Japan

Wood Products Prices

Dollar Exchange Rates of 10th

Jan

2022

Japan Yen 115.20

Reports From Japan

Private sector optimistic

Over 80% of large companies in Japan expect the

economy to grow in 2022 as personal consumption is

expected to rise but this depends on the severity of the just

beginning 6th wave of infection. 13 firms predicted the

economy will be flat as people remain cautious about the

pandemic. But none of the firms said it will contract.

The number of firms forecasting growth in the latest

survey is up from a similar poll a year earlier.

Consumers in Japan continue to hold onto their money as

they see prices of necessities rise due to higher

manufacturer input costs, rising transport cost and the

weakening of the Japanese yen.

See:

https://english.kyodonews.net/news/2022/01/48aab3e4b819-84-of-firms-in-japan-see-economic-growth-in-2022.html

Digital transition will strengthen economic recovery

says OECD

In a press release presenting the latest report on Japan the

OECD says that as the economy regains momentum

efforts can shift from emergency support measures to

targeted policies and reforms to boost labour force

participation and productivity helping to uphold growth

and living standards over the long run.

Improving public spending efficiency, including through

digitalising more government services and gradually

raising the consumption tax, which is low by OECD

standards, could help to reduce the public debt-to-GDP

ratio, ease the pressure on public finances from a rapidly

ageing population and ensure fiscal sustainability. There is

also scope to broaden environment-related taxation.

OECD Secretary-General Mathias Cormann said ¡°Japan is

on track for a steady recovery which will enable a gradual

reduction in support to the economy and a renewed focus

on structural reforms to sustain growth over the long term.

Making better use of the digital transformation and

improving business dynamism will be key to avoiding the

economic scars that persisted after previous downturns and

turn the ongoing rebound into long-lasting growth.¡±

See:

https://www.oecd.org/newsroom/japan-broaden-the-digitaltransition-to-strengthen-economic-recovery-from-covid-19-saysoecd.htm

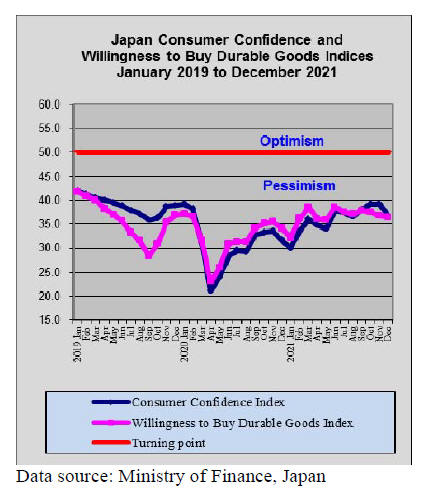

Dip in consumer confidence indices

The Cabinet Office consumer confidence indices dipped

slightly in December and this was put down to the signs

that the Omicron variant had gained a foothold in Japan.

The Cabinet Office survey showed the overall index fell

more than the index for ¡®willingness to buy durable

goods¡¯. The December decline was the first since

September 2021.

Homes from only Japan-grown wood

Mitsubishi Estate, the house builder plans to construct and

sell single-story homes made exclusively from Japangrown

timber saying this will promote domestic forestry

and decarbonisation.

Logs will be purchased in the Kyushu region and

processed at a plant in Kagoshima. The homes will be

constructed with cross laminated timber (CLT)

components and because of the pre-fabrication Mitsubishi

homes can be ready for occupancy in about one month.

See:

https://the-japan-news.com/news/article/0008150957

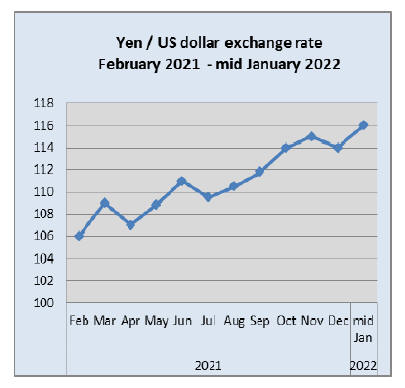

Weak yen beginning to have a negative impact

on

household finances

At the start of the New Year the Governor of the Bank of

Japan (BoJ) appears to have had a change of heart saying

perhaps the costs of holding the yen down outweigh the

benefits as the weak yen is beginning to have a negative

impact on household finances as prices rise.

An analysis by BoJ staff indicated that the impact of the

yen's depreciation has pushed up prices of durable goods

in recent years. The cushion of the weak yen in boosting

exports allowed the government to put off much needed

structural reforms to free up labour markets, spur

innovation and increase productivity.

See:

https://www.forbes.com/sites/williampesek/2021/12/29/whyjapans-economy-may-surprise-us-in-2022/?sh=1060206a1c6e

Furniture growth forecast

The furniture market in Japan is expected to grow at a

strong rate up to 2026 according to growth trends for the

sector published by Mori Intelligence Japan. The Mori site

introducing its forecast say the major factors driving the

demand for furniture products in the country include rising

disposable income, increasing household and commercial

space and rising urbanisation.

It continues ¡°The market share of imported furniture in

Japan has risen significantly in the last few years. Among

imported furniture, wooden furniture occupies the largest

proportion, followed by furniture accessories, metal

furniture, plastic furniture, etc.

With low labour costs, China has become Japan's largest

furniture supplier accounting for nearly 40% of the total

Japanese wooden furniture imports. Some of the other

exporters of furniture products to Japan are Thailand,

Vietnam, Malaysia, the Philippines, Indonesia, Germany

and Italy.

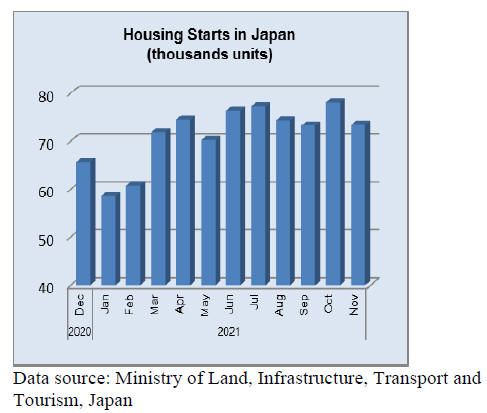

The trends in Japan¡¯s housing sector are central to the

future of the furniture manufacturing sector. The current

upward trend in the country is an increasing number of

one-person households in the country, driven by changes

in culture and life-styles, which is one of the major forces

to influence furniture demand in the country.

Single-person households are the fastest-growing

household group in the country and may eventually

become the largest such group in Japan. Singles need less

space and can, therefore, save on rent and house-building

costs. Due to limited space, furniture needs to be both

pleasing and practical.¡±

See:

https://www.mordorintelligence.com/industry-reports/japanfurniture-market

Rising production costs hitting profits

In November, Inter Ikea group reported a 17% drop in

annual profits attributing the decline to a steep increase in

transport and raw material prices. Container transport

prices are at record levels as a result of the disrupted

maritime logistics and furniture manufacturers both

domestic and those overseas supplying Japan are seeing

steep increases in raw material costs which have pushed

up production costs and it is likely that other furniture

companies will also increase prices.

The domestic press has reported that Ikea, for example,

will increase retail prices by around 9% as it can no longer

afford to absorb the rising costs. It is likely that other

manufacturers will follow suit.

See:

https://japantoday.com/category/business/ikea-to-hikeprices-by-9-due-to-supply-chain-woes

Hitachi forest monitoring system to identify forest

intrusions

Hitachi, along with the US non-profit organisation

Rainforest Connection, has developed a monitoring system

to detect intrusions into forest areas which may signal

illegal activities. The system deployed relies on acoustic

data from specific forest areas and building an algorithm

to detect changes in acoustics.

The Hitachi system picks up the sound of the forest and

informs of changes such as the noise of people, trucks and

chainsaws. In this way, Rainforest Connection has

leveraged technology to promote the protection of

rainforests in many threatened countries.

https://rfcx.org/our_work

and

https://social-innovation.hitachi/jajp/article/rainforest/?WT.mc_id=21JpJpHq-rainforesttaboola&utm_source=taboola&utm_medium=native&utm_campaign=about_cop08&utm_term=all_pc&utm_content=R1_rainfor

est_PC_01&tblci=GiAfv6j0bBr1SoSJdgz0MAR5iV4szHjSQ5vNt9Fg1F5uriDVl1AogbPzxI6Iz9cL#tblciGiAfv6j0bBr1SoSJdgz

0MAR5iV4szHjSQ5vNt9Fg1F5uriDVl1AogbPzxI6Iz9cL

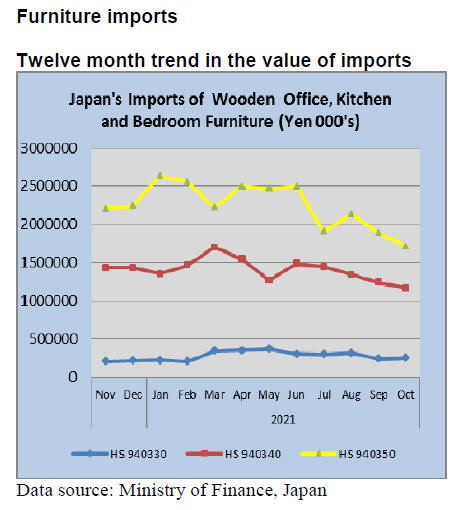

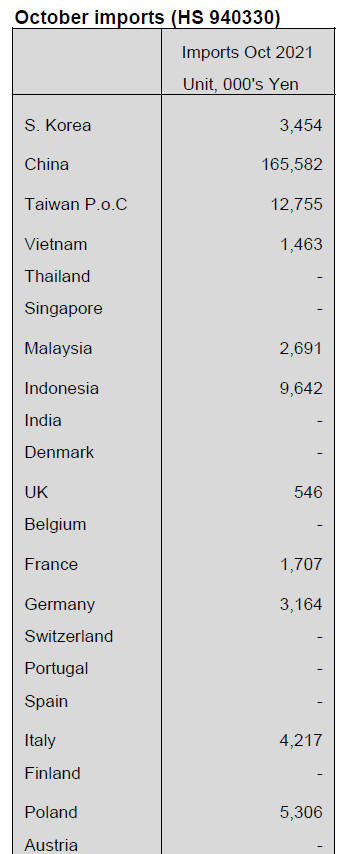

Office furniture imports (HS 940330)

Year on year the value of imports of wooden office

furniture (HS940330) rose over 50% in October building

on the 40% month on month rise in September. Compared

to October 2019 the value of imports in October 2021

increased.

The top shipper of wooden office furniture in

October

2021 was China taking a 66% share of the total value of

wooden office furniture imports.

Since mid year there has been a gradual decline in the

value of wooden furniture imports from China. The US

was the second ranked supplier in October 2021 at around

10% of imports with shippers in Taiwan P.o.C accounting

for around 5%. Of interest was the inclusion of Australia

in the group of top 20 suppliers in October.

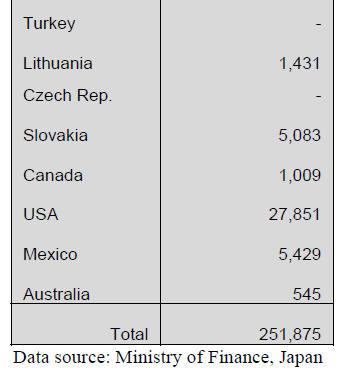

Kitchen furniture imports (HS 940340)

The value of Japan¡¯s wooden kitchen furniture

(HS940340) imports continue to decline. October imports

were 6% below the value of imports in September and

compared to October 2020 there was a 30% decline.

The top shippers of wooden kitchen furniture to

Japan in

October were the Philippines (52% of all October arrivals)

Vietnam (23%) and China (9%). All three of the top

shippers saw October shipments fall below those of a

month earlier.

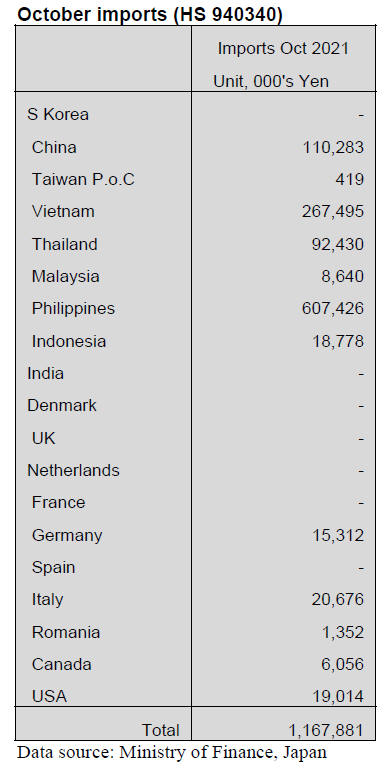

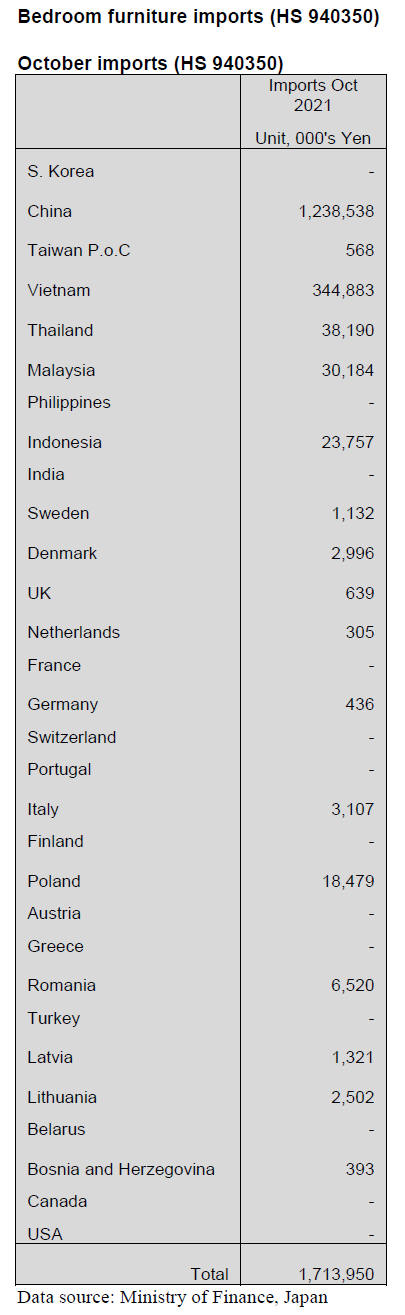

Since the beginning of the second quarter of this

year the

value of Japan¡¯s imports of wooden bedroom furniture

have been declining which, given the stable housing starts

and consequent demand for household furniture suggests

that domestic manufacturers could be gaining market share

over imports.

Year on year, October 2021 imports were 28% below that

in October 2020. Month on month, October arrivals of

wooden bedroom furniture were down 9% continuing the

downward trend.

The top suppliers in terms of value in October were China

(72%) and Vietnan (20%). Shipments from both China and

Vietnam in October were down being impacted mainly by

logistic problems.

The other top shippers in October were Malaysia, Thailand

and Indonesia but after capturing a 15% share of imports

in September the combined value of October shipments

from these three shippers dropped to just 5%.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

South Sea logs and lumber

Log production is low in producing regions in the middle

of rainy season. Logs are tight in PNG and Sarawak,

Malaysia.

Securing ships¡¯ space is difficult so even if logs are

available, there is no mean of transporting for lumber

mills. Lumber mills using South Sea hardwood logs have

difficulty to keep operating. Domestic demand keeps

continuing slowly but hasty orders are hard to accept for

sawmills by shortage of logs.

Some are transporting Malaysian logs through Taiwan. By

difficulty of obtaining containers, some orders are delayed

for a month. Indonesia is in rainy season so log production

is down.

Chinese products remain high in cost. Demand for

laminated free board is inactive by lack of demand in

Japan. In China, shortage of electric power stopped some

operations of manufacturing plants.

Price hike of domestic softwood plywood

One of major companies which produce softwood

plywood in Eastern Japan raise the price of softwood panel

to ¥1,500, 12mm thickness of 3x6. This is ¥200 per sheet

higher than before.

This is going to be ¥75,000 in a cbm which is ¥10,000

more. Not only higher prices of domestic logs and

imported veneer, but also higher price of crude oil, wood

glue and distribution cost are reasons the company raises

the prices.

24mm thickness of 3x6 is ¥3,000 and 28mm thickness

of

3x6 is ¥3,500. Both kinds will be total ¥75,000 in a cbm.

The reason is higher log cost. The amount of log harevst is

not enough as people hoped even though it is in the middle

of log harvest season.

On the other hand, demand of sawn wood and laminated

lumber is still lively because there had been many orders

from companies in western Japan as well. About 70-80%

of necessary logs are able to collect and if collecting more

logs, it has to raise the log price. It is hardly estimating the

total amount of logs would be supplied as wood producers

started cutting down trees.

People at plywood plants have difficulty in managing raw

materials because there are not enough imported logs from

Russia. Russian larch veneer¡¯s price increased and there

are less ships to Japan from Russia because of an influence

on lively demands in China. Japanese people are also

worried about there might be less Douglas fir logs from

Canada due to extensive flooding in British Columbia,

Canada in November.

There are another problem such as cost of crude oil and

natural gas increase, which made high-priced industrial

bond and some trucking companies is asking for

increasing the fuel surcharge due to the price of gasoline

increased.

Usually, it is difficult to reserve trucks at the year-end and

New Year holidays but in this year, economic activity

restarted so there are already less trucks available in the

middle of November. People at plywood companies have

to understand this condition if they really need trucks.

The demand is more than supply for the end of the year so

plywood companies must control supply carefully. No

matter how large or small demand and supply, people at

precutting plants are working very hard. Since a lack of

plywood, precutting companies hesitate to get new orders.

It will result in inconvenience for customers if we do not

control the orders and collecting plywood, a company

says. Some DIY stores could buy a half amount of orders

they want so they are suffering shortage of the supply.

Sumitomo buys New Zealand timber

Sumitomo Corporation has acquired timberland in the

North Island of New Zealand through its local subsidiary

company. Summit Forest New Zealand (SFN), 100%

subsidiary company of Sumitomo Corporation. It has

completed acquisition of 15,000 hectares of timberland

from Ernslaw One. They are 8,000 hectares in Gisborne

area and 7,000 hectares in Coromandel. Purchase amount

is not disclosed but is estimated about 102 billion yen.

SFN owns total of 37,000 hectares of timberland already

so adding the new purchase, total is 52,000 hectares,

which is seventh largest timberland owner in New

Zealand. In newly purchased timberland, log harvest of

200,000 cbms is estimated and adding harvest in already

owned timberland, total would be about 800,000 cbms.

Sumitomo sells about 350-400,000 cbms of radiate pine

logs for New Zealand domestic wood processors then

purchases about 460,000 cbms and it plans to export logs

of 860-900,000 cbms a year.

As log exporters, it is ranked fifth. The market is China.

Cycle is 28-32 years from plantation, thinning and harvest

of radiata pine timber so it is typical rotating sustained

yield business like farm products.

Sumitomo intends to invest on timber resource business,

which can be sustainable growth and trees contribute

preventing global warming trend as tress absorb carbon

dioxide and fix carbon. Sumitomo plans to invest total of

50 billion yen on forest asset including the purchase of this

time.

Sumitomo also has joint venture forest products company

in Russia, which owns 2,660,000 hectares of timberland

with forest certificate.

Iida Group Holdings bought Russian forest products

company

Iida Group Holdings, which has many house builders,

announced that it bought the largest forest products

company in the Russian Far East, Russian Forest Products

with purchase amount of 25 million dollars. This is the

largest overseas purchase in forest products business for

Japan.

RFP owns four million hectares of PEFC certified forest

with annual allowable harvest volume of 4,100,000 cbms

but actual harvest volume is only 1,700,000 cbms. It also

owns wood processing company, which consumes about

800,000 cbms of logs. Products are lumber and veneer Iida

group Holdings plan to supply wood products to house

builders in the group stably and it plans to invest for more

wood processing facilities including wood pellet.

Hokushin to increase the prices

Hokushin (Osaka prefecture), the largest MDF

manufacturer in Japan, announced that it would increase

the sales prices of MDF since March 2022 by about 10%.

The prices differ by the customers but prices of thick star

wood are about 55,000 yen per cbm and thin MDF prices

are about 71,000 yen now then since March 2022, the

prices will be 60,000 yen on star wood and 78,000 yen on

thin MDF.

Hokushin says total manufacturing cost is nearly 20% up.

Compared to March this year, electric power is 15% up,

natural gas is 40% up so total energy cost is 20% up.

Adhesive cost is 20% up. Ocean freight of imported wood

chip is up.

It consulted customers of price hike in April 2020 but by

depressed economy by the COVID 19 epidemic, the prices

are forced to drop in June and July then the prices are back

to the previous level in March 2021 and about 10% price

increase is made by October 2021 but with further increase

of the cost, it needs to increase the prices again.

Novopan to raise the prices

Japan Novopan Industrial Co., Ltd in Osaka, Japan

announced that they will raise the prices of particleboards

in January, 2022. There are two kinds of particleboards

such as floor sheathing and roof sheathing for building

constructions and housing companies of prefabricated

constructions. About 12-15% will be increased in prices.

This is the first time in ten years. The reasons are that

price hike in wood glues and materials. The particleboard

for building constructions called STP2 costs ¥1,400, 9mm

thickness of 3x10 now, but it is going to be ¥1,600.

The prices of wood working and floor board for concrete

condos had been 8% increased since August, 2021.

One of reasons is that benzene and naphtha, which are for

making adhesive for wood, cost double what it did before

so the price of adhesive jumped up by 50-70% more. Also

the company is facing a difficulty in unprofitable of

recycled wood chips due to price hike in trucking and

distribution costs.

|