4.

INDONESIA

Exports fall, many furniture

businesses close

The Chairman of the Indonesian Furniture and Craft

Industry Association (HIMKI), Supriyadi, said the value

of Indonesia’s exports of furniture and crafts will likely

fall below US$1.2 billion by the end of this year and the

downturn in exports is already having a major impact on

companies, many of which have either stopped operating

or cut production. This has resulted in job losses in the

sector and until domestic and international demand picks

up prospects are bleak.

The Director General of Small, Medium and Various

Industry of the Ministry of Industry, Gati Wibawaningsih,

agreed with the forecast export earnings saying this year

furniture and craft exports will not reach the US$2.4

billion level achieved before the pandemic.

The General Chairman of the Association of State-Owned

Banks (HIMBARA), Sunarso, has emphasised that the

Bank would help small and medium industries in this

sector by bringing together HIMKI members and

potenetial buyers at an event in Jakarta in December.

Sunarso also said that he would work with HIMKI to find

solutions to the issue of raw material supply.

See:

https://ekonomi.bisnis.com/read/20200825/257/1283113/eksporlesu-ini-cara-himbara-bantu-industri-mebel-nasional

On a brighter note, HIMKI predicts that in 2021 the

furniture and craft market will return to normal as it

expects demand in the second half of this year will slowly

start improving.

See:

https://jogja.tribunnews.com/2020/09/01/industri-mebeldiprediksi-mulai-normal-pada-tahun-2021

In related news, the Indonesian Furniture and Handicraft

Association (Asmindo) conducted a survey on the impact

of the pandemic on furniture & craft SMEs in 24 central

areas in Indonesia.

This survey was conducted 2-8 July and attracted

responses from 1,160 out of 2,500 Asmindo member

companies in 24 regions.

The survey revealed that 60% of respondents experienced

order delays from the domestic market which amounted to

Rp.173.46 billion and 86% of respondents experienced

order delays in the export market with a value of Rp.545

billion.

Furthermore, 30% of respondents experienced order

cancellation in the domestic market amounting to Rp65

billion with 40% of respondents experiencing export order

cancellations with a value of Rp225.52 billion.

See:

https://www.wartaekonomi.co.id/read303156/pengusahamebel-curhat-penundaan-hingga-pembatalan-order

Increase productivity to boost timber exports

Indroyono Soesilo, Chairman of the Association of

Indonesian Forest Concession Holders (APHI), has

reported there was a decline in the performance of the

forestry sector in the first half of this year and to boost

exports when demand returns, it will be necessary to

improve productivity and the efficient use of natural forest

resources.

Indroyono expressed his appreciation of government

policy initiatives to encourage improvement in natural

forest-based upstream and downstream sector

performance. The initiatives include relief from payments

to the Reforestation Fund, relief from levies on forest

product production, relief on land and building taxes, the

reduction in export taxes on some products and easing of

regulations on importing used plywood machinery.

To increase exports he said the Association must continue

to work together to strengthen market intelligence and

digital marketing and e-commerce and he recommended

establishing an intensive dialogue with Indonesian

Embassy officials in countries importing from Indonesia to

devise ways to boost demand.

Along with efforts to boost exports, domestic consumption

of timber and processed products needs to be encouraged,

said Indroyono.

See:

https://republika.co.id/berita/qg9l1q370/aphi-perlu-naikkanproduktivitas-untuk-genjot-ekspor-kayu

5.

MYANMAR

Second wave - Export

control procedures temporarily

suspended

Manufacturers in Yangon have been advised that

beginning 25 September the Forest Department will cease

its control procedure for issuing the Certificate for

Legality of Forest Products (CLFP) as a precautionary

measure against an apparent second wave of Codid-19.

The number of confirmed cases in Myanmar soared during

to over 3,000 on 14 September. The resumption of control

procedures will be decided on how the current Covid-19

infection rate expands.

The control procedure comprises many steps beginning

with the delivery of logs which were purchased through

the Myanma Timber Enterprise (MTE) open tender, the

cutting permit and the outturn measurement all of which

are required before the CLFP is issued.

According to the current control procedure, logs can only

be purchased from MTE and milling must be carried out

under the supervision of Forest Department (FD) which is

also responsible for checking input and output volumes

and details of the number of pieces in a consignment.

Quantitative control is also applied during container

stuffing and the container is sealed by the FD before it

leaves the factory. A container will only be accepted at the

port if the Customs Department verifies the intact of seal.

This suspension of issuing a CLFP may have an impact on

the exporters who have recently been active in securing

logs during the recent MTE tender where bid prices were

higher reflecting manufacturers plans to resume full

production after the slowdown over the past months.

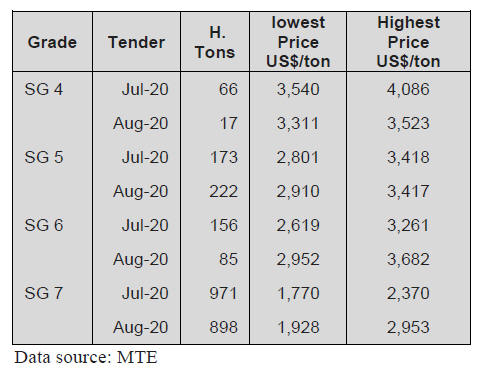

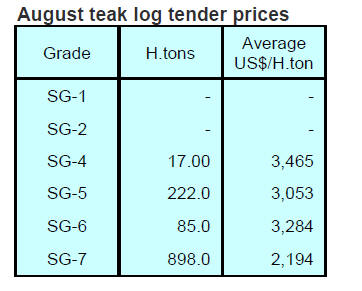

The purchase price of SG6 and SG7 teak logs at the most

recent sale rose by about 14%. A comparison of July and

August sale prices is shown below.

Second wave – public officers to work from

home

The National Committee for Prevention, Control and

Treatment of COVID-19 has announced that only 50% of

public sector workers should report to their offices, the

other half will work from home.

The announcement also stated that government employees

will have to report to the authorities if they suspect they

are infected or have COVID-19 symptoms or if someone

close to them is unwell. A remote working scheme for

government employees was adopted in April and May

when the outbreak of COVID-19 started but it was

cancelled in June.

The same committee has also announced it will, through

the Ministry of Finance, continue with the relaxation of

some regulations and will extend financial support to

businesses until year end.

The measures include extension of tax relief to prioritised

sectors from September 30 to December 31. The Ministry

of Planning, Finance and Industry had, under Notification

1/2020, extended the corporate income tax and

commercial tax payment deadlines for cut, make, pack

(CMP) businesses, hotel and tourism firms and small and

medium-sized enterprises until September 30 without

incurring any penalty. The measure also exempts exporters

from the 2% withholding tax on exported goods until 20

September.

Under Notification 3/2020, income tax payments for the

second to fourth quarters of the financial year have been

extended to December 31. Monthly commercial taxes

from March to November can also be paid by 31

December.

Since April, local businesses in selected sectors have been

able to apply for a 12-month soft loan from the

government at an interest rate of 1%. However, many were

unable to qualify for the funds due to incomplete

documentation and other reasons.

See:

https://www.mmtimes.com/news/myanmar-extendsfinancial-support-measures-local-businesses.html

Discussion on investments which may impact

biodiversity

In late August the Myanmar Centre for Responsible

Business in cooperation with the Environmental

Conservation Department of the Ministry of Natural

Resources and Environmental Conservation (MONREC)

held a workshop for staff involved in investment in sectors

which may have a negative impact on biodiversity. These

sectors include oil and gas, mining, tourism and

agriculture.

U Hla Maung Thein, Director General of the

Environmental Conservation Department, highlighted the

Government’s policy framework on conservation of

biodiversity and protection of the environment specifically

mentioning the 2019 National Environmental Policy, the

Myanmar Sustainable Development Plan, the 2015 EIA

Procedure and recent laws such as the Protection of

Biodiversity and Conservation Areas Law and the Forest

Law.

6. INDIA

Early signs of rise

in economic activity

Early August economic data has shown that an economic

revival has begun with indicators such as power and fuel

demand, rail freight demand and car sales recovering.

However, this comes with a hefty price as the corona virus

infection rates continues to soar. A turn-around would be

welcomed as the Indian economy contracted almost 25%

in the second quarter compared to the same period in the

previous year.

However, IHS Markit economist Shreeya Patel has said, in

contrast to the good news jobs continue to be lost.

Read more at:

https://economictimes.indiatimes.com/news/economy/indicators/indias-factory-activity-grows-for-first-time-in-five-months-inaugust/articleshow/77865605.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Work-from-Home here to stay

Work-from-Home, especially for the IT sector, seems as if

it is here to stay and this will have a profound impact on

the housing sector creating opportunities for IT workers

and others given the chance to work from home to locate

to less costly areas.

That work from home will be the new normal can be

judged by the moves being made by IT giants to have the

government amend labour laws which the government

seems ready to do.

Private sector proposes new partnership with

government

Twenty CEOs of India’s leading businesses have called

for collaboration between government, businesses and

civil society to achieve inclusive growth and reduce

India’s carbon emissions in line with the Paris Agreement.

Specifically, 8 priorities have been identified where

businesses can work with the government and civil society

to stimulate green growth and create a more resilient India:

invest in social infrastructure, ensuring greater

access and resilience

accelerate the power sector transition and clean

mobility adoption

deploy solutions for growing and managing food

suppy

invest to achieve Land Degradation Neutrality

pioneer green manufacturing

transform the green building revolution as the

new norm

invest in research for clean energy sources

provide access to green finance to support

emission saving measures

See:

https://www.wbcsd.org/Overview/About-us/Ouroffices/India/News/Indian-business-leaders-sign-statement-for-agreen-recovery

Teak and mahogany seedlings for farmers

Farmers with unused land are being encoraged to plant

commercially demanded trees. Forest Department

nurseries have available seedlings ready to distribute.

Under the central government ‘National Mission for

Sustainable Agriculture’ all states were provided with

funds to raise commercial species such as teak, mahogany,

red sanders as well as prickly padauk (Vengai in Tamil).

In most areas seedlings are ready for distribution but due

to the corona virus farmers have been unable to collect the

young trees.

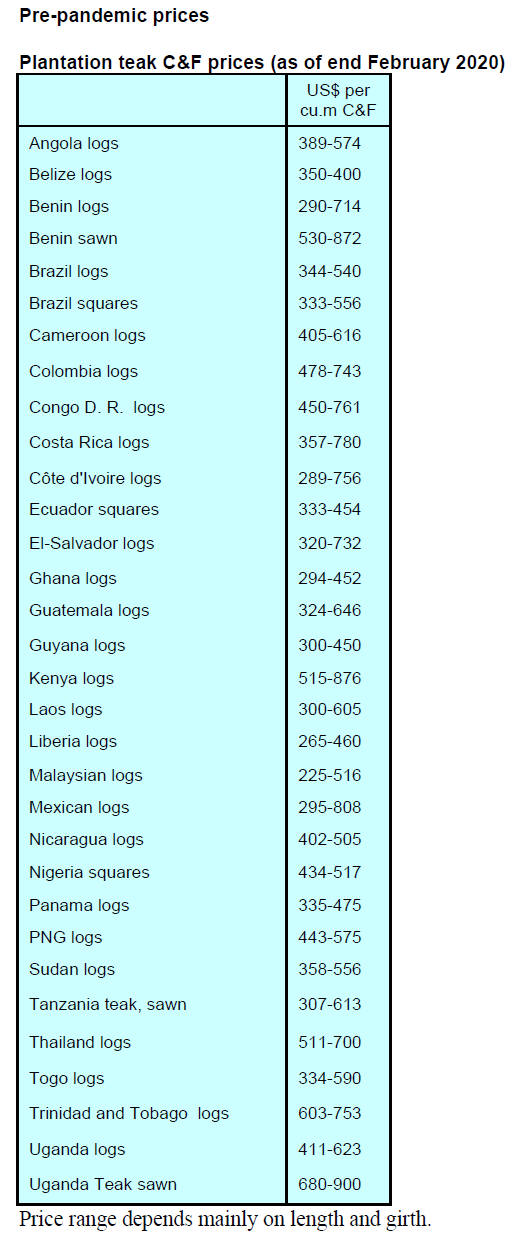

Plantation teak

Shipments of plantation teak have started to arrive as more

supply countries ramp up their harvesting, transport and

port operations. Traders report more countries are offering

shipments of teak but domestic consumption has not

returned to pre-pandemic levels and prices are flat.

C&F prices at Indian ports from various sources continue

within the same range as provided earlier.

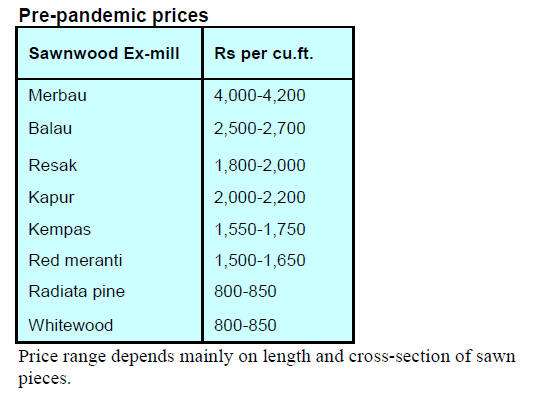

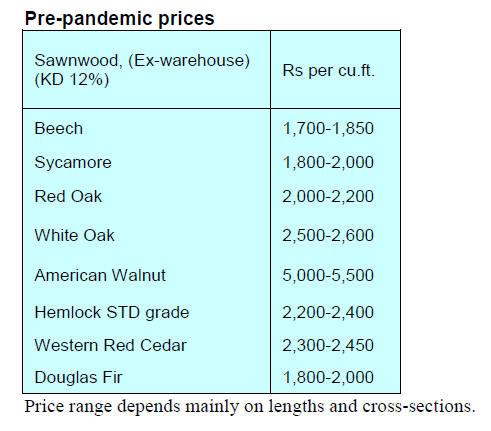

Locally milled sawnwood

Demand for locally milled hardwoods has started to firm

especially in the main urban areas where construction

activity and manufacturing is revving up. Demand for

timber and wood products in the rural areas is currently

stronger than in the cities.

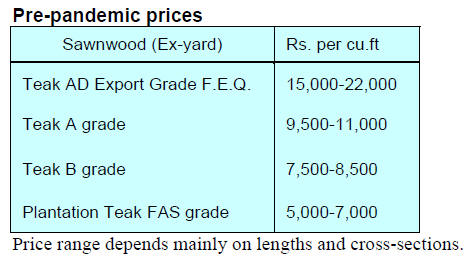

Myanmar teak

The trade in Myanmar teak is on ‘pause‘ at present. There

have been no new shipments in months so what little

demand there is is being met from stocks.

Sawn hardwood prices

Sales of imported sawn hardwood has shown some life

recently and this should continue as the government

encourages businesses to get safely back to work.

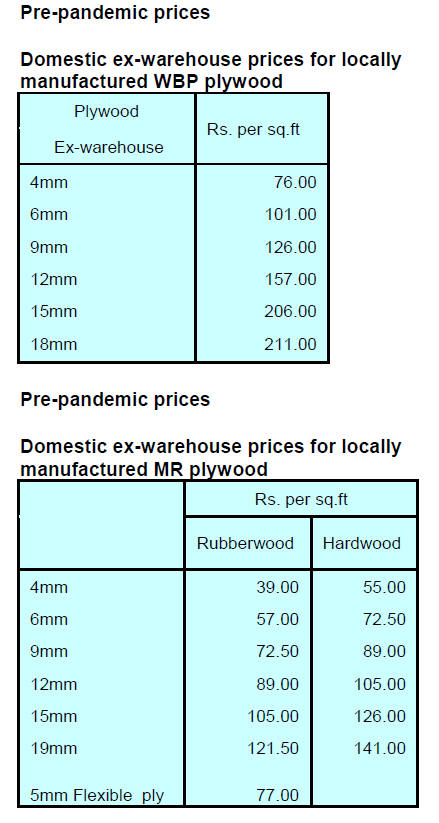

Plywood

Plywood production and sales are improving and mills are

happy to see firming demand as they are keen to raise the

prices as domestic log prices for plywood timbers such as

poplar, casurina and eucalyptus are rising.

One notable feature of the current business is that

deliveries are going first to those who can pay cash.

7.

VIETNAM

Regulations for

Vietnam’s Timber Legality Assurance

System published

On 1 September 2020 the Prime Minister of Vietnam

issued Decree No. 102/2020/ND-CP on Vietnam’s Timber

Legality Assurance System (VNTLAS).

The Decree includes 6 chapters and 30 articles providing

for the legal structure in support of Vietnam’s legal

timber for import and export as well as criteria, authority

and procedures for classifying timber processing and

exporting enterprises and for the issuance of FLEGT

licenses to be issued by Vietnam’s CITES Management

Authority.

According to the Decree, legal timber can be defined as

timber, wood products exploited, imported, confiscated,

transported, traded, processed and exported in accordance

with the provisions of Vietnamese laws and regulations, of

international treaties to which Vietnam is a signatory and

the relevant laws of the country where timber is harvested

for export to Vietnam.

The Government of Vietnam assigned the Ministry of

Agriculture and Rural Development the major

responsibility for implementing the new regulations in

coordination with related ministries.

In December 2018 the Ministry of Agriculture and Rural

Development of Vietnam issued Decision No. 4852/QDBNN-

TCLN on the Implementation Plan of the Voluntary

Partnership Agreement on Forest Law Enforcement,

Governance and Trade (VPA/FLEGT) between Vietnam

and EU. With this VPA/FLEGT Implementation Plan and

the VNTLAS recently put in place Vietnam is expected to

celebrate first FLEGT licenses in 2021.

See:

https://wtocenter.vn/chuyen-de/16110-decree-no-1022020nd-cp-on-vietnamese-legal-timber-security-system

and

https://wtocenter.vn/chuyen-de/16112-decision-no-4852qd-bnntcln-on-issuing-the-implementation-plan-of-the-vpa-flegtagreement-between-vietnam-and-eu

Exports continue to surprise

Vietnam earned US$7.83 billion from forest product

exports in the first eight months of 2020, up 10.3% yearon-

year, accounting for almost 30% of agricultural sector

exports.

The export value of wood and wood products in the same

period was US$7.32 billion, up 9.6% over the same period

last year. The export of non-wood forest products surged

almost 22% in the first 8 months of this year.

The main markets remain US, Japan, China, the EU and

the Republic of Korea accounting for almost 90% of

exports. Timber sector’s imports fell 9.3% in the period.

See:

https://en.vietnamplus.vn/eightmonth-wood-exportturnover-up-103-percent/182402.vnp

Analysts believe this year Vietnam will achieve its 2020

export target of US$12 billion for wood product exports

despite the impact of the COVID-19 pandemic.

Ngoc Ngoi, General Director of the Vinafor Saigon

Company, said to achieve the export target the industry

needs to innovate an example being the Handicraft and

Wood Industry Association of Ho Chi Minh City initiative

in developing an online trading platform to connect local

wood and furniture businesses with foreign partners.

According to the General Department of Forestry,

Vietnam still has many opportunities to expand export

markets and increase export of wooden products.

Vietnam has ratified free trade agreements with many

partners such as the EU, Japan, Chile and the Republic of

Korea.

See:

https://en.vietnamplus.vn/vietnam-likely-to-gain-exporttarget-for-timber-and-wooden-products/182860.vnp

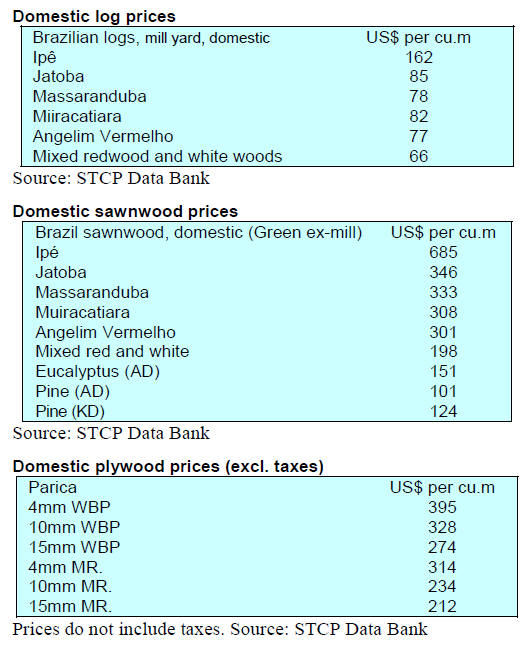

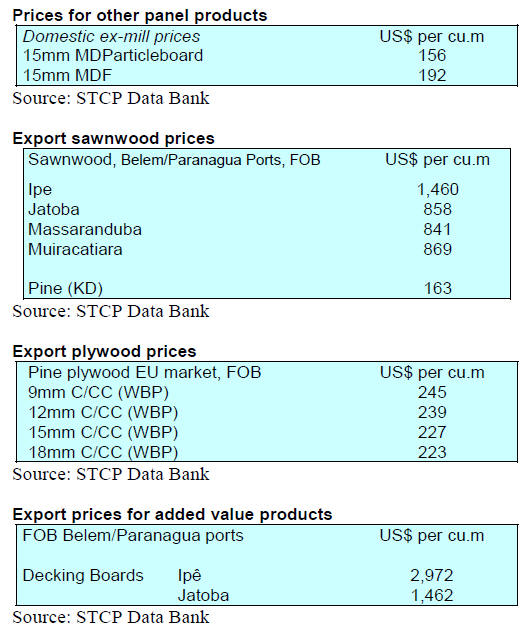

8. BRAZIL

Furniture prices increased as input

costs rise

The Brazilian Institute of Geography and Statistics (IBGE)

has reported that in July this year furniture manufacturers

increased prices by almost 1.5%, this compares to the half

percent decline reported for July 2019. The price increase

introduced in July reflects the higher costs of inputs

which, until July, the manufacturers were absorbing.

The accumulated price increase between January and July

was 4.4%. At the current rate of increase year end could

see a 6% rise in prices.

Preliminary determination clears Brazil of dumping

mouldings

The Brazilian Association for Mechanically Processed

Timber (ABIMCI) has reported that the US Department of

Commerce (DOC) issued a preliminary determination in

its antidumping duty investigation of imports of wood

mouldings and millwork products from Brazil. The DOC

determined that Brazil has not practiced dumping.

Shippers in China were not so lucky as some have been

penalized with heavy duties.

This is a preliminary determination and may be subject to

review but, for now, this is positive news for Brazil. The

final determination will be known in December.

The activities of the ABIMCI Moulding Committee

continue to gather information for the defense the injury

process (which runs parallel to the antidumping process)

through meetings with the producer companies and with

business attorneys.

EU to strengthen environmental requirements in trade

agreements

A motion by the European Parliament's International

Trade Commission calls for the European Union to

strengthen the environmental protection requirements in

its trade agreements. While this is just a recommendation

with no legislative power it does highlight the growing

trend in the European Union to use its commercial and

financial weight to achieve its environmental policies.

The document says that the EU is a significant importer of

commodities with environmental and forestry risk and

therefore must implement measures to ensure that its

demand and investments follow its responsible economy

policy.

The commission recommends "that all new trade or

investment agreements and updates to existing ones

include more ambitious environmental and climate

provisions in relation to the conservation and sustainable

management of forests, including" protection of

indigenous peoples and the rights of local communities ".

The European Union is Brazil's second largest trading

partner and the largest direct investor in the country, and

the EU member countries have declared that deforestation

in the Amazon may be an obstacle to the approval of the

agreement between the EU and Mercosur.

Negotiation of the free trade agreement was concluded in

2019, but the agreement needs to be approved by the

European Council, the European Parliament and national

and regional parliaments.

The document says that trade and international

cooperation are important tools for the consolidation of

higher standards of sustainability and that the EU should

strengthen cooperation with exporters in combating

organised crime, encouraging scientific research,

innovation in biodiversity, “green business” and circular

economy.

See:

https://amazonasatual.com.br/europeus-exigem-provas-deque-produtos-nao-sao-de-areas-desmatadas/

Forest sector exports suffer in first half 2020

In the first six months of this year Brazil’s exports of

wood products were worth US$4.2 billion representing 8%

of all Brazilian agribusiness exports but, compared to the

first half of 2019, earnings were 24% lower according to

the Brazilian Tree Industry (IBÁ).

The biggest decline in wood product exports was of the

main product, pulp where there was an almost 30% year

on year decline. Pulp exports were worth US$3.1 billion

this first half compared to US$4.4 billion in 2019. The

weight of pulp exports increased slightly year on year

totalling 10.3 million tonnes. Brazilian pulp production

expanded in the first half of the year despite the pandemic.

Paper exports also fell, dropping 7% to US$950 million. In

terms of weight there was an increase of 2% in export

sales. Sales in the domestic market in the first half were

2.4 million tonnes. Wood-based panel exports also fell,

dropping 9%, to US$124 million or 580,000 cu.m. Sales in

the domestic market totalled 2.8 million cu.m.

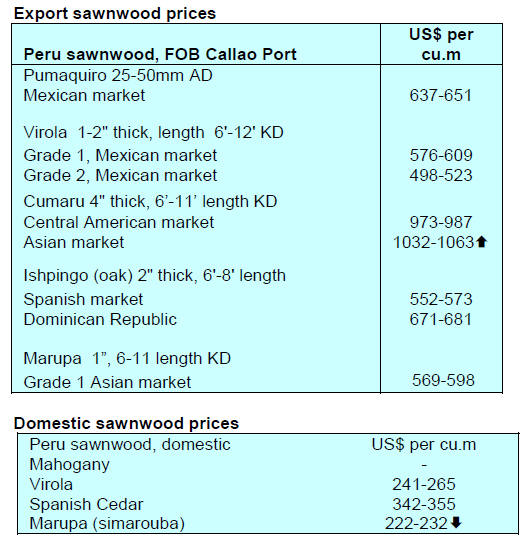

9. PERU

China, the main

buyer throughout the year

China was the main buyer of Peruvian wood products

throughout the year to August with purchases worth

US$37.6 mil. while the second place was Mexico with at

US$19.5 mil. says the Association of Exporters (Adex).

Adex explained that the United States was in third place

with wood product imports of US$14.7 mil.

Other significant buyers were in Hong Kong (US$3.7

mil.), the Dominican Republic (US$2.4 mil.) and New

Zealand (US$1.6 mil.). New markets reported in the

period January-August were Lithuania, Bulgaria, the

Philippines, Senegal and Austria.

Between January and August forestry sector exports

totalled US$90 million reflecting a year on year decline of

41% according to Adex. The main categories exported

were semi-manufactured products at US$36 million,

sawnwood US$34 million and plywood/veneers, US$9

million.

Exports of other products are smaller for example

furniture and its parts around US$5 million, followed by

builders woodwork, other manufactured products and

particleboard.

New listing of forestry company

The Lima Stock Exchange held its first virtual session and

celebrated inclusion of Amazonian Forests (BAM) to its

portfolio. This company was listed in the Alternative

Securities Market (MAV) in July of this year and has

currently already made two placements for an amount of

US$2 million.

Bosques Amazónicos is a forestry company whose

mission is to finance the conservation of Amazonian

ecosystems and the restoration of degraded lands, through

investment in commercial and forestry plantations and the

sale of carbon credits.

Amazon regions unite to prevent forest fires

During September and October specialists from the

regional governments of Loreto, Madre de Dios, Ucayali,

San Martín and Amazonas will participate in a "Virtual

Training on Risks from Forest Fires" organized by

SERFOR. Topics to be addressed include risk

management, legal framework, generation of information

and forest fire surveillance.

This training has the support of the National Service of

Natural Areas Protected by the State (SERNANP), the

Peruvian Society of Environmental Law (SPDA), the

Center for Amazonian Scientific Innovation (CINCIA),

Rainforest Alliance, Law, Environment and Natural

Resources (DAR) and the FOREST Program of USAID

and the US Forest Service (USFS).

Information campaign for plantation owners

In order to support those who have registered their forest

plantations in San Martín, SERFOR and the Regional

Government of San Martín will undertake a campaign to

guide producers on current procedures. SERFOR supports

regional authorities in promoting registration in the

National Registry of Forest Plantations where procedure

are simple and free.

According to current regulations all plantations, whether

for production, protection or restoration installed on

private land must be registered in the National Registry of

Forest Plantations.