Japan

Wood Products Prices

Dollar Exchange Rates of 10th

October

2020

Japan Yen 105.62

Reports From Japan

Manufacturer

sentiment improves

Sentiment among the largest Japanese manufacturers

improved in September from an 11-year low but remains

negative according to the latest Bank of Japan (BoJ)

Tankan survey. The Tankan index represents the

percentage of companies reporting favorable conditions

minus the percentage reporting unfavorable ones.

The Ministry of Labour has reported that the number of

workers laid-off due to the impact of the corona epidemic

was over 60,000 in mid-September and that the pace of

increase in lay-offs increased in September as employment

opportunities deteriorated. Non-regular workers comprised

over 80% of those laid off.

The government has presented a more optimistic economic

assessment for the first time in 15 months.

The Cabinet Office index of business conditions rose in

August, the second consecutive monthly improvement.

The recent improvement reflects the gradual resumption of

economic activity throughout the country.

According to the Japan Center for Economic Research the

country¡¯s GDP growth for August was plus 0.6% and this

was due almost entirely to improvement in external

demand in the EU, and ASEAN.

See:

https://translate.google.com/translate?hl=en&sl=ja&u=https://www.jcer.or.jp/&prev=search&pto=aue

Business travel

Japan and South Korea now allow business trips between

the two countries which were halted because of the

coronavirus pandemic. The entry of expatriates and other

long-term residents as well as business travelers can now

travel provided they have tested negative for the

coronavirus and they provide internal travel itineraries.

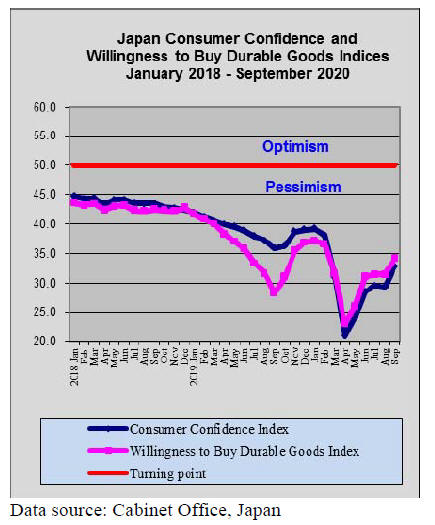

Consumer confidence surges

The Cabinet Office has reported Japan's consumer

confidence improved in September by the second-largest

margin ever. It was the biggest improvement since June

this year and July 2004, when the index rose by 4.4 points

on each occasion, the largest increase since the survey

began on a monthly basis in April 2004.

The improvement was put down to the slowing rate of

corona virus infections in the country and the government

travel subsidy programme ¡®Go to¡¯ which aims to revive

domestic tourism.

Government to strengthen its digital

capabilities

Problems with managing the various subsidy programmes

in response to the coronavirus pandemic have highlighted

the need for Japan to address its digital capabilities. The

government has realized the need to strengthen

digitalisation in both the public and private sectors.

The Prime Minister intends to launch a digital agency to

advance reforms and make a necessary and concentrated

investment from the standpoint of evaluating and

rebuilding a robust digital system for government.

The government has apparently shifted its priority to the

economy, with travel to and from Tokyo now eligible for

subsidies in the Go To Travel campaign.

See:

https://www.japantimes.co.jp/news/2020/10/04/national/katsunobu-kato-digitalization/

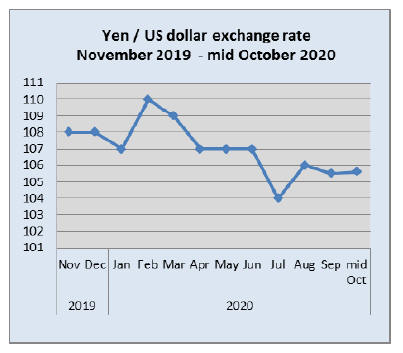

Yen/dollar curve flattens once more

For around two weeks the yen has been appearing to

strengthen against the US dollar only to be pulled down by

political issues in the US. Financial markets responded to

news that US politicians are close to a stimulus deal and

this took the pressure of the yen as a safe haven and took

the steam out of any upward strengthening.

Thousands of homes damaged or washed away

In 2019 and again this year Japan suffered severe damage

from floods brought on by typhoons. Thousands of homes

have been destroyed or severely damaged and the Cabinet

Office reports that As of 1 October 7,895 people from

almost 3,500 households, were still living in temporary

housing as their homes were damaged.

The damage from the typhoon was made worse as in

hundreds of places man made river embankments

collapsed despite meeting central government's standard.

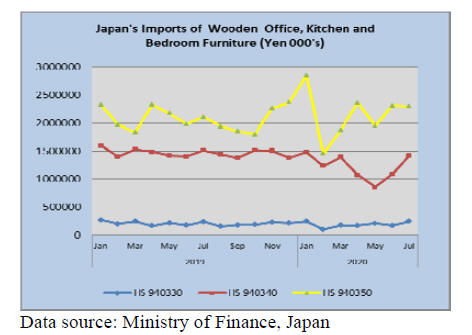

Import update

Furniture imports

The June 2020 upturn in the value of Japan¡¯s wooden

kitchen and bedroom furniture stalled in July with only

imports of wooden kitchen furniture building on the

advances made in the previous month. July consumer

sentiment and the consumer willingness to buy durable

goods (incl. furniture) rose slightly after the sharp June

rebound.

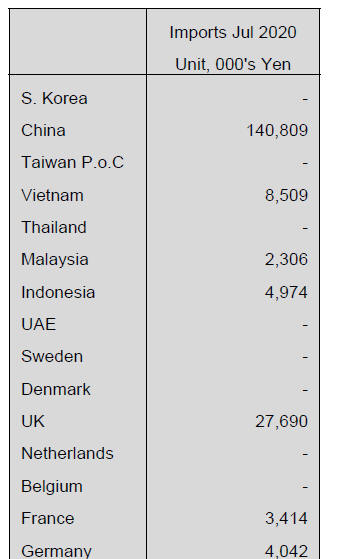

Office furniture imports (HS 940330)

July office furniture imports

The value of July imports of wooden office furniture

(HS940330) rose around 45% from a month earlier but

year on year the value of imports was flat.

July saw the emergence of a new supplier into the list of

top 20 shippers of wooden office furniture, Austria.

Shipments from Austria accounted for 4% of the value of

all July imports. Shippers in China dominated imports

accounting for over 50% of the value of imports but July

shipments were only around the same level as in June. In

contrast, shipments from the Philippines grew four fold to

capture 9% of monthly imports.

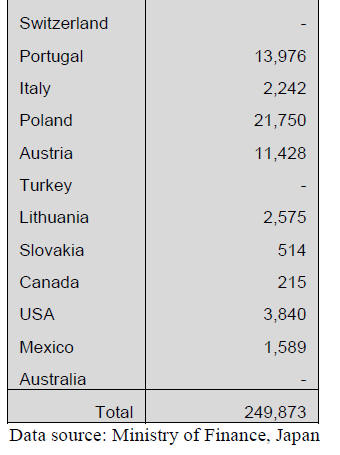

Kitchen furniture imports (HS 940340)

July kitchen furniture imports

Three suppliers, the Philippines, Vietnam and China

accounted for over 90% of the value of Japan¡¯s imports of

wooden kitchen furniture.

The top shipper in July was the Philippines at 41%

of

imports followed by Vietnam, 38% and China 13%.

Shipments from the Philippines and Vietnam were up

sharply in July (both up over 60% from a month earlier) as

were shipments from China which rose 27%.Month on

month, July shipments rose 37% but year on year they

were down 6%.

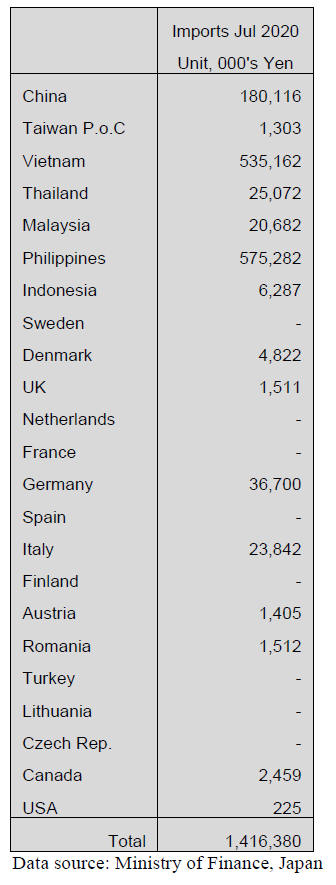

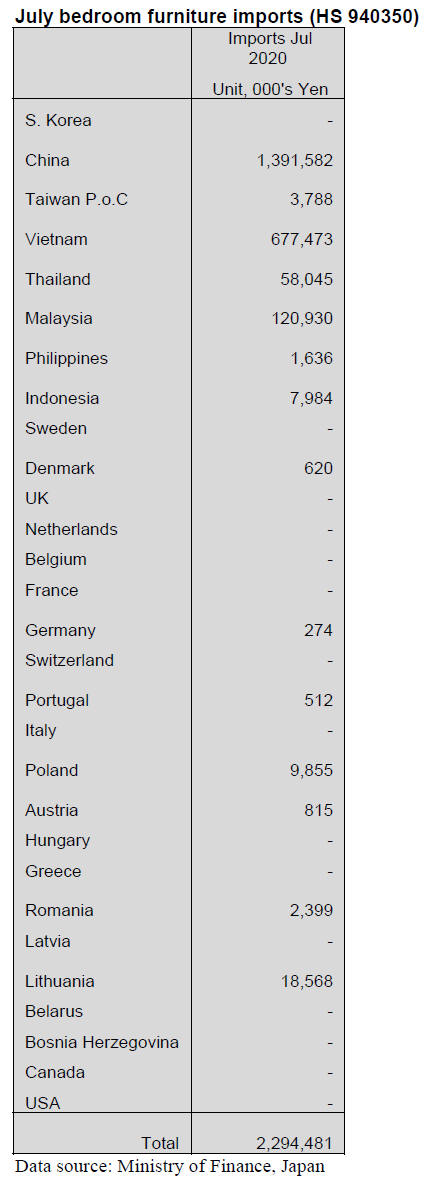

Bedroom furniture imports (HS 940350)

July bedroom furniture imports

The value of Japan¡¯s July imports of wooden bedroom

furniture (HS940350) was up a modest 3% year on year

but were little changed from June levels.

Shipments from China were at around the same level

as in

June but shipments from Vietnam dropped 12%. There

was a rise (20%) in the value of imports from Malaysia the

third largest shipper in July.

Imports from China and Vietnam accounted for over 90%

of imports of HS 940350.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://jfpj.jp/japan_lumber_reports/

Share of main members of wooden house

Main structural members of wooden house are changing.

The Japan Forest products Journal makes the survey every

year to see how use of main materials changes year after

year. This is 22nd survey and previous surveys percentage

of use of main members but since this time, used volume

is adopted instead of percentage so that comparison to

preceding year is impossible.

Responded are all major post and beam wooden house

builders. Total number of houses they built is 54,044 units,

average per company is 2,456 units. Total volume used for

post is 181,000 cbms and for beam is 296,000 cbms. Sill is

59,000 cbms. Standard lumber is 232,000 cbms so total

volume is 768,000 cbms.

Volume used per unit is 3.4 cbms of post, 5.5 cbms of

beam and 1.1 cbms of sill. Share of post is 66.8% of cedar

laminated while redwood laminated is 9.5% and

whitewood laminated is 7.2%. Redwood laminated is top

in beam with 46.6% share then KD Douglas fir is second

with 26.2%. KD cypress is top in sill with 39.4% share

then redwood laminated is second with 26.2%.

Share of laminated lumber is 94.0% in post, 72.3% in

beam and 54.5% in sill. Share of solid wood for post is

3.1% of KD cedar and 2.5% of KD cypress so solid wood

is no more main material.

Meantime, KD solid wood Douglas fir for beam is 26.2%,

second to top redwood laminated lumber. In sill, 39.4% of

KD solid wood cypress is top

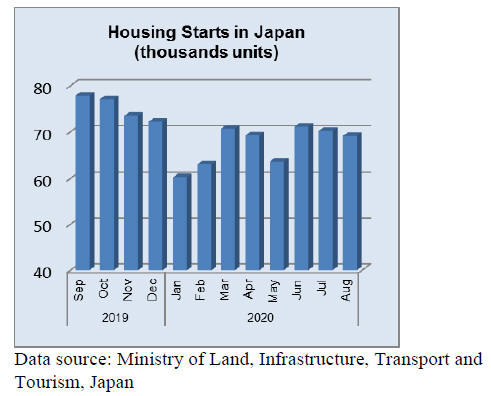

Lumber inventory in Tokyo port

Lumber inventory is Tokyo port had been increasing then

since July, it started declining. Reason is declining new

orders in fear of demand contract by corona virus

epidemic after the summer. The inventory is expected to

keep declining with increasing speed. Housing starts were

forecast to decrease by 30-40% this year but until July,

they are holding with only 10% less so now supply

shortage is feared.

In August, incoming was 50,000 cbms while outgoing was

59,000 cbms. This is the first time that outgoing exceeded

incoming since last March. July end inventory was record

high of 162,000 cbms. Now outgoing volume is more than

incoming so end of October inventory would be about

126,000 cbms, 20% decrease in three months.

Main factor of inventory increase is Russian lumber. Total

volume for the first seven months is 139,000 cbms, 36.3%

more than the same period of last year and July end

inventory was 62,000 cbms, almost double of last

December inventory. Then the importers reduced purchase

after July so August incoming was 7,000 cbms, about half

of July.

Incoming in September and October is less than 10,000

cbms so October end inventory would drop down to

39,000 cbms, which is about 40% higher than October last

year. Inventory of European lumber at the end of August

was 47,000 cbms but the incoming in September and

October largely declined so the inventory at the end of

October would drop down to 40,000 cbms. Compared to

September last year, it is 35% less so oversupply is solved.

The largest drop is North American lumber. Low arrivals

continued after long strike by major Canadian supplier

since July last year so the inventory at the end of July was

35,000 cbms, 30% less than July last year. August arrivals

were 13,000 cbms, 35% less than July and supply in

September and October continues low so that the

inventory at the end of October would be about 25,000

cbms, 50% less than July end.

Contracted volume in the third quarter was low since

domestic major Douglas fir lumber manufacturer reduced

the sales prices but the North American lumber market

skyrocketed while Japan receded so offer for the fourth

quarter largely reduced by the suppliers so incoming

volume in November and December would decrease for

sure so North American lumber inventory would be way

off balance by December.

Plywood

There is difference between domestic and imported

plywood. Domestic softwood plywood movement hit the

bottom and started recovering but imported plywood

market continues stagnant. Market prices of domestic

softwood plywood have hit the bottom and firming since

the manufacturing plants firmly refuse to accept low

offers.

The manufacturers¡¯ inventory has kept falling for four

straight months and it takes one to two weeks waiting for

thick plywood delivery. There is active demand for

restoration of typhoon damages in Kyushu so there are

waiting time of commodity item of 12 mm panels.

The demand for precutting plants seems to be increasing

toward December and the manufacturers continue

production curtailing program. Movement of imported

plywood lacks vividness.

The market prices are calming. Port inventories are

tight

and new arrivals are limited but by lack of demand, there

is no panic in the market.

Rebounding domestic log prices

Market prices of domestic logs had been sliding for nearly

six months then since late July, log production decreased

and the market prices bottomed out in the regions west of

Northern Kanto.

In main log supplying regions, prices of A class logs

suitable for lumber manufacturing are climbing.

In Hokkaido and North East, log market continues weak as

log consumption for plywood and paper and pulp remains

sluggish. October and on is full logging season so that

price increase should simmer down but overall log market

should become steady but total demand is less than last

year so if log supply increases all at once, the prices may

collapse again.

Log price increase in August and September was induced

by supply tightness, not by demand increase so log

suppliers are afraid of another price drop once the supply

increases.

Cypress log prices had been trending about 15,000-18,000

yen per cbm but the prices dropped record low since last

spring in many regions to12,000-13,000 yen. Then the

prices recovered during rainy season of July and by

September, all the regions show recovery. Presently, there

are strong inquiries on 4 metre sill cutting cypress logs and

the prices are 17,000-18,000 yen all over Japan and in

Western Japan, the prices are as high as 19,000 yen.

JAS certificate on super thick plywood

Seihoku Plywood (Tokyo) has acquired JAS certificate on

50 mm thick softwood structural plywood.

It has developed 200 mm plywood, which will be used for

11 stories all wood building Obayashi Corporation will

build. So far, plywood of thickness of 30 mm has been

distributed as floor use but Seihoku intends to develop

market of much thicker plywood. It will respond to

requests of thick plywood based on 50 mm.

JAS certificate on 50 mm thick panel is the most thick

plywood among structural plywood. JAS certificate

obtained is for 100% cedar plywood but larch and cedar

can be used either with single species or combined. The

maximum size is 4x10 (1,200 mm x 3,030 mm) but others

like 3x6 and 2x6 can be made. 50 mm panel is 15 plied

with veneer of 3 mm or thicker.

Japanese plywood industry has been pursuing to make thin

and high quality plywood and veneer by delicate

technology but development of thick plywood for flooring

triggered development of thick plywood. New wood

products like CLT and LVL promote development of thick

plywood.

In the U.S.A., since 2015, super thick plywood named

¡®Mass plywood panel¡¯ (MPP) is developed and is actually

used for buildings. Seihoku is anxious to develop market

of thick softwood plywood so it immediately started

manufacturing and made 200 mm thick 57 plied larch

plywood.

The building Obayashi plan to build will start up next year

and the shipment of the product has started already. 100

cbms of the product will be used. Looking at this

development, requests to make 36 mm and 45 mm

plywood are made from other users.

Seihoku thinks that thick plywood is suitable for flooring

as it solves vibration and sound noise problem. Cost

performance is better than CLT so there is possibility of

various uses.

|