|

Report from

Europe

No strong COVID-19 signs in EU

tropical timber import

data

EU27 (i.e. excluding the UK) tropical timber product

imports continued to defy expectations of COVID-19

driven collapse in the four months to April this year.

Despite all the large western European countries

implementing COVID-19 lockdown measures starting in

the second two weeks of March, and mounting supply-side

problems in tropical countries, total imports of tropical

wood and wood furniture products into in the EU in April

were little changed compared to the previous month.

Unfortunately, this is not a good news story. The signs are

that the EU market for tropical wood products was

weakening well before the effects of COVID-19 were

even apparent.

The lack of evidence so far of a further downturn in direct

response to the COVID-19 outbreak is likely just a

reflection of the long lead times in the tropical wood

supply chain.

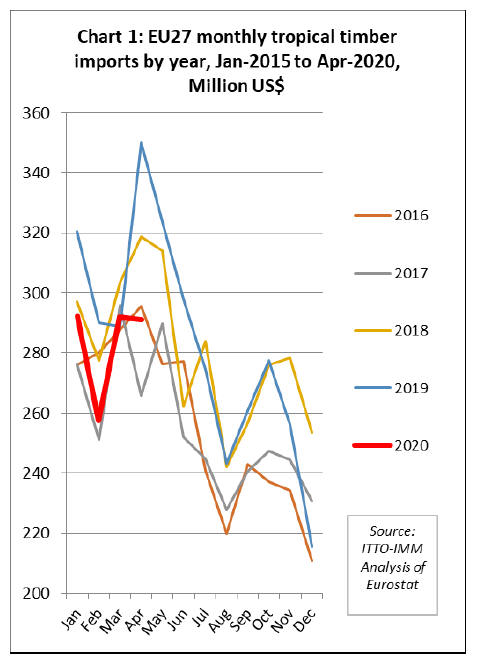

Chart 1, which shows the value of EU27 imports of

tropical wood and wood furniture products reported

monthly during the last five years, highlights that imports

in 2020 were closely mirroring imports in 2016 and 2017

to the end of April.

The tropical trade in the EU in both 2016 and 2017 was

weak overall and the signs were, before the onset of

COVID-19, that 2020 was lining up to be another slow

year. Certainly, well down on 2018 and 2019 when there

was a short-term revival in trade.

Given widespread reports during April of EU importers

struggling to deal with a build-up of stock that could not

be shifted as manufacturers, retailers and construction sites

went into lockdown, a more significant decline in imports

may well be seen in the May and June trade figures.

More positively, it should be said that the DIY sector in

the EU remained quite buoyant in some countries

throughout the lockdown months with many people taking

the opportunity to carry out home improvement work.

In other EU countries with less stringent lockdowns, such

as the Netherlands and Sweden, commercial construction

and some manufacturing activity also continued, at a

slower pace but without interruption.

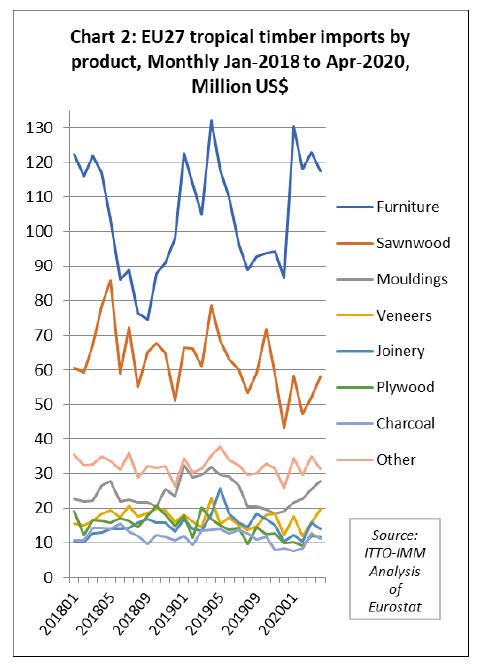

Chart 2 shows that in all tropical wood product groups,

there was no significant downturn in EU27 imports in

March and April this year. In fact, imports of some

product groups, such as sawnwood, mouldings/decking,

and veneer, increased during this period compared to the

previous two months.

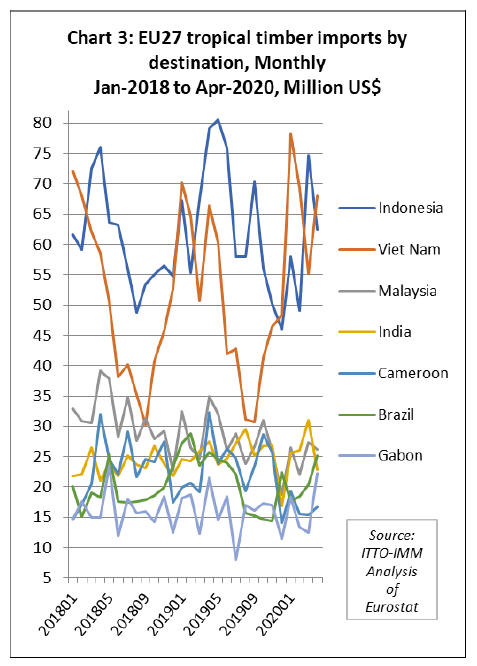

EU imports from tropical countries are typically highly

volatile from month to month, and often show no

consistent pattern (Chart 3), making it difficult at this

stage to assess the likely longer-term effects of COVID-

19. However, the contrasting trends in monthly imports

from the two largest tropical suppliers to the EU -

Indonesia and Vietnam - provide some insights.

EU imports from Indonesia, which are dominated by

garden furniture, decking and plywood, tend to be

strongest in the spring season.

The sharp decline in imports from Indonesia in April this

year, at a time when trade is usually rising, does not bode

well for the rest of 2020.

In contrast to Indonesia, imports from Vietnam are

dominated by interior furniture and tend to be strongest at

the turn of the year, in time for the January sales, and to be

very slow during the summer and early autumn.

In that sense, Vietnamese suppliers have been more

fortunate because the lockdown in EU countries occurred

after a large proportion of shipments to the EU in a typical

year had already arrived. The import data also shows that

quite a lot of shipments from Vietnam continued to arrive

in the EU during April.

The full effects of COVID-19 on EU imports from

Vietnam will only become truly apparent later this year

when the products for next season begin (or fail) to arrive.

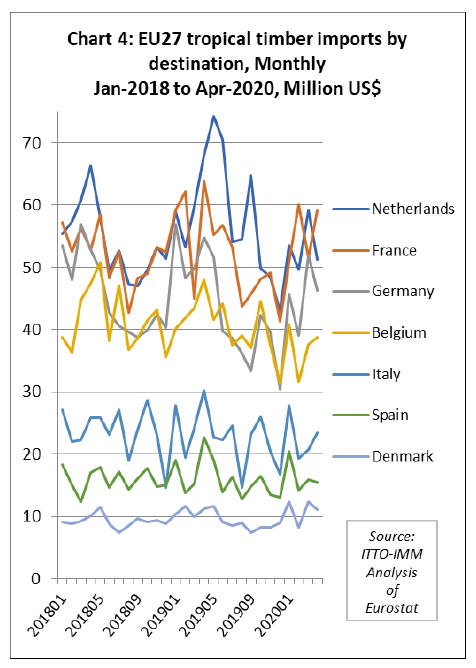

Chart 4 shows that there was no unprecedented downturn

in imports of tropical wood products into any EU27

country in the month of April this year. In fact, imports

were higher in Belgium, France and Italy in April than in

the previous month. There was a decline in Germany and

the Netherlands, but not inconsistent with previous

monthly changes.

EU economy forecast to contract 9% in 2020

It would be wrong to read too much into trade data that

only captures the first few weeks of the lockdown period

and does not account for the long lead times in the tropical

trade. Longer term indices of market health are less

reassuring.

The EU¡¯s ¡®Summer 2020 Economic Forecast¡¯, published 7

July, suggests that the EU economy will experience a deep

recession this year due to the coronavirus pandemic.

Because the lifting of lockdown measures is proceeding at

a more gradual pace than assumed in the Spring Forecast,

the impact on economic activity in 2020 is expected to be

more significant than anticipated.

The ¡®Summer 2020 Economic Forecast¡¯ projects that the

euro area economy will contract by 8.7% in 2020 and

grow by 6.1% in 2021. The EU economy is forecast to

contract by 8.3% in 2020 and grow by 5.8% in 2021.

The Forecast notes that ¡°the impact of the pandemic on

economic activity was already considerable in the first

quarter of 2020, even though most Member States only

began introducing lockdown measures in mid-March.

With a far longer period of disruption and lockdown

taking place in the second quarter of 2020, economic

output is expected to have contracted significantly more

than in the first quarter¡±.

The risks to the Forecast are exceptionally high and

mainly to the downside. The Forecast assumes that

lockdown measures will continue to ease and there will

not be a ¡®second wave' of infections. However, a second

wave is possible, particularly as the temperature cools in

the Autumn months.

There are also considerable risks that the labour market

could suffer more long-term scars than expected and that

liquidity difficulties could turn into solvency problems for

many companies. There are risks to the stability of

financial markets and a danger that Member States may

fail to sufficiently coordinate national policy responses.

The Forecast also notes that a ¡°failure to secure an

agreement on the future trading relationship between the

UK and the EU could also result in lower growth,

particularly for the UK. More broadly, protectionist

policies and an excessive turning away from global

production chains could also negatively affect trade and

the global economy¡±.

On the upside, the forecast notes that ¡°early data for May

and June suggest that the worst may have passed. The

recovery is expected to gain traction in the second half of

the year, albeit remaining incomplete and uneven across

Member States¡±. It suggests ¡°a swifter-than-expected

rebound cannot be excluded, particularly if the early

availability of a vaccine or the epidemiological situation

improves generally to allow a faster lifting of remaining

restrictions than assumed¡±.

EU tropical imports already down 9% before COVID-19

Trade data is also less reassuring about future market

prospects when cumulative EU imports in the first four

months of 2020 are compared to the same period in 2019.

Total EU import value of tropical wood and wood

furniture products was US$1.13 billion between January

and April this year, 9% less than in 2019.

This again highlights that, even before the effects of

COVID-19 are seen in the trade data, there was significant

cooling in the EU market for most tropical wood products

this year.

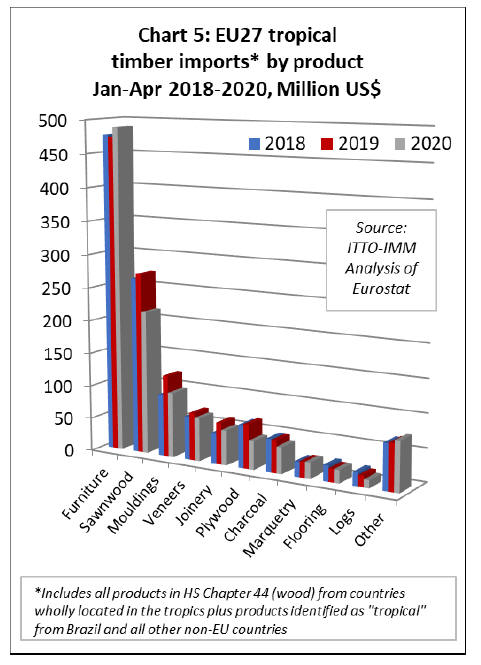

Although imports of wood furniture from tropical

countries increased 3% to US$488 million in the four

month period, imports of most other tropical commodities

declined sharply including sawnwood ( down 21% to

US$215 million), mouldings (down 20% to US$97

million), veneer (down 20% to US$65 million), joinery

(down 16% to US$52 million), plywood (down 36% to

US$43 million), charcoal (down 18% to US$24 million),

and logs (down 31% to US$12 million) (Chart 5).

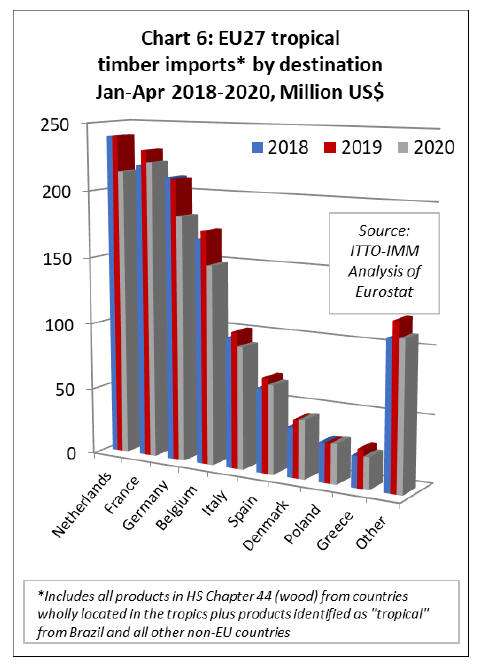

Imports fell into all six of the largest EU destinations for

tropical wood and wood furniture products in the first four

months of this year.

Imports were down 11% to US$214 million in the

Netherlands, 4% in France to US$222 million, 13% in

Germany to US$183 million, 14% in Belgium to US$149

million, 10% in Italy to US$91 million, and 6% in Spain to

US$66 million.

There was a slight gain of 2% in both Denmark, to US$44

million) and Poland, to US$30 million (Chart 6).

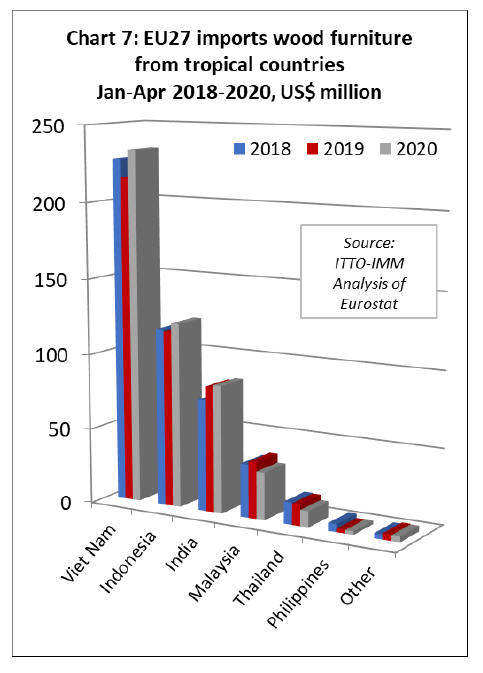

In the furniture sector, EU imports from all three of the

largest tropical supply countries were ahead this year

compared to last after the first four months. Imports were

up 8% from Vietnam at US$233 million, 5% from

Indonesia at US$122 million, and up 2% from India at

US$85 million.

This contrasted with declining imports from smaller

suppliers, including Malaysia, down 16% at US$31

million, Thailand down 24% at US$11 million, and the

Philippines, down 3% at US$2.3 million (Chart 7).

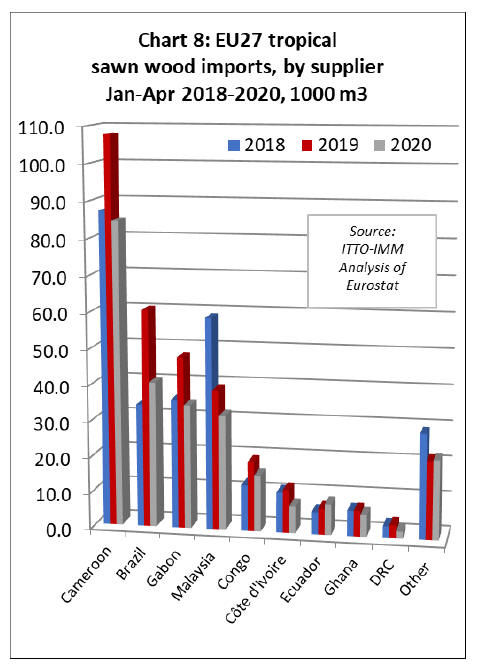

EU imports of tropical sawnwood declined sharply from

all major supply countries in the first four months of 2020;

down 22% from Cameroon to 84,500 cu.m, 33% from

Brazil to 40,500 cu.m, 28% from Gabon to 34,500 cu.m,

18% from Malaysia to 32,000 cu.m, 19% from Congo to

15,700 cu.m, 37% from Côte d'Ivoire to 7,600 cu.m, 16%

from Ghana to 6,100 cu.m, and 46% from DRC to 1,900

cu.m. Ecuador was the only country making gains this

year, rising 20% to 8,600 cu.m, likely driven by strong

demand for balsa for wind turbines (Chart 8).

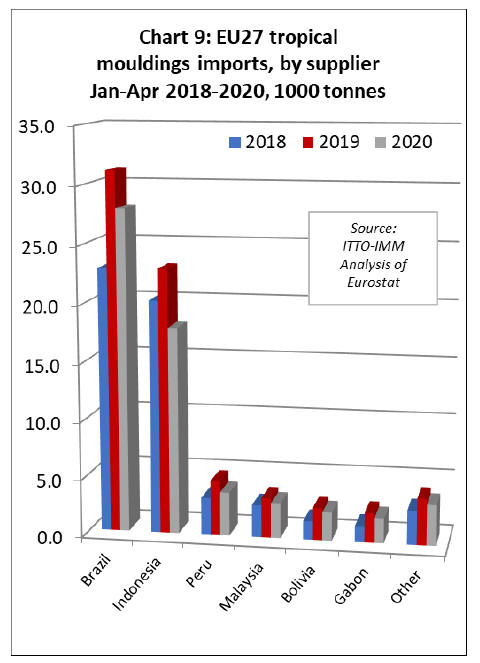

The decline in imports of tropical sawnwood in the first

four months of 2020 was mirrored by a similar decline in

imports of tropical mouldings/decking.

Imports of this commodity were down 10% from Brazil to

28,000 tonnes, 22% from Indonesia to 17,900 tonnes, 21%

from Peru to 3,800 tonnes, 12% from Malaysia to 3,000

tonnes, 12% from Bolivia to 2,500 tonnes, and 17% from

Gabon to 2,200 tonnes (Chart 9).

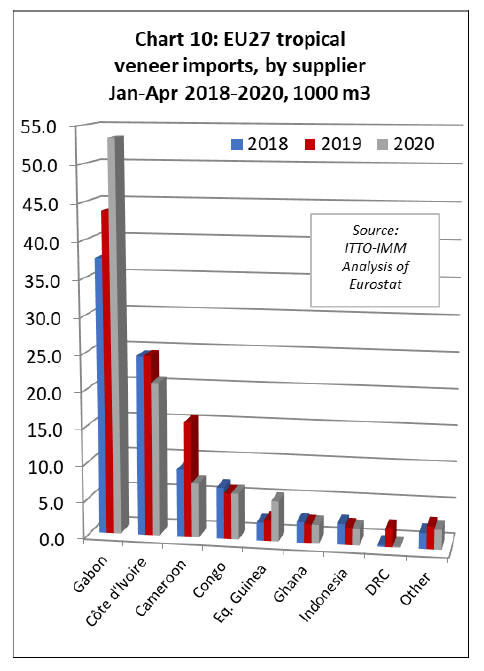

In the veneer sector, imports from Gabon bucked the

wider downward trend in EU imports in the first four

months of 2020. The EU imported 53,400 cu.m of veneer

from Gabon between January and April this year, 22%

more than the same period in 2019. Veneer imports also

doubled from a small base to 5,500 cu.m from Equatorial

Guinea.

However, imports were down 15% from Côte d'Ivoire at

21,000 cu.m, 53% from Cameroon at 7,500 cu.m, and 7%

from Indonesia at 2,250 cu.m.

Imports were stable at 6,300 cu.mcu.m from Congo and

2,500 cu.m from Ghana (Chart 10 above).

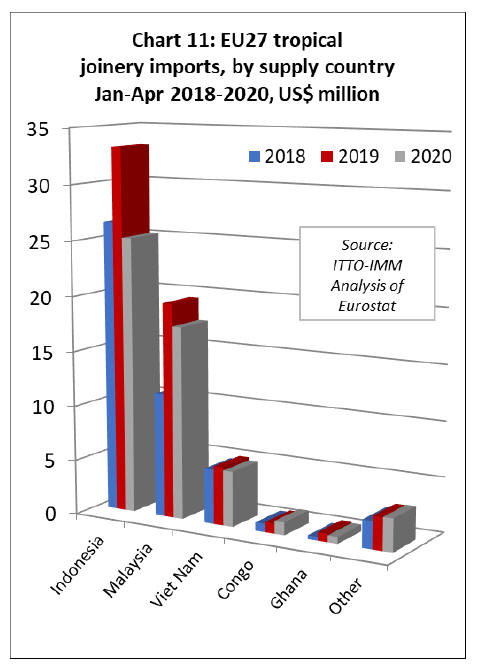

EU imports of joinery products from tropical countries,

which mainly comprise laminated window scantlings,

kitchen tops and wood doors, declined from all three of the

main supply countries in the first four months of 2020.

Imports from Indonesia were down 24% to 25,000 tonnes,

10% from Malaysia to 17,500 tonnes, and 5% from

Vietnam to 5,000 tonnes. There was a 30% increase from

Congo, to 1,160 tonnes (Chart 11).

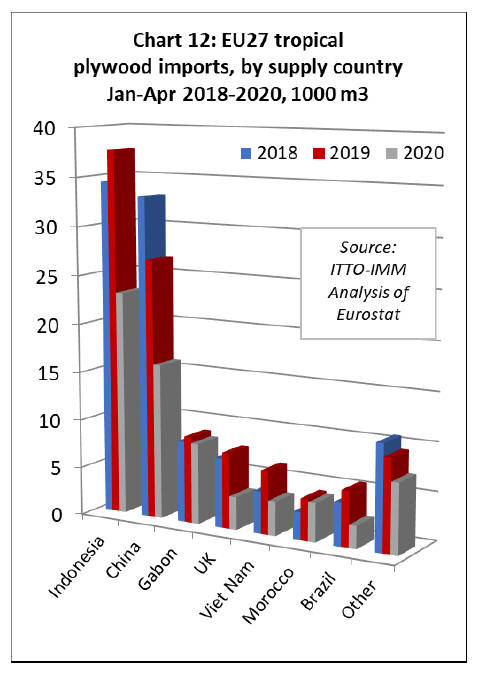

EU imports of tropical hardwood faced plywood were also

down from all the leading supply countries in the first four

months of 2020. Imports fell 39% to 23,100 cu.m from

Indonesia, 40% to 16,000 cu.m from China, 7% to 8,400

cu.m from Gabon, 7% to 4,000 cu.m from Morocco and

46% to 3,500 cu.m from Vietnam.

Imports of tropical hardwood faced plywood into the

EU27 from the UK, now also an external supplier to the

EU, declined 56% to 3,400 cu.m (Chart 12).

|