US Dollar Exchange Rates of

10th

Oct

2021

China Yuan 6.4358

Report from China

Power rationing - wood processing capacity drops

Power rationing policies are in effect in many provinces in

order to limit activities of energy-intensive industrial

enterprises. There are two issues behind this one is that the

government is trying to achieve lower energy consumption

the other reason is that there is a shortage of electricity

production capacity across the country.

Measures to limit electricity use in factories are currently

being enforced in 10 provincial regions including the

economic centres of Jiangsu, Guangdong and Zhejiang

Provinces.

Many companies and factories in Guangdong province

have been required to operate on a staggered schedule in

which production lines are allowed to run for two to three

days a week. Household power use is not limited.

Wood processing enterprises are facing challenges in

terms of environmental impact assessment and the power

issue will further affect processing and production will

decline further.

See:

https://news.chinabm.cn/2021/09271762880.shtml

Furniture orders are coming back to China from

Vietnam

It has been reported that Vietnam's lockdown, which was

due to end on 15 September 2021, has been extended until

the end of September 2021 and many off-shore Chinese

furniture companies say that they are directing orders back

to China.

Vietnam surpassed China as the largest overseas supplier

of veneer and plywood to the US at the end of 2020.

Vietnam surpassed China as the largest furniture exporter

to the US in May 2021.

But the corona virus ravaged Vietnam in mid-year and the

government ordered factories to shutdown resulting in a

sharp drop in output. Factory closures in Vietnam have

forced Chinese investors in Vietnam to put expansion

plans on hold.

Due to the spread of the epidemic, Thailand, Vietnam,

Malaysia and Indonesia have suffered renewed outbreaks.

Most countries have declared a "lockdown", resulting in

the suspension of production in many factories and the

return of orders from ASEAN countries to China.

See:

http://www.vnexpo.org/ArticleShow1.asp?id=7896&BigClassid=68&SmallID=173

Guangxi Chongzuo City was honored as China Panel

Furniture Industry Base

A conference on ¡®China National Light Industry Science

and Technology Innovation and Industry Development¡¯

was held recently. Guangxi Chongzuo City was honored

as the China Panel Furniture Industry Base jointly by

China National Light Industry Council (CNLIC) and

China National Furniture Association (CNFA).

The authorities in Chongzuo City attach great importance

to the development of the wood processing industry and

have observed that the furniture cluster development has

achieved remarkable results with annual output value of

exceeding RMB10 billion.

There are more than 1,000 wood processing enterprises in

this City of which 108 wood processing enterprises have

an annual output value of RMB200 million. At present the

production of high-end panels and high-end furniture in

Chongzuo City equals that of the same industry in

Guangxi Province and thus meets the standard and

requirements of characteristic regions and industrial

cluster management by the China Light Industry Council.

With this honor the popularity of the Chongzuo brand will

be enhanced which is of great significance to the

improvement of Chongzuo panel furniture industry.

Product exhibition, publicity and investment promotion

will be conducted. The China Light Industry Council will

provide guidance, supervision and services for the panel

furniture industry development in the City together with

industrial associations.

Record braking outdoor leisure furniture export from

He¡¯nan Province

Outdoor leisure furniture is one of the emerging segments

with high export potential in He¡¯nan Province and its

products are exported to more than 60 countries and

regions, which is a new trade growth point in He¡¯nan

Province.

According to the Zhengzhou Customs the value of outdoor

leisure furniture and parts exports in He¡¯nan Province

between January and August 2021 surged 78% to

RMB5.73 billion.

The exported outdoor leisure furniture includes cane sofas

and deck chair, items which are sought by European and

the US families.

Pingyu County, Zhumadian City in He¡¯nan Province has

attracted leading enterprises in the outdoor leisure industry

such as Taipusen Group and Yongqiang Group and has

developed as one of the best outdoor leisure products

production bases in central China.

Data show that as of 20 September 2021 the value of

outdoor leisure furniture exports was RMB610 million, a

year-on-year growth of 52%, both export value and growth

were a record high.

The success of exports of outdoor leisure furniture from

Pingyu County is partly explained by the efforts of the

local customs authorities to provide efficient Customs

clearance and policies to support enterprise. Exporters can

clear Customs formalities online bringing down

transaction costs and enhances competitiveness.

GGSC-CN Index Report (September 2021)

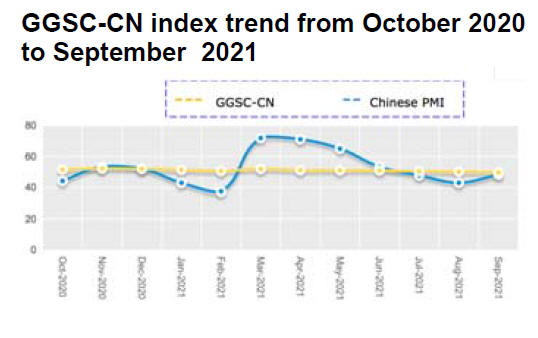

In September 2021, China's PMI index registered 49.6%, a

decrease of 0.5 percentage points from the previous

month. After operating in the expansion range for 18

consecutive months, China's PMI fell below 50%,

indicating that the growth rate of manufacturing industry

has been decreased.

In September the timber manufacturing industry is still not

prosperous enough and there is no prosperity of "golden

September and silver October". The performance of the

production side and demand side is flat, and the

International orders have picked up slightly. Although the

price of raw materials is still rising, the inventory of raw

materials has increased.

The GGSC-CN comprehensive index for

September registered 48.2% (51.6% for

last September and 55.3% for September 2019), an

increase of 5.3 percentage points from the previous month,

and was below the critical value of 50% for three months.

It shows that the operations of the forest products

enterprises represented by the GGSC-CN index shrank

from last month. See below.

Challenges

The transportation cost of raw materials

is too high.

The price of all South American timber has

risen and the timber is in short

supply. There is no way to solve it for the

time being.

The price of pine core

board and Zingana has risen seriously.

The supply of raw materials is unstable.

Products in short supply

Fibreboard,okan, diperyx ,merbau, zingana, pine core

board and thermo wood

Commodity for which the price has been increased

Fibreboard, taun, eucalyptus, okan, diperyx£¬

dahoma, oak, teak

melamine, formaldehyde, diethylene glycol and

other chemical materials.

Colored paper, balance paper, wear-resistant

paper, glue and paraffin.

Commodity for which the price has declined

Oak, miscellaneous firewood.

The GGSC-CN indices

In September 2021 all five sub-indexes of GGSCCN

changed. The production index registered 42.9. But

still below 50% for three months. This indicates that the

production of forest products enterprises represented by

GGSC CN is worse than that of last month.

The new order index registered 42.9 reflecting that the

ability of enterprises to obtain orders is worse than last

month. Among the indices, the new export order index

reflecting international trade, registered 57.1%, an increase

from the previous month showing that orders from abroad

this month is increased from last month.

The main raw material inventory index registered 57.1%,

an increase from the previous month. It shows that the

raw material inventory of the surveyed forest products

enterprises increased in September from last month.

The employment index registered 57.1%, an increase from

the previous month. It shows that the employment of the

forest products enterprises is higher than that of last

month.

The supplier delivery time index was 50.0%. It indicates

that the supply time of raw material suppliers of the

superior forest product enterprises is the same as last

month.

See: http://www.itto-ggsc.org/site/article_detail/id/226

|