Japan

Wood Products Prices

Dollar Exchange Rates of 25th

March

2018

Japan Yen 105.4

Reports From Japan

Missing element in plan to

beat deflation

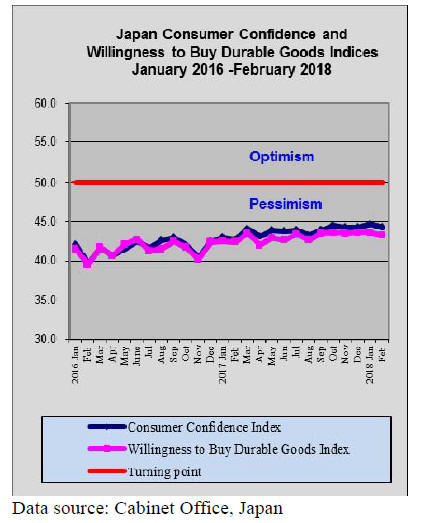

Wages for workers in Japan fell in December and worse,

the decline was the quickest in six months. This was

despite the continuous efforts on the part of the

government to try and convince companies to raise wages.

Rising incomes is a cornerstone of the government’s plan

for the economy. The argument goes that as wages rise

this would spur consumption to lift the economy. This is

not happening even as the labour market heats up and

unemployment falls.

The Ministry of Labour, Health and Welfare figures

demonstrate that, year on year, wages (adjusted for

inflation) were down 0.5% in December 2017. What

seems to be missing from the economic plan is how to lift

confidence amongst households and release some of the

savings into the economy.

Trend to higher interest rates – except in

Japan

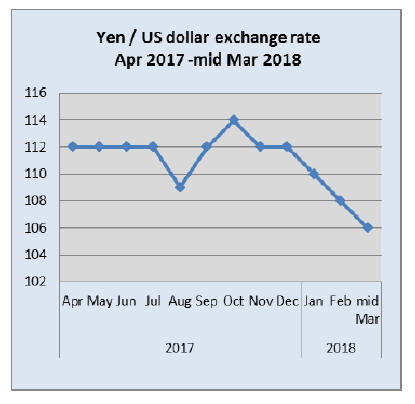

At its latest meeting the Bank of Japan (BoJ) indicated that

it plans to maintain its monetary policy despite the modest

economic expansion but also because expectations for

rising wages have not been met.

The risk is that any change to the policy of the BoJ will

immediately impact the yen/dollar exchange rate and for

now the Bank does not want to see the yen strengthen and

undermine exports. If the yen appreciates beyond 100 to

the US dollar Japanese exporters will suffer. Currently the

yen is 106 to the dollar after strengthening sharply over

the past 3 months.

Analysts point out that in most other major economies the

trend is towards higher interest rates which puts Japan in a

class of its own. Interest rates in the US are set to rise

throughout the year and in the EU rates are firming as they

are elsewhere creating even more of a divergence between

Japan and the rest of the world.

‘Slash and burn’ Japanese homes

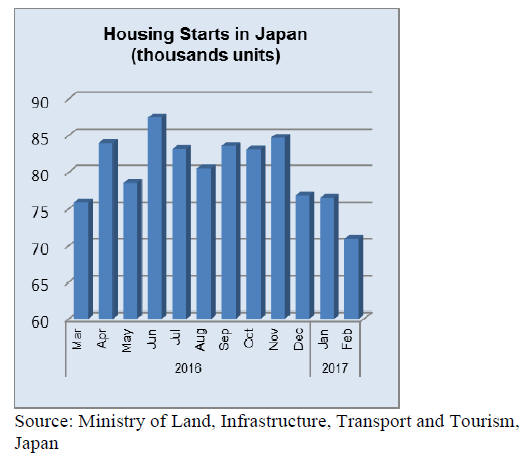

The housing market in Japan is unique in that the value of

an average Japanese home depreciates rapidly, in sharp

contrast to other countries where the home is considered as

a sound investment and retains its value.

In Japan, after around 30 years families usually follow the

local tradition and consider demolishing the house and

rebuilding. Across Japan, sales of new homes are much

higher than second hand homes, the reverse of the

situation in western countries.

The short replacement cycle is good for home builders but

a waste of resources and does not create wealth and the

confidence that brings to home owners.

The Economist Newspaper has quoted Chie Nozawa of

Toyo University as saying this is just like ‘slash-and-burn’

farming. As the population declines there is little

justification for continuing this cycle of home

replacement. To give it credit the Japanese government is

looking to realign housing policies to encourage the sale of

secondhand homes.

As if to drive home the state of the Japanese real estate

market, the domestic media has reported that in 2017 over

US$3 billion was invested in overseas real estate by

Japanese companies and pension funds. This was almost

double the investment in 2016.

This marks a significant shift as previously investments

have been focused on the domestic market.

Japanese real estate developers have also been moving

into new markets, for example Sumitomo is investing in

multi-million dollar residential projects in India and

Vietnam.

For more see:

https://www.theinvestor.jll/news/japan/others/japanese-investorsboost-

spend-overseas-real-estate/

Import round up

Doors

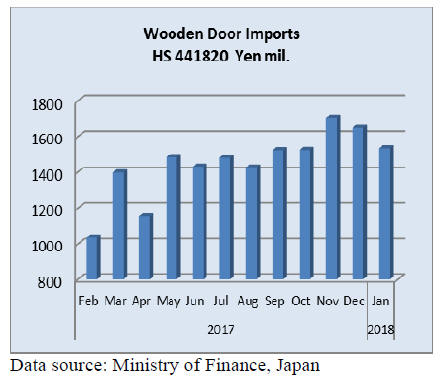

January door imports

January imports of wooden doors (HS441820) were up

20% year on year with the top four shippers, China (58%),

the Philippines (18%), Indonesia (8%) and Malaysia (75)

accounting for over 90% of all January imports.

Compared to a month earlier January imports were down

7%, a reflection of slowed in building activity due to

winter storms across the country.

Window imports

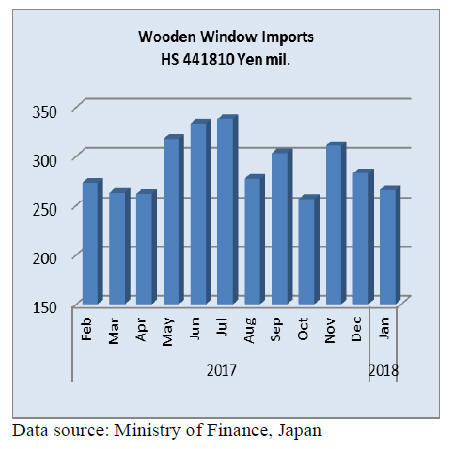

January window imports

Four shippers accounted for over 90% of Japan’s January

2018 wooden window imports; China (32%), US (24%)

the Philippines (22%) and Sweden (14%).

Month on month wooden window imports were down 6%

in January but year on year there was a 5% gain in wooden

window imports.

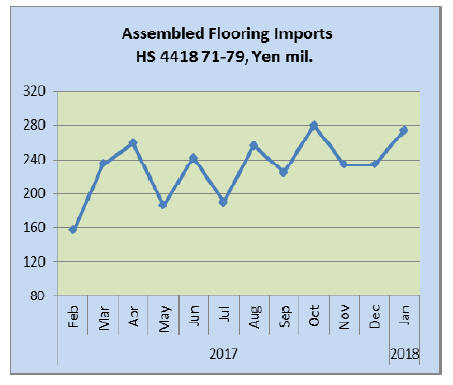

Assembled flooring

January imports

As in previous months wooden flooring imports were

dominated by HS 441875 which accounted for 78% of

January imports followed by HS441879 (13%). China,

Finland, Malaysia, Indonesia and Thailand were the main

shippers of HS441875 (59%, 12%, 7%,6% and 5%

respectively).

Year on year, January 2018 imports of assembled wooden

flooring were down 13% but month on month imports

were up 22%. The figure below illustrates the upward

trend in assembled wooden flooring over the past 12

months.

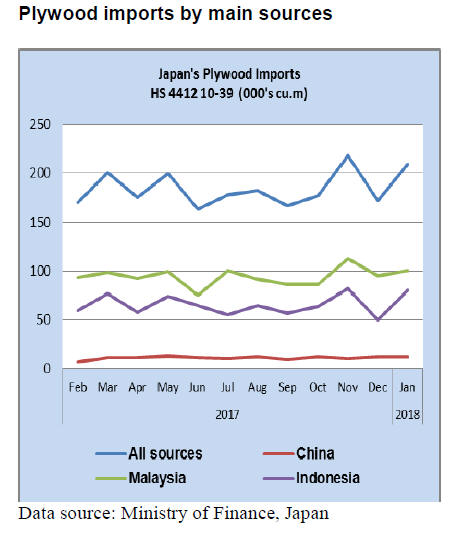

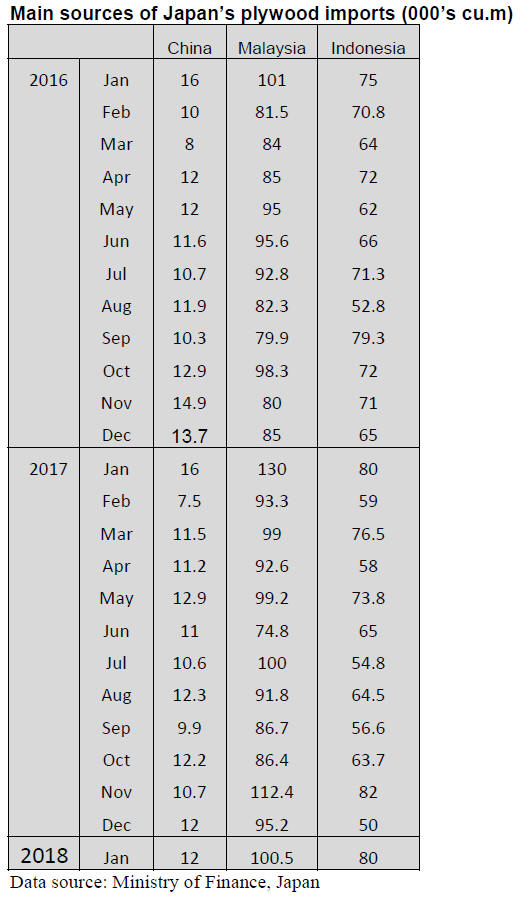

Plywood

January plywood imports

Year on year, Japan’s January 2018 plywood import

volumes were down13% with Malaysia seeing exports to

Japan fall in contrast to the steady year on year shipments

from Indonesia. Shipments of plywood from China

remained stable at around 12,000 cu.m for the month.

Plywood in HS 441231 accounts for most of Japan’s

imports and in January this category of plywood

accounted for 88% of all imports followed by HS441234

at 6% and HS441239 at just 2%. The balance was

HS441210.

Compared to a month earlier shipments from China were

flat while shipments from both Malaysia and Indonesia

rose. Shipments from Indonesia rose 60% compared to

levels in December 2017.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Japan’s wood export in 2017

Total value of wood products’ export was 32.6 billion yen,

37% more than 2016. By items log export was 970,000

cbms, 49% more than 2016 and lumber was 130,000

cbms, 49% more. Wood export started increasing since

2013. Total value in 2013 was 12.37 billion yen then it

increase by three times in 2017 with total value of 32,648

billion yen.

The largest factor of the increase in 2017 was log export

particularly for China. Value of log export to China in

2017 was 10.3 billion yen, 84% more.

Volume of log export was 780,000 cbms, 62% more. An

average value per cbm was 13,271 yen as compared to

11,701 yen in 2016, 1,570 yen more in 2017.

Log export to Korea in 2017 was 130,000 cbms, 29%

more with the value of 2.3 billion yen, 22% more. Since

Korea buys heavy to cypress, an average value per cbm

was high at 17,384 yen.

Log export to Taiwan decreased in volume but the value

increased. An average unit price per cbm was 16,000 yen,

3,084 yen more.

Lumber export increased for two straight years by both

volume and value. Main markets of China, Philippines,

Taiwan and Korea increased the volume then cedar fence

lumber for the U.S. market increased by four times by

shortage of North American red cedar supply and soaring

prices. Rough lumber with dark red color is preferred.

Forest Management law to be submit

To support new forest management system, basic idea of

forest management law is drafted. Main idea is

management of forest, which ownership is unknown.

When forest owners consign forest management to local

government, management right of forest, which ownership

is unknown, can be shifted to the local government with

certain procedures, which opens up log harvest from such

forests.

The new forest management system is that local

governments are assigned or donated forest management

right from forest owners, who have no will to manage by

themselves so that the governments can assign log harvest

and replantation to forest owners, who have will and

ability.

For forests, which ownership is unidentified, local

government would give public notice to shift management

to the government and if there is no response in six

months, management right is shifted to the public

government with governor’s decision.

Also if certain forest owner does not agree to consign

management right but it is not managing forest properly,

the government can have management right if neighboring

forest owners hope public management. There are many

forests, which have good condition for log harvest but

ownership is unknown so legal log harvest is impossible.

This new law opens up solution for log harvest from such

forests.

To promote shifting of management right, the government

requires proper forest management as owner’s

responsibility and if mismanagement could cause natural

disaster such as landslide and floor, local government can

order owner to take necessary precautions or the

government can take over and take necessary measures.

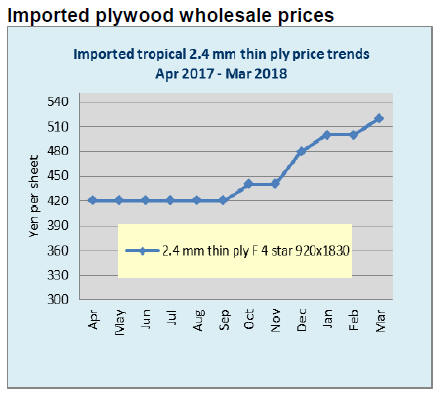

Skyrocketing Indonesian plywood prices

Export prices of Indonesian plywood continue to climb

with no sign of slowing down. In particular, thin panel of

2.5 mm prices shot up to about US$1,000 per cbm C&F,

the highest record.

Weather in Indonesia is much worse than Malaysia and

with tightening control of illegal harvest, log production is

plunging. Log production seems to have dropped more

than half of normal pace with no sign of recovery. By this

log supply shortage, plywood mills’ deliveries are largely

delayed.

Even regular suppliers are two to three months behind

schedule and some have not delivered volumes contracted

last summer.

Looking at price trends for Indonesian plywood, the

bottom prices were summer of 2016. 4 mm plywood

prices were about US$600 per cbm C&F, which are about

US$750, 25% up. 2.5 mm panel prices were US$720-750

in 2016, which are now over USUS$950 with some offer

of US$1,020.

In Japan, 2.5 mm panel market prices were 350-390 yen

per sheet in summer of 2016, which are now about 500

yen. 4 mm prices are 630-650 yen, 30-50 yen up from

February.

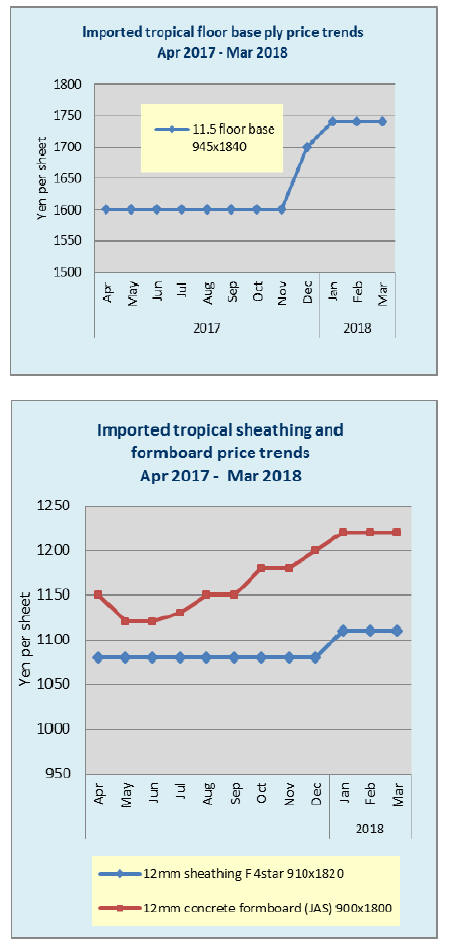

Malaysian plywood market in Japan

Log production in Malaysia continues slow due to

prolonging rainy season so many plywood plants are

forced to shut down and the supply for Japan is largely

delayed.

Supply of coated concrete forming panel is particularly

tight so the prices are firming. Prices of 3x6 JAS coated

concrete forming panel are 1,410-1,420 yen per sheet, 10

yen up from February. The importers are now asking

1,450 yen but there are still some low price offers so price

hike is not going so easy.

However, there is no more offers of less than 1,400 yen so

the pries are gradually climbing. Green 3x6 JAS concrete

forming panel prices are 1,230-1,240 yen, 20 yen up from

February.

Offers made in February are US$530-540 on 3x6 JAS

green concrete forming panel and US$640-650 per cbm

C&F on JAS 3x6 coated concrete forming panel, nearly

US$50 increase. In tight supply, Japan has not much

choice but to accept higher prices to secure the volume.

Plywood

Future supply of South Sea (tropical) hardwood plywood

is becoming more uncertain but with dull demand in

Japan, end users are not so concerned.

Domestic softwood plywood movement is slowing so

supply tightness is easing. Supply of imported plywood in

January was 273,800 cbms, 11.2% less than January last

year and 17.9% more than December.

By source, Malaysian was 103,500 cbms, 22.4% less and

6.4% up. Indonesian was 87,600 cbms, 1.0% less and

54.0% more. Chinese was 63,600 cbms, 7.9% less and

3.9% up. Although the arrivals increased in January, port

inventories remain low and some large warehouse

company commented that the inventories are dropping so

much that they have never experienced.

In Malaysia and Indonesia, rainy season still continue even

in March and high quality logs to produce thin plywood,

floor base and coated concrete forming panel, are very

hard to get so plywood mills have very little log

inventories.

By higher export prices, Japanese floor manufacturers are

increasing the sales prices of flooring and other building

materials since late February. Market prices of coated

concrete forming plywood are hard to go up by inactive

demand.

|