US Dollar Exchange Rates of

25th

Aug

2021

China Yuan 6.4814

Report from China

Rise in CIF prices for sawnwood imports

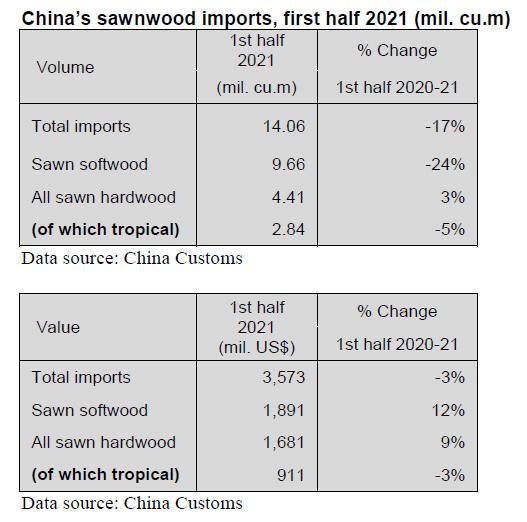

According to China Customs in the first half of 2021

sawnwood imports totalled 14.06 million cubic metres

valued at US$3.573 billion, down 17% in volume and

down 3% in value.

Of total sawnwood imports sawn softwood imports fell

24% to 9.66 million cubic metres, accounting for 69% of

the national total, down 6% over the same period of 2020.

Sawn hardwood imports rose 3% to 4.41 million cubic

metres because imports from the top sources Thailand,

USA, Russia and the Philippines rose 6%, 2%, 7% and

98% respectively.

Of total sawn hardwood imports tropical sawnwood

imports were 2.84 million cubic metres valued at US$942

million, down 5% in volume and down 3% in value and

accounted for about 20% of all imports.

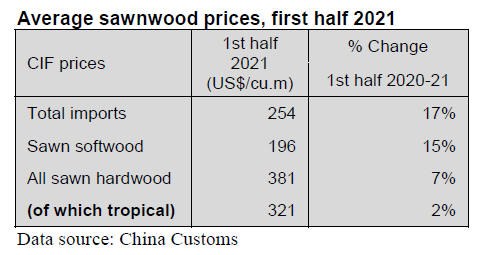

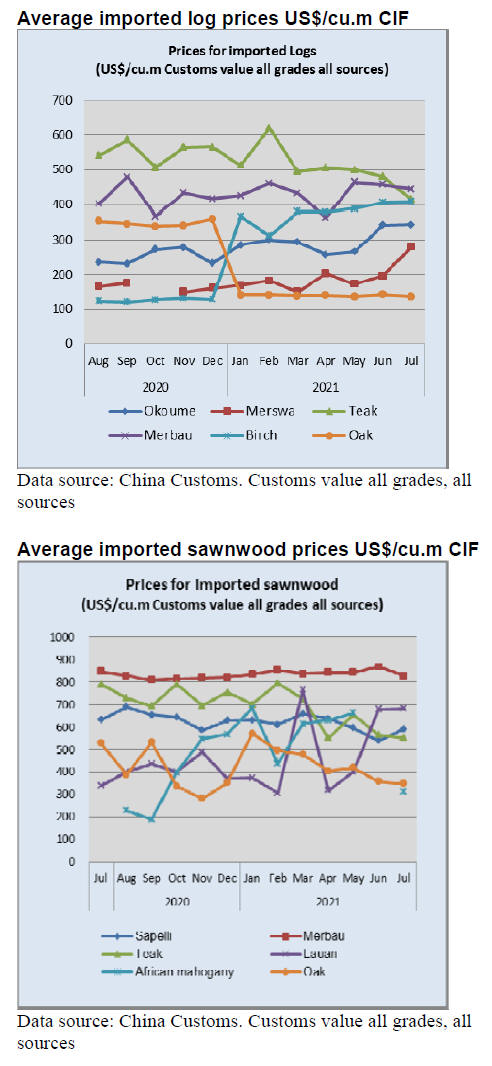

It is worth noting that the CIF prices for imported

sawnwood rose in the first half of 2021. CIF prices for

imported sawn softwood, sawn hardwood and tropical

sawnwood were US$254, US$196, US$381 and US$321

per cubic metre, up 17%, 15%, 7% and 2% respectively

over the same period of 2020.

Possible reasons for the increase aree because prices in

global timber markets have soared as a result of demand

recovery in advanced markets and because some

producing countries have reduced harvests. In addition, the

global logistics efficiency has been disrupted, container

turn-around is not smooth.

Another reason is because domestic demand in China

continues to rise and there is a ban on domestic harvesting

of natural forests. It is expected that the price of timber

will continue to rise in the near future.

Decline from major sawn softwood suppliers

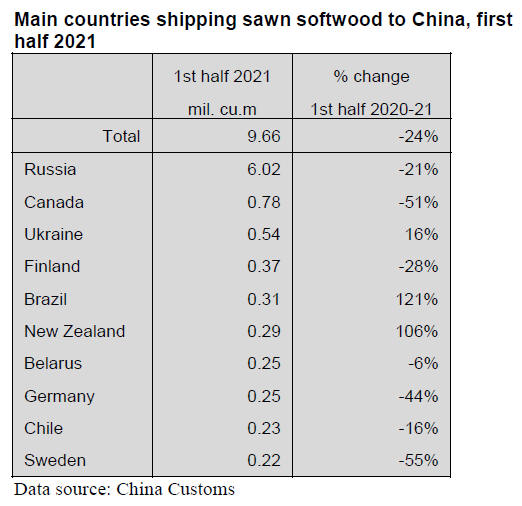

In the first half of 2021, China¡¯s sawn softwood imports

came to 9.66 million cubic metres, down 24% and

accounted for 69% of the national sawnwood import total.

One reason for sharp drop in sawnwood imports was the

decline in shipments from the major suppliers.

Russia remained the main sawn softwood supplier in the

first half of 2021. 63% of China¡¯s sawn softwood was

imported from Russia. However, sawn softwood imports

from Russia fell 21% to 6.02 million cubic metres which

drove down the volume of overall imports.

In addition imports from Canada and Finland previously

major shippers to China fell 51% and 28% respectively. In

contrast, China¡¯s sawn softwood imports from both Brazil

and New Zealand surged and from Ukraine rose 16% in

the first half of 2021.

CIF prices for almost all sawn softwood suppliers

rose in

the first half of 2021. CIF prices for imported sawn

softwood from Canada, Sweden, Chile, Belarus, Finland,

Germany, Ukraine and Russia grew 41%, 36%, 27%, 26%,

24%, 23%, 19% and 13% respectively. However, CIF

prices for imported sawn softwood from New Zealand and

Brazil fell 59% and 42% respectively.

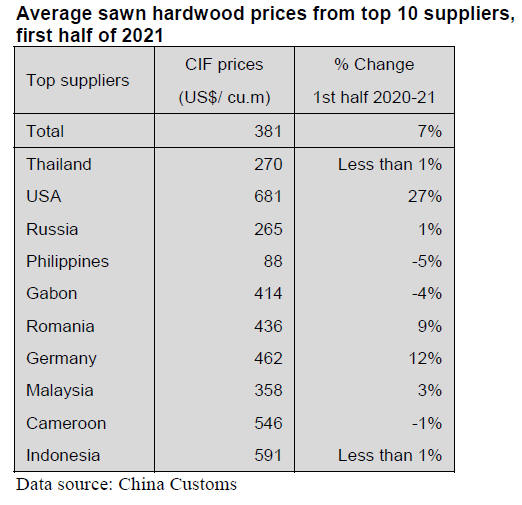

Substantial rise in China¡¯s sawn hardwood

imports

from Philippines

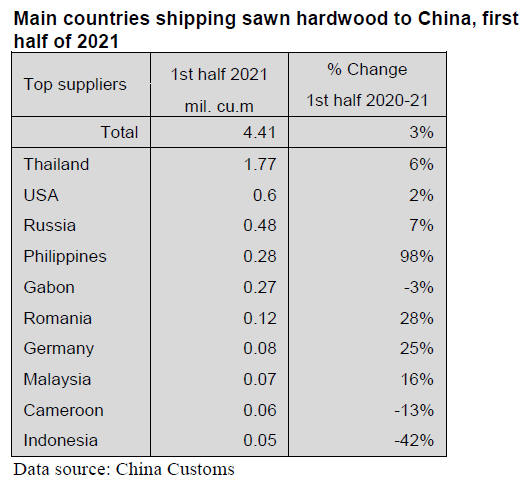

China¡¯s sawn hardwood imports rose 3% to 4.41 million

cubic metres. Hardwood imports from the top sources,

Thailand, USA and Russia grew 6%, 2% and 7%

respectively but the biggest rise was in imports from the

Philippines which rose 98% year on year in the first half of

2021. This was mainly because of a 5% decline in average

price for hardwood imports from the Philippines.

In addition, China¡¯s sawn hardwood imports from

Romania, Germany and Malaysia rose 28%, 25% and 16%

respectively. Vietnam is no longer in the list of main

countries shipping sawn hardwood to China because most

of its sawn hardwood was utilised domestically

particularly by Chinese furniture factories in Vietnam.

China¡¯s sawn hardwood imports from Vietnam plummeted

49% year on year to 30,132 cubic metres in the first half of

2021.

CIF prices for sawn hardwood imports from USA,

Germany and Romania rose 27%, 12% and 9%

respectively.

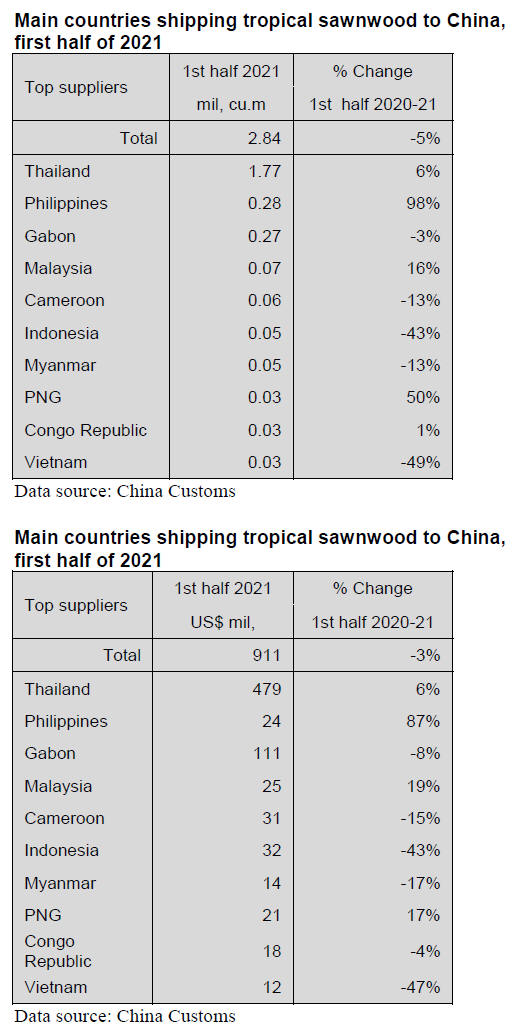

Decline in China¡¯s tropical sawnwood imports

Of total sawn hardwood imports, tropical sawnwood

imports in the first half of 2021 were 2.84 million cubic

metres valued at US$911 million, down 5% in volume and

3% in value and accounted for about 20% of the national

total.

The average price for imported tropical sawnwood was

US$321 per cubic metre, up 2% over the same period of

2020.

Thailand remained the main supplier of tropical sawnwood

for China. Tropical sawnwood imports from Thailand in

the first half of 2021 were 1.77 million cubic metres

valued at US$479 million up 6% in both volume and in

value.

The CIF price for China¡¯s tropical sawnwood imports

from Thailand fell 0.2% slightly to US$270 per cubic

metre in the first half of 2021.

In addition, the Philippines and Gabon were the second

and third largest suppliers of tropical sawnwood to China

in the first half of 2021 accounting for 10% and 9% of the

total tropical sawnwood imports respectively.

The Top 10 countries supplied 93% of China¡¯s tropical

sawnwood requirements in the first half of 2021 namely

Thailand (62%), Philippines (10%), Gabon (9%), Malaysia

(2.5%), Cameroon (2.0%), Indonesia (1.9%), Myanmar

(1.8%), PNG (1.2%), the Republic of Congo (1.14%) and

Vietnam (1.06%).

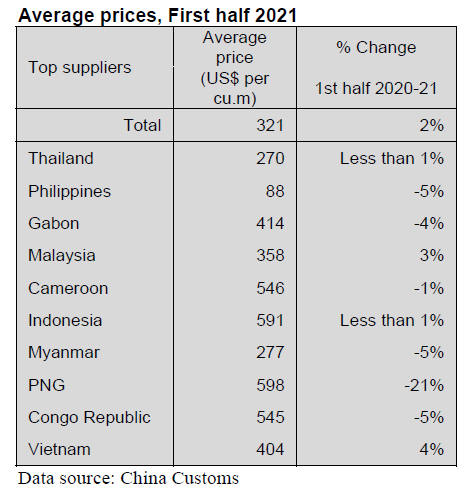

Decline in CIF prices for imported tropical

sawnwood

Data from China Customs shows CIF prices for most of

China¡¯s imported tropical sawn hardwood fell in the first

half of 2021. For PNG there was a 21% decline to US$598

per cubic metre Prices from the Philippines, Myanmar and

the Republic of Congo dropped around 5%. Of the top

suppliers of tropical sawn hardwood imports it was only

for Malaysia and Vietnam that CIF prices increased.

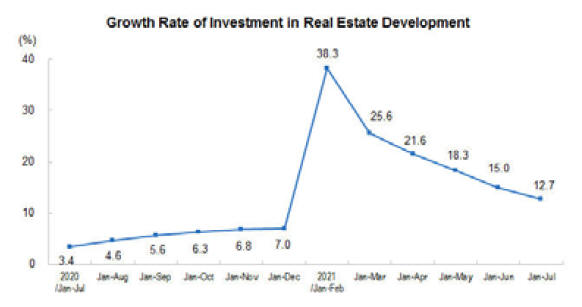

Battling the housing market

After many attempts to take the heat out of the property

market the Chinese government has increased efforts to

break the cycle of growth in the sector that has pushed

homeownership out of reach of most people. Mortgage

rates in a major city have been increased substantially and

the government has pledged to expand the stock of

subsidised rental housing.

The National Bureau of Statistics has reported national

real estate developments and sales in the first seven

months of 2021. Between January and July this year there

was a year-on-year increase of 12.7% in investment in real

estate with a 15% rise in investment in the residential

sector. In the same seven month period the area of

commercial building rose 21% year on year.

Operating conditions of Asian companies in

Gabon

In July 2021 a trial construction of a GGSC-Gabon index

was undertaken. The results are reported below. The index

model and data collection will be further improved.

The GGSC-Gabon indices are compiled by the GGSC

Secretariat with the support of Forest Union of the Asian

Industry in Gabon (UFIAG). The index reflects the

operating conditions of Gabon¡¯s main Asian companies

with forest concessions.

In July the overall GGSC-Gabon index registered 51.8%,

indicating that the operating conditions of participating

companies has improved compared to the previous month.

Specifically, production and manufacturing

activities of

participating enterprises are active; demand was stable,

export orders have shown a good growth and the number

of orders received by enterprises has increased compared

with the previous month.

At the same time, the price of raw materials has increased

significantly and the delivery time has been extended. In

July most companies increased their inventory of raw

materials and finished products.

The GGSC-Gabon sub-indices are as follows:

The production index registered 58.3%, which is

above the critical value of 50% indicating a rise

in production month on month.

The new order index registered 50.0% reflect the

ability of companies granted to obtain orders is

almost same as last month.

The main raw material inventory

index registered 60.0%which is above the critical

value of 50%. This indicates that the raw material

inventory of companies increased in July from

last month.

The employment index registered 50.0%, same as

the previous month

The supplier delivery time

index registered 41.7% sharply lower than the

critical value of 50% indicating the delivery of

raw materials has slowed compared to a month

earlier.

See:

http://www.itto-ggsc.org/site/article_detail_zsbg/id/223

|