2. GHANA

Encouraging growth in sawnwood exports to Asian

markets

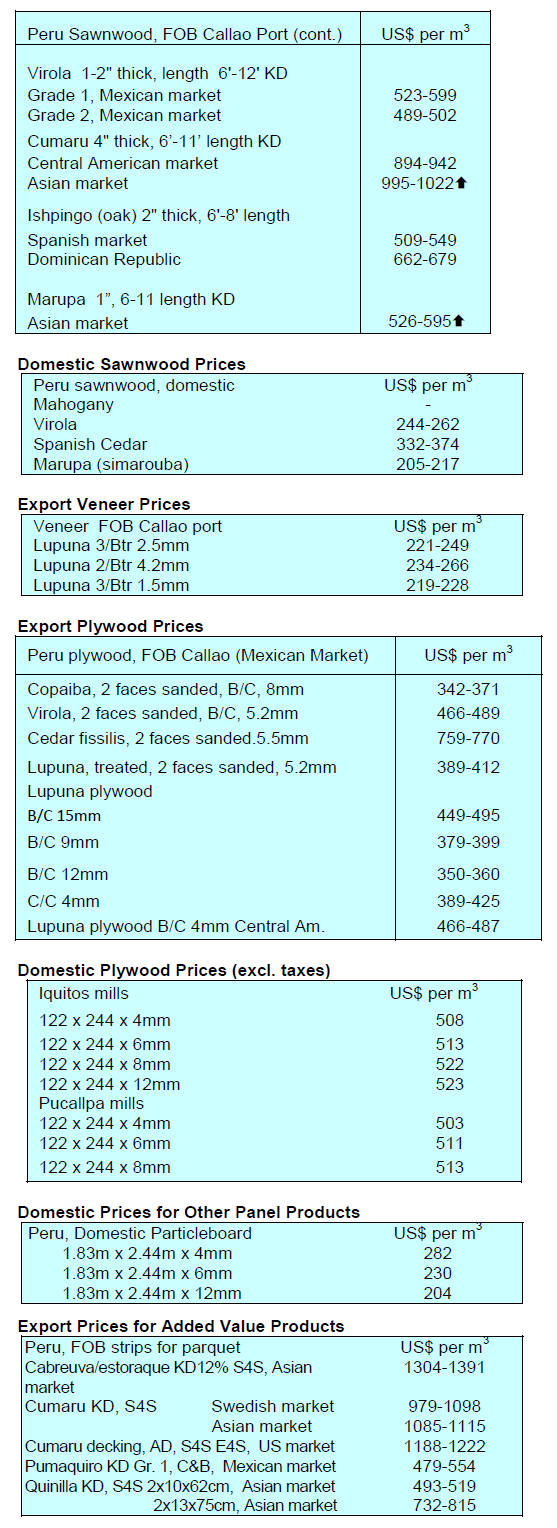

Ghana’s wood product exports in the first five months of

2018 recorded a year-on-year growth in both volume and

value according to available data from the Timber

Inspection Development Division (TIDD) of the Forestry

Commission.

The country exported a total of 144,300 cu.m of wood

products between January and May 2018 to register a 24%

growth when compared to 116,952 cu.m exported in the

same period in 2017. Total export revenues for the first

five months of 2018 also improved, rising 38% to Euro

86.32 million from Euro 62.65 million in 2017.

According to the TIDD, secondary wood products

accounted for close to 88% of the total export volume in

2018 followed by primary wood products at 10% while

tertiary wood products accounted for the balance the

details are in table below;

Primary wood product exports (poles and billets)

expanded 81% from 8,045 cu.m in 2017 to 14,540cu.m in

2018. Exports of secondary wood products, mainly

sawnwood, boules, veneer and plywood also increased

22% while exports of tertiary wood products declined.

The major markets were in Asia with smaller quantities

going to neighbouring African countries. Planation teak,

rosewood, ceiba, papao/apa and wawa were some of the

leading species utilsed for exports.

Distressed banks merged – a move welcomed by

industry associations

The Ghana Central Bank has announced that the

government has taken control of 5 distressed local banks

and merged them into a single entity known as the

Consolidated Bank.

Governor of the Central Bank, Dr. Ernest Addison, said

this action is part of ongoing reforms aimed at

strengthening the country's financial sector. The new

entity has benefitted from an almost US$90 million

recapitalization.

The Association of Ghana Industries (AGI) said it was

hopeful the Central Bank would be able to get the new

financial institution on a sound footing to service the needs

of industry.

In related news, a press release from the AGI said “the

Association notes with concern, related developments in

the Ghanaian economy and reiterates that the influx of

imports remains a major risk to the growth of industry and

the country’s job creation prospects.

Instances of weak local currency and exchange rate

volatilities as experienced in the second quarter reflect the

import-oriented nature of our economy. Businesses came

under intense pressure from cedi depreciation in Q2.

Speculations about new taxes emerging in the mid-year

budget review negatively impacted business confidence.”

See:

https://agighana.org/uploaded_files/document/b6cd3083881d1d7

4f7ec00c3fc03eefe.pdf

3.

MALAYSIA

MTC has new chairman

Dato’ Low Kian Chuan has been appointed Chairman of

the Malaysian Timber Council (MTC). Dato Low, 58, who

holds a Bachelor of Economics and an Advanced Diploma

in Business Administration started his career in the timber

industry working in his father’s sawmill in Terengganu

shortly after graduating from the university in 1984.

He is currently the Executive Chairman of Low Fatt Wood

Group of Companies. Low has a long history with the

timber industry which revolves around his involvement in

the Timber Trade Federation Malaysia (TTFM).

Established in 1957, TTFM was one of the pioneer

organisations that consolidated and brought together those

in the timber sector, especially the sawmillers. It was also

one of the key associations instrumental in the formation

of MTC.

Among Low’s notable achievements was promoting the

idea of producing premium grade laminated scantlings or

lam-scants. Low initiated the R&D to produce high grade

lam-scants for niche markets, which resulted in the 2004

registered trademark ‘Lamtec Malaysia’, a label for

premium wooden laminated scantlings.

Low’s vast exposure and experience in the timber industry

and other sectors will further elevate MTC as an

organisation that advances the collective interest of its

stakeholders.

See:

http://www.mtc.com.my/images/media/625/Press_Release_on_A

ppointment_of_Chairman_-ENG-_Final.pdf

Furniture exports continue to expand

The Malaysian Timber Industry Board (MTIB) has

reported that the timber industry contributed RM23.2

billion to export earnings last year representing an almost

5% increase from a year earlier. Of the total RM8 billion

was from the export of furniture of which 80% was

rubberwood furniture. The MTIB has targeted a 3-5%

growth in wooden furniture exports for 2018.

The Director General of MTIB, Dr. Jalaluddin Harun, said

the Board aims to modernise the timber industry through

automation and increased productivity so as to reduce the

industry’s reliance on semi-skilled foreign labourers.

Malaysian Forestry Conference (MFC)

The 18th MFC was hosted by the Forest Department of

Sarawak and the Sarawak Forestry Corporation. The MFC

is held every three years on a rotational basis amongst the

Forestry Departments of Sarawak, Sabah and Peninsular

Malaysia. The Conference provides a forum for Malaysian

foresters to exchange and share information, views and

experiences in the administration, management and

developments of the nation’s forest resources.

Sarawak Chief Minister, Abang Johari Tun Openg, told

the MFC that the Sarawak government has made it

mandatory for all holders of long-term forest timber

licenses to obtain Forest Management Certification by

2022. He said the decision is in line with the state’s policy

reform.

He acknowledged that achieving certification in the State

will be a challenge especially in terms of the capacity of

both implementing agencies and the private sector.

However, through good collaboration between State

agencies, timber companies, the associations, NGOs and

local communities a balance between environmental

protection, economic growth and socio-economic

development can be achieved.

One major challenge will be how to secure land for

development without encroachment into the permanent

forest estate. This will require a review of policies and

ordinances to strengthen forest management and

protection.

Sarawak and Vietnam cooperation on furniture

KTS Holdings and Pusaka Timber Industries (PTISB),

both from Sarawak, signed memorandums of

understanding with Sudima Panels and Wilsons Hill

Vietnam to collaborate on furniture manufacturing.

The Sarawak companies have recognised the success

Vietnam has achieved in utilising acacia to produce

furniture. Currently, Sarawak’s export of furniture is

negligible, contributing less than 5% of total export

earnings by the timber sector. Sarawak has plans to

establish one million hectares of industrial forest by 2020.

As of December 2017, 400,000 hectares have been

planted, mostly with acacia.

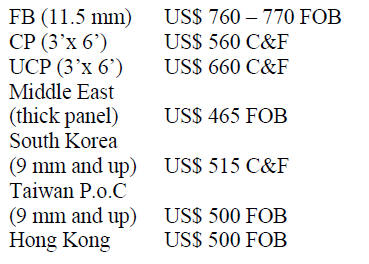

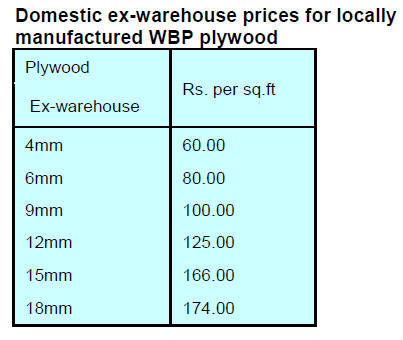

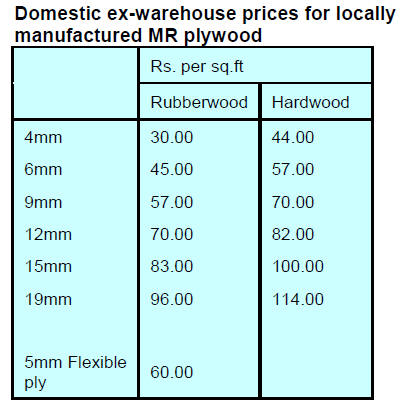

July plywood prices

Plywood traders based in Sarawak reported the following

export prices:

4.

INDONESIA

Non-tariff barriers to hold

back imports

In response to rising global trade tensions and a fear that

Indonesia will become a target market for goods no longer

competitive in the US market the government is

considering ways to limit certain imports through nontariff

means.

The media in Indonesia has reported that Gati

Wibawaningsih from the Ministry of Industry has said that

while the government cannot ban imports of particular

products it must act to protect domestic industry.

See: https://nasional.kontan.co.id/news/pemerintah-menyiapkannon-

tariff-barrier-untuk-menahan-guyuran-impor

Indonesia hopes US will maintain GSP facility

The Indonesian President has expressed the hope that the

US would not revoke the Generalised System of

Preference (GSP) facility for Indonesia. He reminded the

US that over half of the items Indonesia exports to the US

are raw materials for US companies.

Since 2011 Indonesia has enjoyed GSP benefits but the

prospect that the US administration plans to review over

100 products from Indonesia including textiles, plywood,

cotton and several marine products is of considerable

concern.

Manufacturing output up 4%

Industry Minister, Airlangga Hartarto, has reported that

manufacturing output increased 4.4% year-on-year in the

second quarter of 2018. This was higher than 3.9% growth

recorded in the the second quarter of last year. Airlangga

said the manufacturing sector is the backbone of the

country’s economy.

The press release from the ministry reported the natural

rubber sector was the largest contributor to the economy

excluding the oil and gas sectors followed by the leather

and shoe sectors, food and beverages and textiles.

In contrast to the second quarter growth, during the first

time in six months of 2018 manufacturing output declined

as domestic demand weakened and demand in overseas

markets continued to soften.

Forestry staff to study monitoring of production

forests

Staff in the Ministry of Environment and Forestry

(KLHK) Directorate General of Sustainable Production

Forest Management (DG PHPL) will benefit from

‘StuNed’ scholarships and will travel to the Netherlands to

undergo training in monitoring production forests using

spatial technology in remote forest areas. The training will

take place at the University of Twente.

Good prospects for Indonesia's ‘Green Bond’

The World Bank has estimated the potential in Indonesia

for environmental theme funding through green bonds and

sukuk (sharia compliant bonds) and said these could reach

around US$27 billion by 2030.

Philippe Le Houérou, Chief Executive Officer of the

International Finance Corporation, said Indonesia faces

serious challenges in environmental conservation and

there is a great opportunity for the development of

innovative financial tools to support conservation work.

Five point plan for Indonesia’s forestry sector

development

The Ministry of National Development Planning has

produced an assessment of what is required for Indonesia's

forestry sector to contribute more to the national

development agenda.

Arifin Rudiyanto, Deputy for Maritime and Natural

Resources, has said the assessment has five main targets,

namely rationalising the area and forest cover, improving

the economy of forest-based communities, optimising bioeconomic

based multipurpose forests, forest management

and the realisation of good forest governance.

5.

MYANMAR

Launch of third party certification

According to the domestic media the Myanmar Forest

Certification Committee (MFCC) launched its Third Party

Certification System at an 8 August workshop in Yangon.

It is reported that there are four Certification Bodies, three

local and one international, which will issue Legality

Compliance Certificates under the Myanmar Timber

Legality Assurance System (MTLAS).

Barber Cho, Secretary of the MFCC, explained that the

MTLAS Gap Assessment Project conducted in 2016-17

with the assistance of the EU and FAO recommended

MFCC to initiate a system of third party certification. The

Ministry of Natural Resources and Environmental

Conservation (MONREC) assigned the MFCC to

implement this.

To proceed the MFCC contracted international consultants

to design the documentation tracking system and to

conduct auditor training under an MFCC-PEFC supported

project in order to strengthen the MTLAS. This effort was

funded through a grant from the Prince Albert II of

Monaco Foundation.

Cho explained that the MFCC has worked hard to

overcome the challenges to achieve its aim but that the

MFCC still has more to do to make the MTLAS credible

and internationally recognised.

Greater transparency is high on the agenda of the MFCC.

At a recent meeting in Brussels several Competent

Authorities (CAs) complained of the lack of information

being provided by Myanmar. To improve transparency

and access to information the MFCC has launched a

website http://www.mfcc.com.mm.

The Myanmar Timber Enterprise also has a website

(www.myanmatimber.com.mm) and the Secretary of the

MFCC has urged the EU CAs to access these sites. A

recent ‘hit’ analysis showed that few entities in the EU

have been accessing the information that is available

seeming to prefer to rely on third party sources. Cho

appealed to the CAs in the EU to avail themselves of the

latest information.

Bamboo resources waiting to be utlised

The MTE has announced through their website an

invitation to investors. The invitation reads “With the

growing shortage of raw materials around the world and

maximised contribution required of the forestry sector to

the national economy, priority is being given to

downstream processing and value added production

investments.”

The MTE is encouraging the use of lesser known species

and bamboo saying bamboo is an inexhaustible resource

especially for pulp and paper, bamboo chips and other

uses.

MTE says investors interested in bamboo based industries

could consider Rakhine Yoma for its abundant supply of

bamboo and easy access to the sea. The MTE also says

over 60 million pieces of rattan are available from

rainforests of Myanmar yet no serious efforts have been

made to develop this industry.

6. INDIA

Surge in residential sales in top

seven cities

A recent press release from CREDAI provides an

overview of their August CREDAI NATCON 2018

(CREDAI’s national convention) at which over 1,000 real

estate developers from 100 Indian cities discussed

challenges and opportunities against the backdrop of

tremendous growth in residential sales.

Participants reviewed reports which focused on the

unprecedented growth displayed by the real estate industry

in India which showed a 25% year on year rise in sales.

At the convention CREDAI revealed demands for

incentives for developers to participate in affordable

housing to continue the growth in this sector. The

demands included enabling tax benefits, reducing land

area utilisation to 50% and a 12% GST.

According to CREDAI these demands if met would

provide further impetus to the growth of the real estate

sector amidst the positive trends on investments and

residential housing.

The growth witnessed in the fist half of 2018, according to

CREDAI, can be attributed to two main factors, firstly an

improvement in buyers’ confidence on account of

implementation of the Real Estate Regulation and

Development Act (RERA) in most states and stable capital

values that have started to show an upward bias.

These two factors have pushed many fence sitters and new

home buyers to take the purchase decision. This is despite

the fact that the Reserve Bank of India increased interest

rates in the third monetary policy meeting making

borrowing for home loans dearer.

The general consensus amongst the buyers has been that

the markets have bottomed out and capital values are now

expected to rise.

For more see: https://credai.org/press-releases/credai-jll-reportreveals-

25-surge-y-o-y-in-cumulative-residential-sales-in-topseven-

cities-of-india-in-h1-2018-at-natcon-2018-berlin

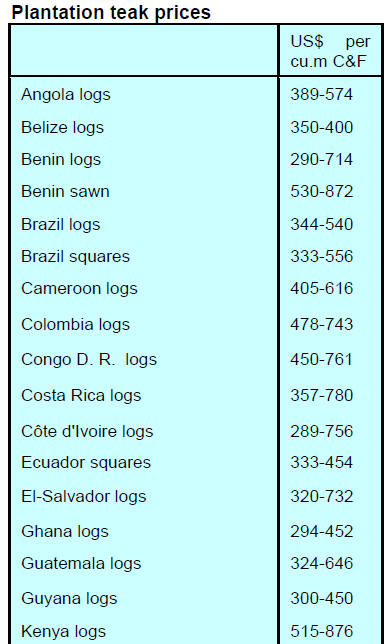

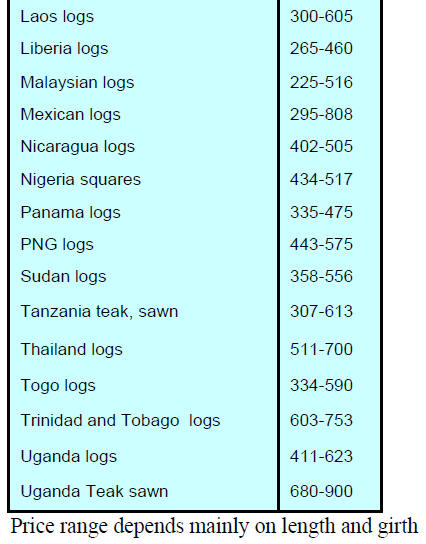

Plantation teak

Demand for imported logs has started to improve and this

has given traders the opportunity to raise prices on the

local market by between 8-10%. However, this change has

not resulted in any change in C&F prices.

The banks in India are coming under mounting pressure to

resume import credit facilities and even the Reserve Bank

of India has asked them revive the facility quickly.

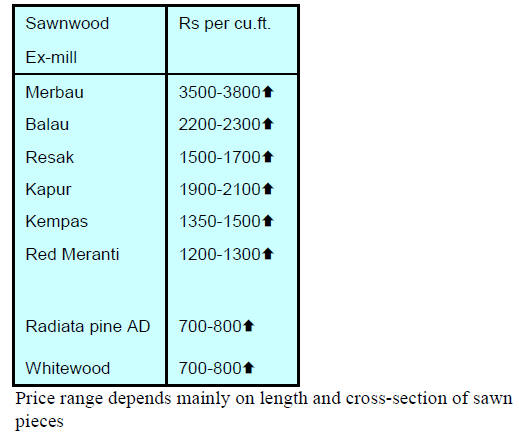

Locally sawn hardwood prices

As the housing market has started to improve demand for

timber has also been rising which provides a welcome

opportunity for importers to begin raising prices to off-set

the weakness in the rupee/dollar exchange rate.

Prices in the domestic market have been increased as

shown below.

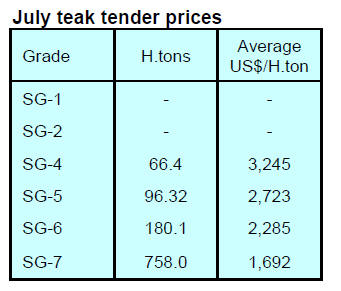

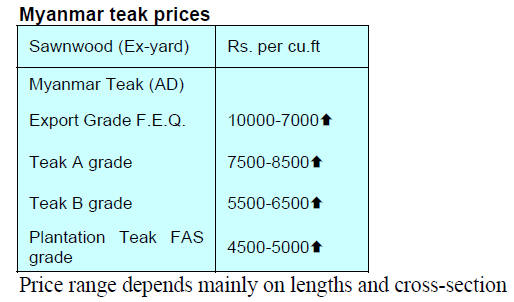

Imported sawn Myanmar teak

Ex-yard prices for imported sawn Myanmar teak have

been increased on the back of improved demand.

Confidence in the housing market has also lifted prices for

Myanmar teak finally giving traders with large teak stocks

to secure some sales. As stock levels fall analyst write

further price increases are likely.

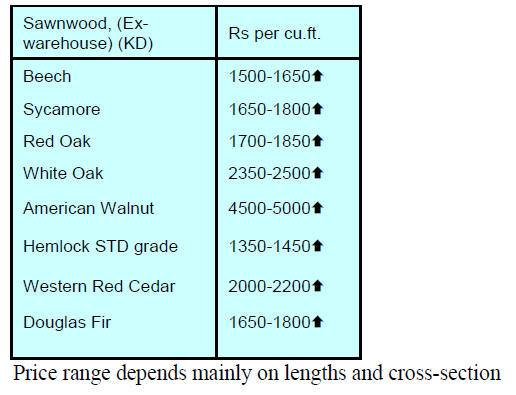

Locally sawn hardwood prices

Prices for imported kiln dry sawnwood have been raised

for the first time in months.

Plywood up-date

Plywood manufacturers report satisfaction with the market

acceptance of the recent price increases.

Analysts write that manufacturers are contemplating

increasing prices by another 5% which will help them

contend with the rising costs of raw materials and revive

their profit margins which have suffered for almost all of

this year.

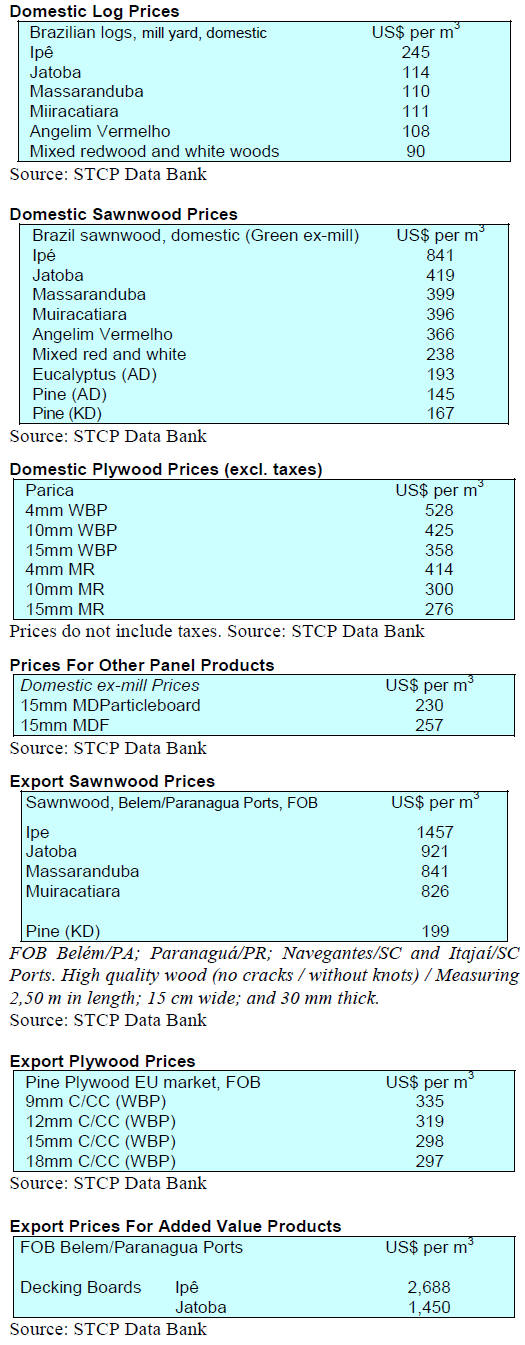

7. BRAZIL

Future of the forest debated

More than 20 industry federations from all over Brazil,

governmental authorities, and forestry sector stakeholders

attending the 106th meeting of the Thematic Council on

Environment and Sustainability (COEMA) part of the

National Industry Confederation (CNI) recently debated

the future of the forest in Brazil.

On the agenda was the National System of Control of the

Origin of Forest Products (SINAFLOR) and discussions

focused on the many problems in implementation.

According to the Federation of Industries of the State of

Rondônia (FIERO), the SINAFLOR platform is not

working properly in Rondônia. FIERO highlighted the

prospects of logging in the state under forest management

plans; adding that "the state should promote the image of

forest management as a differential and show the

consumer market that the only way to undertake controlled

exploitation/logging is through forest management."

In addition, FIERO says enterprises in Rondônia face

difficulties because IBAMA will not authorise

management plans for forests where there is no land title.

This has eliminated vast harvestable forest areas from

commercial use and seriously jeopardised companies in

Rondônia as around 80% of the industrial roundwood

comes from forest areas with only rights of possession.

The COEMA Council has become an important venue for

debate and provide participants with the opportunity to

identify issues of concern and offer solutions.

Logging law needs reviews

In July this year the ‘Normative Instruction No. 005/2014-

SEMA’ came into effect. Article 9, paragraph 1,

establishes that the minimum cutting diameter (MCD)

shall be 0.60m.

The authors worked on the Instruction for 4 years and

were required to provide technical and scientific reasoning

to support the legal requirement but forestry sector

stakeholders claim none were submitted to justify the

60cm blanket limit. The apparent arbitrary increase in

minimum diameter will result in many species being

eliminated from the harvest because even at maturity they

do not reach a diameter of 6ocm.

The Forestry Technical Chamber – CTF (Câmara Técnica

Florestal) composed of several entities such as SEMA

(State Secretariat of Environment), IBAMA (Brazilian

Institute for Environment and Renewable Natural

Resources), SEDEC (State Secretariat for Economic

Development), FAMATO (Federation of Agriculture and

Livestock of Mato Grosso), AMEF (Association of Forest

Engineers of Mato Grosso), OAB (Brazilian Bar

Association), UFMT (Federal University of Mato Grosso),

AREFLORESTA (Mato Grosso Reforestation

Association) and CIPEM (Center for Timber Producers

and Exporters of Mato Grosso State) drafted an

amendment for IN No. 005/2014 based on scientific

studies developed by the Brazilian Agricultural Research

Corporation (EMBRAPA) and with unanimous agreement

of all CTF members.

The group is calling for revoking Article 9 of the

Normative Instruction and redrafting to make it consistent

with the decrees and resolutions of the National

Environmental Council - CONAMA.

Panel export growth

The 50th IBÁ Report produced by the Brazilian Tree

Industry (IBÁ) indicates that there was an increase of

8.6% in wood panel exports in the first six months of

2018. The main markets in June continued to be Latin

America (US$78 million), North America (US$38 million)

and Asia / Oceania (US$18 million).

However the report notes a 28% decline in exports to

Africa, falling from US$7 million to US$5 million year on

year but there was an increase in exports to Europe.

In terms of domestic sales, after the sharp decline recorded

in May, domestic sales picked up in June with some 3

million cu.m being sold. Domestic sales increased almost

2% in the first half of 2018 compared to the same period

in 2017.

Business to business meetings generate US$3 million

in orders

The Bento Gonçalves Furniture Industries Union

(SINDMÓVEIS) coordinates business dialogues as part of

its ‘Orchestra Brazil’ project the aim of which is to

encourage exports of furniture in partnership with the

Brazilian Agency for the Promotion of Exports and

Investments (Apex-Brasil). The latest activity of

‘Orchestra Brazil’ was during the ForMóbile held in São

Paulo.

See:

https://www.formobile.com.br/pt/home.html

The ‘Orchestra Brazil’ project was established in 2006 and

promotes competitive marketing of Brazilian wooden

furniture in international markets.

During the ForMóbile fair more than 200 business to

business meetings were arranged between Brazilian

companies and importers from eight countries, such as

South Africa, Argentina, Bolivia, Chile, Colombia,

Mexico, Paraguay and Peru. Business deals worth around

US$230,000 were concluded with a forecast of almost

US$3 million in sales over the next 12 months.

8. PERU

China scales back flooring

purchases

The Association of Exporters (ADEX) has reported that

Peruvian exports of wooden flooring were worth US$23.8

million in the first four months of 2018 but that this was

down 6% year on year. The main export items were

tongue-and-groove flooring and decking.

During the first four months of this year wooden flooring

exports went mainly to China which accounted for over

half of all flooring exports but this was down almost 20%

compared to the same period in 2017.

The other markets of note were France (US$3.7 million),

the United States (US$1 million) and smaller quantities

were shipped to Belgium, Denmark, Germany, Mexico,

Australia, New Zealand and the Netherlands.

The main exporters were IMK Maderas S.A.C., Grupo

Maderero Amaz S.A.C., Maderera Bozovich S.A.C., E & J

Matthei Maderas del Perú S.A. and Forest Industry

Huayruro S.A.C.

Shihuahuaco captures the attention of buyers

While overall sawnwood exports have declined over the

past three years some companies have increased business

in international markets.

One such company is Maderacre SA which has focused on

developing wooden flooring. For many years mahogany

was the most demanded timber but today it is shihuahuaco

(Dipteryx micrantha) that has captured the attention of

buyers.

Executive boards to be revived

The Ministry of Production has announced that the system

of Executive Boards will be expanded to more sectors.

Speaking on this the Minister of Economy and Finance,

Carlos Oliva, said he considers it important to reactivate

the Executive Boards to strengthen coordination between

the public and private sectors.

The Government will soon publish its competitiveness

strategy which will focus on structural, reforms to raise

competitiveness. In promoting the idea of Executive

Boards he pointed to the success of the Forest Executive

Board which is helping development of the forestry sector.