Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May

2021

Japan Yen 108.76

Reports From Japan

¡¡

Private consumption takes

a battering

The Japanese government has lowered its assessment of

prospects for the economy. This is the first downgrade in

three months and comes as private consumption has taken

a battering due to the extension of the state of emergency.

According to the Cabinet Office the economy shows

¡°further¡± weakness in some areas and is in a severe

situation. In the previous monthly report the government

said the economy showed weakness in some components

but did not use the word ¡°further¡±.The report covering

April says,for the first time in four months, businesses

¡°appear to be pausing¡± their recovery while ¡°some severe

aspects still remain¡±.

The current restrictions under the state of emergency were

due to be lifted 11 May but were extended to the end of

May after pleas by the worst affected prefectures. Because

of the continued high rate of infections the government has

decided to extend the state of emergency in 9 prefectures

to 20 June.

See:

https://www.japantimes.co.jp/news/2021/05/26/business/economy-business/japan-economic-assessment

Firm overseas demand lifts machinery orders

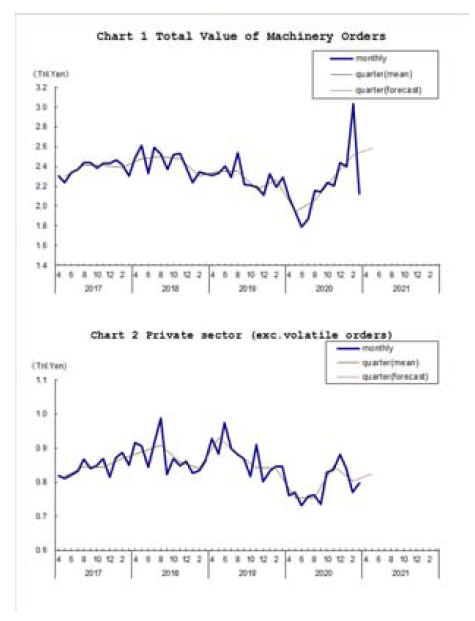

The Cabinet Office says March machinery orders rose

almost 4% compared to February, the first increase in

three months. This is in contrast to the almost 9% decline

in fiscal 2020.

Private-sector machinery orders, excluding those for ships

and power companies, increased a seasonally adjusted by

3.7% in March but for the quarter were down around 5%.

The Cabinet Office has forecast private sector machinery

orders in the second quarter will rise by 2.5% from first

quarter. Supporting the forecast is sentiment among

manufacturers which was at a two-year high in May on

the back of firm overseas demand.

See:

https://www.esri.cao.go.jp/en/stat/juchu/2021/2103juchue.html

First quarter dip in GDP

Data from the Cabinet Office shows that Japan's economy

contracted in the first quarter of this year, dropping by an

annualised 5.1% from the previous quarter. However, the

result was not as bad as the record drop of around 29% in

the April-June quarter last year.

The second state of emergency declared in early January

to try a stem the rate of spread of infections drove down

consumer spending which accounts for more than half of

GDP. In contrast, exports expanded over 2% in the first

quarter 2021 building on the increases for the past three

quarters. The government is forecasting GDP will grow by

4% percent in real terms in the current fiscal year that ends

March 2022.

The risk is that if infections continue to spread a

nationwide state of emergency may be declared but the

government approach at the moment is to enforce effective

measures regionally but prefectural governors have

requested stronger measures before it¡¯s too late.

On 21 May the government extended the state of

emergency to Okinawa as infections in the island

prefecture continue. The inclusion of Okinawa brings the

number of prefectures under the state of emergency to 10.

The aim was to lift the state of emergency on 31 May but

calls have grown for tougher restrictions in Tokyo and

other areas and for the state of emergency to be extended

beyond 31 May.

Responding to the dip in GDP the Governor of the Bank of

Japan (BoJ) warned that, because of uncertainty over the

pace of the country's vaccination rollout, the domestic

economy remains in a "severe" state and economic

activities are at levels lower than before the pandemic.

The BoJ indicated it will consider extending support for

corporate funding beyond the end of September if the

situation demands this.

The BoJ¡¯s view is that the impact of COVID-19 could

subside by mid 2022 if the vaccination effort is ramped up

but that risks are skewed to the downside given

uncertainties on how the differing paces of vaccinations in

countries and regions will impact the global economy.

See:

https://www.japantimes.co.jp/news/2021/05/17/national/japannationwide-state-of-emergency-pressure/

and

https://mainichi.jp/english/articles/20210519/p2g/00m/0bu/083000c

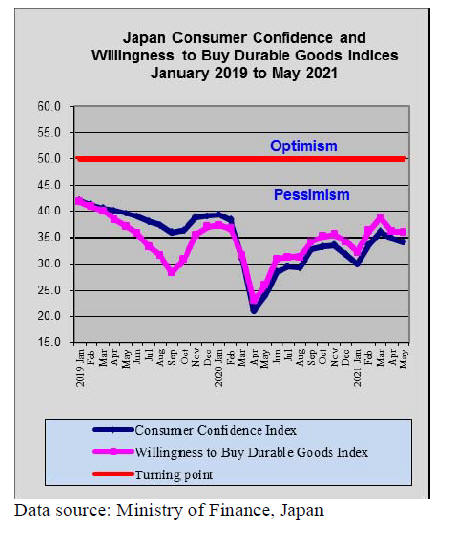

The May consumer confidence indices remain largely the

same as in April.

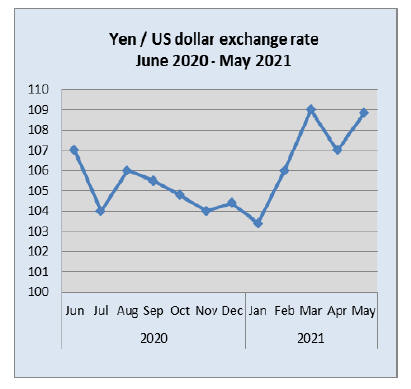

Yen movement hinges on US interest rates

The yen, along with many other major Asia-Pacific

currencies, dipped lower against the dollar briefly midmonth

as a rise in US consumer inflation pushed the US

dollar higher. However, the change was short lived as

Federal Reserve played down the impact of higher

inflation on monetary policy. The yen/dollar exchange rate

at the end of May was little changed from a month earlier.

In April US consumer prices jumped more than seen over

the past decade as demand surged after the economy was

freed of most restrictions on businesses.

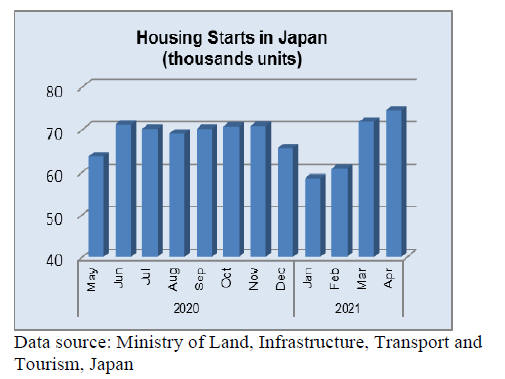

Demolish and rebuild ¨C homes in Japan

A large number of housing starts in Japan are

replacements of existing buildings that are considered to

have reached the end of their service life. The Japanese

government dictates the ¡°useful life¡± of a wooden house

(by far the most common) to be 22 years so it depreciates

them over that period according to a schedule set by the

National Tax Agency.

This unique concept in the housing market creates a great

deal of problems for home buyers. Even if a buyer wanted

to buy an existing (old, 22 years) house they would have

to pay cash as banks will not lend against what is

considered a worthless asset.

Construction activity accounts for 6% of GDP in Japan but

the sector is a huge employer and construction supports

many small suppliers and in Japan the housing legislation

is based on the principle of demolition of existing homes

and replacement.

See:

https://robbreport.com/shelter/home-design/japanesehomes-are-ephemeral-facing-demolition-just-22-years-in-hereswhy-1234608438

April 2021 housing starts were up 8% on April 2020 but

down 5% in pre-pandimic 2019.

Import update

Furniture imports

The value of Japan¡¯s wooden furniture imports

(HS940303/40/50) in the first quarter 2021 have risen to

and in the case of bedroom furniture exceeded, the value

of pre-pandemic 2019 imports.

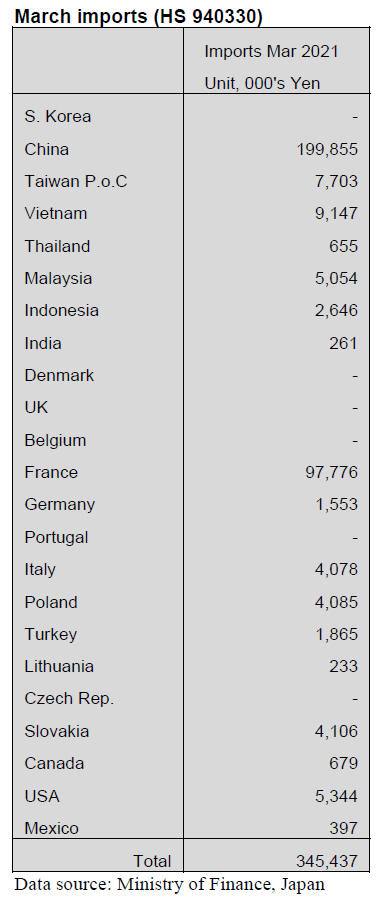

The value of wooden office furniture (HS940330) imports

in the first quarter of 2021 was up 46% on the same period

in 2020 and 6% higher than in the first quarter 2019.

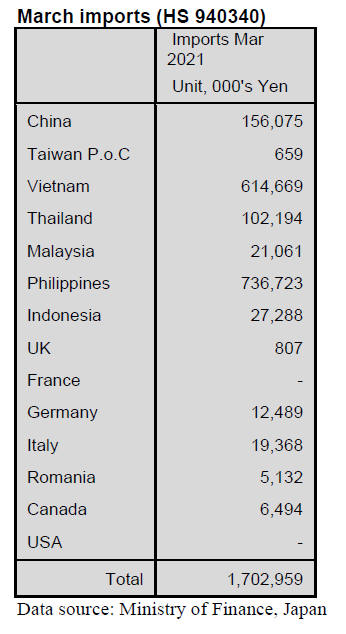

The value of wooden kithen furniture (HS940340) imports

in the first quarter of 2021 were up 10% on the same

period in 2020 and were at the same level as in the first

quarter 2019.

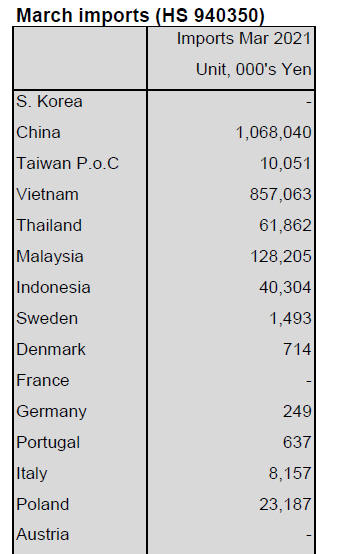

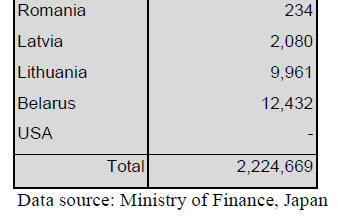

The value of wooden bedroom furniture (HS940350)

imports in the first quarter of 2021 were up 20% on the

same period in 2020 and were up 21% on the first quarter

2019.

Office furniture imports (HS 940330)

Year on year the value of Japan¡¯s imports of wooden

office furniture (HS940330) in March 2021 jumped a

massive 95% and month on month the value of March

imports was 70% higher than in February. For most

shippers March shipments were higher than in February

except those in China.

¡¡

The import data from the Japanese Ministry of

Finance

shows a very large value of wooden office furniture

arrived from France in March and this accounted for

almost 30% of all March wooden office furniture imports.

Manufacturers in Vietnam had consistently held the

number two spot in terms of value of shipments to Japan

but with the surge in imports from France Vietnam

became the third ranked supplier in March.

Kitchen furniture imports (HS 940340)

The recovery of Japan¡¯s wooden furniture imports

continued with wooden kitchen furniture. The value of

March imports rose 22% year on year in March 2021 and

was up 16% from levels in Febuary 2021.

Shipments from just three countries, the Philippines,

Vietnam and China accounted for over 85% of all wooden

kitchen furniture imports in March. The Philippines

topped the list accounting for 43% of March arrivals

followed by Vietnam (36%) and China. However arrivals

from China in March were sharply down compared to a

month earlier.

Bedroom furniture imports (HS 940350)

After starting 2021 on a high note, the value of Japan¡¯s

imports of wooden bedroom furniture dropped in February

and the downtrend continued into March when the value

of imports fell a further 13% compared to a month earlier.

A correction is not surprising given the big jump in first

quarter imports.

Between them, shippers in China and Vietnam accounted

for most (87%) of the value of March arrivals into Japan.

The other significant shpoper in March was Malaysia

which saw a 6% increase in March shipments over

February.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Forestry Agency held meeting to discuss wood

shortage

The Forestry Agency held emergency meeting to exchange

information to deal with shortage of wood products.

Recent incident of sharp drop of imported wood products

from North America and Europe with inflating prices and

resultant demand increase to domestic wood is the main

subject.

Associations of precutting business and contractors

participated the meeting and loudly complain about

shortage of necessary wood products and they may be

forced to reduce production or decline taking orders if this

situation continues. Precutting plants in Tokyo and Osaka

regions, which rely on supply of imported materials, are

struggling to secure necessary materials and are forced to

reduce the operations.

Some plants use its own supply of domestic wood but

supply of domestic wood is also getting tight so there are

some comments that growing log export business should

be restricted temporarily until the supply eases.

The Japan Lumber Importers Association reports that

booming housing starts in the U.S.A., which is main

reason of supply tightness of North American lumber may

last all through this year and it is not certain that supply

tightness is temporary or long lasting.

Domestic wood cannot replace structural materials in

terms of strength but tight supply from North America

would last longer.

The National Federation of Forest Owners Cooperative

Association attended to represent domestic log producers

and log suppliers are not sure if this demand increase is

real since plywood mills reduced log purchase last fall

because of production curtailment program. They are

worried about price drop by oversupply of logs so log

production is being held down partially by this reason.

If domestic logs are used to substitute imported logs,

manufacturing of logs should be changed such as length

and diameter sorting.

The Japan Federation of Plywood Manufacturers

Association and the Japan Laminated Lumber

Manufacturers Association participated the meeting and

reported that the production has been increasing since last

March but the production is not enough to satisfy the

demand and the prices would continue to climb.

Changing construction materials

By supply shortage of Douglas fir and hemlock lumber

from North America, substituting materials are being used.

In Gunma and Ibaraki prefecture, north of Tokyo, Douglas

fir girder and hemlock purlin have been used for years but

now the supply gets real tight and precutting plants need to

look for something else.

In Gunma, local contractors like to use Douglas fir KD

rafter but the supply disrupted since late February so they

consider to use whitewood, cypress and hemlock but

settled with KD cedar by reason of supply stability. KD

Douglas fir rafter is short in supply then the prices soared

to almost 80,000 yen per cbm delivered so price difference

widened to 20-30,000 yen from KD cedar.

Supply of European structural laminated lumber decreased

by 20 -30% and search for substituting materials is

overheated. The market became chaotic by delayed

container arrivals of lamina and finished lumber. Redwood

laminated post became short first then whitewood

laminated post supply gets tight in early April so

precutting plants frantically look for laminated cedar post,

KD cedar and cypress post. KD cedar post prices are now

70-80,000 yen per cbm.

KD cedar post prices had been around 55,000 yen per cbm

delivered up until last March then in April, they jumped up

to 65,000-70,000 yen and May prices may go up by 5,000-

10,000 yen. Cedar laminated post prices were 52-55,000

yen in April.

Struggling precutting plants

Precutting plants face critical shortage of necessary

building materials so many will have to reduce processing

volume considerably in May.

In Tokyo region, laminated lumber manufacturing plants

experience lamina shortage since late March so operation

of precutting plants dropped. Operational rate now

depends on how much materials are available. In

particular, beam supply is way down so some plants run

only 70-80% of the capacity.

Supply of laminate post and beam is short. Solid wood

Douglas fir beam is allocated by past purchase volume.

Redwood laminated beam is very tight. Some precutting

plant says that since late March, beam supply stopped and

40 units are short with beam so May processing may drop

down to 50% of normal pace.

Precutting plants, which mainly use domestic wood, rely

on imported redwood laminated lumber for beam. Also

whitewood laminated post supply started declining since

April so precutting plants look for substituting materials

but laminated cedar lumber supply is not enough to satisfy

shortage of imported products. KD cedar lumber is also

very tight in supply. Demand goes to KD cypress but this

is also short.

After all, precutting plants are so desperate that they can

take any 105 mm square regardless of species now.

In auction market, dealers are buying with high prices to

secure the volume.

On Russian red pine KD taruki (30x40 mm/ 4 meter),

there was no worry about supply shortage since the

inventory has variety of grades but the Russian supply is

shrinking by logs and container shortage. In auction

market, quality red pine taruki prices are now over 80,000

yen per cbm, more than 10,000 yen higher than last

February. There is no substituting material. Supply volume

of poplar LVL is limited.

Red pine taruki can be used not only for newly built

houses and renovation but also for events and stage so

dealers want to keep it in inventory. There is no KD

whitewood stud available now.

The prices were down to 40,000 yen plus in summer of

2020 by over supply but now the prices are over 60,000

yen. To replace this, domestic cedar stud draws more

attention and the prices are 65,000-70,000 yen, 5,000 yen

higher than April. Domestic softwood LVL (45 mm

square/3, 4 meter) can be used as brace, joist and stud so

some dealers are eyeing this item.

Domestic logs and lumber

Demand of domestic logs and lumber has been sharply

increasing when the supply of imported products is steeply

down. Sawmills have started full production since last

March but the demand is far larger than supply.

Supply shortage results in higher prices of lumber.

Particularly Tokyo market, where the demand is larger

than the other regions, extreme high prices are seen in

purchase competition. Log prices are also climbing steeply

with busy demand by sawmills.

Substituting demand of domestic logs and lumber

suddenly spurted since last March and there is no sign of

easing yet. 3 meter cedar 105 mm post prices were 52,000-

53,000 yen until March then they rose to 55,000-60,000

yen in many areas but in Tokyo region the prices soared

70,000-75,000 yen with high spot prices of 80,000-90,000

yen.

Log production is stable. 3 meter post cutting cedar log

prices are 12,000 yen in average but in Tokyo and Kyushu

region where large sawmills are up to 16,000-19,000 yen.

4 meter sill cutting cypress log prices range from 20,000 to

26,000 yen.

Plywood

Pressure for price increase is getting stronger on both

domestic and imported plywood. Users of domestic

softwood plywood are trying to procure necessary volume

as soon as possible in fear of supply tightness after all

kinds of imported building materials are extremely tight.

Also the users fear that the prices of softwood plywood

would go up again as prices of material cedar logs are

climbing by active demand for lumber. One concern is if

precutting plants¡¯ operations are forced to be down by

materials shortage, overall consumption of softwood

plywood would be down but so far, orders are busy to

secure immediate needs.

Softwood plywood manufacturers are considering to raise

the sales prices again since cedar log prices continue

climbing.

In imported plywood, supply shortage of standard

plywood is grave. In particular, plywood used as floor

base is very short and floor manufacturers are increasing

the sales prices. Some consider to change to other

materials like MDF but the prices are also high. Concrete

forming 12 mm panel demand is weak. So far, there is no

influence to construction works.

Domestic logs and lumber export

Cedar log export to China stagnated in the first half of

2020 because of COVID 19 pandemic and the export

prices dropped down to $ 115 per cbm C&F but recovery

of China market was much quicker than expected and log

demand sharply increased in the second half and C&F

prices shot up to $140 by the end of 2020.

According to the trade statistics by the Ministry of

Finance, log export in 2020 was about 1,380 M cbms,

22.5% more than 2019 and the value was 16,341 million

yen, 11.1 more than 2019.

Demand in China continues active in 2021 and March

export prices are $165 per cbm C&F but freight increased

so that revenue to log exporters is not as high as nominal

prices.

At the same time, domestic prices of cedar logs have been

climbing as the demand is increasing to substitute tight

supplied imported products from North America and

Europe since second half of 2020. 8 cm up cedar log

prices were about 7,500 yen per cbm delivered loading

ports in fall of 2020 but they rose to 10,000 yen by

December.

Besides China, cedar fence lumber demand in the U.S.A.

continues active and cedar log demand inn Korea and

Taiwan is also increasing.

Export of domestic lumber continues expanding. It was

13,726 cbms in February 2021, 25.9% more than February

2020. The value is 579.59 million yen, 31.7% more.

Export volume peaked in the fourth quarter 2020 and it

declined by about 30% because of active domestic demand

and shortage of containers. Sawmills give priority to

domestic orders.

Destination of lumber is the U.S.A. with fence lumber,

Philippines with structural lumber for housing, China with

interior finishing of condos and furniture manufacturing.

Total export in 2020 is 169,768 cbms, 18.7% more than

2019 and the value is 6,278 million yen, 115.8% more. In

particular, lumber export to the U.S.A. is 52,485 cbms,

115.8% more. Volume for China is 63,683 cbms, 2.0%

more. Ocean freight to the U.S.A. increased by double or

three times so sawmills¡¯ revenue is squeezed.

Demand for cedar taruki and small lumber is increasing

after the supply from foreign sources decreases and the

prices are up by 3,000-5,000 yen. With this increase,

lumber export business is not as attractive as before.

Hyuga biomass power generation project

Four companies jointly invest to construct biomass power

generation plant in Hyuga, Miyazaki prefecture.

Itochu Corporation (Tokyo) invests 35%, Osaka Gas Co.,

Ltd. 35%, Tokyo Century 25% and Tokyo Energy and

system Inc. 5% to establish Hyuga Wood Biomass Power.

Annual fuel consumption would be more than 200,000

ton. Both domestic and imported materials are used.

Majority would be imported wood pellet. Itochu is in

charge of supplying imported fuel and Green Power Fuel

(GPF) of Osaka Gas group will supply domestic wood

pellet.

Start-up is scheduled in November 2024. Power output is

50,000 kw.

Itochu and Osaka Gas with Mitsui E&S Engineering

invested jointly invested and started up operation of

Ichihara Biomass Power plant in December 2020 at

Ichihara, Chiba prefecture. Power output is 49,900 kw.

|