Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September

2019

Japan Yen 107.82

Reports From Japan

Slowing business investment pulls

down growth

The Japanese economy expanded at a slower pace in the second quarter than

first reported as business investment was lower than expected. GDP expanded

at an annualised rate of 1.3% in the second quarter according to revised

data. The slow pace of growth was not a surprise as manufacturers had been

steadily reducing investment as the global economic outlook became bleaker.

Behind the slight rise in GDP was robust consumer spending.

In an odd twist, companies with a domestic market focus have been spending

more specifically on automation as they try and cope with the labour

shortage.

Private spending is expected to have risen in the third quarter and then

expected to shrink when the consumption tax is increased on 1 October. The

slowing growth has prompted calls for the Bank of Japan (BoJ) to expand its

stimulus package perhaps by lowering interest rates further into negative

territory.

BoJ Governor, Haruhiko Kuroda, is on record as saying cutting interest rates

further into negative territory is among the bank’s policy options because,

while Japan’s economy was sustaining momentum to achieve the BoJ’s 2%

inflation target, global economic risks were increasing.

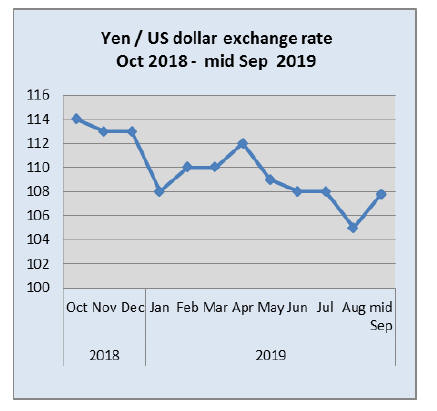

Many analysts are expecting the BoJ to adopt further ease policies to

counter the recent yen strength which may become more of a problem if the

European Central Bank and the Federal Reserve introduce monetary easing

steps.

Business confidence flat-lines

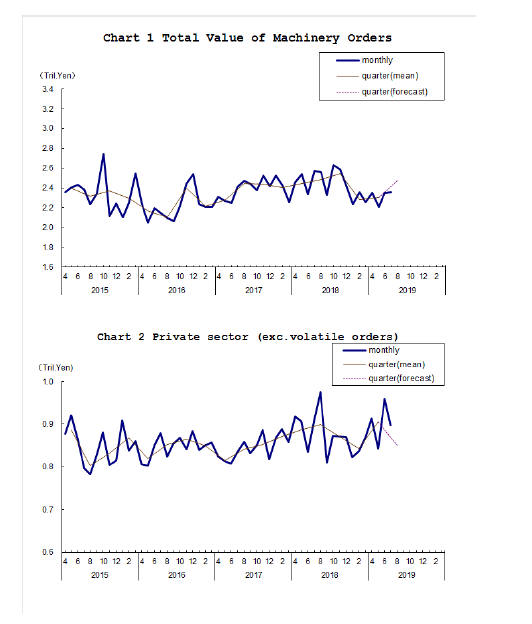

Cabinet Office data on machinery orders showed an almost 7% decline in July

after positive figures were reported for June. Slowing global demand and the

drawn out trade tensions between the US and China derailed corporate

investment.

The government had been hoping on strength in

corporate spending to counter weak exports but this was wishful thinking and

the second quarter GDP growth was revised down. Economists were quick to

comment that it is unlikely that business spending could rise when exports

have declined.

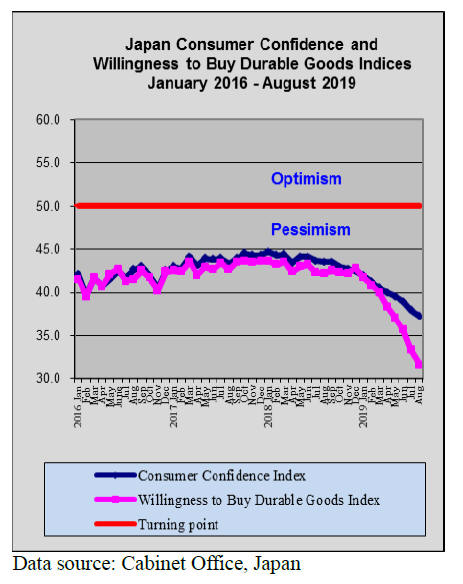

Business confidence in Japan dropped to the lowest level in more than 6

years in September according to a Reuters poll. This along with depressed

consumer confidence has slowed growth prospects giving rise to speculation

that the BoJ could act with more stimulus. The BoJ has to take account of

lower household spending and the risk that consumers could cut back further

as the tax increase comes into effect.

Against this back ground it is a surprise that the Cabinet Office maintained

its assessment of future machinery orders suggesting they are showing signs

of picking up.

BoJ signal it is more open to discussing

expanded stimulus

Bank of Japan (BoJ) Governor Haruhiko Kuroda said cutting interest

rates further into negative territory is among the bank’s policy options but

he stressed that if it were to ease, the BoJ must take into account the

impact such a move could have on Japan’s banking system and financial market

functions.

Markets are rife with speculation the BoJ could ease policy as early as this

month to fend off an unwelcome yen spike that could be caused by expected

monetary easing steps by the US Federal Reserve and the European Central

Bank.

The BoJ has signaled it is more open to discuss the possibility of expanding

stimulus and a decision will be made at their next meeting 18-19 September.

Shop with calculator in hand – multiple tax rates from October

When the new consumption tax rate becomes law on 1 October it will

mark the beginning of complications for households.

From October, food and beverages, excluding alcoholic drinks and eating out

at restaurants and daily necessities will continue to be taxed at the old

rate while the 10% rate will apply to a variety of goods and services.

To ease the financial burden on consumers a reward points system will be

introduced for nine months until June 2020, in which the government will

provide subsidies.

When consumers buy goods at small and medium sized stores with cashless

payments they will be given 5% of the purchase price in reward points.

For consumers the new scheme will initially involve multiple rates according

to the types of store and the items purchased. Retailers will really be

tested as they try to help consumers understand the application of the

different rates.

A local economist said, while the initial burden on of the tax increase on

consumers will be eased, he still anticipates a downturn and a cooling of

growth.

Rush to yen fades as US and China begin to

talk

The U.S. dollar gained ground against the yen in mid-September

because of general weakness in the so called ‘safe-haven’ such as the yen

because of a thawing of tensions between the United States and China. The US

dollar, at almost 108 yen, is at a 2 month high.

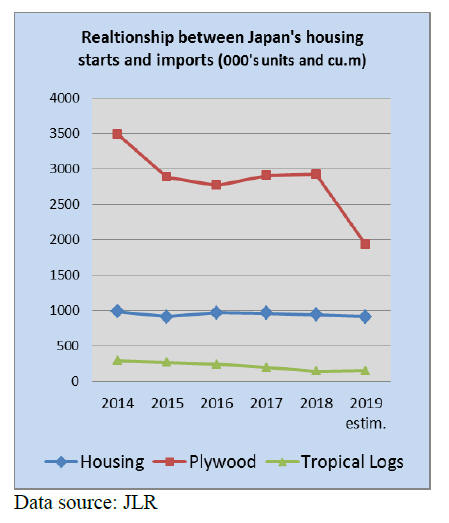

Link between housing starts and plywood

imports breaks

Annual housing starts in Japan have been within a narrow range over

the past 6 years and previously there was a close relationship between

housing starts and imports of plywood (mainly from Malaysia and Indonesia)

and with imports of tropical logs much of which was used to produce plywood.

The first signs of a break in the housing and import relationship came in

2015 when plywood imports dipped sharply. Another turning point was this

year when plywood imports plummeted despite steady housing stock growth.

Import update

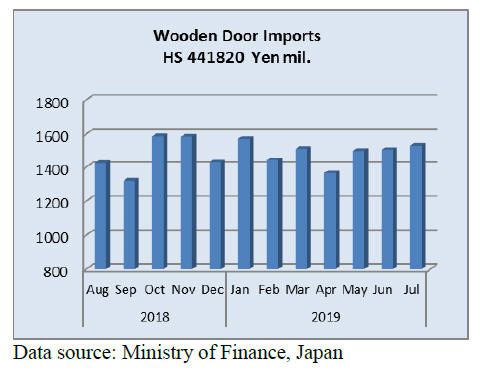

Wooden door imports

The value of Japan’s imports of wooden doors (HS441820) continued

to rise in July adding 7% to the value of June imports.

The top four shippers accounted for almost 90% of July imports with

manufacturers in China accounting for 60% of June imports followed by the

Philippines (21%). A further 5-6% was shipped from both Indonesia and

Malaysia.

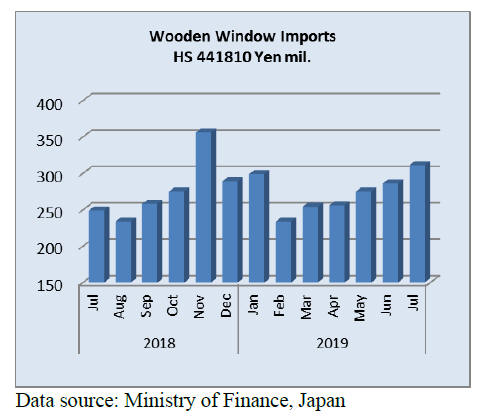

Wooden window imports

July marked the 5th consecutive increase in the value of Japan’s

wooden window imports. The value of July imports was up almost 25% year on

year and month on month July imports rose around 8.5%.

The top three in July were China (43% of imports) the US (27%) and there was

a further rise in imports of wooden windows from the Philippines which

contributed a further 21% to total July window imports.

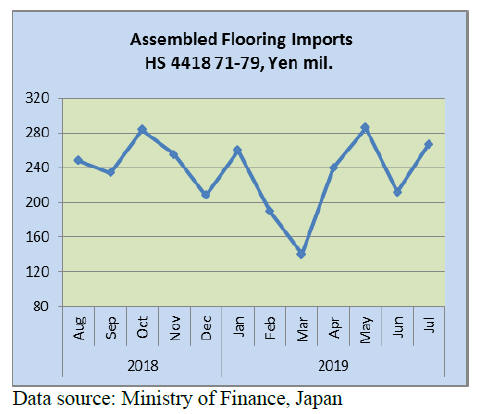

Assembled wooden flooring imports

In July there was a 12% year on year rise in the value of assembled

flooring imports and a 26% month on month increase. Assembled wooden

flooring imported into Japan falling within HS441875 accounted for most of

the July assembled wooden flooring imports with China shipping 61%,

Indonesia 10% and a further 10% from Thailand.

The second largest category of assembled wooden flooring imports in July was

HS441879 and the top shippers were Thailand (48%), Indonesia (25%) and China

(22%).

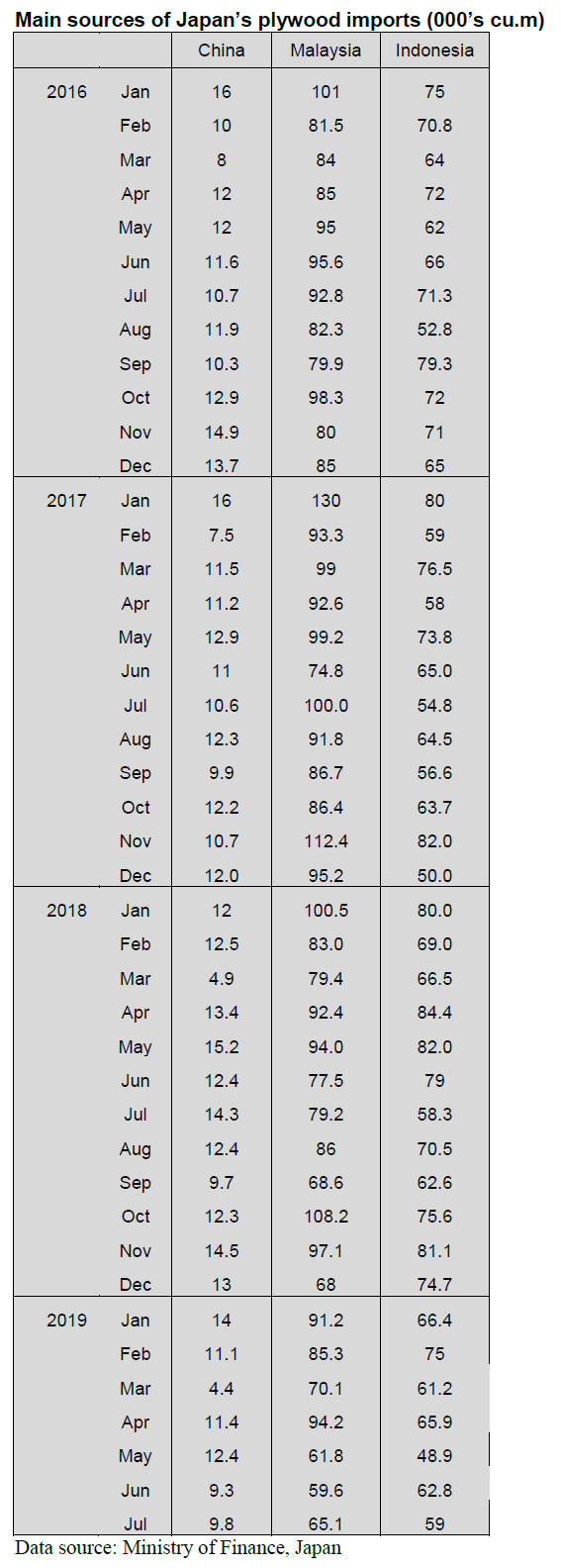

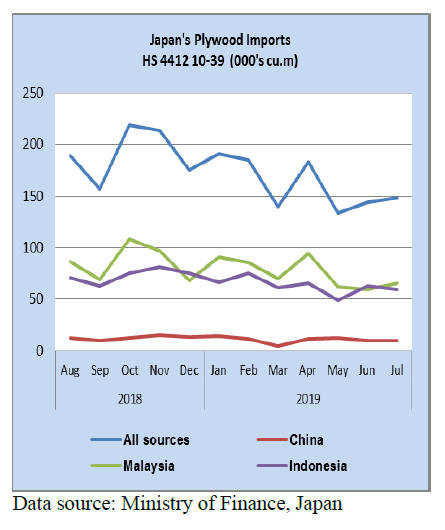

Plywood imports

One category of plywood, HS441875, dominated Japan’s plywood

imports and in July, as in the previous months, plywood in this category

accounted for well over 60% of all plywood imports.

Year on year the volume of July plywood imports from all sources fell 13%

and month on month import volumes were flat. The top three shippers remain

Malaysia, Indonesia and China.

In July shipments from China were down 5% year on year and there was an 18%

decline in arrivals from Malaysia. July shipments from Indonesia were almost

the same volume as in June.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade journal

published every two weeks in English, is generously allowing the ITTO

Tropical Timber Market Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

https://translate.google.com/translate?hl=en&sl=ja&u=https://jfpj.jp/japan_lumber_reports/&prev=search

North American log and lumber imports for the first six months

Log import for the first six months was 1,332,321 cbms, 1.9% less

than the same period of last year. Lumber import was 839,675 cbms, 21.6%

less.

Logs from the U.S.A. are 857,809 cbms, 4.1% less and from Canada are 474,512

cbms, 2.2% more. Total Douglas fir logs decreased to 1,201,791 cbms, 3.8%

less. Export prices of Douglas fir logs from the U.S.A. dropped down to

normal level from high prices in 2018 but the volume didn’t increase.

Meantime, Canadian Douglas fir prices stayed up high but demand by plywood

mills in Japan was strong and the supply increased so that arrivals

increased. A major supplier in Canada stopped the supply for a month in

August but with ample inventory, the supply for the second half seems to be

enough but high export log prices may reduce the demand so the volume in the

second half may be down.

Hemlock, spruce and yellow cedar log supply increased but this depends on

rotation of Alaskan log shipment and there is no change in demand except for

hemlock to which Tanimoto Lumber in Hiroshima quit cutting hemlock logs so

future demand of hemlock logs would decline.

In lumber import, all of three major species of SPF, Douglas fir and hemlock

decreased. SPF lumber import dropped in the first half by drop of export

prices and declining demand of rental units.

The demand recovered in the third quarter and the export prices bottomed out

but by depressed North American lumber market, many sawmills either reduce

the production or shutdown so the supply would stay tight despite more

purchase orders.

Douglas fir lumber supply declined some but hemlock supply markedly

declined. Demand for hemlock decreased by unstable supply. The market

slackened by oversupply so that major supplier in Canada shutdown the mill

for a month in March and April to reduce the supply then the same mill went

onto to the strike in July so fall supply is shaky but present inventory in

Japan is satisfactory.

Domestic log supply for the first half

Domestic logs supply for lumber manufacturing in the first six

months of the year was 6,718,000 cbms, 6.2% more than the same period of

last year and this is the most increase in last five years.

Logs for plywood manufacturing were 2,282,000 cbms, 9.1% more.

Domestic log supply has been increasing since 2010 but this year’s volume is

particularly large as log supply for lumber manufacturing was about

6,300,000 cbms during 2014 and 2018. The reason is favorable weather during

January and April this year with very little snow and warmer temperature.

In last several years, record snow fall was registered in many areas. Also

rather high log prices since fall of 2016 stimulated active harvest.

Log prices depressed from 2015 to fall of 2016 and marked the record low

prices, which discouraged log harvest then the market recovered since fall

of 2016 and the log prices did not drop down to record low of 2015. In

particular, cypress log prices stayed up high for two years. Sawmills like

winter harvested logs so mills’ log inventory was satisfied amply and there

was no log supply shortage during summer months this year. August is the

month when log supply drops every year.

By declining log supply, post cutting cedar log prices firmed up since late

July and cypress log prices are rebounding everywhere so log market seems to

stay firm for coming months. However, lumber market is shaky and cedar

lumber prices are weakening. Sawmills are caught in between high log prices

and softening lumber prices.

Plywood supply for the first six months

Total supply of plywood for the first half of this year is

2,916,200 cbms, 5.6% less than the same period of last year.

Domestic plywood supply is 1,618,100 cbms, 1.1% more while imported supply

is 1,298,000 cbms, 12.7% less.

Shipment of domestic plywood exceeded the production but market of imported

plywood continued stagnant with dull shipment.

Monthly volume of imported plywood continued low. January volume was over

250,000 cbms then it was less than 200,000 cbms in May and June. The volume

from Malaysia was 475,200 cbms, 12.3% less and Indonesia was 432,700 cbms,

14.9% less. Volume from China was 297,500 cbms, 9.1% less and others are

92,500 cbms, 15.6% less. Sluggish market in Japan and high export prices

make future purchase difficult.

Shipment of domestic plywood is 1,643,800 cbms, 5.7% more out of which

softwood plywood is 1,572,300 cbms, 6.0% more. Structural softwood plywood

is 1,447,000 cbms, 4.8% more. Production of softwood plywood in June

recorded the highest of 276,300 cbms and the shipment was 270,200 cbms so

June end inventory was 141,200 cbms, only 8,600 cbms increase since last

January.

Movement of domestic softwood plywood has been very active. Precutting

plants placed orders as August had longer holidays than normal years and

thick panel deliveries are delayed as securing trucks is becoming difficult

chronically now.

All the plywood mills are running to the full but delivery delay occurs.

July production and shipment were record high and the inventory is dropping.

Long panel producing lines broke down in plywood mill in Western Japan so

supply of long length panel is getting tight. Other mills try to cover this

but producing long length panels mean reduced production of standard 12 mm

3x6 panel so it is not easy to make long panel now.

Imported plywood volume has been less than 200,000 cbms a month for three

straight months but the movement in Japan continues dull and slow. The

importers are unable to place orders for future cargoes because of high

export prices and sluggish Japan market.

Among inventories of imported plywood, there are some short items and a

balance is off by items. Port inventories are not high but the market does

not feel any shortage feeling. Recent strong yen makes future cost down so

the market prices are further weakening.

Domestic log export for the first six months

Volume of exported domestic logs and lumber in the first half of

the year was 617,089 cbms of logs, 9.0% more than 2018 and 73,647 cbms of

lumber, 7.3% more. Cedar is leading species and cypress is declining.

Rapidly increased cedar lumber export to the U.S.A. was 11,934 cbms, 8.8%

more so rate of growing is slowing but it is becoming steady business. Log

export to Korea is decreasing but lumber export is increasing.

China, the largest log buyer, imported 520,100 cbms, 12.9% more. If China

keeps buying with this pace, total year volume may reach one million cbms.

Cedar lumber export to China is over 10,000 cbms so China is as large as

U.S.A. as cedar lumber buyer.

For Korea, volume of cedar logs is almost the same as 2018 but cypress logs

decreased. It is possible that China buys Japanese cypress logs and

processes to lumber then exports to Korea, which is why cypress volume for

Korea declined.

Cypress lumber for Korea from Japan also increased so it is competition

between China and Japan in Korean market. For Taiwan, cypress log export

decreased by half then lumber export of cypress increased almost double so

it is shifting from logs to lumber.

Value of export of logs was 8,394 million yen, 12.7% more and lumber was

2,983 million yen, 0.4% more. Compared to increase of lumber volume, the

value did not increase as much as volume, which means drop of unit prices.

Cedar lumber prices for China was 17,660 yen per cbm in 2018 then it is

13,063 yen in 2019. Cedar log prices for China was 12,058 yen in 2018 then

it increased to 12,718 yen In 2019, export log volume may increase but the

value may not increase as much as the volume.

In Kyushu, where is the main log exporting region, cedar log prices for

export is reported weakening.

|