Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Oct

2021

Japan Yen 114.16

Reports From Japan

No change as election result

declared

The ruling coalition retained a comfortable majority in the

House of Representatives following the General Election

on 31 October. The Liberal Democratic Party (LDP) has

been in power for over 60 years. In welcomed the victory

of Prime Minister Fumio Kishida Japan's business leaders

called for strong leadership to revive the economy.

State of emergency lifted acros the country

With more than 70% of the population fully

vaccinated against COVID-19 the rate of the roll-out is

expected to slow down and the country could just make

the target 80% by the end of November. Despite an

initially slow rollout, Japan is now ranked No. 3 for its

vaccination rate among the Group of Seven industrialised

countries.

Tokyo and Osaka have now lifted all coronavirus

restrictions on restaurants and bars, meaning the entire

country is now free from covid restrictions. However,

infections are still being reported but a very low level and

there are concerms that the country will experience an

additional wave of infections.

Economic Security Minister appointed

Just before announcing the General Election the ruling

party prepared a report on economic security which,

analysts say, focuses on the economic and trade ties with

China and the associated risks. The report notes Japan¡¯s

heavy reliance on trade with China and how this was

seriously disrupted due to the coronavirus outbreak.

In a mid-year White Paper the government said several

nations, including Japan, had been spurred to strengthen

economic security after the pandemic exposed supply

chain risks.

Japan appointed an economic security minister whose role

will be to ¡°develop strategies and a legal framework to

enable Japan to boost economic security encompassing

supply chains, resources, innovative technologies and

relevant infrastructure.¡±

See:

https://www.japantimes.co.jp/news/2021/10/25/business/economy-business/china-japan-economic-security/

Growth forecast lowered

The Bank of Japan (BoJ) has lowered its growth and

inflation forecasts for this fiscal year and will maintain its

current loose monetary policy in an attempt to support the

fragile economic recovery.

The BoJ Governor warned that the disruptions of supply

chains will last for some time heightening risks for the

economy as costs will rise for companies and households.

The BoJ now forecast a 3.4% growth down from the

previous 3.8% projection.

See:

https://mainichi.jp/english/articles/20211028/p2g/00m/0bu/031000c

Cost push inflation ¨C no sustainable price growth

Consumer prices rose in September for the first time since

the early stages of the corona pandemic in March 2020.

Given rising energy prices inflation is set to rise in coming

months but analysts say the rise will be modest compared

with other advanced economies as low wage growth

dampens consumption. As it is a cost push rather than

demand pulled inflation it is unlikely that there will be a

sustainable price growth.

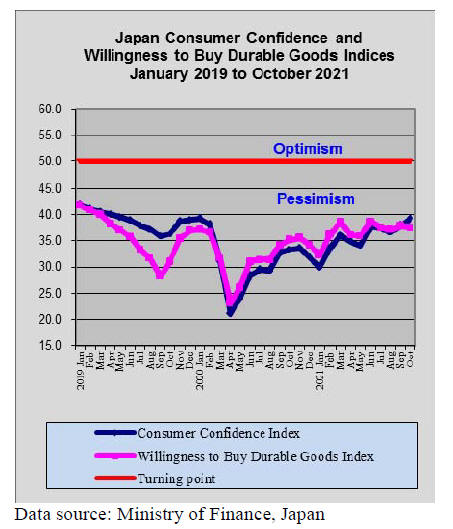

According to the latest data from Japan¡¯s Cabinet Office

consumer confidence rose in October to its highest level in

30 months buoyed by the decline in covid infections and

the lifting of the state of emergency. For the first time in

four months the Cabinet Office raised assessment of

consumer sentiment saying it ¡°continues to pick up.¡±

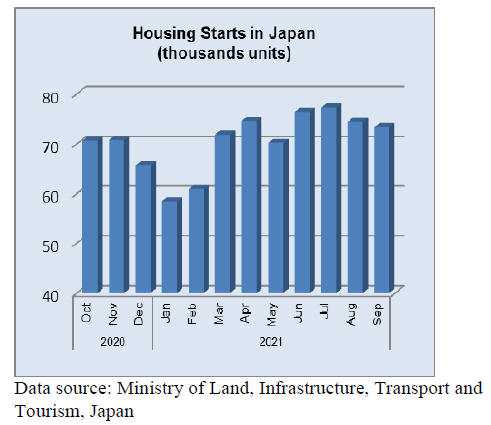

Housing ¨C starts still not at 2019 levels

September housing starts were up 4% year on year but had

not recovered to 2019 levels agaist which they were down

6%. September marked the second straight monthly

decline in starts although the drop in September was only

slight.

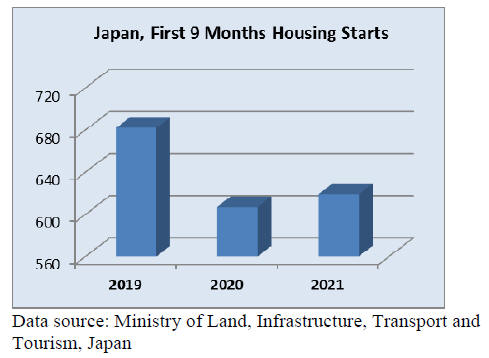

First three quarter housing starts

Housing starts in the first three quarters of 2021 were up

slightly on the same period in 2020 but still around 9%

below pre-pandemic 2019 levels.

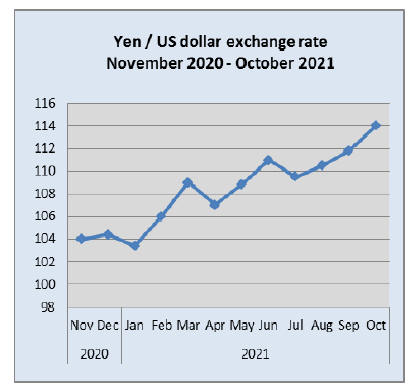

BoJ Governor - weak Yen does more good than

harm

The Yen dipped to a new low against the US dollar

recently. A weak Yen typically drives exports higher but

when, as now, it is combined with surging prices for

imports the economic recovery from the pandemic will be

disrupted.

Wholesale prices have also been rising to such an extent

that soon Japanese companies that currently absorb the

higher costs may have to start passing them on to

consumers. The yen's recent slide has raised concern that

this could hurt business and consumer sentiment by

making things more expensive but the BoJ Governor said

a weak yen does more good than harm.

Import update

Furniture imports

Household spending fell in August as state of emergency

restrictions weighed on sentiment. Private consumption

has been a weak spot the Japanese economy since the

surge in Delta variant infections. Furniture and homeware

retailers in Japan have opened new stores to cater for

people working from home.

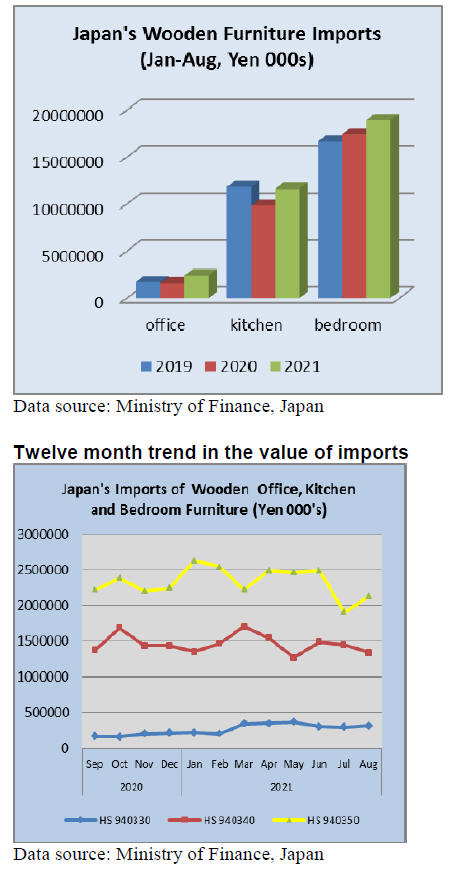

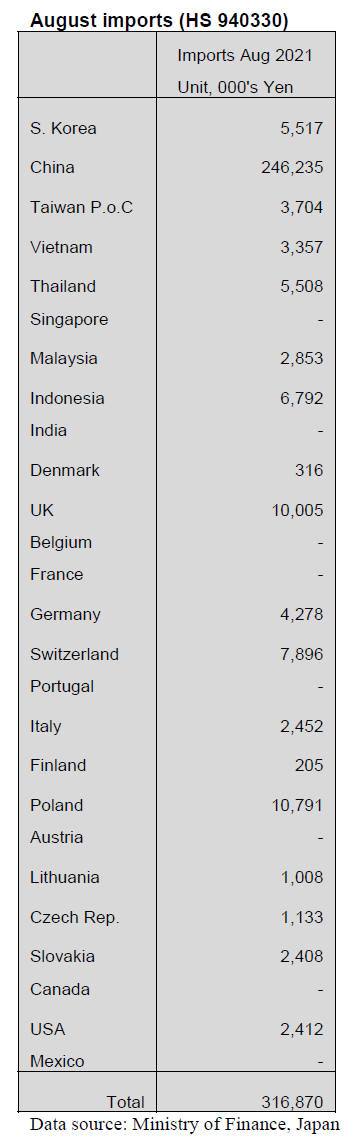

The impact of the pandemic on furniture imports in Japan

has varied. Looking at imports for the first eight months of

2019, 2020 and 2021 imports of office furniture in 2020

held up well against the value of 2019 and the value of

imports in the period Jan-Aug 2021 rose significantly.

There was a decline in the value of wooden kitchen

furniture in 2020 compared to 2019 but the rebound in

2021 was not enough to lift the value of imports up to

2019 levels. In contrast to imports of wooden office and

kitchen furniture, imports of wooden bebroom furniture

have steadily increased from 2019.

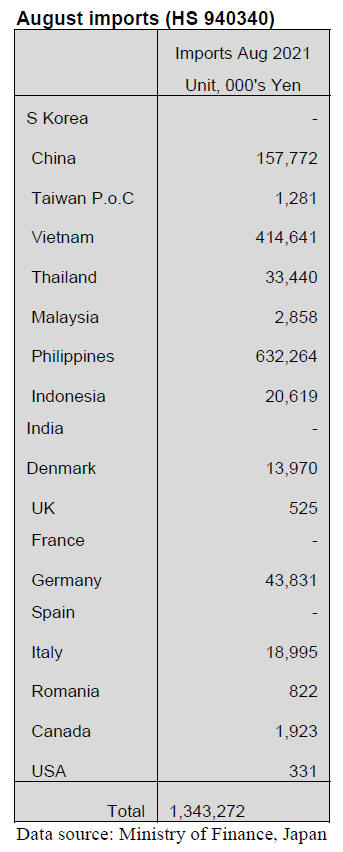

Office furniture imports (HS 940330)

Year on year, the value of imports of wooden office

furniture (HS940330) rose over 43% in August and

compared to August 2019 there was an almost doubling of

the value of imports.

The top shipper of wooden office furniture in August this

year was China whose share of imports was 78%. The

other two significant shippers in Auguest were the UK, a

new comer to this segment of the Japanese market and

Poland, a regular shipper to Japan. Shippers in ASEAN

countries made up most of the balance.

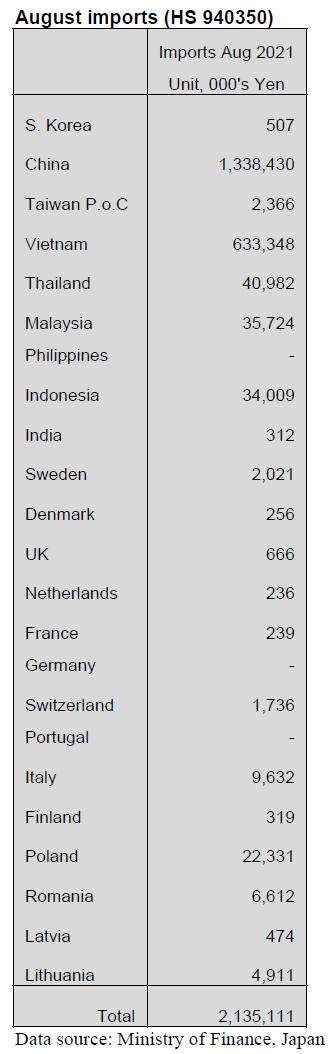

Kitchen furniture imports (HS 940340)

There was a further drop (7%) in the value of Japan¡¯s

imports of wooden kitchen furniture in August. As could

be anticipated there was a rise in imports compare to 2020

but the level of August 2021 imports still has not matched

that of 2019.

In August 2021 wooden kitchen furniture shipments from

manufacturers in the Philippines and Vietnam dominated

imports (47% and 31% respectively). If shipments from

China are added to those from the two top shippers then

90% of shipments are accounted for. the other shippers in

August were Thailand, Indonesia and Germany.

Bedroom furniture imports (HS 940350)

Month on month, August arrivals of wooden bedroom

furniture were up 12% reversing the steep drop in the

value of July imports. However, compared to August 2020

there was a decline in the value of imports of 9% but there

was a rise over the same month in 2019.

The main suppliers in August were, as in previous months,

manufacturers in China, Vietnam and Thailand. The value

of imports from Chian and Vietnam were higher than in

July but of the other three main suppliers, Thailand

Malaysia and Indonesia it was only Malaysia that saw it

month on month shipments rise in August.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Total wood demand and supply in 2020

The Forestry Agency disclosed total wood demand by use

in 2020. Total wood demand in 2020 is 74,439,000 cbms,

9.1% less than 2019.

Decrease of industrial wood demand (lumber, plywood,

pulp and wood chip) of 61,392,000 cbms, 13.9% less is

the main reason of decline.

Wood demand for fuel is 12,805,000 cbms, 23.3% more,

seven straight years¡¯ increase. These are the largest after

59 years since 1961. Self-sufficiency rate and use are

different from 1960s but scale of demand and balance of

two is back to beginning of high economic growth days.

In industrial wood, import wood decreased by 17% while

domestic is 7.7% less so degree of self-sufficiency

improved to 35.8%, 2.4 points up. Degree of selfsufficiency

including fuel and others is 41.8%, 4 points up

and this is the first time of over 40% in 48 years since

1972.

For the supply, domestic is 31,149,000 cbms, 0.5% more

and the imports are 43,290,000 cbms, 15% less. Increase

of domestic is mainly fuel wood of 1,995,000 cbms, which

filled decrease of industrial wood. Demand of logs for

lumber and plywood manufacturing in 2020 declined

while surplus logs are used for fuel. Also domestic log

export increased.

In total industrial wood demand, it is first time in eleven

years since 2009 when new housing starts were down to

780,000 units that log demand for lumber is less than

25,000,000 cbms and for plywood is less than 9,000,000

cbms. Drop this time is the same reason with decline of

housing starts.

Housing starts in 2020 are 815,000 units, 9.9% less than

2019 because of COVID 19. In particular, wood-based

units are 469,000 units, 10.3% less, which caused decrease

of log demand for lumber by 10.9% and for plywood by

14.8%. Decrease of demand for pulp and wood chip is

17.5% because demand for paper shrunk by COVID 19.

It is the first time in 48 years since 1972 that the demand

for pulp and wood chip dropped down to 26,000,000

cbms. Shrinking trend continues and 2021 will have less

than 2020 as Nippon Paper closed paper manufacturing at

Kushiro pant. Wood demand for fuel continues increasing

with increased supply of imports.

Plywood mills in the North East

Plywood mills in the North East are facing high prices of

logs by short supply. 4 meter larch logs for plywood is

about 20,000 yen per cbm delivered and 4 meter cedar

logs for plywood is about 13,000 yen per cbm delivered.

They are 2,000-3,000 yen higher than before last summer.

Plywood mills continue buying logs even with high prices

since precutting plants and dealers complain shortage of

plywood.

Log supply in the North East had been smooth until last

spring as log production recovered by front loading

harvest of the National Forest timber then in summer, log

production dropped as log suppliers concentrate on

replantation, which is usual move in summer months and

housing starts are increasing in the region.

Supply of imported wood products stayed low particularly

from Europe so the demand of domestic wood like lumber

and laminated lumber sharply increased after middle of

August. Now lumber mills, laminated lumber mills and

plywood mills fight to get logs with each other.

Log prices for lumber mills started climbing up since

middle of August and 4 meter larch log prices are 19,000

yen per cbm FOB deck and 3.65 meter cedar log prices in

Akita are 17,000 yen. Plywood mills made agreement with

local forest unions and log suppliers so log supply is rather

stable but there are no extra logs to buy in open market.

Seasonally log supply in the North East should be easing

by increase of clear cutting of private forests but busy

demand for lumber and plywood would last through next

year so log price are likely to stay high for some time in

the region.

South Sea (tropical) logs and lumber

Both logs and lumber of South Sea hardwood continue

stagnant. Rainy season started in September in Sarawak,

which is about a month earlier than normal years then

labor shortage is critical at logging camps so log

production will remain low until next spring.

In Japan, log inventories for South Sea hardwood lumber

are getting low but the demand is limited. Movement of

Chinese made laminated free board has been steady as

domestic dealers have ample inventory and are cautious of

procuring high priced items since future demand is

uncertain.

The suppliers are in no hurry to sell at low prices because

cost of raw materials and transportation has been climbing.

Supply of South Sea hardwood lumber is tight due to

delayed arrivals by production delay and shortage of

containers but the demand is also low.

Plan to build super high wood hybrid building

Tokio Marine Holdings, Inc (Tokyo) and Tokio Marine-

Nichido Co., Ltd. (Tokyo) decided to rebuild Tokio

Marine-Nichido building in Marunouchi, Tokyo. It will

be three under-ground floors and 19 floors high. Total

height would be about 100 meters. It aims to build the

highest and largest wood hybrid high tower building with

maximum use of domestic wood. Volume of wood used

would be about 10,000 cubic meters.

Basic idea is sustainability concept Tokio Marine group

made up, which pursue the highest environmental

performance with active use of domestic wood. It would

have the maximum measures to deal with natural disasters

so it will have anti-earthquake structure, measures for

flood, emergency power generators and will have wide

space for people who have difficulty returning home.

Regarding use of domestic wood, not only structural

members like post but other use will be the highest level

unprecedented in any other cases.

By using matured domestic timber, cycle of plantation,

harvest, utilization and replantation is supported as user.

Also it contributes conservation of timberland, protection

of water resources and revitalization of local economy.

Roof greening would ease heat island phenomenon.

Utilization of rain water and recycle system of water

should conserve water resources.

It aims to obtain premium, which is the highest level of

award by LEED, which is international certification

program of green building.

Kyushu¡¯s three way fight to get logs

Wood biomass power generation plants struggle to have

enough logs to run the plants. After imported wood

products supply got tight, demand for domestic logs

sharply climbed. Competing export log prices shot up to

10,000-12,000 yen per cbm delivered loading ports while

log prices for power generation plants are 6,500-7,000 yen

per cbm delivered wood chip plants.

Log production increased after the demand increased

because log suppliers do not have to make sorting at

landing so it¡¯s easier for log suppliers to ship out camp-run

logs. At log auctions, biomass power generation plants

cannot compete with sawmills and log exporters so

securing logs is becoming very hard now.

In 2020, log prices stayed low so that power generation

plants had plenty of logs and some had to stop accepting

logs but log supply for power plants in Kagoshima in June

and July this year decreased. Power plants in Northern

Kyushu suffered low log supply of 20-30% down

compared to 2020 but now it is improving and the worst

season seems over.

There are three way fights among sawmills, log exporters

and power generation plants and there are some comments

that log export should have some limit to protect domestic

industry.

|