Japan

Wood Products Prices

Dollar Exchange Rates of 10th

January

2018

Japan Yen 111.26

Reports From Japan

Second longest post war

economic expansion

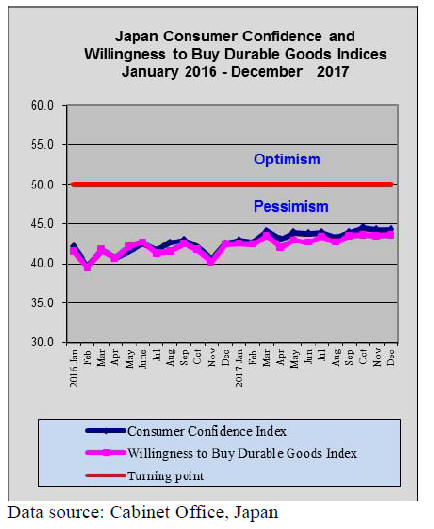

In a survey conducted towards the end of 2017 most large

Japanese companies indicated that they expect the

Japanese economy to expand further in 2018 on the back

of increased capital investment a recovery in individual

consumption and faster export growth.

As the New Year begins the government has been

heartened by data showing the Japanese economy is in its

second longest post war economic expansion with

indications that the good news will continue into 2019

provided international demand remains robust.

Japan’s GDP has grown for seven straight quarters and the

stock market is at a 25 year high but, despite good

corporate profits, consumer spending remains weak as

wage increase have not flowed from major companies.

The Spring wage negotiations are about to begin and

already the government is lobbying hard to get the major

companies to release some of their profit stock pile as

wage hikes.

Traders alert for any hint of a change in

the BoJ weak

yen policy

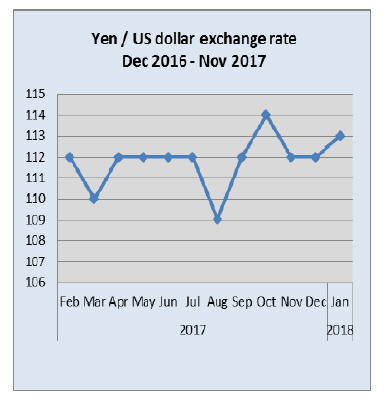

Over the extended year-end holidays the US dollar/yen

exchange rate barely changed as there were no significant

movements in the main economic indicators.

Housing starts in Japan continue to be firm as they are in

the US and there has been no movement in Japan’s

manufacturing output or consumer spending which could

have triggered an exchange rate movement.

Looking further ahead there does seem to be an

expectation that the Bank of Japan (BoJ) will be

considering an interest rate increase during 2018 given

five successive quarters of economic expansion and a very

tight labour market.

The weak yen is the biggest boost to exports and adds

some inflationary pressure because imports are that much

more expensive. A stronger yen would have the opposite

effect on export growth and inflation. Several analysts are

cautioning that currency traders remain alert to any hint of

a change in the BoJ policy and that we may see a period of

volatility in the yen/dollar exchange rate in 2018.

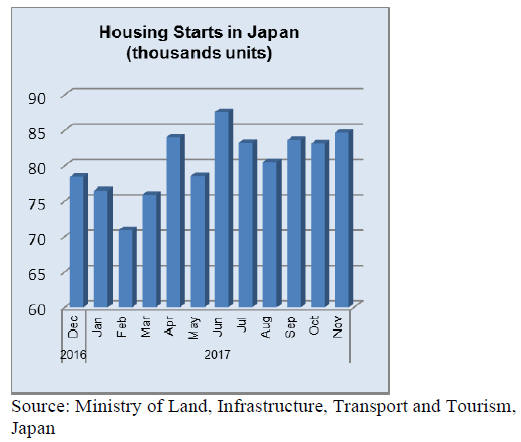

Second half robust housing market continues

Data from Japan’s Ministry of Land, Infrastructure,

Transport and Tourism shows that November 2017

housing starts, while flat month on month, rose around 2%

year on year. On the basis of the past 11 months 2017

annual starts are likely to come in at around 960,000.

Construction companies continue to report firm order book

positions and Ministry data shows orders received by the

top builders rose sharply in November, adding to the rise

reported for October orders.

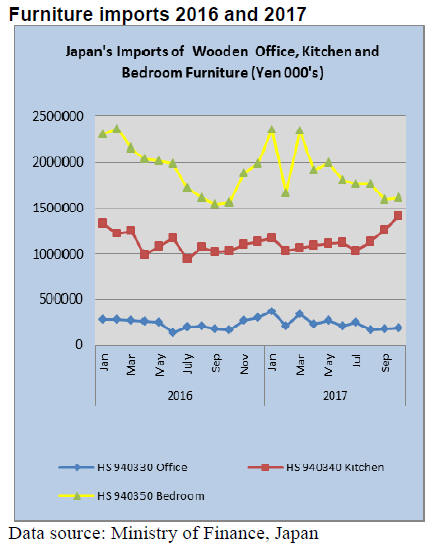

Japan’s wooden furniture imports

The cyclical trend in bedroom furniture imports has once

again been repeated in 2017. After peaking in the Spring

Japan’s imports of wooden bedroom furniture traditionally

drop back in the months to year end only to pick up once

again.

While the trend in bedroom furniture imports is following

a familiar pattern this is not the case with wooded kitchen

furniture. After moving within a narrow range for the past

2-3 years in the second half of 2017 imports of wooden

kitchen furniture have surged. This could be partly the

result of the flood of cash into buy-to-rent properties in

Japan, a tactic used to minimise inheritance taxes by the

wealthy.

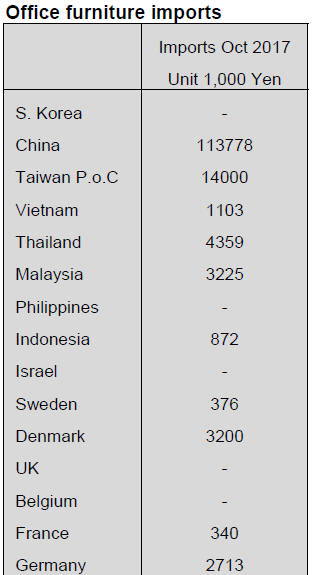

Office furniture imports (HS 940330)

Japan’s imports of wooden office furniture are small

compared to the value of wooden bedroom and kitchen

furniture imports.

Year on year, the value of October imports of wooden

office furniture was up 10% and compared to a month

earlier imports in October rose 6%. For the first 10 months

of 2017 wooden office furniture imports were around 6%

higher than over the same period in 2016.

Shippers in China accounted for over 60% of Japan’s

wooden office furniture and along with shipments from

Italy and Taiwan P.o.C some 80% of all shipments were

accounted for.

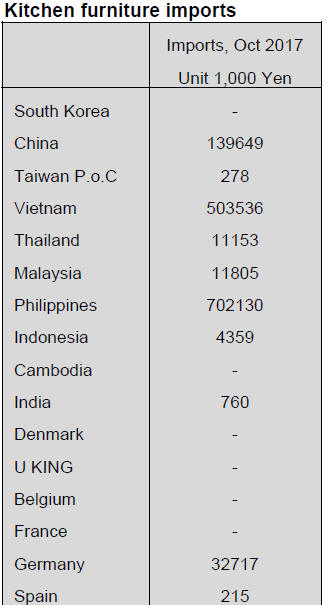

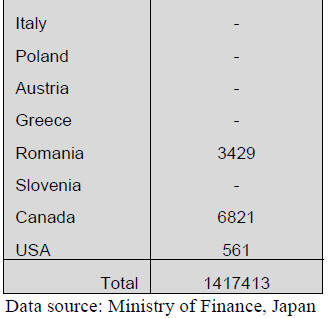

Kitchen furniture imports (HS 940340)

The value of Japan’s imports of wooden kitchen furniture

has been steadily rising since July and October marked

another high. However, despite the second half surge in

imports, the total value in the first 10 months of 2017 was

little different from that during the same period in 2016.

Closer examination of the import flow shows that in the

first half of 2017 imports were below average.

Year on year October 2017 imports were up 37% and

month on month there was a 12% rise in October 2017

from a month earlier. The combined shipments from the

Philippines, Vietnam and China once again account for

over 90% of all September shipments of wooden kitchen

furniture.

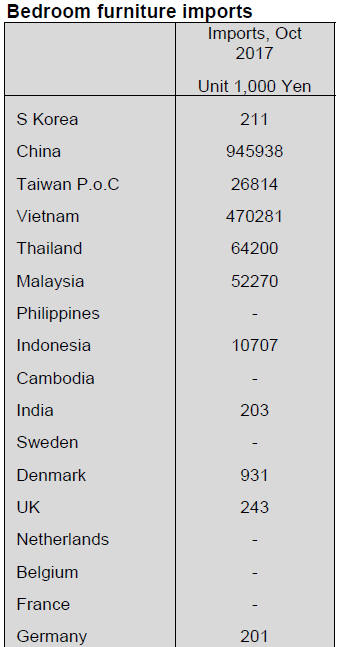

Bedroom furniture imports (HS 940350)

Japan’s imports of wooden bedroom furniture continue the

familiar trend seen in past years of a steady decline in the

second half of the year with an expected up-tick in the

later months of the year and the early months of the New

Year.

October 2017 imports of wooden bedroom furniture were

up around 3% on levels in October the previous year and

month on month there was very little change which may

signal the traditional reversal of the decline in the second

half of each year. However, total imports over the 10

months to October 2017 are down slightly when compared

to the same period in 2016.

Shippers in China and Vietnam dominate Japan’s imports

of wooden bedroom furniture accounting for 59% and

29% respectively. If shipments from Thailand and

Malaysia are included then some 95% of all wooden

bedroom furniture is accounted for.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Government policy in relation to TPP

The government decided general policy in relation to TPP

(now termed the Comprehensive and Progressive

Agreement for Trans-Pacific Partnership). The prime

minister commented that supplementary budget for 2017

should be made based on the general policy for the

Ministry of Agriculture, Forestry and Fisheries.

Based on newly decided policy, 29 billion yen of

supplementary budget is allocated for strengthening

plywood and lumber industry which includes supporting

business of log production and logging road maintenance.

As to policy target for forest and wood industry,

strengthening of international competitive power of

plywood, lumber and laminated lumber are stressed. In the

concrete, lower production cost of wood products

including reduction of log producing cost then expand

share of domestic products are targeted.

Promotion to improve competitive power includes

efficient manufacturing facility, shifting to competitive

items, lowering log producing cost by efficient forest

management.

Concentrating budget allocation to the area where

efficient

forest management is possible is necessary by introducing

high performance harvesting machines and maintenance of

logging road system.

Plywood supply

Total plywood supply in October was 511,900 cbms, 4.0%

more than October last year and 4.0% more than

September.

Demand and supply of domestic plywood were very

active. Total domestic supply in October was 280,300

cbms out of which softwood plywood was 267,800 cbms,

6.5% more and 1.9% more. As monthly production of

softwood plywood, this exceeded past record of last June’s

265,600 cbms and marked the highest record. Meantime,

the shipment of domestic plywood in October was 286,200

cbms, 4.8% more and 2.2% more.

Shipment of softwood plywood was 273,100 cbms, 5.8%

more and 2.1% more.

Besides robust demand of structural panels by precutting

plants, orders for non-structural panels such as floor base

has been increasing, which pushes high level production

and shipment. The softwood plywood inventories dropped

down to 88,200 cbms, 5,300 cbms less than September

end.

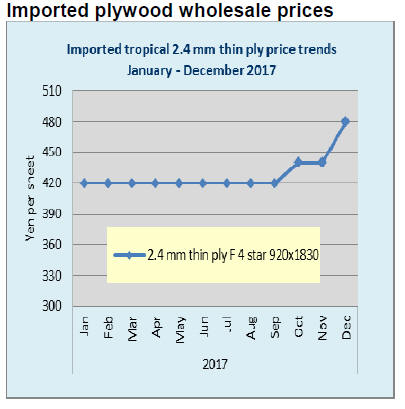

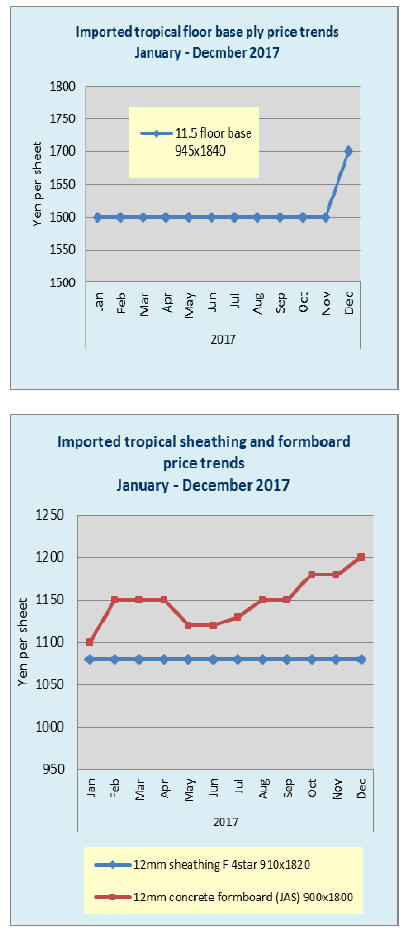

Imported plywood arrivals in October were 231,500 cbms,

1.5% more and 6.9% more. Both Malaysian and

Indonesian supply maintains the same level as last year

and total year supply would be the same as last year.

However, supply tightness of coated concrete forming

panel and thin plywood continues. Supplying plywood

mills suffer log supply shortage so that they produce more

structural and green concrete forming panels, which do not

need quality veneer. Despite the same level of supply,

some items are short.

Tight supply of particleboard

Particleboard (2x6) which is used for floor in

condominiums is tight in supply. Manufacturers’

inventories are low all through the year then since late

November, orders rushed in and it delays construction

works.

Production of PB has been slow this year by various

reasons and supply of 2x6 for floor is particularly low.

Construction of condominiums has been delayed by labor

shortage so the demand for PB was not particularly busy.

Then builders are anxious to finish construction by the end

of the year so they hurry completion of buildings which

results in sudden demand pickup of PB. By the area,

Osaka region is especially tight and dealers are buying all

available PB even at DIY stores.

PB manufactures have enough orders for other PB

products so there is no extra capacity to produce 2x6 PB

for floor so they accept orders from regular customers only

with limited volume.

South Sea (Tropical) logs and lumber

South East Asian countries are in rainy season now so that

log production will not recover until next spring. Log

production in Sarawak, Malaysia for the first eight months

is 3,795,171 cbms, about 24% less than the same period of

last year. Log export volume for major market of China,

India and Japan decreased. Only increase is plantation

wood of acacia mangium for Indonesia.

Local plywood mills have difficulty of securing material

logs so shipment of plywood has been delayed. After

active purchase by China and India slowed down, Sarawak

meranti log prices softened to under $300 but royalty will

be increasing in January so log prices will go up again in

winter.

Market prices of Malaysian Sarawak meranti regular in

Japan are 12,000 yen per koku CIF. Sabah’s kapur log

prices are about 16,000 yen.

Plywood mills are not able to procure enough logs since

rainy season started much sooner than usual years.

Sarawak will start imposing higher tax so log prices will

climb more.

Movement of laminated free board is not so active but

dealers’ inventories are declining. Market prices of

Indonesian mercusii pine are latter half of 110,000 yen.

The suppliers’ export prices are holding high at more than

US$950 per cbm C&F Chinese red pine free board prices

are more than US$850 per cbm C&F and about 115,000

yen in Japan.

|