4.

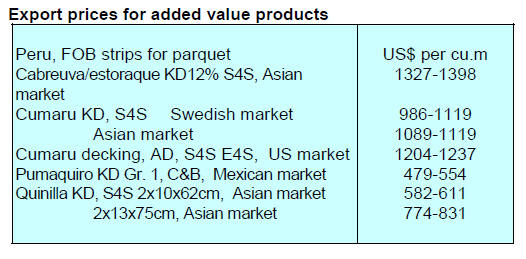

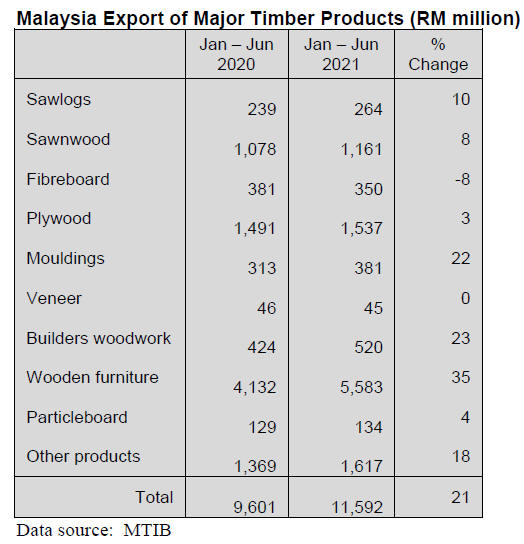

INDONESIA

Exports projected to reach US$12

billion

Chairman of the Association of Indonesian Forest

Concessionaires (APHI), Indroyono Soesilo, said the value

of wood product exports is estimated to climb to US$12

billion by the end of this year. 2020 wood product exports

earnings totalled US$11 billion.

He said that up to July this year exports of wood products

amounted to US$7.5 billion and projecting this to the end

of the year results in a figure of US$12 billion. He

commented that production from the natural forest rose

over 16% up to July compared to the same period last year

but production from industrial forest plantations was lower

year on year.

In related news, the Indonesian furniture sector anticipates

that international orders could rise due to the inevitable

slow-down in production and trade in Vietnam as the

country deals with the latest surge in infections.

See:

https://ekonomi.bisnis.com/read/20210815/257/1429898/vietnam-lockdown-bawa-harapan-order-industri-furnitur-ri-terdongkrak

Furniture imports continue to climb

The Indonesian Furniture and Craft Industry Association

(HIMKI) noted that, during the first half of 2021, furniture

imports rose 36% and craft imports rose 21% year on year.

Over 75% of furniture and craft imports come from China.

See:

https://ekonomi.bisnis.com/read/20210815/257/1429895/impormebel-masih-naik-himki-siapkan-strategi-pertahankan-kinerjaindustri-furnitur

Ease of business licensing to attract investment

Coordinating Minister for Economic Affairs, Airlangga

Hartarto, has identified that easing of the business

licensing process could encourage more foreign

investment. He said Indonesia is committed to improve the

investment climate through structural reforms one of

which is the combining of 76 regulations into one through

the Omnibus Law no. 11 of 2020, theJob Creation Law.

To implement the Job Creation Law digital registration

and licensing procedures have been made easier with the

launch of the latest version of the Online Single

Submission (OSS) which is based on the Risk-Based

Approach (RBA) and the shift from the Negative

Investment List (DNI) to the Investment Positive List

(DPI).

See:

https://en.antaranews.com/news/184978/ease-of-businesslicensing-to-attract-investment-to-indonesia-govt

Accelerated recognition of customary forests

The Minister of Environment and Forestry (LHK), Siti

Nurbaya Bakar, has indicated government recognition of

customary forests now extends over 59,442 hectares with a

total of 80 units involving 42,038 families. The Minister

said efforts continue to facilitate indigenous peoples in

dealing with these matters with local authorities.

See:

https://www.antaranews.com/berita/2331198/menteri-lhktegaskan-pemerintah-terus-percepat-pengakuan-hutan-adat

Net Zero emissions by 2060 or sooner

The Indonesian government has raised its net zero

emissions target to 2060, a decade faster than previously

estimated according to the Minister of Environment and

Forestry. Indonesia updated its Nationally Determined

Contribution (NDC) submitted to the UN Framework

Convention on Climate Change ahead of the climate

summit to be held in Glasgow in November.

See:

https://jakartaglobe.id/news/indonesia-aims-to-reach-netzero-emissions-by-2060-or-sooner

5.

MYANMAR

Covid update

While Covid-19 infections appear to be declining in

Yangon, according to the

website https://www.worldometers.info/coronavirus/count

ry/myanmar/, 389,134 cases have been recorded in the

country and 15,077 people have died. The number of cases

stood at 159,347 on 1 July and jumped to 380,879 on 27

August.

Government offices are closed until 31 August but banks

are open but individuals face problems withdrawing cash.

No cash available, currency depreciating and inflation

rising

The Central Bank has limited individual cash withdrawals

to Ks20 million but allows extra withdrawals for Covid-19

medicine. However, banks are facing cash shortages so at

times they cannot even pay the amount the Central Bank

allows. Private and government banks are in the same

situation.

In related news, the Myanmar kyat continues to weaken

against the US dollar, despite the sale of dollar reserves by

Central Bank of Myanmar (CBM). Since 1 February 2021

the CBM has released more than US$120 million into

domestic markets in an attempt to combat the rapidly

devaluing kyat.

In addition to a weakening local currency the inflation

rate, which was 6% in mid August, is expected to increase

in the coming months according to the World Bank’s

Myanmar Economic Monitor.

With the depreciation of Myanmar kyat trade and

logistical restrictions prices of imported goods have

increased significantly. Fuel prices have jumped nearly

50%.

See:

https://elevenmyanmar.com/news/continued-cash-shortagespose-dim-prospects-for-banks-in-myanmar

Forest Joint Venture Corporation General Assembly

The Forest Joint Venture Corporation (FJV) held a

General Assembly on 31 July 2021 to review activities for

the period of 1 October 2019 to 30 September 2020. A

profit of 1.815 billion MMK (approx. US$1.10 million)

was reported.

Myanma Timber Enterprise (MTE) owns a 45% share of

FJV and the Forest Department a 10% share. On 21 June

2021 an EU Council decision put both MTE and FJV

under the restrictive measures preventing any financial

dealings with the EU.

At the General assembly the Minister of Ministry of

Natural Resources and Environmental Conservation

assured participants that conservation of natural resources

will be given priority over exploitation. However, local

reports say that, since the coup, rare-earth mining has

increased in the Kachin region and illegal logging has

expanded in the Sagaing region but security concerns and

communication restrictions have limited journalists trying

to report on post-coup Myanmar.

See:

https://www.mizzima.com/article/military-rule-could-meanfew-environmental-protections-myanmar

6. INDIA

Rapid decline in

infections after second wave

India has started to emerge from a second wave of

COVID-19. The decline in the number of reported

infections has been surprisingly sharp and has been similar

to the trends seen in parts of Europe. About 15% of adults

in India have received both vaccine shots and nearly 40%

a single shot. A record 8.8 million shots were administered

on 17 August. Health officials are forecasting a likely third

wave particularly in States with a low vaccination rate.

See:

https://theconversation.com/after-indias-brutal-coronaviruswave-two-thirds-of-population-has-been-exposed-to-sars-cov2-165050

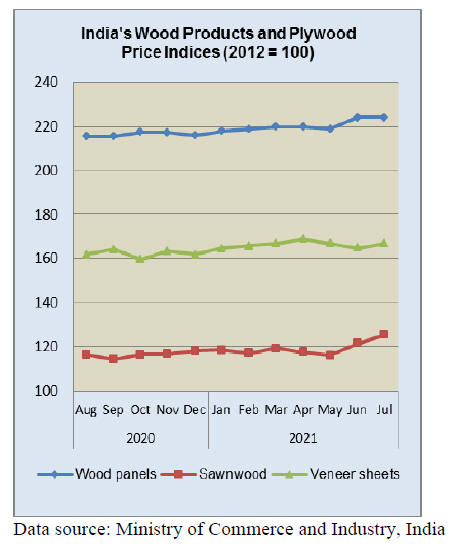

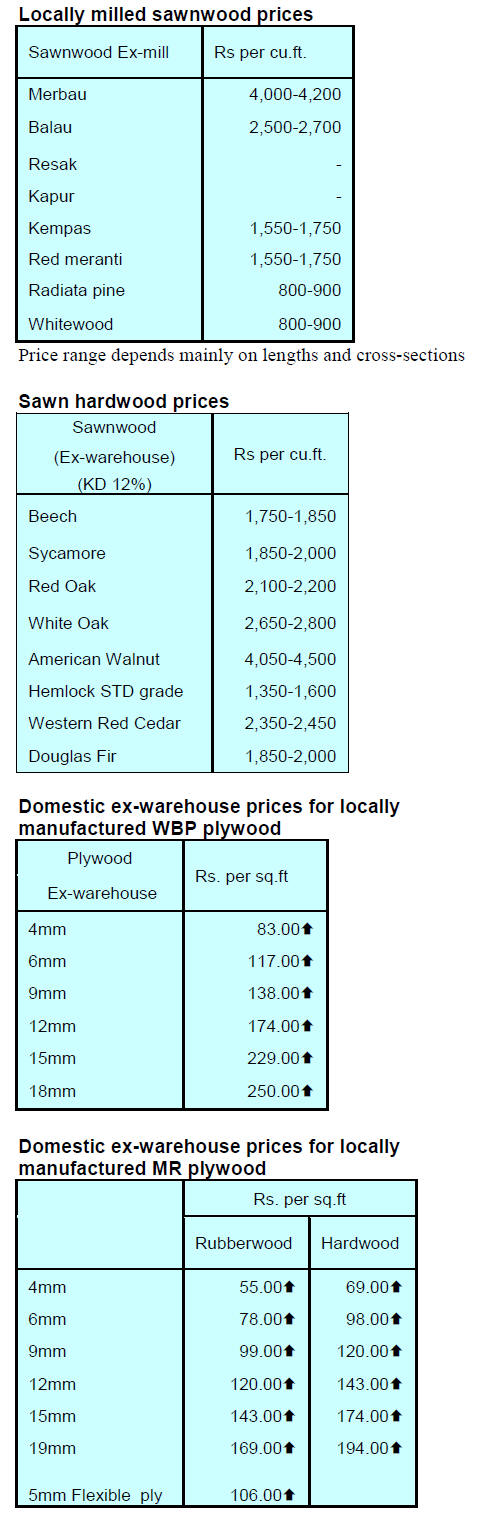

Sawnwood and veneer wholesale prices moved higher

in July

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade, has released

wholesale price indices for July, 2021. The index for

manufactured products increased to 132.0 in July from

131.5 for June.

Out of the 22 manufactured product groups, 13 saw an

increase in prices; 8 groups saw a decline and for one

group the prices remained unchanged in July compared to

June. Included in the group that witnessed a drop in prices

was the furniture sector.

The annual rate of inflation in July was 11% higher than in

July 2020 but slightly down compared to June.

The press release from the Ministry of Commerce and Industry

can be found at:

http://eaindustry.nic.in/cmonthly.pdf

Export recovery continues

After a record US$35.2 billion exports in July export

shipments in August got off to a good start bringinning in

US$7.4 billion in the first week of the month. Early data

from the Ministry of Commerce showed while exports

grew 50% in the first week of August, imports shot up

70% to US$10.5 billion pushing up the trade deficit. After

the second wave of infections there was a significant

increase in domestic economic activities.

The US accounted for most of the increase in exports

during the first week of August followed by UAE and

Saudi Arabia. United Arab Emirates led the increase in

Indian imports followed by China and Nigeria during the

same period.

Uttar Pradesh government to make more land available

for industry

In an effort to attract investment in manufacturing the

Uttar Pradesh government has decided to make more land

available for industry. At a recent meeting between the

State Minister of Industry, the Chief Secretary and key

officials it was suggested that the process of acquiring land

should be simplified.

The state is also considering an amendment of regulations

that could provide for leasing of agricultural land for

industrial parks.

In related news, the massive plantation drive by the Uttar

Pradesh government over the past four years has increased

the state’s forest cover by 127 square kilometres. The

Forest Survey of India says the the forest cover in Uttar

Pradesh is 3.05% against the national average of 2.89%.

The state government’s plantation campaigns have

increased the awareness in people about trees and

environment.

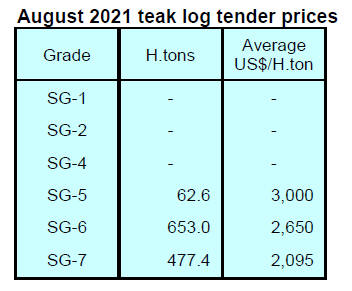

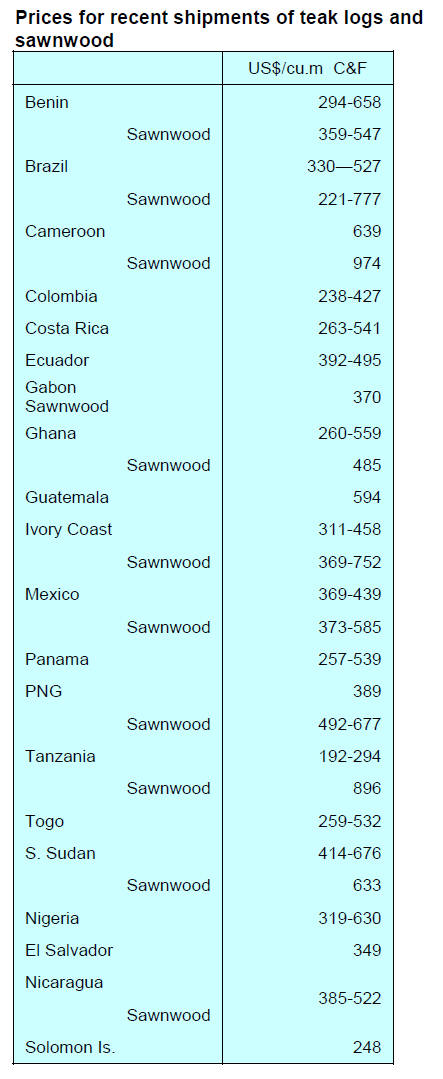

Plantation teak

Shipments of Teak logs and sizes have taken place from

these countries. The price curve is showing that freight

factor is coming down.

7.

VIETNAM

Expanding domestic timber production

Vietnam aims for a 5-5.5% expansion in domestic forestry

production annually between 2021-2025 according to a

government decision approving an investment policy for

sustainable forestry development over the next five years.

In 2025 income from planted production forest is expected

to rise about 1.5 times compared to that in 2020.

Under Resolution No. 84/NQ-CP Vietnam’s forestry

sector “be developed into a modern, effective and

competitive sector with strong production chains”.

The sustainable forestry development programme targets

the sustainable management, protection, development and

exploitation of forests to create jobs, protect the

ecosystem, strengthen capacity to adapt to climate change,

and protect national defence and security.

The programme will focus on maintaining the forest

coverage at 42% and developing new areas in 2021-2025.

See:

https://en.vietnamplus.vn/forestry-production-expected-torise-55-percent-annually-in-20212025-period/206054.vnp

Production suspended – exports affected

In the first seven months of this year Vietnam's wood and

wood product (W&WP) exports earned US$9.6 billion, up

55% year-on-year. However, the suspension of production

at local wood processing enterprises due to the COVID-19

pandemic is having effects on exports, according to the

Vietnam Timber and Forest Product Association

(VIFOREST).

Many members of the Ho Chi Minh (HCM) City Fine Arts

and Woodworking Association (HAWA) have outstanding

orders from overseas but because of the recent surge in

infections and the control measures being enforced

factories have experienced severe production problems

and more than half the works force in the industry has

been laid off according to VIFOREST.

In the Southern region, a major producer of wood products

for export, had 265 wood processing enterprises with a

total of 119,300 employees before the covid control

measures were introduced, now only 141 enterprises are

now in operation with 30,700 employees.

HCM City, Dong Nai, Binh Dương and Tay Ninh have

reported 134 wood processing enterprises suspended

production as they were unable to implement the “3 onsite”

model, which involves workers living on site.

Businesses implementing this model face additional costs

due to the testing of thousands of employees.

The other issue is that to maintain production enterprises

still have to secure raw materials, chemicals, packaging

and other requirements and also process export documents

through Customs and their banks which creates a risk of

infection.

VIFOREST has proposed that the Government allows the

association and the businesses to buy COVID-19 vaccines

and vaccinate staff and workers. The association also said

the Government should consider financial support to wood

processing enterprises. This could be in the form of a

reduction or delay in paying corporate income tax and

other taxes, delay of social insurance payments and land

rent exemption for this year. The Government could also

allow enterprises to extend loan payments and restructure

debts.

The association has requested the Ministry of Industry and

Trade to add raw materials for the wood processing

industry to the list of essential goods to ensure the supply

chain.

See:

https://vietnamnews.vn/economy/1016895/covid-19-production-suspension-hampering-timber-exports.html

Export/import update

According to data from the General Department of

Customs Vietnam’s W&WP exports to South Korea in

July 2021 reached US$81.1 million, up 46.7% compared

to July 2020. In the first 7 months of 2021, the exports of

W&WP to the South Korean market amounted to

US$534.5 million, up 17% over the same period in 2020.

Exports of guest and dining-room furniture in July 2021

totalled US$304 million, up 10.5% compared to July 2020.

In the first 7 months of 2021, export earnings from guest

and dining-room furniture is estimated at US$2.1 billion

US$, up 58% over the same period in 2020.

Exports of W&WP in the last week of August dropped

around 14% compared to the previous week. In particular

there was a sharp drop in wooden furniture exports.

Imports of pine in July 2021 were estimated at 124,100

cu.m worth US$29 million, up 5.3% in volume and up

5.0% in value compared to June 2021; compared to July

2020, there was an increase of 116.4% in volume and an

146.3% in value.

In the first 7 months of 2021, pine imports were estimated

at 896,500 cu.m worth US$203.5 million, up 93% in

volume and 108% in value over the same period of 2020.

Imports of log and sawn wood from Africa in June 2021

reached 75,020 cu.m worth US$26.75 million, down 8.8%

in volume and 14% in value compared to May 2021; up

0.9% in volume but down 1.3% in value over the same

period of 2020.

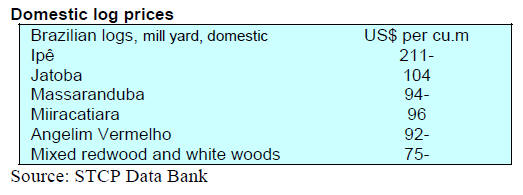

8. BRAZIL

Interest rate jumps 1%

In August the Central Bank of Brazil (BCB) increased the

basic interest rate (Selic) by 1% to 5.25%. The increase

was aimed at dealing with rising inflation as the country

experiences surging prices because the economy is

recovering fast. Inflation in Brazil exceeded 8% in the 12

months to June, more than double the target of 3.75% for

2021.

Forest concessions represent a tool to eliminate

degradation and deforestation

The State of Pará, one of the main timber producing states

in the Amazon Region, considers forest concessions an

instrument to reduce the risks to forests and generate direct

jobs. In the state public forests in the Mamuru-Arapiuns

Region were included in the 2009 Annual Forestry Grant

Plan (PAOF) and licensed in 2010.

Since 2010 forest degradation in concession areas has

fallen and this coincided with the enforcement of SFM by

the Pará State Institute for Forestry Development and

Biodiversity (IDEFLOR-Bio). Currently any deforestation

in the Mamuru-Arapiuns area is outside the forest

concessions.

The State Secretariat of the Environment (SEMAS),

through its Integrated Center for Environmental

Monitoring (CIMAM) carries out the environmental

monitoring of Sustainable Forest Management Plans

(SFMP) in forest concessions in Pará state.

Furniture production booming

Furniture production in Brazil reached 31.7 million pieces

in May 2021 representing a 6.5% increase in the number

produced compared to the previous month according to the

Brazilian Association of Furniture Industries

(ABIMÓVEL).

The accumulated production in this sector between

January and May expanded 29.5% over the same period in

2020.

By way of comparison, production in the manufacturing

industry as a whole saw a 15% increase in the first five

months of 2021 compared to the same period of the

previous year when all industrial sectors were affected by

the Covid-19 control measures.

In terms of employment, despite just a slight increase in

May 2021 in the furniture sector, for the first five months

of the year there was a significant rise in job creation and

this pushed up average earnings for workers.

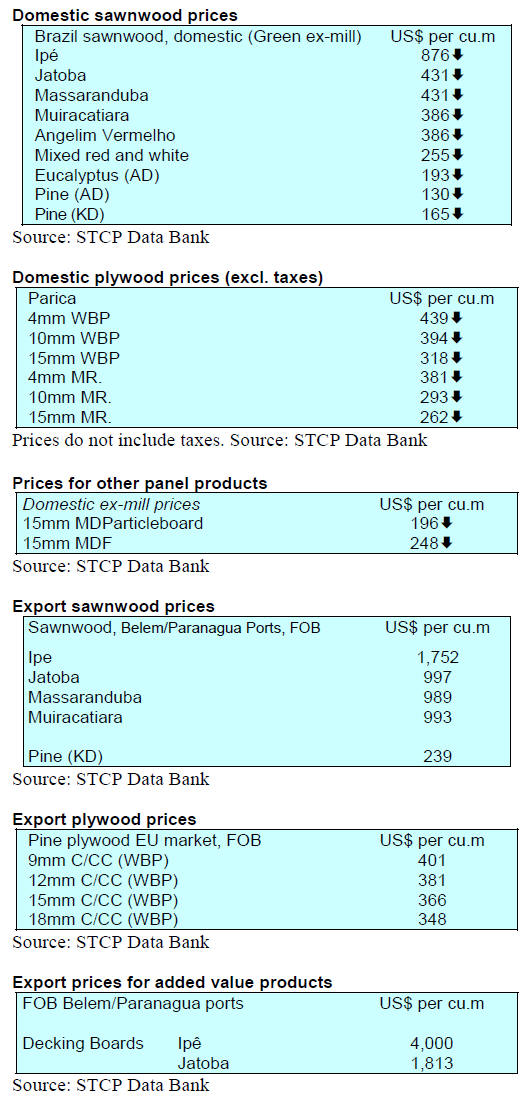

Export update

In July 2021, Brazilian exports of wood-based products

(except pulp and paper) increased almost 74% in value

compared to July 2020, from US$269.7 million to

US$468.9 million.

Pine sawnwood exports grew 51% in value between July

2020 (US$48.9 million) and July 2021 (US$73.7 million).

In vlume terms, exports increased 4% over the same

period, from 275,200 cu.m to 286,100 cu.m.

Tropical sawnwood exports increased 33% in volume,

from 30,900 cu.m in July 2020 to 41,200 cu.m in July

2021. In value terms exports rose 26% from US$12.0

million to US$5.1 million, over the same period.

Pine plywood exports recorded a massive increase in value

in July 2021 in comparison with July 2020, from US$50.6

million to US$162.7 million. In volume terms exports

increased just 20% over the same period, from 212,900

cu.m to 255,800 cu.m.

As for tropical plywood, exports increased in volume

(43%) and in value (110%), from 5,100 cu.m (US$2

million) in July 2020 to 7,300 cu.m (US$4.2 million) in

July 2021.

As for wooden furniture export earnings increased from

US$6.6 million in July 2020 to US$71.7 million in July

2021.

Ensuring transparency in the supply chain

The members of CIPEM (Center for Timber Producers

and Exporters of Mato Grosso State), through the adoption

of Sustainable Forest Management Plans, have been able

to satisfy the requirements of European importers in terms

of verified legal origin and sustainability.

In September 2021, CIPEM will implement an integration

of a control system for timber and forest products between

the Forest Products Trade and Transport System 2.0

(SISFLORA) of Mato Grosso State and the National

System for the Control of the Origin of Forest Product

(SINAFLOR) under IBAMA to ensure transparency in the

supply chain.

This technology will provide improvements in timber

monitoring and inspection activities as well as providing a

guarantee that the forest product are of legal origin and

produced sustainably.

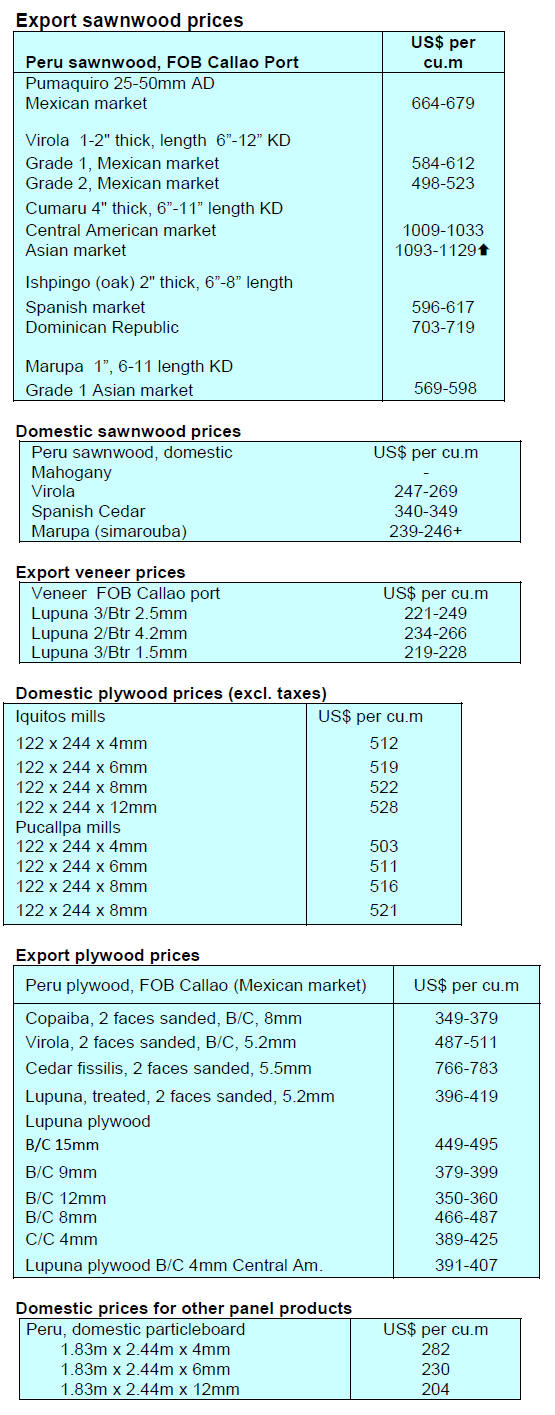

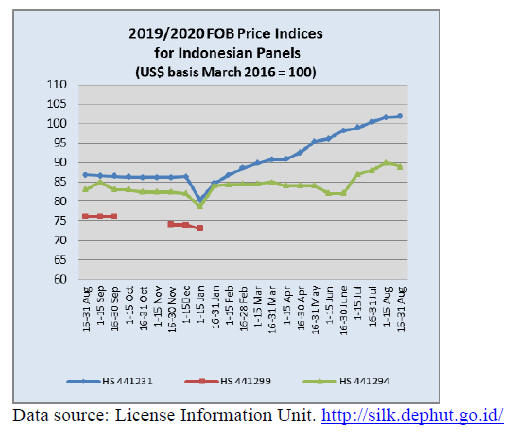

9. PERU

Covid update

As of 27 August the number of citizens infected with

COVID-19 rose to 2,148,419. A total of 18,151,872

vaccine doses have been administered and 7,955,486

people have received two doses.

Peru has reported 199 cases of the COVID-19 Delta

variant in different regions across the country according to

the Ministry of Health. The ministry and regional

governments have developed a national plan to face an

eventual third wave of COVID-19.

The aggressive delta variant is not yet widespread because

the gamma variant is currently the predominant strain but

the delta variant continues to pose a major risk.

Export shipments rising

The Association of Exporters (ADEX) has reported that in

the first half of the year exports of wooden furniture and

furniture parts reached US$1.9 million representing a 60%

increase compared to the same period of 2020 (US$1.2

million).

The ADEX Trade Data Intelligence System shows

shipments of wooden furniture and furniture parts

increased 15% more than in the first 6 months of 2019,

before the pandemic when earnings amounted to US$1.7

million.

Export earnings from wooden furniture and parts ranked

fourth in overall wood product exports (US$56.7 million)

being surpassed by semi-manufactured products (US$5.6

million), sawnwood (US$13.1 million) and wooden

construction products (US$3.4 million). Other main export

products were veneers and plywood (US$1.2 million) and

manufactured products (US$0.7 million).

Of wooden furniture exports the category "other wooden

furniture" accounted for an almost share and included

sideboards, tables, chairs, centerpieces, benches, stools,

desks, shelves, among others.

Between January and June 2021 the main export market

was the United States at US$1.3 million, an increase of

56% compared to the same period in 2020. The North

American market as a whole accounted for 66% of total

shipments. Other export markets were Chile, Italy,

Colombia and Panama.

ADEX pointed out that 2020 was the worst in the last ten

years in terms of exports of wooden furniture and parts.

Although this can be explained by the paralysis of

economic activities as a result of the pandemic, it is also

true that exports had been very volatile and irregular over

the past ten years.

Public sector investment boost to construction

Investments by regional governments has been one of the

drivers of growth in the construction sector this year

according to the Peruvian Chamber of Construction

Executive Director, Guido Valdivia.

He explained that much of the investment was in support

of the Arranca Peru (Get off the Ground, Peru) programme

implemented by the Government which aimed to revive

the economy. The National Institute of Statistics and

Informatics (INEI) has reported that the construction

sector grew over 90% year on year in June this year.

See:

https://andina.pe/ingles/noticia-peru-local-governmentspublic-investment-boosts-construction-sector-858047.aspx

Regions with the highest forest fire alerts this year

The National Forest and Wildlife Service (Serfor) reported

that, to date, it has conducted 54 virtual training courses

with the participation of 4,200 people in forest fire risk

management. The training was extended to more than 18

regions of the country.

For effective preventive work Serfor also provided

technical assistance and training aimed at local authorities,

institutions and agricultural producers to promote good

practices for the management of forest and agricultural

residues.

According to information from the Civil Defense Institute

- INDECI, during 2020 more than 10,391 hectares of

vegetative cover and 16,301 hectares of agricultural crops

were lost to fire.

In almost all cases fires are caused by human activity and

usually start with the burning of agricultural residues and

get out of control to become devastating forest fires.

So far in 2021 Serfor has reported 374 forest fire alerts.

The Departments with the highest number of forest fire

alerts are: Cusco, where 66 forest fire alerts were issued;

Junín with 47 alerts and Puno with 35 alerts.

The implementation of the ITTO-Serfor project which

seeks to raise public awareness about the danger of open

burning the number of fires is expected to drop. This

initiative is carried out in the Cajamarca, Huánuco, Pasco,

Junín and Ucayali regions.

Building skills for forestry professionals

The Forest Resources and Wildlife Supervision Agency

(Osinfor), in agreement with the National University of

Ucayali (UNU), the Forest programme of the Agency for

International Development (USAID) and the United States

Forest Service organised course in forest harvesting

supervision which seeks to strengthen knowledge and

capacities of forestry professionals to face the challenges

of the sector.

After a rigorous selection process 32 young people from

thirteen regions of the country participated in the training.

The Country Director of the Forest Programme of USAID

Peru and the US Forest Service, Juan Pablo Silva,

highlighted the importance of the course for sustainable

forest use as it will allow qualified personnel to be more

skilled in supervision and they will have skills to build

trust among key actors in the forestry sector.