirms-investing-in-myanmar-remain-despite-coup.html

)

Omicron threatens to overwhelm health system

Myanmar could soon face a deadly fourth wave health

experts warn reports FrontierMyanmar. However, its

public health system has been weakened and barely half of

the adult population is vaccinated and this is with the

Chinese vaccines which are said to be less effective

against the Omicron variant.

Official figures from the Ministryof Health show that

around 53% of the adult population is partially or fully

vaccinated and few booster doses have been administered.

See:

https://www.frontiermyanmar.net/en/omicron-wavethreatens-to-overwhelm-myanmars-health-system/

6. INDIA

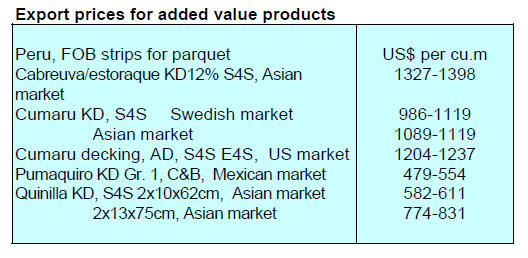

Wholesale price

indices for January 2022

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade, has published

wholesale price indices for January 2022. The index for

manufactured products increased to 137.1 in January 2022

from 136.4 for December 2021.

Out of the main 22 manufactured products 18 groups saw

increases in prices while 3 decreased in January 2022

compared to December 2021. The increase in prices was

mainly contributed by basic metals, motor vehicles,

trailers and semi-trailers, machinery and equipment,

textiles and chemicals products. Some of the groups that

saw a decrease in prices were wood and of products of

wood and cork, tobacco products, pharmaceuticals along

with medicinal chemical and botanical products.

The annual rate of inflation was almost 13% in January

2022 compared to 2.51% in January 2021. The high rate

of inflation in January 2022 is primarily due to rise in

prices of mineral oils, crude petroleum and natural gas,

basic metals, chemical products and food.

See:

https://eaindustry.nic.in/display_data_201112.asp

High frequency indicators showing positive

signs

KPMG in India has published its latest edition of “Indian

Economy Insights”. In introducing this publication, Neeraj

Bansal, a senior partner, provides a snapshot of the state of

the economy.

He writes, “The Indian economy is gaining momentum,

driven by the recovery in industrial output, growth in core

sectors, coupled with fairly focused government initiatives

and policies. While the economy is reviving on the back of

ebbing effects of the second wave and rapid vaccination

drive, it is also witnessing a gradual momentum in some of

the highly distressed sectors.

Recent high frequency indicators are showing positive

signs, raising both business and consumer optimism.

Factors such as rail and freight activity, passenger traffic,

power consumption, e-way bills and Goods and Services

Tax (GST) collections are following a rising trend says

KPMG.

With a revival in demand and improvement in industrial

indices, the economy is observing positive sentiment

among financial institutions. Both Reserve Bank of India

(RBI) and International Monetary Fund (IMF) have

projected a 9.5 per cent GDP growth for the country in

FY22”.

The full report can be found at:

https://assets.kpmg/content/dam/kpmg/in/pdf/2021/11/indianeconomy-insights.pdf

KPMG is a British-Dutch multinational professional services

network and one of the big four accounting organisations.

Decorative veneer flitches in short supply

Plyreporter, the Indian trade magazine has highlighted the

shortage of decorative veneer flitches from European and

North America saying the demand for walnut, oak, ash and

tulip in international markets has soared.

Plyreporter says “the domestic veneer industry is doing

their best to procure veneers and lumber at any cost and

the prices of finished products rise”.

See:

https://www.plyreporter.com/article/92702/decorativeveneer-flitches-supply-short-in-the-world-short-supply-fromeurope-to-impact-indian-wood-veneer-manufacturers

7.

VIETNAM

Vietnam: Wood and Wood Product (W and WP) trade

highlights

According to Vietnam Customs in January 2022 W and

WP export turnover amounted to US$1.5 billion, up 8.3%

compared to December 2021 and 14.3% compared to

January 2021. In particular, the WP export reached

US$1.15 billion, up 6.8% compared to December 2021

and 6% compared to January 2021.

W and WP exporst to the UK in January 2022 totalled

US$30.7 million, up 11.6% compared to December 2021

and 48% compared to January 2021. The share of exports

to the UK accounted for 2% of Vietnam's total W and WP

export turnover, up 0.5% compared to January 2021.

In January 2022, exports of office furniture from Vietnam

valued at US$ 43 million, up 7.5% compared to December

2021, but down 10% compared to January 2021.

In January 2022, W and WP imports into Vietnam reached

US$ 250.1 million, up 13.3% compared to December

2021, but down 10.3% compared to January 2021.

In January 2022 Vietnam imported 49.2 thousand cu.m of

pine wood, worth US$ 15.3 million, down 9.3% in volume

and 8% in value compared to December 2021; compared

to January 2021, it increased by 6.7% in volume and 59%

in value.

The imports of wood from Southeast Asia to Vietnam in

December 2021 reached 87.0 thousand cu.m, worth US$

29.68 million, down 40% in volume and 55% in value

compared to November 2021 but increased by 1.7% in

value compared to December 2020. In 2021, Vietnam

imported 960,330 cu.m from Southeast Asia, worth

US$338.28 million, up 5% in volume and 49% in value

compared to 2020.

Imports from Southeast Asia increased slightly in 2021

Imports of wood from Southeast Asia to Vietnam in

December 2021 reached 87.0 thousand cu.m, with the

value of US$ 29.68 million, down 39.9% in volume and

55% in value compared to November 2021; down 18% in

volume, but increased by 1.7% in value compared to

December 2020. In 2021, imports of wood from Southeast

Asia reached 960.33 thousand cu.m, with the value US$

338.28, up 5.1% in volume and 48.8% in value compared

to 2020.

Suppliers

In 2021, the increase of wood imports from Southeast Asia

comes mostly from Cambodia and Laos. The growth of

imports from Laos accounted for 269% of the total

increase in imports of wood from this region. In contrast,

imports of wood from other sources such as Thailand,

Malaysia and Indonesia decreased against 2020.The

imports of wood from Cambodia and Laos are risky for

Vietnam's wood industry.

This risk is serious especially in the context of

VPA/FLEGT implementation with Vietnam’s

commitment to the EU to avoid illegally sourced wood

from the supply chain and the Vietnam - US Agreement to

improve wood legality.

Under VNTLAS, while importing wood from risky

sources, importers need to submit additional documents to

prove the legality of imported wood. They have to

exercise DDS to assess possible risks and take

countermeasures to assure legality of imported wood.

Thailand: Thailand is one of the major suppliers of

woodbased

panels to Vietnam. Imports of this type of product

from Thailand in December 2021 reached 54,940 cu.m,

with a value of US$13.15 million, up 5% in volume and

15% in value compared to November 2021; down 19% in

volume and 3% in value compared to December 2020.

In 2021, imports of wood of various types from Thailand

amounted to 504,290 cu.m, with a value of US$119.30

million, down 12.5% in volume, but up 8.6% in value

compared to 2020.

Wood imported from Thailand is mainly of fibreboard and

particleboard, accounting for 96% of the total import from

this market. In 2021, fibreboard imports from Thailand

reached 312,200 cu.m, with a value of US$81.39 million,

down 16% in volume, but up 2% in value compared to

2020; particleoard imports volumed at 171,850 cu.m, with

a value of US$30.42 million, down 11% in volume and

19% in value.

Laos: Imports of logs and sawnwood from Laos in

December 2021 were reported at 20,670 cu.m, with a

value of US$12.70 million, down 74% in volume and 75%

in value compared to November 2021; up 35% in volume

and 34% in value compared to December 2020.

In 2021, imports of wood from Laos reached 223,780

cu.m, with a value of US$140.81 million, up 127% in

volume and 154% in value compared to 2020.

In 2021, sawnwood imports contributed 90% of total

imports from Laos reaching 201,000 cu.m, with a value of

US$136.19 million, up 152% in volume and 160.6% in

value compared to 2020; imports of log reached 17,090

cu.m, with a value of US$3.39 million up 35% in volume

and 63% in value compared to 2020.

Malaysia: In December 2021 imports of wood from

Malaysia were reported at 6,010 cu.m, with a value of

US$1.98 million, up 2.4% in volume and 8% in value

compared to November 2021; down 45.9% in volume and

29.1% in value compared to December 2020. In 2021,

imports of raw wood from Malaysia totaled at 143.56

thousand cu.m, with a value of US$ 48.77 million, down

5.4% in volume, but up 39.6% in value compared to 2020.

Particleboard and sawnwood were the major wood

products accounting for 93% of the total wood imports

from Malaysia to Vietnam in 2021.

Sawnwood imports, alone from Malaysia in 2021 reached

82,280 cu.m, with a value of US$33.52 million, up 290%

in volume and 234% in value compared to 2020; particleboard

imports reached 51,190 cu.m, with a value of

US$32.52 million, up 290% in volume and 234% in value.

Items of imported wood

The 3 top wood items imported from Southeast Asia to

Vietnam are fibreboard, particl-board and sawn wood. In

2021, imports of wood as raw material from Southeast

Asia to feed Vietnam’s wood industry increased mainly

due to the enlarged import of sawn wood from this

region. In contrast, imports of fiber-board, particleboard,

and sawn wood from Southeast Asia decreased.

Sawn wood imports: In December 2021, sawn wood

imports from Southeast Asia reached 28,260 cu.m, with

a value of US 15.36 million, down 67.0% in volume and

71% in value compared to November 2021; up 19% in

volume and 22.7% in value compared to December

2020. In 2021, sawn wood imports from Southeast Asia

reached 356,790 cu.m, with a value of US$157.40

million, up 1312% in volume and 95% in value

compared to 2020 accounting for 43% of the total

increase in lumber imports from this region.

Sawn wood imports from Southeast Asia increased

mainly due to the increased imports from Laos, reaching

61.08 thousand cu.m, with a value of US$ 36.94 million,

up 31,986% in volume and 30,710% in value compared

to 2020.

In addition to the supply from Laos, the sawn wood

imports from Malaysia, Cambodia and Thailand also

increased remarkably compared to 2020.

Fibreboard imports: Imports of fibreboard from

Southeast Asia in December 2021 amounted to 26,220

cu.m, worth US$8.05 million, up 57% in volume and

57% in value compared to November 2021; down 51%

in volume and 32% in value compared to December

2020.

In 2021, imports of this wood item from Southeast Asia

reached 331,520 cu.m, with a value of US$87.07

million, down 22% in volume and 5% in value

compared to 2020.

There were four Southeast Asian countries supplying

fibreboard to Vietnam in 2021: Thailand, Indonesia,

Malaysia and Singapore. Imports from these four

sources decreased against 2020. Thailand was the main

supplier of fibreboard to Vietnam, accounting for 94%

of total imports from this region in 2021, reaching

312,120 cu.m with a value of US$81.39 million, down

16.5% in volume, but up 2% in value compared to 2020.

Industry sets an export target of US$17.5 – 18 billion

for 2022

Despite many challenges, the Vietnam Timber and Forest

Product Association has set a target for exports of

US$17.5 – 18 billion in 2022.

The Vietnam Timber and Forest Products Association

pointed out that the five main export groups of the wood

industry have good growth prospects in 2022.

“In 2022, the goal of the export wood industry will reach

17.5 – 18 billion USD. To achieve the goal of exporting

the wood industry in 2022, the main determined are still

commodity groups, in which, wooden chair will reach 4.1

billion USD; wooden furniture will reach 10 billion USD

and a number of other key commodity groups,” said

Chairman of the Vietnam Wood and Forest Products

Association.

According to the Ministry of Agriculture and Rural

Development, in order to achieve the new export target in

the face of rising raw material prices and increasing

logistics costs, domestic planted forests need to improve

productivity and quality to participate in the supply chain.

“The government issued Resolution 84 to implement a

sustainable forestry development programme. This is the

most important thing for the industry. If input is not much,

it must be sourced domestically. Assessment Forest

quality is important,” emphasised Deputy Minister of

Agriculture and Rural Development.

In addition, the wood industry is planning to solve the

problem of transportation costs by increasing the value of

each container according to packaging specifications and

brands. In addition, efforts to reduce the risk of origin

evasion and strictly implement the Legal Timber Trade

Agreement between Vietnam and the United States should

also be prioritised to promote export growth.

See: Vietnam: The wood industry sets an export target of 17.5 -18 billion

USD in 2022 - Woditex

8. BRAZIL

Mato Grosso timber companies take

advantage of ‘hot’

market

The increase in prices and demand for native timber

species from sustainably managed forests has boosted the

timber industry in the state of Mato Grosso, one of the

main producing states of the Amazon region. Companies

are expanding production to meet the demand in the

region.

Additionally, companies in the furniture sector in the state

of Mato Grosso are focusing on the manufacture of

furniture of higher added value using wood from natural

forests, mixing modern with rustic designs.

Small businesses create new jobs

A survey late last year by the Brazilian Micro and Small

Business Support Service (Sebrae) indicates that micro

and small businesses continue to be the main generators of

new job vacancies. According to the survey this group of

enterprises was responsible for 76% of job vacancies in

the country. Commerce was responsible for the creation of

116,700 jobs followed by services (98,700), construction

(16,700) and industry (15,200).

In the case of medium and large companies the largest

number of jobs was created in the service sector (80,800

jobs), followed by commerce (21,300). Agriculture,

industry and construction showed a negative balance for

new opportunities.

See:

https://www.nativanews.com.br/economia/id-998178/pequenas_empresas_s_o_respons_veis_por_76__dos_novos_empregos

Inflation drives furniture prices higher

According to the Consumer Price Index measured by

IBGE (Brazilian Institute of Geography and Statistics)

national furniture prices were driven higher because of a

2% increase in inflation in December 2021 compared to a

month earlier. As a result furniture prices closed 2021 up

16% year on which is high compared to the government’s

inflation target.

In order to control inflation, the Central Bank of Brazil has

been raising the basic interest rate, which reached 10.75%

in early February 2022. However, despite the impact of

inflation and slight drop in sales between January and

November 2021 the IEMI (Market Intelligence Institute)

reports an 8% increase in furniture retail sales in the 11

months of last year.

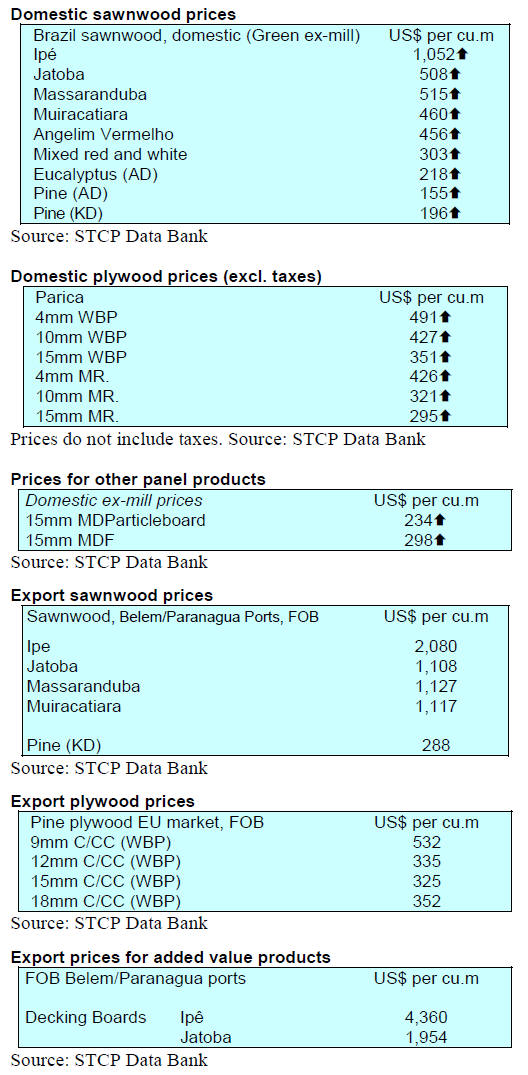

Export update

In January 2022 Brazilian exports of wood-based products

(except pulp and paper) increased 52% in value compared

to January 2021, from US$254.4 million to US$387.1

million.

Pine sawnwood exports grew significantly 42% in value

between January 2021 (US$5.2 million) and January 2022

(US$49.8 million). However, export volumes fell 5% over

the same period in 2020 from 191,000 cu.m to 181,200

cu.m.

Tropical sawnwood exports increased 25% in volume,

from 31.100 cu.m in January 2021 to 39.000 cu.m in

January 2022. In value, exports increased 25.0% from

US$12.8 million to US$16 million over the same period.

Pine plywood exports witnessed a 58% increase in value

in January 2022 compared to January 2021, from US$51.1

million to US$80.9 million. Also the volume of exports

increased 31% over the same period, from 170,400 cu.m

to 222,900 cu.m.

As for tropical plywood, exports increased in volume

(68%) and in value (78%), from 3.800 cu.m (US$1.8

million) in January 2021 to 6.400 cu.m (US32 million) in

January 2022.

As for wooden furniture, the export value increased from

US$41.1 million in January 2021 to US$52.1 million in

January 2022, a 27% growth.

Pará and Santa Catarina State exports – 2022 off to a

good start

In January 2022 timber exports from Pará State, one of the

major timber producing states in the Amazon, grew 110%

compared to January 2021 according to the Association of

Timber Industries Exporters of Pará State (AIMEX).

AIMEX considers the growth "significant" because,

although 2021 was a year of retraction for various sectors

of the economy due to COVID-19, exports in early 2021

exceed those of January 2020, prior to the pandemic, when

revenue from exports was around US$18 million.

AIMEX states that export earnings for almost all products

rose. In total international timber sales by companies in

Pará earned about US$37 million from more than 20,000

tonnes exported. The increase was largely the result of

increased export of flooring and decking and from a surge

in MDF exports.

About 70% of the products exported by the state of Pará

are processed added value products such as flooring,

decking, doors, windows, kitchenware among others.

Furniture export totalled US$899 million in 2021 of which

US$354 million was from manufactures in Santa Catarina.

In the state the furniture manufacturing companies of the

São Bento do Sul furniture cluster accounted for 54% of

these sales according to Brazilian Furniture Industry

Association (ABIMÓVEL), up 31% year on year.

The US was the largest buyers of furniture from Santa

Catarina (70%) followed by the UK (12%) and France

(6%) according to the Federation of Industries of Santa

Catarina.

According to Union of Construction and Furniture

Industries of São Bento do Sul (SINDUSMOBIL) the

positive export performance was the result of the high

product quality combined with compliance with

commercial agreements.

9. PERU

Exports to exceed US$64 billion this

year

The Minister of Foreign Trade and Tourism, Roberto

Sánchez, said Peruvian exports could exceed US$64

billion in 2022.

In 2021 there were 20 regions of the country that increased

exports, 12 of which achieved remarkable growth

including Ica, Arequipa, La Libertad, Piura, Moquegua,

Apurímac, Puno, Cusco, Lambayeque, Ayacucho, Ucayali

and Amazon.

For example exports from Ica were worth US$5,625

million, Arequipa US$5,310 million, Áncash US$4,668

million, La Libertad US$3,883 million and Moquegua

US$3,064 million.

In relation to non-mining exports Madre de Dios stood out

as the region with the highest growth between 2020 and

2021 (+107%) and this was largely from Amazonian nuts

and molded timber.

The United States (US$5,238 million), China (US$2,237

million), the Netherlands (US$1,538 million), Chile

(US$1,242 million) and Ecuador (US$863 million) are the

five most important markets for Peruvian non-mining

shipments.

New headquarters for regional forest and wildlife

authorities

The National Forestry and Wildlife Service (SERFOR)

will improve the operational capacity of Regional Forestry

and Wildlife Authorities (ARFFS) in Madre de Dios,

Loreto, Ucayali and Cajamarca through the investment

programme "Promotion and Sustainable Management of

Forest Production in Peru”.

The programme has a total of US$110 million some of

which will be allocated for the improvement and

expansion of forest management in the departments of

Áncash, Cajamarca, Huánuco, Junín, Loreto, Madre de

Dios, Pasco, San Martín and Ucayali whose combined

forest area is around 69 million hectares.

The improvement of the services of the ARFFS consists of

the construction of institutional headquarters

(infrastructure); provision of equipment, furniture and

technological tools as well as the development and

strengthening of capacities in the departments of Madre de

Dios, Loreto, Ucayali and Cajamarca. The aim is to

optimise the management of forest planning.

Research to promote improved use of resources

In related news SERFOR and the International Center for

Agroforestry Research (ICRAF) signed a cooperation

agreement to coordinate efforts and promote research,

development and technological innovation that help

optimise the management and sustainable use of country’s

resources.

Each institution will promote the development of projects

aimed at knowledge, management, use and conservation of

forest resources and will coordinate actions to strengthen

the capacities of regional authorities.

Osinfor strengthens supervision of agroforestry

contracts in the Amazon

The Supervision Agency for Forest Resources and Wild

Fauna (Osinfor) with technical support from the AgroFor

Project strengthened the capacities and knowledge of its

officials regarding the technical and regulatory aspects of

the Concessions in Use contracts for Agroforestry Systems

(CUSAF).

TheCUSAF contracts are a type of land use right which

allows the formalization of productive forestry and

agroforestry activities of family farmers in areas identified

as agroforestry, silvo-pastoral or recovery production

areas.