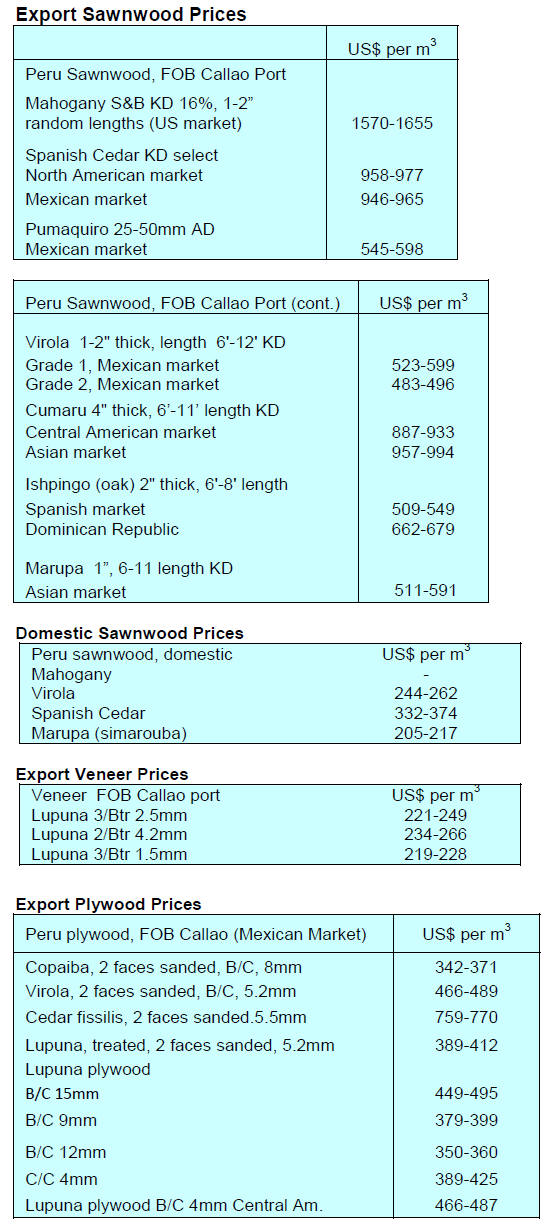

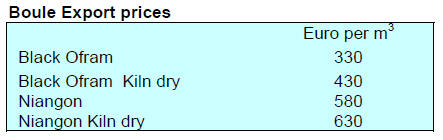

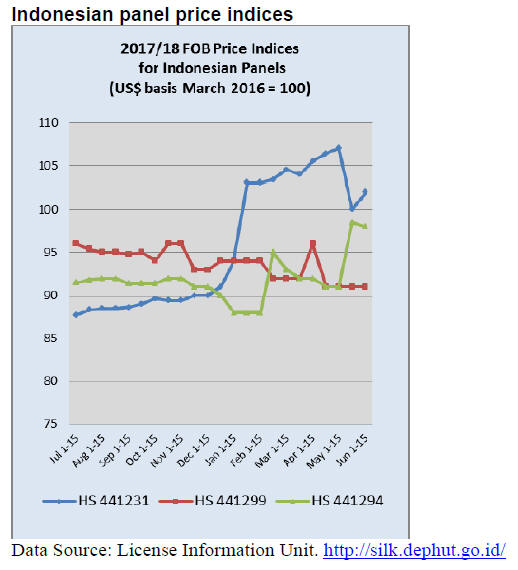

2. GHANA

Q1 2018 exports at year on year high

The volume of wood products exported from Ghana in the

first quarter of 2018 amounted to 72,533 cu.m, 18% higher

than in the corresponding quarter in 2017. The revenue

earned was Euro51.48 million, also a significant increase

of 30% over that in the first quarter of 2017.

The major drivers of this positive growth were exports of

air and kiln dried sawnwood, plywood to regional markets,

rotary veneer, curl veneer, billets and dowels.

The group ‘Other” wood products in the table above

include air-dried boules, kiln-dried boules and poles which

there were exports in 2017 but not in the first quarter of

2018. On the other hand, there were no exports of

furniture parts in the first quarter of 2017 but a cumulative

total of 324 cubic metres was exported in the first quarter

of 2018.

The most popular species exported included teak (52%),

rosewood (9%), papao/apa (7%), ceiba (6%) and

wawa(5%).

Together, China and India accounted for 78% to continue

to be the leading market destination in the first quarter of

this year, with African regional markets at 7% after

Europe at 10%.

Average unit prices for wood products increased from

Euro 546/cu.m in the first quarter of 2017 to Euro

600/cu.m in the first quarter of 2018.

Reafforestation received massive support

The Ghana government has embarked on an extensive

reforestation drive across the country. The government has

committed over GH¢300 million through the Forestry

Commission and the Youth Employment Authority to fund

a programme for the youth to plant trees across the

country over a two-year period.

The programme will begin in June and will employ around

5,000 young people. The Chief Executive of the Forestry

Commission, Mr. Kwadwo Owusu Afriyie, has been

commended for initiating this youth reforestation

programme.

3.

MALAYSIA

Return to previous tax regime could

lower production

costs for furniture makers

The president of the Malaysian Furniture Council (MFC)

has said the repeal of the Goods and Services Tax (GST)

and the re-introduction of the Sales and Services Tax

(SST) will not unduly impact the domestic furniture

industry as exports are not taxed under the SST.

In terms of domestic demand, if the SST is reintroduced at

10% then there would be little change in retail prices for

furniture. The up-side to the return to the previous tax

regime is that production costs could fall as the SST is not

applied to labour inputs.

The MFC expects Malaysia's furniture exports to expand

around 5% from the RM10.14 billion recorded in 2017 on

the back of firming demand in the US, China and the

Philippines.

According to data from the Malaysia External Trade

Development Corporation, the US remained the main

furniture export market in the first four months of this

year. In the same period furniture exports to China jumped

over 50% year on year to RM92 million.

Concern for finances of Sabah logging companies due

to log export ban

Sabah has imposed an interim ban on log exports and

sacrificed a major source of income to ensure the domestic

market enjoy adequate raw material supply. Mohd Shafie

Apdal, Sabah Chief Minister, said the log export ban

announced recently is temporary as a review will be

undertaken to examine the logging and processing sectors.

Deputy Chief Minister and Industry and Trade Minister,

Wilfred Madius Tangau, said the State Cabinet will

examine how best to help local industries and create jobs

for Sabahans while ensuring logging firms do not incur

huge losses because of the ban.

The Sabah forest sector contributed around 7% of total

State income in 2016 and earned just over RM2 billion

from wood product exports. Analysts write “the woodbased

industry in the State is dominated by primary

processing mills many of which are operating well below

capacity due to the shortage of logs”.

The number of mills in Sabah has been steadily falling

from nearly 400 in 2015 to below 200 in 2016 when the

latest review was conducted.

Major plymill switching to plantation logs

Ta An, one of the main timber companies in Sarawak, has

announced it will increase harvests of plantation logs to

supply its plywood mill. Ta An has just over 35,000ha of

plantations, mainly Acacia mangium, of which 22,000 ha

are over 10 years old and can be harvested.

On prospects for 2018, Ta An expects higher demand for

plywood in Japan especially for certified products. Last

year over 90% of Ta An’s plywood was shipped to Japan.

4.

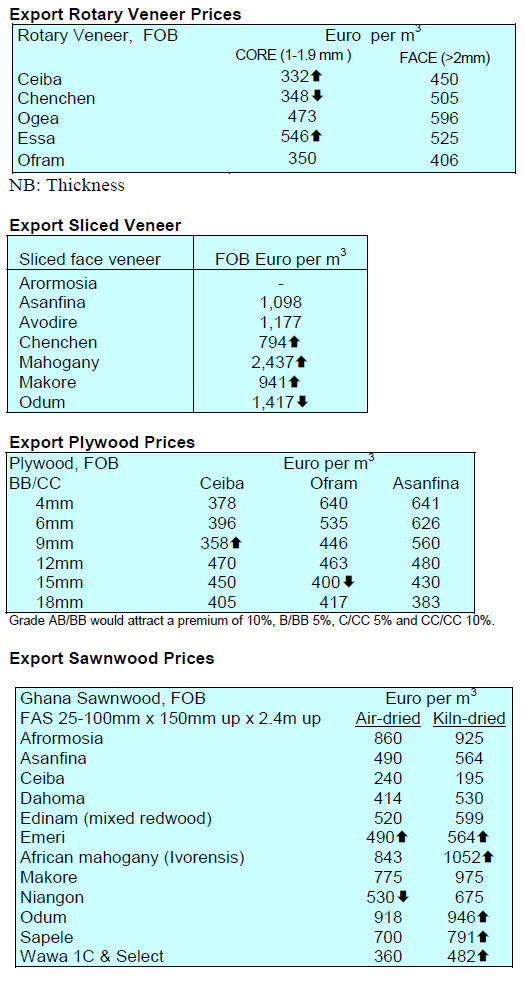

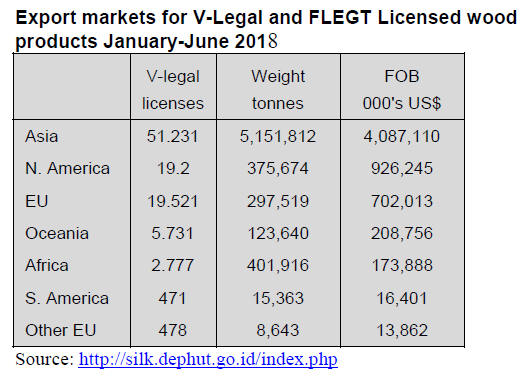

INDONESIA

Indonesia and FAO to

strengthen SVLK

The Ministry of Environment and Forestry and FAO will

work together to help local enterprises cope with the

requirements of the national timber legality assurance

system (Sistem Verifikasi Legalitas Kayu-SVLK).

An agreement for a FAO-EU Forest Law Enforcement,

Governance, and Trade (FLEGT) programme has been

signed by the Director of Forest Product Processing and

Marketing in the Ministry of Environment and Forestry

and FAO’s representative in Indonesia.

The agreement outlines how grants will be processed and

made available to finance work by government

institutions, the private sector associations and civil

society organizations. The aim is to provide capacity

building to stakeholders especially SMEs.

EU and Indonesia launch EU-Indonesia ‘Blue

Book

2018’

Indonesia and the EU recently launched the EU-Indonesia

‘Blue Book 2018’, an annual report of development

cooperation between the European Union and Indonesia.

Analysts write that “the theme of the ‘Blue Book 2018’ is

Climate Change which reflects Indonesia’s and the EU's

commitment to addressing the negative impacts of climate

change.”

A press release from the EU says “The EU has been

supporting several initiatives in Indonesia at the national

and sub-national level in transforming the development

approach and reducing the carbon footprint.

The EU Support to Climate Change Response (EUR 6.49

million) project supporting Aceh Province has introduced

the practice of climate-smart and dynamic agroforestry for

degraded land, conducted in-depth studies on renewable

energy and on carbon-rich peatland protection and has

successfully developed innovative mechanisms at district

level for payment for ecosystem services tailored for

environmental protection and forest conservation by

utilising a Village Fund.

At the national level, the project developed the Capacity

Building and Technology Needs Assessment (CBTNA) to

gather, evaluate, prioritise, and update information on

capacity building and technology needs for reaching

climate change targets set out in the Paris Agreement

ratified by Indonesia. At the provincial level, the project

supported the “Greening" of the Provincial Development

Plans (RPJMD) to reflect climate change commitments

and targets in the official planning and budgeting

framework governing provincial policies of the next five

years.”

For more see:

https://eeas.europa.eu/delegations/indonesia/45119/eu-andindonesia-

highlight-cooperation-climate-change-andenvironment_

en

5.

MYANMAR

Exporters overwhelmed by requests for

documents

verifying legality

Myanmar exporters to the EU are reporting that they are

being asked to provide more and more documents to

mitigate the risk of illegal timber entering the supply

chain.

Exporters complain that they have been asked to provide

all the documents described in a dossier compiled by the

FLEGT Technical Advisor to the Forest Department.

This dossier, it is understood, illustrates to importers how

records are kept along the entire supply chain from harvest

to port of exit. The intention behind the dossier was to

explain what documents are produced throughout the

supply chain.

Barber Cho, Secretary of Myanmar Forest

Certification Committee, explained that the purpose of the

dossier is being misunderstood by EU Competent

Authorities as it was not the intention that records of each

step in the supply chain would be submitted to exporters.

Cho pointed out that some of the documents mentioned are

in support of credible traceability.

In related news, according to the Myanmar Timber

Merchants Association, a 10-member delegation will visit

Brussels this month to explain the current traceability and

legality compliance system in Myanmar.

According to U Myo Min, the advisor to the association

and a delegation member, the delegation will explain that

the national traceability procedure consists 30 steps.

The delegation will comprise officials from Forest

Department, Myanmar Timber Merchants Association, the

FLEGT Technical Advisor and representatives from the

private sector and civil society organisations.

Myanmar meets all LDC graduation criteria

Myanmar has met all three eligibility criteria for the first

time to graduate from Least Developed Country (LDC)

status according to the assessment mentioned in the recent

Report of Committee for Development Policy (CDP) of

the United Nations.

This was reported at a meeting of the United Nations

Economic and Social Council, Committee for

Development Policy held in March but the official

notification was only recently released.

This is the very first time Myanmar meets all LDC

graduation criteria since it was listed in LDC in 1987. If

Myanmar continues to meet at least two out of the three

criteria again in the 2021 Triennial Review by sustaining

its current development momentum, it will pave the way

for Myanmar to graduate from the LDC status in the

following years.

World Bank - economy set to grow almost 7% next

year

According to Ellen Goldstein, World Bank Director for

Myanmar, the government’s efforts to accelerate reforms

and to modernise the financial sector could mean that the

economy may grow almost 7% next year. This was made

known at the launch of the latest Myanmar Economic

Monitor that the medium term outlook for Myanmar

remains positive despite some risks.

Goldstein praised the government’s efforts to conclude the

Myanmar Sustainable Development Plan which could

serve as a platform for resolving conflicts that jeopardise

sustained growth.

See:

http://www.worldbank.org/en/country/myanmar/publication/mya

nmar-economic-monitor-reports

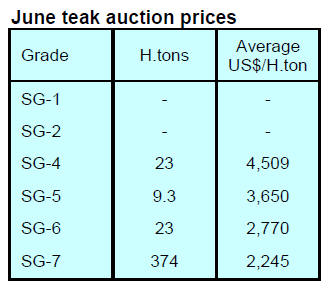

In addition to the regular open auction there was a

Special

Open sale in June at which 1,036 tons of low grade teak

logs were sold at an average price of US$1,626 per H. ton.

6. INDIA

Marayoor Forestry

Department auctions 34 tons of

sandalwood

The latest e-auction of sandalwood conducted by the

Marayoor, Kerala Forestry Department earned Rs281.10

million from the sale of around 34 tonnes of sandalwood

logs. Marayoor sandalwood is of high quality and is used

in the international cosmetic and perfume industries.

There has been a visible decline in the illegal smuggling of

sandalwood from the Marayoor forests with only nine

cases prosecuted in 2017. Illegal felling is still common in

private forests but has fallen in other areas following the

successful control by the police and forestry officers.

For more see:' Red sanders can be grown like any other crop' -

The Hindu

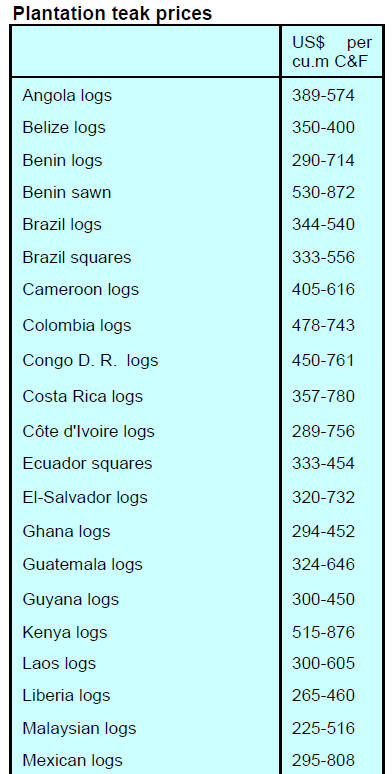

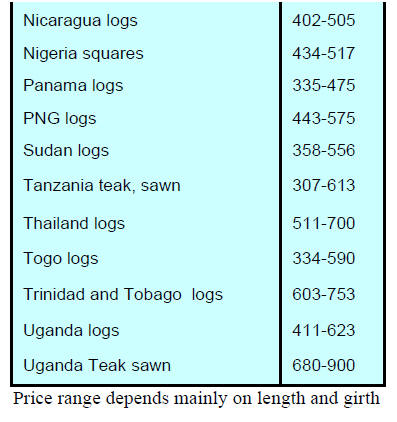

Plantation teak prices

Demand for imported logs continues unchanged but

imports are still affected by the withdrawal of credit

facilities. Another factor impacting imports has been the

weakness of the rupee.

The rupee has fallen against the US dollar by around 5%

over the past month making imports more expensive.

Analysts write that “under these circumstances any rise in

C&F prices is ruled out”. The trade feels that the normal

banking facilities could be restored by the end of July.

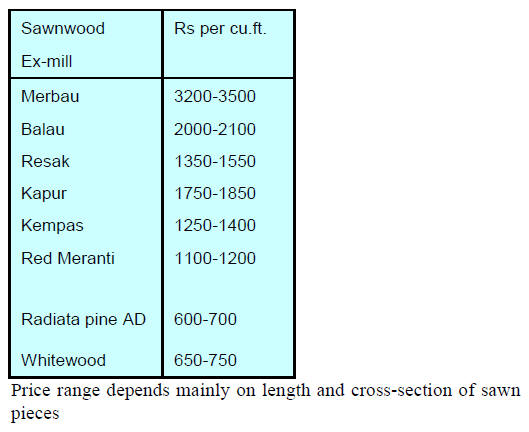

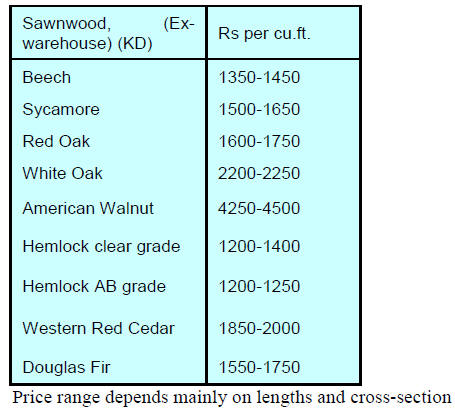

Locally sawn hardwood prices

Traders are under pressure from suppliers to raise prices

but say this is not possible because of stiff competition

amongst traders who are offering alternative timbers

coming from Guyana and Gabon for example.

As is usual, consumers look at price and what is suitable

for the enduses and are less inclined to follow tradition.

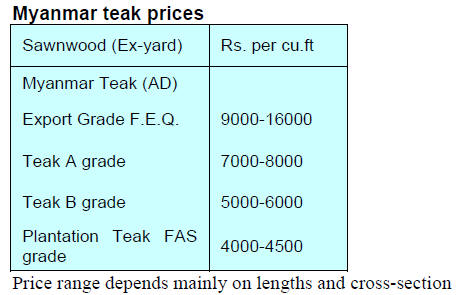

Imported sawn Myanmar teak

The consensus in the trade is that more and more endusers

are moving away from using Myanmar teak as they

find cheaper alternate species good enough for their

purpose.

The trading patterns are changing with teak and gurjan

slipping into the history book because of delivery issues

and prices compared to alternatives.

Gurjan is being replaced by peeler quality logs from

Guyana and imports of okoume veneers have encouraged

some factories to switch completely over to new source.

Indian companies are expanding veneer production in

Gabon. However, Indian endusers still equate red coloured

veneer with strength which has driven some millers to

using pigments to colour pale imported veneers.

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) ex-warehouse

remain unchanged.

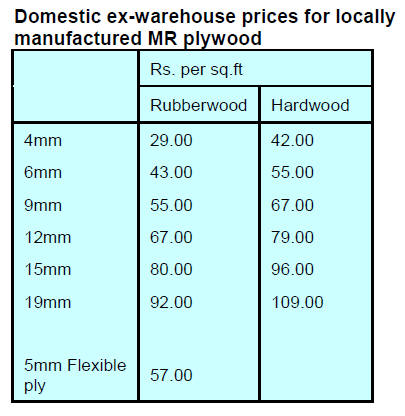

Domestic plywood update

As the prospects are for more rupee weakness which will

drive up raw material costs millers are intending to raise

plywood prices by between 5 to 10% from 1 July 2018.

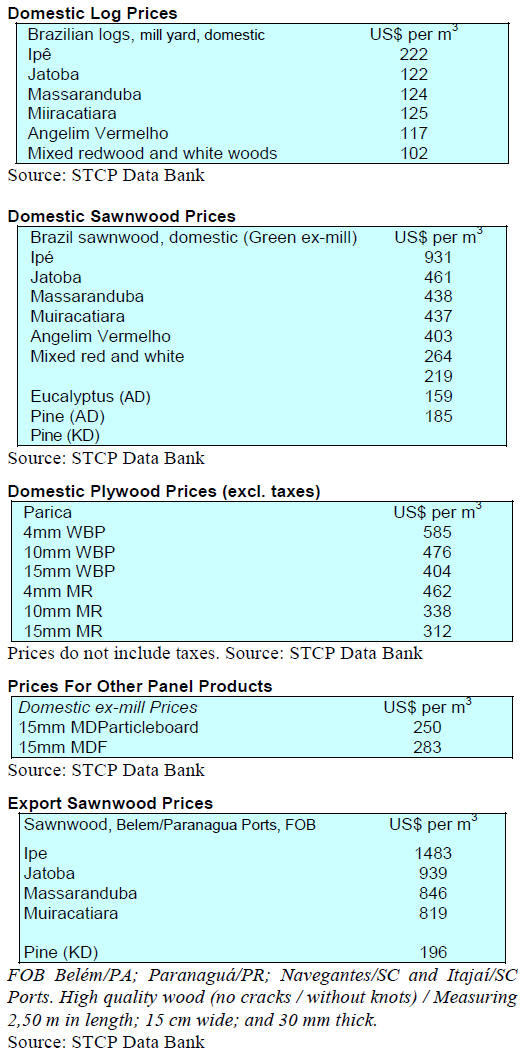

7. BRAZIL

Furniture output shows healthy growth but

below

average in major furniture producing states

April was a good month for the Brazilian furniture

industry. Output increased across the country. However,

while the average national growth in output was 13.5% in

comparison with April last year, in Paraná output

expanded just 9% and in Rio Grande do Sul just 8%.

Between January and April this year, while national

furniture production grew 10%, in Paraná it was only 7%

and in Rio Grande do Sul only 5% year on year. Over the

past 12 months the furniture industry across the country

recorded an 11% increase in production.

Controlled price structures compromises

competitiveness

The Center for Timber Producers and Exporters of Mato

Grosso State (CIPEM) has warned the minimum prices for

forest products set by the State Secretariat of Finance

(SEFAZ-MT) through Administrative Ordinance

“Portaria” Nº 052/2018, may compromise the commercial

competitiveness of timber production of Mato Grosso state

compared to other states.

To address this CIPEM has initiated a dialogue with

SEFAZ-MT emphasising that the state government should

consider the approach taken in other competing states

saying, if the current structure is maintained there will be

an increased risk of weakened competitiveness.

CIPEM requested and was granted a suspension of

Portaria 052/2018 until a review can be conducted without

any immediate change in the basis of the tax Circulation of

Goods and Services). Forestry represents the main

economic activity in 44 municipalities in the Mato Grosso

State so disruption of industrial activity could undermine

State revenues.

Growth of tropical timber exports

Carrefour International Du Bois, considered one of the

largest wood products fairs, was held in late May and

entrepreneurs from Mato Grosso State participated in

search of new technologies and markets.

According to CIPEM local forestry sector

entrepreneurs

picked up many tips on trading in international markets.

Encouragingly, it was learnt that global purchases of

tropical wood products are expected to expand around

30% this year, well above the forecasts made by CIPEM at

the beginning of this year.

Brazilian wood panels exports increase

Exports of Brazilian made wood-based panels in the first

quarter of 2018 totaled US$73 million, an increase of 14%

over the same period last year.

Between January and March of this year the main markets

for woodbased panels were Latin America (11% increase,

equivalent to US$39 million) and North America (21%

increase, US$17 million).

In terms of volume, exports of woodbased panels totaled

308,000 cubic metres in the first quarter of this year, an

increase of 8.5% over the same period in 2017.

8. PERU

Imports of wooden furniture continue to

decline

In the first quarter of 2018, Peru’s imports of wooden

furniture totalled US$11.7 million, a drop of 13%

compared to the same period of last year.

Brazil was the main supplier at US$7.5 million which

represented 68% of total furniture imports in the quarter.

China followed at US$6 million then Chile at

US$400,000.

Peru’s main importers of wooden furniture in the first

quarter were Sodimac, the home improvement chain of the

Falabella Group, (US$4.3 million) then Homecenters

Peruanos (under its banner Promart) at US$2 million.

Consolidated imports of these two home improvement

retailers accounted for 54.8% of the total wooden furniture

imported to Peru.

Technology to fight deforestation in San Martín

Control and surveillance for an early warning of

deforestation was boosted by a decision of the sixth

meeting of the Regional Forestry Board convened by the

Regional Environmental Authority (ARA) of San Martin

to use drones.

This initiative will streamline monitoring efforts in areas

that are under strong pressure from illegal loggers and will

also be utilised in areas of timber and non-timber forest

concessions.

A monitoring unit and geographic information system by

Amazónicos por la Amazonia for surveillance in private

and community conservation initiatives in San Martín was

demonstrated thanks to the support of World Resources

Institute.

ADEX - work of the forestry board will add value to

Peruvian forests

The Minister of Agriculture and Irrigation, Gustavo

Mostajo, has stressed the importance of encouraging the

reform of the forestry sector to avoid unsustainable and

illegal activities such as the cultivation of coca leaf and

informal mining.

ADEX Vice President, Erik Fischer in supporting the

Minister statement said the wood processing sector needs

th support of many public institutions.

Mining companies ready to support

reforestation

Representatives of commercial miners have expressed

their willingness to continue supporting agricultural

projects and reforestation in the areas where they operate.

This was announced during the 1st Agrominera

Convention that took place recently.

During the event, officials of mining companies and two

regional governors commented on the coordination they

have been carrying out for some years on self-sustainable

projects related to agriculture and forest reforestation in

the mountains of the country.