4.

INDONESIA

Encouraging business in ‘Lightwood’

products

In an effort to boost the domestic lightwood industry the

Ministry of Trade held a Lightwood Cooperation Forum.

The Director General of Export Development in the

Ministry of Trade said the country needs to change its

image as a producer of commodity wood products to one

known for innovation and sustainability.

If this can be achieved in parallel with Indonesia’s Timber

Legality Verification System (SVLK) markets will open

around the world as Indonesia will have a competitive

advantage over products from other countries.

Marolop Nainggolan, Director of the Export Development

Cooperation, said lightwood can be a solution to support

the production of sustainable wood products in the

country.

See:

https://www.validnews.id/Kemendag-Dorong-Ekobisnis-Komoditas-Kayu-Ringan--cIX

Business forum a success

The second Indonesia-Latin America and Caribbean (INALAC)

Business Forum held in early November generated

business deals worth over US$70 million. This was double

that achieved last year according to Indonesia’s Foreign

Minister, Retno Marsudi.

Of the many products promoted the furniture and

handicraft manufacturers did well as did those pushing

food and beverages and coconut charcoal. The Ministry of

Foreign Affairs, in collaboration with other ministries and

agencies organises the INA-LAC forum to bring together

Indonesian and the Latin American/Caribbean businesses.

See:

https://en.antaranews.com/news/161008/ina-lac-businessforum-posts-agreements-worth-us7102-mln

In related news, the Indonesian Ambassador to Kuwait,

Tri Tharyat, has urged Indonesian charcoal producers to

explore the market for charcoal in Kuwait where people

enjoy cooking on charcoal during family gatherings.

Developing economic stability for the forestry sector

In launching the ‘APRIL2030’ plan built around the 2020-

2024 National Medium-Term Development Plan (RPJMN)

in the fields of Environment, Disaster Resilience and

Climate Change, the Coordinating Minister for Economic

Affairs, Airlangga Hartarto, highlighted targets for

sustainable forest development.

He explained that there are 3 three main issues that need to

be addressed. The first is climate change and stakeholders

in the forestry sector are expected to play an active role in

climate change adaptation and mitigation, in promoting

environmentally friendly industrial development and a

focus on low-carbon outputs.

The second issue is environmental protection and

preservation. The Minister called for wider adoption of

reduced impact logging, biodiversity protection,

management of conservation areas, development of

environmentally friendly products, certification and forest

fire prevention.

The final issue concerns community empowerment which

he said can be achieved through community involvement

in social forestry programmes.

See:

https://www.liputan6.com/bisnis/read/4411187/pemerintahsoroti-3-isu-utama-bangun-ekonomi-berkelanjutan-di-sektorkehutanan

Food estate programme in protected forests attracts

criticism

A regulation from the Ministry of Environment and

Forestry that allows forests to be converted to farmland to

support the government’s food estate programme has

attracted negative comments according to the Indonesian

Forum for the Environment (Walhi). The ministerial

regulation on forest re-designation for food estate

development allows forests in both protected and

production areas to be converted into farmland.

The Regulation says that protected forest zones can be

converted into Forest Zones for Food Security (KHKP) as

long as the forest does not entirely function as a protected

forest. Ministers, Governors, Heads of State Bodies,

Regents and Mayors can request a permit from the

Minister to convert both production and protected forests

into KHKP.

See:

https://www.thejakartapost.com/news/2020/11/16/foodestate-program-in-protected-forests-may-lead-to-massivedeforestation-walhi.html

Use domestic products for government projects to

support domestic industries

The President has been urged to limit the use of imported

goods for government projects if domestically made items

are available.

The Chairman of the Indonesian Furniture and Crafts

Industry Association (Himki), Abdul Sobur, has reported

that the number of companies failing is still rising and this,

along with weak demand, has resulted in jobs being shed.

He pointed out that payment of social assistance, while

vital for many, cannot replace the advantages from

keeping businesses afloat.

Sobur explained that the majority of furniture and craft

industry entrepreneurs are labor-intensive SMEs and are

scattered across the country and have received little

support while it is importers which have benefitted most

from government procurement.

He said the government National Economic Recovery

(PEN) budget of Rp 695.2 trillion should be used to

support the local industry not to benefit importers.

Enny Sri Hartarti, economist at the Institute For

Development of Economics and Finance (INDEF)

attributed the low absorption of domestic products in

government procurement to the Government Procurement

Policy Institute (LKPP) which needs to make adjustments

to its regulations.

See:

https://nasional.kontan.co.id/news/selamatkan-industridomestik-jokowi-diminta-mengerem-impor-untuk-proyekpemerintah

5.

MYANMAR

Extension of

Covid-19 preventive measures

The government has extended the country’s COVID-19

preventive measures until December 15 as the number of

cases continues to increase. The number of new cases

spiked after the general election on 8 November with cases

reaching a peak of 1,500 compared to 1,300 before the

election. The government requested people to stay-home

for two weeks from 21 November to 5 December.

Teak tender sales online

The Myanma Timber Enterprise (MTE) has announced an

online tender sale of teak in a bid to maintain log supplies

to processing plants. Recently, MTE tested the online

bidding system for inn-kanyin logs.

The teak logs to be offered are made up of 715 tons of

SG6/SG7 and 5,350 tons of other hardwoods. The online

tender will be conducted 4 December 2020.

In other news the MTE announced the harvesting plan for

2020-21 showing the sharp decline on previous years. The

plan is for 3,549 teak trees to be harvested (approx.4,000

tons) and 99,814 Trees (approx. 200,000 tons) for other

hardwoods from five extraction agencies located in three

Regions.

See:

http://www.mte.com.mm/index.php/en/annoucements/1372-19-11-2020-2

FLEGT activities continue

In an online commentary U Myo Min, Advisor to the

Myanmar Forest Products and Timber Merchants

Association, talks about development of the FAO-EU

FLEGT work programme. He writes; Since 25 September

2020 MERN has been facilitating Multi-stakeholder

groups for development of the FAO-EU FLEGT work

programme (2020-2021) by holding visual consultation

workshops the whole states and regions of Myanmar.

See:

http://mernmyanmar.org/states-and-regions-visualconsultation-workshops-for-development-of-fao-eu-flegt-workprogramme-2020-2021/?fbclid=IwAR2yBkczSOwnlqgnKP1Ky2raEbp7jIrfpepxNGjY2U-AO0LPrJ4_Al-SvhU

With support of FAO, a number of key tasks and questions

have been posed and priority actions to fulfill short-term

and medium-term FLEGT objective have been identified

at all state and region consultation workshops.

A national FLEGT workshop was held in November 2019

to reorient FLEGT work in Myanmar towards more

concrete and attainable short-term and medium-term

FLEGT objectives in support of strengthened forest

governance.

It was agreed that FLEGT work should “help promote

legal harvest according to the laws of Myanmar, focusing

on public access to information on applicable legislation

as defined in the EU Timber Regulation (EUTR), as well

as other relevant information related to legal timber

harvest – which are all necessary to allow to adequately

assess the risk of illegally harvested wood or derived

products entering the supply chain and to take adequate

measures to mitigate these risks.”

Investment policy review

With assistance from the Organization for Economic

Cooperation and Development (OECD) Myanmar has

published its second investment policy review which

identifies reforms ranging from means to attract

responsible investment, establishing special economic

zones, strengthening the implementation of environmental

impact assessments and fostering secure and well-defined

land rights.

Among the recommendations it suggested the government

evaluate the economic costs of the remaining restrictions

on foreign participation in the financial, construction and

retail distribution sectors. Also, it was suggested that an

evaluation be made of the costs and benefits of the

remaining restrictions on foreign investment in the

manufacturing sector where there is no national defense or

security issues.

Among several recommendations for promoting

responsible business, it suggested the government boost

transparency in Myanmar’s extractive industries beginning

with state-owned enterprises due to their importance to the

economy.

The policy review also urges Myanmar to ensure that

environmental considerations are included in early

screening of proposed investments by the Ministry of

Investment and Foreign Economic Relations (MIFER), the

Ministry of Natural Resources and Environmental

Conservation (MONREC) and other relevant ministries.

See:(https://www.irrawaddy.com/news/burma/myanmars-secondinvestment-policy-review-urges-further-liberalization.html

Trade weakens as COVID-19 control measures bite

Myanmar’s trade in the first five weeks of fiscal 2020-21

declined by about US$1.5 billion when compared to the

same period of last year as a result of COVID-19. Despite

the downward trend, the Ministry of Commerce has raised

its trade target for the current fiscal year by US$1 billion

to US$34.7 billion with US$16.2 billion in exports and

US$18.5 billion in imports expected.

Exports have so far borne the brunt of COVID-19 but

agriculture exports are on the rise, which aligns with the

government’s plan to boost trade this year. Myanmar is

planning to invest in raising production of agricultural

crops so as to raise exports to offset the decline in demand

for garments.

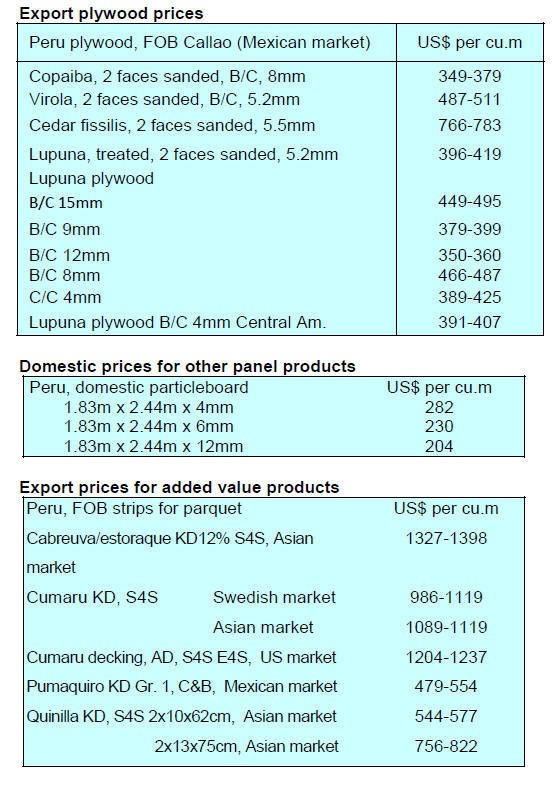

6. INDIA

Wholesale price

indices for wood products

The Office of the Economic Adviser, Department for

Promotion of Industry and Internal Trade, has released

wholesale price indices in India for the year to October

2020. In the second and third quarter there was a

considerable rise in the price index for wood panels but

prices for veneers dipped. The sawnwood price index fell

slightly throughout the second and third quarter of 2020

but reversed direction in October.

See:

https://eaindustry.nic.in/pdf_files/cmonthly.pdf

India continues to seek exemption from

rosewood

trade ban

The Standing Committee of the Convention on

International Trade in Endangered Species of Wild Fauna

and Flora (CITES) recently concluded its 70th meeting

agreeing measures to achieve full compliance with

international wildlife trade regulations.

The meeting held in Sochi, Russian Federation, attracted a

record number of participants with over 700

representatives from more than 80 States and over 100

intergovernmental and non-governmental organizations.

On the sidelines of the meeting representatives of the

Indian government and Indian rosewood importers

discussed the ongoing efforts to have sustainably

harvested India rosewood exempted from the current trade

ban.

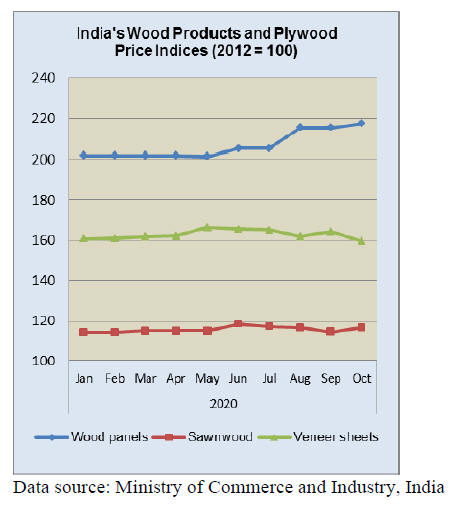

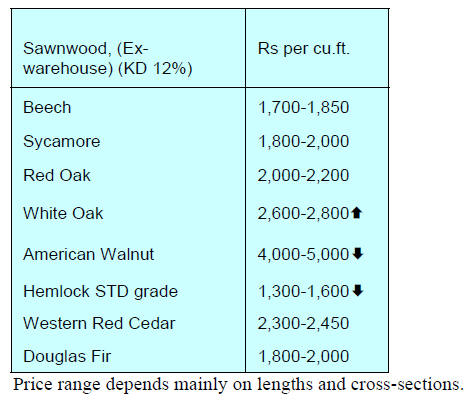

Demand for imported logs improves

The recent weakening of the US dollar against major

currencies has given importers a boost and there has been

a rise in imports of some wood products needed to satisfy

the beginnings of recovery in demand in the Indian

market.

Plantation teak shipments are now arriving and being

distributed to traders and manufacturers as there are few

restrictions on transportation now.

Locally milled sawnwood

Demand for imported sawnwood is steady and the

weakening of the US dollar has allowed replacement of

stocks at favourable prices. Demand in the urban areas is

beginning to recover but it is still in the rural areas

especially the NE of the country is where demand is

strongest.

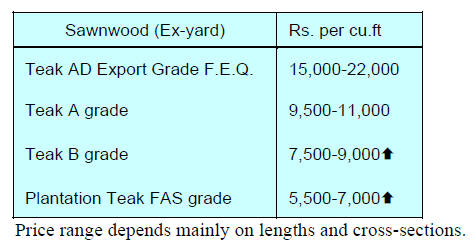

Myanmar teak

The current rise in demand has pushed down available

stocks which resulted in rising prices. As demand for

Myanmar teak is concentrated among high net worth

customers the prices increases have been accepted. As of

the end of November imports from Myanmar are yet to

resume.

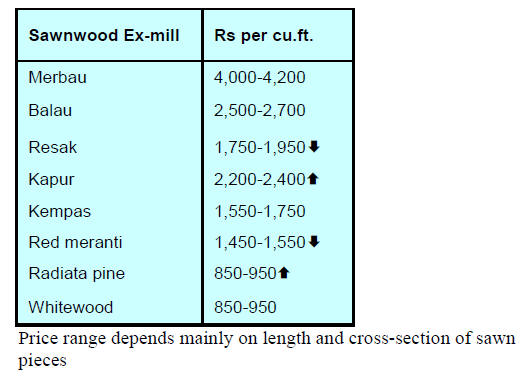

Sawn hardwood prices

There are signs of improvement in demand and importers

have been taking advantage of amended export prices for

US timbers.

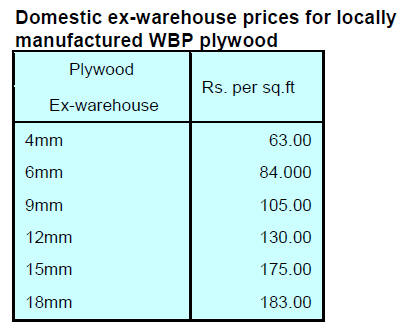

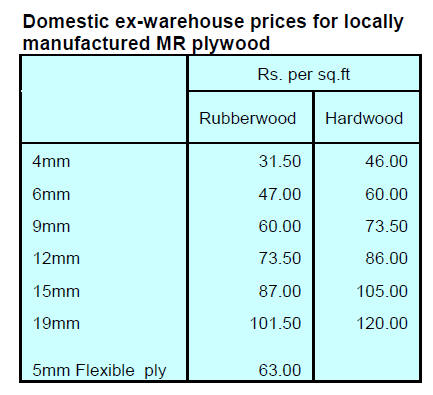

Plywood

Production and sales are improving and mills are keen to

raise panel prices as log costs are trending higher. In

recent weeks mills with a good market share have secured

modest price increases. Traders report demand for woodplastic

products is rising.

Labour issues still plague mills. Workers in factories in the

north of the country are back at work but the resumption

of work in the south of the country has been slow.

2021 Delhi Wood

The 7th International Trade Fair for Furniture Production

Technologies, Woodworking Machinery, Tools, Fittings,

Accessories, Raw Materials and Products, ‘Delhi Wood’

will be held 4 - 7 March 2021. The organisers say ‘Delhi

Wood’ is Asia's largest sourcing platform for furniture

manufacturers, wood-based handicraft makers, sawmillers,

craftsmen, woodworking professionals, builders, architects

and interior designers in the region.

Highlights of DELHIWOOD 2019: 600+ Exhibitors, 12

Country pavilions/ Group participations, 40,000 square

metres of exhibition space, 300 demos of woodworking

machines, seminars and forums for businesses, workshops

and interactive platforms for architects, interior designers

and builders.

See: www.delhi-wood.com

7.

VIETNAM

Vietnam’s tropical

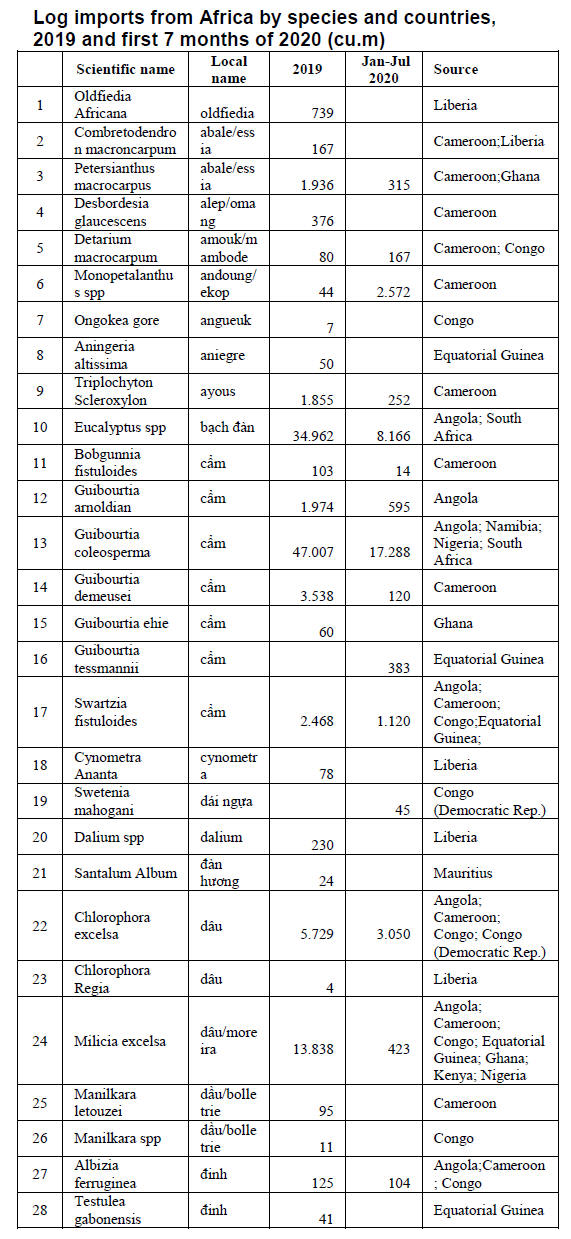

timber imports

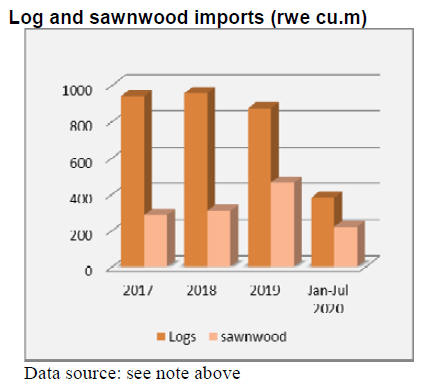

Vietnam imports around 1.5 million cubic metres rwe of

tropical timber annually accounting for about 30% of total

log and sawnwood imports from all sources. Timbers

imported into Vietnam are mainly from Africa, Papua

New Guinea, Laos and Cambodia.

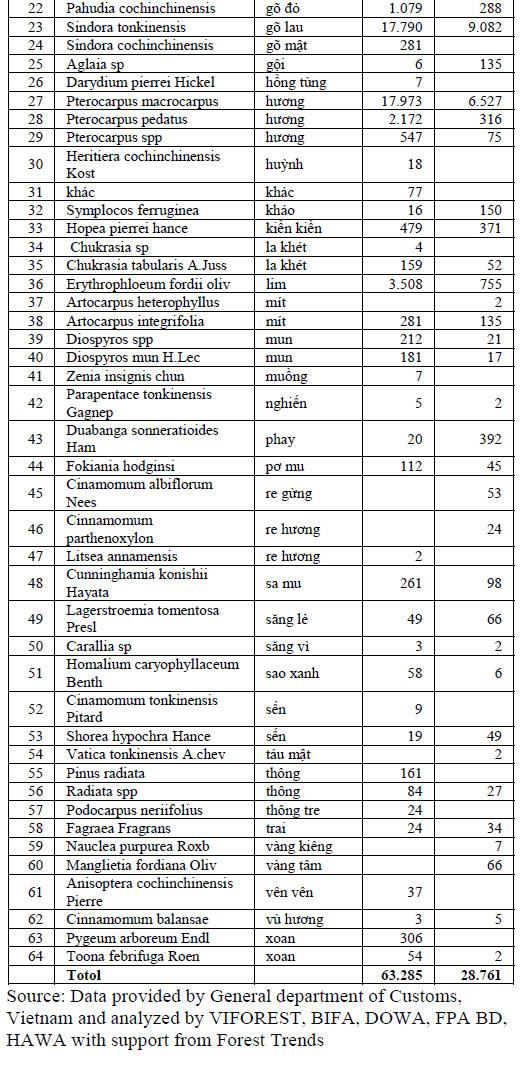

The following analysis has been made possible with data

provided by the General Department of Customs, Vietnam

and analysed by VIFOREST: Vietnam Timber & Forest

Products Association, BIFA: Binh Duong Wood

Processing Association, DOWA: Dong Nai Wood

Processing Association, FPA BD: Forest Products

Association of Binh Dinh Province, HAWA: Handicraft

and Wood Association of Ho Chi Minh City, with support

from Forest Trends.

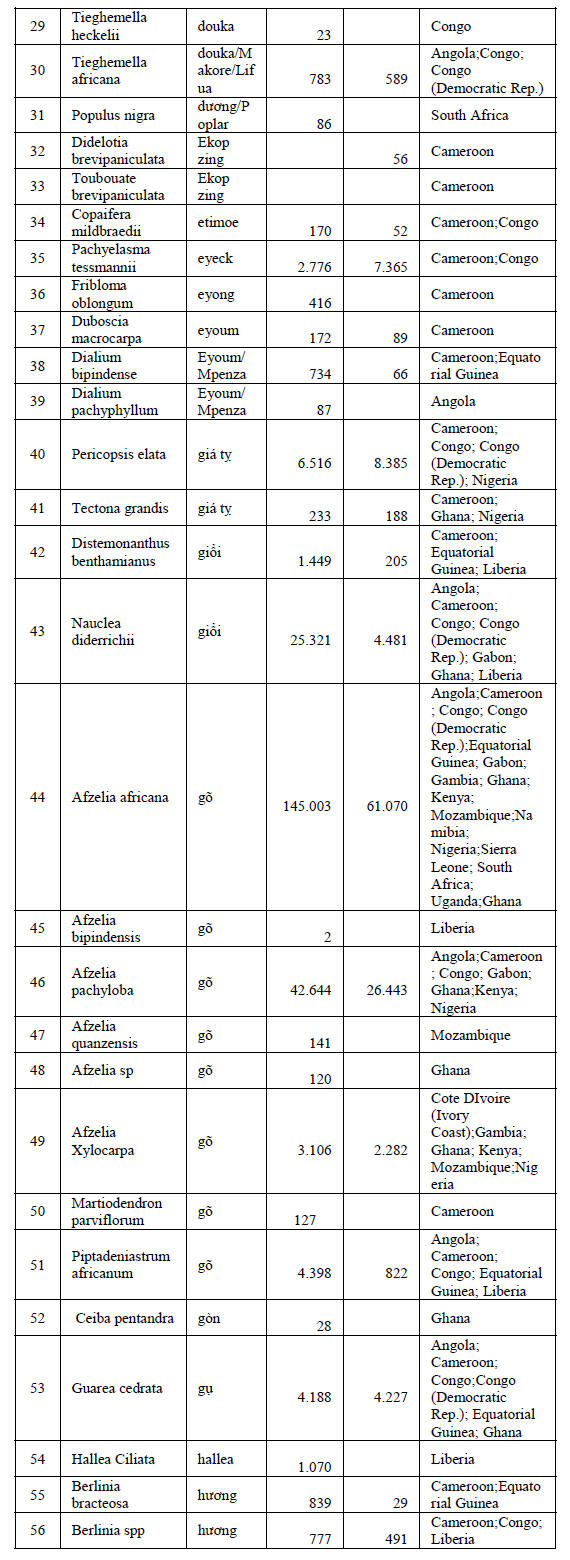

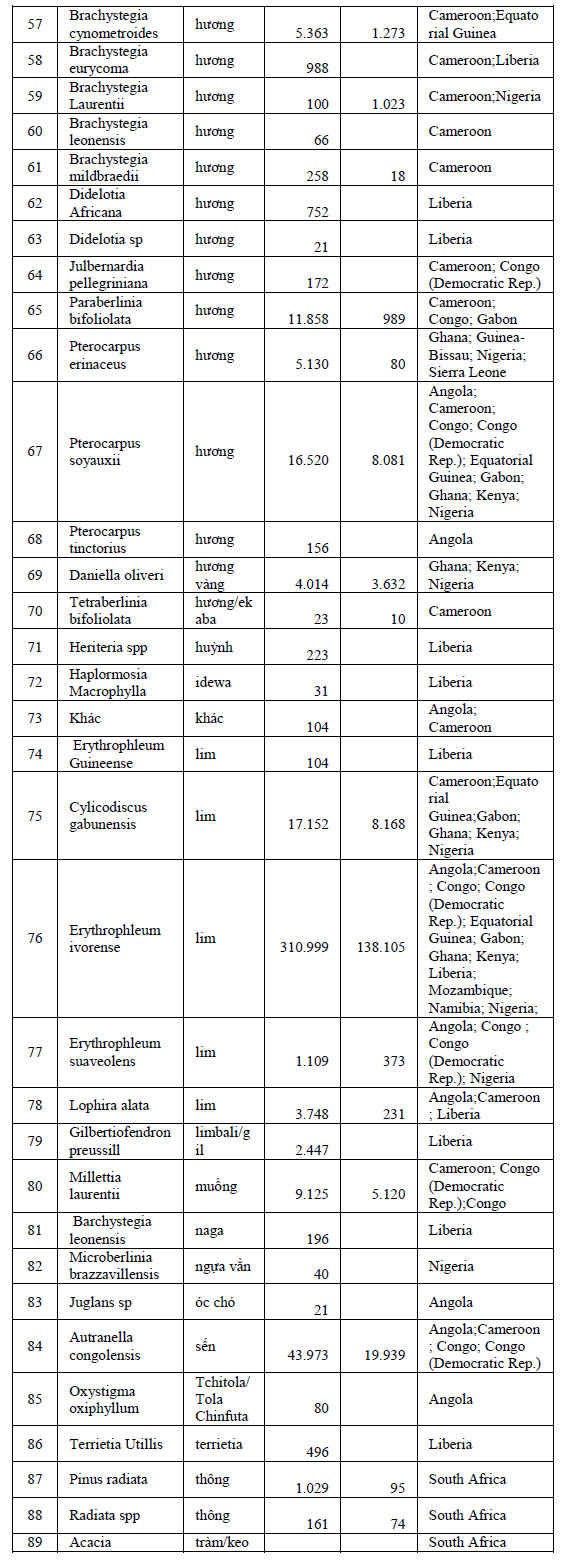

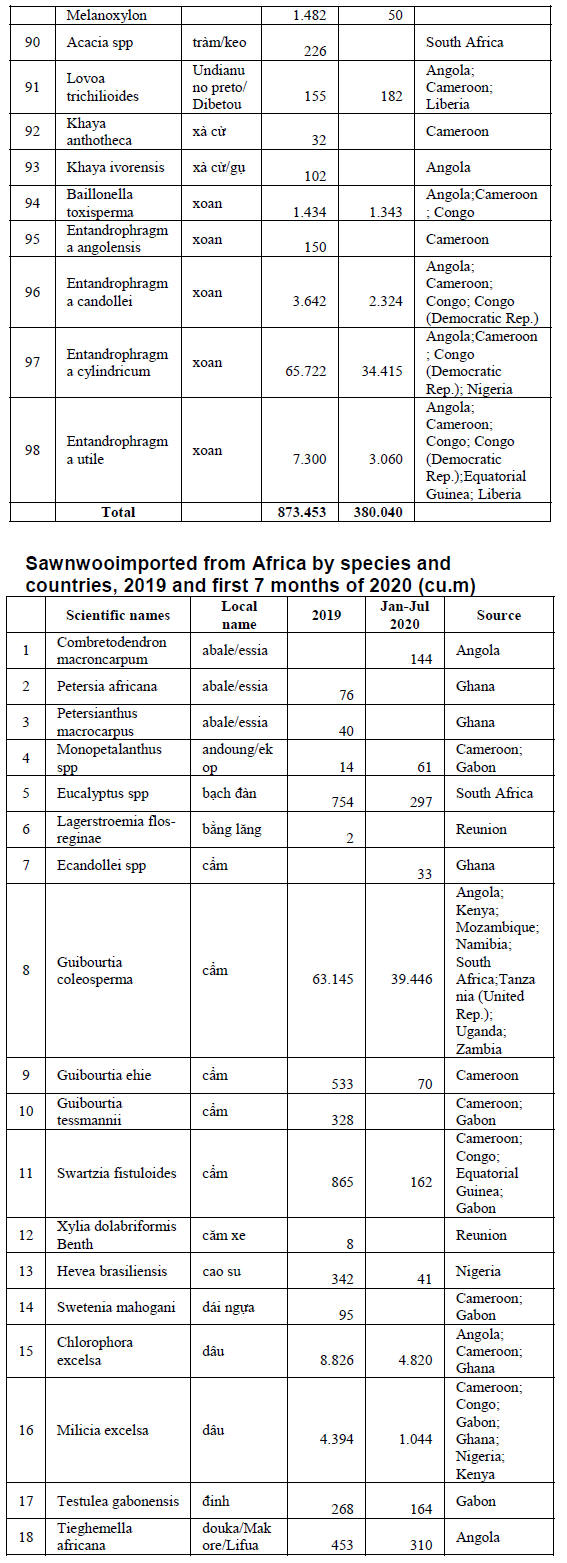

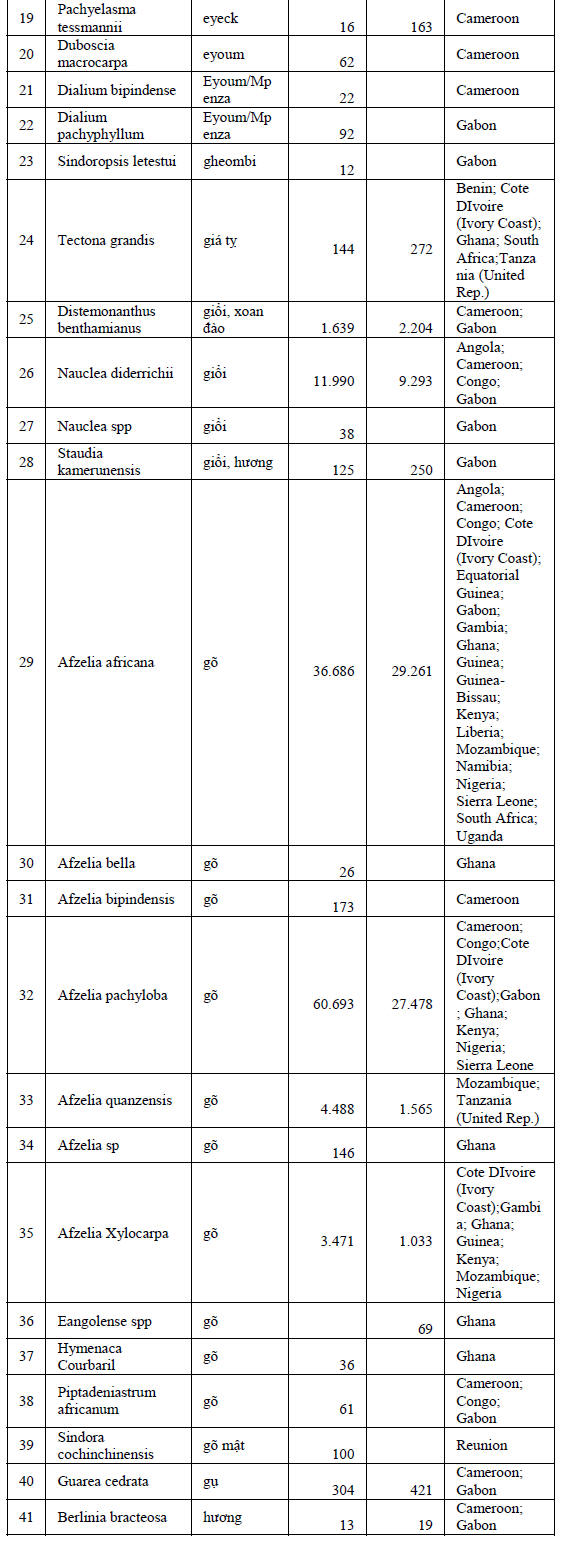

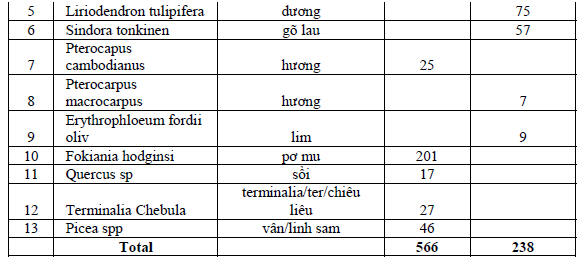

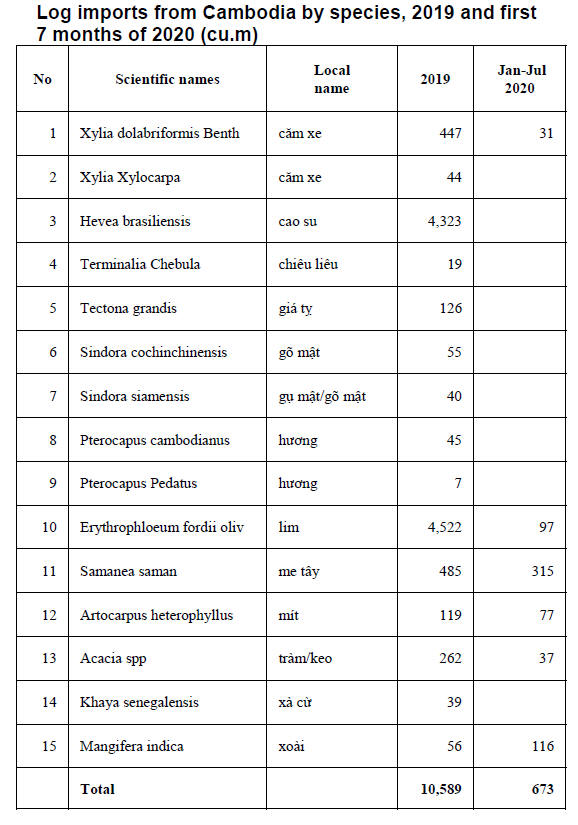

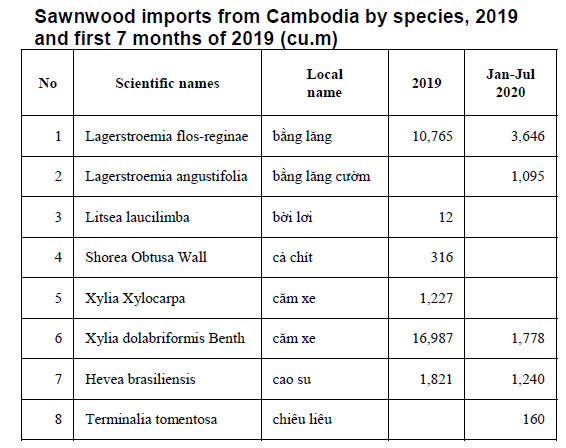

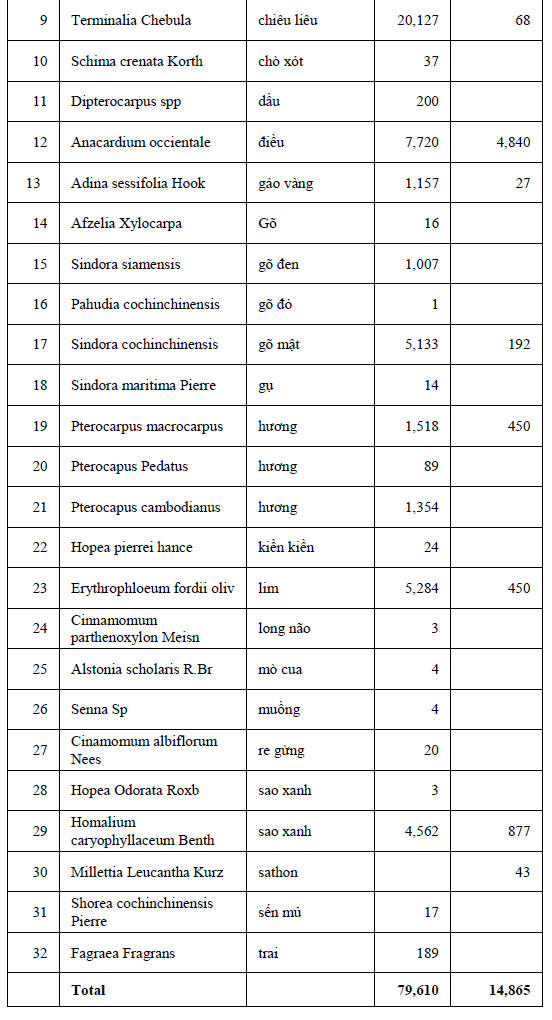

At the end of this section are tables listing species and

sources for log and sawnwood imports. These original

tables have not been checked for spelling. With such a

wide variety of species being imported the term Lesser

Used Species (LUS) could fast become redundant.

Imports from Africa

Vietnam annually imports 1.3 million cubic metres (rwe)

from around 20 African countries. These imports from

African countries represent around 25% of total timber

imports into Vietnam.

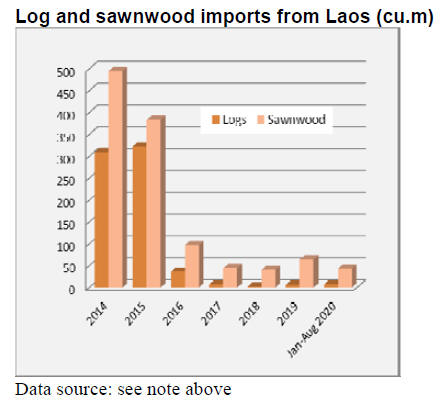

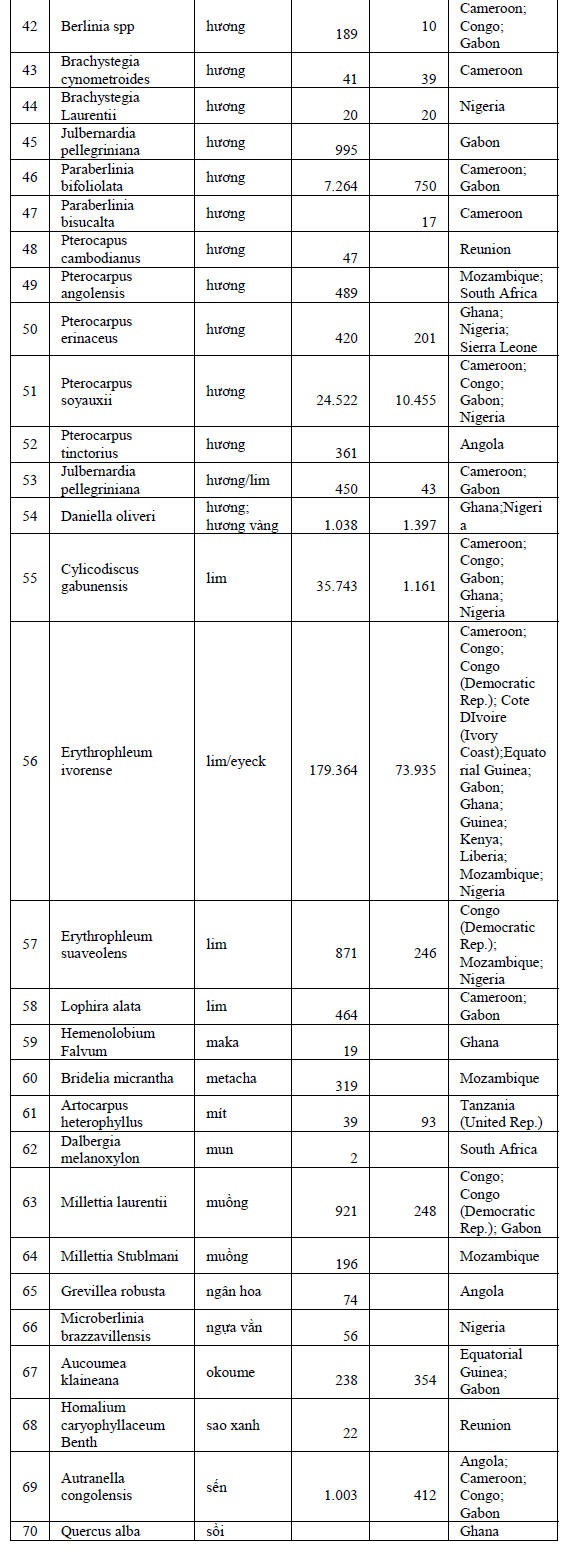

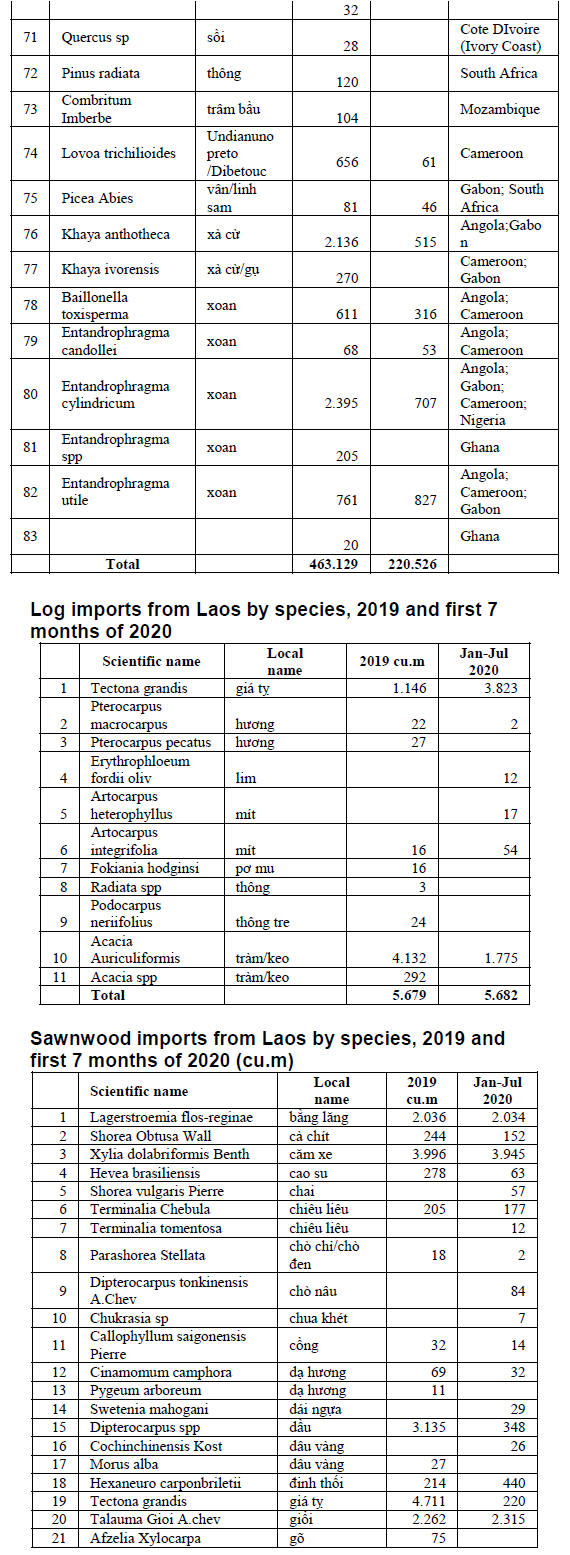

Log and sawnwood imports from Laos

Laos was once once a major supplier of tropical logs and

sawnwood to Vietnam. Order No.15 issued by the Prime

Minister of Laos in May 2016 prohibited the export of

primary wood products so Vietnam’s timber imports from

Laos dropped sharply. On average, Vietnam imports

annually just 5 – 6,000 cu.m of logs and 50,000 – 60,000

cu.m of sawnwood from Laos.

Log and sawn imports from Cambodia

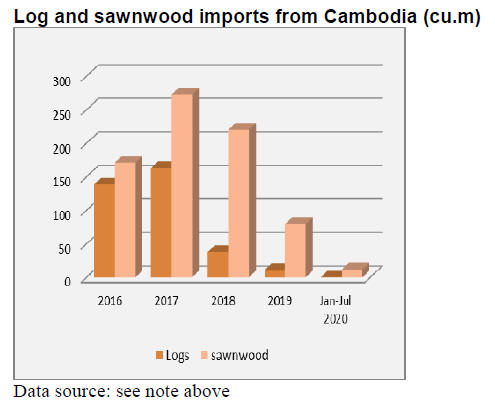

Cambodia was once an important supplier of tropical

timber to Vietnam. In recent years, however, the supply of

timber from Cambodia has become insignificant.

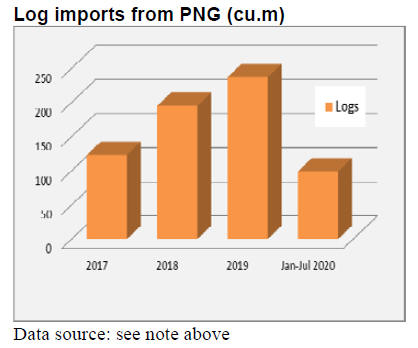

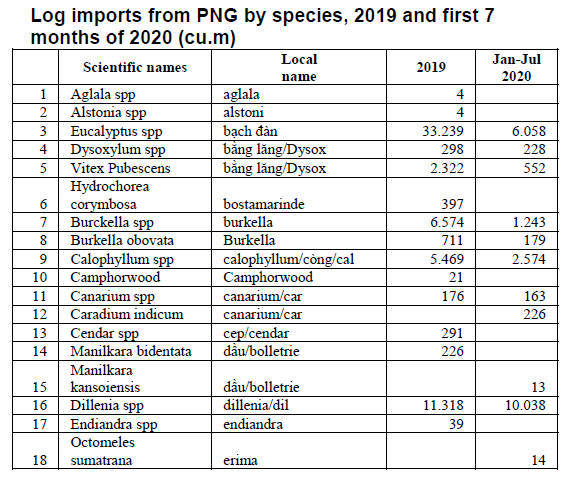

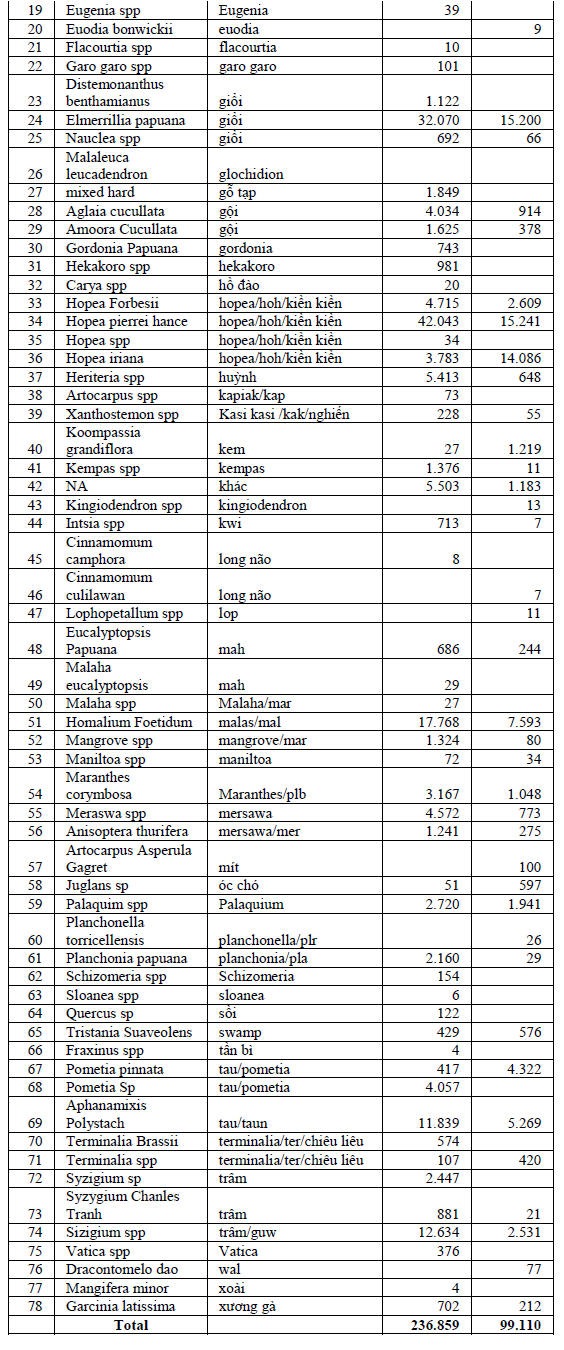

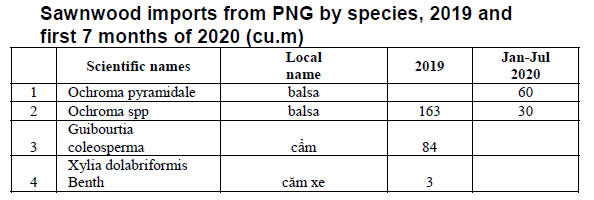

Log and sawnwood imports from Papua New

Guinea

PNG remains an important supplier of logs for Vietnam

and the volume of logs imported from PNG has been

increasing. Imports of sawnwood remain negligible.

VNTLAS and the import of tropical timber

Among the African countries exporting timber to

Vietnam 8 are currently negotiating or have already

concluded VPA/FLEGT agreement with the EU

namely:

Cameroon: VPA/FLEGT signed in October

2010, effective from December 2011.

DRC: VPA/FLEGT negotiations started in

October 2010, not signed yet.

Cote d’Ivoire: Negotiations started in

February, 2013, not signed yet.

Gabon: Negotiations started in September

2010, not signed yet.

Ghana: Signed in November 2009, effective

from December 2009.

Liberia: Signed in July 2011, effective from

December 2013.

Republic of Congo: Signed in May 2010,

effective from March 2013.

See:

http://www.euflegt.efi.int/vpa-africa

In September 2020 the Vietnamese Government

issued Decree 102 guiding the implementation of

VNTLAS, which is central to the VPA/FLEGT

Agreement. This Decree contains a specific chapter

on the control of illegality risks associated with

timbers imported from high risk geographical areas

and of controlled species.

The list of high risk geographical areas and species

will be announced soon. When the list is available

customs-clearance procedures will be applied

relevant to the identified risk.

8. BRAZIL

Bento Gonçalves furniture cluster

recovery

The output and earnings of the Bento Gonçalves furniture

cluster in Rio Grande do Sul State continues to expand. In

the first three quarters of this year earnings topped R$1.5

billion, up about 6% compared to the same period of 2019.

This furniture cluster accounts for over 25% of the State

revenue. The performance in the 9 months to September

has lifted employment and production in the furniture

industry to pre-pandemic levels.

Sindmóveis (Furniture Industry Association of Bento

Gonçalves) says this performance was due to the gradual

resumption of activities after the intense restrictions on

production and movement of people, new consumption

habits and adaptation of the furniture industry to the new

scenario and government emergency measures that helped

maintain consumption.

However, there are still concerns says the Association

especially in relation to political and economic

uncertainties.

Also of concern is the significant increase in costs and

delays in the supply of inputs. This is mainly due to the

mismatch between supply and demand as sales have

recovered faster than production of necessary inputs due to

low stocks as well as rising input costs.

Sindmóveis argues that the furniture sector has not yet

fully recovered from the 2015-2016 crises and has been

struggling to resume levels and then the pandemic spread.

2019 was not a good year either, there was growth in

revenues but this did not necessarily represent real growth.

In 2020 the furniture industry has been able to move

towards a recovery. The number of jobs created in

September meant that the sector surpassed the jobs

numbers seen at the beginning of 2020.

Civil construction and export demand boosts sales

The resumption of civil construction and the increase in

exports both of which have benefitted from the exchange

rate depreciation have contributed to beginning of a

recovery in the Brazilian forest-based industry.

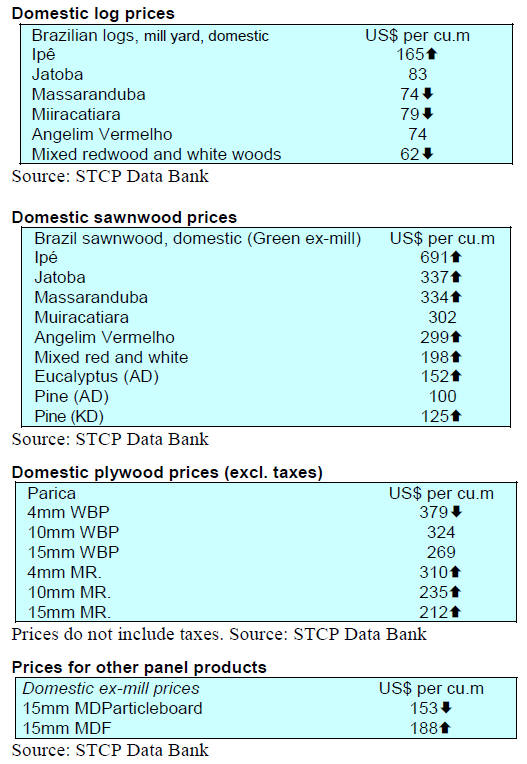

The signs of recovery can be seen in timber price

movements. Wood consumption fell in some segments

between March and May but prices were not affected and

from May there was a strong recovery in demand. The

wood panel and sawmill sectors which supply furniture

and civil construction demand were the ones that suffered

the most from the pandemic but the downturn was not

strong.

As for the National Forest Activity Costs Index (INCAF),

this increased by 1.1% in the third quarter, compared to

1.2% of inflation measured by the IPCA.

In the past 12 months the index registered an increase of

1.8%, compared to 3.1% for the inflation. Fuel, labour

costs, interest rates and foreign exchange changes make up

the index. In the short term, the evolution of INCAF does

not always reflects in the timber prices paid by the

industries/manufacturers which depend much more on the

relationship between supply and demand and the level of

building activity in the United States.

Brazilian wood product prices were competitive before the

pandemic so the real depreciation has added to this

competitiveness in international markets.

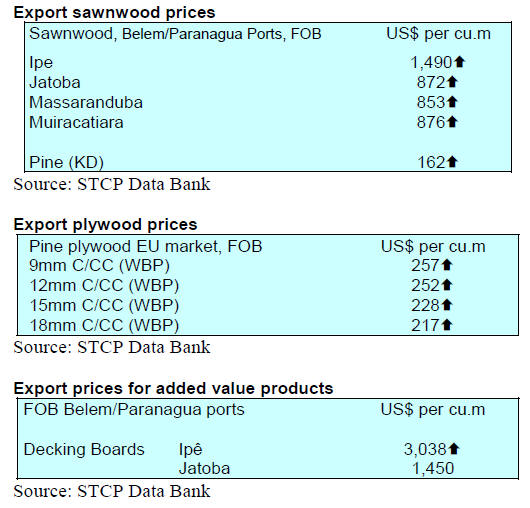

Export update

In October 2020, the value of Brazilian exports of woodbased

products (except pulp and paper) increased 32%

compared to October 2019, from US$222.6 million to

US$293.7 million.

The value of October pine sawnwood exports increased

29% year on year from US$36.6 million in 2019 to

US$47.1 million this October. In volume terms exports

increased 40.6% over the same period, from 190,600 cu.m

to 267,900 cu.m.

On the other hand, tropical sawnwood exports fell 2.4% in

volume, from 41,200 cu.m in October 2019 to 40,200

cu.m in October 2020 and in value terms exports declined

4% from US$16.6 million to US$15.9 million, over the

same period.

Pine plywood exports achieved a massive 60% boost in

October 2020 in comparison with October 2019 rising

from US$37.6 million to US$60 million. The volume of

exports jumped around 23% from 169,100 cu.m to

207,900 cu.m.

However, the volume of October tropical plywood exports

dropped 21% year on year from 8,000 cu.m (US$ 2.9

million) in October 2019 to 6,300 cu.m (US$2.6 million)

in October 2020.

The good news is that wooden furniture export earnings

increased from US$50.5 million in October 2019 to

US$57.2 million in October 2020, a 13% jump.

Argentina revises import procedures – seen as a

barrier by Brazilian furniture exporters

An announcement from Argentina on a change in its

import system, which is in fact a return to the nonautomatic

import license procedure for furniture, as well

as a reduction of the period of validity from 180 to 90 days

and the constant delay in the approval of these licenses has

caused astonishment in the Furniture Industry Association

of the State of Rio Grande do Sul (Movergs), an entity that

represents 2,750 companies that support around 34,000

direct jobs.

According to Movergs, trade in Brazilian furniture,

especially from Rio Grande do Sul state, one of the main

furniture exporting states, with Argentina has fallen year

after year and will be even more affected by these new

measures.

In 2010, Argentina was the second largest destination for

furniture exports from Rio Grande do Sul and in 2019

shipments to Argentina were worth US$943.9 million,

representing the seventh largest market destination for Rio

Grande do Sul furniture Between January and September

2020, exports continued to fall leaving Argentina in the

eighth position in the ranking of markets.

Movergs has approached the Argentine Embassy and the

Brazilian Ministry of Foreign Affairs suggesting

reconsideration of the changes. Movergs points out that

Brazil, Argentina, Paraguay and Uruguay are the founding

members of Mercosur and signatories of the 1991 Treaty

of Asunción, which among the objectives are the free

internal circulation of goods, services and products,

aiming at cooperation and development of the region.

Because of this it would be wise to seek alternatives that

expand cooperation between countries and to strengthen

trade relationships especially in light of the pandemic.

Big jump in roundwood exports over the past decade

Rough wood exports have grown over 9,500% over the

past ten years.

According to the Ministry of Economy Brazil shipped

977,000 tons of round wood in the period January to

October 2020. In the same period in 2010 exports were

just over 10,000 tons.

It is important to note that even the Covid-19 pandemic

exports of roundwood increased. The depreciation of the

Brazilian currency against the dollar made the Brazilian

wood products more competitive in international markets.

Another factor that contributed to the increase in timber

exports was the growth in international demand, mainly in

Asia.

Accessing international markets is still a challenge for

small producers who end up being limited to the local

industry and can only access export markets through

trading companies.

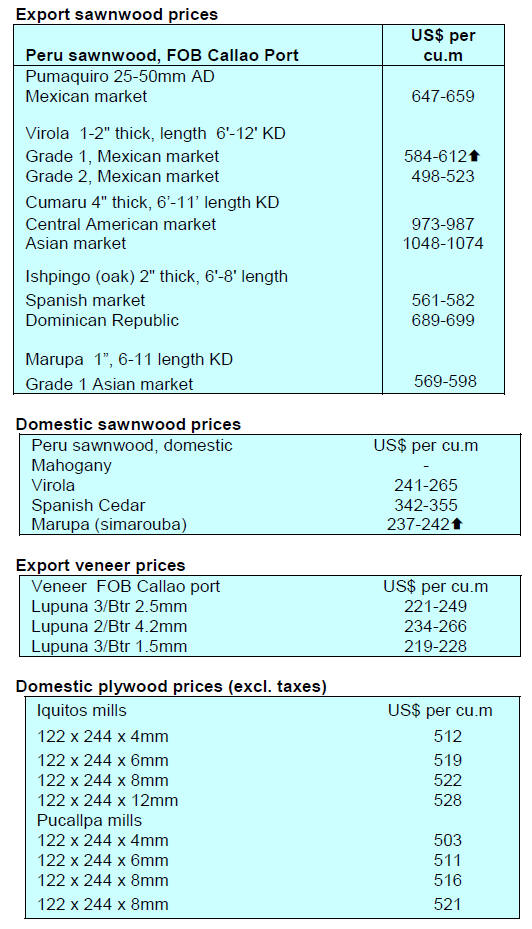

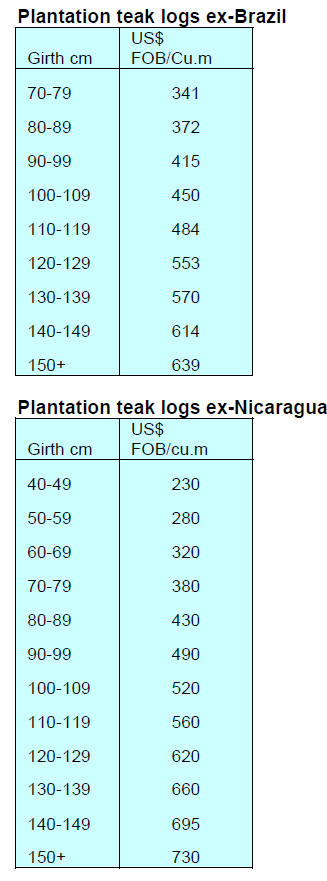

9. PERU

Timber industries – a driver of

national recovery

Speaking at a recent ‘El Cluster Maderero’ conference

during the Virtual Food Expo 2020, the president of the

Ucayali Wood Consortium (CEMU), Roberto Saveri, said

the timber industries represent one of the industrial

activities that can contribute to economic recovery in the

country.

The Amazonian forests are there ready to provide great

business opportunities for sustainable, profitable and

inclusive management for the benefit of the nation but, he

said, the forests of Peru are being lost as people demand

land for agriculture and forests are being degraded by

illegal activities.

To address deforestation and degradation requires action

by the State he said and expansion and strict control of the

forest concession system will harness private sector

resources to generate growth as well as offer the way

forward to conserve these natural resources.

The president of the Ucayali Regional Chamber for the

Secondary Transformation of Wood (Cresetmu), Davis

Scavino, reported on the participation of four of his

associates in ‘Expoalimentaria Virtual 2020’ and their

production of outdoor and home furniture as well as office

and kitchen items. He commented that the members are

working to achieve greater penetration of the domestic

local market.

Decline in export earnings but sawnwood exports less

impacted

According to data from the ADEX Commercial

Intelligence System, timber shipments between January

and August this year totalled US$54.5 million a

contraction of 32% compared to the same period in 2019.

Semi-manufactured products (US$32.3 million) were the

largest group of products shipped but earnings dropped

41%. Sawnwood exports (US$15.1 million) increased by

around 3%; construction product exports (US$2.4 million)

were down 46%; furniture and parts exports fell 22% to

US$1.9 million while veneer and plywood exports

dropped to US$1.6 million, a decline of around 13%.

Looking at just wooden furniture exports in the first nine

months of this year the Extractive Industries and Services

Management Division of the Association of Exporters

(ADEX) says shipments of wooden furniture and parts

dropped around 35% compared to the same period in

2019, the lowest figure for the last ten years.

Around 75% of wooden furniture exports in the first nine

months of the year was to the US. Other markets were

Italy (US$0.3 million) and Chile (US$0.2 million). In

addition, wooden furniture was exported to the Cayman

Islands, Panama, Bolivia, Greece, the Dominican

Republic, Australia and Qatar.

ADEX reported that in the same period there were no

exports to Uruguay, Paraguay, Mexico, France, Ecuador,

Aruba and South Korea.