Japan

Wood Products Prices

Dollar Exchange Rates of 25th

April

2021

Japan Yen 108.60

Reports From Japan

New state of emergency ascorona

cases soar

JapanĦħs fresh state of emergency because of a surge in

infections threatens to dash hopes for an early economic

recovery by further weakening consumption. Under the

state of emergency declaration, local authorities will

impose tougher restrictions including the closure of

establishments that serve alcohol, department stores and

shopping malls.

Most of the new coronavirus cases recorded mid-April in

Tokyo and Osaka were variant infections.

Japan/China economies grow closer

Data from the Ministry of Finance shows that imports

from China more than doubled year-on-year in February

marking the biggest rise since 1979 when the data started

being recorded. Analysts say the steady rise in trade

reflects the close economic ties between the two

economies.

Bank of Japan braces to support companies

In its quarterly report the Bank of Japan (BoJ)

downgraded its economic assessments for two of the

countryĦħs nine regions Hokkaido and the northeastern

region of Tohoku where the impact on businesses of the

corona virus has been severe. The assessments for the

seven other regions concluded regional economies are

picking up but the BoJ expressed concerns on the impact

on the service sector. The BOJ indicated a continued

emphasis on providing financial support for companies

and maintaining financial market stability.

In related news the Cabinet Office retained its view that

weakness has been seen in some sectors as consumption

remains subdued due to the continued impact of the

coronavirus pandemic. The Prime Minister has declared a

third state of emergency, effective 25 April to 11 May in

Tokyo as well as the western prefectures of Osaka, Kyoto

and Hyogo. This is an effort to slow the current surge in

infections during the Golden Week holidays, usually one

of the busiest times of the year for travel.

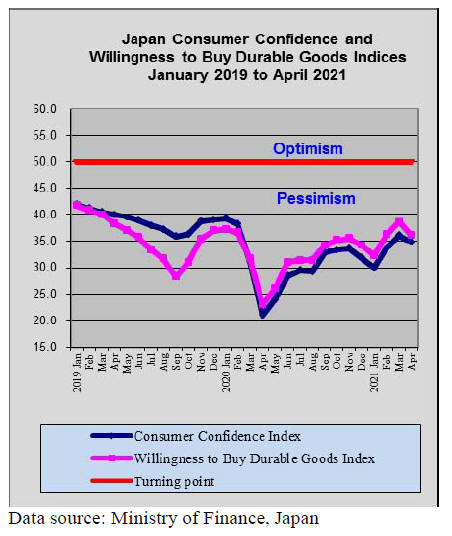

Third state of emergency drives down sentiment

Consumer confidence deteriorated in April according to

the latest Cabinet Office survey as a resurgence of

coronavirus cases led to a third state of emergency for

Tokyo and several other areas

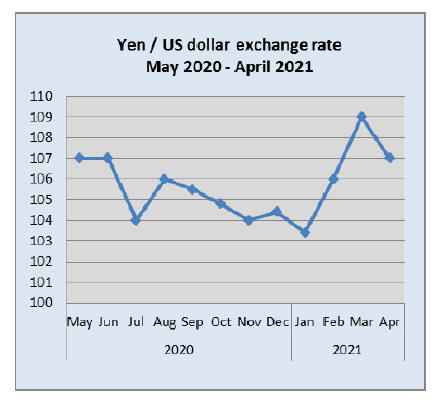

Yen strengthens slightly

At the start of the second quarter 2021 the Japanese Yen

began reversing weakness seen in the first quarter when

there was a steady downward direction in the yen/dollar

exchange rate but now just four weeks into Q2 that trend

has come undone and the yen has begun strengthening

rising to around 107 to the dollar at the end of April.

The US dollar lost steam following the latest policy

statement from the Federal Reserve (Fed) which reflected

on rising commodity prices and a hint of inflation. But,

looking ahead it is only when full US employment is

approaching that the Fed will be inclined to change its

stance.

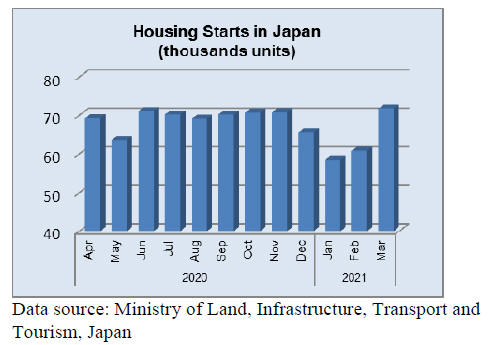

Shortages and rising prices plague home

builders

House builders in Japan have been affected by rising

prices for sawnwood imports from the US the result of

supply limitations and the strong US market for homes

(see page 13). The construction industry in North America

is also reeling from solid wood construction framing

building material prices that continue to soar. The impact

of the rising prices and delayed shipments of sanweood

from the US has prompted Japanese house builders to alert

clients that there may be delays in completion.

March 2021 housing starts were up compared to levels in

February but total first quarter starts are about the same

level as in 2020 at the beginning of the pandemaic and are

around 10% down from the first quarter 2019.

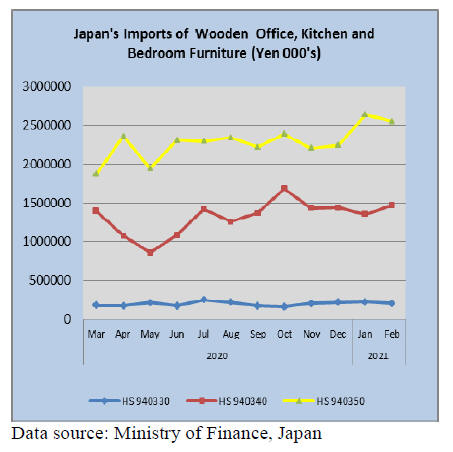

Import update

Furniture imports

The trend in JapanĦħs furniture imports over the 12 months

to February 2021 is illustrated below. Remarkeably

domestic sales of furniture have been sustained which has

encouraged imports even to the point of boosting imports

between May 2020 and February this year. In particular

imports of bedroom furniture have been rising since the

beginning of the third quarter of 2020.

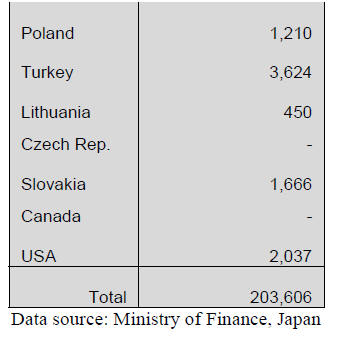

Office furniture imports (HS 940330)

After 3 months of steady increases the value of JapanĦħs

imports of wooden office furniture saw a correction in

February this with imports dipping around 10% from the

level in January. The rise in imports corresponded with the

work from home business operation. If the value of

imports flattens over the next few months then it would

seem consumers have completed their refurbishing to

create home work space.

As in previous months shippers in China dominated

JapanĦħs wooden office furniture imports in February

accounting for 78% of all HS940330 imports but this was

almost 13% down from January. The other two main

shippers in February were Taiwan P.o.C and Vietnam.

Shipments from Taiwan P.o.C jumped 5 fold but, as was

the case for Vietnam, accounted for just 5% of the value of

HS940330 imports.

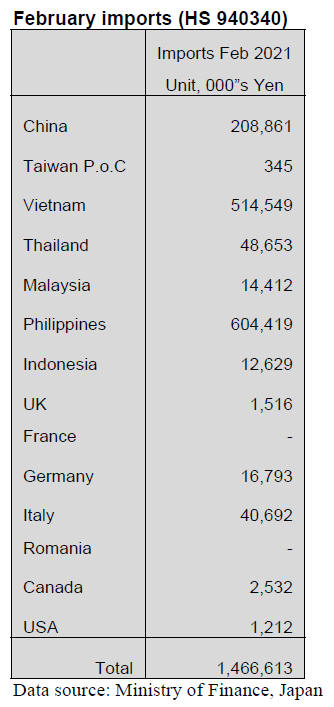

Kitchen furniture imports (HS 940340)

Year on year the value of JapanĦħs imports of wooden

kitchen furniture in February this year jumped almost 20%

and compared to arrivals in January 2020 there was an 8%

increase.

Manufacturers in three countries, the Philippines, Vietnam

and China continue to capture almost all of the demand in

Japan for imported wooden kitchen furniture. February

2021 imports from the Philippines accounted for 41% of

imports with shippers in Vietnam taking a 35% share,

China followed with a 14% share.

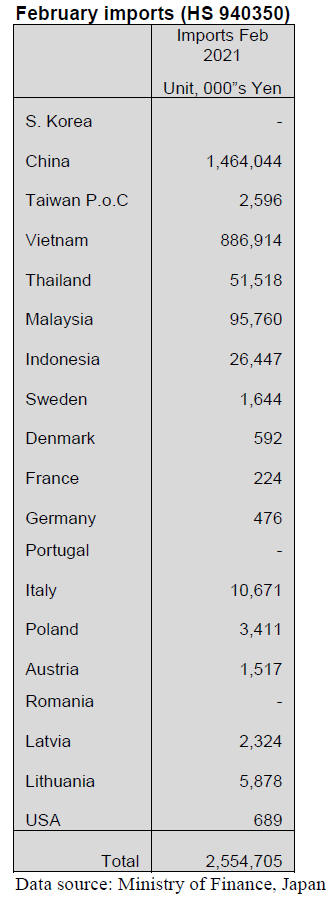

Bedroom furniture imports (HS 940350)

After 2 months of substaintial increases the value of

JapanĦħs imports of wooden bedroom furniture corrected in

February this year dipping slightly.

Imports from the top two shippers, China and Vietnam

were little changed from a month earlier with exporters in

China accounting for almost 60% of all HS940350 imports

and another 35% arriving from Vietnam which indicates it

was the other small shippers that saw most of the decline

in February, the exception being Malaysia where exporters

of wooden bedroom furniture achieved a 20% increase.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Frantic search for substitute materials

Precutting plants are now unable to purchase necessary

building materials they have been using such as North

American and European products after supply sources

reduced supply volume and shortage of containers causes

delay of arrivals of ordered items.

Precutting plants are now looking for substituting

materials desperately but they are not easy to find.

To replace imported laminated products, orders are

rushing to domestic laminated lumber manufacturers but

they are short of lamina from Europe so replacement is not

easy. Naturally the prices of all items continue climbing. If

shortage of necessary materials continues, many precutting

plants will be forced to stop the operations in May.

Precutting plants are asking dealers and importers to find

replacing materials by all means.

Housing companies are not well aware of this situation

and stick to the materials they have been using, which

perplexes precutting plants.

There is no European redwood laminated beam in

distribution channels and the prices in April will be 65,000

yen from 58,000 yen in March, 12% jump in one month

then the second quarter prices would be over 70,000 yen.

KD Douglas fir beam prices are about 60,000 yen but

availability is limited and the prices would further

advance. Whitewood laminated post prices are about 1,900

yen per piece delivered on both imported and domestic

made products in March but after April, the prices are

2,100 yen. Domestic cedar laminated post prices shot up

by 4,000 yen in March and now 52,000-53,000 yen per

cbm delivered.

Whitewood stud supply is very tight and search for

substitution gets heated up. KD cedar supply dried up and

LVL of cedar, Chinese poplar and New Zealand radiate

pine started coming into the market.

Prices of whitewood KD stud in March are 55,000 yen per

cbm delivered and KD cedar stud are 50,000- 55,000 yen.

Small Douglas fir side-cut lumber prices are over 70,000

yen, 3,000-4,000 yen up from February but the supply is

skimpy and substituting domestic cedar lumber supply is

delayed since sawmills carry too much orders.

Overseas inflation is squarely hitting Japan market.

Daishin Plywood quit operation

Daishin Plywood Co., Ltd. (Niigata prefecture) stopped

the operation at the end of March after 55 yearĦħs plywood

manufacturing. Daishin Plywood started in 1965 as

Niigata plant of Sunamachi Veneer in Tokyo. This is the

last major tropical hardwood plywood manufacturing plant

in Japan.

Facing declining resource of tropical hardwood logs with

export restrictions and climbing log prices, it gave up the

business and has been preparing to withdraw from

plywood business since 2020 and notified the customers.

In 2020, the production was 3,800 cbms a month and it

finished the operation in last February and log inventory is

totally consumed. It has been preparing to sell the property

and machines since last year.

The president say that future outlook became uncertain

after Sabah, Malaysia banned log export in 2018 then

PNG increased log export duty.

The company was well known to manufacture particular

size plywood the customersĦħ demand.

Plywood

plywood is getting active since middle of March after

quiet February. It is hard to see future movement since

large precutting plants have started restricting taking

orders because of shortage of wood products such as

structural laminated lumber and stud.

Domestic plywood manufacturersĦħ inventory remains

tight. It is about 0.4 month so produced plywood is

shipped immediately. By earthquake on March 22 off

Miyagi coast, some plywood mills suffer fire damage so

that the production would decrease so precutting plants

hurry procuring plywood. Tight supply of tropical

hardwood imported plywood continues.

It is about time that rainy season is over and log

production gets active but this year, rainy season is

prolonging then labor shortage caused by moving

restriction by COVID 19 so local plywood mills struggle

to secure logs. Also mill workers are short by the same

reason so plywood mills have hard time to satisfy orders.

In Japan, the inventory continues diminishing week after

week. In particular, Indonesian plywood is getting tight so

the dealers are chasing remaining inventory and the prices

are firming particularly coated concrete forming panels.

Domestic logs and lumber

Replacing demand for tight supplied North American and

European wood products to domestic products spurted

rapidly since middle of March so the supply gets tight and

the prices are climbing particularly demand strong Kanto

region.

Log production is steady and normally it is time that log

prices weaken by over supply but sawmills are

aggressively procuring logs to catch up substituting

demand so log prices are firming.

At first short supplied Douglas fir lumber demand shifted

to European redwood and whitewood but after European

supply gets tight, demand shifted to domestic wood in

March. Orders are busy on not only smaller stud and brace

but larger sill, purlin and post. Some demand is

speculative since future prices get higher by increasing

substituting demand.

Japan Kenzai made demand forecast

materials dealers, made survey through 3,000 customers

by internet as to demand forecast. The demand has been

improving after the bottom of the second quarter 2020 but

severe situation continues. It is comparison to the same

period of last year.

The survey is made by indicating increase, slight increase,

unchanged, slight decline and decrease compared to the

same period of last year and responders select one of five

categories. Demand outlook by contractors for the second

quarter is minus 34.5 points.

He first quarter outlook was minus 46 points so it is

improving but still minus outlook continues. DistributorsĦħ

outlook is minus 38 points, improved from last surveyĦħs

48.5 points.

For building materials manufacturers, demand increase is

forecasted on plywood, wood building materials, ceramic

products and house appliances but plywood and house

appliances remain the same as last year but ceramic and

insulation products show 53% indicates declining forecast.

Influence of COVID 19 is becoming smaller but more than

60% forecast close down or bankruptcy of customers so

future continues foggy. For renovation works, there are

more new life style renovation with more than 2.5 million

yen.

CLT promotion meeting

11 th meeting among related Ministries was held to

discuss use of CLT and to make up road map to expand

the market of CLT. The new road map picked up problems

from past road map, which are degree of recognition of

CLT, advantage of market prices, timely supply to meet

the demand, area CLT can cover, designer and operator

and means of maintenance and management. These

problems should be solved and should show means to

improve.

Concrete plans include use of CLT at large events,

contribution to investment for SDG and ESG,

standardization of sizes by unifying individual

manufacturers, development of low cost joint, establishing

stable supply system by unifying manufacturers.

Target is to establish CLT production system of 500 M

cbms a year and reduce the cost down to 70,000-80,000

yen per cbm. As to recognition, first is to let construction

industry know since CLT is not yet well acknowledged

and to promote use of CLT for medium high stories

buildings like four to five stories.

Based on the past road map, the meeting reported that total

of 550 units of CLT buildings have been built at least one

in every prefecture.

|