|

Report from

Europe

EU wood furniture manufacturers reassert home

market dominance

The latest Eurostat trade data shows that the EU’s wood

furniture industry, having lost a little ground to imports in

2017, is struggling to increase sales outside the EU as

global trade slows. However, the sector is once again

reinforcing its dominance in the home market this year.

As reported by ITTO MIS in July (Volume 22, Number

13), the EU wood furniture sector recorded only slow

growth in 2017. The value of EU wood furniture

production was €40.3 billion in 2017, no change from the

previous year. Total imports from outside the region

increased 9% to €6.29 billion.

In 2017, EU wood furniture imports increased 7% from

the tropics, to €1.75 billion, and 3% from China, to €3.18

billion. However, most of the gains were made by other

non-EU temperate countries, such as Ukraine, Bosnia and

Serbia. Total imports from these countries increased 28%

to €1.36 billion.

EU consumption of wood furniture was €37.6 billion in

2017, a gain of 2% compared to 2016. Despite the rise in

imports in 2017 the share of domestic manufacturers in

total EU furniture supply declined only slightly last year.

In 2017, domestic manufacturers accounted for 86.7% of

the total value of wood furniture supplied into the EU

market, down from 87.5% in 2016.

EU wood furniture production data is published only

annually, so it is too early to assess how consumption is

developing in 2018. However, EU monthly data on

internal and external trade provides insights into the

changing share of the various wood furniture supply

countries to the EU, alongside changes in internal

distribution patterns in 2018 which may have long term

implications.

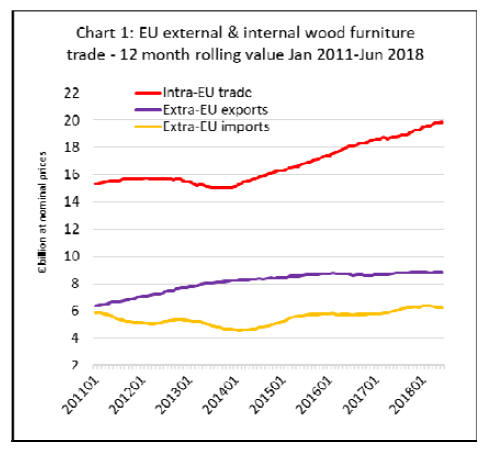

Eurostat trade data reveals that internal EU trade in wood

furniture, which increased 4% to €19.2 billion in 2017,

increased a further 6% in the first half of 2018.

Meanwhile the pace of EU wood furniture exports to non-

EU countries, which were flat at €8.7 billion in 2016 and

2017, have continued at the same rate in the first half of

2018. Wood furniture imports into the EU from outside

the region were rising in the second half of 2017, but

began to dip in the first half of this year (Chart 1).

Poland’s increasing role in EU wood furniture supply

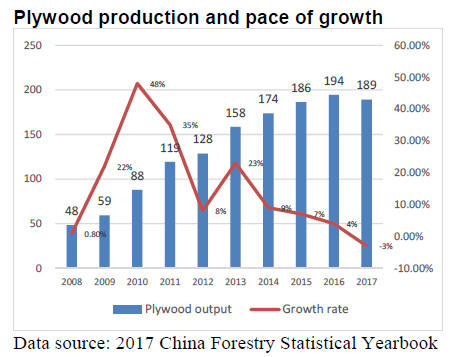

Closer analysis of EU internal trade flows suggests that the

Polish wood furniture industry, which is expanding partly

at the expense of manufacturing in western European

countries, particularly Germany, is playing an important

role to drive the on-going rise in internal EU trade. By far

the largest increase in internal EU wood furniture trade

flows in the last two years was in exports from Poland to

Germany (Chart 2).

In recent years, Poland has quickly emerged as the world’s

sixth largest furniture producer and fourth largest furniture

exporter.

This has been achieved by exploiting the combination of

the EU’s common market in goods, proximity to Germany

and other large western European markets, and low labour

costs. Hourly labour rates average only around €9 in

Poland compared to €27 for the EU as a whole and €34 in

Germany.

Germany is Poland’s largest furniture export market with a

share of around 30% of total trade, followed by UK,

Czech Republic, France and the Netherlands.

In the wood furniture sector, Poland has benefitted from

the relatively large forest resource in Eastern Europe,

although availability of oak, by far the most popular

species, has been a limiting factor in recent years.

Another limiting factor is that Polish brands are not yet

well known in export markets and overseas sales are

largely controlled by large retail chains that dominate

fashion and design trends.

At present, there are over 27,000 Polish companies

involved in furniture manufacturing, although only 407

large and medium-sized enterprises account for three

quarters of production. Poland is the second largest

supplier of furniture to Ikea after China. The Swedish

giant operates a dozen factories in the country and is the

largest company in the furniture industry in Poland.

Nevertheless, the Polish furniture industry is also

characterised by many companies with domestic capital

which are becoming leading players in the Central and

Eastern European market. Efforts are also being made by

these companies to increase production and sales of ownbrand

product.

Rising importance of Netherlands in EU-wide furniture

distribution

In addition to the rising influence of Poland in EU wood

furniture supply, Chart 2 indicates that there has been

significant growth in wood furniture exports by

Netherlands to neighbouring EU countries since 2016.

Wood furniture supply in the Netherlands is fed by

imports from outside the EU, and by domestic wood

furniture manufacturing, both of which have been rising in

the last 2 years.

This suggests that the Netherlands in playing an increasing

role in the wood furniture sector, as in other wood sectors,

in the distribution of products to other EU countries. It is

likely driven by two factors.

First moves to consolidate the retail sector in the EU

which has been accompanied, to some extent, by greater

centralisation of retailers’ procurement operations. This

has led to greater focus on imports through the large ports

in Benelux countries.

Second, the EU Timber Regulation (EUTR) may be

reinforcing this trend towards concentration of the

procurement function.

Smaller importers have become more inclined to buy from

other larger EU importers, or only from EU-based

manufacturers, to avoid the requirement to implement due

diligence systems.

If this latter factor is important, then it should present an

opportunity for Indonesian products which, due to FLEGT

licensing, are the only non-EU wood furniture products

that may be placed on the EU market without any further

due diligence.

However, so far other factors are not leading to a

significant increase in Indonesian wood furniture trade

with the EU – such as very long lead times in supply from

Indonesia and the country’s tight focus on marketing of

only a relatively limited range of mainly exterior, often

teak, products in the EU, without regularly reviewing the

products to ensure they align with changing fashion trends.

Fall in EU wood furniture imports from China and the

tropics in 2018

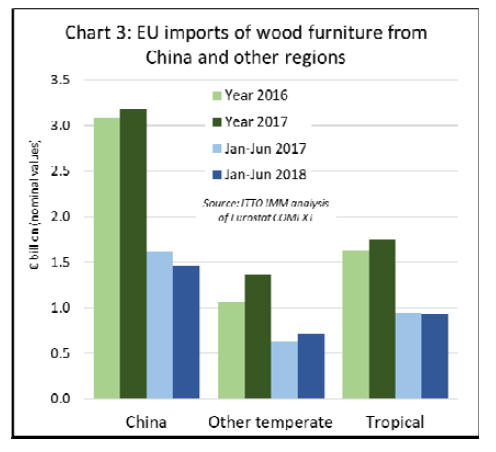

After making gains last year, EU wood furniture imports

from tropical countries and China fell in the first 6 months

of 2018. EU imports from tropical countries decreased 2%

to €940 million, while imports from China fell nearly 10%

to €1.46 billion (Chart 3).

In recent years China’s competitiveness in the EU wood

furniture market has been impeded as prices have risen on

the back of growing domestic demand and new laws for

pollution control pollution in China. EU furniture

importers also continue to question the variable quality of

product imported from China and some have struggled to

obtain the legality assurances required for EUTR

conformance when dealing with complex wood supply

chains in China.

Meanwhile EU imports of wood furniture have continued

to rise from other temperate countries, mainly bordering

the EU. EU imports from these countries increased 14% to

€720 million in the first 6 months of 2018, building on a

28% gain recorded the previous year. The biggest gains

are being made by Ukraine, Bosnia and Serbia.

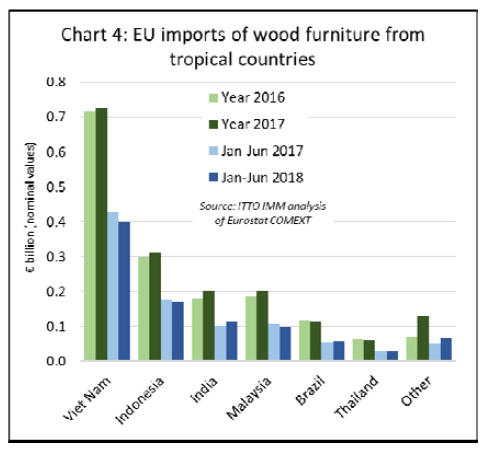

The main South East Asian supply countries have all

followed a similar trajectory in the EU wood furniture

market in the last 18 months. A rise in EU imports last

year was followed by a decline in the first six months of

2018.

After increasing 1% to €730 million in 2017, EU imports

from Viet Nam fell 6% to €400 million in the first six

months of 2018. Imports from Indonesia increased 4% to

€311 million in 2017 but fell back 4% to €171 million in

the first six months of 2018. Imports from Malaysia

increased 10% to €203 million in 2017 and were 8% down

at €99 million in the first 6 months of 2018.

In contrast, EU wood furniture imports from India have

continued to rise, up 12% to €103 million in the first six

months of 2018 after a 12% increase to €202 million for

whole of 2017. Imports from Brazil bounced back in the

first half of 2018, rising 4% to €57 million, after declining

5% to €112 million for the whole year 2017 (Chart 4).

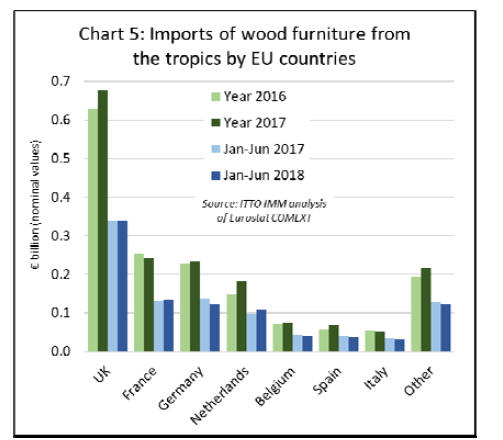

There were also shifts in the destinations for wood

furniture imported into the EU from tropical countries in

the first half of 2018. Imports in the UK, the largest

market, were €339 million between January and June

2018, unchanged from the same period in 2017.

However, in the first half of 2018 there was a sharp fall in

imports of wood furniture from the tropics by Germany (-

11% to €123 million), Belgium (-8% to €39 million),

Spain (-12% to €37 million), and Italy (-4% to €31

million). These losses were partly offset by rising imports

in France (+1% to €134 million) and Netherlands (+12%

to €109 million) (Chart 5).

The large rise in Netherlands imports of wood furniture

from tropical countries in the first half of 2018 may be

related to the wider trend, mentioned earlier, to centralise

procurement functions within the EU, contributing to a

greater share of wood furniture trade passing through

Dutch ports.

|