Japan

Wood Products Prices

Dollar Exchange Rates of 26th

February

2020

Japan Yen 109.59

Reports From Japan

Economy likely to contract in 2020

The Japanese economy shrank 1.6% in the fourth quarter

of 2019 according to a report from the Cabinet Office. The

decline from the third quarter was the largest drop since

2014. The sudden weakness in growth has been blamed on

the rise in consumption tax in October from 8% to 10%

and the impact of unseasonal and deadly typhoons.

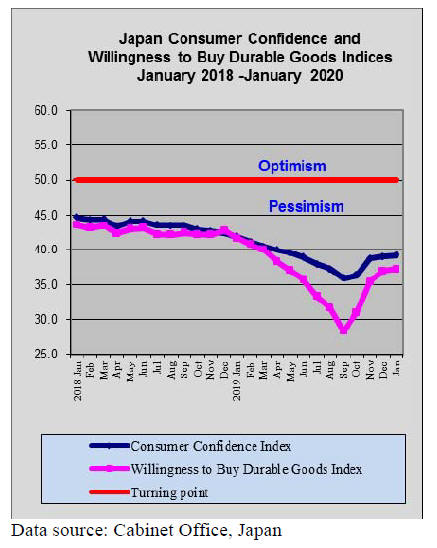

Consumer spending, which underpins the Japanese

economy, has shown almost no expansion since the 2014

increase in consumption tax and this is related to the

steady decline in nominal wage growth.

If a negative impact on Japan¡¯s growth from the corona

virus outbreak is factored in it is possible that Japan¡¯s

economy will contract this year. The has epidemic forced

many Japanese manufacturers in China to suspend

operations in Chinese cites affected by the virus which has

disrupted the supply of components needed by Japanese

companies. The domestic press has quoted analysts as

saying a recession now looks almost inevitable.

The government has moved to boost the economy through

a massive stimulus package but if the spread of the

coronavirus is not contained a recovery could be delayed.

The year has not started well for Japan with exports

dropping and tourist arrival plummeting. In the year of the

2020 Tokyo Olympics there are serious challenges ahead.

The local media has reported that the government and the

Bank of Japan (BoJ) are ready to act if the fallout from the

coronavirus outbreak on the economy broadens.

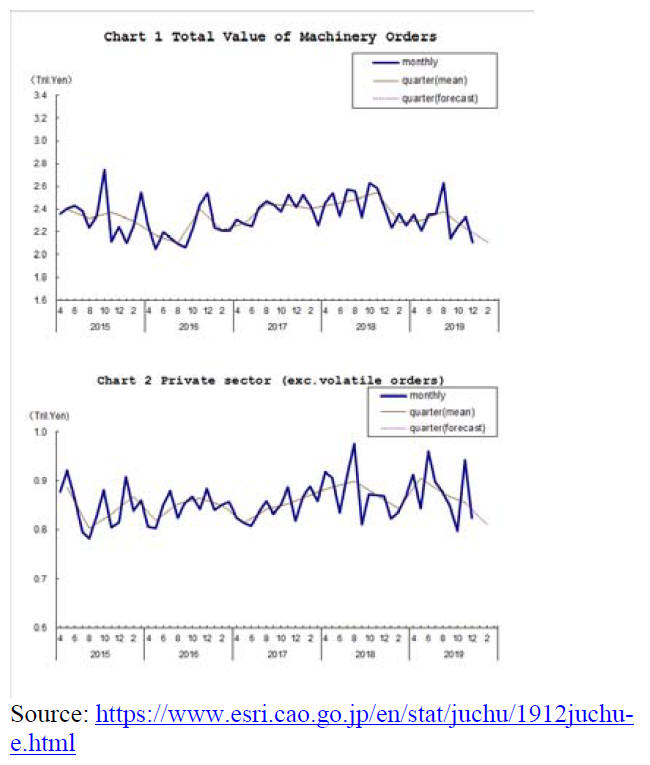

Sharp drop in machinery orders

Cabinet Office data has shown Japan¡¯s core private-sector

machinery orders fell at the fastest pace since 2018 and

orders posted their largest drop in 15 months in December

with a 12.5% decline from the previous month.

The fall in orders, seen as a leading indicator of capital

spending, followed an 18.0 percent jump in November, the

biggest increase since in April 2005, boosted by one-off

orders for railway stock. The 12.5%t fall marked the

sharpest decline since September 2018 when they dropped

17%.

On a quarterly basis, core orders fell 2.1% in the October-

December period, with the Cabinet Office projecting a

5.2% decline in the quarter to March.

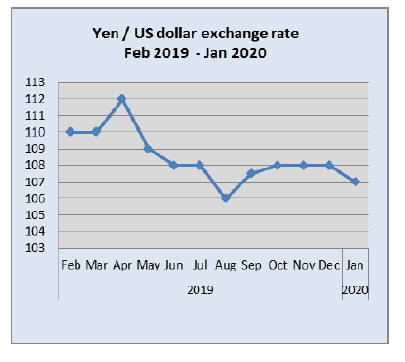

Yen ¡®safe-haven¡¯ status in question

Takeshi Minami, Chief Economist at the Norinchukin

Research Institute, has been quoted as saying the yen may

lose its status as a "safe-haven¡±. Other analysts say a virus

epidemic in Japan would likely undermine confidence in

the economy and spur yen selling.

In the aftermath of the 2008/9 global financial crisis

overseas funds poured into Japanese yen and this trend has

been observed several times when risks to the global

economy are perceived as serious.

In a reversal of this trend, in the current coronavirus crisis

money has not moved to the yen and, in fact, over the past

two weeks the yen has weakened against the US dollar.

See:

https://english.kyodonews.net/news/2020/02/0cd8ce9104b2-focus-japans-yen-may-lose-tatus-as-safe-haven-asset-amidvirus-spread.html

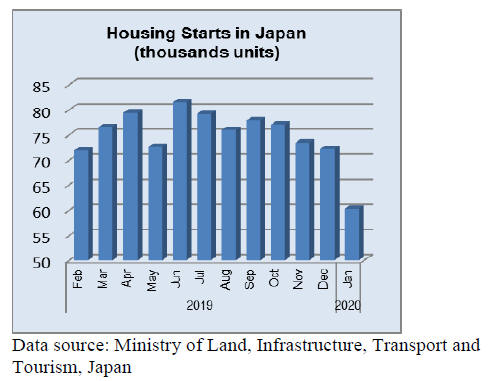

Housing starts at record low

Data from the Ministry of Land, Infrastructure, Transport

and Tourism shows January 2020 housing starts at 60,340

where down over 10% year on year. The January decline

follows on from steady declines that began in October

2019.

Housing starts at 60,340 were the lowest since the current

data set was compiled by the ministry and this was despite

a rather mild winter in many parts of the country. Ministry

data is also showing.

New orders for homes received by the main contractors

dropped 17% year on year in January cancelling out the

19% rise in December.

Import update

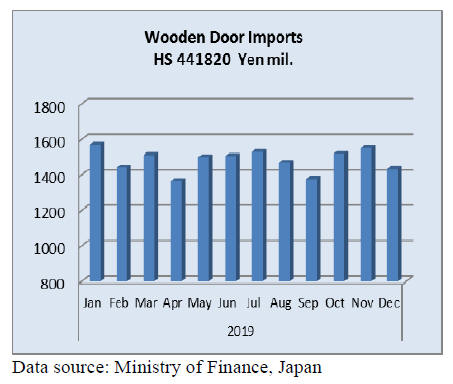

Wooden door imports

Two shippers, China (62%) and the Philippines (23%),

accounted for most of Japan¡¯s wooden door (HS441820)

imports in December repeating their performance in

previous months. When imports from Indonesia and

Malaysia are included then these four shippers provided

over 90% of Japan¡¯s December wooden door imports.

Year on year December wooden door imports were flat as

was month on month imports. However, compared to the

value of 2018 imports there was a 3% increase recorded in

2019.

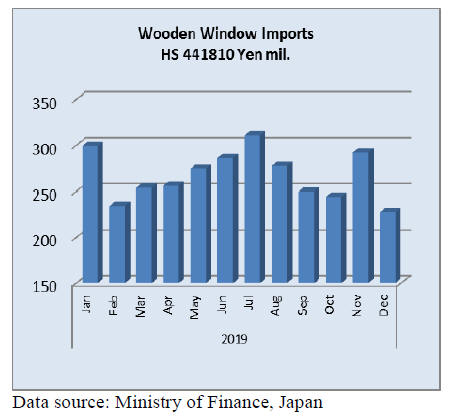

Wooden window imports

Apart from the surge in wooden window (HS441810)

imports in November 2019 there was a steady decline in

the value of imports from mid year which closely mirrors

the trend in housing starts (see above).

As in previous months, December 2019 imports of

wooden windows were dominated by shipments fro China

(51%) and the Philippines and the US (around 20% each).

Year on year the value of Japan¡¯s wooden window imports

were down 21% and December imports were down by

around the same amount compared to November 2019.

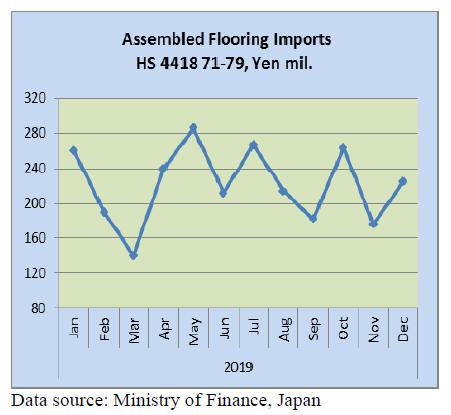

Assembled wooden flooring imports

As in previous months three categories of assembled

flooring dominate Japan¡¯s imports, HS441873, 75 and 79.

HS441875 accounted for over 75% of December imports

with most originating in China (51%) followed by

Malaysia (21%) and Indonesia (17%).

HS441879 was the second largest category of imported

assembled flooring at 15% of total December imports. The

top three suppliers of this category were Thailand (32%),

Indonesia (24%) and China (22%).

Just 8% of December assembled flooring imports were of

HS441873 with China being the mains shipper (55%)

followed by Italy (25%) and Thailand (18%).

Year on year wooden flooring imports (HS441871-79) in

December 2019 were up 8% and compared to a month

earlier there was a 27% increase in the value of imports of

assembled wooden flooring (HS4471/73/75/79). 2019

imports of assembled wooden flooring dropped 8%

compared to the value of 2018 imports.

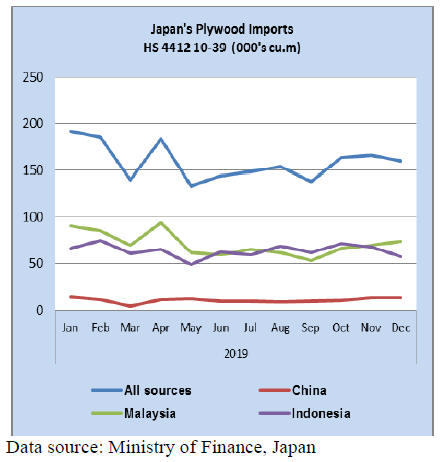

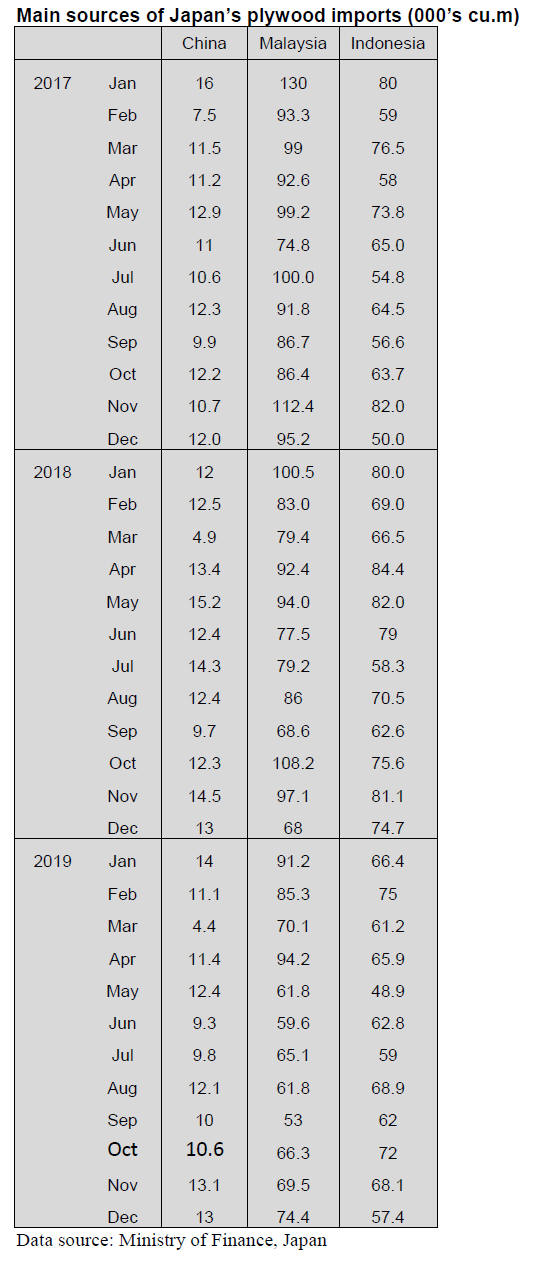

Plywood imports

Year on year, December 2019 imports of plywood

(HS441210/31/33/34/39) were unchanged but month on

month there was an 8% decline in the volume of imports.

Around 90% of December plywood imp0rts were of

HS441231 followed by HS441234 (5%) HS441233 (3%)

and HS441239 (2%).

The volume of plywood imports from Malaysia in 2019

dropped 18% compared to 2018 and there was a 13%

decline in imports from Indonesia and a 13% decline in

imports from China over the same period.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.com/modules/general/index.php?id=7

Housing starts in 2019

Total starts in 2019 are 905,123 units, 4% less than 2018.

The starts decreased for three consecutive years. Owner¡¯s

units and units built for sale increased but rental units

decreased by 54,000 units. This is the lowest in five years

since 2014.

Owner¡¯s units increased in the first half of the year

because of rush-in orders before the consumption tax

increase. Woodbased units decreased by 3% or about

16,000 units with 523,319 units.

Housing starts in 2013 recorded 980,000 units before the

consumption tax increased from 5% to 8%. In 2014 and

2015, the starts decreased down to about 900,000 units

then by extreme low housing loan mortgage rate, the starts

recovered to 960,000 units in 2016 and 2017. Since 2018,

by over built of rental units, total starts have started

declining.

In particular, rental units increased to about 420,000 in

2016 and 2017 then in 2018, they decreased by about

23,000 units and by 54,000 units in 2019. In these two

years, about 77,000 units decreased. Rental units in 2019

are 342,289, 13.7% less, 13.7% less. This is the first time

in seven years that rental units are below 350,000 units.

Owner¡¯s units are 288,738, 1.9% or 5,503 units more, the

first increase in three years but the starts compared to the

same month a year earlier, first seven months are higher

then five months from August to December are lower than

the same month a year earlier.

Units built for sale are 267,696, 4.9% or 12,433 units

more, which is five straight years increase. This is the first

time in five years that the starts exceeded 260,000 units.

Especially detached units built for sale increased for four

straight years with 147,526, 3.6% or 5,129 units more.

This is the second highest record next to 1996¡¯s 147,944.

Condominiums are 117,803, 6.6% or 7,293 units more and

they have held level of over 110,000 units for six straight

years.

2x4 units are 109,625, 6.3% or 7,363 units less. This is

three consecutive year¡¯s decline and is the first time in

seven years that they did not reach 110,000 units since

2012. Decrease of rental units impacted 2x4 starts.

Looking at December starts, start of all types of owners¡¯

unit, rental unit and unit built for sale are lower than the

same month last year. Total starts of 72,174 units in

December are the lowest in eight years since 2011.

Wood based units of 42,822, 8.6% less than December

2018 and this is six straight months decline. This is also

lowest month in eleven years. Decline of owner¡¯s units

and rental units are serious. Rental units in December are

27,611, 10.3% or 3,177 units less. In nine months from

April to December, degree of drop is 15.5%, much larger

than 13.7% for total twelve months.

Owner¡¯s units are 22,294, 8.7% or 2,121 units less, five

straight months decline and degree of drop is getting larger

month after month and large house builders comment

there is no sign of recovery.

Russian log export

Regarding log export from the Far East Russia, the

Russian government announced companies¡¯ name, which

can have preferential duty on log export. Quota by this

preferential duty is 4,000,000 cbms on whitewood, larch

and fir. In 2020, RFPG will have about 60% quota but

preferential duty rate is raised to 13% from 6.5%.

On log export from the Far East, export duty is reduced for

companies, which have certain percentage of export of

processed products like lumber, veneer and wood chip in

total sales. For 2020, requested processed percentage is

raised to 30%,5 points more than 2019.

Top ranking RFPG¡¯s quota volume is 2,300,000 cbms then

Terneiles with 779,000 cbms, Rinbunan Hijau (RH) with

761,000 cbms. RFPG¡¯s volume is reduced by 8.3% but its

share is about 60% in total. Terneiles is up by about 22%

and RH is up by 40%.

Even with preferential duty with quota, 13% duty is heavy

so quota given companies will not be able to increase log

export easily. Standard log export duty rate in 2019 was

40% then in 2020, it is 60% and 2011 will be 80%.

Due to high export duty, log export from Russia continues

declining and in 2019, total log export for Japan from

Russia including the Far East would be less than 100,000

cbms so Russia¡¯s policy to export processed products has

steadily progressing.

Russian softwood log import to Japan for the first eleven

months was 95,541 cbms,19.7% less than the same period

of 2018. In particular, larch log import from the Russian

Far East decreased much with about 62,398 cbms, 35.5%

less. Larch has been mainly used by the Japanese plywood

mills but by higher log export duty, the demand is shifting

to Russian made veneer.

Survey on use of wood biomass energy

The Forestry Agency announced survey on use of biomass

energy in 2018 in December 25, 2019. Main fuel for

power generation of wood chip and pellet increased but

fire wood for heating did not increase.

Raw materials of wood chip of imported wood chip and

sawmill and plywood residue increased but building scrap

wood did not increase and slight increase of unused fiber

in the woods. Majority of energy is consumed for power

generation or in-house use. As FIT system based power

generation facilities increase, use of biomass fuel climbs.

By type of fuel, increase of wood pellet is conspicuous.

Wood pellet production in 2018 was about 130,000 ton,

3.8% more than 2017 but imported pellet climbed to about

1,060,000 ton, 109.2% more and imported fuel will

increase further in coming years.

Total number of power generator by wood based fuel was

290 in 2018, 26 more than 2017. 135 are for outside sales

of electricity based on FIT system, 27 more. Cogeneration

facilities are109, nine less. Steam turbines are

231, eight more and takes 80% share and gasifications are

44, 18 more.

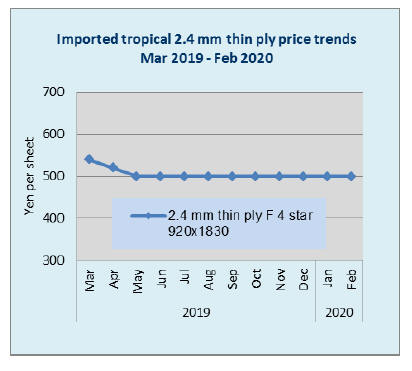

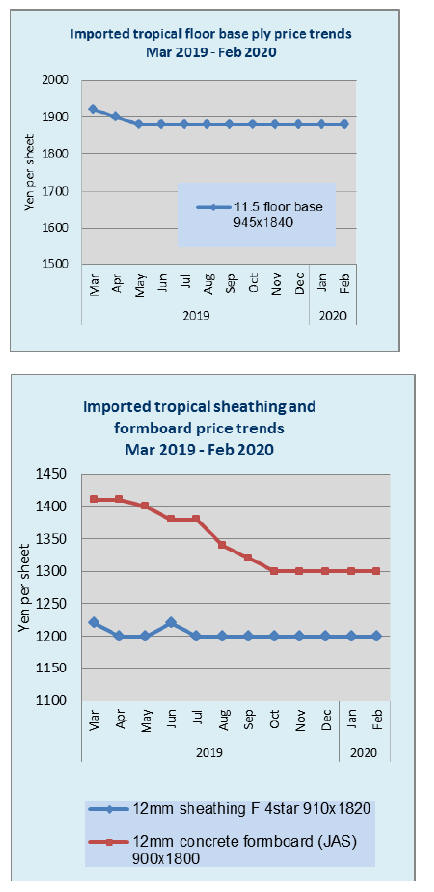

Plywood

Production and shipment of domestic manufactured

plywood continue brisk but movement of imported South

Sea hardwood plywood remains stagnant. Movement of

domestic plywood in wholesale channels has started

slowing a bit but that of direct deals to precutting plants

continues firm.

At this time of last year, the market confused by shortage

of trucks so the deliveries delayed until late February but

there is no such problem this year.

In late December and early January, availability of trucks

was hard so some deliveries delayed and plywood mills

struggle to manage shipment with very low inventories.

There is no strong momentum of the demand generally in

the market but precutting plants¡¯ demand continues strong

and there is no request for postponement of deliveries yet.

Orders for month of February to plywood manufacturers

are normal. The manufacturers are anxious to build up

the inventory as they have been as low as 0.4 month.

Movement of imported plywood continues sluggish.

Movement of concrete forming and structural panel, which

were rather firm until late last year, is now slowing. Some

short items are fulfilled by late December arrivals but

overall inventory continues low.

Facing book closing of March end, the importers are hard

to place new orders now so procurement after Aprilis real

start of future supply.

Review of 2019

European lumber and laminated lumber Japan market of

European lumber and laminated lumber maintained rather

active vigorousness following 2018 so that the prices

stayed up high then after April, the demand has started

weakening and the prices gradually declined.

The supply side was bearish and the export prices had

been skidding little by little and the export prices dropped

down tobreakeven point of supplying mills.

All the other markets were also in slump so there was no

chance to recover both on volume and prices for the

suppliers. Market prices of domestic product of

whitewood laminated post at the beginning of the year

were 1,890 yen per piece delivered and with firm demand,

further advance was expected and price increase was

necessary because cost of lamina was high at 38,000 yen

per cbm FOB truck port yard, which was too high for the

manufacturers of laminated post then the prices climbed to

1,900 yen by March.

However, the market turned weak after purchase of

precutting plants slowed down.

At the same time, European made laminated post prices

dropped so the prices of domestic product started sliding

with weak future arrivals of European products.

The same pattern was on redwood laminated beam. At the

beginning of the year, the prices of domestic made beam

were over 60,000 yen per cbm delivered then around June,

the prices dipped below 60,000 yen to 59,000 yen.

Normally June should be firm period as summer demand

season is coming but the inventory of precutting plants of

redwood beam was heavy so even when the precutting

business improved, the prices of redwood beam did not

change so the prices remained weak despite active

movement. For the third quarter, major suppliers settled

with about Euro 400 per cbm C&F but smaller suppliers

gave priority to move the volume so that they accepted

lower prices.

Profitability of European suppliers critically deteriorated

at this stage but export prices of the suppliers did not

improve because demand of all the other markets were

weak and Japan was only stable market so the supply

centered Japan, which resulted in drop of export prices.

Export prices of whitewood KD stud in the first half of the

year stayed record high. Euro 365 per cbm C&F was

proposed for March and April shipment. Fortunately the

yen¡¯s exchange rate to the Euro gradually shifted

favorably to the buyers so the high prices were accepted as

yen¡¯s cost did not exceed 50,000 yen plus per cbm FOB

port yard despite higher Euro prices.

The market turned when supply and demand balance

collapsed in July by increased supply so the market prices

were below 50,000 yen in late August and 47,000-48,000

yen were the main range in fall. Major supplier skipped

September shipment to restore the market to no avail so

the export prices dropped down to Euro 340 for November

and December shipment. It may take another quarter

before the balance recovers.

After firmness of Japan market changed, supply reduction

has started among European suppliers particularly

Scandinavian suppliers so volume of the proposal for the

first quarter seems to be less than normal quarter. Once

operation of laminated mills and precutting plants in Japan

gets busy, there is a good chance that the export prices

would rebound.

Outlook for 2020

There are many comments on tightening supply from

Europe. This is totally different from 2019 when the

supply pressure for Japan market was strong, which

resulted in poor profitability of the European

manufacturers. The supply has already been declining

from the first quarter 2020.

The key factor is beetle damage of whitewood mainly in

the Central Europe. It has started damaging since middle

of 2018 and degree of damage seems to worsen in 2020.

The European administration offices are demanding forest

products companies to remove damaged whitewood trees

immediately but there is no easy solution. Felled trees

cannot be left in the woods and logs must be disposed as

either logs or processed products so timber owners are

forced to sell at low prices.

However, Japan remains as one of the most stable markets

for the European suppliers so major suppliers plan to

export the same amount of products as 2019 but because

of shortage of log supply, many manufacturers will be

forced to scale down the production in 2020.Some

manufacturers see 20-30% reduction of production in 2020

so supply reduction may spread gradually.

If harvest and disposal of damaged logs have priority,

supply of sound logs is likely to drop probably in the

second quarter this year. Log shortage results in

production drop of lamina, which influences production of

laminated lumber.

Stud supply is the same and oversupply like 2019 is

unlikely in 2020.The first quarter negotiations on

structural laminated lumber and lamina were done in

December 2019 but by uncertain future of the market,

purchase was made for immediate future without any long

range view of possible supply shortage in the second half.

In Europe, demand of large scale wood building with CLT

is growing recently and there are new CLT manufacturing

plants starting up this year.

If lamina manufacturing plants give priority to

manufacture CLT materials, supply of traditional

laminated lumber and lamina may be reduced because

CLT is growing market and the market is in Europe, which

is advantageous in transportation cost.

With beetle damage problem and expansion of CLT

market in Europe, Japan needs to pay higher prices to

secure enough volume for the demand in Japan. In the first

quarter 2020, the export prices of whitewood laminated

post are about Euro 400 per cbm C&F and redwood

laminated beam are about Euro 400-410.

Imported cost in the yen is 52,000-53,000 yen per cbm

FOB truck port yard on both whitewood and redwood with

exchange rate of 121-122 yen per Euro. Lamina

inventories held by the manufacturers in Japan are now

down to proper level but the market prices of finished

products are finally bottoming out. To improve

manufacturers¡¯ profitability, sales prices need to be higher

than present level of 1,800 yen per piece delivered on

whitewood laminated post and 54,000-55,000 yen per cbm

delivered on redwood beam.

Over supply of whitewood KD stud has not been solved

yet so that the prices have not bottomed out yet. The

export prices shot up to record high Euro 350-360 per cbm

C&F in 2019 then they are down to Euro 330-340 now.

Some suppliers have been reducing the supply

intentionally to restore the market but there are still heavy

inventory of 3meter stud.

The market prices declined in the second half of 2019 and

present prices are 47,000 yen per cbm FOB truck port yard

but purchase by precutting plants continues inactive. After

EPA took effect, import duty is reduced step by step but it

has very little impact because the prices dropped much

more than reduction of the duty.

Review of 2019

North American lumber

For the North American lumber business in Japan, 2019

was year of hardship. Export prices of the North American

lumber peaked in 2018 and they had kept sliding. In Japan

market, before lower cost products arrived, the market

prices skidded first so that the importers and wholesalers

suffered loss on their inventories.

The largest hemlock lumber supplying company went onto

strike since July 2019, which continues now, and the

supplyof hemlock lumber drastically dropped. On SPF

lumber, the supply got shaky because of closure and

shutdown oflumber mills by log supply shortage and

depressed North American lumber market.

For 2x4 lumber users in Japan, drop of export prices

contributed to improvement of profitability but generally

the movement was dull. Among North American lumber,

item of the largest drop of export prices was SPF lumber.

Prices of SPF J grade 2x4-8 peaked in the third quarter

2018 at $700 per MBM C&F. They dropped down to

$490-500 in the third quarter 2019, 30% drop from the

peak. Arrived yen cost was 57,000 yen per cbm FOB port

yard at peak time then they were down to about 40,000

yen now.

At peak time, the demand of North American 2x4 lumber

shifted to European and domestic cedar lumber because of

high cost but before such demand was firmed in the

market, North American 2x4 regained the market by

dropped export prices.

However, drop of North American lumber market

squeezed profitability of North American sawmills and

since last July, closure of sawmills or temporary shutdown

continued successively. Canadian sawmills export large

amount of lumber to the U.S. market.

Since 2017, over 20% countervailing and anti-dumping

duty is imposed on Canadian softwood lumber to the

U.S.A. When the market prices skyrocketed in 2018, the

mills made money even with high duty but after the

market prices plunged, high duty becomes burden in

2019.Also log supply became tight after clean-up of

mountain pine beetle damaged timber. By this, the annual

allowable cut in B.C. has kept shrinking so the log prices

have kept climbing, which is another reason of sawmills¡¯

closure.

Despite sizable production reduction by major suppliers,

the fourth quarter export prices rebounded in small degree

and settled at $500-510 on J grade 2x4-8 as the buyers saw

that as long as the North American market is depressed,

supply for Japan would not decrease. Large premium of J

grade compared to the North American lumber market

prices is another reason of stable supply.

Export prices of KD Douglas fir lumber peaked in the

third quarter 2019 and have been declining. Compared to

the peak prices in third quarter 2018, the fourth quarter

2019¡¯s prices of $1,080-1,089 per MBM C&F were about

10% or $127-142 down. The arrived cost dropped down to

54,000-55,000 yen per cbm FOB truck port yard, 8,000

yen down from the peak time.

Market prices of hemlock lumber were the same as

Douglas fir until the third quarter but the supply changed

largely. Inventories of hemlock lumber swelled largely

since fall of 2018 so the largest supplier stopped the

production for four weeks during March and April 2019.

After the inventories dropped, the largest supplier¡¯s mill

went onto strike so the supply abruptly stopped.

Outlook for 2020

The most concern is strike of Western Forest Products in

B.C., which is the largest hemlock lumber supplier for

Japan market. The strike started in last July so it is more

than six months. Hemlock lumber prices are lower than

Douglas fir so it was supposed to grab market share of

Douglas fir lumber but without any supply, the market

share would decline sharply.

On SPF lumber, demand in Japan in 2020 would be less

because of drop of rental unit construction. 2x4 is heavily

used for apartment construction, which would keep

declining this year. The supply side has problem of mill

closures and log supply shortage. Arrivals of 2x4 lumber

for the first ten months last year was 891,843 cbms, 21.5%

less than 2018. The marketers see that as long as there isp

enough premium on J grade, the supply should have no

problem this year.

|