Japan

Wood Products Prices

Dollar Exchange Rates of 25th

Aug

2021

Japan Yen 110.09

Reports From Japan

Corona update

In response to the resurgence in coronavirus infections the

Japanese government is adding eight prefectures,

including Aichi and Hiroshima, to the list of those under a

state of emergency. In a 25 August meeting the

Coronavirus Expert Advisory Board said the number of

new coronavirus cases has been "continuously exceeding

record-high levels for nearly a month," and reported

infections have been increasing at a higher rate in regions

outside the greater Tokyo area, compared to the capital

region. Japan's Cabinet has decided to use yen 1.4 trillion

(US$13 billion) of the fiscal 2021 reserve funds for

purchases of more vaccines as well as medicines.

Japan lags behind other developed economies in its

inoculation drive but aims to finish vaccinating all eligible

people in the nation who wish to receive shots sometime

between October and November.

The Japan Times has commented that this latest and worst

outbreak has highlighted the inability of the country¡¯s

highly regarded medical system to adapt quickly to

emergencies.

Quoting the Japan Times ¡°Japan¡¯s health care system has

an abundance of medical equipment and hospital beds and

near universal health care coverage. But it is built on the

strength of preventative and primary care at private

hospitals and cracks in its emergency care provision

resulting in a notorious ¡°death by delay¡±, a problem that

has existed for decades and has not been addressed.

See:

https://www.japantimes.co.jp/news/2021/08/26/national/japanhospitals-covid-19/

GDP growth

In the April-June period Japan's economy grew at an

annualised 1.3% supported by exports which compensated

for the weak domestic consumption, the result of the latest

surge in corona infections.

Cabinet Office data shows growth was better than the

average projection of 0.7% annualised growth forecast by

private-sector economists. The view among many

economists is that Japan is lagging behind other major

economies in its vaccine rollout which is holding back the

recovery.

In late August the Japanese government retained its view

on the domestic economy saying ¡°increased weakness has

been seen in some sectors¡± and warned of downside risks

from the recent resurgence of coronavirus infections.

The Cabinet Office said the economy shows "further"

weakness in some areas and remains in a severe situation

due to the pandemic. This coincided with the expanded

state of emergency to 21 out of Japan's 47 prefectures.

Looking ahead, the Cabinet Office report said the

economy is expected to continue picking up but warned

full attention should be given to a "further increase in

downside risks" due to the spread of the virus.

See:

https://mainichi.jp/english/articles/20210826/p2g/00m/0bu/034000c

Consumer prices continue down

The government announced that Japan¡¯s core consumer

prices, excluding volatile fresh food, dropped by 0.2% in

August from a year earlier marking 12 consecutive months

of decline underscoring and the challenge for the

government and Bank of Japan in their efforts to spur

inflation.

With booming demand in many advanced economies some

analysts have speculated that an inflation wave could

trickle down to Japan where the government has been

trying to break the cycle of deflation for a decade.

See:

https://www.japantimes.co.jp/news/2021/08/20/business/economy-business/japan-inflation-sluggish/

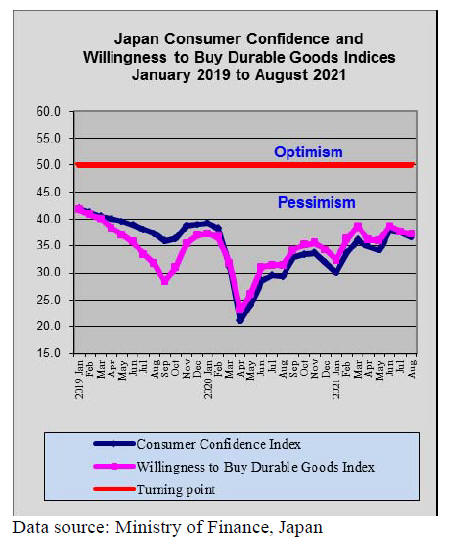

The August dip in the consumer confidence index was

anticipated as the virus situation and state of emergency

measures implemented in the country.

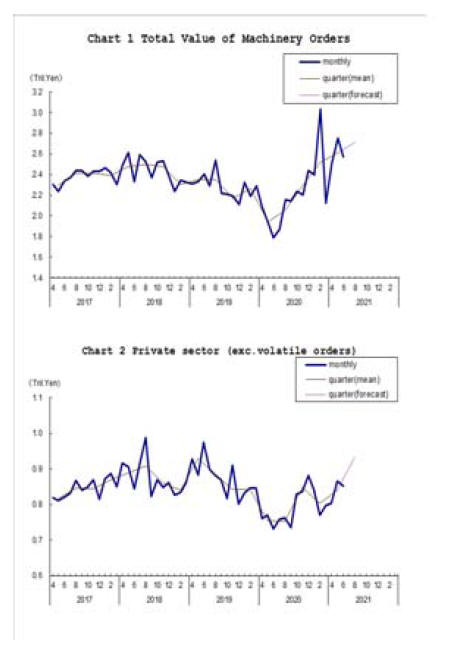

Private sector investment dips

Private sector machinery orders fell 1.5% in June from the

previous month, the first decline in four months but,

despite a serious surge in corona infections the

government remains optimistic on its recovery forecast.

The Cabinet Office maintained its assessment that

machinery orders, seen as a leading indicator of corporate

capital spending, are showing ¡°signs of picking up.¡± In

May, the office revised upward the evaluation for the first

time in five months.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2021/2106juchue.html

Yen exchange rate remain steady

The US dollar gained some strength in mid August

achieveing highs against most major currencies over

continued concerns about the Delta variant but the

advance was short lived and the US dollar/Yen exchange

rate fell back to the narrow 110 range it has maintained for

the past months.

Jump in wood product prices

Data from the Bank of Japan (BoJ) shows July wholesale

prices jumped almost 6% year on year, the fastest pace in

nearly 13 years driven higher by rising energy and

commodity prices.

The BoJ latest survey showed that petroleum and coal

product prices soared 39% from a year earlier and prices

for wood products surged 33% on supply shortages, in part

because of growing demand for new homes and

renovations. Such a steep rise, if prolonged, will inevitably

affect the cost of homes.

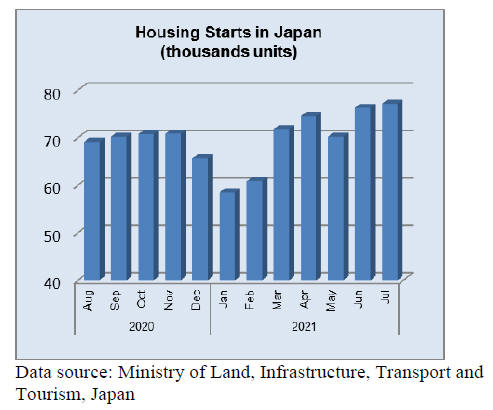

July 2021 housing starts were around 10% higher than

in

July 2020 but compared to June there was little growth.

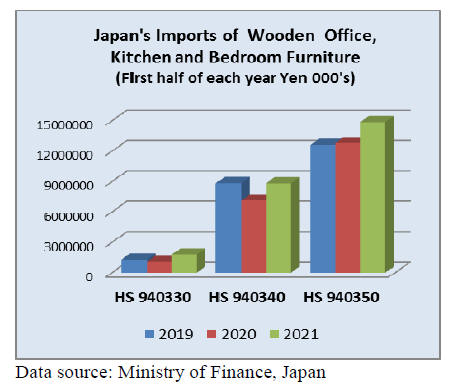

Furniture imports exceed pre-pandemic level

Quite remarkably, Japan¡¯s imports of wooden office,

kichen and bedroom furniture in the first half of 2021 have

exceeded those in pre-pandemic 2019. For office and

kichen furniture the value of imports in 2020 were below

that of 2019 but again, remarkably, imports of wooden

bedroom furniture in 2020 were higher than in 2019 and in

2021 they were above the level seen in 2020.

The combined effect of adjusting home furnishing to adapt

to remote working and the effect of restricted travel and

curtailed holidays put extra cash into household budgets

some of which, it appears, was spent on furniture.

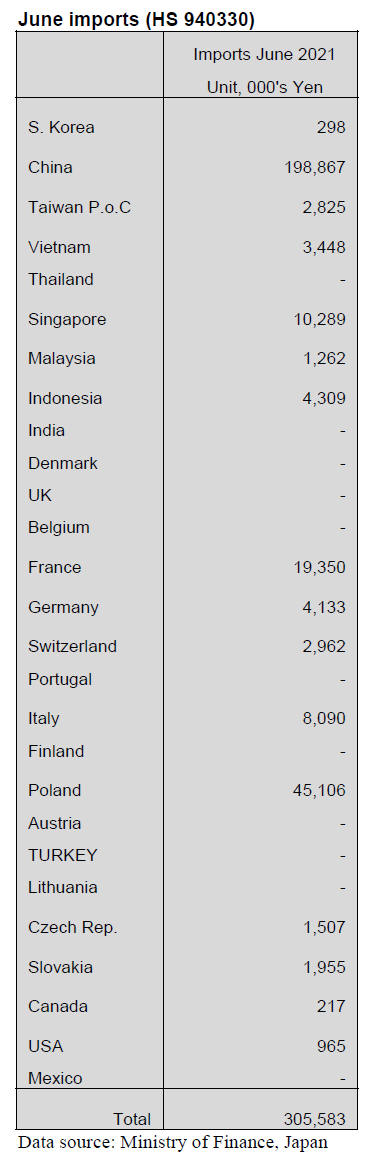

Office furniture imports (HS 940330)

Imports of wooden office furniture dipped slightly (-2%)

in June this year compared to May but compared to June

2020 they were over 70% higher.

The top shippers of wooden office furniture in June this

year were China and Poland, accounting for 80% of all

wooden office furniture imports in the month. Arrivals

from France which was in the top league in May were

down, accounting for just 6% of imports and a relative

new comer, Singapore, was the forth ranked shipper in

June.

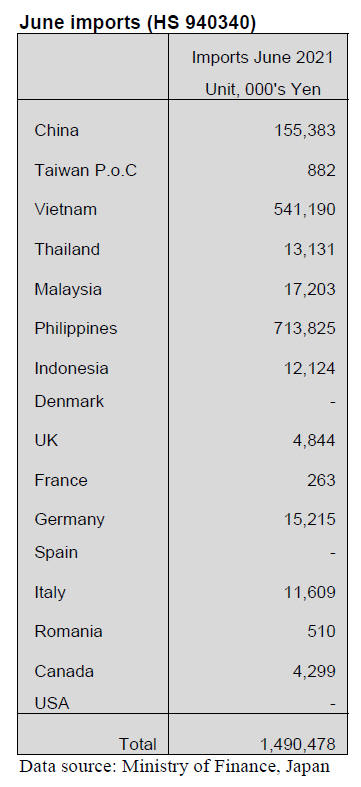

Kitchen furniture imports (HS 940340)

After 2 months of decline Japan¡¯s imports of wooden

kitchen furniture picked up in June. Month on month the

value of June imports rose 17% and year on year there was

a 37% increase.

Over 90% of imports of wooden kitchen furniture were

from shippers in just 3 countries, the Philippines (48% of

imports), Vietnam (36%) and China (10%).

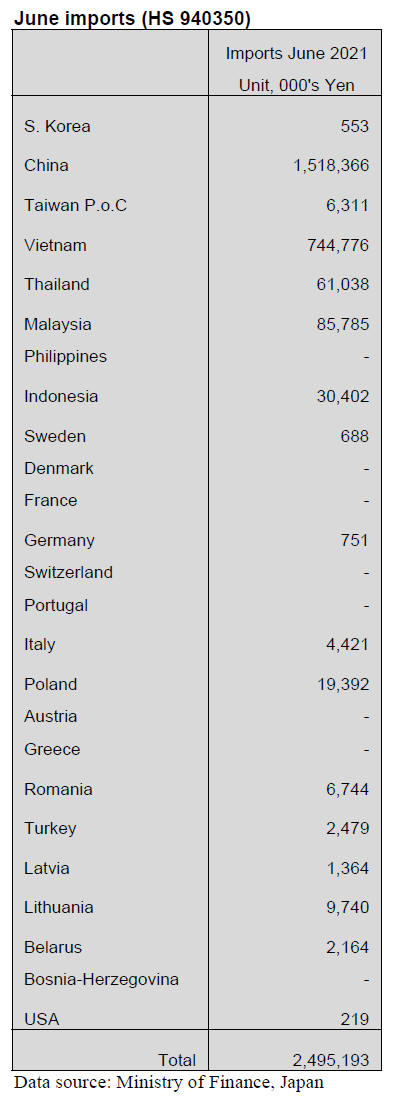

Bedroom furniture imports (HS 940350)

For 2 consecutive months the value of Japan¡¯s imports of

wooden bedroom furniture has remained at around the

same level and current imports are below the highs seen at

the beginning of the year. Never-the-less, June imports

were just under 10% higher than in June 2020.

The main suppliers of wooden bedroom furniture to

Japan

in June were manufacturers in China and imports from

China accounted for over 60% of total June imports of

wooden bedroom furniture.

Shippers in Vietnam claimed the second spot accounting

for 30% of Japan¡¯s imports. Shippers in SE Asia captured

around 7% of market share with the main SE Asian

supplier being Malaysia followed by Indonesia and

Thailand.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Domestic logs and lumber

Movement of domestic logs and lumber settled down and

is pausing since late July. Overheated market in the

Western Japan is easing down. Cypress log prices in the

Western Japan shot up to 50,000 yen in early July then this

was the peak and the prices slightly dropped in late July.

Heavy rain hit the Western Japan in August and log

production started slowing down. Slackening lumber

market should tighten again in late August with fear of

declining supply.

If the supply decreases in large scale, the market of both

logs and lumber may rebound again in September.

Reason of peaking off of domestic lumber prices is that

the imported materials have been increasing gradually

since last month so panic of supply shortage is easing.

South Sea log and products

In Malaysia, lockdown restriction is lifted but in Sarawak,

stricter measures are taken to stop spreading of COVID.

It is about time that log harvest should be active before

rainy season arrives but by short time office hours of

administration offices delays renewing of harvest permit

with labor shortage, log harvest is largely hampered.

Therefore, it is struggle to secure log supply for every

plywood mills.

With higher prices of laminated free board, supply of

Indonesian mercusii pine is unstable so the dealers

continue aggressive purchase of Chinese free board.

Production of mercusii pine lumber face difficult time to

increase because of log shortage and labor shortage by

COVID 19 then tight container space causes delay of

arrivals.

Chinese laminated free board is made of Russian red pine

and by export restrictions by the Russian government, the

prices are constantly increasing.

June plywood supply

Total plywood supply in June is 491,900 cbms, 19.7%

more than June 2020 and 7.4% more than May.

The volume of plywood in last year decreased a lot

because the domestic plywood production was reduced

nearly by 30%. Also the import plywood was less 200,000

cbms in 2020 which made the numbers of supply in this

year higher percentage than last year.

There is still not enough inventory because of a lively

demand even though the plywood manufacturing

companies are going into full commercial production.

The domestic softwood plywood¡¯s shipment is exceeded

production. The inventory of softwood plywood is 85,000

cbms and the structural softwood plywood is 74,500 cbms.

Especially, the inventory of structural softwood plywood

falls below 0.3 months.

It is very hard for some manufacturers to deliver goods by

deadline. The holiday in July and the periodical

inspections in August are the reasons which might cause

delays.

The number of imported plywood exceeded over 200,000

cbms for four months consecutively. Malaysian volume is

19.5% more than the same month of last year but

Indonesian volume is 8.3% less. Producing regions of

Malaysia and Indonesia continue suffering raging COVID

19, which hampers plywood manufacturing and log

production due to labor shortage so recovery of South Sea

hardwood plywood supply is very unlikely through the

year.

If this situation continues, the inventory of softwood

plywood will remain low in a second half of this year.

Import of European lumber

For the first half of this year, import of European lumber is

1,043,388 cbms, 18.2% less than the same period of last

year. This is four consecutive year¡¯s decline. The export

prices advanced and they are more than double of the

same period of last year.

By items, whitewood KD stud and taruki are 397,964

cbms, 11.8% less and semi-finished products like lamina

and genban are 645,517 cbms, 21.6% less. By source,

347,043 cbms from Finland, 14.3% less, 354,760 cbms

from Sweden, 19.7% less, 103,389 cbms from Austria,

15.0% less, 77,674 cbms from Rumania, 7.0% less, 22,270

cbms from Germany, 50.1% less.

Reason of decreased volume for Japan is that many

sawmills in Europe concentrate manufacturing dimension

lumber for the North American market. In central Europe,

supply of whitewood logs is very tight and many sawmills

struggle to secure enough logs.

Export prices of KD whitewood stud are Euro 350 and of

taruki are Euro 360 for January and February shipment,

about Euro 20 up then the prices advanced to Euro 500 for

May and June shipments. They soared to Euro 700-800 for

July and August shipments.

|