Japan

Wood Products Prices

Dollar Exchange Rates of 10th

June

2019

Japan Yen 108.39

Reports From Japan

Trade war impacting markets in the

Asia-Pacific

A key index reflecting the state of the Japanese economy

rose in April but the improvement was not enough to

change the government’s assessment that the economic

outlook is “worsening,”

The Cabinet Office data on manufacturing is positive but

not strong enough to upgrade the economic assessment.

The biggest issue is that companies in Japan continue to

see looming risks from the US-China trade war and the

impact this is having on their markets in the Asia-Pacific

region.

https://asia.nikkei.com/Economy/Japanese-business-sentimentfalls-

to-lowest-point-in-two-years

In related news, Bank of Japan Governor, Haruhiko

Kuroda, has maintained his view the global economy will

recover in the latter half of this year saying he sees the

global economy stabilising from its recent weakness.

The biggest problem for the government in its efforts to

beat deflation is the weakness in household spending. In

April household spending rose less than expected and real

wages declined. Spending grew 1.3% from a year earlier

in April, up for a fifth straight month, but well below

forecasts.

On a month-on-month basis, household spending fell 1.4%

in April after the slight rise in March. To achieve its 2%

inflation target the BoJ needs an improvement in domestic

consumption which accounts for over half of Japan’s

economic growth.

Government optimistic on April to June machinery

orders

Private-sector machinery orders, an indicator of business

sentiment, increased a seasonally adjusted by 3.8% in

March but overall was down by 3.2% in January-March

2019 compared to a year earlier.

Analysts in Japan’s Cabinet Office have forecast an 11%

rise in orders in the April to June period but the data is not

yet available to check the accuracy of this projection.

For details see:

https://www.esri.cao.go.jp/en/stat/juchu/1903juchu-e.html

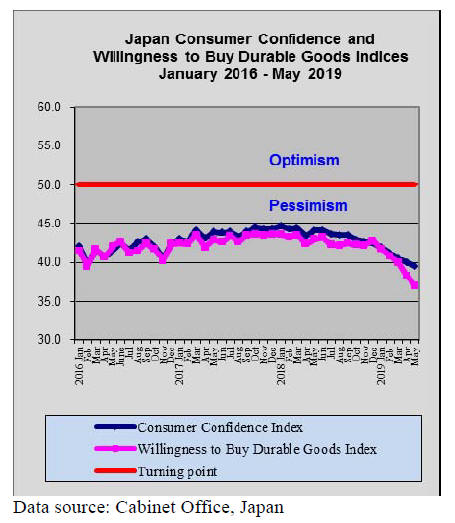

Consumer confidence - consumers reluctant to spend

The May Consumer Confidence Survey conducted by the

Cabinet Office shows consumer confidence declined

further. The overall index fell to 39.5 in May a new low

point.

Among the various indices, the index for households’

inclination to buy durable consumer goods declined in

May along with those measuring expectations on

employment, livelihood and income growth.

Japan’s economy has hit a wall as the U.S.-China trade

war intensifies and global demand continues to weaken.

On the domestic front consumers are reluctant to spend.

Retail sales mirror the continued decline in consumer

confidence as evidenced by the consumer confidence

indices which show weakness.

Consumer spending remains weak as wages have not risen

and if exports falter this could drive both corporate and

consumer sentiment lower.

See: https://www.esri.cao.go.jp/en/stat/shouhi/shouhi-e.html

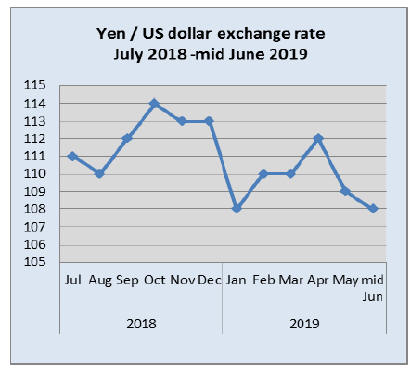

US$/Yen exchange rate more volatile

The US dollar has been weakening over the past week

against many major currencies, due to fresh signs of

weakness in the US economy, as well as more

protectionist rhetoric from the government.

While the US dollar is the traditional safe currency

concerns that the US economy could slowdown has caused

a rush to yen. In recent weeks the US$/Yen exchange rate

has become more volatile and the yen has surged against

the US dollar. In the second week of June the yen had

strengthened to around 108 to the US dollar.

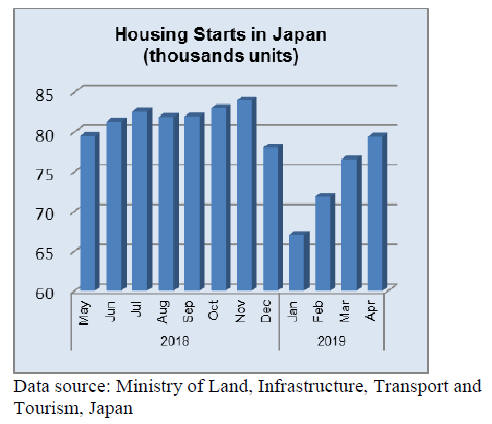

Renewed interest in China for Japanese

property

The Japanese media have recently reported on the renewed

interest in Japanese property by Chinese buyers saying

there has been a surge in interest since the beginning of the

year roughly around the time that trade tensions between

Beijing and Washington intensified.

One of the largest international real estate companies

helping Chinese invest in overseas property has seen

interest in US properties drop and a surge in interest in Japan.

Japanese properties in demand include those in residential

areas in Tokyo and Osaka where Chinese buyers look for a

buy-to-let property or a home for children studying in

Japan.

This is not the first time Japan has seen a surge in Chinese

demand. In 2017 Japan experienced a boom in speculative

property buying by Chinese investors. The current

investors are especially interested in Osaka which will

host the 2025 World Expo and will be home to Japan’s

first casino.

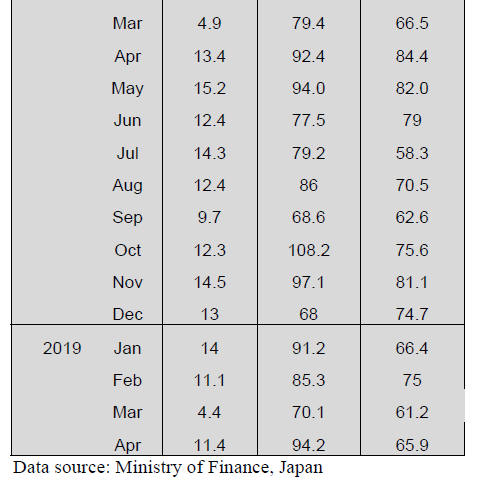

Import update

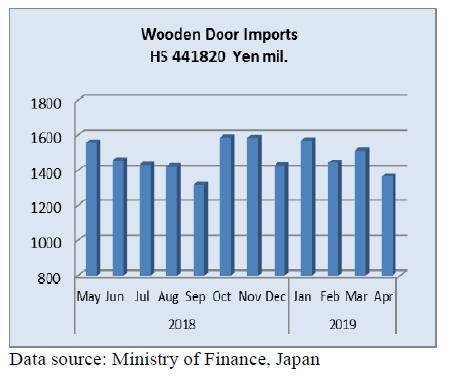

Wooden door imports

Year on year, the value of Japan’s April wooden door

imports rose14% but compared to the value of imports in

March there was a 10% decline in April.

In April the top shippers of wooden doors to Japan were

China and the Philippines. Shippers in China accounted

for 60% of April imports of wooden doors followed by the

Philippines (24%).

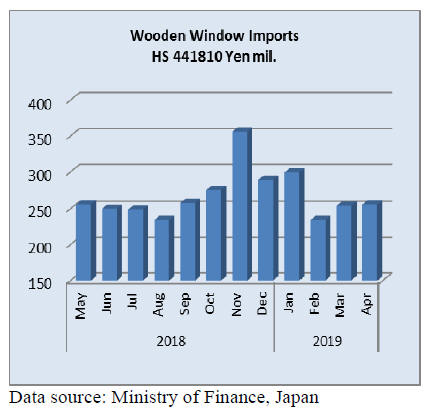

Wooden window imports

Japan’s April 2019 wooden window imports were little

changed from the values imported in April 2018.

Similarly, month on month April imports were unchanged

Just three sources accounted for over 80% of April

imports. China and the US were the main suppliers with

around 33% each of total April window imports. The third

ranked supplier was the Philippines which accounted for a

further 22% of April arrivals.

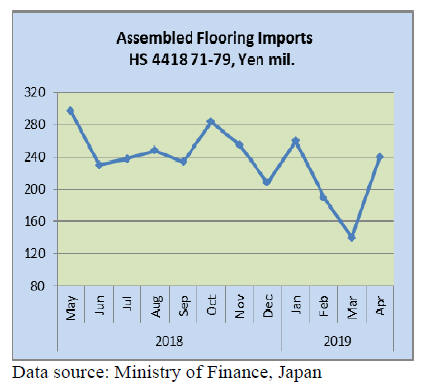

Assembled wooden flooring imports

The value of April assembled flooring imports made a

dramatic recover after dropping sharply in March.

Month on month the value of assembled flooring imports

rose over 70% in April and were up 21% compared to

April 2018.

Japan’s imports of wooden flooring are mainly HS441875

and April imports were dominated by shippers in two

countries, Indonesia and China.

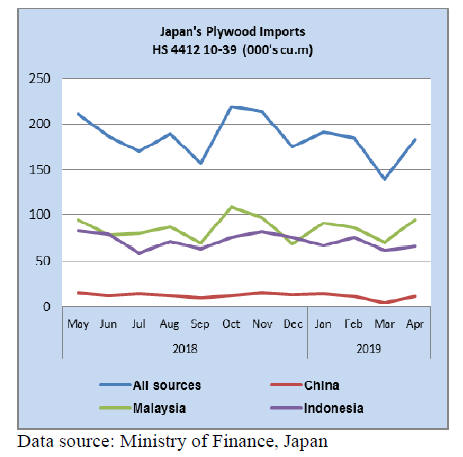

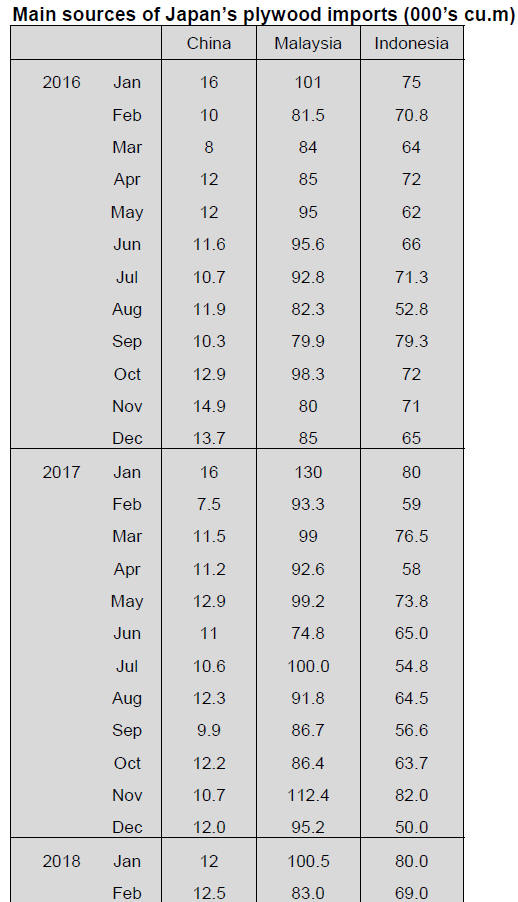

Plywood imports

Japan’s April 2019 plywood imports picked up

significantly rising to 183,000 cubic metres. Plywood

demand remains firm and much of the demand is being

met from domestic raw materials as well as imported

veneer.

The top three plywood suppliers Malaysia, Indonesia and

China continued to dominate Japan’s sources of plywood

imports. April shipments from Malaysia were at the same

level as a year earlier but were up 34% from March.

Shipments from Indonesia were down 22% in April 2019

compared to 2018 and were slightly up from levels in

March.

April shipments from China were around three times the

level in March but were down over 320% year on year.

Trade news from the Japan Lumber Reports

(JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to reproduce news on the Japanese market

precisely as it appears in the JLR.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

National forest business plan for 2019

For the fiscal year 2019 (April 2019 through March 2020),

sales plan is 2,703,000 cbms of logs, 4.1% more than 2018

and 3,310,000 cbms of standing timber.

Harvest plan is 5.4% more of clear cutting and 3.8% less

of thinning so shift to clear cutting is apparent. With

increase of clear cutting, replantation area will be 6,000

hectares, 35.6% more. Continuous operation from clear

cutting to replantation will increase to reduce total cost.

Initial budget for the national forest is 77.2 billion yen,

11.5 billion yen more than 2018.

Sales of logs and timber will increase in 2019. In log sales,

71% would be system sales (sales to particular large users

like sawmills and plywood mills).

Sales volume of timber will increase but it is not certain if

number of buyers increase. Sales volume of timber

doubled in last ten years but about a half of sales were

unsold.

In 2018, for sales volume of 3,200,000 cbms, sold volume

was only 1,530,000 cbms but since 2019, in examination

of system sales of logs, timber purchase volume is

considered as one of conditions so timber purchase should

increase.

For replantation, to reduce cost, use of nursery trees grown

in pot increased, which is easy to plant and trees are

implanted in higher percentage. Number of potted nursery

trees has kept growing year after year and in 2019, it will

be about eight million from two million in 2016.

As case of large lot and long term sales of timber is

increasing, new law requires replantation is now

compulsory for timber purchasers but replantation is done

by budget of the Forestry Agency. In the past, bidding for

timber purchase and replantation have been done

separately but now the purchaser is responsible for

replantation.

Like timber sale in 2015, standard was total area of about

20 hectares and harvest volume of about 6,000 cbms a

year but now large lot like several hundred hectares with

annual harvest volume of several thousand cbms are

planned in ten locations in Japan.

Trade war between the U.S.A. and China

The U.S. government decided to increase retaliatory

import duty on about 5,700 items from 10% to 25%. These

include plywood, furniture, lumber and logs.

Chinese government announced to take necessary actions

for retaliation. If import duty for imported logs from the

U.S.A. is raised, it would be a big blow to forest products

trade between two countries and it would give impact to

worldwide wood demand and supply.

The U.S.A. exports logs and lumber to China then China

exports processed products like plywood and furniture.

Forest products trade between two countries in 2017

before the conflict started was about 3.2 billion dollars by

the U.S.A. and about 4.0 billion dollars by China so total

amount was 7.2 billion dollars.

Export by China has been unchanged much in recent years

but export by the U.S.A. has been increasing year after

year and it is 25.6% more than 2017 and 54.6% more than

2015. In 2018, in export to China, logs were 6,265,783

cbms, 2.4% more than 2017 but lumber was 2,696,084

cbms, 17.3% less than 2017.

In log export, softwood logs were 5,130,815 cbms, 4.5%

more and hardwood logs were 1,134,968 cbms, 6.2% less.

In lumber, hardwood was 2,017,942 cbms, 16.1% less and

softwood was 678,142 cbms, 20.5% less. Import duty

varies by products and species, which influenced purchase

volume.

It is not certain how much of these are processed

and are exported to the U.S. market but the volume of logs

and lumber from the U.S.A. takes about 10% in total wood

supply so China may need to look for substituting supply

source but China’s export to the U.S.A. would decrease so

how much China would need in balance is not certain.

The U.S. government is preparing to impose import duty

on rest of remaining items and as the conflict gets bogged

down, impact would be serious not only on Chinese

economy but also on rest of the world.

U.S. domestic lumber market has been slow since second

half of last year and if export to China declines, U.S.

depressed market is likely to prolong.

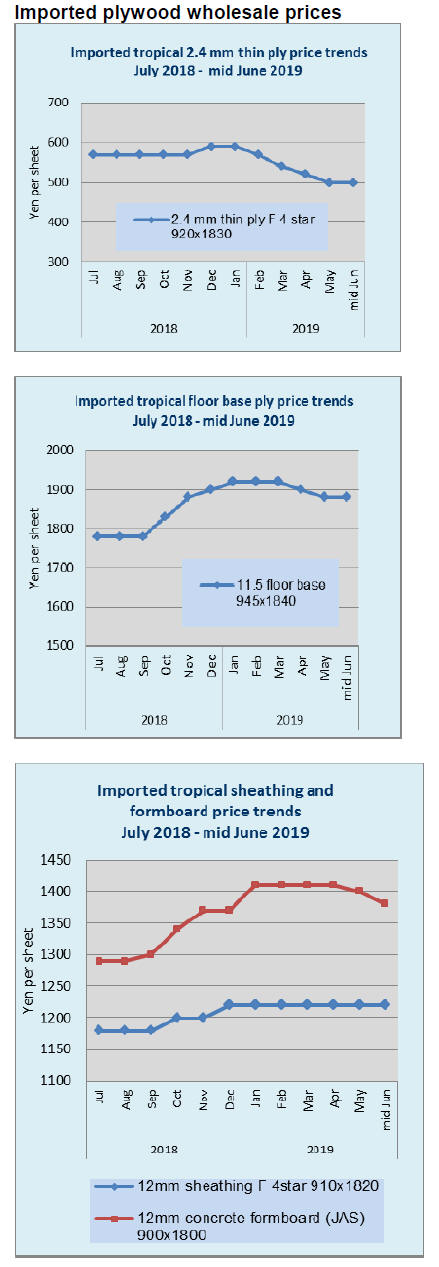

Price hike of softwood plywood

Softwood plywood manufacturers have been suffering

climb of log cost and transportation cost. These increased

about by 10% in last one year.

The manufacturers say that transportation cost has been

the manufacturers’ since delivery term is arrived at

buyers’ desirable place but transportation cost has been

climbing without no end recently.

Trucking companies ask higher cost of drivers and charge

waiting time. The rule requires two drivers for long

distance delivery so bearing such higher transportation

cost is becoming difficult for the plywood manufacturers

so delivery term may change to FOB mill and

transportation cost would be buyer’s account in future.

Also log cost has been increasing by purchase competition

with other users like sawmills and biomass power

generation plants. In Kyushu, log prices climbed by about

20% to 11,000 yen per cbm FOB log yard of auction

markets because of competition with lumber mills and

wood chip plants for biomass power plants.

Shinyei’s new plywood mill will start up shortly at Ohita.

This mill plans to use 30% of cypress logs in total log

consumption and cypress log prices soared to about 17,000

yen, more than 10% increase so neighboring sawmills are

worried about future log procurement.

Some of log market in the Western Japan shows about

25% increase of cedar B class logs at 12,000 yen. In the

North East, larch log prices climbed by about 20% and

cedar log prices are up by about 10%.

The manufacturers have been holding offer price of 1,050

yen per sheet delivered on JAS 12 mm 3x6 plywood for

last one year despite temporary supply shortage by

demand increase to establish stable supply market.

Actually the market prices have been way under 1,050 yen

so at this time, the manufacturers are asking to bring the

actual prices back up to 1,050 yen to cover higher cost.

Majority of plywood is sold direct to precutting plants and

the prices vary by plants while wholesale channels’

volume is much less than precutting business so wholesale

prices do not reflect actual market prices. Since the prices

between precutting plants and plywood mills are not

disclosed, actual prices are not clear but they appear about

5% lower than the proposed prices by plywood mills.

South Sea (tropical) logs and lumber

Import of logs from PNG has been stable and the first

quarter volume from PNG is 40% more than last year.

With stable supply, log market prices in Japan are holding

steady. Logs from Sabah, Malaysia, is zero by export ban

and log supply from Sarawak, Malaysia has no hope to

recover by reduction of export quota and soaring harvest

cost.

As quality logs from South Sea countries to manufacture

face and back are hard to get now, plywood mills in Japan

are developing to make hybrid plywood with domestic

cedar and imported falcate veneer.

Laminated free board had some active trading from early

this year with declining inventories but now the movement

slow down as this is demand slow season. The prices of

Indonesian mercusii pine and Chinese red pine are

unchanged at about 110,000 yen plus.

MDF market

Total supply of MDF in 2018 was 1,007,830 cbms

(395,727 cbms of domestic products and 612,103 cbms of

overseas supply).

Domestic supply dipped below 400,000 cbms after three

years while the imports exceeded 600,000 cbms after five

years. Decrease of domestic supply is production disrupt

by occasional mechanical problems of the manufacturers.

Among imports, Indonesia supply increased by 28.6%

from 2017.

For raw materials supply, softwood materials were steady

for both domestic and imports but South Sea hardwood

chip is becoming hard to procure because of harvest

restrictions in South Sea countries.

Driving demand in Japan is thin MDF for flooring. As

supply of floor base of tropical hardwood is shrinking year

after year, demand of composite floor with combination of

MDF and domestic softwood plywood or tropical

plantation species have been increasing.

Production of composite floor with MDF and softwood

plywood or single use of MDF has been increasing from

about 42,000 M square meter in 2016 to 44,150 M square

meter in 2018.

There was not much change in demand of thick softwood

MDF for building materials. To deal with changing

demand of MDF, acquisition of overseas MDF plant is

progressing to secure the supply for Japan market. This

helps reduce risk of supply disruption by having various

supply sources.

Meantime, demand retreat is feared in Japan after the

consumption tax is raised to 10% in October so if the

supply from overseas plants increase, there would be

supply glut.

Thin MDF supply from domestic manufacturers come

from Daiken Industry and Hokushin, both hardwood base

then N&E, softwood base. These three companies have

been running in full out of which thin MDF for flooring

has been increasing little by little. Hokushin’s production

is 13,700 cbms a month out of which thin MDF is 4,500

cbms in which 3,300 cbms is for floor. N&E’s monthly

production is 9,000 cbms out of which 2,300 cbms for

floor.

Among imports, Malaysian supply is about 14,800 cbms a

month in which 6,000 cbms is for floor. Indonesia supply

is about 3,100 cbms a month in which thin MDF is 800

cbms by SPF. New Zealand supply is 28,400 cbms a

month out of which about 15,000 cbms is thin MDF.

Many of overseas MDF manufacturers are subsidiary of

Japanese companies. Daiken is the largest, which started

hardwood base MDF in Malaysia then bought out

softwood base MDF plant in New Zealand so total is about

31,000 cbms a month, which takes 61% share of total

import MDF.

Also Daiken tied with Hokushin and bought 51% share of

Hokushin’s marketing company, C&H so Hokushin’s

monthly production of 13,500 cbms is also handled by

Daiken now. Therefore, Daiken’s share in total MDF is

53%. Daiken’s share in hardwood base MDF is 65%.

Hardwood

MDF is suitable for thin plywood for flooring so Daiken is

dominant supplier of this type of MDF. IFI (Indonesia

Fiberboard Industry) of Indonesia is new comer in this

business. It uses hardwood chip for raw material and Noda

is supervising quality at manufacturing plant so the quality

is as good as Noda’s MDF. Noda has domestic MDF plant

with monthly production of 12,500 cbms.

For softwood base MDF, Nelson Pine Industry, which has

been supplying MDF through Sumitomo Forestry for

many years with monthly production of 12,500 cbms.

Daiken recently bought out radiate pine base MDF plant in

South Island of New Zealand with monthly production of

12,450 cbms.

Production of softwood plywood to combine with MDF

for flooring has limit as manufacturing floor base plywood

requires smooth surface and high dimensional stability to

prevent warping and curbing so increase of production

needs basic change of machinery.

There is only one plywood mill to be preparing capital

investment to increase floor base plywood,which is Akita

Plywood. Newly starting KeyTec’s Yamanashi mill and

Shinyei’s Ohita mill are both structural panel manufacturer

so there is limit of manufacturing plywood for composite

flooring and it is getting ceiling now.

|