|

Report from

North America

Tropical sawnwood imports rise

US imports of tropical sawn hardwood rose in October to

its highest volume of the year but volumes still lag

behind 2017 levels. The October volume of tropical sawn

hardwood imports was up 23% over September to

20,370 cu.m. That is still more than 10% below October

of last year.

Year-to-date, tropical sawn hardwood imports were down

12% compared to 2017. Imports from Ecuador more than

doubled in October after a few weak months.

The October number is about equal to the same month last

year, but imports from Ecuador remain down 28% year to

date. Imports from Brazil were up 27% in October to draw

level with last year to date and imports from

Malaysia were up slightly continuing growth that is now

up by 50% year-to-date.

Balsa imports were up sharply in October but are still

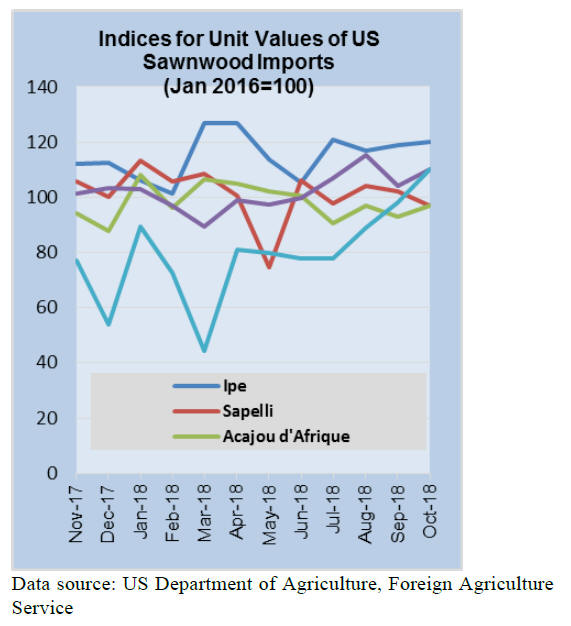

down for the year by nearly one third. Sapelli and

Acajou d’Afrique are similarlybehind year to date

and both fell even more in October. Keruing imports

declined by 24% in October but remain ahead of last year

by 37%. Jatoba imports improved again in October and are

well over doubling 2017 year-to-date.

Plywood imports in steep decline

The US imported less than 51,000 cu.m. of hardwood

plywood in October, down nearly 80% from September

and less than half that of the previous worst month this

decade.

While imports from China declined in October by more

than 90% following the September 24 imposition

of increased tariffs, imports from all other trade partners

dropped by more than 50% for the month.

However, nearly every trading partner, other than China,

is ahead year-to-date indicating that US US importers may

have been increasing their inventories in anticipation

of increasing tariffs.

Feature article on US hardwood importer’s China tariff

challenges

The New York Times Magazine published a recent feature

story on how tariffs on Chinese goods are harming a US

wood products company.

The story can be found at:

https://www.nytimes.com/2018/11/28/magazine/trade-wartariffs-

small-business.html

Housing starts down, home sales mixed

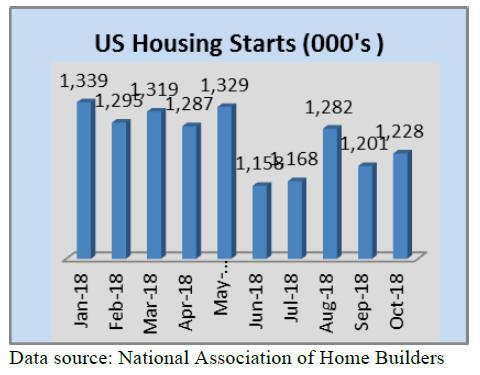

Privately-owned housing starts in October were at a

seasonally adjusted annual rate of 1,228,000. This is

1.5% above the revised September estimate of 1,210,000

but is 2.9% below the October 2017 rate of 1,265,000.

Single-family housing starts in October were at a rate of

865,000; this is 1.8% below the revised September figure

of 881,000.

Sales of newly built, single-family homes fell to a

seasonally adjusted annual rate of 544,000 units in

October after an upwardly revised September report,

according to data from the US Department of Housing and

Urban Development and the US Census Bureau.

This is the lowest sales pace since December 2016.

However, on a year-to-date basis, sales are up 2.8% from

this time in 2017. Looking at the regional numbers on a

year-to-date basis, new home sales rose 6.3% in the

Midwest, 4.1% in the West, and 3.8% in the South. Home

sales fell 17.1% in the Northeast year-to-date.

Existing-home sales increased in October after six straight

months of decreases, according to the National

Association of Realtors. Three of four major US regions

saw gains in sales activity, with the Midwest showing a

small decline. Total existing-home increased 1.4% from

September to a seasonally adjusted rate of 5.22 million in

October. Sales are now down 5.1% from a year ago.

Consumer sentiment remains high

In October US consumer spending increased the fastest in

seven months according to the US Department of

Commerce. Consumer spending, which accounts for more

than two-thirds of US economic activity, jumped 0.6% last

month as households spent more on prescription

medication and utilities, among other goods and services.

US consumer sentiment exceeded analyst estimates as low

unemployment and growing incomes kept Americans in an

upbeat mood, though the outlook soured amid concern that

the labor market will soften. The University of Michigan's

preliminary December sentiment index was unchanged

from November at 97.5 and compares with the median

estimate of 97 in a Bloomberg survey of economists.

|